2026 APRS Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Agricultural Technology

Introduction: APRS Market Position and Investment Value

Apeiron (APRS), positioned as an innovative Web3 gaming ecosystem that combines god simulation with roguelike adventure elements, has been building its presence in the blockchain gaming sector since its launch in 2024. As of February 2026, APRS maintains a market capitalization of approximately $201,274, with a circulating supply of around 197.71 million tokens, and the price hovering around $0.001018. This asset, characterized as a strategic play-to-earn gaming token built on the Ronin blockchain, is playing an increasingly notable role in the Web3 gaming and NFT marketplace sectors.

This article will comprehensively analyze APRS price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. APRS Price History Review and Current Market Status

APRS Historical Price Evolution Trajectory

- 2024: Token launched in April with an initial price of $0.15, reached its all-time high of $0.7901 in May, representing a significant milestone in the project's early trading phase

- 2024-2025: Following the peak in May 2024, the token entered a prolonged correction period, with price declining substantially throughout the remainder of 2024 and into 2025

- 2025: Market conditions deteriorated further, with APRS reaching its all-time low of $0.001001 in December, marking a notable downturn in the token's valuation

APRS Current Market Situation

As of February 8, 2026, APRS is trading at $0.001018, positioning itself near its historical low price range. The token has experienced mixed short-term price movements, with a decline of 0.0023% over the past hour and 11.16% over the past 24 hours. The 24-hour trading range has fluctuated between $0.001018 and $0.00115.

Looking at broader timeframes, APRS has declined 4.41% over the past week and experienced a substantial 82.26% decrease over the past 30 days. The one-year performance shows a decline of 97.65% from previous levels.

The token currently holds a market capitalization of approximately $201,274, ranking at position 3932 in the cryptocurrency market with a market dominance of 0.000040%. With a circulating supply of 197,714,888 APRS tokens representing 19.77% of the total supply of 1 billion tokens, the fully diluted market cap stands at $1,018,000. The market cap to fully diluted valuation ratio is 19.77%.

Daily trading volume has reached $8,190, reflecting current market activity levels. The token is held by 877 addresses and is available for trading on Gate.com. The current market sentiment index stands at 7, indicating an "Extreme Fear" phase in the broader cryptocurrency market environment.

