2026 BSCS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: BSCS Market Position and Investment Value

BSCS, as a fully decentralized protocol designed for launching new ideas and operating as an all-in-one incubation hub, has been developing its multi-chain DeFi ecosystem since its inception in 2021. As of February 2026, BSCS maintains a market capitalization of approximately $162,509, with a circulating supply of around 247.73 million tokens, and the price hovering around $0.000656. This asset, positioned as a comprehensive DeFi platform spanning multiple blockchain networks, is playing an increasingly significant role in areas including launchpad services, yield farming, NFT marketplaces, and DEX aggregation.

This article will comprehensively analyze BSCS price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. BSCS Price History Review and Market Overview

BSCS Historical Price Evolution Trajectory

- 2021: BSCS launched on April 23, 2021 with an initial price of $0.168864. On May 3, 2021, the token reached its all-time high of $1.17, representing a significant surge during the early bull market period for DeFi projects.

- 2021-2025: Following the peak in May 2021, BSCS experienced a substantial decline as the broader cryptocurrency market entered a bearish cycle, with the price gradually decreasing over the subsequent years.

- 2026: On February 6, 2026, BSCS recorded its all-time low of $0.0005531, marking a notable downturn in its price trajectory.

BSCS Current Market Dynamics

As of February 9, 2026, BSCS is trading at $0.000656, showing a 24-hour increase of 10.76%. The token has experienced mixed short-term performance, with a 1-hour change of 0.042%, while facing longer-term declines of 16.88% over 7 days, 28.09% over 30 days, and 71.54% over the past year.

BSCS maintains a circulating supply of 247,727,989 tokens out of a total supply of 398,894,655 tokens, representing a circulation ratio of 49.55%. The maximum supply is capped at 500,000,000 tokens. The current market capitalization stands at $162,509.56, with a fully diluted valuation of $261,674.89. The 24-hour trading volume is $8,643.49.

The token's market dominance is 0.000010%, indicating its relatively small position within the broader cryptocurrency ecosystem. BSCS is deployed on the Binance Smart Chain (BSC) network, with the contract address 0xbcb24afb019be7e93ea9c43b7e22bb55d5b7f45d. The project has attracted 27,452 holders.

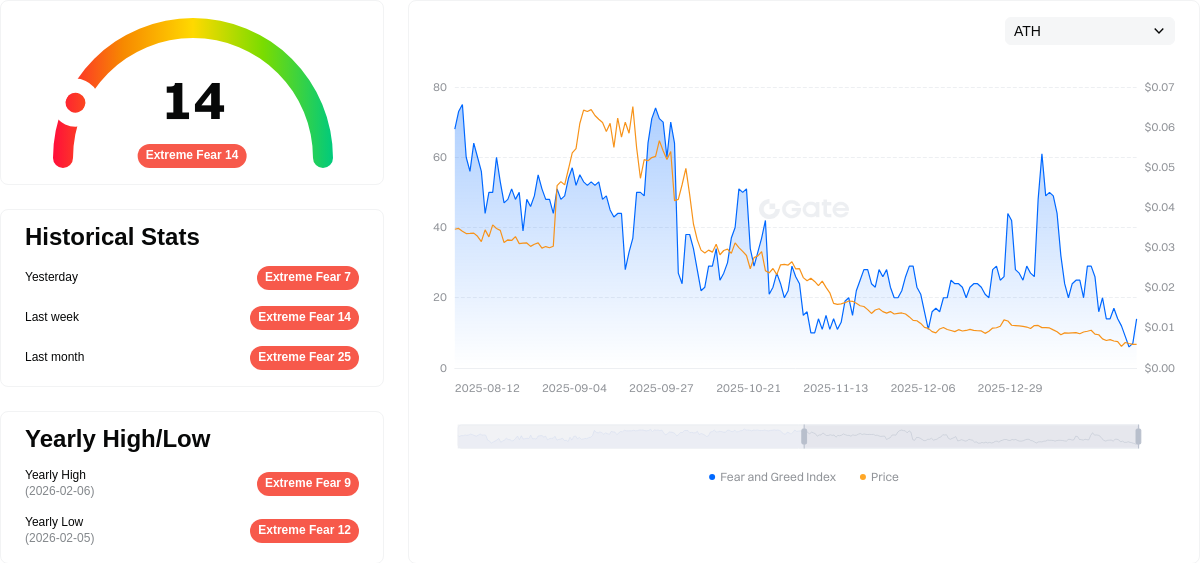

BSC Station operates as a fully decentralized protocol designed for launching new ideas, functioning as an all-in-one incubation hub with a full-stack DeFi platform across multiple blockchain networks. The platform provides services including Launchpad, Yield farming, Tools, NFT Auction, Marketplace, and DEX Aggregator. The current market sentiment index registers at 14, indicating extreme fear in the cryptocurrency market.

