2026 ADAPAD Price Prediction: Expert Analysis and Market Forecast for the Next Bull Cycle

Introduction: ADAPAD's Market Position and Investment Value

ADAPad (ADAPAD), positioned as a token launch platform on Cardano with deflationary mechanisms, has been operating in the cryptocurrency ecosystem since its inception. As of 2026, ADAPAD maintains a market capitalization of approximately $409,150, with a circulating supply of about 371.28 million tokens, and its price hovering around $0.001102. This asset, characterized by its unique deflationary features tied to token sales, unlocks, and IDO participation, is playing a role in the Cardano ecosystem's fundraising infrastructure.

This article will comprehensively analyze ADAPAD's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ADAPAD Price History Review and Market Status

ADAPAD Historical Price Evolution Trajectory

- October 2021: ADAPAD reached a peak price of $1.28 on October 7, marking a significant milestone in its early trading period.

- 2021-2026: Following the October 2021 peak, ADAPAD experienced a prolonged bearish trend, with the price declining substantially over the multi-year period.

- February 2026: The token recorded its lowest price point at $0.00107734 on February 6, representing a decline of approximately 99.9% from its historical high.

ADAPAD Current Market Situation

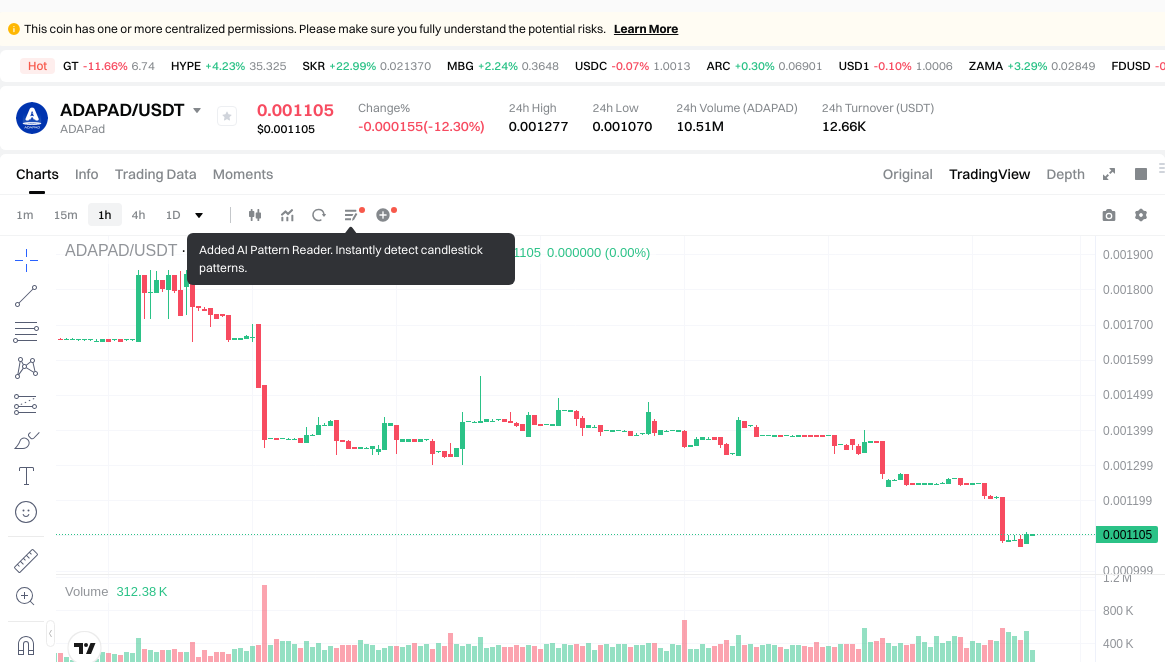

As of February 6, 2026, ADAPAD is trading at $0.001102, reflecting recent short-term volatility across multiple timeframes. Over the past hour, the token showed a modest recovery of 1.01%, gaining approximately $0.000011. However, the 24-hour performance indicates a decline of 12.3%, with the price dropping by $0.000155. The trading range during this period spanned from a low of $0.00107 to a high of $0.001277.

The broader trend analysis reveals more pronounced negative momentum. The 7-day performance shows a 35.42% decrease, equivalent to a $0.000604 decline. The 30-day period demonstrates a 38.87% reduction, with the price falling by $0.000701. The annual perspective indicates a 66.34% decline, representing a $0.002172 decrease from the price one year prior.

