2026 DON Price Prediction: Expert Analysis and Market Forecast for Donuts Token's Future Value

Introduction: DON's Market Position and Investment Value

Salamanca (DON) is a meme coin inspired by the notorious Salamanca cartel, capturing strategic dominance and ambition in the cryptocurrency space. Built on the Binance Smart Chain (BSC), this BEP-20 token has positioned itself within the competitive meme coin sector since its launch in 2025. As of February 8, 2026, DON maintains a market capitalization of approximately $204,500, with a circulating supply of 1 billion tokens and a current trading price around $0.0002045. The project has attracted a holder base of over 8,600 participants, demonstrating community engagement in its early stages.

This article will comprehensively analyze DON's price trajectory from 2026 through 2031, examining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies. Given DON's recent price volatility—declining 18.78% over the past 7 days and 30.55% over 30 days—understanding both short-term market sentiment and long-term potential becomes essential for informed decision-making in this emerging digital asset.

I. DON Price History Review and Market Status

DON Historical Price Evolution Trajectory

As a relatively new cryptocurrency launched in February 2025, Salamanca (DON) has a limited historical price track record. The token has experienced notable volatility in its early trading period:

- 2025: Token launch and initial trading phase, price established an early foundation in the market

- Recent Period: The token has shown significant downward pressure, with a decline of approximately 61.03% over the past year

- Short-term Performance: Price experienced an 18.78% decrease over the past 7 days and a 30.55% decline over the past 30 days

DON Current Market Situation

As of February 08, 2026, Salamanca (DON) is trading at $0.0002045, demonstrating continued market adjustment. The token has displayed mixed short-term performance, with a 0.73% decrease over the past hour and a 0.24% decline over the past 24 hours.

The 24-hour trading range shows DON fluctuating between a high of $0.0002089 and a low of $0.0002032, indicating relatively tight price consolidation. The 24-hour trading volume stands at approximately $28,940.87, reflecting moderate market activity for this emerging meme token.

With a circulating supply of 1 billion DON tokens, which represents 100% of the maximum supply, the token maintains a market capitalization of approximately $204,500. The fully diluted valuation matches the current market cap at $204,500, as all tokens are already in circulation. The token currently holds 8,659 holders and is built on the BEP-20 standard on the Binance Smart Chain.

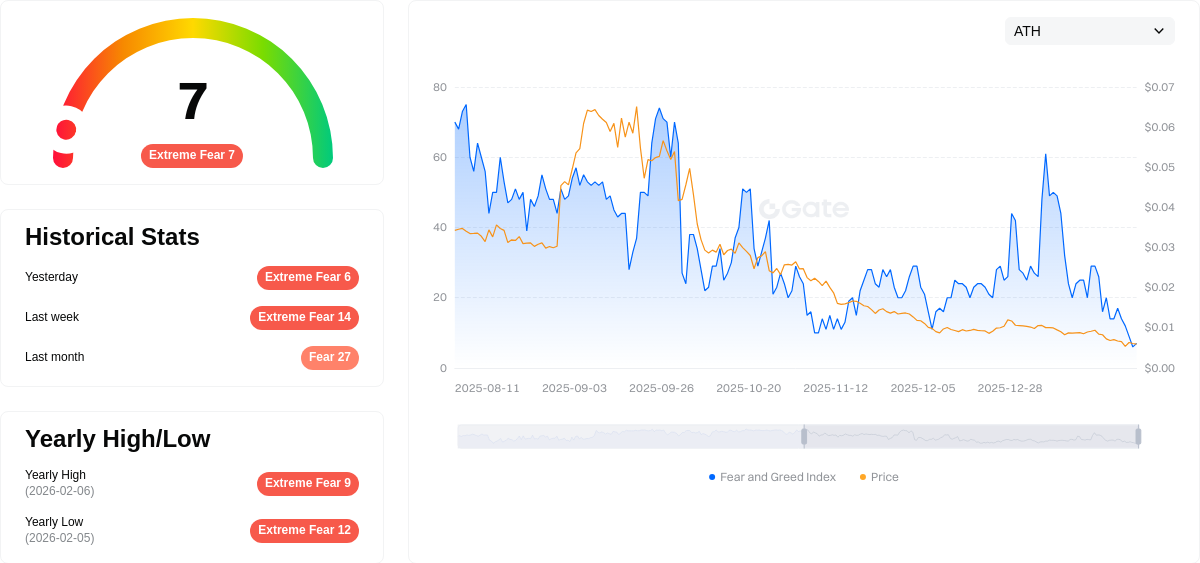

According to market sentiment indicators, the current fear and greed index registers at 7, signaling "Extreme Fear" conditions in the broader cryptocurrency market, which may influence DON's price movements.

