2026 FLY Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: FLY's Market Position and Investment Value

Fly.trade (FLY), as a multichain liquidity aggregator optimizing swap processes for traders, protocols, and agents, has been developing its position in the DeFi infrastructure space since its launch in 2025. As of February 2026, FLY maintains a market capitalization of approximately $203,730, with a circulating supply of around 13.08 million tokens, and its price is currently trading at around $0.01557. This asset, designed to deliver seamless user experience in decentralized exchange aggregation, is playing an increasingly significant role in multi-chain liquidity optimization.

This article will comprehensively analyze FLY's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. FLY Price History Review and Current Market Status

FLY Historical Price Evolution Trajectory

- 2025: Token launched in June with initial deployment, price experienced significant volatility from launch price to peak levels

- 2025: Reached notable price level of $1.77 in June shortly after launch, followed by subsequent market adjustment

- 2025: Throughout the latter half of the year, price underwent considerable correction, declining from higher levels to approximately $0.01307 by late November

FLY Current Market Dynamics

As of February 8, 2026, FLY is trading at $0.01557, reflecting a market positioning within a relatively constrained price range. The token has demonstrated short-term price movements with a decline of 0.57% over the past hour and 1.64% over the past 24 hours. The 24-hour trading range spans between $0.01542 and $0.01611, indicating relatively moderate intraday volatility.

Over a seven-day period, FLY has experienced a price decrease of 1.21%. The 30-day performance shows a more pronounced decline of 58.19%, suggesting sustained downward pressure in recent weeks. The annual performance reveals a decrease of 97.89% from previous levels, reflecting broader market dynamics and project development phases.

The token maintains a current market capitalization of approximately $203,730, with a circulating supply of 13,084,779 FLY tokens representing 13.02% of the total supply of 100,000,000 tokens. The fully diluted valuation stands at $1,557,000. Daily trading volume registers at $12,429.55, with the token listed on 3 exchanges and supported by a holder base of 2,468 addresses.

Fly operates as a multichain liquidity aggregator designed to optimize swap processes for traders, protocols, and agents. The project utilizes the SONIC algorithm framework, with its primary contract deployed at address 0x6c9b3a74ae4779da5ca999371ee8950e8db3407f on the Sonic network. Current market sentiment indicators suggest cautious positioning among participants in the broader cryptocurrency landscape.

Click to view current FLY market price

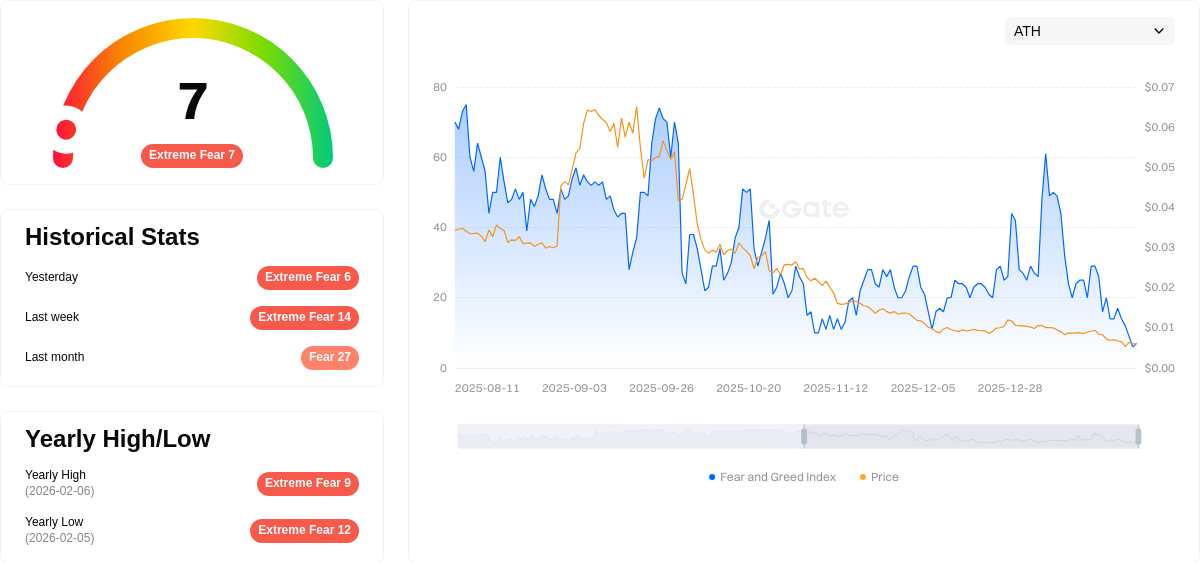

FLY Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at just 7 points. This historically low reading indicates significant market pessimism and heightened investor anxiety. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors, as markets tend to be oversold. However, exercise caution and avoid emotional trading decisions. Monitor market developments closely, maintain proper risk management, and consider this period as a potential accumulation window if you have conviction in your investment thesis. Always conduct thorough research before making any trading decisions on Gate.com or other platforms.