ADAPAD's market capitalization stands at approximately $409,151, with a circulating supply of 371,280,095 tokens out of a total supply of 371,281,061 tokens. The token has a maximum supply cap of 1 billion tokens, with the current circulation representing approximately 37.13% of this maximum. The 24-hour trading volume is recorded at $12,629, indicating relatively limited market activity. The market capitalization to fully diluted valuation ratio sits at 37.13%, reflecting the current circulation relative to maximum supply.

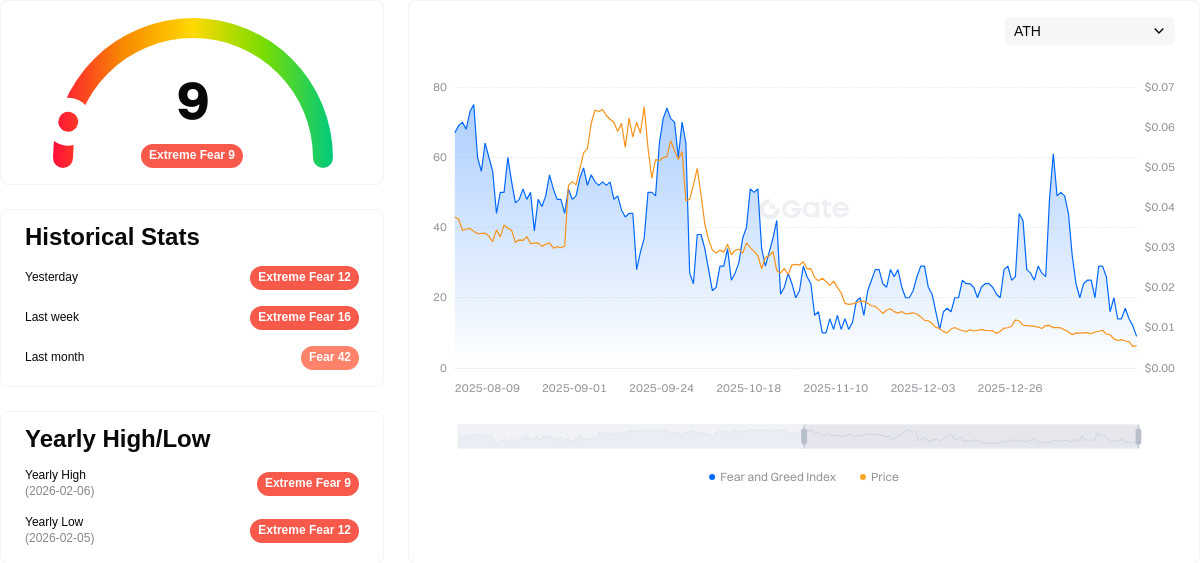

The token holder count is documented at 2,180 addresses, suggesting a modest community size. ADAPAD maintains a market dominance of 0.000017%, positioning it as a smaller-cap asset within the cryptocurrency ecosystem. The current market environment is characterized by extreme fear, with the market sentiment index recording a value of 9.

Click to view the current ADAPAD market price

ADAPAD Market Sentiment Index

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with the index at a critically low level of 9. This indicates heightened investor anxiety and bearish sentiment across the market. Such extreme conditions often create contrarian opportunities, as panic selling may be overdone. Experienced traders typically view extreme fear as a potential accumulation phase. However, caution remains warranted, and proper risk management is essential. Monitor market fundamentals and technical indicators closely before making investment decisions on Gate.com.

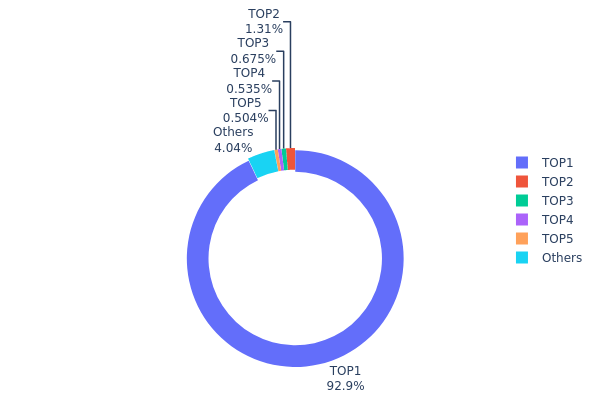

ADAPAD Holding Distribution

The holding distribution chart reveals the allocation of tokens across different wallet addresses, serving as a critical indicator of market concentration and decentralization levels. By analyzing the percentage of tokens held by top addresses versus smaller holders, investors can assess potential risks related to price manipulation and market stability.

