2026 BEER Price Prediction: Expert Analysis and Market Forecast for the Cryptocurrency Token

Introduction: BEER's Market Position and Investment Value

Beercoin (BEER), positioned as a universal currency of enjoyment that brings people together regardless of background, has been actively traded since its launch in 2024. As of February 2026, BEER maintains a market capitalization of approximately $1.01 million, with a circulating supply of 888,888,888,888 tokens, and a current price around $0.000001136. This asset, often described as "liquid gold" by its community, is carving out its niche in the social token and meme coin ecosystem.

This article will comprehensively analyze BEER's price trajectory from 2026 through 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. BEER Price History Review and Current Market Status

BEER Historical Price Evolution Trajectory

- 2024: BEER token launched in May with an initial price of $0.00015, experiencing significant volatility in its early trading phase

- 2024: Price reached its peak level of $0.0005852 on June 5, demonstrating strong initial market interest

- 2024-2026: Market underwent a correction phase, with price declining from the historical high to $0.000001068 recorded on February 2, 2026

BEER Current Market Situation

As of February 3, 2026, BEER is trading at $0.000001136, showing a 24-hour price increase of 3.17%. The token's 24-hour trading range spans from $0.000001084 to $0.00000117, with total trading volume reaching $13,215.72.

The current market capitalization stands at approximately $1.01 million, with all 888,888,888,888 tokens in circulation, representing a 100% circulating supply ratio. The fully diluted market cap matches the current market cap at $1.01 million. BEER maintains 29,094 token holders and ranks #2494 in the cryptocurrency market with a market dominance of 0.000036%.

Recent price performance indicates mixed trends across different timeframes. While the token shows a modest recovery in the past 24 hours with a 3.17% gain, broader timeframes reveal more challenging conditions. The 7-day performance shows a decline of 24.06%, the 30-day period reflects a decrease of 37.34%, and the 1-year performance indicates a reduction of 81.37% from previous levels.

The token is currently trading approximately 99.81% below its all-time high of $0.0005852 set on June 5, 2024, and just 6.37% above its all-time low of $0.000001068 recorded on February 2, 2026. Market sentiment indicators show an extreme fear reading with a VIX index of 17.

BEER operates as a Solana-based token with the contract address AujTJJ7aMS8LDo3bFzoyXDwT3jBALUbu4VZhzZdTZLmG and is available for trading on Gate.com.

Click to view current BEER market price

BEER Market Sentiment Indicator

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the BEER index at 17. This exceptionally low reading suggests investors are highly pessimistic about near-term prospects. Such extreme fear often creates contrarian opportunities, as markets typically recover after reaching these sentiment extremes. Cautious investors may consider this period for strategic positioning, while risk-averse traders should maintain defensive strategies. Monitor market developments closely as sentiment can shift rapidly during periods of high uncertainty.

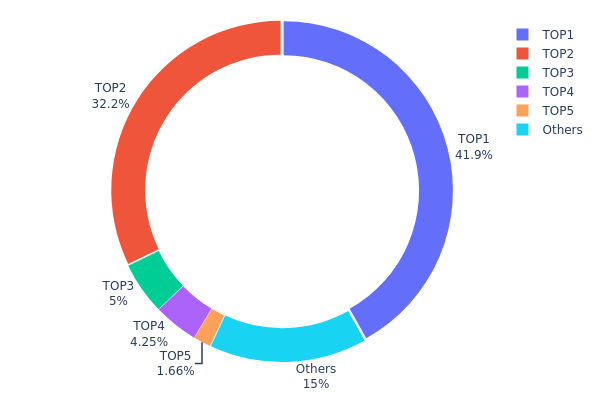

BEER Holding Distribution

The holding distribution chart reflects the concentration of token ownership across different wallet addresses on the blockchain. By analyzing the proportion held by top addresses versus smaller holders, this metric provides insights into the degree of decentralization and potential market manipulation risks within the token ecosystem.

Based on the current data, BEER exhibits significant concentration characteristics. The top address holds approximately 365.45 billion tokens, accounting for 41.88% of the total supply, while the second-largest address controls 280.71 billion tokens (32.17%). Together, the top two addresses command 74.05% of the circulating supply, indicating an extremely centralized ownership structure. The top five addresses collectively hold 84.95% of all tokens, leaving only 15.05% distributed among other market participants.

This high concentration level poses substantial risks to market stability and price discovery mechanisms. With nearly three-quarters of the supply controlled by just two entities, BEER faces elevated vulnerability to coordinated selling pressure or price manipulation. Large holders possess disproportionate influence over market dynamics, potentially triggering sharp volatility through relatively small position adjustments. The limited distribution among retail participants also suggests constrained liquidity depth, which could amplify price swings during periods of increased trading activity.

