2025 ZEX Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: ZEX's Market Position and Investment Value

Zeta Markets (ZEX) is building the fastest, simplest and most secure perpetual derivatives platform on the market. Since its launch in June 2024, ZEX has established itself as a significant player in the decentralized derivatives space. As of December 21, 2025, ZEX has a market capitalization of approximately $69.57 million with a circulating supply of 181.44 million tokens, currently trading at $0.06957. Leveraging Solana's cutting-edge scalability, this innovative asset combines CEX-comparable features and performance while maintaining the self-custodial nature and transparency inherent to decentralized platforms.

This article will provide a comprehensive analysis of ZEX's price dynamics from 2025 through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors. The analysis aims to equip investors with professional price forecasts and actionable investment strategies for navigating ZEX's market trajectory.

I. ZEX Price History Review and Current Market Status

ZEX Historical Price Movement Trajectory

- June 2024: ZEX reached its all-time high of $0.3184 on June 27, 2024, marking the peak of early trading momentum following the token's launch.

- August 2024: The token experienced a significant decline, reaching its all-time low of $0.0218 on August 5, 2024, representing a sharp correction from peak valuations.

- December 2025: ZEX trades at $0.06957, demonstrating recovery from the August lows while remaining substantially below historical peaks.

ZEX Current Market Status

As of December 21, 2025, ZEX is trading at $0.06957, reflecting a 3.63% decline over the past 24 hours. The token shows mixed performance across different timeframes: it has declined 0.37% in the last hour, fallen 22.17% over the past week, and dropped 17.22% over the past month. On a one-year basis, ZEX has depreciated 3.28% from launch levels.

The token commands a market capitalization of approximately $12.62 million with a fully diluted valuation of $69.57 million. The 24-hour trading volume stands at $41,964.09, indicating moderate liquidity in the current market environment. ZEX maintains a market share of 0.0021% within the broader cryptocurrency ecosystem, with a circulating supply of 181,438,032 tokens out of a maximum supply of 1,000,000,000.

Currently ranked at position 1,065 by market cap, ZEX is held by approximately 30,127 token holders. The asset is listed on 4 exchanges, with Gate.com being a primary trading venue. Market sentiment indicators reflect extreme fear conditions with a VIX reading of 20.

Click to view current ZEX market price

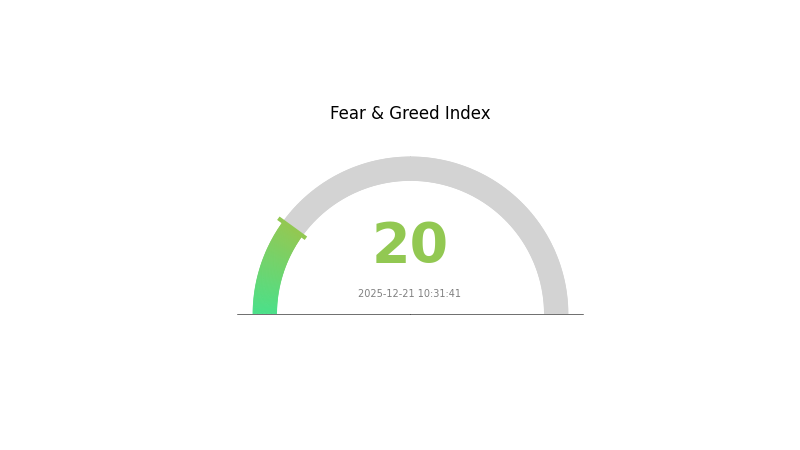

ZEX Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 20. This reading signals heightened market anxiety and significant selling pressure across digital assets. During such periods, investors often panic sell, creating potential buying opportunities for contrarian traders. However, extreme fear also indicates elevated volatility and risk. Market participants should exercise caution, conduct thorough research, and consider their risk tolerance before making investment decisions. Long-term investors may view this as an accumulation opportunity, while short-term traders should remain vigilant about further downside movements.

