2026 ADAPAD Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: ADAPAD's Market Position and Investment Value

ADAPad (ADAPAD), as a deflationary token launch platform on Cardano, has been operating in the crypto ecosystem since its inception. As of February 2026, ADAPAD maintains a market cap of approximately $405,809, with a circulating supply of around 371.28 million tokens, and the price hovering around $0.001093. This asset, characterized by its unique deflationary mechanisms including a 10% fee on token sales and up to 25% early unlock fees, is playing a role in the token launch infrastructure within the Cardano ecosystem.

This article will comprehensively analyze ADAPAD's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ADAPAD Price History Review and Market Status

ADAPAD Historical Price Evolution Trajectory

- October 2021: ADAPAD reached its price peak at $1.28, marking a significant milestone in the token's early trading period.

- 2021-2025: The token experienced a prolonged downward trend, with price declining substantially from its all-time high.

- February 2026: ADAPAD hit its historical low at approximately $0.00107734, representing a decline of over 99% from its peak value.

ADAPAD Current Market Situation

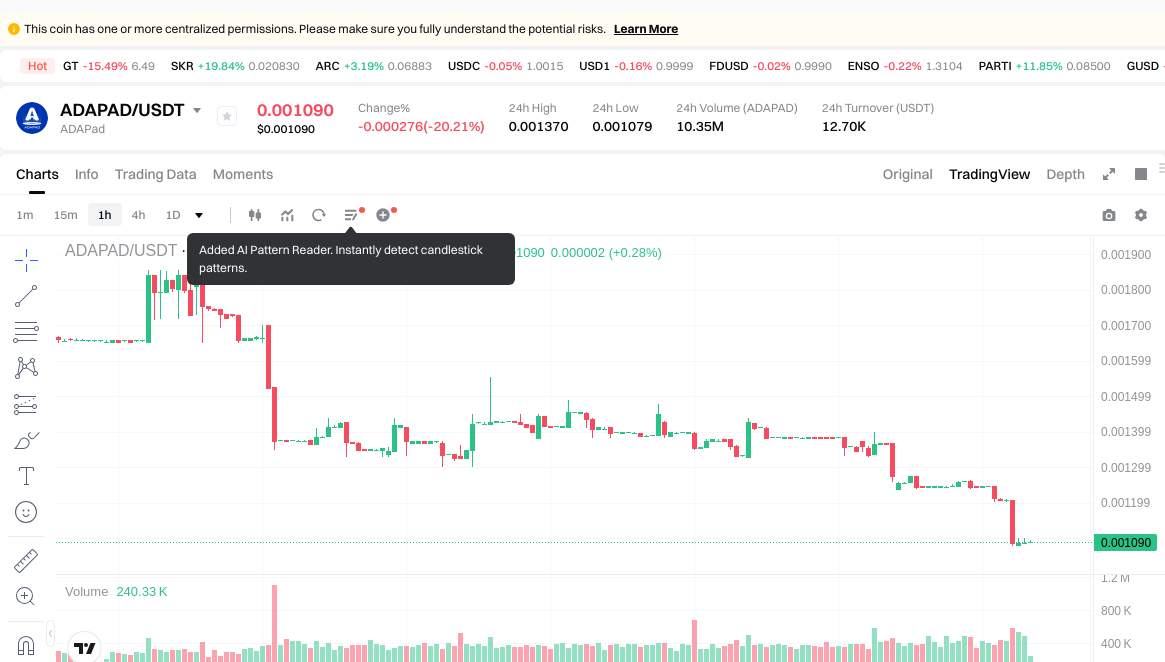

As of February 6, 2026, ADAPAD is trading at $0.001093, positioning near its all-time low. The token demonstrates notable short-term volatility, with a modest 1-hour gain of 0.18% but experiencing a significant 24-hour decline of 20.27%. The broader trend remains bearish, evidenced by a 35.93% decrease over the past 7 days and a 39.65% drop over the past 30 days. Year-over-year performance shows a substantial contraction of 66.71%.

The current 24-hour trading volume stands at approximately $12,686.96, indicating relatively limited market activity. The token's market capitalization is approximately $405,809, with a circulating supply of 371,280,120 ADAPAD tokens, representing 37.13% of the maximum supply of 1 billion tokens. The fully diluted market cap closely matches the current market capitalization, reflecting the alignment between circulating supply valuation and total token supply projection.