Click to view current BSCS market price

BSCS Market Sentiment Indicator

2026-02-09 Fear & Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index standing at just 14. This exceptionally low reading signals severe market pessimism and panic selling pressure among investors. When the index reaches such extreme levels, it historically presents contrarian opportunities for long-term investors, as markets tend to overreact during fear-driven periods. However, traders should exercise caution and conduct thorough risk management. Monitor market developments closely on Gate.com to identify potential entry points while protecting capital from further downside risks.

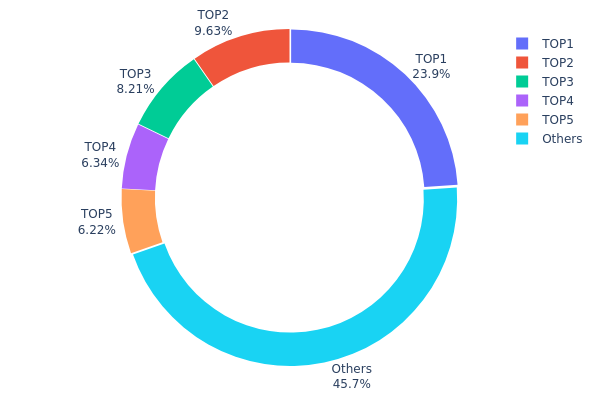

BSCS Holding Distribution

The holding distribution chart visualizes the concentration of token ownership across different wallet addresses, serving as a critical indicator of market structure and decentralization level. By analyzing the proportion held by top addresses versus the broader holder base, investors can assess potential centralization risks and market manipulation susceptibility.

According to the current data, BSCS exhibits a moderate concentration pattern. The top holder controls 23.88% of the total supply (100,000K tokens), while the second and third largest addresses hold 9.62% and 8.21% respectively. The top five addresses collectively account for 54.26% of the circulating supply, with the remaining 45.74% distributed among other holders. Notably, the fifth-largest address is a burn address (0x0000...00dead) holding 6.22%, which effectively reduces the actual circulating supply and demonstrates a deflationary mechanism.

This distribution structure presents a dual-edged characteristic. On one hand, the top holder's 23.88% stake creates potential price influence capability, particularly during periods of low liquidity where large-scale selling could trigger significant volatility. On the other hand, the 45.74% held by dispersed addresses provides a meaningful counterbalance, preventing absolute control by any single entity. The presence of the burn address further enhances long-term value stability by permanently removing tokens from circulation. This configuration suggests a relatively balanced on-chain structure, though investors should remain vigilant regarding movements from the top three addresses, which together control over 41% of the supply and could materially impact market dynamics.

Click to view current BSCS Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb2fc...cf3799 | 100000.00K | 23.88% |

| 2 | 0x0ec4...a9d6b1 | 40289.91K | 9.62% |

| 3 | 0x0d07...b492fe | 34373.75K | 8.21% |

| 4 | 0xe190...dafce3 | 26528.63K | 6.33% |

| 5 | 0x0000...00dead | 26043.69K | 6.22% |

| - | Others | 191351.74K | 45.74% |

II. Core Factors Influencing BSCS Future Price

Supply Mechanism

- Token Supply Structure: BSCS has a maximum supply of 500,000,000 tokens, with current circulation at 269,957,380 BSCS and total supply of 392,544,039.97 BSCS.

- Historical Pattern: As a token with controlled supply, BSCS demonstrates typical scarcity characteristics in the cryptocurrency market, though circulation continues to increase gradually.

- Current Impact: With approximately 54% of maximum supply already in circulation, future token releases may exert moderate supply pressure on price movements.

Institutional and Major Holder Dynamics

- Market Recognition: BSCS currently holds a market ranking of 2763 with a market capitalization of $177,005.33, indicating limited mainstream recognition at present.

- Adoption Status: As a DeFi platform on BNB Smart Chain, BSCS serves users through various financial services including lending, trading, liquidity mining, and yield farming.

