2025 XTER Price Prediction: Expert Analysis and Market Outlook for the Next Generation of Blockchain Technology

Introduction: Market Position and Investment Value of XTER

Xterio (XTER) is a global, cross-platform play-and-earn developer and publisher dedicated to creating deeply engaging gaming worlds enhanced by digital ownership. As of December 24, 2025, XTER has a market capitalization of approximately $4.16 million with a circulating supply of 141.63 million tokens, trading at around $0.02935 per token. This innovative gaming asset is playing an increasingly important role in the Web3 gaming ecosystem.

This article will provide a comprehensive analysis of XTER's price dynamics and market trends, combining historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to offer investors professional price forecasts and actionable investment strategies for the period ahead.

Xterio (XTER) Market Analysis Report

I. XTER Price History Review and Current Market Status

XTER Historical Price Trajectory

Based on available data, Xterio (XTER) has experienced significant volatility since its market emergence:

- September 13, 2025: All-Time High (ATH) reached at $0.13862, representing the peak valuation during the token's trading history.

- December 17, 2025: All-Time Low (ATL) recorded at $0.02779, marking the lowest point in token value.

- December 24, 2025: Token currently trading at $0.02935, reflecting a continued downward pressure with a 92.63% decline over the past year.

XTER Current Market Dynamics

As of December 24, 2025, XTER is trading at $0.02935 with the following market characteristics:

Price Performance:

- 1-hour change: -0.48%

- 24-hour change: -1.54%

- 7-day change: -8.30%

- 30-day change: -38.17%

- 1-year change: -92.63%

Market Capitalization Metrics:

- Market Cap: $4,156,861.51

- Fully Diluted Valuation (FDV): $29,350,000.00

- Market Cap to FDV Ratio: 14.16%

- Market Dominance: 0.00092%

Supply and Distribution:

- Circulating Supply: 141,630,716 XTER (14.16% of total supply)

- Total Supply: 1,000,000,000 XTER

- Maximum Supply: 1,000,000,000 XTER

- Token Holders: 28,156

Trading Activity:

- 24-hour Trading Volume: $12,387.35

- High (24h): $0.03018

- Low (24h): $0.0292

- Listed on: 15 exchanges

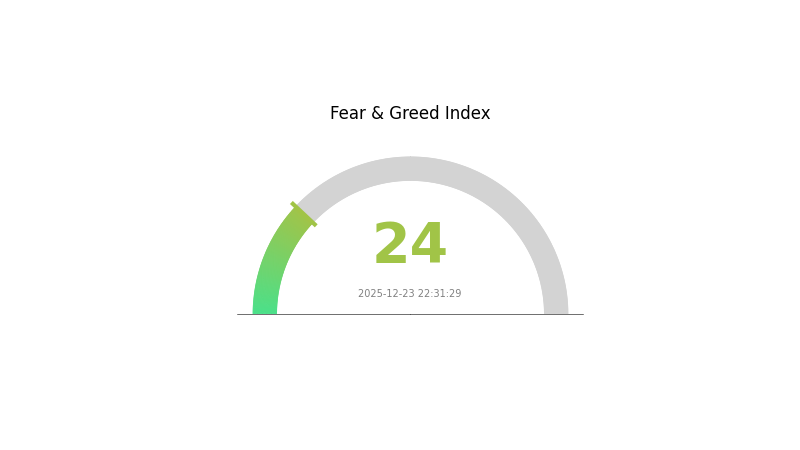

Market Sentiment: The current market sentiment reflects extreme fear (VIX: 24), indicating heightened investor anxiety and risk aversion in the broader cryptocurrency market.

Check current XTER market price

XTER Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index dropping to 24. This indicates significant market pessimism and heightened risk aversion among investors. During such periods of extreme fear, opportunities often emerge for contrarian investors. Market volatility typically peaks when sentiment reaches this level, creating potential entry points for long-term investors. However, caution remains essential as further downside movements could occur. Monitor key support levels closely and consider dollar-cost averaging strategies to mitigate timing risks during this period of market distress.

