2026 BILLY Price Prediction: Expert Analysis and Market Outlook for the Next Bull Run

Introduction: BILLY's Market Position and Investment Value

Billy (BILLY), described as "the cutest dog on Solana," has been actively traded since its launch in June 2018. As of February 6, 2026, BILLY maintains a market capitalization of approximately $405,000, with a circulating supply of 1 billion tokens and a current price around $0.000405. This meme token, operating on the Solana blockchain, has attracted a community of over 33,000 holders and is listed on multiple exchanges including Gate.com.

This article will comprehensively analyze BILLY's price trajectory from 2026 to 2031, incorporating historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. BILLY Price History Review and Current Market Status

BILLY Historical Price Evolution Trajectory

- 2024: Token launch on Solana network in June, initial listing price at $0.1252

- 2024: Price peaked at $0.2858 in July, representing early-stage trading volatility

- 2024-2026: Market experienced significant correction, with price declining from historical high to current levels

BILLY Current Market Dynamics

As of February 6, 2026, BILLY is trading at $0.000405, reflecting a notable decline from its historical peak. The token has recorded a 24-hour trading volume of approximately $15,012.35, indicating relatively modest market activity.

Recent price movements show notable downward pressure across multiple timeframes. Over the past hour, the token has decreased by 11.57%, while the 24-hour period reflects a 23.5% decline. The broader trend continues this pattern, with a 45.14% decrease over seven days and a 65.69% decline across the past month. The annual performance shows a 90.86% reduction from year-earlier levels.

The token's 24-hour price range spans from $0.0004161 to $0.0005556, demonstrating intraday volatility. BILLY maintains a fully circulating supply of 1 billion tokens, with market capitalization and fully diluted valuation both standing at $405,000. The token represents approximately 0.000018% of the overall cryptocurrency market share.

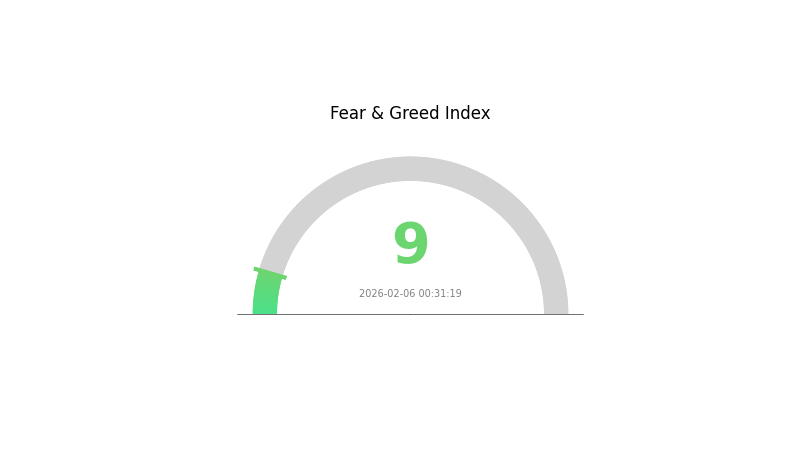

BILLY operates on the Solana blockchain and has attracted a holder base of 33,176 addresses. The token is available for trading on six exchanges. Current market sentiment indicators suggest an atmosphere of extreme fear, with a volatility index reading of 9.

Click to view current BILLY market price

BILLY Market Sentiment Index

2026-02-06 Fear & Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently in a state of extreme fear, with the BILLY index at just 9. This exceptionally low reading signals severe market pessimism and panic selling pressure. Investors are displaying heightened risk aversion, creating potential opportunities for contrarian traders. During such extreme fear periods, historically savvy investors often accumulate quality assets at depressed valuations. However, extreme fear conditions warrant careful risk management and thorough fundamental analysis before making investment decisions in the volatile crypto market.

