2026 ASTRA Price Prediction: Expert Analysis and Market Forecast for the Next Generation Blockchain Protocol

Introduction: ASTRA's Market Position and Investment Value

Astra Protocol (ASTRA), as a project focused on simplifying trading on the BNB network through AstraSwap exchange, has been developing its ecosystem since its establishment. As of February 2026, ASTRA maintains a market capitalization of approximately $300,760 with a circulating supply of around 730 million tokens, and the price is currently around $0.000412. This asset, characterized by its community-focused approach and charitable initiatives, is playing a role in the decentralized exchange landscape.

This article will comprehensively analyze ASTRA's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment to provide investors with professional price forecasts and practical investment strategies.

I. ASTRA Price History Review and Market Status

ASTRA Historical Price Evolution Trajectory

- 2023: On February 24, ASTRA reached a notable price level of $0.500054, representing a significant point in its trading history.

- 2024: On August 27, the token experienced substantial downward pressure, recording a low of $0.00035647.

- Recent Period: The token has shown considerable volatility, with price fluctuations reflecting broader market dynamics and project developments.

ASTRA Current Market Situation

As of February 7, 2026, ASTRA is trading at $0.000412, with a 24-hour trading volume of $21,866.35. The token has demonstrated mixed short-term performance, showing a 1.95% increase over the past 24 hours, while experiencing a decline of 0.19% in the last hour.

Over longer timeframes, ASTRA has faced considerable headwinds. The 7-day performance indicates a decline of 28.29%, while the 30-day trend shows a decrease of 36.53%. The annual performance reflects a decline of 75.13% from the previous year.

The token's market capitalization stands at $300,760, with a circulating supply of 730 million tokens out of a maximum supply of 1 billion tokens, representing 73% of the total supply in circulation. The fully diluted market capitalization is $412,000. ASTRA currently ranks 3520 in the overall cryptocurrency market, with a market share of 0.000016%.

The token's 24-hour price range has fluctuated between $0.0003845 and $0.0005339, indicating moderate intraday volatility. The current holder count stands at 2,512, suggesting a modest user base.

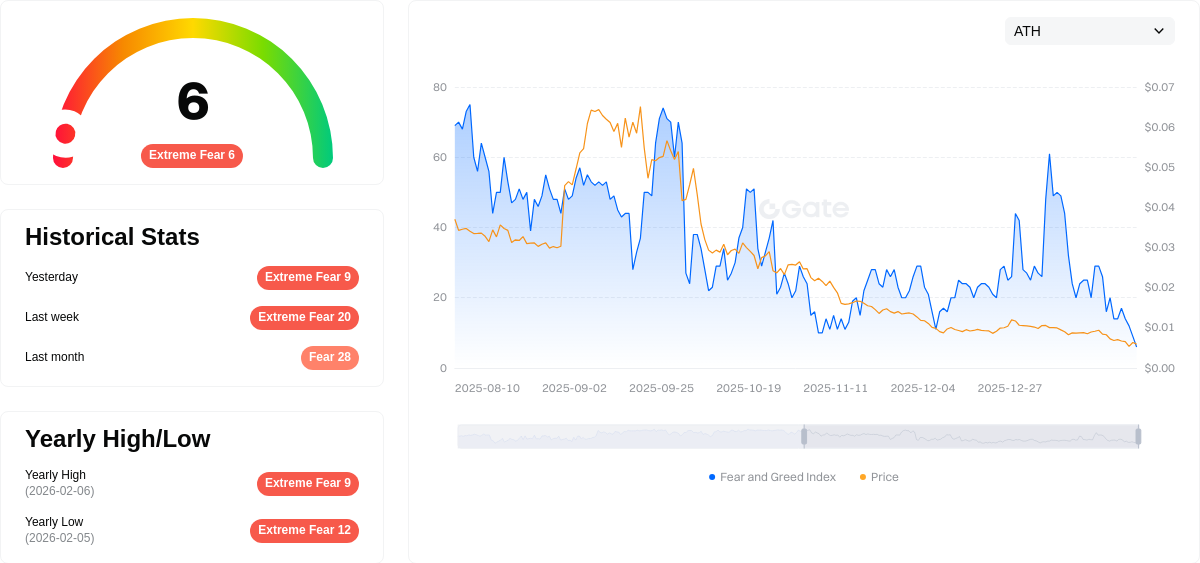

The crypto market sentiment index currently reads 6, indicating a state of extreme fear among market participants, which may be contributing to the recent price pressures across the broader digital asset ecosystem.