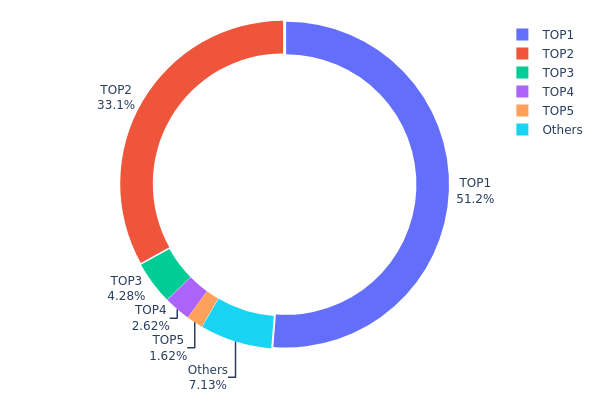

XTER Holdings Distribution

Address holdings distribution refers to the on-chain allocation of tokens across different wallet addresses, serving as a critical indicator of token concentration and market structure health. This metric reveals the degree of decentralization by measuring what percentage of total supply is held by top addresses versus distributed among the broader holder base.

The current XTER holdings data exhibits pronounced concentration risk. The top two addresses control 84.35% of the total supply, with the leading address alone commanding 51.25% of all tokens in circulation. This extreme concentration in the top tier represents a significant structural imbalance, leaving the asset vulnerable to potential large-scale selling pressure or coordinated movements by these major holders. While the third-ranked address holds a notably reduced 4.28%, the steep drop-off from rank two to rank three underscores the binary concentration pattern rather than a gradual, healthy distribution curve.

From a market stability perspective, such high concentration levels introduce substantial systemic risk. The top holders possess disproportionate influence over price discovery and market sentiment, potentially enabling significant value manipulation through coordinated transactions. The remaining 7.14% distributed across other addresses suggests limited decentralization among smaller participants, further constraining organic market participation and liquidity resilience. This distribution pattern indicates XTER currently lacks the decentralized holder base typical of mature cryptographic assets, with the network's health and price stability heavily dependent on the behavior and intentions of a small number of actors.

Click to view current XTER holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0876...c6199f | 512500.00K | 51.25% |

| 2 | 0x8dab...0d4690 | 331000.00K | 33.10% |

| 3 | 0x0fb8...9e2fd8 | 42823.56K | 4.28% |

| 4 | 0x93de...85d976 | 26151.24K | 2.61% |

| 5 | 0xc851...bcbaf2 | 16226.82K | 1.62% |

| - | Others | 71298.38K | 7.14% |

Core Factors Influencing XTER's Future Price Movement

Supply Mechanism

-

Token Unlock Schedule: Market concerns regarding upcoming token unlock plans have triggered selling pressure among speculative holders. The December 2025 market data shows XTER experienced an 18.2% decline partly due to worries about token release schedules and their potential impact on token supply dynamics.

-

Current Impact: The token unlock concerns remain a significant downward pressure on price momentum. Investors are closely monitoring the vesting schedule and its implications for market supply equilibrium.

Institutional and Major Holder Dynamics

-

Institutional Investment: Binance Labs invested $15 million in Xterio in July 2023 to expand the platform's AI and Web3 gaming development capabilities, signaling institutional confidence in the project's long-term potential.

-

Strategic Partnerships: Xterio has established strategic collaborations with major gaming industry players. XPLA serves as one of the lead investors in Xterio's $40 million funding round, facilitating integration of Xterio's games and digital assets into the XPLA ecosystem. Com2uS, through its partnership with XPLA, represents potential access to established gaming franchises on the Xterio platform.

Macroeconomic Environment

-

Market Sentiment: The Fear and Greed Index stands at 29 (Fear territory) as of December 2025, reflecting cautious market sentiment. Global cryptocurrency market capitalization hovers near $3.05 trillion, creating a risk-averse environment for emerging gaming tokens like XTER.

-

Regulatory Dynamics: Market sentiment remains influenced by regulatory developments and institutional adoption trends. Current macroeconomic uncertainty has contributed to elevated selling pressure across altcoin segments.

Technology Development and Ecosystem Building

-

AI Integration: Xterio has integrated AI technology through collaboration with Palio, an AI agent project developed by researchers from OpenAI, Stanford University, and Google Brain. Palio functions as an AI companion within Xterio games, enhancing player interaction, task completion, and in-game guidance.

-

GameFi Infrastructure: Xterio provides a comprehensive GameFi-as-a-Service (GaaS) platform featuring an end-to-end blockchain gaming solution. The platform includes Web2 and Web3 tool suites, APIs, and pre-built smart contracts enabling traditional game developers to seamlessly integrate blockchain technology while maintaining high-quality player experience and digital asset ownership.