Click to view the current APRS market price

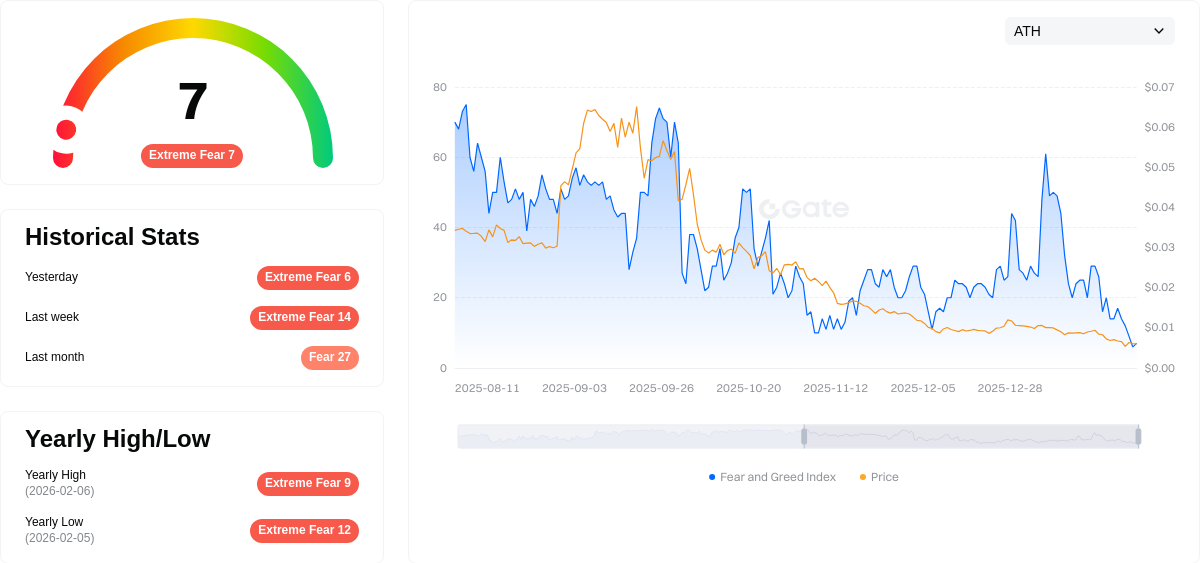

APRS Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index hitting 7. This exceptionally low reading indicates severe market pessimism and panic selling pressure among investors. When fear reaches such extreme levels, it often creates significant buying opportunities for long-term investors, as assets become heavily oversold. However, caution is advised, as extreme fear can precede further price declines. Experienced traders may view this as a potential accumulation phase, while risk-averse investors should carefully assess their positions. Market volatility remains high during such periods.

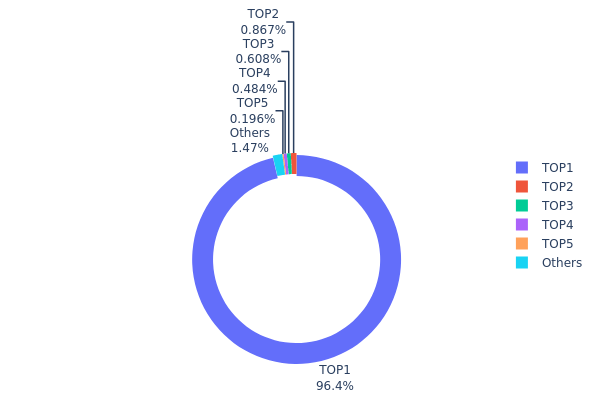

APRS Holdings Distribution

Based on the current on-chain data, APRS exhibits an extremely concentrated holdings pattern. The top-ranked address holds 963,721.46K tokens, accounting for 96.37% of the total circulation, demonstrating near-absolute control over the token supply. The second through fifth largest addresses hold 0.86%, 0.60%, 0.48%, and 0.19% respectively, while all remaining addresses collectively hold only 1.5% of the total supply. This distribution structure indicates a highly centralized asset allocation pattern.

This extreme concentration level poses significant structural risks to the market. When a single address controls over 96% of the circulating supply, it can trigger substantial price volatility through relatively small trading actions. Such concentration also increases susceptibility to market manipulation, as the dominant holder can influence price discovery mechanisms and liquidity distribution. From a decentralization perspective, this holdings structure deviates significantly from the distributed governance principles typically associated with blockchain assets, more closely resembling a centralized token management model.

The current holdings distribution reflects APRS's underdeveloped on-chain ecosystem maturity. The limited number of participating addresses and the disproportionate concentration of tokens suggest insufficient market penetration and inadequate liquidity dispersion. This structure may impede the token's organic price discovery process and increase vulnerability to sudden liquidity shocks. For potential investors, the extreme centralization warrants careful consideration regarding counterparty risks and market stability factors.

Click to view current APRS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5882...fe97b1 | 963721.46K | 96.37% |

| 2 | 0xf89d...5eaa40 | 8670.96K | 0.86% |

| 3 | 0xeab4...6bdc15 | 6079.99K | 0.60% |

| 4 | 0xa461...705867 | 4844.51K | 0.48% |

| 5 | 0x5077...bab2f6 | 1955.63K | 0.19% |

| - | Others | 14727.45K | 1.5% |

II. Core Factors Influencing APRS Future Price

Market Demand and Investor Behavior

- Market Sentiment: Blockchain assets, particularly newly issued tokens and NFTs, typically experience significant price volatility. This volatility may be influenced by various factors, including market sentiment, investor behavior, and external economic events.

- Behavioral Patterns: The collective actions of investors and traders can create momentum in either direction, affecting short-term price movements and potentially establishing longer-term trends.

- Risk Appetite: Changes in overall market risk appetite can significantly impact demand for APRS, as investors shift between risk-on and risk-off positions.

Technology Development and Ecosystem Performance

- Platform Innovation: The pace of technological advancement and successful implementation of new features within the project's ecosystem can enhance utility and drive adoption.

- Network Effects: As more users and developers engage with the platform, the value proposition may strengthen, potentially supporting price appreciation.