Click to view current ASTRA market price

ASTRA Market Sentiment Index

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index hitting a low of 6. This indicates heightened market anxiety and pessimism among investors. Such extreme fear conditions often present contrarian opportunities, as panic-driven selling may create attractive entry points for long-term investors. However, caution is warranted, as further downside pressure could occur. Traders should exercise risk management and avoid emotional decision-making during volatile periods. Monitor market fundamentals and technical support levels closely.

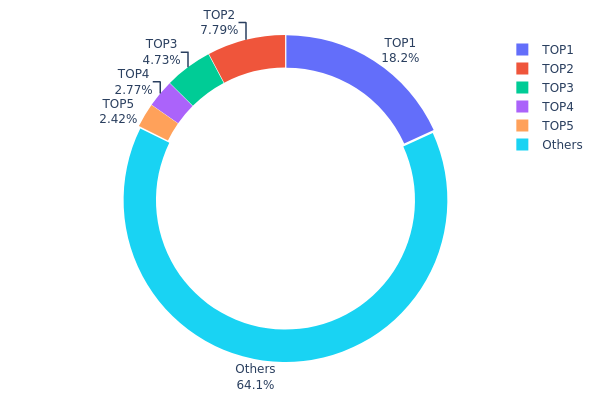

ASTRA Holding Distribution

The holding distribution chart reflects the concentration level of token holdings across different addresses on the blockchain, serving as a crucial indicator for assessing market structure and decentralization degree. By analyzing the distribution pattern of tokens among top holders and other addresses, we can evaluate the market's susceptibility to price manipulation and the stability of its on-chain structure.

According to the current data, ASTRA exhibits a moderate concentration pattern in its holding distribution. The top address holds 181,938.63K tokens, accounting for 18.19% of the total supply, while the top five addresses collectively control 358,999.38K tokens, representing approximately 35.89% of the total circulation. The remaining 64.11% is distributed among other addresses. This distribution structure suggests that while there is a certain degree of concentration among major holders, it has not reached an extremely centralized state. The proportion held by other addresses exceeds 60%, indicating a relatively broad base of market participants.

From a market impact perspective, this distribution pattern presents both opportunities and risks. The 18.19% holding by the single largest address grants it significant influence over short-term price movements, potentially triggering substantial volatility through large-scale buying or selling activities. However, compared to projects with extreme concentration where top holders control over 50% of the supply, ASTRA's distribution demonstrates better decentralization characteristics. The diversified holding structure among the remaining 64.11% of addresses provides certain resistance to market manipulation and enhances overall liquidity stability. This balanced distribution pattern suggests that ASTRA maintains reasonable on-chain structure health while preserving adequate market depth.

Click to view current ASTRA Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9642...2f5d4e | 181938.63K | 18.19% |

| 2 | 0x3f9f...bcd577 | 77909.01K | 7.79% |

| 3 | 0x0d07...b492fe | 47310.25K | 4.73% |

| 4 | 0xeaa5...2636f3 | 27665.21K | 2.76% |

| 5 | 0xbf8f...8fdf98 | 24214.28K | 2.42% |

| - | Others | 640962.62K | 64.11% |

II. Core Factors Influencing ASTRA's Future Price

Supply Mechanism

- Limited Supply Cap: ASTRA has a maximum total supply of 1 billion tokens, creating inherent scarcity that may positively influence long-term value appreciation.

- Token Buyback Program: The project has implemented buyback mechanisms where transaction fees trigger ASTRA repurchases, creating deflationary pressure designed to stabilize token value over time.

- Current Impact: Reduced circulating supply through strategic buybacks could enhance token scarcity, potentially supporting price stability when demand remains constant or increases.

Institutional and Whale Dynamics

- Institutional Holdings: Available materials indicate significant whale wallet concentration, with on-chain data showing increased accumulation by large holders during certain market phases.

- Strategic Partnerships: ASTRA has established collaborations with industry leaders including NVIDIA (through the Inception program), Alibaba Cloud, and Saudi NEOM, providing scalable infrastructure and advanced AI tools for the ecosystem.

- Market Behavior Patterns: Analysis shows that when large holders significantly increase their positions, it often signals notable market movements, with trading value distribution serving as a key indicator.

Macroeconomic Environment

- Regulatory Developments: Cryptocurrency prices remain highly volatile and susceptible to regulatory announcements, with policy changes potentially causing disproportionate short-term price fluctuations.

- Market Sentiment Influence: ASTRA operates in a 24/7 global market influenced by rapidly changing sentiment, where social media and community factors exert considerable impact on price behavior.

- Geopolitical Factors: External events including international tensions and trade dynamics can trigger significant daily price volatility, as observed across the broader cryptocurrency market.

Technological Development and Ecosystem Building

- AI Integration Infrastructure: ASTRA's AI infrastructure leverages NVIDIA's advanced GPU technology, enabling adaptive narratives and generative content creation within the TokenPlay AI platform.

