2025 XNA Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Introduction: XNA's Market Position and Investment Value

Neurai (XNA), as a platform aiming to harness the power of AI algorithms using blockchain assets, has been making strides since its inception in 2023. As of 2025, Neurai's market capitalization has reached $1,601,584, with a circulating supply of approximately 16,015,849,151 tokens, and a price hovering around $0.0001. This asset, often referred to as the "AI-blockchain bridge," is playing an increasingly crucial role in the fields of data analytics, predictive modeling, and IoT connectivity.

This article will provide a comprehensive analysis of Neurai's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering investors professional price forecasts and practical investment strategies.

I. XNA Price History Review and Current Market Status

XNA Historical Price Evolution Trajectory

- 2023: XNA reached its all-time high of $0.0069 on December 29, marking a significant milestone for the project.

- 2024: The market experienced a downturn, with XNA's price declining throughout the year.

- 2025: XNA hit its all-time low of $0.0000981 on November 22, reflecting a challenging period for the token.

XNA Current Market Situation

As of November 25, 2025, XNA is trading at $0.0001, with a market cap of $1,601,584.91. The token has experienced a 1.86% decrease in the last 24 hours and a more substantial 82.95% decline over the past year. XNA's current price is significantly below its all-time high, indicating a prolonged bearish trend. The token's trading volume in the last 24 hours stands at $9,300.92, suggesting moderate market activity. With a circulating supply of 16,015,849,151.30 XNA and a maximum supply of 21,000,000,000, the project has a circulating ratio of 76.27%.

Click to view the current XNA market price

XNA Market Sentiment Indicator

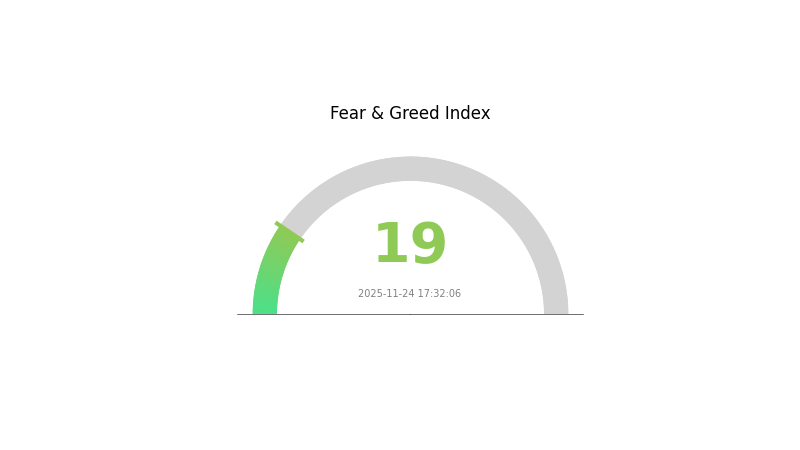

2025-11-24 Fear and Greed Index: 19 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the Fear and Greed Index plummeting to 19. This significant drop indicates widespread pessimism among investors. During such periods of intense fear, savvy traders often view it as a potential buying opportunity, adhering to the contrarian investment strategy of "be fearful when others are greedy, and greedy when others are fearful." However, caution is advised as market sentiment can shift rapidly.

XNA Holdings Distribution

The address holdings distribution data for XNA reveals an interesting pattern in token concentration. With no specific addresses holding significant percentages, it suggests a relatively decentralized distribution of XNA tokens across the network. This absence of large individual holdings indicates that no single entity or wallet has disproportionate control over the token supply.

Such a distribution pattern can be viewed positively for market stability. The lack of whale accounts reduces the risk of sudden large sell-offs that could dramatically impact price. It also suggests a lower likelihood of market manipulation by individual actors. However, it's important to note that this distribution snapshot represents a moment in time, and token movements could alter this picture.

Overall, the current XNA holdings distribution reflects a relatively healthy on-chain structure with a good degree of decentralization. This may contribute to more organic price discovery and potentially lower volatility, although market dynamics are influenced by many factors beyond token distribution alone.

Click to view the current XNA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing XNA's Future Price

Institutional and Whale Dynamics

- Corporate Adoption: Notable companies in the synthetic biology field are adopting XNA technology, potentially driving its value.

Macroeconomic Environment

- Geopolitical Factors: International regulations and policies regarding synthetic biology research may impact XNA's development and adoption.

Technological Development and Ecosystem Building

- Synthetic Biology Advancements: Progress in creating artificial life forms and XNA-based systems could significantly affect XNA's value.

