2026 BMON Price Prediction: Expert Analysis and Market Forecast for Beamon Token's Future Value

Introduction: BMON's Market Position and Investment Value

Binamon (BMON), positioned as a complete digital monster metaverse project on the BSC chain, has been operating in the NFT and blockchain gaming space since its launch in 2021. As of 2026, BMON maintains a market capitalization of approximately $291,203, with a circulating supply of about 170.19 million tokens, and the price is trading around $0.001711. This asset, serving as the native utility token for discovering, purchasing, and selling ultra-rare NFTs within the Binamon ecosystem, is playing a role in the evolving GameFi and metaverse sectors.

This article will comprehensively analyze BMON's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. BMON Price Historical Review and Current Market Status

BMON Historical Price Evolution Trajectory

- 2021: BMON reached a peak price of $0.813157 on August 23, marking its all-time high since launch

- 2021-2026: The token experienced significant market correction, with price declining over multiple market cycles

- 2026: On February 6, BMON touched its historical low at $0.00160073, representing a substantial retreat from previous highs

BMON Current Market Situation

As of February 7, 2026, BMON is trading at $0.001711, showing modest short-term recovery with a 1.84% increase over the past 24 hours and a 0.29% gain in the last hour. However, the token continues to face downward pressure across longer timeframes, declining 15.67% over the past week, 20.82% over the past month, and 39.16% over the past year.

The token's market capitalization stands at approximately $291,203, with a fully diluted valuation of $391,168. BMON's circulating supply represents 56.73% of its total supply, with 170,194,929 tokens in circulation out of a total supply of 228,619,895 tokens and a maximum supply cap of 300,000,000 tokens. The 24-hour trading volume reached $20,237, reflecting relatively modest market activity.

Binamon operates as a digital monster metaverse on the BSC (Binance Smart Chain), utilizing the $BMON token for discovering, purchasing, and trading NFTs within its ecosystem. The project has attracted 70,526 token holders, indicating an established community presence despite current market challenges.

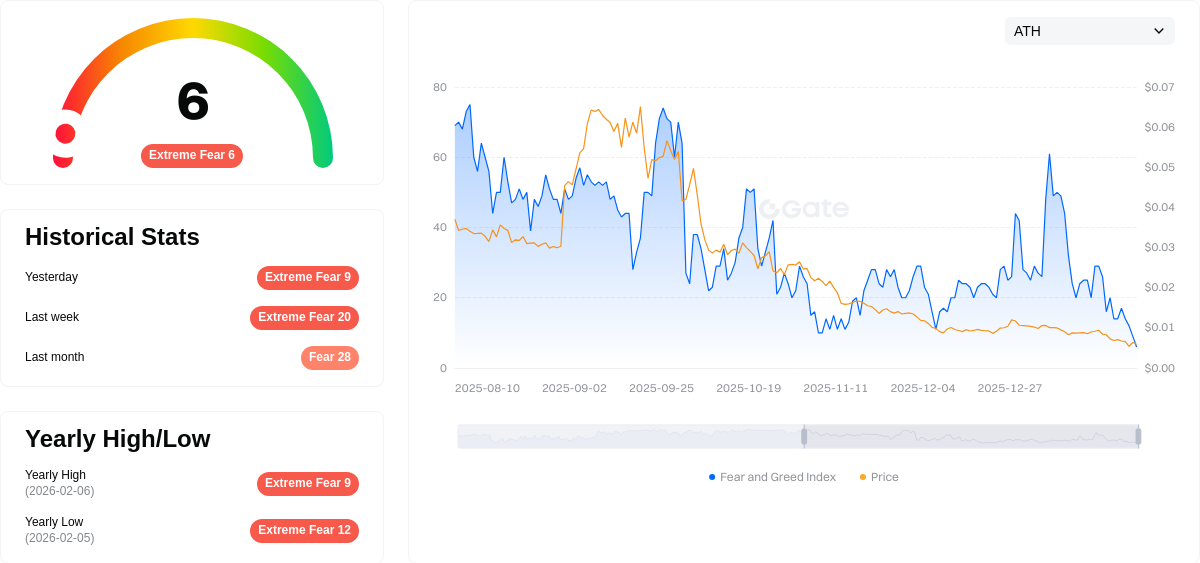

The broader cryptocurrency market sentiment currently registers at an Extreme Fear level with a volatility index of 6, which may be influencing BMON's price performance alongside other digital assets.

