2026 CHO Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Introduction: CHO's Market Position and Investment Value

Choise (CHO), as a pioneering blockchain B2B enterprise infrastructure solution, has been operating since 2017, partnering with leading banks, fintech companies, and startups globally to deliver crypto-fiat services. As of February 2026, CHO maintains a market capitalization of approximately $227,584, with a circulating supply of around 109.57 million tokens, and the price hovering near $0.002077. This asset, recognized for its role in bridging traditional finance and blockchain technology, is playing an increasingly important role in enterprise crypto adoption and digital banking services.

This article will comprehensively analyze CHO's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. CHO Price History Review and Market Status

CHO Historical Price Evolution Trajectory

- 2022: CHO reached its all-time high of $1.38 on September 1, 2022, marking a significant milestone in the token's trading history.

- 2026: The token experienced substantial price fluctuation, declining to its all-time low of $0.00204206 on February 2, 2026.

CHO Current Market Situation

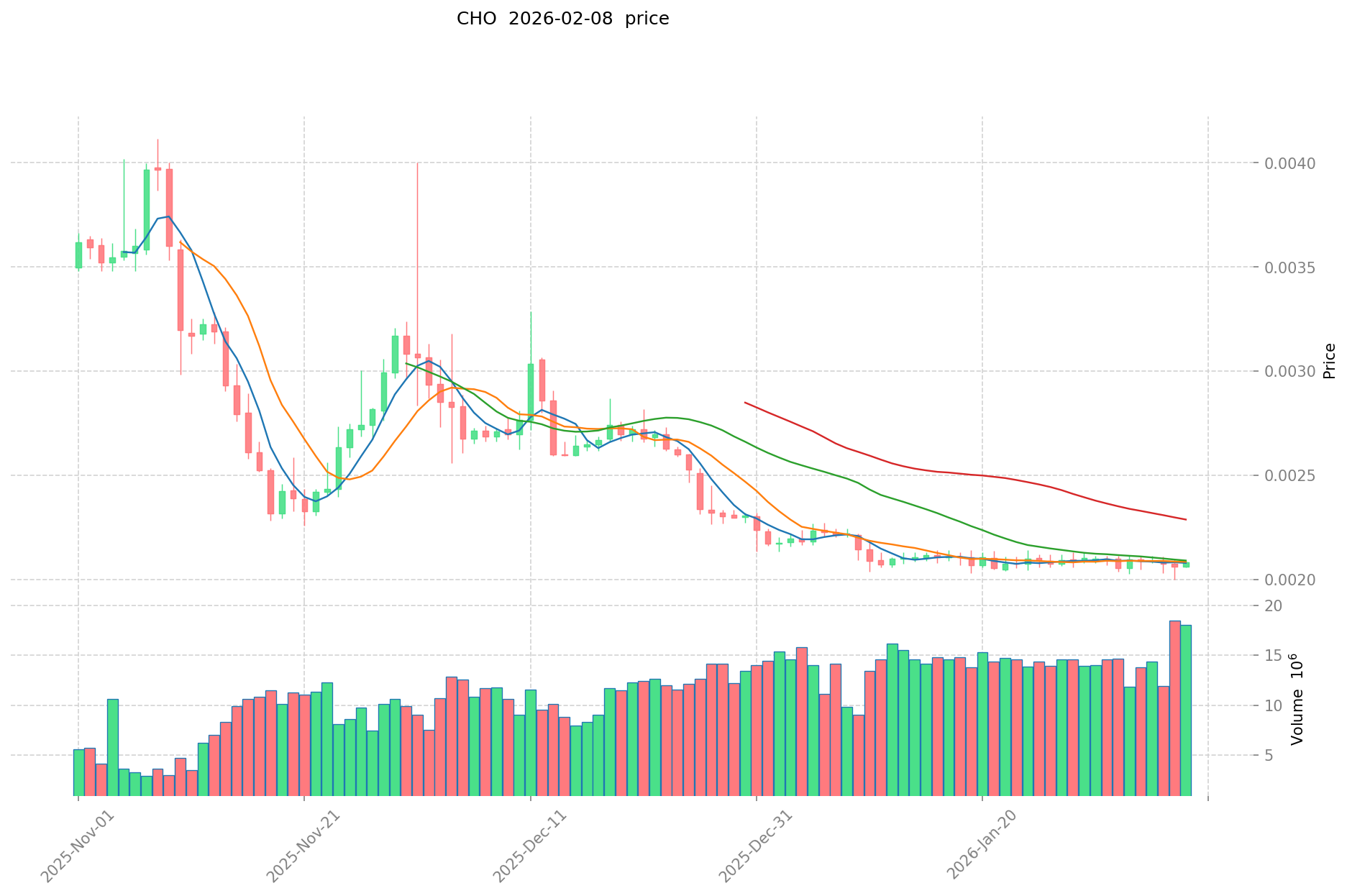