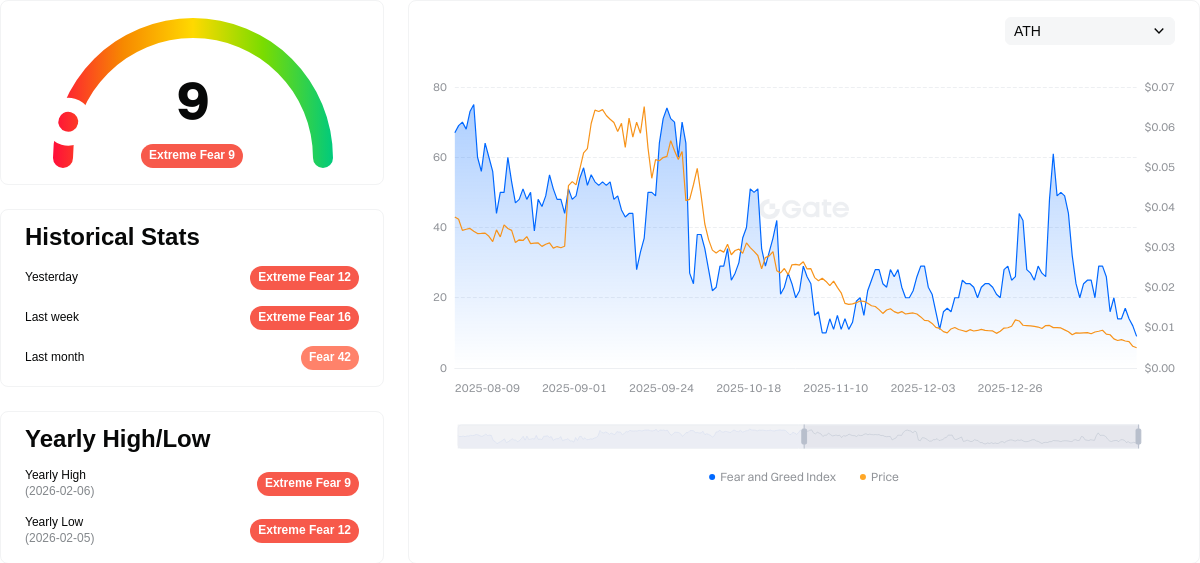

ADAPAD maintains a holder base of 14,927 addresses, suggesting a relatively modest community distribution. The token's market dominance stands at 0.000018%, reflecting its position as a smaller-cap asset within the broader cryptocurrency ecosystem. The current Fear and Greed Index reading of 9 indicates an "Extreme Fear" sentiment in the market, which may be influencing trading behavior across digital assets including ADAPAD.

Click to view current ADAPAD market price

ADAPAD Market Sentiment Indicator

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 9. This historically low reading signals intense market pessimism and widespread investor anxiety. During such periods, excessive fear often creates contrarian opportunities for contrarian investors. Market volatility typically peaks when sentiment reaches extreme levels, presenting both significant risks and potential entry points. Traders should exercise caution while monitoring key support levels and maintaining disciplined risk management strategies during this phase of market uncertainty.

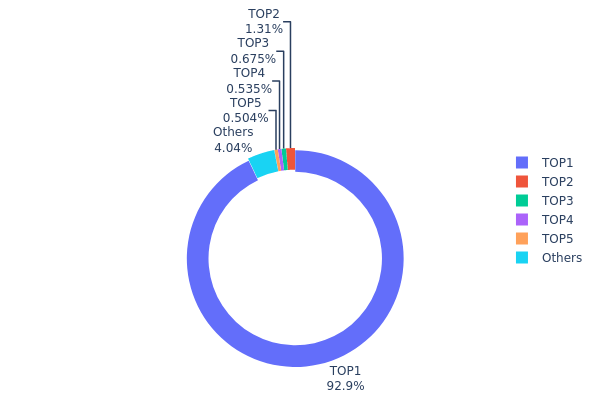

ADAPAD Holding Distribution

The holding distribution chart is a critical on-chain metric that reveals how tokens are allocated across different wallet addresses, providing insights into the degree of decentralization and potential concentration risks within a cryptocurrency ecosystem. By analyzing the distribution pattern, we can assess market structure stability, evaluate the influence of major holders, and identify potential vulnerabilities in token economics.

