2026 EDGEN Price Prediction: Expert Analysis and Market Forecast for the Next Generation Blockchain Token

Introduction: EDGEN's Market Position and Investment Value

LayerEdge (EDGEN), as a pioneering force in democratizing blockchain verification through its people-powered zero-knowledge verification layer, has been making significant strides since its launch in 2025. As of February 2026, EDGEN maintains a market capitalization of approximately $646,845.5, with a circulating supply of around 260.3 million tokens and a current price hovering around $0.002485. This asset, recognized as a "community-driven verification infrastructure token," is playing an increasingly important role in the Web3 security and verification domain.

This article will comprehensively analyze EDGEN's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. EDGEN Price History Review and Market Status

EDGEN Historical Price Evolution Trajectory

- February 2025: EDGEN launched on Gate.com with an initial price movement, establishing its market presence in the zero-knowledge verification layer sector

- June 2025: The token reached a notable price level of $0.08, reflecting early market interest in the people-powered verification concept

- January 2026: Market conditions shifted downward, with the price experiencing significant adjustment from previous levels

EDGEN Current Market Situation

As of February 5, 2026, EDGEN is trading at $0.002485, representing recent market dynamics in the verification layer space. The token has shown a 1.99% decrease over the past hour and a 3.94% decline over the past 24 hours. Over a seven-day period, the price has adjusted by 28.03%, while the 30-day movement shows a 41.14% change.

The 24-hour trading volume stands at $17,321.74, with the price range fluctuating between $0.002496 and $0.002705 during this period. The market capitalization sits at approximately $646,845.50, with a circulating supply of 260.3 million EDGEN tokens out of a total supply of 1 billion tokens, representing a circulation ratio of 26.03%. The fully diluted market cap is estimated at $2.485 million.

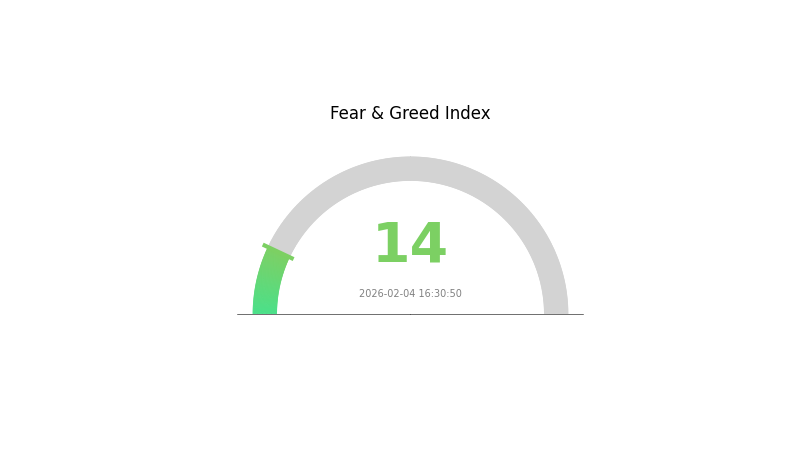

The current market dominance stands at 0.000095%, reflecting EDGEN's position in the broader cryptocurrency ecosystem. The token operates on the Ethereum blockchain using the ERC-20 standard, with over 4,312 holders participating in the network. The market sentiment index indicates a reading of 14, suggesting cautious market conditions in the current environment.

Click to view current EDGEN market price

EDGEN Market Sentiment Index

02-04-2026 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear sentiment, with the index dropping to 14. This historically low reading suggests significant market pessimism and risk aversion among investors. Such extreme fear periods often present contrarian opportunities, as excessive selling pressure may create potential entry points for long-term investors. Market participants should exercise caution while monitoring key support levels and accumulating quality assets strategically during these periods of heightened uncertainty.