As of February 8, 2026, CHO is trading at $0.002077, showing a modest 24-hour price increase of 0.28%. The token's intraday trading range spans from a low of $0.002059 to a high of $0.00209. Over the past hour, CHO has demonstrated slight upward momentum with a 0.05% gain.

Looking at broader timeframes, CHO's price performance reflects varied trends across different periods. The 7-day performance shows a decline of 1%, while the 30-day period indicates a decrease of 5.92%. The annual perspective reveals a more substantial contraction, with the token declining 85.61% over the past year.

CHO maintains a market capitalization of approximately $227,585, with a circulating supply of 109,573,888.74 tokens representing 10.96% of the total supply of 1 billion tokens. The fully diluted market cap stands at $2,077,000. The 24-hour trading volume reaches $36,173.83, while the token holds a market dominance of 0.000083%.

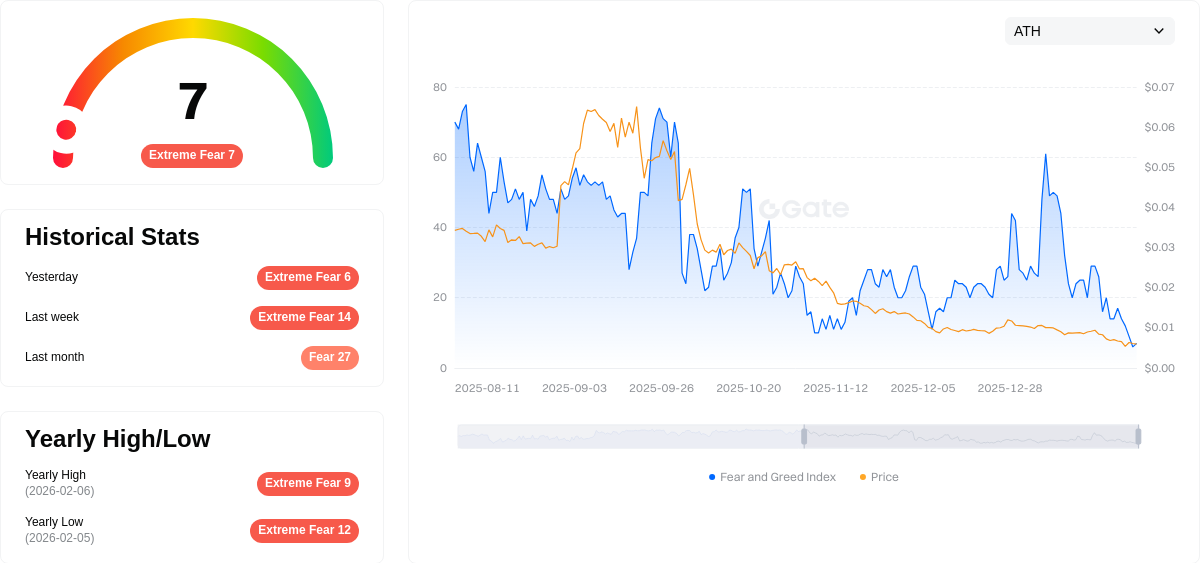

The current market sentiment indicator registers at 7, reflecting an extreme fear level in the broader cryptocurrency market. CHO is ranked #3792 among tracked cryptocurrencies and is held by 3,741 addresses according to available data.

