2026 ANI Price Prediction: Expert Analysis and Market Forecast for Artificial Nervous Intelligence Token

Introduction: ANI's Market Position and Investment Value

Ani Grok Companion (ANI) positions itself as a memecoin blending AI companion concepts with cryptocurrency utility. Since its launch in 2024, the token has established a presence in the memecoin sector with a market capitalization of approximately $627,889 and a circulating supply of nearly 1 billion tokens. As of February 5, 2026, ANI is trading at around $0.0006279, representing a significant shift from its historical peak. This asset, characterized as an "adorable AI companion in the memecoin world," operates within the Solana blockchain ecosystem and has attracted over 18,000 holders.

This article will comprehensively analyze ANI's price trajectory from 2026 to 2031, examining historical patterns, market supply-demand dynamics, ecosystem developments, and broader macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ANI Price History Review and Market Status

ANI Historical Price Evolution Trajectory

- 2025: ANI reached its historical peak of $0.0276 on August 17, with price experiencing significant volatility during the memecoin market cycle

- 2026: Price declined sharply in January, touching its historical low of $0.0006068 on January 30, representing a substantial correction from previous highs

ANI Current Market Dynamics

As of February 5, 2026, ANI is trading at $0.0006279, showing mixed short-term performance across different timeframes. Over the past hour, the token demonstrated modest upward movement with a 0.55% increase. However, broader timeframe analysis reveals notable pressure, with a 13.22% decline over 24 hours and a 7.95% decrease across the past week.

The 30-day performance shows a significant 49.2% downturn, reflecting recent market challenges. Despite this near-term weakness, the annual perspective remains considerably positive, with ANI recording an 821.25% gain over the past year.

ANI's market capitalization stands at approximately $627,889, with a fully diluted valuation matching this figure due to 100% circulating supply of 999,982,931.46 tokens. The 24-hour trading volume reached $13,899.59, while the token is held by 18,089 addresses. ANI operates on the Solana blockchain and is currently listed on 6 exchanges, including Gate.com.

The current price represents a 97.72% decline from its all-time high, while trading just 3.48% above its all-time low. Today's trading range has fluctuated between $0.0006204 and $0.0007387.

Click to view current ANI market price

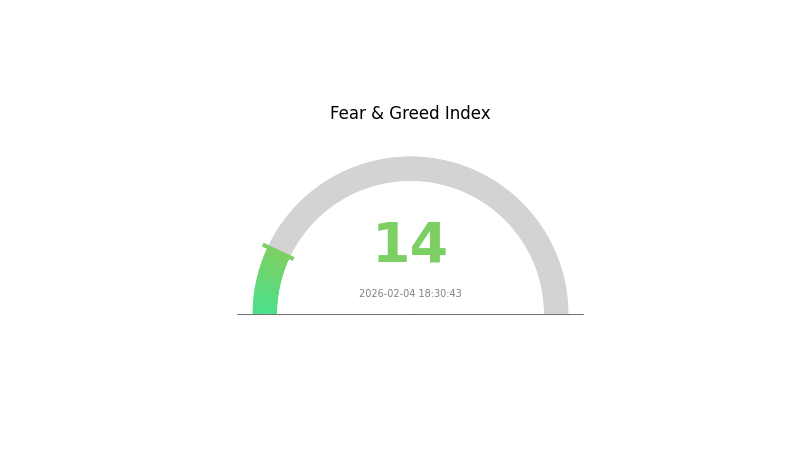

ANI Market Sentiment Index

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the ANI index registering at 14. This level indicates heightened risk aversion among investors, suggesting significant market pessimism and potential selling pressure. When the index reaches extreme fear territory, it often signals capitulation and may present contrarian buying opportunities for long-term investors. Market participants should exercise caution and conduct thorough due diligence before making investment decisions. Monitor market developments closely as sentiment can shift rapidly in response to macroeconomic factors and industry news.

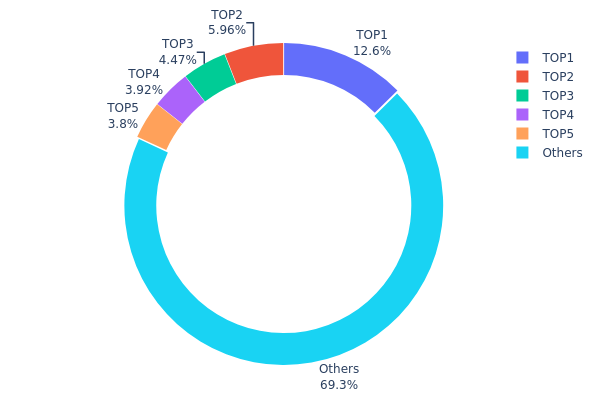

ANI Holding Distribution

The ANI holding distribution chart reveals a moderately concentrated ownership structure, with the top five addresses collectively controlling approximately 30.72% of the total token supply. The largest holder possesses 125,870.87K tokens (12.58%), while the remaining top four addresses hold between 3.80% and 5.95% each. Meanwhile, approximately 69.28% of ANI tokens are distributed among other addresses, suggesting a relatively decentralized base layer of holders beyond the major stakeholders.