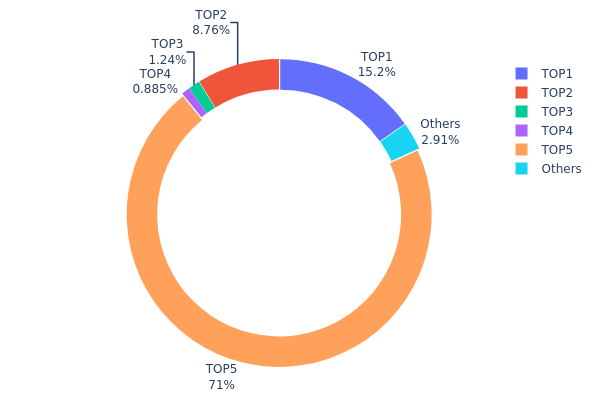

EDGEN Token Holding Distribution

The token holding distribution chart reveals the allocation of EDGEN tokens across different wallet addresses, serving as a critical indicator of decentralization and potential market manipulation risks. According to the latest on-chain data, EDGEN exhibits an extremely concentrated holding structure. The top holder (0xe1ff...62d1a6) controls an overwhelming 710,000K tokens, representing 71.00% of the total supply. The second and third largest addresses hold 152,087.88K (15.20%) and 87,576.02K (8.75%) respectively. Cumulatively, the top three addresses control approximately 94.95% of the entire token supply, while the remaining addresses outside the top five collectively hold merely 2.93%.

This highly centralized distribution pattern presents significant structural risks to the EDGEN market. Such concentration in a limited number of wallets creates substantial vulnerability to price manipulation, as major holders possess sufficient capacity to dramatically influence market prices through coordinated buying or selling activities. The dominant position of the largest holder, controlling over 70% of supply, raises particular concerns about single-point control and potential liquidity shocks. In typical healthy token ecosystems, a more dispersed holding structure with the top 10 addresses controlling less than 50% of supply is generally preferred to ensure market stability and prevent concentrated power dynamics.

From a market structure perspective, this distribution configuration suggests EDGEN remains in an early development phase with limited organic circulation among retail participants. The minimal 2.93% holdings among "Others" indicates insufficient broad-based community participation and raises questions about true decentralization claims. While such concentration may enable coordinated project development in early stages, it simultaneously increases systemic risks associated with sudden large-scale token movements and reduces confidence among potential investors who may perceive elevated exposure to whale manipulation.

Click to view current EDGEN Token Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb8bb...1d6f4a | 152087.88K | 15.20% |

| 2 | 0x4b2c...3dd03e | 87576.02K | 8.75% |

| 3 | 0x58ed...a36a51 | 12430.07K | 1.24% |

| 4 | 0x0d07...b492fe | 8849.08K | 0.88% |

| 5 | 0xe1ff...62d1a6 | 710000.00K | 71.00% |

| - | Others | 29056.95K | 2.93% |

II. Core Factors Influencing EDGEN's Future Price

Supply Mechanism

- Community-Driven Token Distribution: A significant portion of EDGEN tokens is allocated through community programs, encouraging widespread ownership and active participation among users.

- Historical Pattern: Token distribution strategies that prioritize community engagement have typically fostered sustained holder interest and reduced selling pressure during market volatility.

- Current Impact: The ongoing community allocation approach may support price stability by distributing tokens among engaged participants rather than concentrating supply in limited hands.

Institutional and Major Holder Dynamics

- Investor Sentiment: Market confidence plays a direct role in EDGEN price movements. Positive news regarding widespread adoption or technological breakthroughs tends to drive upward momentum, while uncertainty or regulatory concerns may create downward pressure.

- Macroeconomic Trends: Broader economic conditions, including monetary policy shifts and inflation expectations, influence investor appetite for digital assets like EDGEN.

Macroeconomic Environment

- Regulatory Landscape: Government policies and legal clarity in major cryptocurrency markets significantly affect EDGEN's trading environment. Clear regulatory frameworks typically support market confidence, while ambiguous or restrictive policies may introduce uncertainty.

- Global Economic Conditions: Macroeconomic factors, including interest rate policies and geopolitical developments, shape the overall risk appetite for digital assets and can influence capital flows into or out of EDGEN.

Technological Development and Ecosystem Building

- Technology Adoption: LayerEdge's technological advancements and their practical implementation in real-world applications represent a key driver for long-term value. Successful deployment and user adoption of LayerEdge's infrastructure could enhance demand for EDGEN tokens.

