2026 DCK Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: DCK's Market Position and Investment Value

DexCheck (DCK), as an AI-powered blockchain analytics platform, has been providing real-time insights into crypto and NFT markets since its launch in 2023. As of February 2026, DCK maintains a market capitalization of approximately $895,244, with a circulating supply of around 678 million tokens, and the price holds at approximately $0.00132. This asset, recognized as a comprehensive web3 data analytics solution, is playing an increasingly vital role in simplifying blockchain analysis and optimizing trading strategies.

This article will comprehensively analyze DCK's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. DCK Price History Review and Market Status

DCK Historical Price Evolution Trajectory

- 2023: Token launched in July with an initial offering price of $0.014, marking the beginning of DCK's market journey

- 2024: Reached a notable peak of $0.18378 in March, representing significant price appreciation from its launch period

- 2025-2026: Experienced substantial correction, with the price declining to $0.001289 in February 2026

DCK Current Market Situation

As of February 04, 2026, DCK is trading at $0.00132, reflecting a decline of 7.08% over the past 24 hours. The token has shown negative momentum across multiple timeframes, with a 0.76% decrease in the past hour, a 20.53% drop over the past week, and a 20.19% decline over the past month. The annual performance shows a substantial decrease of 91.73% compared to the previous year.

The current trading range over the past 24 hours shows a high of $0.001413 and a low of $0.001289, with a daily trading volume of approximately $16,408.76. The token's market capitalization stands at around $895,244.66, with a circulating supply of 678,215,649 DCK tokens, representing approximately 67.82% of the total supply of 960,416,884.58 tokens.

DCK currently ranks #2587 in the cryptocurrency market, with a market dominance of 0.000047%. The fully diluted market cap is calculated at approximately $1,267,750.29, with a maximum supply capped at 1,000,000,000 tokens. The token is held by approximately 13,975 addresses and is available for trading on 5 exchanges.

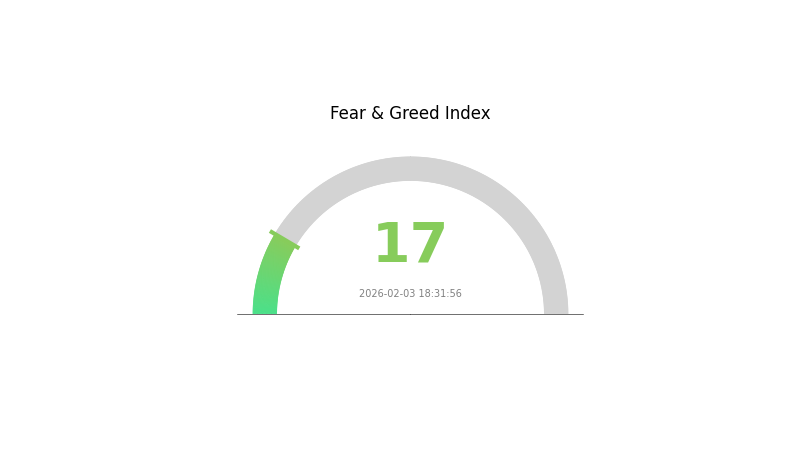

The current market sentiment index indicates a reading of 17, suggesting an environment of extreme fear among market participants.

Click to view current DCK market price

DCK Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 17. This indicates significant market pessimism and risk aversion among investors. During such periods, volatility tends to be elevated, and market sentiment is heavily skewed toward bearish outlooks. Traders should exercise caution and consider their risk management strategies carefully. This extreme fear environment may present opportunities for contrarian investors, but it also suggests heightened market uncertainty. Monitor market developments closely and adjust your investment positions accordingly.

