2026 FRED Price Prediction: Expert Analysis and Market Forecast for the Digital Asset's Future Growth

Introduction: FRED's Market Position and Investment Value

First Convicted Raccon (FRED) serves as a justice-themed memecoin within the Solana ecosystem, having launched in 2024 with the mission of "Justice for Fred". As of 2026, FRED maintains a market capitalization of approximately $430,332, with a fully circulating supply of 999,843,302 tokens, and a current price hovering around $0.0004304. This Solana-based asset, supported by over 30,429 holders across 4 exchanges, represents an emerging community-driven project in the broader memecoin landscape.

This article will comprehensively analyze FRED's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. FRED Price History Review and Market Status

FRED Historical Price Evolution Trajectory

- 2024: Token launched in November with an initial price of $0.2204, reaching a peak of $0.2388 on November 15, 2024, representing the highest price level recorded

- 2025-2026: Market entered a significant correction phase, with price declining substantially from the 2024 peak

- 2026: Price touched a low of $0.0004039 on February 5, 2026, marking a considerable contraction from previous levels

FRED Current Market Dynamics

As of February 6, 2026, FRED is trading at $0.0004304, reflecting short-term volatility across multiple timeframes. The token has experienced a decrease of 4.26% over the past hour and 7.75% over the past 24 hours. The 24-hour trading range spans from $0.0004039 to $0.000504, indicating active price movement within this period.

Broader timeframe analysis shows more pronounced declines, with a 38.91% decrease over the past 7 days and a 63.58% decline over the past 30 days. The yearly performance indicates an 88.13% decline from price levels one year prior.

The token maintains a market capitalization of approximately $430,332, with 100% of the maximum supply of 999,843,302 tokens currently in circulation. The fully diluted valuation matches the market capitalization at $430,332, given complete token distribution. FRED holds a market share of 0.000018% within the broader cryptocurrency ecosystem.

The 24-hour trading volume stands at $13,178, while the token is supported by a holder base of 30,429 addresses. FRED is available for trading on 4 exchanges, including Gate.com. The current market sentiment index registers at 12, corresponding to an extreme fear reading.