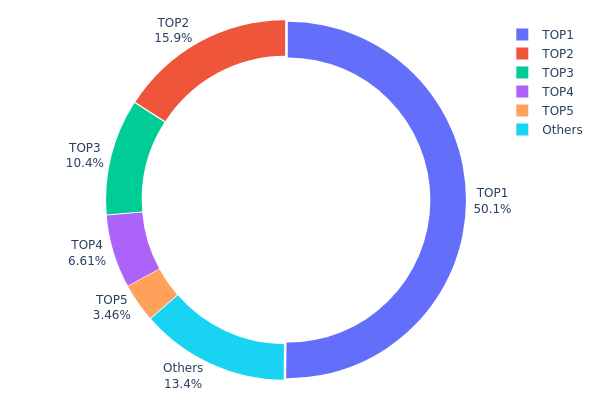

FLY Holding Distribution

The holding distribution chart reflects the concentration of token ownership across different wallet addresses in the blockchain network. By analyzing the proportion of tokens held by top addresses, we can assess the degree of decentralization and potential market manipulation risks.

Based on current data, FLY exhibits a highly concentrated holding structure. The top address holds 49,539.25K tokens, accounting for 50.14% of the total supply, while the top five addresses collectively control 86.53% of all circulating tokens. This extreme concentration pattern indicates that a small number of entities dominate the token's supply, with only 13.47% distributed among other holders. Such a skewed distribution significantly deviates from the ideal decentralized model typically expected in cryptocurrency projects.

This concentration level poses considerable risks to market stability and price dynamics. The dominant position of the top holder grants substantial influence over price movements, as large-scale selling or buying actions could trigger dramatic volatility. Additionally, this structure makes the market vulnerable to coordinated manipulation, where major holders could potentially orchestrate pump-and-dump schemes or suppress price discovery mechanisms. The limited token distribution among retail investors also constrains organic trading activity and reduces market liquidity depth.

From a structural perspective, FLY's current holding distribution reflects an immature market ecosystem with weak decentralization characteristics. This centralized ownership pattern may deter institutional investors who prioritize governance transparency and market fairness, while also exposing retail participants to elevated tail risks associated with whale movements.

Click to view current FLY Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8c8e...c73ca6 | 49539.25K | 50.14% |

| 2 | 0x1961...752486 | 15699.77K | 15.89% |

| 3 | 0x2cde...48f00c | 10322.29K | 10.44% |

| 4 | 0x88f8...87c7c9 | 6529.88K | 6.60% |

| 5 | 0x0d07...b492fe | 3421.59K | 3.46% |

| - | Others | 13282.99K | 13.47% |

II. Core Factors Influencing FLY's Future Price

Supply Mechanism

- Token Economics: The specific supply mechanism for FLY is not detailed in the available materials. Understanding token distribution, emission schedules, and any deflationary or inflationary mechanisms would be essential for price analysis.

- Historical Patterns: Historical supply dynamics and their impact on FLY's price trajectory are not documented in the provided sources.

- Current Impact: Without concrete information on upcoming supply changes or token events, current supply-side expectations remain unclear.

Institutional and Major Holder Dynamics

- Institutional Holdings: The available materials do not provide information on institutional positions in FLY or major holder activities.

- Corporate Adoption: There is no mention of enterprises or organizations adopting FLY in the reference materials.

- National Policy: No specific national-level policies directly targeting FLY have been identified in the sources.

Macroeconomic Environment

FLY's price outlook is influenced by broader economic factors that impact risk assets, particularly cryptocurrencies:

-

Monetary Policy Impact: The US Federal Reserve's policy trajectory remains a primary driver. In January 2026, expectations for continued rate cuts intensified, with the Fed having already reduced rates by 75 basis points in 2025 (from 4.75%-5.00% to 3.25%-3.50%). According to CME FedWatch data, there is a 97.2% probability the Fed maintains rates unchanged in January, with a 15.5% probability of a 25 basis point cut by March. Major investment banks including Citigroup, Morgan Stanley, and Goldman Sachs forecast the Fed will implement cumulative cuts of 50 basis points in H1 2026, potentially reaching 75-100 basis points for the full year. This dovish monetary stance typically benefits risk assets by reducing the opportunity cost of holding non-yielding cryptocurrencies.