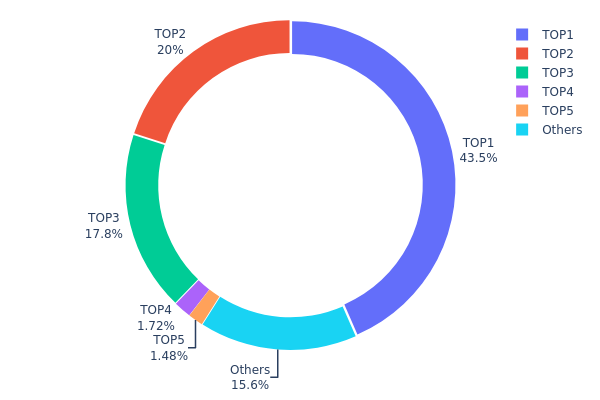

ZEX Holdings Distribution

Address holdings distribution represents the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing decentralization levels and potential market manipulation risks. By analyzing the top holders and their proportional stake in total circulating supply, investors can gauge the degree of wealth concentration and the likelihood of coordinated selling or price volatility stemming from large holders.

ZEX currently exhibits pronounced concentration risk, with the top three addresses commanding 81.22% of all tokens in circulation. The largest holder alone maintains a dominant position at 43.45%, while the second and third largest holders account for 20.00% and 17.77% respectively. This extreme concentration in the hands of a few addresses raises significant concerns regarding market stability and decentralization principles. The remaining 15.58% distributed among other addresses, combined with the top five holders representing 84.42% of total supply, underscores a highly centralized token structure.

Such concentrated holdings present meaningful implications for price discovery and market dynamics. The potential for coordinated token movements by these major stakeholders could introduce substantial volatility and create asymmetric information advantages. Additionally, the heavy reliance on a small number of addresses for liquidity and market participation suggests limited genuine market depth and elevated risk of rapid price fluctuations driven by individual holder decisions rather than organic market forces.

Click to view current ZEX holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | Bs5XaF...T2DBXt | 434524.48K | 43.45% |

| 2 | 3zmHxC...NfrbAN | 200000.00K | 20.00% |

| 3 | EibcRb...HqyrAT | 177703.40K | 17.77% |

| 4 | AC5RDf...CWjtW2 | 17231.41K | 1.72% |

| 5 | BWLKab...i98GN2 | 14829.50K | 1.48% |

| - | Others | 155708.31K | 15.58% |

II. Core Factors Affecting ZEX Future Price

Market Demand and Investor Confidence

-

Market Demand: ZEX's future price is primarily influenced by market demand and investor confidence in the token. As the native token of Zeta Markets, a decentralized options platform, its value is directly tied to platform adoption and user activity.

-

DeFi Platform Activity: ZEX's market prospects are closely related to the activity level of the DeFi options market. Growth in active users and trading volume on Zeta Markets can drive increased demand for the governance token.

-

Regulatory Environment: The regulatory landscape surrounding cryptocurrency and DeFi platforms significantly impacts ZEX's price trajectory. Favorable regulatory developments can boost investor confidence, while regulatory uncertainty may create downward pressure.

Broader Cryptocurrency Market Trends

-

Market Sentiment: ZEX's price movement is influenced by overall cryptocurrency market trends and sentiment. During bull markets, positive sentiment typically supports token valuations, while bear market conditions can suppress prices across the sector.

-

Correlation with Major Assets: As an altcoin, ZEX tends to correlate with Bitcoin and Ethereum price movements, particularly during periods of significant market volatility.

III. 2025-2030 ZEX Price Forecast

2025 Outlook

- Conservative Forecast: $0.05705 - $0.06957

- Base Case Forecast: $0.06957

- Optimistic Forecast: $0.08348 (requires sustained market interest and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with increasing adoption momentum, transitioning toward mainstream recognition with stabilizing fundamentals.

- Price Range Predictions:

- 2026: $0.06734 - $0.10484 (10% upside potential)

- 2027: $0.05985 - $0.13331 (30% upside potential)

- 2028: $0.07952 - $0.16239 (60% upside potential)

- Key Catalysts: Enhanced tokenomics implementation, strategic partnerships, ecosystem expansion, improved market liquidity on platforms like Gate.com, and growing institutional interest in the asset class.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.09055 - $0.18796 (97% upside potential by 2029), achieving stronger market positioning through proven use cases and network effects.