Click to view current BMON market price

BMON Market Sentiment Indicator

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index at just 6 points. This historically low reading indicates widespread panic and risk aversion among investors. Such extreme sentiment often precedes market reversals, as excessive pessimism can create buying opportunities. Long-term investors may consider this a potential accumulation phase, while short-term traders should remain cautious about heightened volatility and sudden price swings that typically accompany extreme fear conditions.

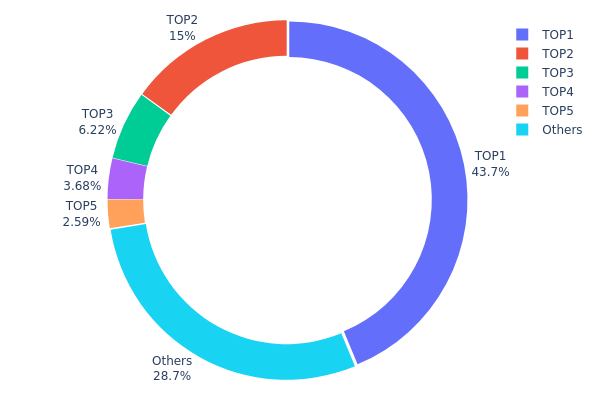

BMON Holding Distribution

The holding distribution chart reveals the concentration of token ownership across different wallet addresses, serving as a crucial indicator of decentralization levels and potential market manipulation risks. Based on the current data, BMON exhibits a highly centralized distribution pattern. The top holder controls 100 million tokens, accounting for 43.74% of the total supply, while the second-largest address holds 34.375 million tokens (15.03%). The top five addresses collectively control approximately 71.24% of the circulating supply, with the remaining 28.76% distributed among other participants.

This concentrated holding structure presents significant implications for market dynamics. The dominant position of the top two addresses creates substantial price volatility risks, as large-scale sell-offs by these major holders could trigger sharp price corrections. Additionally, such concentration raises concerns about potential market manipulation, where coordinated actions by top holders could artificially influence price movements. The limited distribution among smaller holders also suggests relatively weak community engagement and restricted organic market activity.

From a structural perspective, BMON's current holding distribution indicates a relatively centralized on-chain architecture with low decentralization levels. This concentration pattern is commonly observed in early-stage projects or tokens with significant institutional holdings. While such distribution may provide stability during certain market conditions, it fundamentally contradicts the decentralization principles inherent to blockchain technology and increases systemic risks for retail investors.

Click to view current BMON Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0c89...518820 | 100000.00K | 43.74% |

| 2 | 0x7536...d9a85c | 34375.00K | 15.03% |

| 3 | 0x3c2b...2bf108 | 14215.41K | 6.21% |

| 4 | 0x10d3...f9b711 | 8417.53K | 3.68% |

| 5 | 0x0d07...b492fe | 5918.66K | 2.58% |

| - | Others | 65693.30K | 28.76% |

II. Core Factors Influencing BMON's Future Price

Market Adoption and Sentiment

- Market Dynamics: BMON's price movements are significantly influenced by market sentiment and user adoption trends. When positive news emerges regarding widespread adoption or major technological breakthroughs, market optimism typically drives price increases. Conversely, negative news such as regulatory crackdowns or security vulnerabilities may trigger market concerns.

- Historical Patterns: BMON reached its peak at $0.813157 on August 23, 2021, while its lowest point of $0.00215932 occurred on November 21, 2025. These fluctuations demonstrate the substantial impact of market sentiment, user adoption trends, and external factors on price performance.

- Current Market Context: As of early 2025, BMON maintains a circulating market capitalization of approximately $631,200, with a current price around $0.002632, reflecting ongoing market volatility.

Institutional and Whale Activity

- Market Positioning: As an NFT gaming token, BMON's investment potential is closely tied to institutional interest and large holder activities in the broader cryptocurrency market.

- Regulatory Environment: The cryptocurrency sector continues to face evolving regulatory frameworks globally. Regulatory tightening or favorable policy developments can significantly impact market confidence and BMON's price trajectory.

Macroeconomic Environment

- Policy Influence: Federal Reserve policy shifts and global economic uncertainty factors play crucial roles in cryptocurrency market performance. Recent market conditions have shown that macroeconomic headwinds can lead to broader market sell-offs, affecting tokens like BMON.