Click to view current CHO market price

CHO Market Sentiment Index

2026-02-08 Fear & Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with the Fear & Greed Index at 7, signaling significant pessimism among investors. This historically low reading suggests market participants are deeply worried about price declines and volatility. Such extreme fear conditions often present contrarian opportunities for long-term investors, as markets tend to recover from oversold levels. However, caution is advised, as the market may continue testing support levels. Monitor key technical levels and risk management strategies carefully during this period of heightened market anxiety.

CHO Holding Distribution

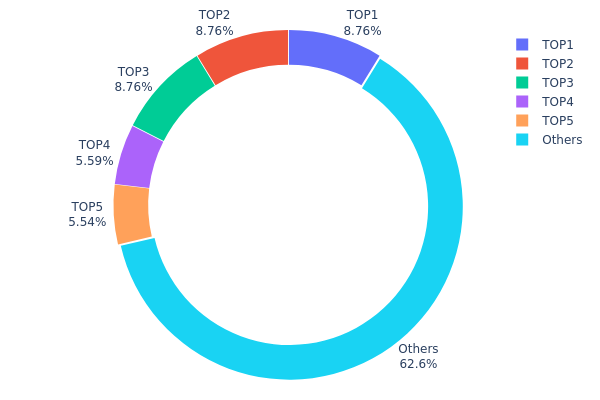

The holding distribution chart visualizes the percentage allocation of CHO tokens across different address categories, serving as a key indicator of token decentralization and market structure. This metric helps assess whether token supply is concentrated among a few major holders or distributed more evenly across the ecosystem, which directly impacts market stability and price volatility potential.

Based on current on-chain data, CHO demonstrates a moderately concentrated holding pattern. The top three addresses each hold 87.55 million tokens (8.75% per address), collectively controlling 26.25% of total supply. Including the fourth and fifth largest holders with 5.59% and 5.54% respectively, the top five addresses account for approximately 37.38% of circulating supply. The remaining 62.62% is distributed among other addresses, suggesting a relatively balanced structure compared to extremely concentrated token economies.

This distribution pattern indicates CHO maintains reasonable decentralization while retaining some concentration in key stakeholders. The presence of three equal-sized top holders (likely representing project treasury, ecosystem fund, or strategic reserves) provides structural stability, while the majority holding by smaller participants (62.62%) reduces single-entity manipulation risk. However, the combined 37.38% concentration among top holders means coordinated movements could still significantly impact market dynamics. This structure typically supports steady development while maintaining sufficient liquidity dispersion to absorb regular trading activity without excessive volatility amplification.

Click to view current CHO Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfa3e...1af80d | 87550.00K | 8.75% |

| 2 | 0xe56e...9b35d2 | 87550.00K | 8.75% |

| 3 | 0xcd38...dae148 | 87550.00K | 8.75% |

| 4 | 0x284d...3cad93 | 55931.12K | 5.59% |

| 5 | 0x58ed...a36a51 | 55449.35K | 5.54% |

| - | Others | 625969.53K | 62.62% |

II. Core Factors Influencing CHO's Future Price

Supply Mechanism

- Market Participation and Capital Flow: The supply dynamics of CHO are closely tied to market participation levels and capital movement patterns. Active market engagement and sustained capital inflows typically support price stability and growth potential.

- Historical Patterns: Historical data suggests that periods of increased market participation have corresponded with improved price performance, while reduced engagement has often preceded downward pressure.

- Current Impact: Future price trajectories depend significantly on whether spot market participation continues to strengthen. Without sustained capital inflows and increased trading activity, the market may face ongoing pressure, and any rebounds could lack durability.

Institutional and Major Holder Dynamics

- Ecosystem and Platform Support: Key support from blockchain foundations and strategic partnerships plays an important role in price dynamics. Strategic acquisitions by major ecosystem players can provide meaningful support signals to the market.

- Market Sentiment: Investor sentiment remains a crucial factor, with emotional indicators serving as useful barometers for market positioning and potential trend shifts.

Macroeconomic Environment

- Fundamental Analysis: Macroeconomic conditions, including broader financial market trends and risk appetite, influence cryptocurrency valuations. Financial data and industry environment factors contribute to price formation.

- Market Cycles: Historical cycle patterns and periodic market phases continue to shape price expectations and investor behavior.

