2026 ARCHAI Price Prediction: Expert Analysis and Market Forecast for the Next Generation AI Token

Introduction: ARCHAI's Market Position and Investment Value

ARCH AI (ARCHAI), as an innovative AI agent platform leveraging proprietary ChainGraph technology and multimodal agent capabilities, has been making strides in the blockchain-based artificial intelligence sector since its launch in early 2025. As of February 2026, ARCHAI maintains a market capitalization of approximately $1.47 million, with a circulating supply of 900 million tokens and a current price hovering around $0.0016. This asset, characterized as a "next-generation AI agent ecosystem," is playing an increasingly important role in integrating AI functionalities across social platforms like Telegram and Twitter.

This article will comprehensively analyze ARCHAI's price trends from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ARCHAI Price History Review and Current Market Status

ARCHAI Historical Price Evolution Trajectory

- February 2025: Token reached historical high of $0.08301 during initial market enthusiasm

- December 2025: Price experienced significant correction, touching historical low of $0.001, representing substantial decline from peak levels

- Early 2026: Market showing signs of stabilization with gradual recovery patterns observed in recent trading sessions

ARCHAI Current Market Dynamics

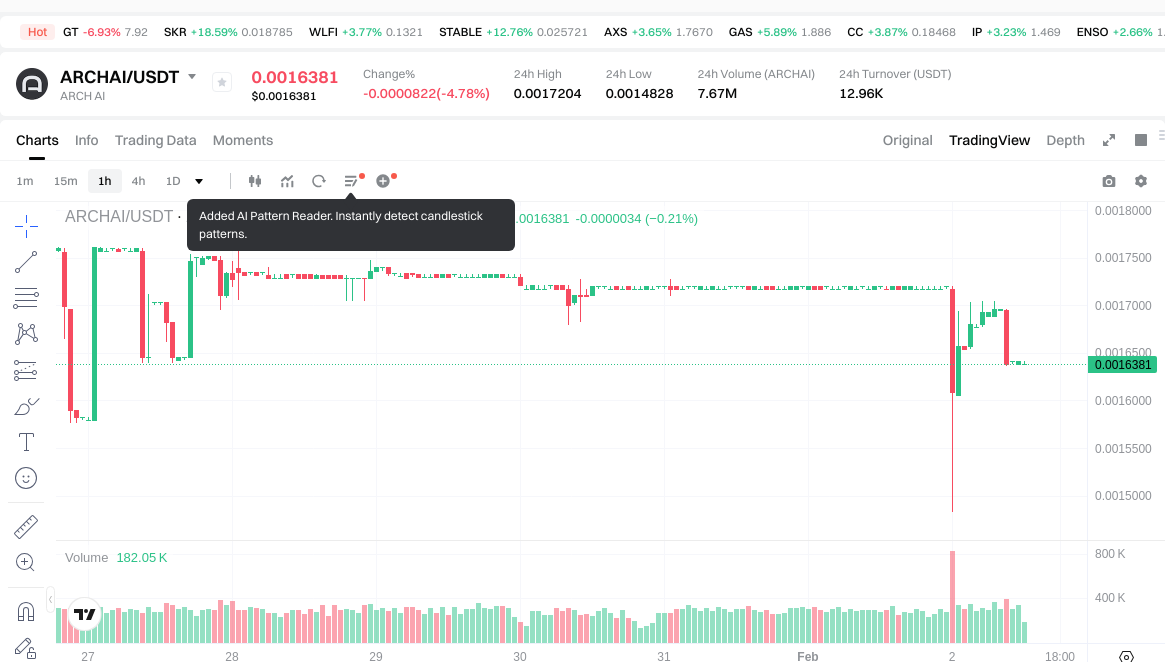

As of February 02, 2026, ARCHAI is trading at $0.0016381, reflecting a 24-hour price movement of -4.58%. The token has demonstrated modest short-term volatility, with a 1-hour change of 0.19% and a 7-day increase of 3.35%. Over the past 30 days, the token has declined by 14.21%.

The current 24-hour trading range spans from $0.0014828 to $0.0017204, with total trading volume reaching $12,946.38. Market capitalization stands at $1,474,290, with a fully diluted valuation matching this figure as the entire supply of 900,000,000 tokens is already in circulation. The circulating supply represents 100% of the maximum supply, indicating complete token distribution.

ARCHAI maintains a market dominance of 0.000054%, ranking 2,244 in the cryptocurrency market. The token has attracted 506,344 holders since its market debut. Current market sentiment indicators suggest a cautious trading environment, with broader market conditions showing elevated concern levels.