- Optimistic Scenario: $0.15445 - $0.1707 (133% cumulative upside by 2030), contingent on widespread adoption and successful protocol upgrades.

- Transformation Scenario: $0.1707+ (assuming radical regulatory clarity, major institutional adoption surge, and ZEX becoming a dominant player in its category).

- 2025-12-21: ZEX trading at baseline levels, establishing foundation for multi-year growth trajectory.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.08348 | 0.06957 | 0.05705 | 0 |

| 2026 | 0.10484 | 0.07653 | 0.06734 | 10 |

| 2027 | 0.13331 | 0.09068 | 0.05985 | 30 |

| 2028 | 0.16239 | 0.112 | 0.07952 | 60 |

| 2029 | 0.18796 | 0.13719 | 0.09055 | 97 |

| 2030 | 0.1707 | 0.16258 | 0.15445 | 133 |

ZEX Investment Strategy and Risk Management Report

IV. ZEX Professional Investment Strategy and Risk Management

ZEX Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors seeking exposure to decentralized perpetual futures trading with a long-term growth horizon

- Operational Recommendations:

- Accumulate ZEX during market downturns to build a diversified crypto portfolio position

- Hold through market cycles to benefit from potential protocol adoption and ecosystem expansion

- Reinvest any staking rewards or yield generated from ZEX holdings to compound returns over time

- Set a multi-year investment timeline (3-5 years minimum) to weather market volatility

(2) Active Trading Strategy

-

Price Action Analysis:

- Monitor support and resistance levels: Current support around $0.0694-$0.0695 (24H low), with resistance near $0.0724 (24H high)

- Track volume patterns during market movements to confirm trend strength

- Observe price behavior during major market news or protocol announcements

-

Wave Trading Key Points:

- Utilize the significant downtrend context (down 22.17% in 7 days) to identify potential reversal opportunities

- Set position sizes accordingly given current market conditions and volatility

- Consider scaling into positions rather than entering at once during uncertain market phases

ZEX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total crypto portfolio allocation

- Moderate Investors: 3-7% of total crypto portfolio allocation

- Aggressive Investors: 7-15% of total crypto portfolio allocation

(2) Risk Hedging Strategies

- Position Sizing: Limit individual trade size to no more than 2-5% of total trading capital to protect against sudden price movements

- Stop-Loss Implementation: Set automated stop-loss orders at 15-20% below entry price to limit downside exposure

(3) Secure Storage Solutions

- Self-Custody Approach: Store ZEX tokens on Solana-compatible wallets by maintaining private key control through hardware backup methods

- Exchange Holdings: For active trading, maintain only necessary ZEX on Gate.com for immediate trading operations

- Security Considerations: Enable two-factor authentication on all exchange accounts; never share private keys or seed phrases; verify all wallet addresses before transactions; be cautious of phishing attempts targeting Solana ecosystem users

V. ZEX Potential Risks and Challenges

ZEX Market Risks

- High Volatility: ZEX has experienced significant price swings, declining 3.63% in 24 hours and 22.17% over 7 days, indicating substantial market volatility that can lead to rapid losses

- Low Liquidity on Secondary Markets: With only 4 exchange listings and 24-hour trading volume of approximately $41,964, ZEX exhibits limited liquidity which may result in high slippage during large trades

- Concentration Risk: Approximately 81.86% of total supply remains in circulation potential reserves, creating supply dilution risks if tokens enter the market

ZEX Regulatory Risks

- DeFi Regulatory Uncertainty: As a decentralized derivatives platform, ZEX operates in an evolving regulatory landscape where potential restrictions on derivatives trading could impact platform viability

- Jurisdictional Compliance: Different regulatory approaches across jurisdictions may limit user access to the platform or restrict certain trading features

- Evolving Stablecoin Regulations: Since perpetual DEXs rely on stablecoins for margin and settlement, regulatory changes affecting stablecoins could directly impact ZEX operations

