2026 BSW Price Prediction: Expert Analysis and Market Forecast for Biswap Token Growth

Introduction: BSW's Market Position and Investment Value

Biswap (BSW), as a decentralized exchange platform featuring a three-tier referral system and the lowest platform transaction fee (0.1%) in the market, has established its presence in the DeFi ecosystem since its launch in 2021. As of February 2026, BSW maintains a market capitalization of approximately $1.15 million, with a circulating supply of around 498.98 million tokens, and the price hovering near $0.002312. This asset, recognized as a benchmark-oriented DEX platform on the BNB Chain, is playing an increasingly important role in decentralized token exchange and liquidity provision.

This article will comprehensively analyze BSW's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. BSW Price History Review and Market Status

BSW Historical Price Evolution Trajectory

- 2021: Biswap launched in July with an initial offering price of $0.6421, followed by rapid growth reaching a peak of $2.1 in December during the DeFi boom period

- 2022-2025: The token experienced a prolonged correction phase as market sentiment shifted, with price declining significantly from its peak levels

- 2026: In early February, BSW recorded its lowest price point at $0.0021886, representing a substantial retreat from previous highs

BSW Current Market Situation

As of February 3, 2026, BSW is trading at $0.002312, showing a 24-hour increase of 4.09% with a trading range between $0.002164 and $0.002449. The token's market capitalization stands at $1,153,637.60 with a circulating supply of 498,978,200 BSW, representing 71.28% of the total supply of 576,898,100 tokens. The maximum supply is capped at 700,000,000 BSW.

The 24-hour trading volume reaches $16,218.75, while the fully diluted market cap is calculated at $1,333,788.41. BSW's market dominance stands at 0.000048%. Over different timeframes, BSW shows mixed performance: a 0.83% gain in the past hour, a 4.09% increase over 24 hours, but declines of 13.86% over 7 days and 25.41% over 30 days. The annual performance reflects a significant decrease of 94.8% compared to the previous year.

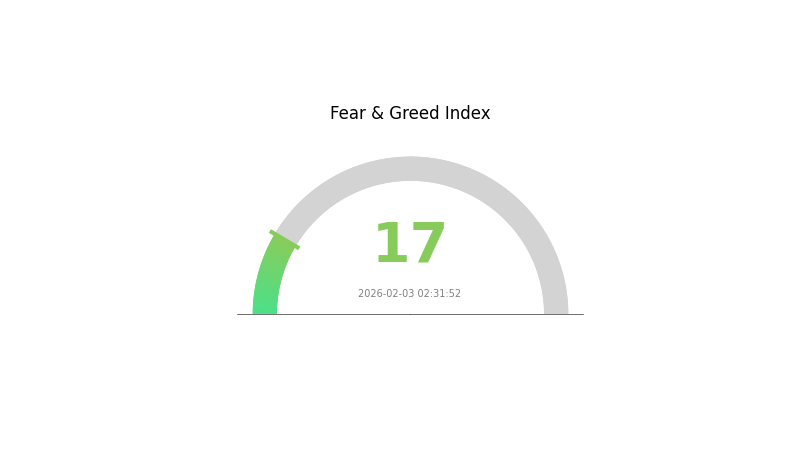

The current market sentiment index registers at 17, indicating extreme fear conditions in the broader cryptocurrency market. Biswap operates as a decentralized exchange platform on the BNB Chain with a three-tier referral system and competitive platform transaction fees of 0.1%. The platform has attracted 169,351 token holders and is listed on 7 exchanges.

Click to view current BSW market price

BSW Market Sentiment Indicator

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of 17. This exceptionally low level indicates severe market pessimism and heightened investor anxiety. During such periods of extreme fear, assets are typically oversold, creating potential opportunities for contrarian investors. However, extreme fear also signals significant market volatility and risk. Traders should exercise caution and implement strict risk management strategies. Monitor market developments closely and consider dollar-cost averaging into positions rather than making large lump-sum investments. These conditions often precede market reversals, but timing remains crucial.

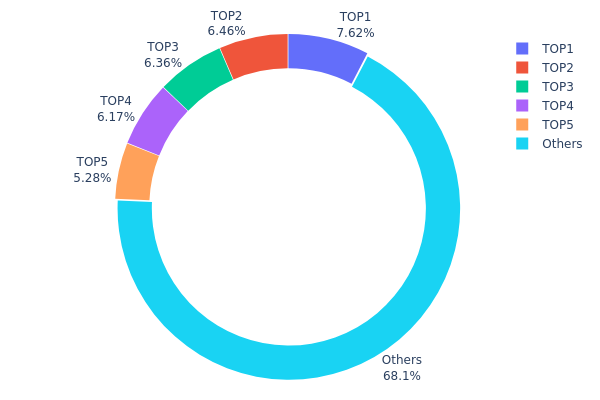

BSW Holding Distribution

The holding distribution chart of a cryptocurrency reflects the percentage of token supply held by different on-chain addresses, serving as a key indicator of decentralization and potential market manipulation risks. For BSW, the current on-chain data reveals a moderately concentrated holding structure. The top five addresses collectively control approximately 31.85% of the total supply, with the largest holder at address 0x6368...14d6c5 possessing 53.35 million tokens (7.62%). Notably, the burn address (0x0000...00dead) ranks third with 6.35% of supply, indicating an active token deflation mechanism. The remaining 68.15% is distributed among a broader base of holders, suggesting reasonable token circulation across the ecosystem.

