2026 FYN Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: FYN's Market Position and Investment Value

Affyn (FYN), positioned as a sustainable play-to-earn metaverse project integrating virtual and real-world advantages on the Polygon blockchain, has undergone significant market evolution since its launch in 2022. As of 2026, FYN maintains a market capitalization of approximately $181,787, with a circulating supply of around 383.92 million tokens, and the price stabilizing at approximately $0.0004735. This asset, characterized as a "metaverse gaming token," is playing an increasingly important role in bridging virtual and physical gaming experiences.

This article will comprehensively analyze FYN's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price predictions and practical investment strategies.

I. FYN Price History Review and Current Market Status

FYN Historical Price Evolution Trajectory

- 2022: Token launched on March 30, 2022 with an initial price of $0.1684, reaching its all-time high of $1.84 on February 1, 2022, representing significant early-stage growth momentum

- 2022-2025: Market experienced considerable volatility, with price movements reflecting broader cryptocurrency market cycles and metaverse sector trends

- 2026: Price declined to an all-time low of $0.0004289 on February 5, 2026, followed by a slight recovery to the current level of $0.0004735

FYN Current Market Status

As of February 9, 2026, FYN is trading at $0.0004735, showing a 1.02% increase over the past 24 hours. The token has experienced mixed short-term performance, with a 0.19% gain in the last hour but a 5.66% decline over the past week. Over longer timeframes, FYN has faced downward pressure, declining 34.46% in the past 30 days and 80.83% over the past year.

The 24-hour trading range spans from $0.0004667 to $0.00055, with a total trading volume of $10,034.33. The current market capitalization stands at approximately $181,787, ranking FYN at position 4067 among cryptocurrencies. With a circulating supply of 383,922,023 FYN tokens out of a maximum supply of 1,000,000,000, the circulating ratio is 38.39%. The fully diluted market capitalization is calculated at $473,500.

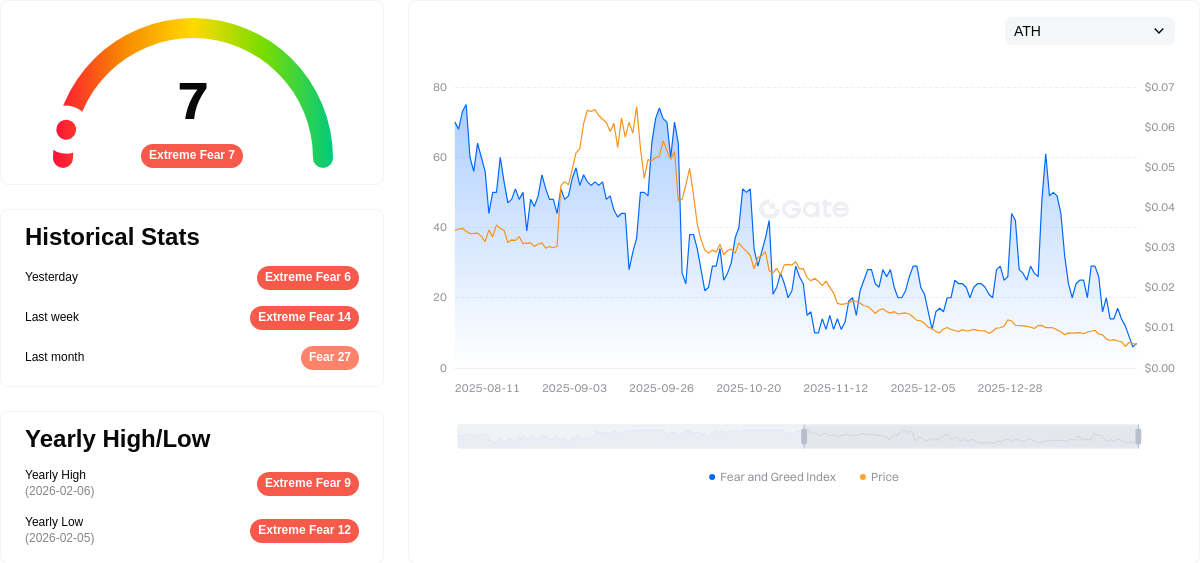

FYN maintains a market dominance of 0.000018%, with 28,243 token holders. The cryptocurrency market sentiment index currently registers at 7, indicating an "Extreme Fear" environment, which may influence trading behavior across the broader market.