- Web3 Entertainment Platform: The core ecosystem includes TokenPlay AI (built on Alibaba Cloud) allowing token communities to rapidly deploy gamified tools and interactive experiences without technical expertise, alongside the NovaToon web comics platform.

- Ecosystem Applications: ASTRA positions itself at the convergence of AI and blockchain technology trends, representing a forward-looking approach to future entertainment and content creation, though actual adoption and execution capability remain critical determinants of long-term value.

III. 2026-2031 ASTRA Price Prediction

2026 Outlook

- Conservative forecast: $0.00026 - $0.00041

- Neutral forecast: $0.00041 (average price level)

- Optimistic forecast: $0.00061 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual growth phase with steady price appreciation

- Price range forecast:

- 2027: $0.00036 - $0.00071 (23% increase from 2026 baseline)

- 2028: $0.00047 - $0.00077 (47% increase from 2026 baseline)

- 2029: $0.00048 - $0.00080 (67% increase from 2026 baseline)

- Key catalysts: Enhanced ecosystem development, potential technological upgrades, and broader market acceptance

2030-2031 Long-term Outlook

- Baseline scenario: $0.00054 - $0.00078 (80% increase from 2026 baseline)

- Optimistic scenario: $0.00067 - $0.00109 (85% increase from 2026 baseline in 2031)

- Transformative scenario: Approaching $0.00109 (contingent on significant market expansion and widespread utility adoption)

- 2026-02-07: ASTRA trading within early-stage price discovery range

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00061 | 0.00041 | 0.00026 | 0 |

| 2027 | 0.00071 | 0.00051 | 0.00036 | 23 |

| 2028 | 0.00077 | 0.00061 | 0.00047 | 47 |

| 2029 | 0.0008 | 0.00069 | 0.00048 | 67 |

| 2030 | 0.00078 | 0.00075 | 0.00054 | 80 |

| 2031 | 0.00109 | 0.00076 | 0.00067 | 85 |

IV. ASTRA Professional Investment Strategy and Risk Management

ASTRA Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors with medium to long-term horizons who believe in the project's community-driven governance model and the BNB network ecosystem development

- Operational Recommendations:

- Consider accumulating positions during market corrections when the price approaches historical support levels

- Monitor the project's roadmap execution and community engagement metrics as key holding indicators

- Storage Solution: Utilize Gate Web3 Wallet for secure custody with multi-signature protection and regular security audits

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Given the 24-hour range of $0.0003845 to $0.0005339, traders may identify entry points near lower bounds and exit targets near resistance

- Volume Analysis: Monitor the 24-hour trading volume of $21,866.35 to gauge market participation and liquidity conditions

- Swing Trading Considerations:

- Short-term volatility remains elevated with a 7-day decline of 28.29%, suggesting caution for swing traders

- Position sizing should account for the relatively lower market capitalization of $300,760 and potential liquidity constraints

ASTRA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Limit allocation to 1-2% of crypto portfolio due to high volatility and lower market ranking

- Aggressive Investors: May allocate 3-5% with strict stop-loss disciplines

- Professional Investors: Could consider 5-10% allocation with active hedging strategies and continuous monitoring

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine ASTRA holdings with more established BNB ecosystem tokens to reduce concentration risk

- Dynamic Stop-Loss: Implement trailing stop-loss orders 15-20% below entry prices to protect against sudden downturns

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate Web3 Wallet for active trading needs with convenient access and transaction capabilities

- Cold Storage Strategy: For long-term holdings, consider transferring tokens to hardware wallets after accumulation

- Security Precautions: Enable two-factor authentication, verify contract addresses (0x201332Bd45c8628D814F870bFb584B385A7C351e on Ethereum), and never share private keys or seed phrases

V. ASTRA Potential Risks and Challenges

ASTRA Market Risks

- High Volatility: The token has experienced a 75.13% decline over one year, indicating significant price instability that may continue

- Low Liquidity: With a market capitalization of approximately $300,760 and ranking at 3520, liquidity may be limited during high-volatility periods

- Market Concentration: Only 1 exchange listing suggests concentrated trading activity, which may amplify price swings and slippage risks

ASTRA Regulatory Risks

- Compliance Uncertainty: As regulatory frameworks for decentralized exchanges and community-governed tokens evolve, ASTRA may face compliance challenges in various jurisdictions

- Charitable Donation Structure: The 10% transaction fee allocation to charitable causes may encounter scrutiny regarding tax implications and transparency requirements

- BNB Ecosystem Dependence: Regulatory actions targeting the BNB network could indirectly impact ASTRA's operations and token value

ASTRA Technical Risks

- Smart Contract Vulnerabilities: Despite audits, decentralized exchange protocols may contain undiscovered vulnerabilities that could lead to exploits

