2026 GAIN Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: GAIN's Market Position and Investment Value

Griffin AI (GAIN), as the fastest-growing no-code agent builder platform for DeFi, has achieved significant milestones since its launch in 2025. As of 2026, GAIN maintains a market capitalization of approximately $626,980, with a circulating supply of around 230 million tokens, and the price stabilizes near $0.002726. This asset, recognized as the "gas of agentic DeFi," is playing an increasingly critical role in revolutionizing decentralized finance through intelligent agent technology.

With over 15,000 live agents already deployed and partnerships with major blockchain ecosystems including BNB Chain, NEAR Protocol, Cardano Foundation, Arbitrum, 1inch, and Uniswap, Griffin AI is addressing a substantial market opportunity. The platform's Transaction Execution Agent (TEA) demonstrates practical utility by executing swaps and yield strategies seamlessly across major chains and wallets.

This article provides a comprehensive analysis of GAIN's price trends from 2026 to 2031, incorporating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to offer professional price forecasts and practical investment strategies for investors.

I. GAIN Price History Review and Market Status

GAIN Historical Price Evolution Trajectory

- 2025: Griffin AI launched its native token GAIN and achieved rapid growth in the DeFi agent builder market, with the price reaching a notable level of $0.24997 in September

- 2026: The market experienced significant volatility in January, with the price declining to $0.002676, representing a substantial correction from the previous high

GAIN Current Market Status

As of February 5, 2026, GAIN is trading at $0.002726, showing a decrease of 0.58% over the past 24 hours. The token has experienced mixed short-term performance, with a 0.95% decline in the last hour and a 2.22% decrease over the past week. The 30-day performance indicates a 25.66% decline, while the annual performance shows a 97.48% decrease from peak levels.

The current market capitalization stands at $626,980, with a circulating supply of 230 million tokens out of a total supply of 1 billion GAIN tokens, representing a 23% circulation ratio. The fully diluted market capitalization is $2.726 million. The 24-hour trading volume records $13,472.86, with GAIN ranking at position 2,854 in the cryptocurrency market.

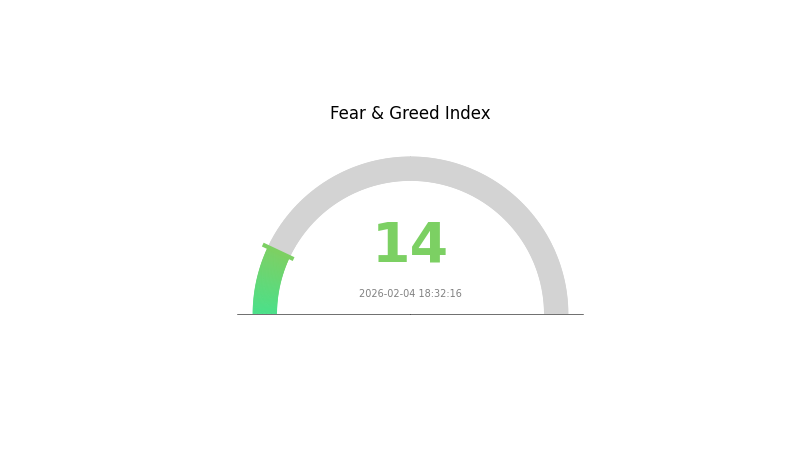

The token operates on the BSC (BNB Smart Chain) as a BEP-20 token, with a contract address at 0xa890f8ba60051ec8a5b528f056da362ba208a96f. The project maintains a holder base of 4,150 addresses and is listed on 3 exchanges, including Gate.com. The current market sentiment index indicates a reading of 14, classified as extreme fear territory.

Click to view current GAIN market price

GAIN Market Sentiment Index

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 14. This indicates heightened market anxiety and significant pessimism among investors. During periods of extreme fear, market volatility typically increases as traders react emotionally to negative sentiment. However, such conditions often create contrarian opportunities for long-term investors. Market participants should exercise caution while considering whether current prices present accumulation opportunities aligned with their investment strategy.