Technical Development and Ecosystem Building

- Technical Analysis Methods: Price trend analysis through chart patterns and technical indicators provides insights into potential support and resistance levels, helping market participants assess risk-reward dynamics.

- Fundamental Factors: The underlying fundamentals, including technology development progress and ecosystem expansion, contribute to long-term value assessment and market positioning.

III. 2026-2031 CHO Price Prediction

2026 Outlook

- Conservative Forecast: $0.00121 - $0.00208

- Neutral Forecast: Around $0.00208

- Optimistic Forecast: Up to $0.00266 (subject to favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual growth phase with potential volatility as the token seeks broader market recognition and use case expansion

- Price Range Predictions:

- 2027: $0.00221 - $0.00278 (approximately 14% potential increase)

- 2028: $0.00208 - $0.00332 (approximately 23% potential increase)

- 2029: $0.00186 - $0.00304 (approximately 41% potential increase)

- Key Catalysts: Market sentiment shifts, potential ecosystem developments, and broader cryptocurrency market trends

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00185 - $0.00299 (assuming steady market conditions and continued project development)

- Optimistic Scenario: $0.00248 - $0.00338 (assuming positive market momentum and successful ecosystem expansion)

- Transformative Scenario: Up to $0.00465 (under exceptionally favorable conditions including significant adoption breakthroughs and bull market alignment)

- 2031-02-08: CHO potentially reaching $0.00319 average (representing approximately 53% growth from 2026 baseline)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00266 | 0.00208 | 0.00121 | 0 |

| 2027 | 0.00278 | 0.00237 | 0.00221 | 14 |

| 2028 | 0.00332 | 0.00257 | 0.00208 | 23 |

| 2029 | 0.00304 | 0.00295 | 0.00186 | 41 |

| 2030 | 0.00338 | 0.00299 | 0.00185 | 44 |

| 2031 | 0.00465 | 0.00319 | 0.00248 | 53 |

IV. CHO Professional Investment Strategy and Risk Management

CHO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to blockchain infrastructure and enterprise crypto solutions with a multi-year investment horizon

- Operational Recommendations:

- Consider accumulating CHO during periods of market consolidation, particularly when trading near support levels

- Monitor Choise.ai's B2B partnership announcements and ecosystem expansion milestones as potential catalysts

- Implement a secure storage solution immediately after acquisition to mitigate exchange-related risks

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Utilize 50-day and 200-day moving averages to identify potential trend reversals and momentum shifts

- Volume Analysis: Monitor trading volume patterns on Gate.com to gauge market interest and potential breakout opportunities

- Swing Trading Considerations:

- Given CHO's relatively modest market capitalization, be prepared for higher volatility compared to larger-cap assets

- Set predetermined profit-taking levels and stop-loss orders to manage emotional decision-making

CHO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio allocation

- Aggressive Investors: 3-5% of total crypto portfolio allocation

- Professional Investors: Up to 8% of crypto portfolio with active hedging strategies

(2) Risk Hedging Approaches

- Diversification Strategy: Balance CHO exposure with more established digital assets to reduce portfolio concentration risk

- Position Sizing: Avoid allocating more than 5% of total investable capital to CHO given its lower market ranking

(3) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet offers convenient access with enhanced security features for CHO token management

- Hardware Wallet Approach: For holdings intended for long-term storage, consider transferring CHO to a hardware wallet supporting ERC-20 tokens

- Security Precautions: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts; verify contract addresses before transactions

V. CHO Potential Risks and Challenges

CHO Market Risks

- Liquidity Concerns: With a current 24-hour trading volume of approximately $36,174, CHO exhibits relatively limited liquidity, which may result in wider bid-ask spreads and increased price slippage during larger transactions

- Price Volatility: CHO has experienced substantial price fluctuations, with year-over-year declines approaching 85%, indicating elevated volatility that may not suit risk-averse investors

- Market Competition: The blockchain B2B services sector faces intense competition from established infrastructure providers and emerging solutions, potentially impacting CHO's market positioning

CHO Regulatory Risks

- Jurisdictional Uncertainty: Evolving regulatory frameworks for crypto-fiat services and digital banking solutions could impact Choise.ai's operational model across different markets

- Compliance Requirements: Increasing regulatory scrutiny on crypto payment cards and digital banking services may necessitate operational adjustments that could affect project development timelines