Click to view current DON market price

DON Market Sentiment Indicator

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 7. This exceptionally low reading signals severe market pessimism and heightened risk aversion among investors. Such extreme fear periods often present significant opportunities for contrarian traders and long-term investors to accumulate assets at depressed valuations. However, caution remains essential as further downside movements are possible. Monitor market developments closely and consider your risk tolerance before making investment decisions.

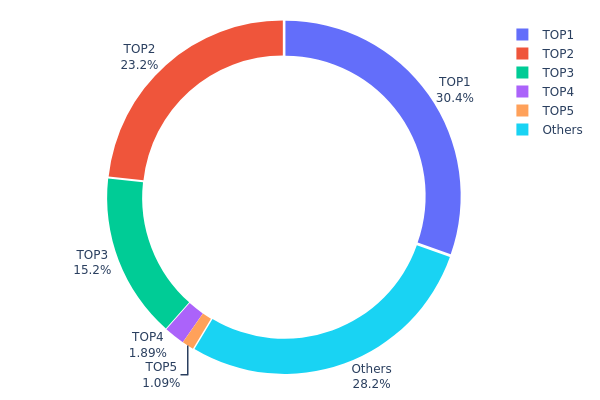

DON Holdings Distribution

The holdings distribution chart reflects the proportion of total circulating supply held by different addresses, serving as a key indicator of token concentration and decentralization levels. This metric provides crucial insights into market structure stability and potential price manipulation risks.

Based on the current data, DON exhibits a highly concentrated holdings pattern. The top three addresses collectively control 68.80% of the total supply, with the largest holder alone accounting for 30.39% (303,927.51K tokens). Such extreme concentration presents significant structural vulnerabilities to the market. When a small number of addresses control the majority of circulating supply, price discovery mechanisms may be compromised, and the market becomes susceptible to single-entity influence or coordinated selling pressure.

From a market dynamics perspective, this concentration pattern introduces considerable volatility risks and liquidity concerns. Large holders possess substantial market-moving power, where their trading decisions can trigger cascading price effects. The presence of a burn address (0x0000...00dead) holding 1.08% indicates some deflationary mechanism, though this proportion remains relatively modest. The "Others" category comprising 28.23% suggests limited retail participation, further reinforcing the dominance of whale addresses. This structure typically correlates with heightened price volatility and reduced market resilience during adverse conditions.

Click to view current DON Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 303927.51K | 30.39% |

| 2 | 0x5513...cde6c5 | 232498.01K | 23.24% |

| 3 | 0x4982...6e89cb | 151744.22K | 15.17% |

| 4 | 0x1a64...00326a | 18949.40K | 1.89% |

| 5 | 0x0000...00dead | 10850.69K | 1.08% |

| - | Others | 282030.17K | 28.23% |

II. Core Factors Influencing DON's Future Price

Supply Mechanism

The supply dynamics of cryptocurrencies play a fundamental role in price formation. Changes in token supply, whether through programmed issuance schedules or burning mechanisms, can create significant price pressure. Market participants closely monitor supply metrics as they directly impact scarcity and potential value appreciation.

Institutional and Whale Activity

Large-scale market participants continue to shape cryptocurrency price movements through their trading behavior and long-term positioning strategies. The flow of institutional capital and strategic accumulation by major holders can signal market confidence and drive momentum in either direction.

Macroeconomic Environment

-

Monetary Policy Impact: Central bank policies regarding interest rates, quantitative measures, and monetary stance create ripple effects across risk asset classes. Shifts in monetary conditions influence liquidity availability and investor risk appetite, which in turn affect cryptocurrency valuations.

-

Inflation Hedge Characteristics: During periods of currency devaluation concerns and rising consumer prices, alternative assets may attract increased attention from investors seeking to preserve purchasing power.

-

Geopolitical Factors: International tensions, trade relations, and regional conflicts contribute to market uncertainty. These developments can drive capital flows toward or away from cryptocurrency markets as participants reassess risk profiles.

