2026 DYP Price Prediction: Expert Analysis and Market Forecast for the Digital Asset

Introduction: DYP's Market Position and Investment Value

Dypius (DYP), as a decentralized ecosystem focusing on scalability, security, and global adoption through next-generation infrastructure, has been making strides in the digital asset space since its launch in 2020. As of 2026, DYP maintains a market capitalization of approximately $256,273, with a circulating supply of around 229.92 million tokens, and the price hovering near $0.0011146. This asset, characterized as a "comprehensive DeFi and Metaverse platform," is playing an increasingly important role in yield farming, staking, DeFi tools, NFTs, and Metaverse applications.

This article will comprehensively analyze DYP's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. DYP Price History Review and Market Status

DYP Historical Price Evolution Trajectory

- 2020: Dypius (DYP) launched in October with an initial publish price of $2, marking the beginning of its trading journey in the decentralized ecosystem space.

- 2023: In November, DYP reached its all-time high of $0.211299, demonstrating significant market interest during a period of increased activity in DeFi and NFT sectors.

- 2026: The token experienced substantial volatility, with prices declining to an all-time low of $0.00044629 in January, followed by a recovery period in early February.

DYP Current Market Status

As of February 8, 2026, DYP is trading at $0.0011146, positioned within a 24-hour price range between $0.0011111 and $0.0015114. The token has experienced mixed performance across different timeframes, with a 24-hour decline of 26.06%, while showing positive momentum over the 7-day period with an 11.43% increase and a 30-day gain of 30.01%.

DYP maintains a market capitalization of approximately $256,274, with a circulating supply of 229,924,337 tokens, representing nearly 100% of its total supply of 229,926,862. The token's 24-hour trading volume stands at $1,637.49, reflecting relatively modest trading activity. With a market dominance of 0.000010%, DYP operates as a niche player within the broader cryptocurrency ecosystem.

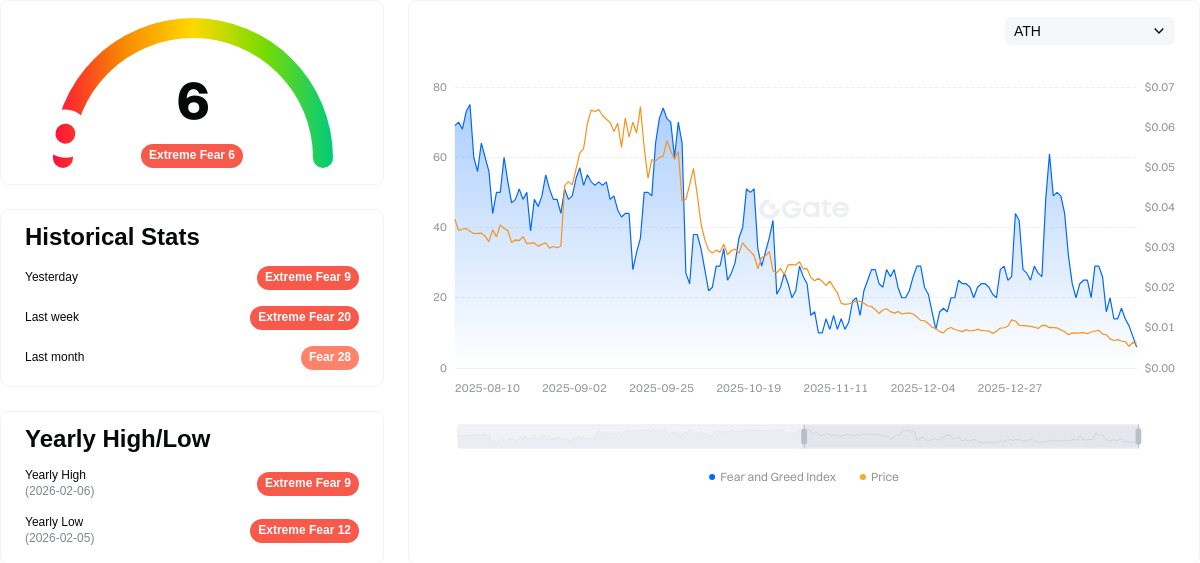

The current market sentiment, as indicated by the VIX index at 6, reflects "Extreme Fear," suggesting cautious investor behavior across the cryptocurrency market. DYP's fully diluted valuation aligns with its market cap at $256,276, indicating minimal token unlock pressure from the current supply structure.

Click to view the current DYP market price

DYP Market Sentiment Index

2026-02-07 Fear & Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 6, signaling heightened anxiety among investors. Such low readings typically indicate significant market pessimism and potential panic selling. However, historically, extreme fear levels have often presented buying opportunities for contrarian investors, as markets tend to recover from oversold conditions. Traders should exercise caution and conduct thorough research before making investment decisions during such volatile periods on Gate.com.

