2025 XAVA Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of XAVA

Avalaunch (XAVA) is an investor-centric platform designed to provide an environment where everyone can benefit. Since its launch in May 2021, the project has established itself as a unique ecosystem focused on correcting identified inefficiencies while continuously improving and perfecting its products and technologies. As of December 2025, XAVA maintains a market capitalization of approximately $14.68 million with a circulating supply of approximately 46.95 million tokens, trading at around $0.1468 per token.

This article will provide a comprehensive analysis of XAVA's price trends and market dynamics, combining historical performance patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions to offer investors professional price forecasts and practical investment strategies for the period through 2030.

XAVA Market Analysis Report

I. XAVA Price History Review and Current Market Status

XAVA Historical Price Evolution

-

December 2021: XAVA reached its all-time high (ATH) of $20.09, marking the peak of its market cycle during the broader cryptocurrency bull market of late 2021.

-

2022-2025: Extended bear market period, with XAVA experiencing significant depreciation from its peak, declining approximately 92.7% from its ATH.

-

November 2025: XAVA touched its all-time low (ATL) of $0.137347 on November 23, 2025, representing the lowest point in the token's trading history.

XAVA Current Market Status

As of December 23, 2025, XAVA is trading at $0.1468, reflecting a modest recovery from its recent lows. The token demonstrates the following market characteristics:

Price Performance:

- 1-hour change: -0.069%

- 24-hour change: -2.39%

- 7-day change: -6.87%

- 30-day change: +5.77%

- 1-year change: -74.46%

Market Metrics:

- Market capitalization: $6,892,298.76

- Fully diluted valuation (FDV): $14,680,000

- Circulating supply: 46,950,264 XAVA (46.95% of total supply)

- Total supply: 100,000,000 XAVA

- 24-hour trading volume: $14,389.36

- Number of token holders: 37,427

Market Position:

- Global ranking: #1,358

- Market dominance: 0.00045%

- Trading on 1 exchange

The token is currently experiencing downward pressure in short-term timeframes (1-hour and 7-day), though the 30-day performance shows modest positive movement. Market sentiment indicators reflect extreme fear conditions, with a VIX reading of 25.

Visit XAVA Market Price on Gate.com for real-time trading data

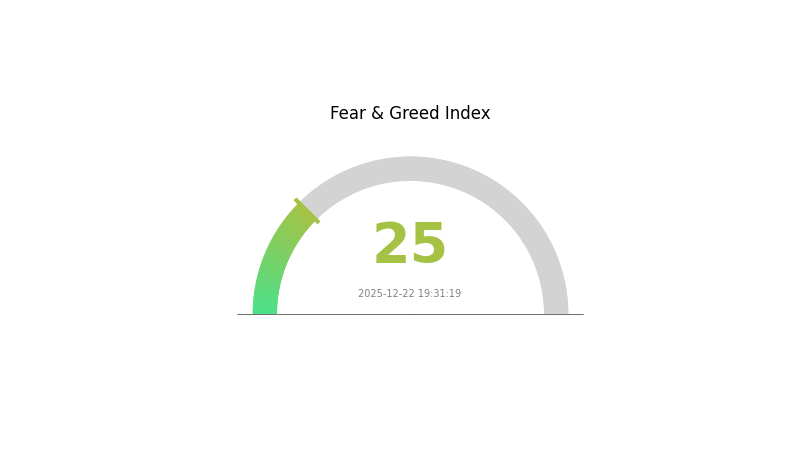

XAVA Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index hitting 25. This reading indicates severe market pessimism and potential capitulation among investors. Such extreme fear levels historically present contrarian buying opportunities for long-term investors, as panic selling often creates attractive entry points. However, proceed with caution and conduct thorough due diligence before making investment decisions. Monitor market developments closely on Gate.com to stay informed about the latest price movements and market trends during this volatile period.