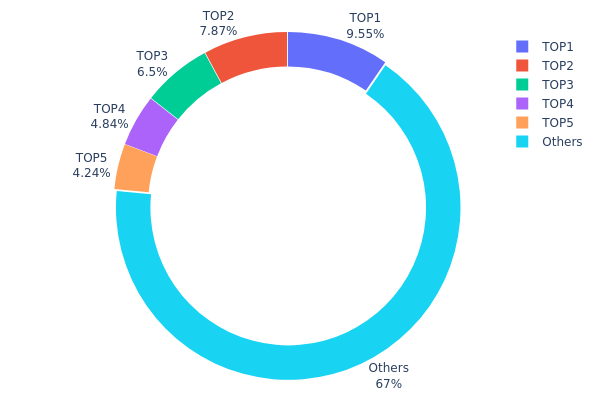

DCK Token Holdings Distribution

The token holdings distribution chart reveals the allocation pattern of DCK tokens across different wallet addresses, serving as a crucial indicator of decentralization and market structure. According to the latest data as of February 4, 2026, the top 5 addresses collectively hold 330,053.88K DCK tokens, representing 33.00% of the total supply, while the remaining 67.02% is distributed among other addresses.

From a concentration perspective, DCK demonstrates a moderate level of centralization. The largest holder controls 9.54% of the total supply, followed by the second and third largest addresses holding 7.86% and 6.50% respectively. While no single entity dominates with an overwhelming majority, the combined holdings of the top 5 addresses exceeding one-third of the supply suggests a relatively concentrated ownership structure. This concentration level falls within a moderate range—not severe enough to indicate complete centralization, yet significant enough to warrant attention regarding potential price influence.

This distribution pattern has notable implications for market dynamics. The substantial holdings by top addresses could potentially lead to increased price volatility during large-scale transactions or profit-taking activities. However, the fact that over two-thirds of the supply remains distributed among numerous smaller holders provides a certain degree of decentralization and reduces the risk of single-entity manipulation. The current structure suggests a market where whale movements can influence short-term price action, while the broader holder base provides foundational liquidity and stability. This balance between concentrated large holders and distributed smaller participants creates a market environment that, while susceptible to coordinated movements, maintains reasonable on-chain structural integrity and decentralization characteristics.

Click to view current DCK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x564e...d0f8f4 | 95452.78K | 9.54% |

| 2 | 0x6d83...30f063 | 78697.34K | 7.86% |

| 3 | 0x60aa...8c6696 | 65037.53K | 6.50% |

| 4 | 0x0e30...d75a9f | 48431.88K | 4.84% |

| 5 | 0x4982...6e89cb | 42434.35K | 4.24% |

| - | Others | 669946.12K | 67.02% |

II. Core Factors Influencing DCK's Future Price

Supply Mechanism

- Market Demand and Adoption Trends: DCK's price outlook is influenced by evolving market demand patterns and the rate of adoption across different user segments. The token's value proposition depends on how effectively it captures market share within its target ecosystem.

- Historical Patterns: Past price movements have shown correlation with broader cryptocurrency market cycles and investor sentiment shifts. Understanding these patterns helps contextualize potential future trajectories.

- Current Impact: Based on available market analysis, projections suggest a potential annual growth rate of approximately 5%, though this estimate remains subject to multiple variables including market conditions and adoption velocity.

Institutional and Major Holder Dynamics

- Institutional Participation: The level of institutional involvement plays a significant role in DCK's price stability and long-term valuation. Institutional investors typically bring capital depth and longer investment horizons to digital assets.

- Market Structure: The distribution of holdings and trading patterns among major market participants influences liquidity dynamics and price discovery mechanisms.

Macroeconomic Environment

- Monetary Policy Impact: Broader economic factors, including central bank policies and interest rate environments, affect risk appetite for cryptocurrency investments. These macroeconomic conditions create the backdrop against which DCK and similar assets are evaluated.

- Market Sentiment: Overall investor sentiment in cryptocurrency markets, shaped by regulatory developments and economic indicators, remains a critical factor in price formation.

- Regulatory Landscape: Policy changes and regulatory clarity in key jurisdictions can significantly impact market confidence and trading activity for digital assets like DCK.

Technical Development and Ecosystem Building

- Platform Evolution: Ongoing development efforts and technical improvements to the underlying platform or protocol can enhance utility and attract new users, supporting long-term value accrual.

- Ecosystem Applications: The growth and diversity of applications built around or utilizing DCK contribute to its fundamental value proposition and network effects.