Click to view the current FYN market price

FYN Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 7. This indicates investors are highly pessimistic about market conditions. Extreme fear typically presents both risks and opportunities—while market prices may face downward pressure, savvy investors often view such periods as potential entry points for long-term positioning. Market volatility remains elevated, and it's crucial to maintain disciplined risk management and avoid emotional decision-making during such turbulent times.

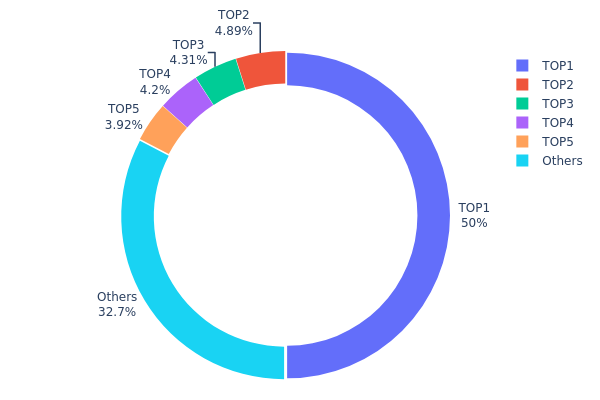

FYN Holdings Distribution

The holdings distribution chart reveals the concentration level of FYN tokens across different wallet addresses on the blockchain. This metric serves as a critical indicator of token decentralization and potential market manipulation risks. By analyzing the distribution pattern, investors can assess whether the token supply is broadly distributed among community participants or concentrated in the hands of a few major holders.

Current data shows a moderate concentration pattern in FYN's address distribution. The top holder controls 499,999.86K tokens, representing 49.99% of the total supply, indicating that nearly half of all FYN tokens are held by a single address. This is followed by four other major addresses holding between 3.91% and 4.88% each. Collectively, the top five addresses account for approximately 67.27% of the total supply, while the remaining 32.73% is distributed among other holders.

This concentration level suggests a centralized token structure that warrants careful consideration. The dominance of the largest holder creates potential vulnerabilities, including heightened price volatility risks and the possibility of significant market impact from single-address movements. Such concentration patterns typically indicate that FYN's on-chain structure remains in an early development phase, where token distribution has not yet achieved broad community dissemination. While this doesn't necessarily indicate immediate manipulation concerns, investors should remain vigilant about potential large-scale sell-offs or coordinated market actions that could materially affect token pricing dynamics.

Click to view current FYN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4d6b...47d51f | 499999.86K | 49.99% |

| 2 | 0x36d3...348e09 | 48889.19K | 4.88% |

| 3 | 0x76fa...894413 | 43063.92K | 4.30% |

| 4 | 0x6aa5...dd8666 | 41963.45K | 4.19% |

| 5 | 0xa5a5...e26763 | 39171.00K | 3.91% |

| - | Others | 326912.58K | 32.73% |

II. Core Factors Influencing FYN's Future Price

Supply and Demand Dynamics

- Supply-Demand Ratio: The price of FYN is primarily influenced by the balance between market supply and demand. When demand exceeds supply, prices tend to rise, while oversupply relative to demand may lead to price declines.

- Market Volatility: Cryptocurrency markets are characterized by significant price fluctuations. FYN's price movements can be affected by broader market sentiment, trading volumes, and liquidity conditions. Lower trading volumes may make prices more susceptible to manipulation, while higher volumes generally reflect more stable price discovery.

- Macroeconomic Trends: Changes in the global economic environment can impact FYN's valuation. Factors such as inflation rates, currency fluctuations, and interest rate adjustments by central banks may influence investor appetite for digital assets.

Regulatory Environment

- Policy Changes: Regulatory developments in major jurisdictions can significantly affect cryptocurrency prices. Enhanced regulatory clarity may boost investor confidence, while restrictive policies could dampen market enthusiasm.

- Compliance Requirements: As regulatory frameworks evolve, compliance obligations for cryptocurrency projects may increase, potentially impacting operational costs and market positioning.

Technological Advancements

- Innovation and Development: Technological improvements within the cryptocurrency ecosystem can enhance utility and adoption. While specific technical upgrades for FYN were not detailed in the available materials, general advancements in blockchain technology, scalability solutions, and security enhancements typically contribute to long-term value appreciation.

- Market Competition: The competitive landscape among cryptocurrencies affects individual project performance. Projects that demonstrate strong technical foundations and active development communities tend to attract more investor interest.

Investor Sentiment and Market Psychology

- Market Confidence: Investor perception plays a crucial role in price formation. Positive news, partnership announcements, or increased adoption can drive bullish sentiment, while negative developments may trigger sell-offs.