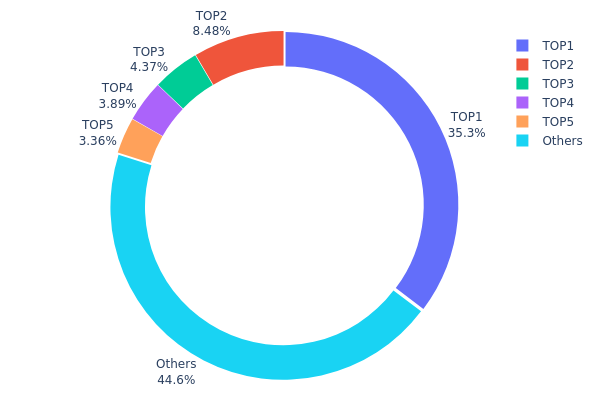

DYP Holding Distribution

The holding distribution chart illustrates how DYP tokens are allocated across different wallet addresses, providing crucial insights into the token's decentralization level and market structure. According to the latest data, the top 5 addresses collectively control 103,399.08K DYP tokens, representing 44.94% of the total supply, while the remaining 55.39% (127,527.78K tokens) is distributed among other holders.

The concentration analysis reveals a moderate to high centralization pattern. The largest single address (0x7617...f390af) holds approximately 35.30% of the total supply, indicating significant control by a single entity. This level of concentration poses potential risks to market stability, as large-scale sell-offs from this address could trigger substantial price volatility. The second-largest holder commands 8.47%, while addresses ranked 3-5 maintain holdings between 3.36% and 4.37%, suggesting a gradual distribution decline among top holders.

This distribution structure reflects a partially centralized ecosystem that may impact market dynamics in several ways. The dominant position of the top address could lead to increased price sensitivity to single-entity decisions, potentially amplifying volatility during market stress periods. However, the fact that over 55% of tokens remain distributed among numerous smaller holders provides some degree of market resilience and suggests active community participation. From a governance perspective, this concentration level may influence protocol decision-making processes if DYP employs token-weighted voting mechanisms.

Click to view current DYP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7617...f390af | 81170.34K | 35.30% |

| 2 | 0x1166...39421d | 19494.12K | 8.47% |

| 3 | 0xf16e...969b91 | 10050.62K | 4.37% |

| 4 | 0x1f5c...7485ba | 8952.35K | 3.89% |

| 5 | 0x0d07...b492fe | 7731.65K | 3.36% |

| - | Others | 102527.78K | 44.61% |

II. Core Factors Influencing DYP's Future Price

Supply Mechanism

Based on the available materials, specific information regarding DYP's supply mechanism, tokenomics, or emission schedule is not provided. Without concrete data on token distribution models, halving events, or programmatic supply changes, this section cannot be accurately completed.

Institutional and Major Holder Dynamics

The reference materials do not contain specific information about institutional holdings in DYP, corporate adoption patterns, or entity-level policy frameworks directly related to this token. However, broader market dynamics suggest that institutional participation in cryptocurrency markets continues to evolve, with regulatory clarity remaining a key consideration for large-scale adoption.

Macroeconomic Environment

-

Monetary Policy Impact: China's economic policy framework for 2025 emphasizes a moderately accommodative monetary stance, with expectations for strategic interest rate adjustments and adequate liquidity provision. The fiscal policy orientation has shifted toward being more proactive, with expanded deficit ratios and continued targeted support measures. These macroeconomic adjustments may influence capital flows across asset classes, including digital assets.

-

Innovation and High-Tech Development: China's continued emphasis on high-quality development, particularly in advanced manufacturing and technological innovation, reflects a structural economic transformation. The country's Global Innovation Index ranking improved to 11th position in 2024, representing one of the fastest innovation capacity increases over the past decade. This innovation-driven growth model may create indirect supportive conditions for technology-oriented sectors.

-

Global Economic Positioning: China's economic growth rate of approximately 5% in 2024 positions it among leading major economies, with the country contributing roughly 30% to global economic growth. International institutions including the World Bank and International Monetary Fund have maintained positive outlooks for China's 2025 economic trajectory. This macroeconomic stability may provide a foundation for risk asset performance.

-

Geopolitical Considerations: The reference materials indicate that China's economy navigated external pressures including subdued global growth momentum and heightened geopolitical tensions. The economy's demonstrated resilience in managing these challenges, combined with policy measures to support domestic demand and enterprise development, suggests adaptive capacity in responding to international uncertainties.

Technical Development and Ecosystem Building

The provided materials do not contain specific information about DYP's technical roadmap, protocol upgrades, decentralized applications, or ecosystem development initiatives. Without access to project-specific technical documentation or development announcements, this section cannot be substantiated with verifiable information.

