2026 CREO Price Prediction: Expert Analysis and Market Forecast for the Next Generation of 3D Design Software Solutions

Introduction: CREO's Market Position and Investment Value

Creo Engine (CREO), positioned as a web3 gaming ecosystem that connects multiple gaming worlds through a unified hub, has been developing since its launch in 2022. As of 2026, CREO maintains a market capitalization of approximately $362,870, with a circulating supply of around 290.3 million tokens and a current price hovering near $0.00125. This asset, operating within the blockchain gaming sector, is playing an increasingly notable role in the web3 gaming landscape.

This article will comprehensively analyze CREO's price trends from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. CREO Price History Review and Market Status

CREO Historical Price Evolution Trajectory

- 2024: The token reached a significant milestone in March, with price climbing to $0.26

- 2025-2026: The market experienced a substantial correction phase, with price declining from previous levels

- 2026: Price reached its lowest recorded level at $0.001231 in February

CREO Current Market Situation

As of February 6, 2026, CREO is trading at $0.00125, representing a decline of 5.07% over the past 24 hours. The token's 24-hour trading range spans from $0.001231 to $0.001321, with a total trading volume of $33,517.71.

From a broader timeframe perspective, CREO has experienced downward pressure across multiple periods: a 14.97% decrease over the past 7 days, a 32.74% decline over 30 days, and a significant 90.79% reduction over the past year.

The token currently maintains a market capitalization of approximately $362,870.77, with a circulating supply of 290,296,616 CREO tokens out of a total supply of 788,886,709. The fully diluted market cap stands at $986,108.39, with the circulating supply representing 29.03% of the total supply. CREO holds approximately 0.000041% of the overall cryptocurrency market share.

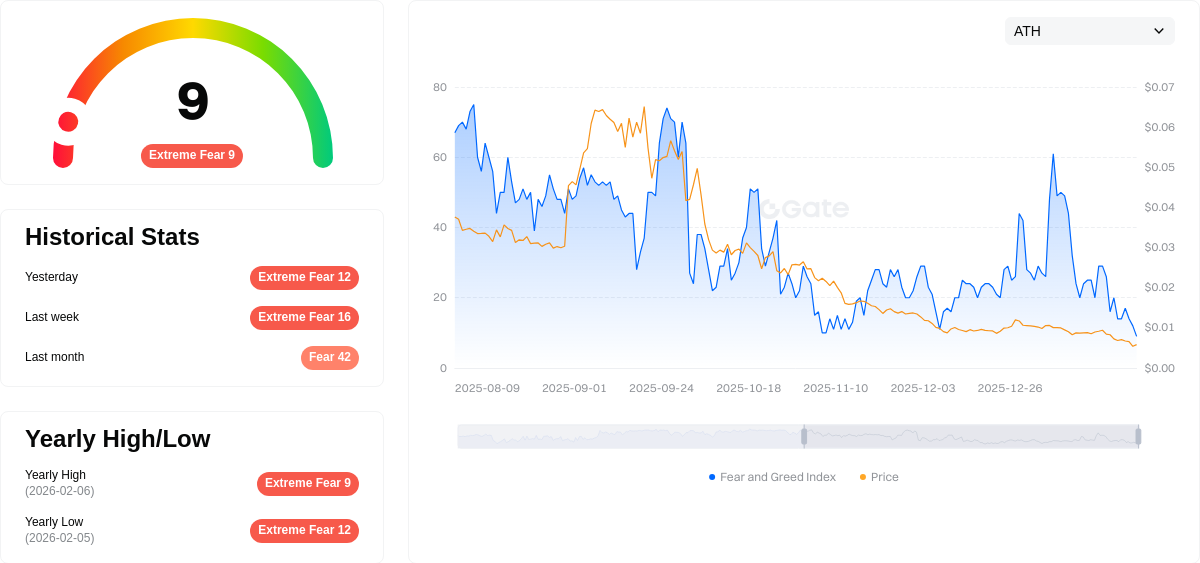

The Fear & Greed Index currently registers at 9, indicating an "Extreme Fear" sentiment in the broader market environment. With 18,149 token holders and availability across 8 exchanges, CREO maintains a presence in the web3 gaming ecosystem as a BEP-20 token on the BSC chain.