- Innovation Momentum: Continued technological innovation and platform improvements may strengthen EDGEN's competitive position within the cryptocurrency landscape, potentially attracting additional development activity and user engagement.

III. 2026-2031 EDGEN Price Forecast

2026 Outlook

- Conservative Forecast: $0.00216 - $0.00251

- Neutral Forecast: $0.00251 (average price scenario)

- Optimistic Forecast: $0.00271 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: EDGEN may enter a gradual growth phase with moderate price fluctuations, supported by potential project developments and broader market sentiment.

- Price Range Forecast:

- 2027: $0.00183 - $0.00269

- 2028: $0.00188 - $0.00276

- 2029: $0.00197 - $0.003

- Key Catalysts: Sustained community engagement, potential technological upgrades, and overall crypto market recovery could drive price momentum during this period.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00185 - $0.00297 (assuming stable market conditions and continued project activity)

- Optimistic Scenario: $0.00285 - $0.00367 (with enhanced ecosystem development and increased market demand)

- Transformative Scenario: Above $0.00367 (under exceptionally favorable conditions including major partnerships or significant technological breakthroughs)

- 2026-02-05: EDGEN trading within predicted early-year range as market participants assess long-term value proposition

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00271 | 0.00251 | 0.00216 | 1 |

| 2027 | 0.00269 | 0.00261 | 0.00183 | 5 |

| 2028 | 0.00276 | 0.00265 | 0.00188 | 6 |

| 2029 | 0.003 | 0.0027 | 0.00197 | 8 |

| 2030 | 0.00297 | 0.00285 | 0.00185 | 14 |

| 2031 | 0.00367 | 0.00291 | 0.0016 | 17 |

IV. EDGEN Professional Investment Strategy and Risk Management

EDGEN Investment Methodology

(I) Long-Term Holding Strategy

- Target Investors: Investors who believe in the democratization of blockchain verification and zero-knowledge proof infrastructure

- Operational Recommendations:

- Consider accumulating positions during market corrections, particularly when the token trades below its 30-day moving average

- Monitor the growth of the LayerEdge user base and verification node activity as key indicators of network adoption

- Gate Web3 Wallet provides a secure storage solution for EDGEN holdings with multi-chain support

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume fluctuations, as the current daily volume of approximately $17,321 suggests relatively low liquidity conditions

- Support and Resistance Levels: Track key price levels, with recent data showing support near $0.002451 and resistance potential around previous price ranges

- Swing Trading Key Points:

- Given the significant volatility (down 28.03% over 7 days), implement strict stop-loss orders to protect capital

- Consider reducing position sizes during periods of high volatility to manage exposure effectively

EDGEN Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-8% of crypto portfolio allocation

- Professional Investors: 10-15% of crypto portfolio allocation with active monitoring

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance EDGEN holdings with established cryptocurrencies and stablecoins to reduce concentration risk

- Position Sizing: Limit initial investment to amounts that align with the high-risk nature of emerging blockchain projects

(III) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet offers secure storage with support for ERC-20 tokens like EDGEN

- Cold Storage Option: For larger holdings, consider transferring to hardware wallets after accumulation

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (0xaa9806c938836627ed1a41ae871c7e1889ae02ca) before transactions

V. EDGEN Potential Risks and Challenges

EDGEN Market Risks

- High Volatility: The token has experienced a 93.70% decline over one year and 41.14% decline over 30 days, indicating substantial price volatility that may continue

- Limited Liquidity: With a 24-hour trading volume of approximately $17,321 and market cap of around $646,845, liquidity constraints may result in significant slippage during larger transactions

- Market Cap Concentration: The circulating supply represents only 26.03% of total supply, with potential dilution risk as more tokens enter circulation

EDGEN Regulatory Risks

- Blockchain Verification Services: As LayerEdge operates in the blockchain verification infrastructure space, evolving regulatory frameworks for decentralized verification services may impact operations

- Token Classification: Regulatory clarity regarding the token's utility status across different jurisdictions remains an ongoing consideration