ZEX Technology Risks

- Solana Network Dependencies: ZEX's performance and availability are directly tied to Solana's network stability; any Solana network outages or congestion could disrupt trading operations

- Smart Contract Vulnerabilities: As a complex derivatives protocol, potential undiscovered security flaws in smart contracts could lead to fund loss or operational failures

- Competitive Platform Pressure: Increasing competition from other perpetual DEXs on Solana and other blockchains may impact user adoption and trading volumes

VI. Conclusions and Action Recommendations

ZEX Investment Value Assessment

Zeta Markets presents a specialized investment opportunity for participants seeking exposure to decentralized perpetual derivatives trading on the Solana blockchain. The platform's focus on speed, simplicity, and security addresses key pain points in derivatives trading. However, investors must recognize that ZEX carries significant risk factors including extreme price volatility, limited market liquidity, regulatory uncertainty surrounding DeFi derivatives, and dependencies on Solana network stability. The project is still in growth phases with relatively low market capitalization ($12.6 million) and circulating supply metrics suggesting substantial dilution potential. Investment should be approached with appropriate risk management and realistic return expectations.

ZEX Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% of crypto portfolio) on Gate.com to understand the platform mechanics before scaling up; prioritize education on perpetual derivatives mechanics and risk management before trading

✅ Experienced Investors: Allocate 3-7% of crypto portfolio with active position management based on technical analysis; utilize volatility cycles for tactical entries and exits; maintain strict stop-loss disciplines given current market conditions

✅ Institutional Investors: Conduct thorough due diligence on smart contract audits and protocol governance structures; negotiate custom positions through Gate.com's institutional services; maintain diversified exposure across multiple DeFi protocols rather than concentrated ZEX positions

ZEX Trading Participation Methods

- Spot Trading on Gate.com: Purchase and hold ZEX tokens directly through Gate.com's spot trading markets for long-term holding strategies

- Liquidity Protocol Participation: Engage with Zeta's native trading venues on the Solana blockchain to experience the core perpetual derivatives functionality

- Dollar-Cost Averaging: Implement systematic purchases over time to reduce timing risk, particularly given current price volatility

Cryptocurrency investments carry extreme risk and this report does not constitute investment advice. Investors must conduct independent research and consult with professional financial advisors before making any investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Does ZEC have a future?

Yes. With privacy features gaining renewed attention and a halving event scheduled for November 2025, ZEC's long-term outlook remains strong. Market trends indicate potential growth ahead.

Is ZEC Coin a good investment?

ZEC Coin offers strong technical fundamentals and privacy features that appeal to long-term investors. With solid community support and growing adoption, it presents promising investment potential for those seeking privacy-focused cryptocurrencies.

What factors influence ZEX price predictions?

ZEX price predictions are influenced by supply and demand dynamics, block reward changes, protocol updates, market sentiment, trading volume, and broader cryptocurrency market trends.

How does ZEC compare to other privacy coins in terms of adoption and value potential?

ZEC leads in institutional adoption with strong partnerships and real-world use cases. Its established ecosystem and regulatory clarity position it favorably against competitors, offering superior value potential in the privacy coin sector.

Is Zeta Markets (ZEX) a Good Investment?: Analyzing Growth Potential and Risks in the DeFi Options Market

2025 ZEXPrice Prediction: Analyzing Market Trends and Expert Forecasts for the Future of ZEX Token

Is Drift Protocol (DRIFT) a good investment?: Analyzing the potential and risks of this decentralized trading platform

Is Drift Protocol (DRIFT) a good investment?: Analyzing the potential and risks of this decentralized derivatives platform

2025 ORCA Price Prediction: Will This DeFi Token Surge or Sink in the Crypto Ocean?

TURBOS vs SOL: The Battle of High-Performance Engines in Modern Automotive Engineering

How to Set Price Alerts for Cryptocurrency on Mobile and Desktop

ONG price prediction analysis: Is Ontology Gas undervalued after token burning?

Introduction to Spark Token and Flare Network for Beginners

What is SAROS: Understanding the Ancient Eclipse Cycle and Its Modern Applications

Can You Mine Bitcoin on Your Smartphone?