Click to view current FRED market price

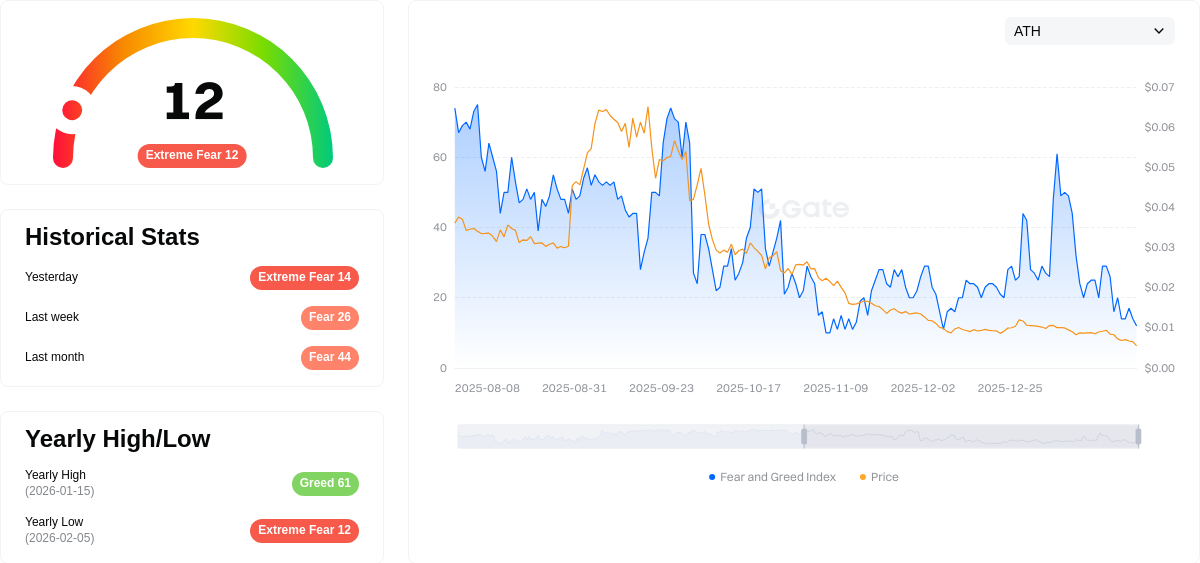

FRED Market Sentiment Index

2026-02-05 Fear & Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear as the Fear & Greed Index plummets to 12, signaling severe market pessimism. This critically low reading indicates investors are highly risk-averse, with widespread selling pressure and negative sentiment dominating the market landscape. Such extreme fear levels historically present contrarian buying opportunities, as market bottoms frequently coincide with peak fear conditions. However, caution remains warranted until stability returns and sentiment begins reversing toward neutral territory.

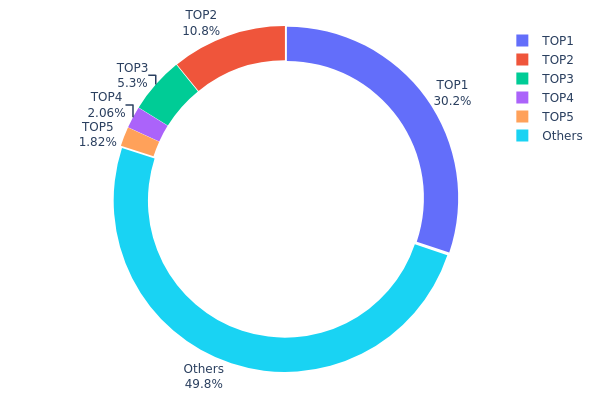

FRED Holdings Distribution

The holdings distribution chart illustrates the concentration of token ownership across different wallet addresses, providing crucial insights into the decentralization level and potential market manipulation risks. By analyzing the proportion of tokens held by top addresses versus the broader holder base, we can assess the token's circulation structure and evaluate potential price volatility stemming from concentrated holdings.

Based on current on-chain data, FRED exhibits significant concentration characteristics. The top address controls 301,551.77K tokens, accounting for 30.16% of total supply, while the second-largest holder possesses 10.84%. The top five addresses collectively control approximately 50.16% of the circulating supply. This concentration level indicates a relatively centralized distribution structure, where a small number of major holders possess substantial influence over market dynamics.

Such concentration patterns present both opportunities and risks for market participants. On one hand, large holders may provide stability during market turbulence through their long-term holding behavior. On the other hand, this structure creates potential vulnerability to significant sell pressure should major holders decide to liquidate positions. The "Others" category, representing 49.84% of supply distributed among remaining addresses, suggests a moderately diverse holder base, though the dominance of top addresses remains noteworthy. This distribution profile warrants careful monitoring, particularly during periods of high volatility, as concentrated holdings may amplify price movements in either direction.

Click to view current FRED Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 301551.77K | 30.16% |

| 2 | u6PJ8D...ynXq2w | 108473.32K | 10.84% |

| 3 | ASTyfS...g7iaJZ | 53005.32K | 5.30% |

| 4 | G4jXDi...z5RVXH | 20558.83K | 2.05% |

| 5 | 9gjaZL...k3nPpi | 18174.98K | 1.81% |

| - | Others | 498005.83K | 49.84% |

II. Core Factors Influencing FRED's Future Price

Supply Mechanism

- Market-Driven Dynamics: FRED's price outlook is shaped by market demand, adoption trends, and institutional participation. The token's supply structure responds to broader economic factors and user engagement patterns.

- Historical Patterns: Past crypto market cycles have demonstrated strong periodicity, with price movements closely aligned with economic cycles. Analysis of previous bull and bear markets reveals significant consistency in timing and magnitude of price shifts.

- Current Influence: As of February 2026, global liquidity patterns and monetary policy shifts continue to affect FRED's valuation trajectory. The interaction between supply dynamics and evolving demand creates ongoing price volatility.

Institutional and Major Holder Dynamics

- Institutional Positioning: Traditional financial institutions are gradually increasing their exposure to digital assets. The evolving regulatory landscape and improved market infrastructure have facilitated greater institutional participation in the crypto space.