-

Platform Development: The Xterio platform includes a game gallery, NFT marketplace, on-chain interface, decentralized identity system, integrated wallet, and community applications. Key titles in development include Overworld, Age of Dino, and 3T, with Titans Legend in closed beta testing.

-

Soul-Bound Token (SBT) System: Xsoul represents Xterio's first SBT initiative, rewarding and recognizing important community members with non-transferable, non-tradeable tokens providing permanent user benefits and whitelist access to future NFT offerings.

-

Community Recognition Program: The platform operates a tiered badge system including gold badges for community members and pink badges for content creators with 10,000+ social media followers, fostering ecosystem participation and content creation.

Three. 2025-2030 XTER Price Forecast

2025 Outlook

- Conservative Forecast: $0.01584 - $0.02933

- Base Case Forecast: $0.02933

- Optimistic Forecast: $0.03725 (requires market recovery and positive sentiment shift)

2026-2028 Medium-Term Outlook

- Market Stage Expectation: Gradual recovery phase with steady accumulation period, characterized by incremental institutional interest and ecosystem development

- Price Range Forecast:

- 2026: $0.01864 - $0.04694

- 2027: $0.0361 - $0.05375

- 2028: $0.02863 - $0.06852

- Key Catalysts: Technological upgrades, increased adoption metrics, market sentiment recovery, strengthening of fundamental use cases, and positive regulatory developments

2027-2030 Long-Term Outlook

- Base Case Scenario: $0.04011 - $0.05375 (assumes steady ecosystem growth and moderate market expansion)

- Optimistic Scenario: $0.05773 - $0.06852 (assumes accelerated adoption, successful protocol upgrades, and broader market bull phase)

- Transformative Scenario: $0.06235 - $0.07606 (assumes breakthrough developments, mainstream integration, substantial increase in user base and transaction volume)

- 2030-12-24: XTER at $0.07606 (reaching projected peak under favorable accumulation conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03725 | 0.02933 | 0.01584 | 0 |

| 2026 | 0.04694 | 0.03329 | 0.01864 | 13 |

| 2027 | 0.05375 | 0.04011 | 0.0361 | 36 |

| 2028 | 0.06852 | 0.04693 | 0.02863 | 59 |

| 2029 | 0.06696 | 0.05773 | 0.03002 | 96 |

| 2030 | 0.07606 | 0.06235 | 0.04053 | 112 |

Xterio (XTER) Professional Investment Strategy and Risk Management Report

IV. XTER Professional Investment Strategy and Risk Management

XTER Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Web3 gaming enthusiasts, blockchain technology believers, and patient capital allocators with 2-5 year investment horizons

- Operational Recommendations:

- Dollar-cost averaging (DCA) approach: Allocate fixed capital amounts monthly to reduce timing risk and volatility impact

- Set clear long-term targets: Establish predetermined price levels or project milestones before exiting positions

- Monitor project development: Track Xterio's game launches, studio expansions, and Web3 ecosystem integration progress

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages (MA): Use 20-day and 50-day moving averages to identify trend direction and support/resistance levels

- RSI (Relative Strength Index): Monitor overbought (>70) and oversold (<30) conditions for potential entry and exit signals

- Range Trading Key Points:

- Support Level: $0.0292 (24-hour low) represents a strong buying zone

- Resistance Level: $0.03018 (24-hour high) marks potential profit-taking levels

- Volume Analysis: Trade confirmation requires above-average 24-hour trading volume

XTER Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of total portfolio allocation

- Aggressive Investors: 5-8% of total portfolio allocation

- Professional Investors: 8-12% of total portfolio allocation with derivative hedging strategies

(2) Risk Hedging Solutions

- Position Sizing: Limit single-position exposure to prevent catastrophic losses during extreme market downturns

- Staggered Entry Strategy: Enter positions gradually across multiple price points rather than lump-sum purchases to reduce timing risk

(3) Secure Storage Solutions

- Hardware Storage Option: Consider cold storage solutions for long-term holdings exceeding 6-12 months

- Hot wallet Management: Use reputable wallet providers for active trading and short-term holdings

- Security Precautions: Enable multi-signature authentication, maintain backup seed phrases offline, and never share private keys or recovery phrases with any entity

V. XTER Potential Risks and Challenges

XTER Market Risks

- Severe Price Volatility: XTER has experienced a -92.63% decline over the past year, reflecting extreme sensitivity to market sentiment and gaming sector performance fluctuations