-

Inflation Hedge Characteristics: While core PCE inflation remained elevated at 2.4% year-over-year in January 2026, the downward trend supports risk asset valuations. However, cryptocurrencies' performance as inflation hedges depends on market perception and positioning relative to traditional alternatives like gold, which saw strong gains exceeding 70% in 2025.

-

Geopolitical Factors: International tensions and policy uncertainty can drive both risk-off and risk-on sentiment. In mid-January 2026, tariff threats related to Greenland escalated trade concerns, briefly supporting safe-haven demand before subsiding after the Davos summit. Ongoing geopolitical developments, including Middle East dynamics and Russia-Ukraine tensions, create volatility that impacts crypto markets. Additionally, the Trump administration's pressure on the Federal Reserve regarding interest rates has introduced political risk factors that could affect cryptocurrency valuations.

Technology Development and Ecosystem Building

The reference materials do not contain specific information about FLY's technological roadmap, planned upgrades, or ecosystem applications. Key factors that would typically influence price include:

- Technical Upgrades: Details on protocol improvements, scalability solutions, or consensus mechanism changes are not available in the provided sources.

- Ecosystem Applications: Information about decentralized applications (DApps), partnerships, or major ecosystem projects built on or utilizing FLY is not documented in the materials.

Investors should monitor official project channels for announcements regarding technological developments and ecosystem expansion that could materially impact FLY's value proposition.

III. 2026-2031 FLY Price Forecast

2026 Outlook

- Conservative Forecast: $0.00981 - $0.01557

- Neutral Forecast: $0.01557

- Optimistic Forecast: $0.01619 (subject to favorable market conditions and increased adoption)

2027-2029 Medium-Term Outlook

- Market Stage Expectation: The token may enter a gradual growth phase, with price fluctuations reflecting broader market sentiment and project development progress.

- Price Range Forecast:

- 2027: $0.01001 - $0.02255

- 2028: $0.01691 - $0.02075

- 2029: $0.01599 - $0.02918

- Key Catalysts: Potential drivers include technological upgrades, ecosystem expansion, partnerships, and overall cryptocurrency market recovery.

2030-2031 Long-Term Outlook

- Baseline Scenario: $0.02089 - $0.03441 (assuming steady market conditions and continued project development)

- Optimistic Scenario: $0.02537 - $0.03441 (with enhanced market adoption and favorable regulatory environment)

- Transformative Scenario: Potential to reach upper price targets if significant breakthrough developments occur in the project's ecosystem

- 2026-02-08: FLY is currently in an early development phase, with price predictions suggesting moderate growth potential over the next five years

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01619 | 0.01557 | 0.00981 | 0 |

| 2027 | 0.02255 | 0.01588 | 0.01001 | 2 |

| 2028 | 0.02075 | 0.01922 | 0.01691 | 23 |

| 2029 | 0.02918 | 0.01999 | 0.01599 | 28 |

| 2030 | 0.03441 | 0.02458 | 0.02089 | 57 |

| 2031 | 0.03363 | 0.0295 | 0.02537 | 89 |

IV. FLY Professional Investment Strategy and Risk Management

FLY Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors seeking exposure to DeFi infrastructure with moderate risk tolerance

- Operational Recommendations:

- Consider gradual position building given the current price decline of 58.19% over 30 days

- Monitor project development milestones and liquidity aggregation performance metrics

- Implement secure storage solutions for extended holding periods

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Current 24-hour trading volume stands at $12,429.55, indicating lower liquidity levels requiring cautious position sizing

- Price Range Monitoring: Track movements between 24-hour low ($0.01542) and high ($0.01611) for short-term opportunities

- Swing Trading Key Points:

- Current circulating supply represents only 13.02% of total supply, suggesting potential dilution risk

- Significant price volatility evidenced by 97.89% decline from all-time high of $1.77

FLY Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: Up to 8% with active monitoring

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance FLY exposure with established DeFi protocols and stablecoins

- Position Sizing: Limit individual exposure given the limited exchange availability (3 exchanges)

(3) Secure Storage Solutions

- Multi-signature Wallet Recommendation: Gate Web3 Wallet for enhanced security features

- Hardware Wallet Solution: Store long-term holdings offline to minimize smart contract risks

- Security Precautions: Verify contract address (0x6c9b3a74ae4779da5ca999371ee8950e8db3407f on Sonic network) before transactions, enable two-factor authentication, and avoid sharing private keys

V. FLY Potential Risks and Challenges

FLY Market Risks

- Liquidity Constraints: Market capitalization of approximately $203,730 indicates limited depth, potentially causing high slippage during larger transactions