- Ecosystem Applications: XNA is being explored for applications in new drug development, live therapies, biosensors, sustainable biofuel production, and biomaterial manufacturing.

III. XNA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00006 - $0.00008

- Neutral prediction: $0.00008 - $0.00012

- Optimistic prediction: $0.00012 - $0.00014 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.00012 - $0.00014

- 2028: $0.00009 - $0.00018

- Key catalysts: Technological advancements, wider market adoption, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00013 - $0.00018 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00018 - $0.00024 (assuming strong market performance and increased utility)

- Transformative scenario: $0.00024 - $0.00030 (assuming breakthrough technology adoption and market leadership)

- 2030-12-31: XNA $0.00017 (66% growth from 2025, indicating positive long-term trend)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00014 | 0.0001 | 0.00006 | 0 |

| 2026 | 0.00013 | 0.00012 | 0.00009 | 18 |

| 2027 | 0.00014 | 0.00012 | 0.00012 | 22 |

| 2028 | 0.00018 | 0.00013 | 0.00009 | 31 |

| 2029 | 0.00018 | 0.00016 | 0.00009 | 56 |

| 2030 | 0.00024 | 0.00017 | 0.00013 | 66 |

IV. XNA Professional Investment Strategies and Risk Management

XNA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate XNA during market dips

- Set price targets for partial profit-taking

- Store XNA in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trend directions and potential reversals

- RSI (Relative Strength Index): Spot overbought/oversold conditions

- Key points for swing trading:

- Monitor XNA's correlation with broader crypto market trends

- Set strict stop-loss orders to manage downside risk

XNA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for XNA

XNA Market Risks

- High volatility: XNA price may experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Market sentiment: Susceptible to broader crypto market trends

XNA Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on AI-related cryptocurrencies

- Cross-border compliance: Challenges in adhering to varying international regulations

- Tax implications: Evolving tax laws may impact XNA holders

XNA Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the XNA protocol

- Scalability challenges: May face issues as the network grows

- Competitive pressure: Risk of being outpaced by other AI-focused blockchain projects

VI. Conclusion and Action Recommendations

XNA Investment Value Assessment

XNA presents a speculative opportunity in the AI-blockchain intersection, with potential long-term value but significant short-term risks due to market volatility and project maturity.

XNA Investment Recommendations

✅ Beginners: Consider small, exploratory positions after thorough research

✅ Experienced investors: Implement dollar-cost averaging with strict risk management

✅ Institutional investors: Conduct comprehensive due diligence and consider as part of a diversified crypto portfolio

XNA Trading Participation Methods

- Spot trading: Buy and hold XNA on reputable exchanges like Gate.com

- Staking: Participate in XNA staking programs if available

- DeFi integration: Explore decentralized finance options involving XNA as they develop

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

DeepSnitch AI is predicted to 1000x by 2026, developing AI tools for crypto trading. Other potential 1000x candidates include Pi Network and PUMP.

Will Solana hit $1000 dollars?

Yes, Solana could potentially hit $1000 during a strong bull market. Some experts predict it might even reach $2000 with favorable conditions and announcements.

Does nano coin have a future?

Yes, Nano has a promising future. Its ongoing development into a commercial-grade financial network and continuous improvements suggest it could become a significant player in the cryptocurrency market by 2025.

How high will Solana go in 2025?

Solana may reach $336.25 in 2025, with an average price around $302.69 based on expert forecasts and current market trends.

2025 TRACAI Price Prediction: Analyzing Market Trends and Potential Growth Factors

COOKIE vs CHZ: A Sweet Showdown Between Dessert Favorites

2025 CGPT Price Prediction: Expert Analysis and Market Forecast for the Next Year

Sahara AI (SAHARA) Price Analysis: Recent Volatility Trends and Market Correlations

why is crypto crashing and will it recover ?

KAITO Price Prediction 2025, 2x or 10x?

What is HBAR price volatility in 2025: support and resistance levels analyzed

Is EVAA Protocol (EVAA) a good investment?: A Comprehensive Analysis of Price Potential, Risk Factors, and Future Prospects

What are the major security risks and smart contract vulnerabilities facing HBAR in 2025?

What is SHIB token holdings and fund flow: exchange net inflows, concentration, staking rate, and on-chain lock-up analysis?

What is Kaspa (KAS) vs Bitcoin: Competitive Analysis of Performance, Market Cap, and User Base in 2025?