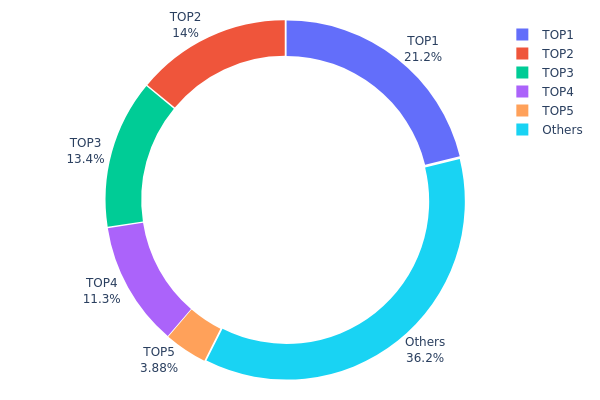

XAVA Holdings Distribution

The address holdings distribution map represents the concentration of token ownership across blockchain addresses, serving as a critical indicator of token decentralization and market structure health. By analyzing the top holders and their respective percentages of total supply, investors can assess the level of wealth concentration, identify potential market risks, and evaluate the token's vulnerability to large-scale liquidations or coordinated selling pressure.

Based on the current data, XAVA exhibits moderate concentration characteristics. The top four addresses collectively hold 59.87% of the total token supply, with the largest holder controlling 21.18%. This concentration level presents both risks and structural considerations for the market. While a single address commanding over 20% of circulating supply could theoretically facilitate significant price movements, the distribution across multiple top holders suggests some degree of decentralization. The remaining 36.26% held by other addresses indicates that a substantial portion of tokens is dispersed across retail investors and smaller stakeholders, which can help mitigate extreme concentration risks.

The current address distribution pattern suggests moderate centralization risk with potential price volatility implications. Should any of the top four holders execute substantial position adjustments, the market could experience notable pressure given their combined dominance. However, the presence of a fragmented "Others" category representing over one-third of supply provides a stabilizing effect on the overall market structure. This distribution indicates XAVA maintains reasonable decentralization fundamentals, though continued monitoring of large holder movements remains essential for assessing on-chain market dynamics and identifying potential inflection points in token accumulation or distribution phases.

Click to view current XAVA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xeb4a...b39576 | 21188.15K | 21.18% |

| 2 | 0x820d...617a8c | 14010.23K | 14.01% |

| 3 | 0xa6a0...ecd329 | 13439.42K | 13.43% |

| 4 | 0xb53e...e10d6a | 11250.00K | 11.25% |

| 5 | 0x5fa1...edce21 | 3875.87K | 3.87% |

| - | Others | 36236.33K | 36.26% |

II. Core Factors Affecting XAVA's Future Price

Technology Development and Ecosystem Construction

-

Avalanche TVL Growth: Recent on-chain data shows that Avalanche's Total Value Locked (TVL) growth rate has been comparable to Solana over the past month, demonstrating strong ecosystem momentum and increasing capital inflows into the network.

-

Ecosystem Expansion: The expansion of the Avalanche ecosystem and community activity levels are key drivers for XAVA's future price performance.

Market Dynamics

- Market Demand: Future price movements are primarily influenced by market demand, technological developments, and overall cryptocurrency market trends.

Note: The provided source materials contained limited and fragmented information specific to XAVA price drivers. The analysis above reflects only the verifiable information that could be extracted from the available resources. For comprehensive price analysis, additional authoritative sources on XAVA's tokenomics, governance mechanisms, institutional adoption, and macroeconomic factors would be beneficial.