III. 2026-2031 DYP Price Forecast

2026 Outlook

- Conservative estimate: $0.00084 - $0.00111

- Neutral estimate: Around $0.00111

- Optimistic estimate: Up to $0.00147 (contingent on favorable market conditions and ecosystem expansion)

2027-2029 Mid-term Outlook

- Market phase expectation: The token may enter a gradual accumulation and recovery phase, with potential price stabilization as the broader crypto market matures and DeFi protocols gain renewed attention.

- Price range forecast:

- 2027: $0.00071 - $0.00138, with an average around $0.00129 representing approximately 16% growth

- 2028: $0.00072 - $0.00139, averaging $0.00134 with roughly 20% cumulative growth

- 2029: $0.00124 - $0.00146, averaging $0.00136 with approximately 22% cumulative growth

- Key catalysts: Increased adoption of DeFi Yield Protocol's staking mechanisms, potential protocol upgrades, partnerships within the DeFi ecosystem, and overall recovery in decentralized finance sector sentiment could serve as primary price drivers.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00097 - $0.00165 (assuming steady DeFi sector growth and maintained protocol utility)

- Optimistic scenario: $0.00141 - $0.00181 (contingent on significant protocol enhancements, expanded use cases, and favorable regulatory developments)

- Transformative scenario: Potential to reach the upper range of $0.00181 by 2031 (requiring exceptional adoption rates, strategic partnerships, and substantial increases in total value locked)

- February 8, 2026: DYP baseline average price projection stands at approximately $0.00111 (reflecting current market positioning)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00147 | 0.00111 | 0.00084 | 0 |

| 2027 | 0.00138 | 0.00129 | 0.00071 | 16 |

| 2028 | 0.00139 | 0.00134 | 0.00072 | 20 |

| 2029 | 0.00146 | 0.00136 | 0.00124 | 22 |

| 2030 | 0.00165 | 0.00141 | 0.00097 | 26 |

| 2031 | 0.00181 | 0.00153 | 0.00086 | 37 |

IV. DYP Professional Investment Strategy and Risk Management

DYP Investment Methodology

(I) Long-Term Holding Strategy

- Target Investors: Believers in DeFi ecosystem development and long-term value investors who recognize Dypius' multi-product ecosystem potential

- Operational Recommendations:

- Consider accumulating positions during market corrections, as DYP has shown a 30-day price increase of approximately 30% while maintaining relatively low market capitalization

- Monitor the development progress of Dypius ecosystem products including yield farming, staking, DeFi tools, NFTs, and Metaverse offerings

- Storage Solution: Utilize Gate Web3 Wallet for secure asset custody, enabling seamless interaction with Dypius ecosystem products while maintaining private key control

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume trends; current volume of approximately $1,637 suggests lower liquidity requiring careful position sizing

- Price Range Monitoring: Recent 24-hour price range between $0.0011111-$0.0015114 indicates volatility opportunities for short-term traders

- Swing Trading Key Points:

- Consider the 7-day upward trend of approximately 11.43% as potential momentum indicators

- Implement strict stop-loss orders due to high volatility, as evidenced by the 24-hour decline of approximately 26%

DYP Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of cryptocurrency portfolio

- Aggressive Investors: 5-8% of cryptocurrency portfolio

- Professional Investors: May allocate higher percentages based on comprehensive ecosystem analysis and risk tolerance

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance DYP holdings with established DeFi protocol tokens to mitigate project-specific risks

- Position Sizing Strategy: Given DYP's market cap ranking of 3671, limit individual position exposure to prevent liquidity-related losses

(III) Secure Storage Solutions

- Recommended Hot Wallet: Gate Web3 Wallet provides convenient access for active trading and ecosystem interaction with multi-layer security features

- Cold Storage Option: For long-term holdings exceeding trading needs, consider hardware wallet solutions with proper backup procedures

- Security Precautions: Never share private keys or seed phrases; verify contract addresses (ETH: 0x39b46b212bdf15b42b166779b9d1787a68b9d0c3) before transactions; beware of phishing attempts

V. DYP Potential Risks and Challenges

DYP Market Risks

- High Volatility: The 24-hour price decline of approximately 26% demonstrates significant short-term price fluctuations that may result in substantial losses

- Liquidity Constraints: With daily trading volume around $1,637, large position entries or exits may face slippage and execution challenges

- Market Capitalization Vulnerability: Current market cap of approximately $256,273 suggests susceptibility to market manipulation and investor sentiment shifts

DYP Regulatory Risks

- DeFi Regulation Evolution: Global regulatory frameworks for decentralized finance products including yield farming and staking continue evolving, potentially impacting Dypius operations

- Multi-Jurisdiction Compliance: As a platform offering diverse services across NFTs, Metaverse, and DeFi tools, Dypius may face varying regulatory requirements in different regions