Click to view current ARCHAI market price

ARCHAI Market Sentiment Index

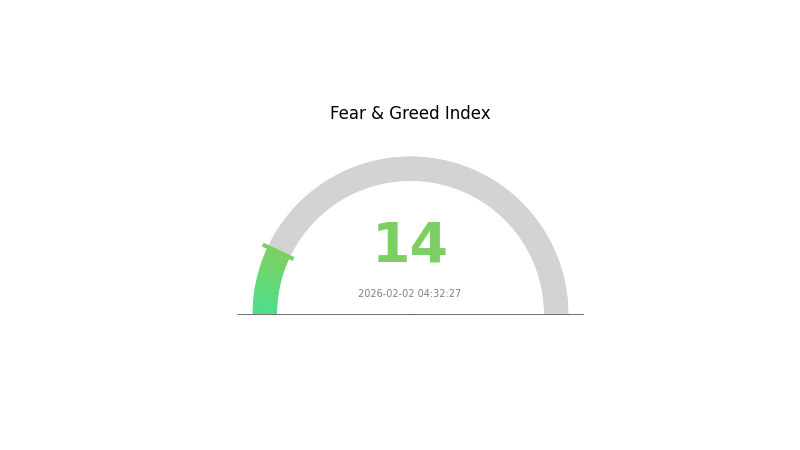

02-02-2026 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index registering at just 14 points. This indicates heightened market anxiety and pessimism among investors. During such periods, risk-averse sentiment dominates trading activity, often leading to increased selling pressure and price volatility. Traders should exercise caution and consider their risk tolerance carefully. However, extreme fear historically presents contrarian opportunities for long-term investors seeking favorable entry points. Monitor market fundamentals closely and avoid emotional decision-making during such uncertain times.

ARCHAI Holding Distribution

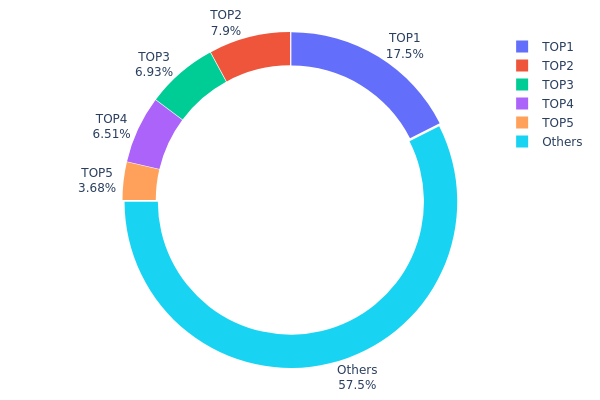

According to the on-chain data, ARCHAI's holding distribution exhibits notable concentration characteristics. The top address (0x7c97...07d424) holds approximately 144.15 million tokens, accounting for 17.52% of the total supply, making it the largest single holder. The second-ranked address is the burn address (0x0000...00dead), which locks 65 million tokens representing 7.90% of the supply, effectively reducing circulating tokens. The third through fifth addresses hold 6.92%, 6.51%, and 3.68% respectively, while the combined holdings of other addresses constitute 57.47%.

From a concentration perspective, ARCHAI demonstrates moderate centralization. The top five addresses collectively control approximately 42.53% of the total supply, indicating that a significant portion of tokens remains in the hands of major holders. This concentration level suggests potential price volatility risks, as large holders possess substantial influence over market liquidity and price movements. However, considering that the second-largest position belongs to the burn address, the actual controlling stake by active addresses is relatively lower, which somewhat mitigates centralization concerns.

The current holding structure reflects a mixed market characteristic. While over half of the tokens are distributed among smaller holders, maintaining a certain degree of decentralization, the presence of several whale addresses indicates an on-chain structure that has not yet achieved complete dispersion. This distribution pattern is common in early-stage projects or those undergoing active market-making phases, requiring continued monitoring of large holder behavior and transfer dynamics to assess potential market impacts.

Click to view current ARCHAI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7c97...07d424 | 144153.79K | 17.52% |

| 2 | 0x0000...00dead | 65000.00K | 7.90% |

| 3 | 0xd73e...0c4cc2 | 57000.00K | 6.92% |

| 4 | 0x82d7...c96b46 | 53566.02K | 6.51% |

| 5 | 0x17e9...814b94 | 30278.62K | 3.68% |

| - | Others | 472689.95K | 57.47% |

II. Core Factors Influencing ARCHAI's Future Price

Supply Mechanism

- Market-Driven Supply Dynamics: ARCHAI's price trajectory appears influenced by natural market forces rather than fixed supply schedules. The token's value responds to real-time demand fluctuations across high-tech and digital economy sectors.

- Historical Patterns: Past price movements suggest volatility management between current and future pricing expectations. Historical operations have demonstrated influence on future market conditions, though they do not solely determine outcomes.

- Current Impact: Price volatility management remains an ongoing process. Current market operations continue to shape near-term price expectations, with fluctuations reflecting the "management" of price movements between present and anticipated future values.