Macroeconomic Environment

- Cryptocurrency Market Trends: BSCS price performance correlates strongly with overall cryptocurrency market conditions, particularly during bull market phases when growth potential may expand.

- Market Sentiment: The broader crypto market environment significantly influences BSCS valuation, with bull markets potentially driving increased interest in DeFi platforms.

- Investment Risk: Like all cryptocurrency investments, BSCS carries inherent volatility and uncertainty, requiring investors to conduct thorough market analysis.

Technical Development and Ecosystem Building

- BNB Smart Chain Integration: BSCS operates as a DeFi platform built on BNB Smart Chain (BEP20), leveraging the network's infrastructure and efficiency.

- DeFi Services: The platform provides comprehensive financial tools including lending protocols, decentralized trading, liquidity mining opportunities, and yield farming mechanisms.

- Platform Features: BSCStation aims to deliver diverse financial services within the decentralized finance ecosystem, though specific application adoption details require further monitoring.

III. 2026-2031 BSCS Price Prediction

2026 Outlook

- Conservative Prediction: $0.0006

- Neutral Prediction: $0.00065

- Optimistic Prediction: $0.00081 (requires favorable market conditions)

2027-2029 Outlook

- Market Phase Expectation: BSCS may experience gradual growth during this period, with potential consolidation phases followed by moderate upward momentum as the crypto market matures.

- Price Range Predictions:

- 2027: $0.00067 - $0.00083

- 2028: $0.00052 - $0.00113

- 2029: $0.00071 - $0.00128

- Key Catalysts: Increased adoption of blockchain technology, potential ecosystem developments, broader market sentiment improvements, and regulatory clarity in key jurisdictions could serve as primary drivers for price appreciation.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00104 - $0.00129 (assuming steady ecosystem growth and stable market conditions)

- Optimistic Scenario: $0.00099 - $0.00168 (assuming accelerated adoption, strategic partnerships, and positive regulatory developments)

- Transformative Scenario: Potential to reach upper bounds of predicted ranges (contingent upon breakthrough technological implementations, mass adoption, and exceptionally favorable market cycles)

- 2026-02-09: BSCS trading within the $0.0006 - $0.00081 range (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00081 | 0.00065 | 0.0006 | 0 |

| 2027 | 0.00083 | 0.00073 | 0.00067 | 11 |

| 2028 | 0.00113 | 0.00078 | 0.00052 | 19 |

| 2029 | 0.00128 | 0.00096 | 0.00071 | 45 |

| 2030 | 0.00129 | 0.00112 | 0.00104 | 70 |

| 2031 | 0.00168 | 0.0012 | 0.00099 | 83 |

IV. BSCS Professional Investment Strategy and Risk Management

BSCS Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: DeFi ecosystem believers and investors seeking passive income through yield farming platforms

- Operational Recommendations:

- Consider accumulating BSCS during market corrections when the token trades below its 30-day average

- Participate in the platform's yield farming programs to generate additional returns while holding

- Utilize Gate Web3 Wallet for secure long-term storage with multi-signature protection

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume (currently $8,643) relative to market cap to identify accumulation or distribution phases

- Support/Resistance Levels: Track the recent low of $0.0005909 and high of $0.000656 as key trading boundaries

- Swing Trading Key Points:

- Given the -16.88% weekly decline, look for reversal signals at established support levels

- Set stop-loss orders 10-15% below entry points due to high volatility

BSCS Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: Up to 10% of crypto portfolio with active hedging strategies

(II) Risk Hedging Solutions

- Diversification Approach: Balance BSCS exposure with established DeFi tokens and stablecoins

- Position Sizing: Use dollar-cost averaging to mitigate timing risk given the -28.09% monthly decline

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and yield farming participation

- Cold Storage Solution: Hardware wallet for long-term holdings exceeding 30% of total BSCS position

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly verify contract addresses (0xbcb24afb019be7e93ea9c43b7e22bb55d5b7f45d on BSC)

V. BSCS Potential Risks and Challenges

BSCS Market Risks

- High Volatility: The token has declined 71.54% over the past year, indicating significant price instability

- Low Liquidity: With only $8,643 in 24-hour trading volume and trading on limited exchanges, large orders may face slippage

- Market Cap Concentration: At $162,509 market cap with 0.000010% market dominance, BSCS remains highly susceptible to broader market movements