- Limited Trading Volume: Current 24-hour trading volume of $12,387.35 is relatively modest, potentially resulting in increased slippage during larger trades and difficulty executing exit strategies

- Speculative Sentiment Dominance: Market emotions heavily influence pricing, creating susceptibility to pump-and-dump dynamics and sudden capitulation events

XTER Regulatory Risks

- Gaming Industry Regulation: Different jurisdictions implement varying regulatory frameworks for play-to-earn gaming models, potentially affecting Xterio's operational scope and revenue streams

- Token Classification Uncertainty: Regulatory classification of XTER as a security or utility token remains ambiguous in several major markets, creating potential compliance challenges

- Cross-Border Operational Constraints: Different countries may impose restrictions on blockchain-based gaming platforms and token transactions, affecting user access and market expansion

XTER Technical Risks

- Smart Contract Vulnerabilities: All BEP-20 tokens face potential security risks from smart contract bugs, though established standards reduce but do not eliminate this threat

- Blockchain Network Dependency: XTER operations depend on BSC network stability; network congestion or security incidents could impact trading and functionality

- Ecosystem Development Execution: Successful Web3 universe expansion requires significant technical development; delays or failed implementations could undermine token utility and adoption

VI. Conclusions and Action Recommendations

XTER Investment Value Assessment

Xterio presents a high-risk, speculative investment opportunity in the play-to-earn gaming sector. The project's global studio infrastructure across major tech hubs (San Francisco, Los Angeles, Tokyo, Singapore) demonstrates operational credibility. However, the -92.63% year-over-year decline and limited market capitalization ($4.16 million) indicate either significant market repricing or fundamental challenges. The 14.16% circulating-to-fully-diluted valuation ratio suggests potential future dilution risks. Investors should view XTER as an early-stage venture investment requiring substantial patience and capital preservation discipline.

XTER Investment Recommendations

✅ Beginners: Start with micro positions (0.5-1% of portfolio) through Gate.com's trading platform using DCA strategies; focus on understanding project fundamentals before increasing exposure

✅ Experienced Investors: Implement position-based trading strategies with strict stop-loss levels at -15 to -20% below entry points; monitor quarterly gaming releases and studio announcements for catalysts

✅ Institutional Investors: Conduct comprehensive due diligence on Xterio's game pipeline and revenue models; consider positions only after validating project traction and user adoption metrics

XTER Trading Participation Methods

- Spot Trading: Purchase XTER directly on Gate.com against BNB or stablecoins for long-term holdings or active trading

- Limit Orders: Set predetermined buy/sell prices to capture strategic entry and exit points without constant market monitoring

- Staking and Rewards: Monitor potential yield opportunities and liquidity farming programs as the ecosystem develops

Cryptocurrency investment carries extreme risk and is highly speculative. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial circumstances. Consult professional financial advisors before making investment decisions. Never invest capital that you cannot afford to lose completely.

FAQ

What is the price prediction for Xterio airdrop?

Based on current market analysis, Xterio (XTER) is predicted to reach approximately $0.02083 by end of 2025. However, price predictions depend on market conditions, adoption rates, and overall crypto sentiment. Long-term growth potential exists as the project develops.

How much is the xter coin worth today?

As of today, Xter coin is worth $0.02994. The price has increased 0.7% in the past hour and 0.4% since yesterday, though it has decreased 5.7% over the past week.

What factors influence XTER price movements and market sentiment?

XTER price movements are driven by trading volume, technical indicators like RSI and moving averages, market sentiment, adoption trends, and broader cryptocurrency market dynamics. Current sentiment remains bearish.

2025 AXS Price Prediction: Analyzing Market Trends and Potential Growth Factors for Axie Infinity's Token

2025 STARHEROES Price Prediction: Analyzing Market Trends and Growth Potential for the Rising Crypto Asset

2025 APRS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 VOXEL Price Prediction: Expert Analysis and Market Forecast for the Next 12 Months

2025 APRS Price Prediction: Analyzing Market Trends and Future Outlook for Aspires Token

2025 WNDR Price Prediction: Expert Analysis and Market Forecast for the Digital Asset

Leading Incubation Platform Launches Season 4 Program with 14 Blockchain Projects

What is DeFi, and how is it different from traditional finance?

Mobile Mining: A Guide and Overview

Futures Là Gì? Hướng Dẫn Giao Dịch Futures Cho Người Mới

Is Web3 Dead?