- Market Correlation: BMON's performance tends to correlate with major cryptocurrency market trends. When Bitcoin experiences significant price movements, such as recent declines below $70,000, smaller tokens often face increased pressure.

- Geopolitical Factors: International trade tensions and global risk sentiment shifts impact overall cryptocurrency market dynamics, creating ripple effects across various tokens including BMON.

Technology and Ecosystem Development

- NFT Gaming Integration: As a token within the NFT gaming sector, BMON's value proposition is closely linked to developments in blockchain gaming and NFT utility applications.

- Market Innovation: The broader cryptocurrency ecosystem's technological advancements, including developments in decentralized applications and gaming platforms, may influence BMON's adoption and utility.

- Competitive Landscape: The NFT gaming token space remains highly competitive, with BMON's future dependent on its ability to differentiate and maintain relevance within evolving market conditions.

III. 2026-2031 BMON Price Forecast

2026 Outlook

- Conservative Prediction: $0.00147 - $0.00171

- Neutral Prediction: Around $0.00171

- Optimistic Prediction: Up to $0.00176 (requires favorable market conditions)

2027-2029 Mid-term Outlook

- Market Phase Expectation: The token may experience gradual growth as the project develops and gains traction in the blockchain gaming sector

- Price Range Predictions:

- 2027: $0.00109 - $0.00191

- 2028: $0.00117 - $0.00243

- 2029: $0.00155 - $0.00314

- Key Catalysts: Ecosystem expansion, increased user adoption, and potential partnerships could drive price appreciation during this period

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00187 - $0.00263 (assuming steady project development and market stability)

- Optimistic Scenario: $0.00205 - $0.00277 (assuming strong community growth and ecosystem maturity)

- Transformative Scenario: Up to $0.00376 (requires exceptional market conditions, widespread adoption, and significant platform innovations)

- February 7, 2026: BMON trading within the predicted range of $0.00147 - $0.00176 (early phase of projected growth cycle)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00176 | 0.00171 | 0.00147 | 0 |

| 2027 | 0.00191 | 0.00174 | 0.00109 | 1 |

| 2028 | 0.00243 | 0.00182 | 0.00117 | 6 |

| 2029 | 0.00314 | 0.00212 | 0.00155 | 24 |

| 2030 | 0.0029 | 0.00263 | 0.00187 | 53 |

| 2031 | 0.00376 | 0.00277 | 0.00205 | 61 |

IV. BMON Professional Investment Strategy and Risk Management

BMON Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term crypto investors with moderate risk tolerance and belief in the metaverse gaming sector

- Operational Recommendations:

- Consider gradual accumulation during market downturns, as BMON has shown significant volatility with a 1-year decline of 39.16%

- Monitor project development milestones and NFT marketplace activity on the Binamon platform

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use 20-day and 50-day MAs to identify potential trend reversals, particularly relevant given the recent 7-day decline of 15.67%

- Volume Analysis: Monitor the 24-hour trading volume (currently $20,237.53) for signs of accumulation or distribution

- Swing Trading Key Points:

- Establish entry positions near the recent 24-hour low of $0.001663 and set stop-losses below the all-time low of $0.00160073

- Take partial profits near resistance levels around the 24-hour high of $0.001735

BMON Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% with active risk monitoring

(2) Risk Hedging Solutions

- Diversification Strategy: Balance BMON exposure with established metaverse and gaming tokens to reduce sector-specific risk

- Position Sizing: Given the 56.73% market cap to FDV ratio, be aware of potential dilution from unlocked supply

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and NFT interactions on the Binamon platform

- Cold Storage Option: Hardware wallet solutions for long-term holdings exceeding $1,000 in value

- Security Precautions: Never share private keys, enable two-factor authentication, and verify all BSC contract addresses (0x08ba0619b1e7a582e0bce5bbe9843322c954c340) before transactions

V. BMON Potential Risks and Challenges

BMON Market Risks

- High Volatility: BMON has declined 39.16% over the past year and 20.82% in the last 30 days, indicating significant price instability

- Low Liquidity: With a market cap of only $291,203.52 and 24-hour volume of $20,237.53, large orders may experience substantial slippage