III. 2026-2031 DCK Price Prediction

2026 Outlook

- Conservative prediction: $0.00117 - $0.00132

- Neutral prediction: $0.00132 average price level

- Optimistic prediction: $0.00149 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: DCK is anticipated to enter a gradual growth phase with moderate volatility as the project matures and expands its user base

- Price range prediction:

- 2027: $0.00076 - $0.00164

- 2028: $0.00093 - $0.00192

- 2029: $0.00131 - $0.00186

- Key catalysts: Technological developments, ecosystem expansion, broader market sentiment shifts, and potential strategic partnerships could serve as primary drivers for price appreciation during this period

2030-2031 Long-term Outlook

- Baseline scenario: $0.00165 - $0.00179 (assuming steady market conditions and consistent project development)

- Optimistic scenario: $0.00213 - $0.00247 (contingent upon significant ecosystem breakthroughs and widespread adoption)

- Transformative scenario: Prices exceeding $0.00247 (under exceptionally favorable conditions including major technological innovations and substantial market expansion)

- 2026-02-04: DCK trading within the predicted range of $0.00117 - $0.00149 for the year (reflecting current market positioning)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00149 | 0.00132 | 0.00117 | 0 |

| 2027 | 0.00164 | 0.00141 | 0.00076 | 6 |

| 2028 | 0.00192 | 0.00153 | 0.00093 | 15 |

| 2029 | 0.00186 | 0.00172 | 0.00131 | 30 |

| 2030 | 0.00247 | 0.00179 | 0.00165 | 35 |

| 2031 | 0.00241 | 0.00213 | 0.00171 | 61 |

IV. DCK Professional Investment Strategy and Risk Management

DCK Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Cryptocurrency enthusiasts interested in AI-powered analytics platforms and Web3 data infrastructure

- Operational Recommendations:

- Consider accumulating positions during market pullbacks, particularly when DCK trades near significant support levels

- Monitor the development progress of DexCheck's Telegram bot suite and platform feature rollouts as potential value catalysts

- Utilize Gate Web3 Wallet for secure storage, enabling participation in staking and DAO governance features available to DCK token holders

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume (currently around $16,408) for liquidity assessment and entry/exit timing

- Support and Resistance Levels: Track the recent low near $0.001289 as a key support zone and the 24-hour high of $0.001413 as near-term resistance

- Swing Trading Considerations:

- DCK has shown notable volatility with a 7-day decline of approximately 20.53%, presenting potential opportunities for short-term traders

- Consider the token's circulating supply of 678 million DCK (67.82% of total supply) when evaluating liquidity conditions

DCK Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of cryptocurrency portfolio allocation

- Aggressive Investors: 3-5% of cryptocurrency portfolio allocation

- Professional Investors: Up to 7-10% with active monitoring and hedging strategies

(II) Risk Mitigation Approaches

- Portfolio Diversification: Balance DCK holdings with established cryptocurrencies and other blockchain analytics tokens

- Position Sizing: Use dollar-cost averaging to build positions gradually, reducing timing risk in a volatile market

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active traders needing quick access to PRO features and staking opportunities

- Cold Storage Approach: Consider hardware wallet solutions for long-term holdings exceeding 5% of total portfolio value

- Security Precautions: Enable two-factor authentication, maintain separate seed phrase backups in secure physical locations, and never share private keys or recovery phrases

V. DCK Potential Risks and Challenges

DCK Market Risks

- High Volatility: DCK has experienced significant price fluctuations, with a 1-year decline of approximately 91.73% from its all-time high of $0.18378 in March 2024

- Limited Liquidity: With a relatively modest market capitalization of approximately $895,000 and trading on 5 exchanges, liquidity constraints may impact large position entries or exits

- Market Cap Concentration: The token's small market share (0.000047%) makes it susceptible to broader cryptocurrency market downturns and sentiment shifts

DCK Regulatory Risks

- Analytics Platform Compliance: Evolving regulations regarding blockchain data analytics and trading tools may impact DexCheck's operational model