- Corporate Adoption: The integration of blockchain technology into traditional finance systems has accelerated, with various enterprises exploring applications within FRED's ecosystem. This growing acceptance supports broader market legitimacy.

- National Policy: Regulatory developments across jurisdictions continue to shape the operating environment for digital assets. Recent court decisions and policy clarifications have provided greater certainty for market participants.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve policies and global economic conditions play crucial roles in determining crypto asset valuations. Interest rate decisions, quantitative measures, and inflation management strategies directly influence investor sentiment toward alternative assets like FRED.

- Inflation Hedge Attributes: During periods of elevated inflation expectations, digital assets may attract attention as potential stores of value. However, the relationship between inflation and crypto prices remains complex and influenced by multiple variables including energy costs, housing prices, and wage dynamics.

- Geopolitical Factors: International tensions, trade policies, and regulatory divergence contribute to market uncertainty. These factors can drive demand for assets perceived as less correlated with traditional financial systems, potentially benefiting FRED's positioning.

Technological Development and Ecosystem Building

- Infrastructure Advancements: Ongoing improvements in blockchain scalability, security protocols, and user experience continue to enhance the utility of crypto networks. Layer 2 solutions and cross-chain interoperability efforts support ecosystem expansion.

- Smart Contract Evolution: The development of more sophisticated smart contract capabilities enables new use cases and applications. These technological enhancements contribute to the overall value proposition of blockchain-based systems.

- Ecosystem Applications: FRED's ecosystem supports multiple application scenarios across various sectors. The breadth and depth of these applications influence adoption rates and long-term sustainability of the platform.

III. 2026-2031 FRED Price Prediction

2026 Outlook

- Conservative Prediction: $0.00023 - $0.00042

- Neutral Prediction: $0.00042 average trading range

- Optimistic Prediction: up to $0.00057 (requires sustained market momentum and increased trading volume)

2027-2029 Outlook

- Market Stage Expectation: potential gradual recovery phase with moderate volatility

- Price Range Prediction:

- 2027: $0.00025 - $0.00064

- 2028: $0.00032 - $0.00066

- 2029: $0.00045 - $0.00087

- Key Catalysts: broader market sentiment shifts, enhanced token utility implementation, and growing community engagement

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00061 - $0.00099 (assuming steady ecosystem development and maintained market interest)

- Optimistic Scenario: $0.00074 - $0.00125 (contingent upon successful protocol upgrades and expanded use cases)

- Transformative Scenario: potentially reaching $0.00125 by 2031 (dependent upon significant technological breakthroughs and mainstream adoption acceleration)

- 2026-02-06: FRED trading within projected early-year consolidation zone

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00057 | 0.00042 | 0.00023 | -2 |

| 2027 | 0.00064 | 0.00049 | 0.00025 | 14 |

| 2028 | 0.00066 | 0.00057 | 0.00032 | 31 |

| 2029 | 0.00087 | 0.00061 | 0.00045 | 42 |

| 2030 | 0.00099 | 0.00074 | 0.00061 | 72 |

| 2031 | 0.00125 | 0.00087 | 0.00044 | 101 |

IV. FRED Professional Investment Strategy and Risk Management

FRED Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to meme tokens with community-driven narratives

- Operational Recommendations:

- Consider dollar-cost averaging to reduce entry price volatility

- Monitor community engagement and social media sentiment regularly

- Implement secure storage solutions immediately after purchase

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use 20-day and 50-day moving averages to identify potential trend reversals

- Volume Analysis: Monitor trading volume relative to the 24-hour average of $13,178 to confirm price movements

- Swing Trading Considerations:

- Set stop-loss orders 10-15% below entry points given the token's high volatility

- Monitor the 24-hour price range ($0.0004039 - $0.000504) to identify optimal entry and exit points

FRED Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio

- Moderate Investors: 2-3% of crypto portfolio

- Aggressive Investors: 5-7% of crypto portfolio

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance FRED holdings with established cryptocurrencies to mitigate meme token volatility

- Position Sizing: Limit single position exposure to amounts you can afford to lose completely

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet for active trading and quick access

- Cold Storage Approach: Hardware wallet solutions for long-term holdings

- Security Precautions: Enable two-factor authentication, never share private keys, regularly update wallet software, and verify contract addresses before transactions