- Compliance Requirements: Future regulatory developments may impose additional compliance obligations on verification network participants

EDGEN Technical Risks

- Network Adoption: Success depends on achieving sufficient user participation in the verification network to ensure security and decentralization

- Technology Competition: The zero-knowledge proof and blockchain verification sectors face significant competition from established players and emerging technologies

- Smart Contract Risk: As an ERC-20 token, EDGEN is subject to potential vulnerabilities in smart contract code, though the contract is publicly verifiable on Etherscan

VI. Conclusion and Action Recommendations

EDGEN Investment Value Assessment

LayerEdge presents an approach to democratizing blockchain verification through its user-powered zero-knowledge verification layer. The project's emphasis on leveraging Bitcoin's security foundation while distributing verification across millions of devices offers potential long-term infrastructure value. However, the significant price volatility, limited liquidity, and early-stage development present considerable short-term risks. The project's success will largely depend on achieving substantial user adoption and demonstrating the technical viability of its verification network.

EDGEN Investment Recommendations

✅ Beginners: Approach with extreme caution; consider limiting exposure to 1-2% of total crypto portfolio, and only invest amounts you can afford to lose entirely ✅ Experienced Investors: Consider small speculative positions while monitoring network growth metrics and user adoption; implement strict risk management protocols ✅ Institutional Investors: Conduct comprehensive due diligence on the technical architecture and team before considering participation; await clearer evidence of network adoption and regulatory clarity

EDGEN Trading Participation Methods

- Spot Trading: Purchase EDGEN through Gate.com's spot market with proper verification of the ERC-20 contract address

- Dollar-Cost Averaging: Spread purchases over time to mitigate timing risk in volatile market conditions

- Secure Storage: Transfer holdings to Gate Web3 Wallet for secure custody after purchase

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is EDGEN? What are its main uses?

EDGEN is a blockchain-based utility token designed for decentralized data processing and AI model training. Its main purpose is enabling users to contribute computing resources, earn rewards, and access advanced AI services within the Web3 ecosystem.

What is the EDGEN price prediction for 2024-2025?

EDGEN demonstrated strong market momentum during 2024-2025, with market capitalization growing from 200 billion USD to 239 billion USD. The upward trend reflects robust ecosystem expansion and increased adoption. Market fundamentals suggest continued growth potential into 2026.

What are the main factors affecting EDGEN price?

EDGEN price is primarily influenced by token distribution through community programs, market demand and supply dynamics, user participation levels, and trading volume fluctuations in the market.

Is EDGEN a high-risk investment? What should I pay attention to?

EDGEN shows strong fundamentals with official backing and ecosystem support. Monitor market volatility and project updates regularly. Diversify your portfolio and only invest what you can afford. Stay informed on development progress and community sentiment for optimal positioning.

How to perform EDGEN technical analysis for price prediction?

Analyze EDGEN using GAN and LSTM models on historical price data and trading volume patterns. Study support/resistance levels, moving averages, and market momentum indicators to forecast price trends accurately.

What are the advantages of EDGEN compared to similar tokens?

EDGEN excels with innovative layered network technology, superior transaction speed, and stable community support. Its transparent development roadmap and efficient architecture distinguish it from competitors in the market.

2025 Worthwhile Zero-Knowledge Projects to Watch: The Future of Scalable and Private Blockchains

What is zk-SNARKs? Understanding encryption technology that promotes Web3 privacy

How Zero-Knowledge Proofs are Changing Privacy in Crypto Assets: From ZK-Rollups to Private Transactions

Nillion: Solving the Web3 Data Privacy Dilemma with Blind Computation

Humanity Protocol: Revolutionizing Web3 Identity Verification in 2025

Bedrock Deep Dive: Comprehensive Analysis of Whitepaper, Technical Innovations & Future Roadmap

Comprehensive Guide to APR vs APY in Cryptocurrency

What Is Slippage? How Can You Prevent Slippage in Crypto Trading?

Free Bitcoin Mining

What is Crypto DePIN? DePIN's Potential for Web3

Understanding Bull Flag and Bear Flag Patterns in Trading