This concentration level indicates a balanced market structure that falls between extreme centralization and complete dispersion. While the 12.58% held by the top address represents significant influence, it remains below the threshold typically associated with single-entity market manipulation risks. The presence of multiple substantial holders in the 3-6% range creates a multi-polar power structure that can provide stability during market volatility, as no single entity dominates price discovery mechanisms.

From a market dynamics perspective, this distribution pattern suggests moderate resilience against coordinated dumping events, though large holders retain sufficient capacity to impact short-term price movements. The nearly 70% held by smaller addresses indicates healthy retail participation and community engagement, which often correlates with sustainable long-term project development and reduced vulnerability to whale-driven volatility.

Click to view current ANI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | GpMZbS...TvxFbL | 125870.87K | 12.58% |

| 2 | Cw32Ny...YLwZeh | 59563.00K | 5.95% |

| 3 | ASTyfS...g7iaJZ | 44726.49K | 4.47% |

| 4 | 8guCM6...nSXmxh | 39228.13K | 3.92% |

| 5 | D1YdAg...2KgwFN | 38000.68K | 3.80% |

| - | Others | 692560.37K | 69.28% |

II. Core Factors Influencing ANI's Future Price

Supply Mechanisms

-

AI Technology Development and Cost Reduction: The development of AI technology, particularly in artificial narrow intelligence (ANI) systems, is closely tied to breakthrough innovations in deep learning algorithms and computing infrastructure. As training costs for AI large models have declined by over 90% annually since 2023—far exceeding Moore's Law's rate of cost reduction—this trend significantly impacts market adoption and deployment scale.

-

Historical Patterns: According to industry data, the rapid decline in AI model training costs has accelerated technology diffusion from early adopters to mainstream users. DeepSeek's breakthrough in achieving GPT-4o-level performance at just 5.576 million USD training cost (compared to approximately 100 million USD for GPT-4o) represents a 96% cost advantage, demonstrating how efficiency improvements drive market expansion.

-

Current Impact: The ongoing cost reduction in AI computation and infrastructure is expected to stimulate explosive demand growth, following the "Jevons Paradox" principle where improved efficiency leads to increased total consumption rather than decreased usage. This creates favorable conditions for broader ANI technology adoption across industries.

Institutional and Major Stakeholder Dynamics

-

Institutional Holdings: Major cloud computing platforms including Microsoft Azure, AWS (Amazon Bedrock and SageMaker), Huawei Cloud, Tencent Cloud, and Alibaba Cloud have integrated advanced AI models into their service offerings, indicating strong institutional commitment to AI infrastructure development.

-

Enterprise Adoption: Leading technology companies are deploying ANI systems across various sectors. Hardware manufacturers such as NVIDIA, AMD, and Intel are providing specialized AI computing support, while enterprises like Baidu's Qianfan Platform and 360 have integrated advanced AI capabilities to optimize user services.

-

National Policies: China's "New Generation Artificial Intelligence Development Plan" (2017) established clear strategic objectives, aiming to develop mature AI theory and technology systems with internationally leading industrial competitiveness by 2030. Recent policies emphasize scenario-based applications and deep integration with the real economy to cultivate new economic growth drivers.

Macroeconomic Environment

-

Monetary Policy Impact: Global investment in AI infrastructure has intensified, with major technology companies (Amazon, Microsoft, Alphabet, Meta) increasing capital expenditure from an average of 12.7% of revenue in 2021 to 17.2% in 2024, with projections reaching 22% in 2025—reflecting approximately 50% year-over-year growth in AI-related capital allocation.

-

Computing Power Demand Expansion: According to the "China AI Computing Power Development Assessment Report 2022-2023", China's intelligent computing power scale reached 155.2 EFLOPS in 2021 and is projected to reach 1,271.4 EFLOPS by 2026, representing a compound annual growth rate of 52.3%—significantly outpacing general computing power growth of 18.5% during the same period.

-

Geopolitical Factors: International AI competition has evolved beyond pure technology domains into a critical factor affecting national competitiveness and industrial policy. The emergence of innovative AI solutions from different regions has reshaped global narratives around technological leadership and created new dynamics in cross-border technology collaboration frameworks.

