2026 BOT Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: BOT's Market Position and Investment Value

Hyperbot (BOT), as an AI-driven on-chain contract trading terminal, has been serving the decentralized exchange ecosystem since its launch in 2025. As of 2026, BOT maintains a market capitalization of approximately $737,528, with a circulating supply of around 319 million tokens, and the price hovering around $0.002312. This asset, characterized as an intelligent trading execution platform, is playing an increasingly important role in on-chain trading data aggregation and smart money tracking.

This article will comprehensively analyze BOT's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. BOT Price History Review and Market Status

BOT Historical Price Evolution Trajectory

- 2025: The token launched on September 24, with price experiencing significant volatility throughout the year, moving from its peak to lower levels.

- 2025: In late November, the price reached a relatively lower range, reflecting broader market adjustments and trading dynamics.

BOT Current Market Status

As of February 4, 2026, Hyperbot (BOT) is trading at $0.002312, representing a decline of 8.72% over the past 24 hours. The 24-hour trading range has been between $0.002111 and $0.002632, with a total trading volume of approximately $14,755.

The token's market capitalization stands at approximately $737,528, with a circulating supply of 319,000,010 BOT tokens, representing 31.9% of the maximum supply of 1,000,000,000 tokens. The fully diluted market capitalization is calculated at $2,312,000.

Over different time frames, BOT has experienced notable price movements. In the past hour, the price decreased by 1.34%, while the 7-day and 30-day periods show declines of 16.38% and 10.04% respectively. The token's current price level is positioned significantly below its earlier trading ranges.

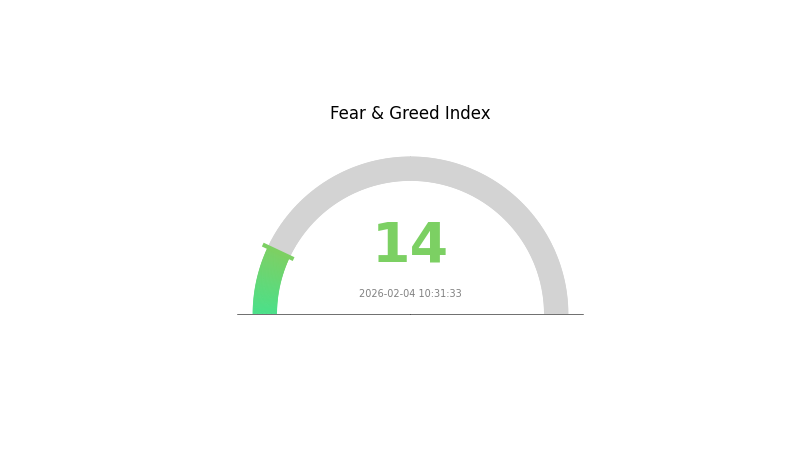

The cryptocurrency market sentiment index currently indicates a reading of 14, classified as "Extreme Fear," which may be influencing broader trading patterns across digital assets. BOT is ranked 2,740 in the overall cryptocurrency market, with a market dominance of 0.000085%. The token is held by approximately 7,870 addresses and is listed on 5 exchanges.

Click to view current BOT market price

BOT Market Sentiment Indicator

2026-02-04 Fear & Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 14. This level indicates significant market pessimism and heightened anxiety among investors. When the Fear & Greed Index reaches such lows, it typically suggests that assets may be oversold and potential buying opportunities could emerge. However, traders should exercise caution and conduct thorough research before making investment decisions. Historical patterns show that extreme fear periods often precede market reversals, but timing remains uncertain. Consider your risk tolerance and investment strategy carefully during this volatile period.

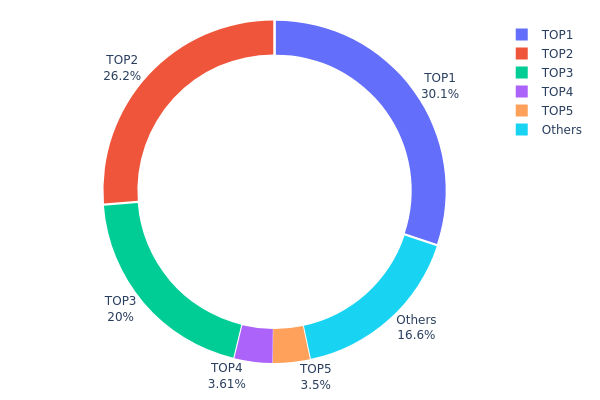

BOT 持仓分布

The holdings distribution chart illustrates how BOT tokens are allocated across different wallet addresses, serving as a crucial indicator of the token's decentralization level and concentration risk. By analyzing the proportion of tokens held by top addresses versus smaller holders, this metric reveals the underlying power dynamics within the BOT ecosystem and potential vulnerabilities to market manipulation.