- Cross-border Restrictions: Potential limitations on international crypto transactions could constrain the adoption of Choise.ai's B2B services in certain jurisdictions

CHO Technical Risks

- Smart Contract Dependencies: As an ERC-20 token deployed on Ethereum, CHO remains subject to potential smart contract vulnerabilities that could affect token functionality

- Network Congestion: During periods of high Ethereum network activity, transaction costs may increase, potentially impacting the economic viability of smaller CHO transactions

- Integration Complexity: The success of Choise.ai's B2B model depends on seamless technical integration with partner platforms, and any integration challenges could delay ecosystem expansion

VI. Conclusion and Action Recommendations

CHO Investment Value Assessment

Choise.ai represents a specialized play on the intersection of blockchain technology and traditional financial services infrastructure. While the project demonstrates an established operational history since 2017 and targets the growing demand for crypto-fiat services among banks and fintech companies, investors should carefully weigh the token's significant year-over-year price decline and limited current liquidity against its long-term potential. The project's B2B focus differentiates it from consumer-oriented platforms, but success depends heavily on continued partnership development and market adoption of enterprise crypto solutions. Current market conditions suggest elevated near-term volatility risk.

CHO Investment Recommendations

✅ Newcomers: Begin with minimal allocation (under 1% of crypto portfolio) to gain exposure while learning about enterprise blockchain applications; prioritize understanding the project's B2B model before increasing position size ✅ Experienced Investors: Consider CHO as a tactical allocation within a diversified blockchain infrastructure thesis; monitor partnership announcements and ecosystem metrics as potential entry or exit signals ✅ Institutional Investors: Evaluate CHO within the context of broader enterprise blockchain adoption trends; conduct thorough due diligence on Choise.ai's client relationships and regulatory compliance framework before committing significant capital

CHO Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale of CHO tokens through Gate.com's spot market, offering straightforward exposure with transparent pricing

- Dollar-Cost Averaging: Systematic periodic purchases to smooth out entry price volatility and reduce timing risk in an uncertain market environment

- Strategic Rebalancing: Periodic portfolio adjustments to maintain target CHO allocation percentages as market conditions evolve

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of CHO and when did it reach its all-time high?

CHO reached its all-time high of 67.61 THB on September 7, 2014. Current market price fluctuates based on real-time trading activity. Check live market data for the latest price information.

How to analyze and predict the future price trend of CHO?

Analyze CHO price trends by examining market sentiment, historical data patterns, and trading volume metrics. Monitor blockchain activity, project developments, and macroeconomic factors. Use technical analysis tools and market reports for more accurate price forecasts and trend predictions.

What factors affect CHO price fluctuations?

CHO price is influenced by market liquidity, trading volume, market sentiment, and overall crypto market conditions. These factors drive continuous price volatility.

What are the risks of CHO price prediction and how should I hedge them?

CHO price volatility stems from market sentiment shifts, low trading volume, and regulatory uncertainty. Mitigate risks by diversifying holdings, setting stop-loss orders, monitoring market fundamentals closely, and avoiding over-leveraging positions.

How is the price correlation between CHO and mainstream cryptocurrencies such as BTC and ETH?

CHO shows relatively low price correlation with BTC and ETH, typically exhibiting independent price movements. This independence provides greater investment potential during market fluctuations.

What are professional analysts' predictions for CHO's future price?

Professional analysts predict CHO's price will be influenced by supply dynamics, adoption trends, and market sentiment. Based on tokenomics and crypto market trends, CHO could experience upward or downward movement depending on market conditions and ecosystem development.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Survey Note: Detailed Analysis of the Best AI in 2025

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Kaspa’s Journey: From BlockDAG Innovation to Market Buzz

Best Crypto Wallets 2025: How to Choose and Secure Your Digital Assets

Popular GameFi Games in 2025

Byzantine Fault Tolerance Explained

What is Ergo? A Combination of Bitcoin and Ethereum

7 Strategies for Earning Passive Income with Crypto Assets

A detailed explanation of the differences, advantages, and disadvantages between PoS and PoW

Which ASIC Miner Should You Buy? A Review of Top Models for Cryptocurrency Mining