Technical Development and Ecosystem Building

Ongoing technological improvements and ecosystem expansion efforts contribute to long-term value proposition. Development activity, protocol upgrades, and growing application layers strengthen network utility and user adoption potential over time.

III. 2026-2031 DON Price Prediction

2026 Outlook

- Conservative Forecast: $0.00012 - $0.00021

- Neutral Forecast: $0.00021 (average projected price)

- Optimistic Forecast: $0.00024 (requires favorable market conditions and increased adoption)

2027-2029 Mid-Term Outlook

- Market Stage Expectations: DON may enter a gradual growth phase with steady price appreciation as the project develops its ecosystem and expands user adoption

- Price Range Predictions:

- 2027: $0.00013 - $0.00026

- 2028: $0.00015 - $0.00028

- 2029: $0.00021 - $0.00033

- Key Catalysts: Projected cumulative price changes show growth momentum, with a 9% increase expected in 2027, 19% in 2028, and 27% in 2029 compared to the 2026 baseline

2030-2031 Long-Term Outlook

- Baseline Scenario: $0.0002 - $0.0003 (assuming stable market conditions and moderate project development)

- Optimistic Scenario: $0.00031 - $0.00044 (assuming enhanced ecosystem growth and broader market adoption)

- Transformative Scenario: The 2031 high forecast of $0.00044 represents a 48% cumulative increase from 2026 levels, contingent upon exceptional project milestones and favorable crypto market dynamics

- 2026-02-08: DON price predictions remain in early development stage with conservative baseline valuations

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00024 | 0.00021 | 0.00012 | 0 |

| 2027 | 0.00026 | 0.00022 | 0.00013 | 9 |

| 2028 | 0.00028 | 0.00024 | 0.00015 | 19 |

| 2029 | 0.00033 | 0.00026 | 0.00021 | 27 |

| 2030 | 0.00031 | 0.0003 | 0.0002 | 44 |

| 2031 | 0.00044 | 0.0003 | 0.00023 | 48 |

IV. DON Professional Investment Strategy and Risk Management

DON Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with moderate to high risk tolerance interested in meme coin sector exposure

- Operational Recommendations:

- Consider allocating only a small portion of your portfolio to DON, as meme coins typically carry higher volatility

- Monitor community engagement and social media sentiment regularly, as these factors often drive meme coin valuations

- Implement a dollar-cost averaging approach to mitigate entry timing risk

- Storage Solution: Gate Web3 Wallet provides a secure and user-friendly option for storing DON tokens, supporting BSC network assets

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($28,940.87 as of February 8, 2026) to identify potential breakout or breakdown patterns

- Support and Resistance Levels: Track the 24-hour range ($0.0002032 - $0.0002089) to establish short-term trading zones

- Swing Trading Considerations:

- Given DON's recent negative performance across multiple timeframes (-0.73% in 1H, -18.78% in 7D, -30.55% in 30D), exercise caution when entering positions

- Set strict stop-loss orders to protect against further downside volatility

DON Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of total crypto portfolio

- Aggressive Investors: 2-3% of total crypto portfolio

- Professional Investors: Up to 5% of total crypto portfolio, with active risk monitoring

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance DON holdings with more established cryptocurrencies and stablecoins

- Position Sizing: Never allocate more capital than you can afford to lose completely, given the speculative nature of meme coins

(3) Secure Storage Solutions

- Gate Web3 Wallet Recommendation: A comprehensive solution supporting BSC network tokens like DON, offering both security and convenience for asset management

- Hardware Wallet Option: For larger holdings, consider transferring DON to hardware storage after initial accumulation

- Security Precautions: Enable two-factor authentication, never share private keys or seed phrases, and verify contract addresses (0x42fe1937e1db4f11509e9f7fdd97048bd8d04444) before transactions

V. DON Potential Risks and Challenges

DON Market Risks

- High Volatility: DON has experienced significant price declines across various timeframes, with a 61.033% drop over one year, indicating substantial downside risk

- Limited Liquidity: With a market cap of approximately $204,500 and relatively low trading volume, DON may face liquidity challenges during periods of market stress

- Meme Coin Dependency: As a meme coin inspired by fictional content, DON's value is heavily reliant on community sentiment and social media trends rather than fundamental utility

DON Regulatory Risks

- Uncertain Classification: Meme coins may face increased regulatory scrutiny as authorities worldwide develop clearer frameworks for digital assets