III. 2025-2030 XAVA Price Forecast

2025 Outlook

- Conservative Forecast: $0.0937-$0.1464

- Neutral Forecast: $0.1464

- Bullish Forecast: $0.1669 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Phase Expectations: Gradual accumulation phase with increasing adoption and utility expansion

- Price Range Predictions:

- 2026: $0.10652-$0.19268

- 2027: $0.11004-$0.24453

- 2028: $0.18864-$0.28715

- Key Catalysts: Protocol upgrades, partnership announcements, increased institutional interest, and broader market recovery

2029-2030 Long-term Outlook

- Base Case Scenario: $0.12915-$0.29308 (assumes continued mainstream adoption and stable macroeconomic conditions)

- Bullish Case Scenario: $0.20846-$0.31133 (assumes accelerated institutional adoption and favorable regulatory environment)

- Transformative Scenario: $0.31133+ (extreme positive conditions including major enterprise integration, breakthrough utility cases, and significant market capitalization expansion)

- 2030-12-31: XAVA $0.27072 (average projection at year-end)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1669 | 0.1464 | 0.0937 | 0 |

| 2026 | 0.19268 | 0.15665 | 0.10652 | 6 |

| 2027 | 0.24453 | 0.17466 | 0.11004 | 18 |

| 2028 | 0.28715 | 0.2096 | 0.18864 | 42 |

| 2029 | 0.29308 | 0.24837 | 0.12915 | 69 |

| 2030 | 0.31133 | 0.27072 | 0.20846 | 84 |

XAVA Professional Investment Strategy and Risk Management Report

IV. XAVA Professional Investment Strategy and Risk Management

XAVA Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Risk-averse investors seeking exposure to Avalanche ecosystem projects with a medium to long-term investment horizon

- Operational Recommendations:

- Establish a core position during periods of market correction, particularly when XAVA trades below its 30-day average

- Implement dollar-cost averaging (DCA) strategy to mitigate timing risk, allocating funds at regular intervals regardless of price fluctuations

- Monitor the platform's product development and user adoption metrics as key performance indicators for position sizing adjustments

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Monitor trend direction changes and potential reversal points; use for entry and exit signal confirmation

- Relative Strength Index (RSI): Identify overbought conditions above 70 and oversold conditions below 30 for tactical trading opportunities

- Key Trading Points:

- Support levels: Monitor the current price range of $0.1463-$0.1538 for stable accumulation zones

- Resistance identification: Track historical volatility patterns and establish dynamic resistance levels based on weekly consolidation zones

XAVA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Active Investors: 3-7% of total portfolio allocation

- Professional Investors: 7-15% of total portfolio allocation (with hedging strategies in place)

(2) Risk Hedging Strategies

- Position Sizing Protocol: Limit single position to maximum recommended allocation to prevent catastrophic portfolio loss

- Stop-loss Implementation: Establish predetermined exit points at 15-20% below entry price to contain downside exposure

(3) Secure Storage Solutions

- Self-custody Option: Utilize Gate Web3 wallet for direct control of XAVA tokens on Avalanche C-Chain, ensuring private key security and eliminating counterparty risk

- Exchange Custody: Maintain a portion of holdings on Gate.com for active trading liquidity while keeping majority in self-custody

- Security Considerations: Never share private keys or recovery phrases; enable multi-factor authentication; verify contract addresses before transfers (XAVA contract: 0xd1c3f94DE7e5B45fa4eDBBA472491a9f4B166FC4)

V. XAVA Potential Risks and Challenges

XAVA Market Risks

- Price Volatility: XAVA has experienced a 74.46% decline over the past year, indicating significant downside exposure; current 24-hour volatility of -2.39% reflects continued market uncertainty

- Liquidity Constraints: Trading volume of approximately $14,389 USD in 24 hours is relatively modest, potentially resulting in slippage on larger orders

- Market Sentiment: With only 37,427 active holders and 0.00045% market dominance, the token faces limited adoption and network effects

XAVA Regulatory Risks

- Regulatory Uncertainty: Evolving cryptocurrency regulations across jurisdictions could impact platform operations and token utility

- Compliance Requirements: Changes in securities or derivatives regulations could affect XAVA's trading status on regulated exchanges

- Jurisdictional Restrictions: Potential limitations on XAVA trading or holding in certain regulatory frameworks may reduce addressable market