Based on current data, BOT exhibits a highly concentrated ownership structure, with the top three addresses collectively controlling 76.31% of the total supply. Specifically, the largest holder accounts for 30.09%, the second for 26.22%, and the third for 20.00%. This extreme concentration significantly deviates from the ideal decentralized model typically advocated in cryptocurrency markets. The remaining 16.59% distributed among smaller addresses suggests limited retail participation and minimal token distribution breadth.

Such a concentrated holdings pattern presents substantial implications for market stability and price discovery mechanisms. First, the dominance of a few large holders creates pronounced centralization risk, where coordinated actions by these major addresses could trigger severe price volatility or even market manipulation scenarios. Second, this distribution structure may discourage new investors, as concerns about potential large-scale sell-offs by whale addresses could suppress buying interest. Furthermore, the limited token dispersion among broader market participants suggests weak organic demand formation, potentially hindering the development of a healthy secondary market ecosystem.

Click to view current BOT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xdb13...5422ba | 300999.99K | 30.09% |

| 2 | 0x73d8...4946db | 262232.86K | 26.22% |

| 3 | 0xf6b5...12af16 | 200000.00K | 20.00% |

| 4 | 0xb39c...0553c1 | 36092.20K | 3.60% |

| 5 | 0x7be8...3d1060 | 35000.00K | 3.50% |

| - | Others | 165674.95K | 16.59% |

II. Core Factors Influencing BOT's Future Price

Supply Mechanism

- Token Economics Structure: BOT operates within a defined tokenomics framework that governs its circulation and distribution patterns. The supply dynamics are structured to balance market demand with controlled token release schedules.

- Historical Patterns: Previous market cycles have demonstrated that trading bot tokens tend to exhibit price sensitivity to platform adoption rates and transaction volume growth. Historical data suggests correlation between increased bot usage and token value appreciation.

- Current Impact: As of 2026, the meme trading bot sector continues to show robust growth momentum, with leading platforms processing billions in transaction volume. This sustained activity level provides fundamental support for token valuation.

Institutional and Major Holder Dynamics

- Institutional Positioning: The cryptocurrency trading bot sector has attracted attention from digital asset investment firms seeking exposure to infrastructure plays. Data indicates growing institutional recognition of automated trading solutions as essential market infrastructure.

- Corporate Adoption: Major cryptocurrency platforms and decentralized exchanges have integrated trading bot functionalities, validating the sector's utility. Trading bot platforms like Trojan Bot, Banana Gun, and Sol Trading Bot have demonstrated significant revenue generation capacity, with monthly fee revenues reaching tens of millions of dollars.

- Regulatory Landscape: The regulatory environment for cryptocurrency trading tools continues to evolve. Clearer frameworks in major jurisdictions may influence institutional participation levels and overall market sentiment toward bot-related tokens.

Macroeconomic Environment

- Monetary Policy Influence: Global monetary policy trajectories, particularly interest rate decisions by major central banks, create ripple effects across risk asset markets including cryptocurrencies. Anticipated policy adjustments may shift capital allocation patterns between traditional and digital assets.

- Market Liquidity Conditions: The availability of risk capital and overall market liquidity levels directly impact cryptocurrency market activity. Trading bot tokens may benefit from increased market participation during periods of improved liquidity conditions.

- Broader Market Sentiment: Cryptocurrency market sentiment, influenced by major asset price movements (Bitcoin, Ethereum), affects trading activity levels. Higher trading volumes typically correlate with increased demand for automated trading solutions.

Technology Development and Ecosystem Building

- AI and Machine Learning Integration: The integration of artificial intelligence and machine learning capabilities represents a significant development vector for trading bot platforms. Advanced algorithms capable of pattern recognition and predictive analytics may enhance bot performance and attract user adoption.

- Cross-Chain Expansion: Trading bot platforms continue expanding support across multiple blockchain networks, increasing addressable market size. Multi-chain functionality enables users to execute strategies across diverse ecosystems, potentially driving platform usage growth.

- Ecosystem Applications: The meme trading bot sector has developed a competitive landscape featuring platforms like GMGN, Photon, and BullX. These platforms collectively process billions in monthly transaction volume, demonstrating substantial user demand. The ecosystem benefits from network effects as increased liquidity attracts additional participants, creating self-reinforcing growth dynamics.

III. 2026-2031 BOT Price Prediction

2026 Outlook

- Conservative Prediction: $0.00169 - $0.00238

- Neutral Prediction: $0.00238 - $0.00315

- Optimistic Prediction: $0.00315 (requires favorable market conditions and increased adoption)

As of February 2026, BOT is expected to experience modest growth with a projected price change of approximately 3%. The token's price range reflects early-stage market dynamics, where conservative estimates suggest support around $0.00169, while optimistic scenarios could see the price reaching $0.00315. The average trading price is anticipated to stabilize near $0.00238, indicating a cautiously positive sentiment in the near term.