Institutional and Major Holder Dynamics

- Institutional Positioning: While specific institutional holdings data for ARCHAI is not extensively documented in available materials, the token appears positioned within broader cryptocurrency market structures where institutional participation influences price stability.

- Enterprise Adoption: Information regarding specific enterprise adoption of ARCHAI remains limited in current market data. The token exists within an ecosystem where enterprise-level blockchain adoption continues to evolve.

- National Policies: Regulatory frameworks affecting digital assets continue to develop globally. Countries are increasingly establishing oversight mechanisms for cryptocurrency markets, which indirectly impacts tokens like ARCHAI through broader market sentiment and compliance requirements.

Macroeconomic Environment

- Monetary Policy Impact: Global central bank policies, particularly those affecting liquidity conditions and interest rates, create cascading effects on cryptocurrency valuations. Tightening or loosening monetary conditions influence investor risk appetite for digital assets.

- Inflation Hedging Characteristics: Digital assets demonstrate varying performance during inflationary periods. Structural factors beyond total demand, including technological innovation related to artificial intelligence, big data, and mobile technologies, contribute to long-term value propositions in the crypto space.

- Geopolitical Factors: International competition and policy shifts play crucial roles in shaping cryptocurrency market dynamics. Trade policies, technological sovereignty concerns, and cross-border capital flow regulations create both opportunities and constraints for digital asset markets.

Technological Development and Ecosystem Building

- Innovation-Driven Value Creation: ARCHAI's potential price appreciation connects to broader technological innovation trends. High-tech industries and digital economy sectors that drive significant technological advancement often correlate with increased interest in blockchain-based assets.

- Digital Transformation Integration: The ongoing digitalization across industries creates foundational support for cryptocurrency adoption. As traditional sectors increasingly integrate digital technologies, blockchain-based solutions find expanding application scenarios.

- Ecosystem Applications: The development of decentralized applications and broader ecosystem projects continues to mature. While specific DApp implementations for ARCHAI require further documentation, the token exists within a growing landscape of blockchain utility and application development.

III. 2026-2031 ARCHAI Price Prediction

2026 Outlook

- Conservative prediction: $0.00157 - $0.00164

- Neutral prediction: approximately $0.00164

- Optimistic prediction: up to $0.00213 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual growth phase with moderate volatility, reflecting emerging market recognition and ecosystem development

- Price range prediction:

- 2027: $0.00113 - $0.00194, average around $0.00188

- 2028: $0.00159 - $0.00241, average around $0.00191

- 2029: $0.00125 - $0.00290, average around $0.00216

- Key catalysts: Project development milestones, community expansion, potential partnerships, and broader crypto market sentiment

2030-2031 Long-term Outlook

- Baseline scenario: $0.00182 - $0.00288 (assuming steady project development and stable market conditions)

- Optimistic scenario: $0.00253 - $0.00325 (assuming successful ecosystem expansion and increased market adoption)

- Transformative scenario: potential to reach $0.00325 by 2031 (contingent on significant technological breakthroughs, major partnership announcements, and favorable regulatory environment)

- February 2, 2026: ARCHAI trading within $0.00157 - $0.00213 range (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00213 | 0.00164 | 0.00157 | 0 |

| 2027 | 0.00194 | 0.00188 | 0.00113 | 15 |

| 2028 | 0.00241 | 0.00191 | 0.00159 | 16 |

| 2029 | 0.0029 | 0.00216 | 0.00125 | 31 |

| 2030 | 0.00288 | 0.00253 | 0.00182 | 54 |

| 2031 | 0.00325 | 0.0027 | 0.00143 | 65 |

IV. ARCHAI Professional Investment Strategies and Risk Management

ARCHAI Investment Methodology

(I) Long-term Holding Strategy

- Target Audience: Investors seeking exposure to AI-powered blockchain infrastructure with moderate risk tolerance

- Operational Recommendations:

- Consider accumulating positions during market downturns, particularly when price approaches recent support levels around $0.0015

- Monitor project development milestones related to ChainGraph technology and social platform integrations

- Storage Solution: Utilize Gate Web3 Wallet for secure storage, ensuring private key management and enabling easy access to ARCHAI tokens on Base network

(II) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Monitor the 24-hour price range between $0.0014828 and $0.0017204 to identify potential entry and exit points

- Volume Analysis: Track the 24-hour trading volume of $12,946.38 to assess market liquidity and trading activity

- Swing Trading Considerations:

- The token has shown 3.35% growth over 7 days, suggesting potential for short-term momentum trading

- Set stop-loss orders to manage downside risk, particularly given the 30-day decline of 14.21%

ARCHAI Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-8% of crypto portfolio allocation

- Professional Investors: Up to 10% of crypto portfolio allocation, with active monitoring