- Smart Contract Jurisdiction: Regulatory uncertainty regarding smart contract-based financial services may affect platform functionality and user participation

DYP Technical Risks

- Smart Contract Vulnerabilities: Despite development efforts, DeFi protocols face inherent risks of coding errors or exploits that could compromise user funds

- Ethereum Network Dependencies: As an ETH-based token, DYP remains subject to Ethereum network congestion, gas fee fluctuations, and potential technical issues

- Ecosystem Integration Complexity: The platform's multi-product offering (yield farming, staking, NFTs, Metaverse) increases technical complexity and potential points of failure

VI. Conclusion and Action Recommendations

DYP Investment Value Assessment

Dypius presents a multi-faceted DeFi ecosystem with diverse product offerings spanning yield farming, staking, NFTs, and Metaverse components. The recent 30-day price appreciation of approximately 30% and 7-day gain of approximately 11.43% indicate developing market interest. However, the project's relatively small market capitalization, limited liquidity, and high short-term volatility pose notable risks. Long-term value depends on successful ecosystem development, user adoption across product lines, and the team's ability to navigate competitive DeFi and Metaverse markets. Short-term risks include pronounced price volatility, liquidity constraints, and evolving regulatory landscapes.

DYP Investment Recommendations

✅ Beginners: Approach with caution; consider allocating only a minimal percentage of cryptocurrency portfolio (1-2%) after thorough research. Prioritize learning about DeFi mechanics, Dypius ecosystem products, and risk management before investing. ✅ Experienced Investors: May consider moderate allocation (3-5%) as part of diversified DeFi portfolio. Monitor ecosystem development milestones, trading volume trends, and competitor dynamics for position adjustments. ✅ Institutional Investors: Conduct comprehensive due diligence on Dypius team, technology infrastructure, smart contract audits, and regulatory compliance status before considering allocation. Liquidity constraints may limit position sizing.

DYP Trading Participation Methods

- Spot Trading: Purchase DYP directly on Gate.com with support for various trading pairs, suitable for investors seeking straightforward exposure

- Ecosystem Participation: Engage with Dypius platform products including yield farming and staking to earn additional returns while understanding protocol mechanics

- Portfolio Integration: Incorporate DYP as part of broader DeFi strategy, balancing allocations across multiple protocols to manage project-specific risks

Cryptocurrency investment carries extreme risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is DYP (Dynamic Yield Protocol)? What are its main functions and uses?

DYP is a DeFi Yield Protocol built on Ethereum blockchain using smart contracts for decentralized finance services. Its main functions include yield farming for liquidity providers and automated market making (AMM) for decentralized trading, offering efficient and transparent financial services.

What is the historical price performance of DYP token? What is the price trend over the past year?

DYP experienced significant volatility over the past year, with a sharp decline by late 2025 followed by recovery in early 2026. As of February 2026, DYP is down 13% year-over-year, reflecting market fluctuations typical of emerging crypto assets.

How to predict DYP's future price? What analysis methods are available?

Predict DYP price using technical analysis, market trends, and historical data patterns. Combine on-chain metrics, trading volume analysis, and fundamental DeFi protocol developments. Short-term predictions rely on price charts; long-term forecasts consider ecosystem growth and adoption rates.

What are the main factors affecting DYP price?

DYP price is primarily influenced by supply mechanism, scarcity, market demand, and technology ecosystem development. Total supply of 229,926,862 tokens, institutional adoption, and macroeconomic conditions also significantly impact price movements.

What are the advantages and disadvantages of DYP compared with other DeFi tokens such as AAVE and UNI?

DYP focuses on decentralized budgeting and resource allocation through unique governance mechanisms, while AAVE specializes in lending and UNI in decentralized trading. DYP offers innovative budget voting systems, providing differentiated value in DeFi ecosystem with distinct use cases and governance approaches.

What risks should I be aware of when investing in DYP tokens?

DYP token investments carry price volatility risks and potential capital loss. Market fluctuations are unpredictable. Investors should carefully evaluate their risk tolerance and investment capacity before participating.

What are professional analysts' price predictions for DYP in 2024-2025?

Professional analysts predict DYP will experience steady growth during 2024-2025, driven by increasing demand and limited supply. Price forecasts range between 0.50-1.50 USD, with positive market momentum supporting long-term appreciation potential.

DYP的流动性如何?在哪些交易所可以交易?

DYP具有良好的流动性,在多个主流交易平台上交易。DYP日均交易额稳定,提供充足的市场深度,适合各类投资者交易需求。

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Everything About Decentralized Science

Flash Loan: In-Depth Analysis

Stop Loss vs. Stop Limit: Which Works Best in Crypto Trading?

Top 10 Monero Wallets for Storing Your XMR

What is KTON: A Comprehensive Guide to Kusama's Native Parachain Token and Its Role in the Polkadot Ecosystem