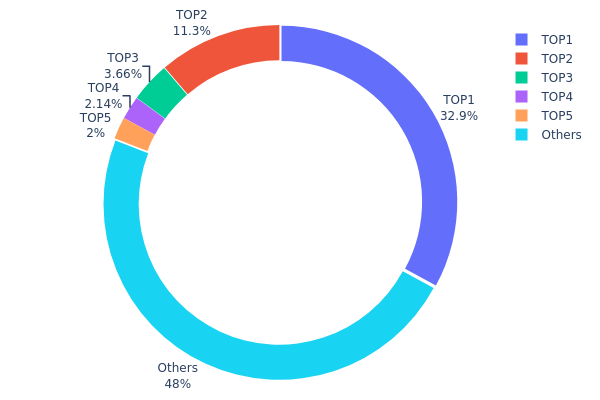

BILLY Holding Distribution

The holding distribution chart reflects the percentage of tokens held by different addresses on the blockchain, serving as a key indicator of token concentration and market structure. By analyzing the distribution of tokens across various wallet addresses, we can assess the degree of centralization, potential market manipulation risks, and the overall health of the token ecosystem.

According to the current data, the top holder controls 323,584.51K BILLY tokens, accounting for 32.92% of the total supply. The second-largest address holds 111,120.91K tokens (11.30%), while the third through fifth addresses hold 3.66%, 2.13%, and 2.00% respectively. Combined, the top five addresses control approximately 52.01% of the total token supply, with the remaining 47.99% distributed among other addresses. This distribution pattern reveals a moderately high concentration level, where a significant portion of tokens is controlled by a small number of addresses. The dominance of the top holder at nearly one-third of the supply, coupled with the second holder's 11.30% stake, suggests potential vulnerabilities in market stability.

Such concentration levels carry both opportunities and risks for market participants. On one hand, if these large holders are project team members, foundations, or long-term institutional investors, their holdings may contribute to price stability and reduced circulating supply volatility. On the other hand, the significant control exercised by a few addresses increases the risk of coordinated selling or market manipulation, potentially triggering sharp price movements during periods of low liquidity. The relatively even distribution among the remaining 47.99% of holders indicates some degree of decentralization at the retail level, which could provide a buffer against extreme volatility, though this remains secondary to the influence of major holders.

Click to view current BILLY Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 323584.51K | 32.92% |

| 2 | u6PJ8D...ynXq2w | 111120.91K | 11.30% |

| 3 | ASTyfS...g7iaJZ | 35992.51K | 3.66% |

| 4 | HDmzpt...731dpD | 21002.62K | 2.13% |

| 5 | DU8W6r...g4DRys | 19678.89K | 2.00% |

| - | Others | 471463.93K | 47.99% |

II. Core Factors Influencing BILLY's Future Price

Market Demand and Adoption Trends

- Market Demand Dynamics: BILLY's price outlook is shaped by evolving market demand patterns. As adoption trends develop, the token's value proposition becomes increasingly tied to user engagement and participation levels within its ecosystem.

- Adoption Growth Projections: Market analysis suggests potential annual growth rates around 5%, reflecting gradual adoption expansion. This growth trajectory depends on sustained community interest and broader market conditions supporting meme token participation.

- Current Market Positioning: BILLY operates within a competitive meme token landscape where sentiment-driven trading remains a primary price determinant. Market positioning continues to evolve as the project develops its community presence.

Broader Economic Factors

- Macroeconomic Environment Impact: Global economic conditions, including inflation trends and monetary policy shifts, create ripple effects across cryptocurrency markets. These macro factors influence risk appetite among investors, potentially affecting BILLY's trading patterns.

- Regulatory Landscape: Regulatory developments in key markets may shape the operational environment for meme tokens. Changes in regulatory frameworks could impact trading accessibility and institutional participation levels.

- Market Liquidity Considerations: Liquidity conditions in broader crypto markets influence price stability. During periods of reduced liquidity, meme tokens may experience heightened volatility, while improved liquidity conditions could support more stable price discovery.