2027-2029 Mid-Term Outlook

- Market Stage Expectation: Gradual expansion phase with increasing market recognition

- Price Range Predictions:

- 2027: $0.00241 - $0.00407 (19% growth)

- 2028: $0.00301 - $0.00502 (47% growth)

- 2029: $0.00232 - $0.0062 (82% growth)

- Key Catalysts: Potential ecosystem development, broader market recovery trends, and enhanced utility adoption

During this mid-term period, BOT is projected to enter a gradual expansion phase characterized by steady price appreciation. The 2027 forecast suggests a price range between $0.00241 and $0.00407, representing a 19% increase from the previous year. By 2028, the momentum could accelerate with prices potentially reaching $0.00502, reflecting a 47% cumulative growth. The 2029 outlook appears particularly dynamic, with projections indicating prices could range from $0.00232 to $0.0062, marking an 82% growth trajectory. This period's performance may largely depend on ecosystem maturation and broader cryptocurrency market conditions.

2030-2031 Long-Term Outlook

- Baseline Scenario: $0.0038 - $0.00651 (assuming continued ecosystem development and stable market conditions)

- Optimistic Scenario: $0.00521 - $0.00651 (assuming accelerated adoption and favorable regulatory environment)

- Transformative Scenario: Approaching $0.00651 (under exceptionally favorable conditions including significant partnerships or technological breakthroughs)

Looking toward the longer horizon, BOT's price trajectory from 2030 to 2031 suggests potential maturation of the project. The 2030 baseline scenario forecasts a price range between $0.0038 and $0.00651, representing a substantial 125% growth from initial levels. By 2031, the market may stabilize with predictions indicating a narrower range of $0.00563 to $0.00604, with an average price around $0.00586, reflecting a cumulative 153% increase. This convergence of price predictions suggests potential market consolidation as the token establishes a more defined valuation framework. The transformative scenario reaching toward $0.00651 would require exceptional conditions such as major technological advancements or strategic partnerships that significantly enhance BOT's utility and market position.

It is important to note that these predictions are based on mathematical models and current market data. Cryptocurrency markets remain highly volatile, and actual prices may deviate significantly from these projections due to unforeseen market events, regulatory changes, or shifts in investor sentiment. Investors should conduct thorough research and consider their risk tolerance before making investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00315 | 0.00238 | 0.00169 | 3 |

| 2027 | 0.00407 | 0.00277 | 0.00241 | 19 |

| 2028 | 0.00502 | 0.00342 | 0.00301 | 47 |

| 2029 | 0.0062 | 0.00422 | 0.00232 | 82 |

| 2030 | 0.00651 | 0.00521 | 0.0038 | 125 |

| 2031 | 0.00604 | 0.00586 | 0.00563 | 153 |

IV. BOT Professional Investment Strategy and Risk Management

BOT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to AI-driven trading infrastructure and DeFi innovation

- Operational Recommendations:

- Consider accumulating positions during market corrections, as BOT has shown significant volatility with a 93.75% decline from its all-time high

- Monitor the project's development progress and user adoption metrics, particularly the growing holder base of 7,870 addresses

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term holdings, ensuring private key management and multi-layer security protocols

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current 24-hour trading range between $0.002111 (low) and $0.002632 (high) provides reference points for entry and exit positions

- Volume Analysis: Monitor the 24-hour trading volume of $14,755 to assess market liquidity and participation levels

- Swing Trading Considerations:

- BOT exhibits notable short-term volatility, with recent declines of 1.34% (1H), 8.72% (24H), and 16.38% (7D)

- Set appropriate stop-loss levels given the token's price proximity to its all-time low of $0.001714

BOT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Allocate no more than 1-2% of crypto portfolio to BOT given its high volatility and early-stage nature

- Aggressive Investors: May consider 3-5% allocation while maintaining diversification across multiple assets

- Professional Investors: Position sizing should account for the token's low market cap of approximately $737,528 and limited liquidity

(2) Risk Hedging Solutions

- Portfolio Diversification: Maintain exposure across multiple blockchain sectors to mitigate project-specific risks

- Position Scaling: Implement dollar-cost averaging to reduce entry price volatility impact

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet offers convenient access for active trading while maintaining security standards

- Cold Storage Approach: Consider offline storage solutions for long-term holdings exceeding immediate trading needs

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (BSC: 0x59537849f2a119ec698c7aa6c6daadc40c398a25) before transactions

V. BOT Potential Risks and Challenges

BOT Market Risks

- High Volatility: BOT has experienced a 93.75% decline over the past year, indicating substantial price instability that may continue

- Limited Liquidity: With a circulating market cap of approximately $737,528 and 24-hour volume of $14,755, the token faces potential slippage risks during larger transactions