Technological Development and Ecosystem Building

-

Deep Learning Framework Innovation: The industry has developed nearly 40 AI learning frameworks, with platforms such as TensorFlow, PyTorch, PaddlePaddle, Jittor, and MindSpore significantly lowering entry barriers for AI technology implementation. These open-source frameworks enable developers to access cutting-edge capabilities while fostering rapid iteration and application deployment.

-

Mixed Expert Models and Efficient Architectures: Advanced techniques including Mixture of Experts (MoE), Multi-head Latent Attention (MLA), DualPipe algorithms, and FP8 mixed-precision training technologies have enabled efficient inference and low-cost training while enhancing model performance. These innovations are driving higher penetration rates and market competitiveness in industrial applications.

-

Ecosystem Applications: AI technology has achieved substantial development across multiple vertical domains including finance, education, transportation, healthcare, smart homes, and marketing. Intelligent terminals, model predictive control systems, recommendation engines, localization and mapping solutions, as well as autonomous vehicles, drones, intelligent robots, and voice assistants are experiencing rapid advancement, creating diverse commercial application scenarios that support sustained ecosystem growth.

III. 2026-2031 ANI Price Prediction

2026 Outlook

- Conservative prediction: $0.00036 - $0.00063

- Neutral prediction: Around $0.00063

- Optimistic prediction: Up to $0.00088 (requires favorable market conditions)

2027-2029 Mid-term Outlook

- Market stage expectation: The token may experience gradual growth with moderate volatility as the project develops its ecosystem and expands its user base

- Price range prediction:

- 2027: $0.00042 - $0.00082 (approximately 20% potential increase)

- 2028: $0.00056 - $0.00115 (approximately 25% potential increase)

- 2029: $0.00069 - $0.00133 (approximately 54% potential increase)

- Key catalysts: Potential technological improvements, growing adoption within the community, and broader market recovery could serve as primary drivers

2030-2031 Long-term Outlook

- Base scenario: $0.00103 - $0.00153 (assuming steady project development and stable market conditions)

- Optimistic scenario: $0.00126 - $0.00178 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: Prices may exceed $0.00178 by 2031 (under exceptionally favorable conditions including mainstream adoption and significant technological breakthroughs)

- 2026-02-05: ANI trading within the range of $0.00036 - $0.00088 (early development stage with price discovery ongoing)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00088 | 0.00063 | 0.00036 | 0 |

| 2027 | 0.00082 | 0.00076 | 0.00042 | 20 |

| 2028 | 0.00115 | 0.00079 | 0.00056 | 25 |

| 2029 | 0.00133 | 0.00097 | 0.00069 | 54 |

| 2030 | 0.00153 | 0.00115 | 0.00103 | 83 |

| 2031 | 0.00178 | 0.00134 | 0.00126 | 113 |

IV. ANI Professional Investment Strategy and Risk Management

ANI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking to capture potential growth in AI-themed memecoin projects

- Operational Suggestions:

- Consider gradual accumulation during market downturns to average entry costs

- Monitor project development updates and community engagement metrics

- Storage Solution: Utilize Gate Web3 Wallet for secure non-custodial storage of ANI tokens on the Solana network

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume ($13,899.59 as of current data) to identify liquidity trends and potential breakout signals

- Price Range Indicators: Track support levels near recent low ($0.0006068) and resistance near 24-hour high ($0.0007387)

- Swing Trading Key Points:

- Set clear entry and exit targets based on technical levels and avoid emotional decision-making

- Implement stop-loss orders to protect capital during volatile market conditions

ANI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio

- Aggressive Investors: 5-10% of crypto portfolio

- Professional Investors: Allocate based on comprehensive risk assessment and portfolio diversification strategy

(2) Risk Hedging Solutions

- Diversification Approach: Balance ANI holdings with established cryptocurrencies and stablecoins to reduce concentration risk

- Position Sizing: Avoid overexposure by limiting any single asset to a predetermined percentage of total portfolio

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet offers multi-chain support including Solana, providing secure self-custody for ANI tokens

- Hardware Wallet Option: For larger holdings, consider transferring to hardware storage solutions compatible with Solana-based tokens

- Security Precautions: Never share private keys or seed phrases; verify contract address (9tqjeRS1swj36Ee5C1iGiwAxjQJNGAVCzaTLwFY8bonk) before transactions to avoid scam tokens

V. ANI Potential Risks and Challenges

ANI Market Risks

- Extreme Volatility: ANI has experienced significant price fluctuations, with a 30-day decline of approximately 49.2%, indicating substantial short-term volatility

- Low Market Capitalization: With a market cap of approximately $627,889, ANI is susceptible to large price swings from relatively small trading volumes

- Limited Liquidity: Trading on only 6 exchanges may result in wider spreads and difficulty executing large orders without impacting price

ANI Regulatory Risks

- Memecoin Classification: Regulatory treatment of memecoins remains uncertain across jurisdictions, potentially affecting trading availability