Community and Social Dynamics

- Community Engagement: The strength and activity level of BILLY's community represents a fundamental value driver. Active community participation in social media, governance discussions, and promotional activities can influence market perception and trading interest.

- Social Media Influence: Meme tokens are particularly sensitive to social media trends and viral moments. The amplification of positive sentiment through online channels may contribute to temporary price movements, while negative sentiment can trigger rapid corrections.

- Cultural Relevance: BILLY's connection to cultural references and meme culture affects its resonance with target audiences. Maintaining cultural relevance in a fast-moving digital landscape presents both opportunities and challenges for sustained interest.

III. 2026-2031 BILLY Price Prediction

2026 Outlook

- Conservative Prediction: $0.00031 - $0.00041

- Neutral Prediction: $0.00041 (average scenario)

- Optimistic Prediction: $0.00059 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: The token may enter a gradual growth phase with moderate volatility as the project matures and expands its ecosystem presence.

- Price Range Prediction:

- 2027: $0.00047 - $0.00062

- 2028: $0.00052 - $0.00082

- 2029: $0.00050 - $0.00072

- Key Catalysts: Potential drivers include broader market recovery, enhanced utility within the ecosystem, and increased trading volume across major platforms like Gate.com.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00052 - $0.00081 (assuming steady market conditions and sustained community engagement)

- Optimistic Scenario: $0.00063 - $0.00086 (contingent upon significant ecosystem developments and favorable regulatory environment)

- Transformative Scenario: Beyond $0.00086 (requires breakthrough partnerships, mass adoption, or substantial protocol upgrades)

- 2026-02-06: BILLY is currently in early prediction phase with projected price changes ranging from 1% to 86% growth through 2031

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00059 | 0.00041 | 0.00031 | 1 |

| 2027 | 0.00062 | 0.0005 | 0.00047 | 24 |

| 2028 | 0.00082 | 0.00056 | 0.00052 | 39 |

| 2029 | 0.00072 | 0.00069 | 0.0005 | 71 |

| 2030 | 0.00081 | 0.00071 | 0.00052 | 74 |

| 2031 | 0.00086 | 0.00076 | 0.00063 | 86 |

IV. BILLY Professional Investment Strategies and Risk Management

BILLY Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Risk-tolerant investors with medium to long-term horizons

- Operational Recommendations:

- Consider accumulating positions during market corrections rather than all at once

- Set clear profit-taking targets and stop-loss levels before entering positions

- Storage Solution: Gate Web3 Wallet offers secure storage options for BILLY tokens with user-controlled private keys

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Profile: Monitor the 24-hour trading volume ($15,012) to identify potential support and resistance levels

- Price Action Analysis: Track key price levels including current support at $0.0004161 (24h low) and resistance at $0.0005556 (24h high)

- Swing Trading Key Points:

- Consider the high volatility, with 24-hour price movements exceeding 23%

- Monitor Solana network activity as BILLY operates on the Solana blockchain

BILLY Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: May allocate up to 5-8% with active risk management

(2) Risk Hedging Solutions

- Position Sizing: Limit exposure to meme tokens given their speculative nature and high volatility

- Stop-Loss Orders: Consider setting stop-loss orders 15-20% below entry points to protect against sudden downturns

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet provides convenient access for active traders

- Cold Storage Option: For long-term holdings, consider transferring to hardware wallets after accumulation

- Security Precautions: Never share private keys, enable two-factor authentication, and be cautious of phishing attempts targeting Solana token holders

V. BILLY Potential Risks and Challenges

BILLY Market Risks

- Extreme Volatility: BILLY has experienced a 90.86% decline over the past year, demonstrating significant price instability

- Limited Market Depth: With a market capitalization of approximately $405,000, the token may experience substantial price swings with relatively small trading volumes

- Meme Token Dynamics: As a meme token, BILLY's value is heavily influenced by social media sentiment and speculative trading rather than fundamental utility

BILLY Regulatory Risks

- Cryptocurrency Classification: Ongoing regulatory developments may impact how meme tokens are classified and traded