- Concentrated Supply: Only 31.9% of total supply is currently in circulation, with potential selling pressure if additional tokens enter the market

BOT Regulatory Risks

- DeFi Platform Oversight: AI-driven trading terminals and copy-trading mechanisms may face evolving regulatory scrutiny across different jurisdictions

- Smart Contract Compliance: Automated trading execution systems could encounter regulatory challenges as authorities develop frameworks for algorithmic trading in crypto markets

- Cross-chain Operations: Integration with multiple DEXs and blockchains increases exposure to varying regulatory environments

BOT Technical Risks

- Smart Contract Vulnerabilities: As with any DeFi protocol, potential security flaws in smart contracts could expose users to loss of funds

- Integration Dependencies: Reliance on multiple blockchain networks and DEX protocols creates technical dependencies that could impact service reliability

- AI Model Limitations: The effectiveness of AI-driven whale tracking and signal detection remains subject to market condition changes and model accuracy

VI. Conclusion and Action Recommendations

BOT Investment Value Assessment

Hyperbot presents an innovative approach to on-chain trading through AI-powered whale tracking and automated copy-trading mechanisms. The platform addresses real market needs for data aggregation across multiple DEXs and intelligent trade execution. However, investors should carefully consider the significant price depreciation from its all-time high of $0.18925 to current levels around $0.002312, along with the project's early-stage status reflected in its relatively small market cap and holder base. The token's long-term value proposition depends on successful execution of its roadmap, user adoption growth, and competitive differentiation in the crowded DeFi trading tools sector.

BOT Investment Recommendations

✅ Beginners: Start with minimal position sizes (under 1% of crypto portfolio) to gain familiarity with the project while limiting downside exposure. Focus on understanding the platform's functionality before increasing allocation.

✅ Experienced Investors: Consider strategic position building during periods of reduced volatility, while maintaining strict risk management protocols. Monitor on-chain metrics such as active users, trading volume, and holder growth as indicators of project traction.

✅ Institutional Investors: Conduct thorough due diligence on smart contract audits, team credentials, and competitive landscape before considering allocation. The current low liquidity levels may present challenges for larger position sizes.

BOT Trading Participation Methods

- Spot Trading: BOT is available for trading on Gate.com and four other exchanges, with BEP20 token standard on BSC providing access through standard wallet infrastructure

- DeFi Integration: Users can interact with Hyperbot's native platform for accessing AI-driven trading signals and copy-trading features

- Dollar-Cost Averaging: Implement systematic purchase schedules to mitigate entry timing risk given the token's high volatility profile

Cryptocurrency investments carry extreme risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is BOT token and what are its practical applications?

BOT token powers automated trading and task management tools on Telegram. It enables users to automate trading operations, receive real-time information alerts, and streamline portfolio management efficiently.

How to conduct BOT price prediction, what are the analysis methods?

BOT price prediction utilizes fundamental analysis examining project development and adoption, technical analysis studying price charts and trading volume, and machine learning algorithms like regression analysis to identify patterns and forecast price movements.

BOT的历史价格走势如何,目前处于什么价位?

BOT has shown volatility in recent weeks. On January 18, 2026, it traded at 0.003666, with peaks near 0.004599. The token demonstrates strong recovery potential with historical lows around 0.003153, indicating consolidation patterns typical of emerging assets.

What risks should I pay attention to when investing in BOT tokens?

BOT token investment involves market volatility and liquidity risks. Monitor holder quality and DEX liquidity closely. Manage position size carefully in small-cap investments for risk control.

What are the advantages and disadvantages of BOT compared to other AI-based tokens?

BOT's strength lies in its clear embedded channel strategy and copy-trading loop. However, it faces challenges in execution robustness during volatility, AI signal stability, and potential overfitting risks in market conditions.

What are professional analysts' predictions for BOT's future price?

Professional analysts predict BOT's price will depend on market demand and crypto economy trends. Supply dynamics, technology adoption, and market sentiment will drive price movements. Predictions are typically based on historical performance and broader market conditions.

What are the main factors affecting BOT price fluctuations?

BOT price fluctuations are primarily driven by market sentiment, trading volume, Bitcoin price movements, overall crypto market conditions, and project development updates. Additionally, macroeconomic factors and regulatory news significantly impact price volatility.

What are BOT's development prospects in 2024 and the coming years?

BOT is positioned for strong growth with anticipated 20% annual compound growth rate. Increasing demand for intelligent automation across robotics and healthcare sectors will drive market expansion and adoption.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Comprehensive Guide to Token Generation Events

Comprehensive Guide to Creating and Selling NFTs for Free

How to Profit from Cryptocurrency — Leading Strategies of Recent Years

Best Crypto Trading Bots for Automated Trading

Top 5 Tokens Recommended for DeFi Investment