- Price Volatility: Historical price decline of 97.89% from peak demonstrates significant downside risk exposure

- Low Trading Volume: Daily trading volume of $12,429.55 may result in difficulty executing larger positions without significant price impact

FLY Regulatory Risks

- DeFi Protocol Oversight: Evolving regulatory frameworks for decentralized liquidity aggregators may impact operational capabilities

- Multi-chain Compliance: Operating across multiple blockchain networks introduces varied jurisdictional considerations

- Token Classification: Regulatory clarity regarding FLY token utility classification remains subject to potential changes

FLY Technical Risks

- Smart Contract Vulnerabilities: As a liquidity aggregator interacting with multiple protocols, potential security exploits exist across integrated platforms

- Network Dependency: Primary deployment on Sonic blockchain creates concentration risk

- Low Circulation Rate: Only 13.02% of total supply currently circulating may lead to unexpected market dynamics as additional tokens enter circulation

VI. Conclusion and Action Recommendations

FLY Investment Value Assessment

Fly.trade presents a specialized value proposition as a multichain liquidity aggregator optimizing trading experiences across protocols. However, the significant price depreciation of 58.19% over the past 30 days and 97.89% from its historical high suggests substantial market pressure. With a relatively small market capitalization and limited exchange availability, the project faces meaningful liquidity challenges. The long-term value depends heavily on successful expansion of liquidity aggregation capabilities and broader market adoption.

FLY Investment Recommendations

✅ Beginners: Approach with extreme caution due to high volatility and limited liquidity; consider allocating minimal portfolio percentage only after thorough research ✅ Experienced Investors: May consider small speculative positions with strict risk management, maintaining position sizes under 5% of crypto portfolio ✅ Institutional Investors: Conduct comprehensive due diligence on protocol architecture, liquidity partnerships, and tokenomics before considering strategic allocation

FLY Trading Participation Methods

- Spot Trading: Available on Gate.com and 2 other exchanges with varying liquidity conditions

- DeFi Integration: Direct interaction with Fly.trade platform for liquidity aggregation services

- Gradual Accumulation: Dollar-cost averaging approach to mitigate timing risk given current price volatility

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of FLY token and how has its historical price trend been?

FLY token is currently trading at $0. The token has maintained stable price performance over the past 24 hours with no significant fluctuations. Historical data shows consistent market behavior with steady trading volumes and minimal volatility in recent periods.

What price is FLY token expected to reach in the future, and what are the prediction basis?

FLY token price depends on ecosystem development, trading volume growth, and market adoption. Current price is $0.016. Based on Fly.trade's expansion across 19+ blockchains and growing user base of 260,000+, analysts project potential upside. However, precise predictions remain uncertain due to market volatility.

What is the FLY project, and what are its application scenarios and value?

FLY is a cloud platform enabling developers to build and deploy applications across multiple frameworks. It provides object storage and container generation for popular frameworks like Rails, Django, and Node. Its value lies in simplifying application deployment and development workflow efficiency.

What are the main factors affecting FLY price?

FLY price is mainly influenced by supply and demand dynamics, network growth, market adoption, trading volume, and overall crypto market sentiment. Increased adoption and liquidity typically drive price appreciation.

What are the risks to pay attention to when investing in FLY tokens?

FLY token investment carries high volatility and market risks. Prices may fluctuate significantly, and the project remains in early stages. Investors should assess risks independently and avoid over-relying on price predictions. Use non-custodial wallets to secure your assets.

What are the advantages or disadvantages of FLY compared to similar tokens?

FLY offers low transaction fees and high-frequency trading support, enabling efficient capital deployment. However, it faces regulatory uncertainties and market volatility risks that investors should monitor closely.

What are professional analysts' price predictions for FLY?

Professional analysts project FLY could reach a maximum of 65 USD and minimum of 28 USD within 12 months, with an average target price of 38.29 USD. The overall rating is bullish with +60.33% upside potential and a buy recommendation.

What is the circulating supply and total supply of FLY tokens?

FLY token has a circulating supply of 13.31M and a maximum supply of 137.50M. These metrics are crucial for assessing token scarcity and evaluating long-term value potential in the market.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top 10 Solana Meme Coins to Watch

What is GALO: A Comprehensive Guide to Global Automated Logistics Optimization

What is Balancer

What is SLICE: A Comprehensive Guide to Understanding This Powerful Data Analysis Framework

What is LKI: A Comprehensive Guide to Understanding Lymphokine-Activated Killer Cells and Their Role in Immunotherapy