BSCS Regulatory Risks

- DeFi Platform Scrutiny: Launchpad and yield farming services may face increased regulatory attention in various jurisdictions

- Cross-chain Operations: Operating across multiple blockchain networks may expose the project to diverse regulatory frameworks

- Token Classification Uncertainty: The functional utility of BSCS within the ecosystem may attract regulatory examination regarding securities classification

BSCS Technical Risks

- Smart Contract Vulnerabilities: DeFi protocols are susceptible to exploits, particularly in yield farming and DEX aggregator components

- Network Dependency: Primary deployment on BSC creates centralization concerns and dependency on Binance Smart Chain infrastructure

- Competition Pressure: The launchpad and DeFi aggregation space faces intense competition from established platforms with larger user bases

VI. Conclusion and Action Recommendations

BSCS Investment Value Assessment

BSCS presents a high-risk, high-volatility opportunity within the DeFi infrastructure sector. The platform's all-in-one approach spanning launchpad, yield farming, NFT marketplace, and DEX aggregation offers comprehensive functionality. However, significant challenges exist: the token has experienced a 71.54% decline over the past year, trades with limited liquidity, and maintains a modest market cap of approximately $162,000. The circulating supply represents 49.55% of fully diluted valuation, suggesting potential future dilution. While the recent 24-hour gain of 10.76% shows short-term momentum, the broader downtrend (-16.88% weekly, -28.09% monthly) indicates persistent selling pressure. Long-term value depends on the platform's ability to attract projects to its launchpad and users to its DeFi services amid fierce competition.

BSCS Investment Recommendations

✅ Beginners: Avoid direct exposure until establishing experience with established DeFi tokens; if interested, limit allocation to under 1% of portfolio and focus on learning the platform's ecosystem ✅ Experienced Investors: Consider small speculative positions (2-3% of crypto allocation) with strict stop-losses; evaluate participation in yield farming programs after thorough smart contract audit review ✅ Institutional Investors: Conduct comprehensive due diligence on platform usage metrics, smart contract security audits, and competitive positioning before considering strategic allocation; monitor regulatory developments affecting multi-chain DeFi platforms

BSCS Trading Participation Methods

- Spot Trading: Purchase BSCS on Gate.com with USDT or other trading pairs for direct exposure

- Yield Farming Participation: Stake BSCS tokens within the BSC Station platform to earn farming rewards while maintaining exposure

- Dollar-Cost Averaging: Establish systematic purchase schedules to mitigate timing risk given current price volatility and downtrend patterns

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is BSCS? What are its uses and value?

BSCS is a cryptocurrency token built on Binance Smart Chain, serving as a DeFi platform offering financial services including lending, trading, and yield farming. Currently priced at $0.0006557, it has significant growth potential during bull market cycles as market recognition increases.

BSCS的历史价格走势如何?目前价格是多少?

BSCS current price is $0.00059 with market cap of $161.83K USD. It has risen 1.69% in the past 24 hours with trading volume of $21,825.72 USD. The token shows steady upward momentum.

What is the BSCS price prediction for 2024?

BSCS price predictions depend on market trends and project developments. As a DeFi platform on Binance Smart Chain with 269.96 million circulating supply, BSCS shows potential growth during bull markets, though exact price targets remain uncertain and subject to market dynamics.

What are the main factors affecting BSCS price?

BSCS price is primarily influenced by market sentiment, adoption rate, DeFi ecosystem development, trading volume, community engagement, and overall cryptocurrency market conditions.

What are the risks of BSCS? What should I pay attention to when investing?

BSCS investment involves market volatility and potential losses. Investors should understand market conditions and be prepared for price fluctuations. Assess your risk tolerance before investing and only invest what you can afford to lose.

What are the advantages and disadvantages of BSCS compared to similar projects?

BSCS offers superior scalability and decentralized architecture compared to competitors, enabling faster transactions and lower costs. However, it faces challenges in network adoption and regulatory clarity that some established projects have already navigated.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What is AIX9: A Comprehensive Guide to the Next Generation of Enterprise Computing Solutions

What is KLINK: A Comprehensive Guide to Understanding the Revolutionary Communication Platform

What is ART: A Comprehensive Guide to Understanding Assisted Reproductive Technology and Its Impact on Modern Fertility Treatment

What is KAR: A Comprehensive Guide to Knowledge and Reasoning Systems in Modern Technology

What is MART: A Comprehensive Guide to Multi-Agent Reinforcement Learning Through Time