This concentration level presents a dual-edged scenario for market dynamics. While the top holders maintain significant influence over price movements through potential large-scale transactions, the distribution is not extreme compared to many emerging projects where top addresses often exceed 50% collective ownership. The presence of what appear to be protocol-related addresses (likely staking pools or liquidity reserves based on holding patterns) among the top five indicates locked liquidity rather than purely speculative holdings. However, the combined power of these major holders could still introduce volatility during coordinated sell-offs or strategic repositioning.

From a structural perspective, BSW's holding distribution demonstrates moderate decentralization with functional concentration. The substantial portion held outside the top five addresses (68.15%) suggests an established user base and active trading ecosystem. This distribution pattern typically correlates with reduced manipulation vulnerability compared to heavily concentrated projects, though it remains susceptible to coordinated actions by major holders. The burn mechanism evidenced by the third-largest address contributes positively to long-term tokenomics by permanently removing supply from circulation.

Click to view current BSW Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6368...14d6c5 | 53352.58K | 7.62% |

| 2 | 0x0d07...b492fe | 45205.33K | 6.45% |

| 3 | 0x0000...00dead | 44507.51K | 6.35% |

| 4 | 0x436f...56b3b5 | 43180.68K | 6.16% |

| 5 | 0x2ddf...bf0f55 | 36927.16K | 5.27% |

| - | Others | 476826.75K | 68.15% |

II. Core Factors Influencing BSW's Future Price

Supply Mechanism

- Platform Ecosystem Expansion: BSW's future price trajectory is closely tied to the platform's ability to expand its ecosystem. Continued development and integration of new features could enhance the token's utility and demand.

- Historical Patterns: Historical data shows that token delisting announcements do not always result in sustained price declines. BSW has demonstrated volatility in response to market events, with some recovery potential following initial negative reactions.

- Current Impact: The ongoing market volatility and external risk factors continue to influence BSW's price movements. The token's performance remains sensitive to broader market conditions and competitive pressures.

Market Competition and Platform Positioning

- Competitive Landscape: BSW operates in a highly competitive decentralized finance environment. The platform's ability to maintain and strengthen its market position against competitors will be crucial for price stability and growth.

- Core Functionality: The token's value proposition depends on its core functions within the platform ecosystem. Sustained innovation and user adoption are key drivers for maintaining competitive advantages.

Macroeconomic Environment

- Market Volatility: The broader cryptocurrency market experiences significant volatility, which directly impacts individual token prices including BSW. Global economic conditions and investor sentiment play substantial roles in price determination.

- Risk Factors: External risk factors, including regulatory developments and market-wide shifts, continue to pose challenges for price predictability and stability.

Technical Development and Ecosystem Building

- Platform Development: Continued technical development and ecosystem expansion initiatives could positively influence BSW's valuation. The platform's ability to deliver on roadmap commitments will be monitored by market participants.

- Ecosystem Applications: The growth and adoption of applications within the BSW ecosystem may contribute to increased token utility and demand over time.

III. 2026-2031 BSW Price Prediction

2026 Outlook

- Conservative prediction: $0.00172 - $0.00232

- Neutral prediction: Around $0.00232

- Optimistic prediction: Up to $0.00257 (requires favorable market conditions and sustained adoption)

2027-2029 Outlook

- Market stage expectation: Potential gradual recovery phase with moderate volatility as the DeFi sector continues to evolve

- Price range prediction:

- 2027: $0.00196 - $0.00318

- 2028: $0.00143 - $0.00295

- 2029: $0.0015 - $0.00314

- Key catalysts: Platform development progress, user base expansion, and overall cryptocurrency market sentiment may influence price movements

2030-2031 Long-term Outlook

- Baseline scenario: $0.00268 - $0.00301 (assuming steady ecosystem development and market stability)

- Optimistic scenario: $0.00374 - $0.00446 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: Potential to reach upper ranges if significant technological breakthroughs or strategic partnerships materialize

- 2026-02-03: BSW trading within the predicted range of $0.00172 - $0.00257 (based on current market analysis)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00257 | 0.00232 | 0.00172 | 0 |

| 2027 | 0.00318 | 0.00245 | 0.00196 | 5 |

| 2028 | 0.00295 | 0.00281 | 0.00143 | 21 |

| 2029 | 0.00314 | 0.00288 | 0.0015 | 24 |

| 2030 | 0.00446 | 0.00301 | 0.00268 | 30 |

| 2031 | 0.00422 | 0.00374 | 0.00213 | 61 |

IV. BSW Professional Investment Strategy and Risk Management

BSW Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term development of decentralized exchanges and are willing to hold assets for extended periods