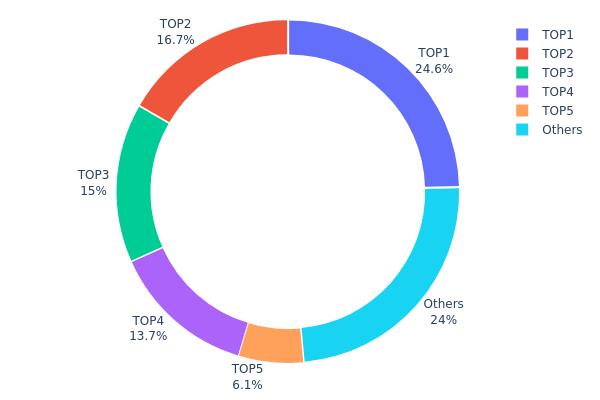

GAIN Holding Distribution

The holding distribution chart illustrates the concentration of token ownership across different wallet addresses, serving as a key indicator of decentralization and potential market manipulation risks. By examining the percentage of total supply held by top addresses, analysts can assess whether a token's ownership structure poses systemic risks to price stability and market integrity.

Current data reveals a moderate to high concentration pattern in GAIN's holding structure. The top five addresses collectively control approximately 76.01% of the total token supply, with the largest single address holding 24.58% (128,724.26K tokens). This concentration level suggests that a relatively small number of entities maintain significant influence over the token's circulating supply. The second and third-largest holders possess 16.69% and 14.99% respectively, while the remaining addresses outside the top five account for only 23.99% of total supply. Such distribution characteristics indicate limited decentralization in GAIN's current ownership landscape.

This concentrated holding pattern presents several implications for market dynamics. Large holders possess substantial power to influence price movements through coordinated selling or buying activities, potentially creating elevated volatility during periods of significant transactions. The dominance of top addresses may also limit organic price discovery mechanisms, as retail participants hold comparatively minimal influence over market direction. While concentrated holdings do not inherently indicate malicious intent, they introduce structural vulnerabilities that warrant careful monitoring by prospective investors and market participants.

Click to view current GAIN Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x73d8...4946db | 128724.26K | 24.58% |

| 2 | 0xa39c...b3c709 | 87381.20K | 16.69% |

| 3 | 0x6e0b...bed395 | 78518.52K | 14.99% |

| 4 | 0x08a0...1705cf | 71514.28K | 13.66% |

| 5 | 0x4982...6e89cb | 31908.62K | 6.09% |

| - | Others | 125465.71K | 23.99% |

II. Core Factors Influencing GAIN's Future Price

Supply Mechanism

- Market Demand Dynamics: GAIN's price movements are fundamentally driven by the interaction between market demand and available supply. Historical analysis of commodity markets demonstrates that price volatility often stems from shifts in consumption patterns and production capacity adjustments.

- Historical Patterns: Past observations indicate that periods of constrained supply, whether due to production disruptions or policy interventions, typically correlate with upward price pressure. Conversely, oversupply conditions have historically led to price corrections.

- Current Influence: Present market conditions suggest that supply-side factors continue to play a significant role in price determination, though the specific magnitude depends on evolving production capabilities and inventory levels.

Institutional and Major Player Dynamics

- Institutional Positioning: Large-scale market participants influence price discovery through their trading activities and strategic positioning decisions. Their collective behavior often serves as a leading indicator of broader market sentiment.

- Industry Adoption: The integration of relevant technologies and practices by established enterprises can create sustained demand patterns that support price stability or growth trajectories.

- Policy Framework: Regulatory developments at various governmental levels establish the operational environment that shapes market participation and investment flows.

Macroeconomic Environment

- Monetary Policy Impact: Central bank decisions regarding interest rates and liquidity conditions affect investment appetite across asset classes, creating spillover effects that influence pricing dynamics in related markets.

- Inflation Hedge Characteristics: During periods of currency depreciation concerns, certain assets demonstrate varying degrees of value preservation capability, though performance outcomes depend on multiple concurrent factors.

- Geopolitical Considerations: International relations and regional stability considerations contribute to risk assessment frameworks that market participants incorporate into their positioning strategies.

Technical Development and Ecosystem Building

- Analytical Framework Enhancement: Advances in fundamental analysis methodologies enable more sophisticated evaluation of value drivers, incorporating factors such as cost structures, profitability metrics, and supply chain dynamics.

- Data Infrastructure Improvements: Enhanced data collection and processing capabilities support more timely market assessments, allowing participants to respond more efficiently to emerging trends.

- Ecosystem Applications: The development of complementary analytical tools and market intelligence platforms contributes to improved price discovery mechanisms and market efficiency.