- Risk Appetite: Broader market risk tolerance influences capital flows into cryptocurrencies. During periods of risk-on sentiment, digital assets may benefit from increased investment, whereas risk-off environments could lead to capital outflows.

Company Performance and Fundamentals

- Project Development: The progress and execution of the project's roadmap, including feature releases and ecosystem expansion, can impact investor confidence and token valuation.

- Transparency and Communication: Clear communication from project teams regarding developments, challenges, and strategic directions helps maintain stakeholder trust and market stability.

III. 2026-2031 FYN Price Prediction

2026 Outlook

- Conservative Forecast: $0.00026 - $0.00047

- Neutral Forecast: $0.00047 (average scenario)

- Optimistic Forecast: Up to $0.00062 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: Gradual growth phase with moderate volatility as the project matures and expands its user base

- Price Range Forecast:

- 2027: $0.00028 - $0.00058 (projected 15% change)

- 2028: $0.00054 - $0.00077 (projected 19% change)

- 2029: $0.00036 - $0.00079 (projected 40% change)

- Key Catalysts: Platform development milestones, partnership announcements, broader cryptocurrency market trends, and increased token utility within the ecosystem

2030-2031 Long-Term Outlook

- Baseline Scenario: $0.00055 - $0.00107 (assuming steady ecosystem growth and market stability)

- Optimistic Scenario: $0.00073 - $0.00111 (contingent on successful platform expansion and favorable regulatory environment)

- Transformative Scenario: Potential to reach upper range of $0.00111 by 2031 (requires exceptional adoption rates, major partnerships, and sustained bull market conditions with projected 90% cumulative change)

- 2026-02-09: FYN trading near baseline levels (early stage of predicted growth trajectory)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00062 | 0.00047 | 0.00026 | 0 |

| 2027 | 0.00058 | 0.00055 | 0.00028 | 15 |

| 2028 | 0.00077 | 0.00056 | 0.00054 | 19 |

| 2029 | 0.00079 | 0.00066 | 0.00036 | 40 |

| 2030 | 0.00107 | 0.00073 | 0.00055 | 54 |

| 2031 | 0.00111 | 0.0009 | 0.00081 | 90 |

IV. FYN Professional Investment Strategy and Risk Management

FYN Investment Methodology

(I) Long-Term Holding Strategy

- Target Investors: Investors who believe in the long-term potential of metaverse and blockchain gaming integration

- Operational Recommendations:

- Consider accumulating positions during periods of market correction, as FYN has experienced notable volatility with a 34.46% decline over the past 30 days

- Monitor project development milestones related to Affyn's metaverse expansion and real-world integration features

- Utilize Gate Web3 Wallet for secure storage, ensuring private keys are stored offline and backed up properly

(II) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current 24-hour range shows support near $0.0004667 and resistance at $0.00055, which can be used for intraday trading decisions

- Volume Analysis: Monitor the 24-hour trading volume of approximately $10,034 to identify potential breakout opportunities

- Swing Trading Key Points:

- Given the 5.66% weekly decline, traders may consider short-term positions during oversold conditions with strict stop-loss orders

- Watch for correlation with broader Polygon ecosystem performance and metaverse sector trends

FYN Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: Up to 8% of crypto portfolio with active hedging strategies

(II) Risk Hedging Solutions

- Position Sizing: Limit single-position exposure given the token's relatively low market capitalization of approximately $181,787

- Diversification: Balance FYN holdings with established metaverse and gaming tokens to reduce concentration risk

(III) Secure Storage Solutions

- Mobile Wallet Recommendation: Gate Web3 Wallet offers convenient access while maintaining security for active traders

- Cold Storage Solution: For long-term holdings, consider transferring to hardware wallet solutions with multi-signature capabilities

- Security Considerations: Be cautious of phishing attempts, verify contract addresses (0x3B56a704C01D650147ADE2b8cEE594066b3F9421 on Polygon), and never share private keys

V. FYN Potential Risks and Challenges

FYN Market Risks

- High Volatility: The token has declined 80.83% over the past year, indicating significant price instability that may result in substantial losses

- Limited Liquidity: With a 24-hour trading volume of only $10,034 and trading on one exchange, large orders may face slippage and difficulty in execution

- Market Capitalization Concentration: With only 38.39% of tokens in circulation and a relatively small holder base of 28,243, the token may be susceptible to manipulation

FYN Regulatory Risks

- Gaming Token Classification: Evolving regulations around play-to-earn and metaverse tokens may impact FYN's utility and trading availability in certain jurisdictions