- Compliance Evolution: Future regulations may impose restrictions on trading, marketing, or usage of meme-based cryptocurrencies

- Cross-border Considerations: Different jurisdictions may adopt varying approaches to regulating speculative digital assets like DON

DON Technical Risks

- Smart Contract Dependency: As a BEP-20 token on Binance Smart Chain, DON is subject to potential vulnerabilities in its underlying smart contract code

- Network Risks: DON's functionality depends on the continued operation and security of the BSC network

- Limited Exchange Coverage: Currently listed on only one exchange, which may limit trading options and increase centralization risk

VI. Conclusion and Action Recommendations

DON Investment Value Assessment

DON represents a highly speculative meme coin investment with significant risk factors. The token has demonstrated consistent negative performance across short, medium, and long-term horizons, with particularly concerning declines of 30.55% over 30 days and 61.033% over one year. While the project draws inspiration from popular culture and operates on the established BSC infrastructure, its small market capitalization ($204,500), limited exchange presence, and meme-dependent value proposition suggest considerable uncertainty. The token may appeal to investors seeking exposure to niche meme coins with community-driven narratives, but fundamental value drivers remain unclear. Prospective investors should approach DON with extreme caution and only allocate capital they are prepared to lose entirely.

DON Investment Recommendations

✅ Beginners: Avoid allocation until you have established a solid foundation in cryptocurrency fundamentals and understand the unique risks of meme coins. If you choose to participate, limit exposure to less than 1% of your crypto portfolio.

✅ Experienced Investors: Consider DON only as a small speculative position (1-3% of crypto holdings) with clearly defined exit strategies and stop-loss levels. Actively monitor community developments and social sentiment.

✅ Institutional Investors: Exercise extreme caution given limited liquidity, single-exchange listing, and lack of fundamental value drivers. Conduct thorough due diligence on smart contract security and community authenticity before any allocation.

DON Trading Participation Methods

- Spot Trading: Purchase DON directly on Gate.com, the primary exchange offering DON trading pairs

- Gate Web3 Wallet Integration: Store and manage DON tokens securely using Gate Web3 Wallet, which supports BSC network assets

- Community Engagement: Monitor official channels (website: salamanca.club, Twitter: @salamanca_token) to stay informed about project developments

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is DON token and what are its uses?

DON is the governance token of Doni Finance platform, enabling holders to participate in platform governance voting and receive various benefits and rewards.

How to predict DON token price trends?

Predict DON price trends by analyzing token supply dynamics, market demand, adoption trends, and overall crypto market sentiment. Use technical analysis with price charts and trading volume data, combined with fundamental analysis of project developments and ecosystem growth.

What are the risks to pay attention to when investing in DON tokens?

DON token investments carry regulatory risks, project execution uncertainties, and market volatility. Success depends on project development progress, market adoption, and regulatory environment changes. Carefully assess these factors before investing.

What distinguishes DON token from other mainstream cryptocurrencies?

DON token operates on existing blockchains, while mainstream cryptocurrencies like Bitcoin have native blockchains. DON serves specific ecosystem functions, whereas mainstream cryptocurrencies primarily focus on transactions and value storage. DON's utility-driven value differs from market-dependent mainstream crypto valuations.

What is the historical price performance of DON token?

DON token has shown minimal price activity with its all-time high at $0. As of February 8, 2026, the token maintains a current price of $0 USD, with no significant price movement recorded in the past 24 hours.

What are the main factors affecting DON token price?

DON token price is primarily influenced by supply and demand dynamics, market sentiment, regulatory policies, competitive landscape, trading volume, and ecosystem development progress.

Professional analysts view on DON token's future prospects?

Professional analysts view DON token's future as promising due to its role in Arkham's decentralized intelligence economy, potential for scalability, and increasing demand for crypto data analysis.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Top 5 Meme Coins to Invest in 2025: Risks and Rewards

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Meme Coin Price Predictions for 2025:Factors Influencing Meme Coin Prices

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

MemeBox Price and Airdrop Guide 2025: What You Need to Know

Top 8 Cryptocurrency Exchanges for Lowest Trading Fees

Stochastic RSI Indicates Bitcoin Price Bottom

Comprehensive Guide to Creating and Selling NFT Tokens

Comprehensive Guide to Blockchain Technology and Applications in Thailand

XRP Price Prediction for 2025, 2030, and 2035