- Exchange Listings: Changes in exchange policies toward speculative tokens could affect liquidity and accessibility

- Geographic Restrictions: Some jurisdictions may impose restrictions on trading highly speculative digital assets

BILLY Technical Risks

- Smart Contract Dependencies: As a Solana-based token, BILLY is subject to the security and performance of the Solana network

- Network Congestion: During periods of high activity, Solana network congestion could impact transaction speeds and costs

- Limited Development Activity: The project's primary value proposition as "the cutest dog on Solana" may indicate limited technical roadmap or utility development

VI. Conclusion and Action Recommendations

BILLY Investment Value Assessment

BILLY represents a highly speculative meme token within the Solana ecosystem. With a current price of $0.000405, down significantly from its all-time high of $0.2858 in July 2024, the token demonstrates extreme volatility characteristic of meme coins. The relatively small market cap of $405,000 and 33,176 holders indicate a niche community following. While the token has achieved listings on 6 exchanges including Gate.com, investors should recognize this as a high-risk, speculative asset without clear fundamental value drivers. Short-term price movements may be influenced by social media trends and community sentiment rather than technological developments or utility expansion.

BILLY Investment Recommendations

✅ Beginners: Avoid allocating significant capital to BILLY; if participating, limit exposure to less than 1% of crypto portfolio and only invest amounts you can afford to lose completely ✅ Experienced Investors: Consider BILLY only as a speculative position with strict risk controls, stop-losses, and position sizing discipline; monitor community sentiment and trading volumes closely ✅ Institutional Investors: Given the limited market depth and speculative nature, BILLY may not meet institutional investment criteria for risk management and compliance standards

BILLY Trading Participation Methods

- Spot Trading: Purchase BILLY on Gate.com and other supporting exchanges with immediate settlement

- Gate Web3 Wallet: Store and manage BILLY holdings using Gate Web3 Wallet's secure infrastructure

- Active Monitoring: Track price movements, holder counts, and trading volumes to identify potential entry and exit opportunities

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is BILLY token? What are its practical uses?

BILLY token is primarily designed for speculative trading and community engagement. Its value derives from brand influence and community appeal rather than intrinsic utility. The token enables participation in the community ecosystem and serves as a trading asset.

What is the BILLY price prediction for 2024-2025?

Based on market analysis, BILLY is projected to reach 150-180 USD by end of 2025. This forecast considers current market trends and analyst assessments as of February 2026.

What are BILLY's advantages compared to other similar tokens?

BILLY operates on Solana blockchain, offering high-speed transactions and low fees. Compared to meme coins on other blockchains, BILLY provides superior efficiency and cost-effectiveness, making it more accessible to users.

What are the main factors affecting BILLY price?

BILLY price is primarily influenced by market sentiment, news events, regulatory developments, and trading volume. Additionally, Bitcoin market trends, project fundamentals, community activity, and macroeconomic factors play significant roles in price movements.

What risks should I pay attention to when investing in BILLY?

BILLY investment carries risks including potential partial or total loss. Market volatility, liquidity fluctuations, and unforeseen factors may impact value. Investors should only invest amounts they can afford to lose and conduct thorough research before deciding.

What is BILLY's historical price performance?

BILLY reached an all-time high of $0.231516 in July 2024, then declined to a low of $0.00081141 in January 2026. Current price trades between $0.00082391 and $0.0008504, showing significant volatility in its market history.

What are professional analysts' price predictions for BILLY?

Professional analysts predict BILLY's average price could reach $0.002018 by 2025, with potential highs of $0.002623 and lows of $0.001291, indicating stable short-term prospects.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

Cryptocurrency Halving Explained: The Comprehensive Guide

Top Cold Wallets for Cryptocurrency: Rankings

Home Bitcoin Mining: A Beginner’s Guide

Comprehensive Guide to Cronos Price Predictions and Investment Analysis

Comprehensive Guide to Corporate Bankruptcy Restructuring: John J. Ray III's Proven Strategies