- Securities Compliance: Potential reclassification of gaming tokens as securities could affect the project's operational structure and token economics

- Cross-Border Operations: Affyn's integration of virtual and real-world elements may face scrutiny from multiple regulatory bodies across different regions

FYN Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token on Polygon, FYN is subject to potential smart contract exploits or bugs that could affect token functionality

- Blockchain Dependency: The project's reliance on Polygon network means any network congestion, security issues, or downtime could impact FYN operations

- Adoption Challenges: The success of Affyn's metaverse depends on user adoption and engagement, which remains uncertain in the competitive blockchain gaming landscape

VI. Conclusion and Action Recommendations

FYN Investment Value Assessment

FYN represents a speculative investment in the convergence of blockchain gaming and metaverse technology. While Affyn's vision of integrating virtual and real-world experiences on Polygon blockchain presents interesting potential, the token faces significant challenges including substantial price decline, limited liquidity, and intense market competition. The project's long-term value proposition depends heavily on successful execution of its metaverse platform and sustained user engagement. In the short term, investors should be prepared for continued volatility and risk of further price depreciation.

FYN Investment Recommendations

✅ Beginners: Avoid allocation or limit exposure to less than 1% of total crypto portfolio due to high volatility and limited track record ✅ Experienced Investors: Consider small speculative positions with clear exit strategies, focusing on project milestones and ecosystem development ✅ Institutional Investors: Conduct thorough due diligence on project fundamentals, team credentials, and partnership validations before any allocation

FYN Trading Participation Methods

- Spot Trading: Purchase FYN through Gate.com with proper risk management and position sizing

- Portfolio Integration: Include FYN as part of a diversified metaverse and gaming token portfolio to mitigate single-asset risk

- Research-Based Approach: Monitor project announcements, development updates, and community engagement before making investment decisions

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is FYN? What are its uses and characteristics?

FYN is a Web3 cryptocurrency token designed for decentralized finance applications. It features fast transaction processing, low fees, and strong community governance. FYN enables smart contract functionality and serves as a utility token within its ecosystem.

What is the historical price performance of FYN?

FYN reached an all-time high of ¥11.71 on February 1, 2022, but has since declined significantly. Currently, FYN trades in the ¥0.003259-¥0.003466 range, representing a 99.97% decrease from its peak. The token has experienced substantial volatility throughout its market history.

What is the FYN price prediction for 2024?

FYN price predictions for 2024 cannot be determined with certainty. As of February 8, 2026, the real-time price of 1 FYN is 0.7174 KRW. Cryptocurrency prices fluctuate significantly, so check the latest data before trading.

What are the main factors affecting FYN price?

FYN price is primarily influenced by market sentiment, investor confidence, trading volume, technology developments, and market demand. Positive news about adoption and breakthroughs drive price appreciation, while negative sentiment creates downward pressure on the token.

How to perform FYN price technical analysis?

FYN price technical analysis relies on trading volume, moving averages, and RSI indicators. Identify key support and resistance levels to determine entry and exit points. Analyze current market trends using real-time price charts and candlestick patterns for accurate predictions.

What are the advantages of FYN compared to similar tokens?

FYN stands out with its decentralized community governance model and stable market liquidity. With 1 billion total supply and strong public trading support, FYN maintains stable value proposition in the market.

What are the main risks of investing in FYN?

FYN investment risks include market volatility, high leverage exposure, rapid price fluctuations in crypto markets, and potential liquidity constraints. Investors should carefully assess their risk tolerance and market understanding before investing.

What are FYN's future development prospects and market potential?

FYN demonstrates innovative cryptocurrency technology with broad market potential and development space. Its unique features and novel applications attract specific user groups, driving market value growth and positioning it for significant expansion.

XRP Price Analysis 2025: Market Trends and Investment Outlook

Treasure NFT Marketplace: A 2025 Guide for Web3 Gamers and Investors

Mastering the Crypto Fear and Greed Index: 2025 Trading Strategies

What Is the Best Crypto ETF in 2025: Top Performers and Beginner's Guide

What is SwissCheese (SWCH) and How Does It Democratize Investment?

What Is the Best AI Crypto in 2025?

Rafał Zaorski – Who Is He? What Is His Net Worth?

Games You Can Earn Money From – TOP 11 Games in 2025

Six Cryptocurrencies That Have Achieved Over 1,000x Total Growth

How to Choose and Set Up the Best Cryptocurrency Wallet in Recent Years

NANO/XNO Cryptocurrency Project: Future Prospects and Analysis