- Compliance Evolution: Future regulatory frameworks for AI-themed tokens may impose additional requirements on projects and exchanges

- Geographic Restrictions: Certain regions may implement restrictions on memecoin trading, limiting market access for some investors

ANI Technical Risks

- Smart Contract Dependency: As a Solana-based token, ANI is subject to potential vulnerabilities in its smart contract code

- Network Risks: Reliance on Solana network exposes ANI to blockchain-level issues such as network congestion or downtime

- Project Development Risk: Limited information on technical roadmap and development team may affect long-term sustainability

VI. Conclusion and Action Recommendations

ANI Investment Value Assessment

ANI presents itself as an AI-themed memecoin on the Solana network, combining elements of AI narrative with memecoin culture. While the project has shown substantial growth over a one-year period, recent performance indicates significant volatility with a 49.2% decline over 30 days. The relatively small market capitalization and limited exchange listings suggest ANI remains a highly speculative asset. Investors should approach with caution, recognizing that memecoin investments carry elevated risk compared to established cryptocurrency projects.

ANI Investment Recommendations

✅ Beginners: Limit exposure to a small percentage of overall portfolio (1-2%) and prioritize learning about blockchain technology and market dynamics before investing ✅ Experienced Investors: Consider ANI as a speculative position within a diversified crypto portfolio, utilizing technical analysis and risk management tools ✅ Institutional Investors: Conduct thorough due diligence on tokenomics, community metrics, and project fundamentals before considering allocation

ANI Trading Participation Methods

- Spot Trading: Purchase ANI directly on Gate.com and other supported exchanges with available trading pairs

- Gradual Accumulation: Implement dollar-cost averaging to mitigate timing risk in volatile market conditions

- Community Engagement: Monitor project updates through official channels (website: anicompanion.net, Twitter community) to stay informed about developments

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ANI token? What are its main uses and value?

ANI is a community-driven AI Meme token gaining value from Grok narrative momentum, not technical fundamentals. It's an unofficial token leveraging the Grok ecosystem buzz and social community engagement for its primary value proposition.

What is ANI's historical price trend? What price level is it currently at?

ANI has historically fluctuated between $76.72 and $98.33. Currently as of February 2026, ANI is trading in the mid-range. Price predictions suggest potential movement toward $93.77 by 2032, reflecting steady market positioning within its established range.

How to predict ANI price? What are the main factors affecting ANI price?

ANI price prediction depends on Bitcoin and major cryptocurrency fluctuations, market demand, trading volume, and social media trends. Monitor these key indicators for price movement analysis.

What are the risks to pay attention to when investing in ANI tokens?

Main risks include fragmented liquidity across multiple chains, potential smart contract vulnerabilities, and rapid fluctuations in project momentum. Investors should conduct thorough due diligence before participating.

Compared with other AI-related tokens such as FET and AGIX, what are the advantages and disadvantages of ANI?

ANI focuses on decentralized AI infrastructure with strong technical foundation. Advantages include innovative tokenomics and community governance. Compared to FET's autonomous agents and AGIX's AI marketplace, ANI emphasizes direct AI computation access. Disadvantages may include smaller ecosystem size and lower transaction volume than established competitors currently.

What is the technical team and project progress of ANI? What is the future roadmap?

ANI is backed by a strong technical team focused on AI-driven blockchain innovation. The project continues advancing its core infrastructure with scheduled upgrades planned for 2026. Future roadmap includes enhanced smart contract capabilities, expanded ecosystem partnerships, and improved scalability solutions to drive mainstream adoption.

What is the ANI price prediction target for 2024-2025?

ANI price prediction for 2024-2025 is difficult to determine precisely, but market trends and project development will significantly impact its value. Based on current market analysis, ANI could reach $0.001-0.003 USD range, depending on market conditions and adoption growth.

How to buy and trade ANI tokens on exchanges?

Log in to the trading platform, select the ANI trading pair, choose your payment token (SOL, ETH, or USDC), enter the transaction amount, adjust slippage settings, and complete the trade. You can also access ANI's token details page directly for trading.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Top 5 Meme Coins to Invest in 2025: Risks and Rewards

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Meme Coin Price Predictions for 2025:Factors Influencing Meme Coin Prices

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

MemeBox Price and Airdrop Guide 2025: What You Need to Know

Three electronic banks accept dollars beyond the reach of central banks

What Is a CBDC (Central Bank Digital Currency)? An In-Depth Comparison with Cryptocurrency

Phil Konieczny – Who Is He? What Is His Wealth? Why Does He Wear a Mask?

What is altseason and how to get ready for it

Comprehensive Guide to Bitcoin Mining Locations: Where to Mine Profitably