III. 2026-2031 GAIN Price Prediction

2026 Outlook

- Conservative prediction: $0.00223 - $0.00269

- Neutral prediction: $0.00269 (average price scenario)

- Optimistic prediction: $0.00309 (requires favorable market conditions and increased adoption)

The year 2026 may present a relatively stable to slightly declining trend for GAIN, with price change projections indicating a -1% movement. Market participants should maintain cautious expectations during this consolidation phase.

2027-2029 Outlook

- Market stage expectation: Gradual recovery and growth phase following initial consolidation

- Price range predictions:

- 2027: $0.00159 - $0.00416 (6% price change anticipated)

- 2028: $0.00335 - $0.00455 (29% price change anticipated)

- 2029: $0.00375 - $0.00593 (48% price change anticipated)

- Key catalysts: Enhanced market adoption, technological developments within the ecosystem, and broader cryptocurrency market momentum may drive price appreciation during this period

The mid-term outlook suggests progressive growth, with 2029 potentially marking a significant milestone as price change projections reach 48%, indicating strengthening market confidence.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00409 - $0.00728 (assuming steady ecosystem development and maintained market interest)

- Optimistic scenario: $0.00499 - $0.00785 (contingent upon accelerated adoption and favorable regulatory environment)

- Transformational scenario: Price could approach upper bounds if exceptional market conditions align, including breakthrough partnerships or major platform integrations

- 2026-02-05: GAIN trading within early-stage consolidation range as market establishes support levels

The long-term projections through 2031 suggest potential price appreciation of up to 124% compared to 2026 levels, with average price estimates reaching $0.00613 by 2031. However, investors should note that cryptocurrency markets remain highly volatile, and actual performance may vary significantly based on numerous external factors including regulatory developments, technological advancements, and overall market sentiment.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00309 | 0.00269 | 0.00223 | -1 |

| 2027 | 0.00416 | 0.00289 | 0.00159 | 6 |

| 2028 | 0.00455 | 0.00353 | 0.00335 | 29 |

| 2029 | 0.00593 | 0.00404 | 0.00375 | 48 |

| 2030 | 0.00728 | 0.00499 | 0.00409 | 82 |

| 2031 | 0.00785 | 0.00613 | 0.00392 | 124 |

IV. GAIN Professional Investment Strategy and Risk Management

GAIN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to DeFi infrastructure and AI-driven automation platforms

- Operational Recommendations:

- Consider accumulating positions during periods of reduced volatility, particularly when the token trades near key support levels

- Monitor integration announcements with major blockchain ecosystems as potential catalysts for price appreciation

- Utilize Gate Web3 Wallet for secure storage of GAIN tokens, enabling direct participation in platform governance and staking opportunities as they become available

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Track momentum shifts in GAIN's price action, particularly useful given the token's historical volatility patterns

- Relative Strength Index (RSI): Identify potential overbought or oversold conditions, especially important considering the token's recent 30-day decline of approximately 25%

- Trading Key Points:

- Establish clear entry and exit positions based on technical indicators and volume patterns

- Monitor the token's performance relative to broader DeFi sector movements and AI-related cryptocurrency trends

GAIN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of cryptocurrency portfolio allocation

- Active Investors: 3-7% of cryptocurrency portfolio allocation

- Professional Investors: 5-10% of cryptocurrency portfolio allocation, with potential for tactical overweighting based on market conditions

(2) Risk Hedging Approaches

- Portfolio Diversification: Balance GAIN holdings with established layer-1 tokens and stablecoins to reduce concentration risk

- Position Sizing: Implement gradual accumulation strategies rather than concentrated purchases, particularly given the token's limited trading history

(3) Secure Storage Solutions

- Gate Web3 Wallet Recommendation: Non-custodial solution supporting BSC-based tokens, providing user control over private keys while enabling seamless interaction with DeFi protocols

- Hardware Wallet Option: For larger holdings, consider transferring tokens to hardware wallets compatible with BEP-20 standard after initial acquisition

- Security Considerations: Enable two-factor authentication, maintain secure backup of recovery phrases, and verify contract addresses before transactions

V. GAIN Potential Risks and Challenges

GAIN Market Risks

- High Volatility Exposure: The token has experienced significant price fluctuations, with a year-to-date decline of approximately 97% from its historical peak, indicating substantial volatility risk

- Limited Liquidity Conditions: With a 24-hour trading volume of approximately $13,472, market depth may be insufficient for large transactions without price impact

- Market Concentration: Current circulation represents only 23% of total supply, suggesting potential selling pressure as additional tokens enter circulation