Click to view current CREO market price

CREO Market Sentiment Index

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index reaching just 9 points. This exceptionally low reading suggests widespread panic and pessimism among investors. Market participants are heavily risk-averse, with selling pressure dominating trading activity. Such extreme fear levels historically present contrarian opportunities for long-term investors, as excessive pessimism often precedes market recoveries. However, caution remains essential as further price declines are possible. Traders should closely monitor market developments and adjust their risk management strategies accordingly during this volatile period.

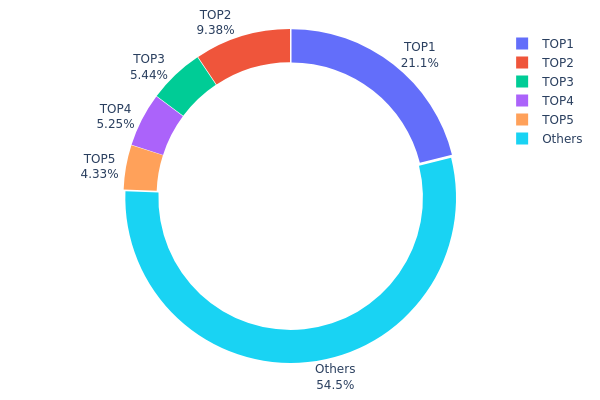

CREO 持仓分布

The address holding distribution chart visualizes the allocation of CREO tokens across different wallet addresses, serving as a critical indicator of token centralization and potential market manipulation risks. This metric reflects the degree of decentralization within the CREO ecosystem and provides insights into the structural stability of its on-chain distribution.

Based on current data, CREO exhibits a moderately concentrated holding structure. The top address (0x0000...00dead) holds 211,113.39K tokens, representing 21.11% of total supply, which is identified as a burn address—a positive signal for token deflation. The second-largest holder controls 9.37% of supply, while addresses ranked 3-5 hold between 4.32% and 5.44% respectively. The top five addresses collectively account for 45.48% of total supply, with the remaining 54.52% distributed among other participants. This distribution pattern suggests a relatively balanced ecosystem compared to many emerging tokens where top holders frequently exceed 60-70% concentration.

The current holding structure presents both stabilizing factors and potential volatility risks. The substantial burn allocation reduces circulating supply and mitigates dumping pressure, while the diversified distribution among remaining top holders limits single-entity manipulation capabilities. However, the combined 24.37% held by addresses ranked 2-5 still represents significant influence over market dynamics. The 54.52% held by smaller addresses indicates reasonable retail participation, though coordinated actions by major holders could still trigger meaningful price movements. Overall, CREO demonstrates acceptable decentralization for its stage, with chain-on structural stability supported by the permanent supply reduction through burns and relatively dispersed ownership beyond the top tier.

Click to view the current CREO Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 211113.39K | 21.11% |

| 2 | 0x2e8f...725e64 | 93774.14K | 9.37% |

| 3 | 0x1ab4...8f8f23 | 54445.56K | 5.44% |

| 4 | 0x4982...6e89cb | 52457.30K | 5.24% |

| 5 | 0xeaed...6a6b8d | 43258.05K | 4.32% |

| - | Others | 544951.56K | 54.52% |

II. Core Factors Influencing CREO's Future Price

Market Sentiment and Demand Dynamics

- Market Sentiment: Investor sentiment plays a significant role in CREO's price volatility. Positive market sentiment driven by technological innovations or favorable regulatory developments can boost demand and drive prices higher.

- Demand Fluctuations: During periods of uncertainty, particularly amid macroeconomic instability, demand for CREO as a digital asset may experience notable increases, influencing its exchange rate dynamics.