- Operational Recommendations:

- Accumulate positions during market downturns and maintain holdings through market cycles

- Monitor the development progress of Biswap platform features, including NFT marketplace and gaming products

- Consider using Gate.com's flexible savings products to generate passive income while holding BSW

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels around $0.0022 (near recent lows) and $0.0024 (near recent highs)

- Volume Analysis: Track daily trading volume changes to identify potential trend reversals

- Swing Trading Points:

- Consider short-term volatility opportunities within the 24-hour price range

- Set stop-loss orders to manage downside risk given recent price weakness

BSW Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 10% with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance BSW holdings with established cryptocurrencies and stablecoins

- Position Sizing: Use dollar-cost averaging to reduce timing risk in volatile markets

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet for convenient trading and platform interaction

- Security Best Practices: Enable two-factor authentication, regularly review transaction history, and never share private keys or seed phrases

V. BSW Potential Risks and Challenges

BSW Market Risks

- High Volatility: BSW has experienced significant price decline of 94.8% over the past year, indicating substantial downside risk

- Low Liquidity: With 24-hour trading volume of approximately $16,219, the token may face liquidity constraints during large transactions

- Market Dominance: BSW represents only 0.000048% of total crypto market capitalization, suggesting limited market influence

BSW Regulatory Risks

- DeFi Regulatory Uncertainty: Evolving regulations around decentralized exchanges may impact platform operations

- Cross-border Compliance: Operating on BSC chain requires adherence to various jurisdictional requirements

- Token Classification: Potential regulatory changes in token classification could affect BSW's trading status

BSW Technical Risks

- Smart Contract Vulnerabilities: Decentralized exchange platforms face ongoing risks from potential code exploits

- Chain Dependency: BSW operates on BNB Smart Chain, creating exposure to underlying blockchain performance and security

- Competition Risk: Intense competition from other DEX platforms may impact user adoption and platform growth

VI. Conclusion and Action Recommendations

BSW Investment Value Assessment

BSW represents a high-risk investment in the decentralized exchange sector with notable challenges including significant historical price decline and limited market presence. While Biswap offers competitive trading fees and multiple platform features including NFT marketplace, investors should carefully weigh the substantial volatility and market risks. The project's long-term value depends on successful execution of platform development and user acquisition in a highly competitive environment.

BSW Investment Recommendations

✅ Beginners: Approach with extreme caution; consider allocating only minimal amounts as part of broader crypto education, and prioritize understanding DeFi mechanics before investing ✅ Experienced Investors: Suitable only for those with high risk tolerance; maintain strict position limits and implement rigorous risk management protocols ✅ Institutional Investors: Conduct thorough due diligence on platform fundamentals, user metrics, and competitive positioning before considering allocation

BSW Trading Participation Methods

- Spot Trading: Purchase BSW directly on Gate.com with available trading pairs for immediate exposure

- Flexible Savings: Utilize Gate.com's savings products to earn yield on BSW holdings while maintaining liquidity

- Portfolio Integration: Incorporate BSW as a small-cap DeFi component within diversified crypto allocations

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What are the price predictions for BSW token in 2024 and 2025?

Based on market analysis, BSW was predicted to reach approximately $0.05995 in 2024, with continued growth expected through 2025. These projections reflect positive market sentiment and adoption trends in the DeFi ecosystem.

Which factors affect BSW price movement?

BSW price is driven by supply and demand dynamics, block reward halving, protocol upgrades, and market events. Regulatory changes, institutional adoption, and overall cryptocurrency market sentiment also significantly influence its price trajectory.

How to predict BSW price movements through technical analysis?

Use technical indicators like moving averages, RSI, and MACD to analyze BSW price trends. Monitor trading volume, support and resistance levels, and chart patterns. BSW may reach $0.00233 in one week and $0.00247 in four weeks based on current technical analysis.

How is BSW's investment potential compared to other DEX tokens like UNI and CAKE?

BSW demonstrates strong potential with limited supply and frequent burn mechanisms. Its lower market cap and scarcity dynamics suggest significant appreciation potential compared to established DEX tokens like UNI and CAKE, making it an attractive investment opportunity.

What risks and uncertainties exist in BSW price predictions?

BSW price predictions face market volatility, regulatory changes, and technology adoption uncertainties. Trading volume fluctuations, macroeconomic factors, and competitive blockchain developments significantly impact price movements and forecast accuracy.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

A Complete Guide to the 1inch Swap

Understanding the Stock-to-Flow Model: Bitcoin's Scarcity and Price Relationship

Top Stablecoin Interest Rate Solutions for Passive Income

Top 7 Solutions to Survive Cryptocurrency Bear Markets

Top 10 Profitable Play-to-Earn NFT Games