- Competition Landscape: The relative performance and innovation rate compared to similar projects in the blockchain gaming and NFT space may influence market positioning.

Broader Blockchain Market Performance

- Market Correlation: APRS price movements often correlate with broader cryptocurrency market trends, particularly major assets that serve as market benchmarks.

- Sector Performance: The performance of the gaming and NFT sectors within the blockchain ecosystem can create tailwinds or headwinds for related tokens.

- Liquidity Conditions: Overall market liquidity and trading volume in the cryptocurrency space affect price discovery and volatility patterns.

Regulatory Environment

- Policy Developments: Changes in cryptocurrency regulations across different jurisdictions can impact market access and investor confidence.

- Compliance Framework: The project's ability to adapt to evolving regulatory requirements may influence institutional participation and mainstream adoption.

- Legal Clarity: Greater regulatory clarity in key markets could reduce uncertainty and potentially support more stable price development.

III. 2026-2031 APRS Price Prediction

2026 Outlook

- Conservative Prediction: $0.00078 - $0.00106

- Neutral Prediction: Around $0.00106

- Optimistic Prediction: Up to $0.00145 (contingent on favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: The cryptocurrency market may enter a growth phase driven by broader institutional adoption and technological advancements in the blockchain ecosystem.

- Price Range Predictions:

- 2027: $0.00115 - $0.00181, with an average around $0.00126

- 2028: $0.00137 - $0.00223, with an average around $0.00154

- 2029: $0.00164 - $0.00246, with an average around $0.00188

- Key Catalysts: Potential drivers include enhanced network utility, strategic partnerships, expansion of use cases within decentralized applications, and overall positive sentiment in the crypto markets.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00152 - $0.00252 by 2030 (assuming steady market growth and maintained project development)

- Optimistic Scenario: $0.00199 - $0.00347 by 2031 (dependent on accelerated adoption, significant protocol upgrades, and sustained bull market momentum)

- Transformative Scenario: Prices could potentially exceed current projections if APRS achieves widespread integration across major platforms and demonstrates exceptional utility within its ecosystem

- 2026-02-08: APRS is positioned in an early growth phase with potential for gradual appreciation over the forecast period

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00145 | 0.00106 | 0.00078 | 4 |

| 2027 | 0.00181 | 0.00126 | 0.00115 | 23 |

| 2028 | 0.00223 | 0.00154 | 0.00137 | 50 |

| 2029 | 0.00246 | 0.00188 | 0.00164 | 84 |

| 2030 | 0.00252 | 0.00217 | 0.00152 | 113 |

| 2031 | 0.00347 | 0.00235 | 0.00199 | 130 |

IV. APRS Professional Investment Strategy and Risk Management

APRS Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Believers in the Web3 gaming ecosystem and blockchain-based play-to-earn models

- Operational Recommendations:

- Consider accumulating APRS during market downturns when the token trades closer to historical support levels

- Monitor the development progress of Apeiron's three-token economic system and NFT marketplace expansion

- Utilize Gate Web3 Wallet for secure storage with multi-signature protection and regular security audits

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of approximately $8,190 to identify liquidity patterns and potential breakout signals

- Support and Resistance Levels: Track the historical low of $0.001001 as a critical support zone and previous resistance levels for entry/exit points

- Swing Trading Key Points:

- Be aware of high volatility, as evidenced by the 82.26% decline over 30 days

- Set strict stop-loss orders given the token's significant price fluctuations

APRS Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: Up to 10% with active hedging strategies

(II) Risk Hedging Solutions

- Diversification Strategy: Balance APRS holdings with established gaming tokens and Layer-1 blockchain assets

- Position Sizing: Limit exposure due to the token's current low market cap of approximately $201,274 and limited exchange availability

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading with enhanced security features

- Cold Storage Solution: Hardware wallet integration for long-term holdings exceeding trading needs

- Security Precautions: Enable two-factor authentication, avoid sharing private keys, and verify contract addresses (ETH: 0x95b4B8CaD3567B5d7EF7399C2aE1d7070692aB0D) before transactions

V. APRS Potential Risks and Challenges

APRS Market Risks

- Extreme Volatility: The token has declined 97.65% over the past year from its all-time high of $0.7901 in May 2024, indicating substantial price instability