- Token Classification Uncertainty: Regulatory clarity regarding utility tokens with revenue-sharing mechanisms remains an evolving area across jurisdictions

- Cross-border Operations: DexCheck's integration with multiple blockchains and global user base may face varying regulatory requirements in different regions

DCK Technical Risks

- Smart Contract Dependencies: As a BEP-20 token on BSC (Binance Smart Chain), DCK is subject to the underlying blockchain's technical stability and security

- Platform Development Risks: The ongoing development of Telegram bot suite and MEV relay features introduces execution risks typical of evolving technology projects

- Integration Complexity: DexCheck's multi-blockchain integration approach may encounter technical challenges or compatibility issues as blockchain ecosystems evolve

VI. Conclusion and Action Recommendations

DCK Investment Value Assessment

DexCheck presents an interesting value proposition as an AI-powered analytics platform addressing the growing need for accessible blockchain data and trading insights. The token's utility model, including PRO feature access, staking rewards, and DAO participation, provides multiple use cases beyond speculation. However, the significant price decline over the past year and relatively small market capitalization indicate substantial risk factors. The project's long-term value depends heavily on the successful development and adoption of its Telegram bot ecosystem and the continued expansion of its analytics platform functionality.

DCK Investment Recommendations

✅ Beginners: Exercise extreme caution due to high volatility; if interested, limit exposure to less than 1% of total investment capital and thoroughly research the platform's features before participating ✅ Experienced Investors: Consider DCK as a speculative allocation within a diversified cryptocurrency portfolio, focusing on the project's development milestones and user adoption metrics ✅ Institutional Investors: Evaluate DexCheck's competitive positioning within the blockchain analytics sector, assess the team's execution capabilities, and monitor revenue generation from the Telegram bot revenue-sharing model

DCK Trading Participation Methods

- Spot Trading: DCK is available for trading on Gate.com and 4 other exchanges, with spot trading offering straightforward exposure to price movements

- Staking Participation: Token holders can participate in staking programs to earn rewards while supporting platform operations

- Platform Engagement: Acquire DCK tokens to access PRO features, private sales, and participate in DAO governance decisions affecting the DexCheck ecosystem

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is DCK and what are its uses?

DCK is the token of DexCheck, an AI-powered analytics platform designed to help traders and investors analyze digital assets comprehensively. It powers the platform's advanced features for market insights and trading intelligence.

What is the current price of DCK? What are the historical highest and lowest prices?

DCK's current price fluctuates in real-time markets. Historical all-time high reached $0.1836, while all-time low was $0.0016. Price movements vary based on market conditions and trading volume.

What are the main factors affecting DCK price?

DCK price is primarily influenced by market demand, trading volume, technological developments, regulatory policies, and overall crypto market sentiment. Investor behavior and macroeconomic conditions also play significant roles in price fluctuations.

Will DCK price rise or fall in the future?

DCK price trends are difficult to predict with certainty. However, based on recent performance showing decline, the token may experience further price volatility in the near term. Long-term direction depends on market adoption, ecosystem development, and overall crypto market sentiment.

What are the advantages of DCK compared with other similar tokens?

DCK offers abundant trading pairs covering mainstream and emerging cryptocurrencies, providing superior market variety. Its enhanced liquidity, lower fees, and robust security infrastructure give it a competitive edge over similar tokens in the market.

How to analyze and predict DCK price trends?

Analyze DCK price by monitoring trading volume, market capitalization, and blockchain ecosystem development. Historical data shows bullish trends driven by increased adoption. Experts predict sustained price growth through 2030 as decentralized finance expands and network utility strengthens.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Ethereum 2.0 in 2025: Staking, Scalability, and Environmental Impact

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is BOOP: Understanding the Web3 Token in 2025

Altcoin Season Index 2025: How to Use and Invest in Web3

Investigating the True Identity of Bitcoin Founder Satoshi Nakamoto

How to Participate in Cryptocurrency Airdrops and Essential Security Measures

Top 7 Hardware Picks for Cryptocurrency Mining

What Does DYOR Mean in Crypto?

What Is a Cryptocurrency Airdrop: Where to Find Them and How to Profit