According to the current data, ADAPAD exhibits an extremely high concentration ratio, with the top address holding 312,690.98K tokens, representing 92.93% of the total circulating supply. The second-largest holder controls only 1.31% (4,418.50K tokens), while the third through fifth addresses hold 0.67%, 0.53%, and 0.50% respectively. The remaining addresses collectively account for merely 4.06% of the supply. This distribution pattern indicates a severe centralization issue, where a single entity or smart contract controls the overwhelming majority of tokens.

Such an extreme concentration structure presents significant implications for market dynamics and price volatility. The dominant position of the top address creates substantial selling pressure risk, as any large-scale liquidation could trigger dramatic price fluctuations. Additionally, this concentration level raises concerns about potential market manipulation, as the primary holder possesses sufficient influence to control price movements. From a decentralization perspective, ADAPAD's current on-chain structure deviates significantly from the ideal distributed token model, suggesting that either the project is in its early development phase with tokens locked in treasury contracts, or there exists a high degree of institutional control. Investors should carefully evaluate the nature of the top address—whether it represents a project treasury, liquidity pool, or centralized entity—before making investment decisions.

Click to view the current ADAPAD Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5880...c9c532 | 312690.98K | 92.93% |

| 2 | 0x82cb...c64362 | 4418.50K | 1.31% |

| 3 | 0x0d07...b492fe | 2270.79K | 0.67% |

| 4 | 0xa698...879f2f | 1800.00K | 0.53% |

| 5 | 0xd2ff...722c66 | 1695.37K | 0.50% |

| - | Others | 13598.22K | 4.06% |

II. Core Factors Influencing ADAPAD's Future Price

Supply Mechanism

- Deflationary Token Model: ADAPAD implements a deflationary mechanism through token burns and staking rewards, gradually reducing circulating supply over time.

- Historical Pattern: The total supply is capped at 1,000,000,000 ADAPAD tokens, with approximately 67,000,000 ADAPAD currently in circulation, creating scarcity dynamics that may support long-term value appreciation.

- Current Impact: The controlled supply release combined with ecosystem growth could potentially create upward pressure on token valuation as demand increases relative to available supply.

Institutional and Major Holder Dynamics

- Institutional Holdings: While specific institutional investment data remains limited, ADAPAD's integration within the Cardano ecosystem positions it within a network that has attracted significant institutional interest.

- Enterprise Adoption: The project's focus on DeFi launchpad services within the Cardano network may attract projects seeking fundraising infrastructure, though concrete enterprise partnerships require further development.

- Regulatory Landscape: The evolving regulatory framework for DeFi platforms and token offerings continues to shape the operational environment, with increasing clarity potentially benefiting compliant projects.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies regarding interest rates and liquidity conditions influence overall cryptocurrency market sentiment, with accommodative policies generally supporting digital asset valuations.

- Inflation Hedge Characteristics: As part of the broader cryptocurrency ecosystem, ADAPAD may serve as an alternative investment during periods of fiat currency depreciation, though its correlation with traditional inflation hedges varies.

- Geopolitical Factors: Global economic uncertainty and evolving attitudes toward decentralized finance across different jurisdictions continue to impact investor sentiment toward DeFi tokens.

Technical Development and Ecosystem Building

- Cardano Integration: ADAPAD's deep integration with the Cardano blockchain leverages the network's proof-of-stake consensus mechanism and scientific approach to development, potentially benefiting from Cardano's technical roadmap.

- DeFi Protocol Growth: The expansion of decentralized finance protocols on Cardano, with reports indicating significant growth in Total Value Locked (TVL), creates a supportive environment for launchpad platforms.

- Ecosystem Applications: ADAPAD serves as a launchpad infrastructure for new projects within the Cardano ecosystem, with its value proposition tied to the success and quantity of projects utilizing its platform for token launches.