- Limited Liquidity: With only $8,190 in 24-hour trading volume and availability on a single exchange, APRS faces potential liquidity constraints

- Low Market Capitalization: A circulating market cap of approximately $201,274 and fully diluted valuation of $1,018,000 suggests vulnerability to market manipulation

APRS Regulatory Risks

- Gaming Token Classification: Evolving regulations regarding play-to-earn tokens may impact APRS's operational model

- NFT Marketplace Compliance: Regulatory scrutiny of NFT trading platforms could affect the broader Apeiron ecosystem

- Cross-border Gaming Restrictions: Potential limitations on blockchain gaming in certain jurisdictions may reduce user adoption

APRS Technical Risks

- Blockchain Dependency: The project's reliance on Ronin blockchain infrastructure exposes it to potential network vulnerabilities or performance issues

- Smart Contract Vulnerabilities: The ERC-20 token contract on Ethereum may contain undiscovered security flaws despite standard implementations

- Limited Holder Base: With only 877 holders, the token faces concentration risk and potential exit pressure

VI. Conclusion and Action Recommendations

APRS Investment Value Assessment

APRS presents a high-risk, speculative opportunity within the Web3 gaming sector. While the project combines strategic card-based gameplay with a three-token economic system on Ronin blockchain, the token has experienced significant depreciation and faces substantial challenges. The current market conditions, including limited liquidity, low trading volume, and a circulating supply of only 19.77% of total supply, suggest caution. Long-term value depends heavily on the successful execution of Apeiron's game development roadmap and broader adoption of blockchain gaming.

APRS Investment Recommendations

✅ Beginners: Avoid direct investment until demonstrating clearer project traction and market stability; focus on learning about Web3 gaming fundamentals first ✅ Experienced Investors: Consider small speculative positions not exceeding 2-3% of crypto portfolio, with strict stop-loss protocols ✅ Institutional Investors: Conduct comprehensive due diligence on Apeiron's development team, tokenomics sustainability, and competitive positioning before any allocation

APRS Trading Participation Methods

- Spot Trading: Available on Gate.com with USDT trading pairs for direct purchases

- DeFi Interaction: Access through decentralized exchanges supporting Ethereum-based tokens, verifying contract address 0x95b4B8CaD3567B5d7EF7399C2aE1d7070692aB0D

- Ecosystem Participation: Engage with Apeiron's gameplay and NFT marketplace to understand utility before financial commitment

Cryptocurrency investment carries extreme risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is APRS? What are its main uses and characteristics?

APRS is a decentralized protocol enabling real-time data sharing and location tracking for amateur radio operators. Its main uses include emergency communication, weather tracking, and asset monitoring. Key features are real-time updates, global accessibility, and low-latency performance.

APRS price受哪些因素影响?如何进行价格预测?

APRS价格受市场需求、供应量、技术发展和市场竞争影响。价格预测基于历史趋势、交易额数据和市场分析。专家评估风险和潜在增长动力。

What is the historical price trend of APRS and what is the current market price?

APRS is currently trading at ¥0.032095, down 25.30% in the last 24 hours with a market cap of ¥3.2584 million. The token has shown volatility, with a 24-hour trading volume of ¥2.745 million.

What are the risks of investing in APRS? How should I evaluate its investment value?

APRS carries market volatility and technical risks. Evaluate its value by analyzing project fundamentals, community adoption, transaction volume, and market sentiment. Strong tokenomics and ecosystem development indicate higher potential returns.

What are the differences and advantages of APRS compared to other similar cryptocurrencies or tokens?

APRS offers superior staking rewards through optimized yield mechanisms and advanced compounding strategies. It features lower transaction costs, faster settlement times, and innovative tokenomics designed for sustainable growth, outperforming traditional alternatives in transaction volume and holder benefits.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

What is Dencun? Everything About Ethereum's Cancun-Deneb Upgrade

Bitcoin Forecast: What Will BTC Be Worth After the 2028 Halving

How to Claim NIGHT Tokens in Midnight's Glacier Drop

How to Earn Money with Cryptocurrencies and Bitcoin?

Complete Analysis of Layer 1 vs Layer 2