Based on the current data, ADAPAD exhibits an extremely high concentration level, with the top address holding 312,690.98K tokens, accounting for 92.93% of the total supply. This dominant position represents a significant concentration risk, as a single entity controls nearly all circulating tokens. The second through fifth largest holders possess 4,418.50K (1.31%), 2,270.79K (0.67%), 1,800.00K (0.53%), and 1,695.37K (0.50%) respectively, while all remaining addresses collectively hold only 13,598.22K tokens (4.06%). This distribution pattern indicates a highly centralized token structure that deviates substantially from the decentralization principles typically valued in blockchain projects.

Such extreme concentration poses multiple implications for market dynamics and price behavior. The overwhelming dominance of a single address creates substantial liquidity risks and vulnerability to manipulation, as the largest holder possesses sufficient tokens to significantly influence market prices through relatively modest trading activities. This concentration level may deter institutional participation and reduce overall market confidence, as the potential for coordinated price movements or sudden large-scale liquidations remains elevated. Furthermore, the limited token distribution among smaller holders suggests constrained community engagement and restricted organic market development, which could negatively impact long-term ecosystem growth and adoption prospects.

Click to view current ADAPAD Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5880...c9c532 | 312690.98K | 92.93% |

| 2 | 0x82cb...c64362 | 4418.50K | 1.31% |

| 3 | 0x0d07...b492fe | 2270.79K | 0.67% |

| 4 | 0xa698...879f2f | 1800.00K | 0.53% |

| 5 | 0xd2ff...722c66 | 1695.37K | 0.50% |

| - | Others | 13598.22K | 4.06% |

II. Core Factors Influencing ADAPAD's Future Price

Supply Mechanism

- Market Supply Dynamics: ADAPAD's price trajectory is shaped by fundamental supply-demand relationships within the cryptocurrency market. Token availability and distribution patterns directly impact valuation metrics.

- Historical Patterns: Past market cycles have demonstrated that periods of increased token circulation often correlate with price adjustments, while constrained supply phases have occasionally supported upward price movements.

- Current Implications: Present market conditions reflect ongoing adjustments in token distribution, with price movements responding to shifting liquidity patterns and holder behavior.

Institutional and Large Holder Activity

- Institutional Positioning: Information regarding specific institutional holdings in ADAPAD remains limited in available materials. Market participants should monitor publicly disclosed positions through official channels.

- Corporate Adoption: Details about enterprise-level integration of ADAPAD are not extensively documented in current references. Adoption patterns may evolve as the project develops its utility framework.

- Regulatory Environment: The broader cryptocurrency regulatory landscape continues to develop across jurisdictions, potentially affecting market sentiment and trading conditions for digital assets including ADAPAD.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies regarding interest rates and liquidity conditions influence risk asset preferences, which may extend to cryptocurrency markets. Investors often adjust portfolio allocations in response to changing monetary environments.

- Inflation Hedge Characteristics: Digital assets have demonstrated varying correlations with inflation metrics. ADAPAD's performance in different economic conditions depends on multiple market factors and investor sentiment shifts.

- Geopolitical Considerations: International developments and policy changes can create volatility in global financial markets, with potential spillover effects on cryptocurrency valuations through risk appetite adjustments.

Technological Development and Ecosystem Building

- Infrastructure Evolution: The cryptocurrency sector continues experiencing technical innovations that may influence platform capabilities and user adoption patterns. ADAPAD's development roadmap would determine its positioning within this evolving landscape.

- Ecosystem Applications: The utility and practical implementation of ADAPAD-related applications remain areas for ongoing development. Ecosystem growth depends on developer engagement and user adoption of platform functionalities.

- Network Effects: As with many blockchain projects, the value proposition strengthens through expanded use cases and community participation. The trajectory of ecosystem development represents a significant factor in long-term price considerations.