Click to view current BEER Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 365450801.60K | 41.88% |

| 2 | 4TYF8i...CExvz7 | 280711319.28K | 32.17% |

| 3 | u6PJ8D...ynXq2w | 43661849.83K | 5.00% |

| 4 | 2Ejnns...z2Ps3e | 37072433.68K | 4.24% |

| 5 | A77HEr...oZ4RiR | 14495507.00K | 1.66% |

| - | Others | 131018612.54K | 15.05% |

II. Core Factors Influencing Future BEER Prices

Supply Mechanism

- Deflationary Model: BEER adopts a deflationary mechanism with a gradual reduction in total supply.

- Historical Pattern: Previous supply reductions have historically driven price increases due to scarcity effects.

- Current Impact: The ongoing deflationary trend is expected to create upward pressure on prices.

Macroeconomic Environment

- Consumer Demand Trends: The shift from mass-market to premium and craft beer consumption reflects evolving consumer preferences, with younger demographics and female consumers driving market upgrades. The transition toward diversified and personalized product offerings continues to reshape demand patterns.

- Production Cost Fluctuations: Raw material prices, particularly barley, hops, and packaging materials, remain sensitive to climate conditions, geopolitical factors, and supply chain disruptions. Rising input costs present ongoing challenges for cost management, with potential impacts on profit margins if price increases cannot be effectively transferred to consumers.

- Consumption Recovery: Despite overall market pressure, the catering and hospitality sectors show signs of gradual recovery. Government policies promoting service consumption and improved consumer confidence may provide support for on-premise beer consumption, though the recovery remains moderate.

Market Structure and Competition

- Industry Concentration: The market demonstrates high concentration with CR5 market share reaching 92.9% by 2021, forming a stable oligopolistic structure. Major players leverage scale advantages and brand influence to maintain competitive positions.

- Premium Strategy: The industry's shift toward premiumization aims to improve average selling prices and profitability. Success depends heavily on market acceptance and brand positioning effectiveness.

- Channel Evolution: Distribution channels continue to diversify, with e-commerce platforms gaining share (rising from 1.9% in 2018 to 3.5% in 2022), while on-premise channels face headwinds from weak dining recovery.

Policy and Regulatory Environment

- Government Support Measures: Recent policies promoting consumption, including the State Council's opinions on service consumption development and expanded domestic demand initiatives, aim to stabilize market confidence and boost consumption in dining, tourism, and related sectors.

- Quality and Safety Oversight: Regulatory bodies maintain strict standards for product safety and quality, ensuring industry compliance while promoting sustainable development through environmental protection requirements and technology advancement initiatives.

III. 2026-2031 BEER Price Prediction

2026 Outlook

Based on current market data and analytical frameworks, BEER's price trajectory for 2026 remains in an early formation stage. Market participants should note that concrete price predictions require additional fundamental data and market validation. As of February 2026, the token's price discovery phase continues to develop alongside broader market conditions.

2027-2029 Outlook

- Market Stage Expectation: The medium-term period suggests a potential growth phase, with price change indicators showing progressive momentum from 21% in 2027, advancing to 45% in 2028, and further expanding to 77% by 2029.

- Price Range Prediction:

- 2027: Early adoption phase with moderate volatility expected

- 2028: Accelerated growth potential as market maturity increases

- 2029: Continued expansion trajectory subject to market validation

- Key Catalysts: The price change acceleration pattern suggests potential underlying factors such as ecosystem development, adoption metrics, and broader market sentiment shifts. However, specific catalysts require additional fundamental analysis and market data for precise identification.

2030-2031 Long-term Outlook

- Baseline Scenario: The 2030-2031 period shows sustained growth indicators, with price change metrics reaching 88% in 2030 and 95% in 2031, suggesting a maturing market phase.

- Optimistic Scenario: Should favorable market conditions persist and adoption curves accelerate beyond baseline expectations, enhanced performance metrics may materialize.

- Transformative Scenario: Under exceptional market conditions, including widespread adoption, technological breakthroughs, or significant ecosystem expansions, price trajectories could exceed current projections.

Note: All projections are subject to market volatility, regulatory developments, and macroeconomic factors. Investors should conduct independent research and consider risk management strategies when evaluating BEER's long-term potential.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0 | 0 | 0 | 0 |

| 2027 | 0 | 0 | 0 | 21 |

| 2028 | 0 | 0 | 0 | 45 |

| 2029 | 0 | 0 | 0 | 77 |

| 2030 | 0 | 0 | 0 | 88 |

| 2031 | 0 | 0 | 0 | 95 |

IV. BEER Professional Investment Strategies and Risk Management

BEER Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to meme coin culture and entertainment-oriented digital assets

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate volatility risks associated with meme tokens

- Monitor community engagement metrics and social media sentiment as key indicators

- Secure storage through Gate Web3 Wallet for enhanced asset protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($13,215.72) relative to market cap for liquidity assessment

- Support/Resistance Levels: Track the 24-hour range ($0.000001084 - $0.00000117) to identify entry and exit points

- Swing Trading Considerations:

- Capitalize on high volatility patterns, as evidenced by the 3.17% 24-hour gain

- Set strict stop-loss orders due to the token's significant historical drawdown (-81.37% over 1 year)