- Historical Patterns: Market sentiment shifts have historically correlated with price movements, where periods of optimism tend to support upward price trends while negative sentiment can trigger sell-offs.

Macroeconomic Environment

- Macroeconomic Trends: Global macroeconomic factors such as inflation concerns, geopolitical tensions, and central bank interest rate adjustments can prompt investors to turn to digital assets like CREO as a store of value.

- Inflation Hedging Characteristics: In uncertain economic times, CREO's potential as an inflation hedge may attract increased investor interest, thereby affecting its price trajectory.

- Geopolitical Factors: International political developments and regulatory changes across different jurisdictions can create volatility in cryptocurrency markets, impacting CREO's price performance.

Technology Development and Innovation

- Technological Innovation: Advances in blockchain technology and improvements in CREO's underlying infrastructure are critical factors that can enhance market acceptance and adoption rates.

- Market Acceptance: The degree to which the market embraces CREO's technological capabilities and use cases will be instrumental in determining its long-term price stability and growth potential.

- Regulatory Evolution: Policy changes and regulatory frameworks surrounding digital assets can significantly impact CREO's operational environment and investor confidence, thereby influencing price movements.

III. 2026-2031 CREO Price Forecast

2026 Outlook

- Conservative Projection: $0.00096 - $0.00125

- Neutral Projection: Around $0.00125

- Optimistic Projection: Up to $0.00137 (contingent on favorable market conditions and increased adoption)

2027-2029 Mid-Term Outlook

- Market Phase Expectation: The token may enter a gradual accumulation and growth phase, with potential volatility influenced by broader crypto market trends and project-specific developments

- Price Range Projections:

- 2027: $0.001 - $0.00141

- 2028: $0.00106 - $0.00187

- 2029: $0.00119 - $0.00231

- Key Catalysts: Market sentiment shifts, technological improvements in the CREO ecosystem, and expanded use cases could serve as primary drivers for price appreciation during this period

2030-2031 Long-Term Outlook

- Baseline Scenario: $0.00178 - $0.00271 in 2030, $0.00156 - $0.00322 in 2031 (assuming steady ecosystem development and moderate market conditions)

- Optimistic Scenario: Approaching $0.00271 in 2030 and $0.00322 in 2031 (with accelerated adoption and positive regulatory developments)

- Transformative Scenario: Reaching upper bounds requires significant platform breakthroughs, institutional interest, and sustained bull market momentum

- February 6, 2026: CREO trading within the projected 2026 range (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00137 | 0.00125 | 0.00096 | 0 |

| 2027 | 0.00141 | 0.00131 | 0.001 | 4 |

| 2028 | 0.00187 | 0.00136 | 0.00106 | 8 |

| 2029 | 0.00231 | 0.00161 | 0.00119 | 29 |

| 2030 | 0.00271 | 0.00196 | 0.00178 | 56 |

| 2031 | 0.00322 | 0.00233 | 0.00156 | 86 |

IV. CREO Professional Investment Strategy and Risk Management

CREO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a long-term perspective on Web3 gaming ecosystem development

- Operational Recommendations:

- Consider accumulating positions during market corrections when volatility presents opportunities

- Monitor the development progress of Creo Engine's gaming ecosystem and user adoption metrics

- Utilize secure storage solutions like Gate Web3 Wallet for asset management

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track 50-day and 200-day moving averages to identify trend directions and potential reversal points

- Volume Analysis: Monitor trading volume changes to confirm price movements and identify potential breakout opportunities

- Swing Trading Key Points:

- Pay attention to the significant volatility shown in recent price movements (24H: -5.07%, 7D: -14.97%)

- Set stop-loss levels to manage downside risk in volatile market conditions

CREO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio

- Aggressive Investors: 5-8% of crypto portfolio

- Professional Investors: May allocate up to 10% with active risk management

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens and blockchain gaming projects

- Position Sizing: Implement gradual position building to average entry costs

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking

- Security Considerations: Enable two-factor authentication and regularly review wallet security settings