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance ARCHAI holdings with established cryptocurrencies and stablecoins to reduce overall volatility

- Position Sizing: Implement gradual accumulation strategy rather than single large purchases to average entry costs

(III) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet provides secure storage for ERC-20 tokens on Base network with user-friendly interface

- Multi-signature Option: Consider multi-signature wallet solutions for larger holdings to enhance security

- Security Considerations: Never share private keys, enable two-factor authentication, and regularly update wallet software to protect against potential vulnerabilities

V. ARCHAI Potential Risks and Challenges

ARCHAI Market Risks

- Price Volatility: The token has experienced substantial price fluctuations, ranging from an all-time high of $0.08301 in February 2025 to an all-time low of $0.001 in December 2025

- Limited Trading Volume: With a 24-hour trading volume of approximately $12,946, liquidity may be constrained, potentially leading to slippage during larger trades

- Market Concentration: Trading on a limited number of exchanges may impact price discovery and market depth

ARCHAI Regulatory Risks

- AI Technology Oversight: Evolving regulatory frameworks for AI-powered blockchain applications may introduce compliance requirements that could affect project operations

- Cross-Platform Integration Compliance: Integration with social platforms like Telegram and Twitter may face regulatory scrutiny regarding data privacy and user protection

- Token Classification Uncertainty: Regulatory authorities may revise token classification standards, potentially impacting ARCHAI's market accessibility

ARCHAI Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token on Base network, potential smart contract bugs or exploits could affect token security

- Platform Dependency: Reliance on Base blockchain infrastructure means network congestion or technical issues could impact token functionality

- Technology Adoption Risk: The success of proprietary ChainGraph technology and multimodal AI agents depends on market adoption and competitive differentiation

VI. Conclusion and Action Recommendations

ARCHAI Investment Value Assessment

ARCH AI presents an innovative approach to AI agent technology through its ChainGraph infrastructure and social platform integrations. The project targets the growing intersection of artificial intelligence and blockchain technology. However, investors should note the token's market capitalization of approximately $1.47 million and limited exchange availability, which may indicate early-stage development. The recent 30-day price decline of 14.21% suggests market consolidation, while the 7-day uptick of 3.35% may indicate stabilization. Long-term value depends on successful technology deployment and ecosystem growth, while short-term risks include market volatility and liquidity constraints.

ARCHAI Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2% of crypto portfolio) and focus on understanding the project's technology and roadmap before increasing exposure ✅ Experienced Investors: Consider dollar-cost averaging strategy during market dips, while maintaining strict risk management protocols and portfolio diversification ✅ Institutional Investors: Conduct thorough due diligence on technology architecture, team credentials, and competitive positioning before committing capital

ARCHAI Trading Participation Methods

- Spot Trading: Purchase ARCHAI tokens on Gate.com with support for multiple trading pairs and competitive fees

- Wallet Storage: Transfer tokens to Gate Web3 Wallet for secure self-custody and easy access to Base network ecosystem

- Portfolio Monitoring: Utilize Gate.com's analytical tools to track price movements, trading volume, and market trends in real-time

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ARCHAI? What are its uses and value?

ARCHAI is an AI Agent protocol built on ChainGraph, enabling multi-agent interactions, automated trading, content generation, and investment analysis. It enhances AI applications across Web3, delivering real utility in decentralized finance and autonomous systems.

What is the current price of ARCHAI token? How has its historical price trend been?

ARCHAI is currently trading at $0.0073, down 94.59% from its all-time high of $0.146. The token has experienced significant decline since its peak, reflecting broader market dynamics in the crypto space.

How do professional analysts predict ARCHAI's future price? What are the influencing factors?

Professional analysts predict ARCHAI price by analyzing project fundamentals, market sentiment, trading volume, technological developments, and regulatory environment. Key factors include team credibility, adoption rate, macroeconomic conditions, and competitive landscape within the AI crypto sector.

What risks are involved in investing in ARCHAI? What should I pay attention to?

ARCHAI investments carry price volatility and market sentiment risks. Monitor negative news that may trigger price drops. Ensure adequate risk management and only invest capital you can afford to lose.

What are the advantages and disadvantages of ARCHAI compared to other AI-related tokens?

ARCHAI offers superior technical innovation and stronger market potential versus competing AI tokens. However, its complexity may create higher entry barriers for new users initially.

What is the background of ARCHAI's technical team and how is the project progressing?

ARCHAI's technical team focuses on ChainGraph technology with steady project progression. The team is advancing core infrastructure development, with significant milestones expected in the coming years, positioning ARCHAI for substantial market growth and adoption.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Free Money for App Registration 2025

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks

Games You Can Earn From – TOP 11 Games

Phil Konieczny – Who Is He? What Is His Wealth? Why Does He Wear a Mask?