- Network Dependency: Reliance on the BNB network exposes ASTRA to potential network congestion, upgrade risks, or technical failures

- Limited Holder Base: With 2,512 holders, the concentration of token ownership may create centralization risks and governance challenges

VI. Conclusion and Action Recommendations

ASTRA Investment Value Assessment

Astra Protocol presents a community-focused proposition within the BNB network ecosystem, emphasizing charitable contributions and transparent governance. However, the token's significant underperformance over the past year (down 75.13%), combined with relatively low market capitalization ($300,760) and limited exchange listings, suggests substantial risks. The circulating supply of 730 million tokens (73% of total supply) provides moderate transparency regarding token distribution. While the project's 10% transaction fee structure supports marketing, development, and charitable initiatives, investors should carefully weigh these long-term value propositions against near-term volatility and liquidity constraints.

ASTRA Investment Recommendations

✅ Beginners: Approach with extreme caution due to high volatility and low liquidity; if interested, allocate no more than 1% of crypto portfolio and prioritize education about the BNB ecosystem and DeFi protocols before investing

✅ Experienced Investors: Consider small-cap allocation (2-3%) as a speculative position, with active monitoring of community developments, transaction volume trends, and broader BNB network adoption metrics

✅ Institutional Investors: Evaluate carefully given limited liquidity and exchange availability; if pursuing exposure, implement strict risk management protocols, consider OTC arrangements to minimize market impact, and conduct thorough due diligence on governance structures

ASTRA Trading Participation Methods

- Spot Trading on Gate.com: Access ASTRA trading pairs with competitive fees and comprehensive charting tools for technical analysis

- Wallet Integration: Use Gate Web3 Wallet to interact directly with the AstraSwap decentralized exchange and participate in community governance

- Dollar-Cost Averaging: Spread purchases over time to mitigate entry timing risk in this volatile asset class

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ASTRA and what is its use case?

ASTRA is an automation platform that helps users put their finances on autopilot by efficiently routing money between accounts, saving time and simplifying financial management.

What is the current price of ASTRA token?

The current price of ASTRA token is $0.0004927 USD as of February 7, 2026. The price has increased by 8.31% in the last 24 hours, with strong market momentum.

What are experts predicting for ASTRA price in 2024/2025?

Experts predict ASTRA price to reach approximately $0.3977 in 2025, based on current market trends and analysis. Price predictions for 2024 are not available from expert sources.

What factors could influence ASTRA price movements?

ASTRA price movements are influenced by market sentiment, overall crypto trends, supply and demand dynamics, trading volume, regulatory developments, and project announcements. Macroeconomic factors and investor risk appetite also impact price significantly.

Is ASTRA a good investment for long-term holders?

Yes, ASTRA is an excellent long-term investment. It demonstrates strong growth potential and solid market fundamentals. Long-term holders can benefit from its strategic development trajectory and increasing adoption in the crypto ecosystem.

What are the main risks associated with ASTRA?

ASTRA faces market volatility, regulatory uncertainty, and technology adoption risks. Competition from other blockchain projects, token liquidity fluctuations, and smart contract vulnerabilities also present potential challenges to long-term value.

How does ASTRA compare to other similar tokens in the market?

ASTRA offers higher growth potential with greater volatility compared to established tokens like DOT. While ASTRA has a lower market cap, it provides stronger scalability solutions and innovative features, making it attractive for investors seeking emerging opportunities in the blockchain ecosystem.

What is ASTRA's market cap and trading volume?

ASTRA's market cap is currently $0 USD, with a 24-hour trading volume of $12,161.13 USD. The current price stands at $0.000404 per ASTRA token.

Where can I buy and sell ASTRA tokens?

You can buy and sell ASTRA tokens on AlphaGrowth.io, which lists all relevant markets for ASTRA trading. The platform provides real-time pricing, bid-ask spreads, and trading volume information for seamless token transactions.

What is the tokenomics and supply of ASTRA?

ASTRA has a maximum supply of 1,000,000,000 tokens. The tokenomics features deflationary mechanisms and community-driven distribution. Current circulating supply reflects ongoing token burns and staking rewards for holders.

Can AI Companions (AIC) Reach $0.2729 in Price Prediction?

What is BNB?

Factors That Could Cause BNB's Price to Drop

BNB Price Analysis: Historical Highs and Future Trends

Where to Buy BNB: A Comprehensive Guide

What specific applications does AIC have on the BNB Smart Chain?

Comprehensive Guide to Smart Contracts

Comprehensive Guide to CPU Mining

What is the Fear and Greed Index in Crypto

Comprehensive Guide to Inflation and Investment Solutions

What Are Meme Coins? 7 Top Tokens to Watch