V. CREO Potential Risks and Challenges

CREO Market Risks

- High Volatility: CREO has experienced significant price fluctuations with 1-year decline of -90.79%

- Liquidity Concerns: Daily trading volume of approximately $33,517 indicates relatively limited market liquidity

- Market Cap Position: With a market cap ranking of 3295, the token faces competition from larger gaming projects

CREO Regulatory Risks

- Gaming Token Classification: Evolving regulatory frameworks may affect how gaming tokens are classified and traded

- Jurisdictional Restrictions: Web3 gaming projects may face varying regulatory treatments across different regions

- Compliance Requirements: Future regulatory changes could impact token utility and trading availability

CREO Technical Risks

- Smart Contract Security: BEP-20 tokens depend on the security of underlying smart contract code

- Network Dependencies: Project relies on BSC network performance and security

- Development Execution: Success depends on the team's ability to deliver on roadmap commitments and ecosystem growth

VI. Conclusion and Action Recommendations

CREO Investment Value Assessment

Creo Engine operates in the growing Web3 gaming sector, offering a gaming ecosystem hub concept. However, investors should note the significant price decline over the past year (-90.79%) and relatively low market capitalization. The project's long-term value proposition depends on successful ecosystem development and user adoption. Short-term risks include high volatility, limited liquidity, and competitive pressures within the blockchain gaming space. The circulating supply represents approximately 29.03% of total supply, suggesting potential dilution concerns.

CREO Investment Recommendations

✅ Beginners: Consider waiting for clearer ecosystem development milestones and improved market conditions before entering positions ✅ Experienced Investors: May consider small speculative positions with strict risk management, monitoring ecosystem growth metrics closely ✅ Institutional Investors: Conduct thorough due diligence on project fundamentals, team execution capability, and competitive positioning before any allocation

CREO Trading Participation Methods

- Spot Trading: Purchase CREO directly on Gate.com and other supported exchanges

- DCA Strategy: Implement dollar-cost averaging to mitigate timing risk in volatile market conditions

- Portfolio Integration: Include as part of a diversified Web3 gaming token portfolio with appropriate position sizing

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of CREO token? What are its all-time high and all-time low prices?

CREO's all-time high price is US$0.1985 and all-time low is US$0.0007728. Current price fluctuates based on market conditions. Check real-time data on major crypto platforms for the latest price updates.

What price could CREO reach within the next 12 months? What factors will influence its price movement?

CREO could potentially reach higher valuations driven by increased adoption, market demand, and ecosystem development. Key factors include trading volume, technological advancements, market sentiment, competitive positioning, and regulatory environment.

What are the advantages and disadvantages of CREO compared to similar cryptocurrencies?

CREO offers high decentralization and autonomous architecture with innovative technical potential. However, it faces relatively lower market recognition, limited liquidity, and intense market competition compared to established peers.

What are the main risks of investing in CREO? How should I evaluate its long-term value?

CREO faces market volatility and technological risks. Evaluate long-term value by monitoring project development, ecosystem adoption, transaction volume, and community growth. Strong fundamentals and increasing utility suggest positive potential for sustained appreciation.

How is the fundamentals of CREO project? What about the team background, technical innovation and ecosystem development status?

CREO, developed by PTC, features advanced MCAD technology with a strong technical team. The project demonstrates continuous innovation in parametric and direct modeling, with expanding ecosystem adoption across engineering and design sectors globally.

What are the main cryptocurrency analysts' price predictions for CREO?

Major analysts predict CREO price targets ranging from 40.00 GBX to 70.00 GBX. These forecasts are based on CREO's growth potential and market performance analysis as of February 2026.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

Is Bitcoin Dollar-Cost Averaging a Smart Investment? A Detailed Look at Its Benefits and Drawbacks

How to Buy Solana Meme Coins: A Step-By-Step Guide

Stablecoins: Definition and Mechanism of Operation

Top 10 Best Decentralized Exchanges

What is GameFi? The Difference Between Traditional Gaming Projects and GameFi