III. 2026-2031 ADAPAD Price Prediction

2026 Outlook

- Conservative Forecast: $0.00078 - $0.0011

- Neutral Forecast: $0.0011 (average scenario)

- Optimistic Forecast: Up to $0.00155 (requires favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual growth phase with moderate volatility as the project matures and expands its ecosystem

- Price Range Predictions:

- 2027: $0.00069 - $0.00161 (approximately 20% potential increase from 2026 baseline)

- 2028: $0.00094 - $0.00169 (approximately 33% potential increase)

- 2029: $0.0009 - $0.0017 (approximately 43% potential increase)

- Key Catalysts: Platform development milestones, strategic partnerships, broader DeFi integration, and overall cryptocurrency market sentiment

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00118 - $0.00189 in 2030 (assuming steady ecosystem growth and stable market conditions)

- Optimistic Scenario: $0.00111 - $0.00217 by 2031 (approximately 60% potential increase, contingent on successful protocol upgrades and expanded user base)

- Transformative Scenario: Price could exceed conservative estimates if ADAPAD achieves significant mainstream adoption, forms major institutional partnerships, or benefits from breakthrough developments in the launchpad sector

- 2026-02-06: ADAPAD trading within early 2026 baseline range as market participants assess long-term value proposition

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00155 | 0.0011 | 0.00078 | 0 |

| 2027 | 0.00161 | 0.00133 | 0.00069 | 20 |

| 2028 | 0.00169 | 0.00147 | 0.00094 | 33 |

| 2029 | 0.0017 | 0.00158 | 0.0009 | 43 |

| 2030 | 0.00189 | 0.00164 | 0.00118 | 48 |

| 2031 | 0.00217 | 0.00176 | 0.00111 | 60 |

IV. ADAPAD Professional Investment Strategies and Risk Management

ADAPAD Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors who believe in the long-term development potential of the Cardano ecosystem and launchpad platforms

- Operational Suggestions:

- Monitor Cardano network upgrades and ADAPad platform IDO activity to assess ecosystem growth

- Consider dollar-cost averaging during market downturns to reduce entry cost volatility

- Use Gate Web3 Wallet for secure storage with private key backup and multi-signature protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume trends; current volume of approximately $12,629 suggests limited liquidity, requiring caution with large orders

- Support and Resistance Levels: Observe the 24-hour low of $0.00107 as potential support and the high of $0.001277 as resistance

- Swing Trading Considerations:

- High volatility presents opportunities; 7-day decline of 35.42% indicates significant short-term fluctuation risks

- Set strict stop-loss levels; given the 66.34% annual decline, risk management is essential

ADAPAD Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: No more than 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio, with close monitoring of platform developments

- Professional Investors: Up to 5-10%, with active hedging strategies and diversification across Cardano ecosystem tokens

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine with stablecoins or major cryptocurrencies to reduce single-asset risk

- Liquidity Management: Set phased profit-taking targets; avoid concentrated large-volume trading due to low liquidity

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and participation in DeFi activities

- Cold Storage Solution: Transfer long-term holdings to hardware wallets for enhanced security

- Security Precautions: Never share private keys or seed phrases; beware of phishing websites and fake token contracts (verify official contract addresses: ETH 0xDB0170e2d0c1CC1b2E7a90313d9B9afA4f250289, BSC 0xDB0170e2d0c1CC1b2E7a90313d9B9afA4f250289)

V. ADAPAD Potential Risks and Challenges

ADAPAD Market Risks

- High Volatility: Short-term price declines of over 35% within 7 days and 38.87% within 30 days indicate extreme market volatility

- Low Liquidity: With a market cap of approximately $409,000 and daily trading volume of around $12,629, large trades may significantly impact prices

- Current Price Near ATL: Trading near the all-time low of $0.00107734 (recorded on February 6, 2026) presents both downside and potential recovery risks

ADAPAD Regulatory Risks

- Launchpad Platform Compliance: Token sale platforms face increasing regulatory scrutiny in various jurisdictions; regulatory changes could impact ADAPad's operational model

- Cross-chain Token Compliance: ADAPAD operates on both Ethereum and BSC networks; multi-chain deployment may face complex regulatory requirements

- Securities Classification Risk: Token sale participation mechanisms may be classified as securities offerings in certain regions, potentially affecting platform operations

ADAPAD Technical Risks

- Smart Contract Vulnerabilities: Launchpad platforms require complex smart contract interactions; unaudited code may present security risks

- Cardano Ecosystem Dependency: ADAPad's success is closely tied to Cardano network development; any technical issues or delayed upgrades could impact the platform

- Multi-chain Bridge Risks: Cross-chain operations between Ethereum and BSC involve bridge security; historical bridge hack incidents highlight potential vulnerabilities

VI. Conclusion and Action Recommendations

ADAPAD Investment Value Assessment

ADAPad operates as a token launchpad on Cardano with a deflationary mechanism incorporating 10% fees on token sales and up to 25% early unlock penalties. However, the token faces significant challenges: a 66.34% annual decline, current trading near all-time lows, limited market capitalization of approximately $409,000, and low daily trading volume. While the deflationary model and Cardano ecosystem positioning offer theoretical value propositions, current market performance suggests substantial risks. The low liquidity and high volatility require extreme caution. Long-term value depends on Cardano ecosystem growth, IDO platform activity, and successful execution of the deflationary mechanism.