- Market Cap Ranking: Currently ranked 3546, BMON has minimal market share (0.000016%), making it susceptible to delisting or reduced exchange support

BMON Regulatory Risks

- Gaming Token Classification: NFT and gaming tokens face evolving regulatory scrutiny in multiple jurisdictions

- BSC Ecosystem Concerns: Regulatory actions targeting Binance Smart Chain could indirectly impact BSC-based projects like Binamon

- Securities Classification Risk: Gaming tokens with utility and reward mechanisms may face classification challenges in certain regions

BMON Technical Risks

- Smart Contract Vulnerability: BSC-based tokens are subject to potential exploits, despite the maturity of the BEP-20 standard

- Platform Dependency: BMON's value is closely tied to the success and continued operation of the Binamon metaverse platform

- Supply Inflation: With 170.19 million tokens circulating out of a 300 million max supply, additional token releases could create selling pressure

VI. Conclusion and Action Recommendations

BMON Investment Value Assessment

BMON presents as a high-risk, speculative investment in the NFT gaming and metaverse sector. While the project offers a complete digital monster ecosystem on BSC with over 70,526 holders, significant concerns exist regarding its long-term viability. The token has experienced severe depreciation (down 39.16% year-over-year) and maintains extremely low liquidity with minimal market presence. The project's value proposition centers on its NFT marketplace and gaming mechanics, but faces intense competition in an increasingly crowded gaming metaverse space. Short-term risks are substantial given current downward price momentum and limited trading volume.

BMON Investment Recommendations

✅ Beginners: Avoid or allocate no more than 0.5% of portfolio; prioritize established projects with proven track records and higher liquidity ✅ Experienced Investors: Consider small speculative positions (1-2% maximum) only if actively monitoring project developments and prepared for potential total loss ✅ Institutional Investors: Generally unsuitable due to insufficient liquidity, limited market depth, and lack of established institutional-grade infrastructure

BMON Trading Participation Methods

- Spot Trading: Available on Gate.com with direct BMON trading pairs for immediate exposure

- NFT Marketplace Participation: Engage directly with the Binamon platform to acquire digital monster NFTs using BMON tokens

- DeFi Integration: Explore BSC-based decentralized exchanges for additional trading options, ensuring verification of contract addresses

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How has BMON performed historically? What was the price movement over the past year?

BMON has demonstrated significant volatility over the past year, trading from a low of $0.002019 to a high of $0.861467. Currently, BMON fluctuates between $0.002019 and $0.002082, showing active market dynamics and substantial growth potential.

What are professional analysts' price predictions for BMON in the future?

Professional analysts predict BMON's future price will be influenced by supply dynamics, market sentiment, and adoption trends. Specific forecasts vary based on broader cryptocurrency market conditions and historical performance data.

What are the main factors affecting BMON price?

BMON price is primarily influenced by market adoption, technological breakthroughs, regulatory policies, and security events. Positive news drives price increases, while negative developments trigger declines. Trading volume and overall market sentiment also play significant roles.

BMON与其他同类代币相比有什么优势和劣势?

BMON provides real-time network monitoring and diagnostics capabilities. Advantages include detailed performance metrics and specialized functionality. Disadvantages include limited smart contract compatibility and smaller community ecosystem compared to mainstream tokens.

What risks should I consider when investing in BMON?

BMON investment involves price volatility, technical risks, and market competition risks. Evaluate your risk tolerance and market conditions before investing. Conduct thorough research on project fundamentals and market trends to make informed decisions.

What is BMON's liquidity and trading volume like? Which exchanges can trade it?

BMON maintains robust liquidity with strong daily trading volume. The token is available for trading on multiple major cryptocurrency exchanges, providing users with convenient access and competitive pricing for buy and sell orders.

What is the fundamentals of BMON project? What is the team background and development plan?

BMON is developed by Helo, focusing on operation and maintenance monitoring systems. The team plans to expand functionality and enhance system performance. Currently showing stable market performance with continued optimization planned for the future.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

10 Best NFT Marketing Agencies To Promote Your Digital Art

What Is an Automated Market Maker?

What Are Crypto Trading Patterns? A Basic Introduction

Comprehensive Guide to FUD in Cryptocurrency: Understanding Market Manipulation and Investor Protection Strategies

What is SNET: A Comprehensive Guide to the Singularitynet Ecosystem and Its Decentralized AI Services