GAIN Regulatory Risks

- DeFi Regulatory Uncertainty: Ongoing global discussions regarding DeFi regulation could impact platform operations and token utility

- AI Technology Oversight: Emerging regulatory frameworks for AI systems may introduce compliance requirements affecting the platform's automated agents

- Cross-border Operational Challenges: Integration with multiple blockchain ecosystems across different jurisdictions may create regulatory complexity

GAIN Technical Risks

- Smart Contract Vulnerabilities: As with all blockchain-based platforms, potential security vulnerabilities in smart contracts could affect token value and platform functionality

- Integration Dependencies: Platform success relies on continued partnerships with major blockchain networks and DeFi protocols, creating third-party dependency risks

- Technology Evolution Pressure: Rapid advancement in AI and blockchain sectors requires continuous platform development to maintain competitive positioning

VI. Conclusion and Action Recommendations

GAIN Investment Value Assessment

GAIN represents a position in the intersection of DeFi infrastructure and AI automation, targeting a substantial market opportunity where traditional DeFi projects may lack advanced AI capabilities. The platform's partnerships with established blockchain ecosystems including BNB Chain, NEAR Protocol, and Cardano Foundation provide foundational credibility. However, investors should carefully consider the token's current early-stage market position, reflected in its relatively low market capitalization of approximately $626,980 and limited trading history. The significant price decline from historical peaks underscores the elevated risk profile typical of emerging cryptocurrency projects.

GAIN Investment Recommendations

✅ Beginners: Consider small exploratory positions only after developing foundational understanding of DeFi mechanisms and AI agent functionality. Prioritize education about the platform's technology before making investment decisions.

✅ Experienced Investors: Evaluate GAIN as a speculative allocation within a diversified DeFi portfolio, maintaining strict position sizing discipline. Monitor integration developments and agent adoption metrics as indicators of platform traction.

✅ Institutional Investors: Conduct comprehensive due diligence on the platform's technical architecture, team credentials, and competitive positioning. Consider pilot deployments of Griffin AI agents to assess practical utility before significant token allocation.

GAIN Trading Participation Methods

- Spot Trading: Acquire GAIN tokens through Gate.com spot markets, enabling direct ownership and potential participation in platform governance

- Gradual Accumulation: Implement dollar-cost averaging strategies to reduce timing risk, particularly given current market volatility

- Monitoring Integration Milestones: Track announcements of new blockchain integrations and partnership developments as potential catalysts for increased adoption

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make careful decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What factors influence GAIN token price movements?

GAIN token price is influenced by supply and demand dynamics, market liquidity, trading volume, investor sentiment, broader crypto market trends, and speculative trading activity.

How to analyze GAIN price trends using technical analysis?

Study historical price movements and chart patterns using moving averages, RSI, and MACD indicators. Analyze trading volume trends and support/resistance levels to identify potential price direction and momentum shifts for GAIN.

What is the current market cap and trading volume of GAIN?

As of February 2026, GAIN has a market cap of approximately $0.22 billion USD. Trading volume data is currently unavailable. Market metrics fluctuate based on trading activity and market conditions.

What are the risks and volatility factors for GAIN price prediction?

GAIN price prediction involves market volatility risks including price fluctuations, trading volume changes, and market sentiment shifts. High volatility can cause significant price swings, affecting investment returns. Key factors include regulatory changes, macroeconomic conditions, and adoption trends impacting GAIN's market performance.

How does GAIN compare to other similar tokens in the market?

GAIN demonstrates competitive advantages with growing market cap and trading volume. Its innovative features and strong community engagement position it favorably against comparable tokens. As of 2026, GAIN shows robust market momentum and growth potential.

What is the historical price performance of GAIN token?

GAIN token's price fluctuated between $0.002714 and $0.00277 over the last 24 hours. In the past week, it ranged from $0.002695 to $0.00277, demonstrating moderate volatility typical of emerging digital assets in current market conditions.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Is Göztepe S.K. Fan Token (GOZ) a good investment?: A comprehensive analysis of risks, returns, and market potential for football fans and crypto investors

Is Griffin AI (GAIN) a good investment?: A Comprehensive Analysis of the Emerging AI Token's Potential and Risks

Is STEPN Failing to Generate Profits? Exploring the Factors Behind Its Downturn

LABUBU vs BTC: Which Digital Asset Will Dominate the Future of Collectibles and Cryptocurrency?

GOZ vs BTC: Which Cryptocurrency Offers Better Investment Potential in 2024?