III. 2026-2031 ADAPAD Price Prediction

2026 Outlook

- Conservative prediction: $0.00071 - $0.00109

- Neutral prediction: Around $0.00109

- Optimistic prediction: Up to $0.00125 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: The token may enter a gradual growth phase, with price fluctuations reflecting broader market sentiment and project development progress

- Price range predictions:

- 2027: $0.00067 - $0.00127, with an average around $0.00117

- 2028: $0.00088 - $0.00151, with an average around $0.00122

- 2029: $0.00074 - $0.00173, with an average around $0.00136

- Key catalysts: Platform ecosystem expansion, strategic partnerships, and overall cryptocurrency market recovery could serve as primary drivers for price appreciation

2030-2031 Long-term Outlook

- Baseline scenario: $0.00146 - $0.00225 in 2030 (assuming steady project development and stable market conditions)

- Optimistic scenario: $0.00101 - $0.00268 in 2031 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: Potential to reach upper price targets if the project achieves significant breakthrough in technology implementation or secures major institutional partnerships

- 2026-02-06: ADAPAD trading within the projected range (current market positioning reflects early-stage valuation)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00125 | 0.00109 | 0.00071 | 0 |

| 2027 | 0.00127 | 0.00117 | 0.00067 | 7 |

| 2028 | 0.00151 | 0.00122 | 0.00088 | 11 |

| 2029 | 0.00173 | 0.00136 | 0.00074 | 24 |

| 2030 | 0.00225 | 0.00155 | 0.00146 | 41 |

| 2031 | 0.00268 | 0.0019 | 0.00101 | 73 |

IV. ADAPAD Professional Investment Strategy and Risk Management

ADAPAD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the Cardano ecosystem development and launchpad model with moderate to high risk tolerance

- Operational Recommendations:

- Consider accumulating positions during market downturns, as ADAPAD has experienced significant price corrections (down 66.71% over the past year)

- Monitor the deflationary mechanism effectiveness, including the 10% fee on token sales and up to 25% early unlock fees

- Storage Solution: Use Gate Web3 Wallet for secure storage, supporting both ETH and BSC chain assets with multi-signature protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume (currently $12,686.96) to identify liquidity trends and potential breakout points

- Support and Resistance Levels: Current 24h low at $0.001079 represents a key support level near the all-time low of $0.00107734

- Swing Trading Key Points:

- Watch for volatility opportunities, as ADAPAD shows high short-term fluctuation (24h range: -20.27%)

- Set strict stop-loss orders due to the token's low liquidity and high volatility characteristics

ADAPAD Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance ADAPAD holdings with more established Cardano ecosystem tokens to reduce concentration risk

- Position Sizing: Implement fractional buying strategy to average entry costs given the token's high volatility

(3) Secure Storage Solutions

- Multi-chain Wallet Recommended: Gate Web3 Wallet, supporting both Ethereum (ETH) and Binance Smart Chain (BSC) networks where ADAPAD is deployed

- Cold Storage Option: For long-term holdings exceeding $1,000 equivalent, consider hardware wallet integration with Gate Web3 Wallet

- Security Precautions: Verify contract addresses (ETH: 0xDB0170e2d0c1CC1b2E7a90313d9B9afA4f250289, BSC: 0xDB0170e2d0c1CC1b2E7a90313d9B9afA4f250289) before any transaction, enable two-factor authentication, and never share private keys

V. ADAPAD Potential Risks and Challenges

ADAPAD Market Risks

- Liquidity Risk: With only one exchange listing and a 24-hour trading volume of approximately $12,686, ADAPAD faces significant liquidity constraints that may result in high slippage during large trades

- Price Volatility: The token has declined 66.71% over the past year and 39.65% in the past 30 days, demonstrating extreme price instability that may lead to substantial capital losses

- Market Cap Risk: With a circulating market cap of only $405,809 and a market dominance of 0.000018%, ADAPAD is highly susceptible to manipulation and may lack sufficient investor interest

ADAPAD Regulatory Risks

- Launchpad Platform Scrutiny: Token launch platforms face increasing regulatory attention globally, particularly regarding securities laws and investor protection requirements

- Cross-chain Compliance: Operating on multiple chains (ETH and BSC) may expose the project to varied regulatory frameworks and compliance obligations

- Jurisdictional Uncertainty: Evolving cryptocurrency regulations in different regions may affect ADAPAD's accessibility and operational viability

ADAPAD Technical Risks

- Smart Contract Risk: Multi-chain deployment increases the attack surface and potential vulnerability exposure across different blockchain environments