XAVA Technology Risks

- Smart Contract Vulnerabilities: Risks associated with contract execution on Avalanche C-Chain; comprehensive audits and security assessments are critical

- Protocol Dependency: XAVA's functionality depends on the continued stability and security of the Avalanche blockchain network

- Development Execution: Success depends on the Avalaunch team's ability to deliver on product roadmap commitments and maintain technological competitiveness

VI. Conclusion and Action Recommendations

XAVA Investment Value Assessment

Avalaunch positions itself as an investor-centric platform aimed at addressing inefficiencies in the cryptocurrency ecosystem. However, the project faces significant headwinds, including substantial year-over-year price depreciation (-74.46%), limited market capitalization ($14.68 million), and constrained trading liquidity. The token's recent all-time low ($0.137347) achieved in November 2025 suggests continued market skepticism. While the platform's long-term vision of improving product efficiency has merit, current market metrics indicate a highly speculative asset appropriate only for risk-tolerant investors with conviction in the project's turnaround potential.

XAVA Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of portfolio) through dollar-cost averaging on Gate.com; focus on understanding the Avalaunch platform use case before increasing exposure

✅ Experienced Investors: Consider tactical accumulation during further price declines to $0.13-0.14 levels; implement strict stop-losses at 20% below entry and secure majority of holdings in self-custody via Gate Web3 Wallet

✅ Institutional Investors: Conduct comprehensive due diligence on Avalaunch's development roadmap and competitive positioning; any institutional participation should include detailed smart contract audits and regulatory compliance assessments

XAVA Trading Participation Methods

- Direct Purchase on Gate.com: Access XAVA trading pairs; utilize limit orders to optimize entry prices during low volatility periods

- Gate Web3 Wallet Integration: Transfer purchased XAVA to self-custody wallet for long-term holding; verify contract address (0xd1c3f94DE7e5B45fa4eDBBA472491a9f4B166FC4) on Avalanche C-Chain explorer before completing transfers

- Project Ecosystem Participation: Engage with Avalaunch platform offerings to understand platform mechanics and potential use case value drivers

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and should consult with qualified financial advisors. Never invest more than you can afford to lose.

FAQ

What is Xava used for?

Xava is a utility token used within the Xava ecosystem for governance, staking rewards, and accessing platform features. It enables users to participate in protocol decisions and earn yields through various DeFi mechanisms.

What will XAVA price be in 2025?

In 2025, XAVA is expected to reach $6.44 during an upward trend, but could drop to $0.003404 if momentum weakens. Predictions depend on market conditions and adoption rates.

Is XAVA a good investment?

XAVA demonstrates strong long-term investment potential as an Avalanche-based launchpad token with solid fundamentals. However, like all cryptocurrencies, it carries volatility risks. Consider your investment goals and risk tolerance carefully.

How does XAVA compare to other similar cryptocurrencies?

XAVA is an investor-centric DeFi platform built on Avalanche, offering superior transaction speed and lower fees compared to competitors. It provides enhanced yield opportunities and stronger community governance, positioning itself as a compelling alternative in the evolving DeFi ecosystem.

Avalanche (AVAX) 2025 Price Analysis and Market Trends

FTT Explained

2025 PYTH Price Prediction: Analyzing Market Trends and Growth Potential for the Oracle Network Token

2025 VELO Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Next Bull Run

2025 WPrice Prediction: Analyzing Market Trends and Future Valuation of Global W Index

2025 YFI Price Prediction: Potential Growth Factors and Market Analysis for Yearn Finance Token

Integrating USDT Stablecoin into the Solana Ecosystem

Web3 Development Grants: Exciting Opportunities for Blockchain Innovators

Discover Diverse Game Genres and Experiences on Solana's Play-to-Earn Platform

Comprehensive Guide to Securing Your Digital Wallet After a Breach

What is NUMI: A Comprehensive Guide to Understanding Natural User-Machine Interfaces