ADAPAD Investment Recommendations

✅ Beginners: Exercise extreme caution; consider observing platform development and market stabilization before entry; limit allocation to no more than 1% of crypto portfolio if participating ✅ Experienced Investors: Monitor Cardano ecosystem developments and ADAPad platform IDO metrics; employ strict risk management with stop-loss orders; consider small position sizing for potential recovery scenarios ✅ Institutional Investors: Conduct thorough due diligence on platform fundamentals, smart contract audits, and competitive landscape; assess liquidity constraints before position building; integrate into diversified Cardano ecosystem strategies only with comprehensive risk controls

ADAPAD Trading Participation Methods

- Spot Trading: Trade ADAPAD on Gate.com with verification of official contract addresses before transactions

- DeFi Participation: Use Gate Web3 Wallet to interact with Cardano ecosystem applications, though verify ADAPad platform compatibility and security

- Dollar-Cost Averaging: For long-term believers, consider systematic periodic purchases to mitigate timing risks and volatility

Cryptocurrency investment carries extreme risks; this article does not constitute investment advice. Investors should make prudent decisions based on their risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ADAPAD project? What are its main application scenarios?

ADAPad (ADAPAD) is a cryptocurrency project focused on trading and investment within the crypto market. With a circulating supply of 67 million tokens, it serves as a utility token for blockchain-based trading activities and ecosystem participation.

What is the historical price trend of ADAPAD? How is the current market performance?

ADAPAD has declined 3.02% over the past 24 hours, with current market cap of ¥1,087,923 CNY and ranking #2798 on CoinMarketCap. The token shows moderate volatility typical of emerging crypto assets, with gradual stabilization in recent trading periods.

What are professional analysts' price predictions for ADAPAD? What are the potential factors for future price movements?

Analysts predict ADAPAD could appreciate driven by increasing market demand and blockchain adoption. Potential upside factors include ecosystem expansion and technological upgrades. Downside pressures may come from regulatory changes and market competition.

How is ADAPAD's market liquidity and trading volume? What impact does this have on price stability?

ADAPAD has low market liquidity with a circulating market value of $8.36k, resulting in significant price volatility. The 24-hour price range is considerable, making the token susceptible to sharp price fluctuations. Limited trading volume further constrains stability, requiring caution when entering or exiting positions.

What risks should I consider when investing in ADAPAD? What are the main drivers of price fluctuations?

ADAPAD carries high volatility risk. Price is primarily driven by Bitcoin market trends and macroeconomic factors. Trading volume and market sentiment also significantly influence price movements, with ADAPAD often mirroring Bitcoin's performance.

What are ADAPAD's advantages and disadvantages compared to similar projects?

ADAPAD offers decentralized governance and transparency with strong community support. Advantages include robust security and fair token distribution. Disadvantages may include slower transaction speed and lower trading volume compared to established competitors.

What are the main factors influencing ADAPAD price(technical development, market sentiment, regulatory policies, etc.)?

ADAPAD price is primarily influenced by technical developments in its blockchain ecosystem, market sentiment, and regulatory policies. Trading volume, Bitcoin correlation, and broader cryptocurrency market trends significantly impact its valuation.

Cardano (ADA) Price Prediction 2025 & 2030 – Is ADA Set to Soar?

Cardano (ADA): A History, Tech Overview, and Price Outlook

How Does Cardano's Proof of Stake (PoS) Mechanism Work?

What is Cardano?

Cardano (ADA) Price Analysis and Outlook for 2025

Factors Affecting Cardano's Price

What is a Private Key? How Does It Differ from a Public Key and What Can You Do with It?

Using and Calculating RSI in Cryptocurrency Trading

Cryptocurrency theft topped $2 billion in 2025—it's time to rethink how assets are stored.

What Are RWAs (Real World Assets): A Complete Guide to Tokenizing Real-World Assets

How to Begin Trading NFTs