- Cardano Ecosystem Dependency: As a Cardano-focused launchpad, ADAPAD's success is heavily dependent on the Cardano blockchain's adoption and development progress

- Deflationary Mechanism Risk: While the 10% sales fee and 25% early unlock penalty are designed to reduce supply, these mechanisms may also discourage liquidity and trading activity

VI. Conclusion and Action Recommendations

ADAPAD Investment Value Assessment

ADAPAD presents a high-risk investment opportunity within the Cardano launchpad sector. While its deflationary tokenomics and positioning in the growing IDO market offer potential upside, the token faces significant headwinds including severe price depreciation (down 66.71% over one year), extremely low liquidity (only $12,686 in 24h volume), and minimal market presence (market cap of $405,809). The circulating supply represents only 37.13% of total supply, suggesting potential future selling pressure. Long-term value proposition depends heavily on Cardano ecosystem growth and the project's ability to attract quality IDO projects. Short-term risks remain elevated due to volatility, liquidity constraints, and ongoing market correction.

ADAPAD Investment Recommendations

✅ Beginners: Avoid or allocate no more than 0.5-1% of crypto portfolio, only if already familiar with Cardano ecosystem and understand launchpad dynamics. Consider this a high-risk speculative position.

✅ Experienced Investors: May consider 2-3% allocation as part of a diversified altcoin strategy, focusing on accumulation during extreme market weakness while maintaining strict risk management protocols.

✅ Institutional Investors: Given low liquidity and minimal market infrastructure, ADAPAD does not meet typical institutional investment criteria. Only suitable for venture-style allocations in early-stage blockchain project portfolios with extensive due diligence.

ADAPAD Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale of ADAPAD tokens with various trading pairs, suitable for both short-term trading and long-term accumulation

- Gate Web3 Wallet Integration: Self-custody solution supporting both ETH and BSC chains, enabling direct interaction with decentralized applications while maintaining asset control

- Dollar-Cost Averaging (DCA): Given high volatility, implement systematic periodic purchases to reduce timing risk and average entry prices over extended periods

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ADAPAD? What are its main uses?

ADAPAD is a cold wallet tool for storing, sending, and receiving digital assets. It manages private keys to ensure secure ownership of your ADAPAD tokens and provides complete asset control.

What will ADAPAD price prediction be like in 2024? What are the main factors affecting the price?

ADAPAD price in 2024 depends on overall crypto market trends and ADAPad's development progress. Key factors include market volatility, Bitcoin correlation, trading volume, and ecosystem adoption growth.

What are the risks of investing in ADAPAD? How should I assess the prospects of this project?

ADAPAD faces market volatility and technical risks. Evaluate project prospects by analyzing team strength, technological innovation, market demand, and community development. Assess your risk tolerance before investing carefully.

What distinguishes ADAPAD from other similar cryptocurrency projects?

ADAPAD focuses on decentralized finance with unique token distribution mechanisms that enhance liquidity. Unlike other projects, ADAPAD features specialized market positioning and distinct user targeting strategies, setting it apart in the competitive crypto landscape.

What is ADAPad's historical price performance? Where is the current price relative to its historical highs and lows?

ADAPad has experienced significant price fluctuations since its launch. Currently, the price trades below its historical peak but remains above its historical lows, positioning it in a moderate recovery phase within its price range.

How to buy and trade ADAPAD? Which exchanges can I purchase from?

You can purchase and trade ADAPAD through major cryptocurrency exchanges. Simply select USDT as your trading pair and exchange it for ADAPAD. The process is straightforward through most platforms' trading interfaces or Web3 wallet features.

Cardano (ADA) Price Prediction 2025 & 2030 – Is ADA Set to Soar?

Cardano (ADA): A History, Tech Overview, and Price Outlook

How Does Cardano's Proof of Stake (PoS) Mechanism Work?

What is Cardano?

Cardano (ADA) Price Analysis and Outlook for 2025

Factors Affecting Cardano's Price

Cryptocurrency Halving Explained: The Comprehensive Guide

Top Cold Wallets for Cryptocurrency: Rankings

Home Bitcoin Mining: A Beginner’s Guide

Comprehensive Guide to Cronos Price Predictions and Investment Analysis

Comprehensive Guide to Corporate Bankruptcy Restructuring: John J. Ray III's Proven Strategies