BEER Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio

- Aggressive Investors: 2-5% of crypto portfolio

- Professional Investors: Up to 10% with active monitoring protocols

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance BEER holdings with established cryptocurrencies and stablecoins

- Position Sizing: Limit individual position to prevent overexposure to meme coin volatility

(3) Secure Storage Solutions

- Gate Web3 Wallet Recommendation: Utilize Gate Web3 Wallet for secure Solana-based token management with multi-signature capabilities

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly verify wallet addresses before transactions

V. BEER Potential Risks and Challenges

BEER Market Risks

- High Volatility: The token experienced a 24.06% decline over 7 days and 37.34% over 30 days, indicating substantial price instability

- Liquidity Concerns: With a market cap of approximately $1.01 million and limited exchange presence (trading primarily on Gate.com), liquidity may be constrained during high-volume periods

- Meme Coin Dynamics: As a meme-oriented token, BEER's value is heavily influenced by social sentiment rather than fundamental utility, creating unpredictable price movements

BEER Regulatory Risks

- Classification Uncertainty: Regulatory bodies worldwide continue to develop frameworks for digital assets, which may impact meme tokens differently than utility tokens

- Compliance Evolution: Future regulatory requirements may affect the token's availability on trading platforms or require additional compliance measures

- Jurisdictional Variations: Different countries maintain varying stances on cryptocurrency trading, potentially limiting accessibility for certain investor groups

BEER Technical Risks

- Smart Contract Dependency: As a Solana-based token, BEER relies on the security and performance of the underlying blockchain infrastructure

- Network Congestion: Solana network disruptions or congestion could impact transaction processing and token accessibility

- Protocol Vulnerabilities: Potential undiscovered vulnerabilities in the token contract (address: AujTJJ7aMS8LDo3bFzoyXDwT3jBALUbu4VZhzZdTZLmG) could pose security risks

VI. Conclusion and Action Recommendations

BEER Investment Value Assessment

BEER represents a high-risk, speculative investment within the meme coin category, characterized by its entertainment-oriented value proposition and community-driven dynamics. While the token has achieved full circulation (100% of 888,888,888,888 tokens) and maintains a dedicated holder base of 29,094 participants, its significant historical decline (-81.37% from all-time high of $0.0005852) and recent negative momentum (-24.06% over 7 days) suggest considerable volatility. The token's market cap of approximately $1.01 million and limited exchange presence indicate it remains a niche asset suitable primarily for risk-tolerant investors with specific interest in meme coin markets.

BEER Investment Recommendations

✅ Beginners: Limit exposure to no more than 0.5-1% of total crypto portfolio; prioritize education on meme coin dynamics before participating ✅ Experienced Investors: Consider tactical allocation of 2-3% for portfolio diversification, with active monitoring of community sentiment and volume trends ✅ Institutional Investors: Exercise caution given liquidity constraints and market depth limitations; conduct thorough due diligence on token contract security and community sustainability

BEER Trading Participation Methods

- Spot Trading on Gate.com: Access BEER trading pairs with competitive fees and liquidity on the Gate.com platform

- Gate Web3 Wallet Integration: Store and manage BEER tokens directly through Gate Web3 Wallet for seamless blockchain interaction

- Community Engagement: Participate in BEER's social channels (Twitter: @beercoinmeme, Website: beercoin.wtf) to stay informed about project developments and market sentiment

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What are the main factors affecting BEER price?

BEER price is primarily influenced by trading volume, market sentiment, liquidity conditions, and overall crypto market trends. Supply dynamics and community adoption also play significant roles in price movements.

How to predict future beer price trends?

Global beer market is projected to reach 1.05 trillion USD by 2035 with a 3.4% CAGR. Future beer prices may rise with market expansion. Specific trends depend on supply-demand dynamics and production costs.

How do raw material costs (malt, hops, etc.) affect beer prices?

Raw material costs directly impact beer pricing. Fluctuations in malt and hops prices increase production expenses, driving up final beer prices. Higher commodity costs compress margins unless passed to consumers.

How do seasonal factors affect BEER price prediction?

Seasonal factors significantly impact BEER prices. Demand surges during summer and holidays, driving prices higher. Supply chain adjustments and inventory management are crucial. Predictive models must incorporate these seasonal patterns to accurately forecast price movements and market trends.

What data and metrics can be used for BEER price prediction?

BEER price prediction relies on trading volume, market capitalization, on-chain metrics, historical price trends, and sentiment indicators. Key factors include liquidity depth, holder distribution, and macroeconomic indicators affecting cryptocurrency markets.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

How to Create an NFT Token for Free and Sell It on NFT Marketplaces: A Complete Guide

Top 12 Decentralized Exchanges (DEX) Recommended

Ultimate Guide to Bitcoin Trading Solutions: 12 Strategies for Smart Entry and Exit

How to Earn Cryptocurrency Through Knowledge: Top 6 Learn-to-Earn Programs

What is GATA: A Comprehensive Guide to Gene Regulation and Transcription Factors in Cell Development