V. FRED Potential Risks and Challenges

FRED Market Risks

- High Volatility: The token has declined 88.13% over the past year and 63.58% in the last 30 days, indicating extreme price instability

- Low Liquidity: With a 24-hour trading volume of only $13,178 and market cap of $430,332, the token faces significant liquidity constraints

- Limited Market Depth: Trading on only 4 exchanges may result in price slippage during larger transactions

FRED Regulatory Risks

- Meme Token Classification: Uncertain regulatory treatment of meme tokens may impact trading availability

- Exchange Compliance: Limited exchange listings may be affected by evolving regulatory requirements

- Jurisdictional Restrictions: Potential trading restrictions in certain regions based on local securities laws

FRED Technical Risks

- Smart Contract Vulnerabilities: As a Solana-based token, potential risks include contract exploits or protocol-level issues

- Network Dependencies: Token performance tied to Solana network stability and transaction processing

- Project Sustainability: Limited public information about development roadmap or technical upgrades

VI. Conclusion and Action Recommendations

FRED Investment Value Assessment

FRED represents a high-risk, community-driven meme token with limited market capitalization and liquidity. The token's significant price decline of 88.13% from its all-time high of $0.2388 in November 2024 to current levels reflects the inherent volatility of meme token investments. With 30,429 holders and a fully diluted market cap of $430,332, FRED occupies a niche position in the meme token sector. Short-term risks include continued price volatility, limited liquidity, and uncertain regulatory environment.

FRED Investment Recommendations

✅ Beginners: Consider avoiding FRED until gaining more experience with established cryptocurrencies; if interested, allocate no more than 0.5% of your total investment portfolio ✅ Experienced Investors: Approach with extreme caution; limit exposure to 1-3% of crypto portfolio and implement strict stop-loss strategies ✅ Institutional Investors: Current market conditions suggest limited institutional suitability due to low liquidity and high volatility characteristics

FRED Trading Participation Methods

- Spot Trading: Purchase FRED directly on Gate.com with various trading pairs

- Wallet Storage: Use Gate Web3 Wallet for secure storage and portfolio management

- Community Engagement: Follow official social channels to stay informed about project developments

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is FRED? What are its basic characteristics and use cases?

FRED is a blockchain-based prediction token enabling decentralized price forecasting. Key features include real-time data feeds, community-driven predictions, and smart contract automation. It facilitates transparent price discovery and rewarding accurate predictors through tokenomics incentives.

How to predict FRED price? What are the analysis methods?

Use technical analysis methods like moving averages and RSI indicators on historical price data. Monitor trading volume, market trends, and fundamental factors affecting FRED to forecast future price movements accurately.

What are the main factors affecting FRED price?

FRED price is primarily influenced by market sentiment, adoption rate, and regulatory policies. Investor confidence, trading volume, and macroeconomic conditions also play significant roles in price movements.

What are the risks and limitations of FRED price predictions?

FRED price predictions face data reliability challenges and potential legal risks. Third-party platform data may be unreliable; verify independently. Official sources and reputable platforms provide more dependable information for accurate forecasting.

FRED与其他类似资产相比有什么优势或劣势?

FRED offers real-time economic data with high accuracy and reliability from the Federal Reserve. Advantages include comprehensive datasets and trusted sources. Disadvantages may include slower updates on certain indicators compared to specialized platforms, and limited interactive features for advanced analysis.

How has FRED price performed historically? Are there any trend patterns?

FRED has demonstrated a long-term upward trend with periodic volatility. Historical data shows sustained price appreciation over extended periods, with key support levels established during corrections, indicating bullish momentum in the broader trajectory.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

Everything About Asset Tokenization

What Does DYOR Mean in Crypto?

Everything You Need to Know About the Ethereum ERC-20 Token Standard

![[Cryptocurrency Investment Guide] Inverted Hammer Candlestick Pattern](https://gimg.staticimgs.com/learn/0ecdcb62677e87289caf34e32e85dd6e537dbe2b.png)

[Cryptocurrency Investment Guide] Inverted Hammer Candlestick Pattern

What Is a Trader: Understanding the Trading Profession Before You Start