2026 GORK Price Prediction: Expert Analysis and Market Outlook for the Emerging Meme Coin

Introduction: GORK's Market Position and Investment Value

XAI gork (GORK), positioned as a meme coin on the Solana blockchain inspired by xAI's Grok AI chatbot, has gained attention through humorous social media interactions and community engagement since its launch in 2025. As of 2026, GORK has a market capitalization of approximately $434,197, with a circulating supply of about 999.99 million tokens, and the price remains around $0.0004342. This asset, characterized by its community-driven nature, is operating within the broader meme coin ecosystem on Solana.

This article will comprehensively analyze GORK's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem developments, and macroeconomic environments to provide investors with professional price forecasts and practical investment strategies.

I. GORK Price History Review and Market Overview

GORK Historical Price Evolution Trajectory

- 2025: GORK experienced significant volatility throughout the year, reaching an all-time high of $0.0955 on May 4, 2025, reflecting strong initial market enthusiasm for this Solana-based meme coin inspired by xAI's Grok AI chatbot.

- 2026: The token entered a substantial correction phase, with prices declining sharply from previous highs. By February 5, 2026, GORK recorded its all-time low of $0.0004329, representing a considerable decline from its peak levels.

GORK Current Market Status

As of February 6, 2026, GORK is trading at $0.0004342, with a 24-hour trading volume of $19,710.18. The token has experienced notable price fluctuations across different timeframes: a -0.29% change over the past hour, -15.09% decline in the last 24 hours, and a -37.45% decrease over the past week. The 30-day performance shows a -57.72% decline, while the one-year performance indicates a 577.64% increase from its initial trading levels.

The current market capitalization stands at approximately $434,197, with a fully diluted market cap of $434,200. GORK has a circulating supply of 999,993,741 tokens, representing 100% of the total and maximum supply of 1 billion tokens. The token's 24-hour price range spans from $0.0004329 to $0.000543. With a market dominance of 0.000018% and approximately 15,623 holders, GORK maintains a presence within the broader cryptocurrency ecosystem on the Solana blockchain. The current market sentiment indicator reflects an extreme fear level at 12.

Click to view the current GORK market price

GORK Market Sentiment Index

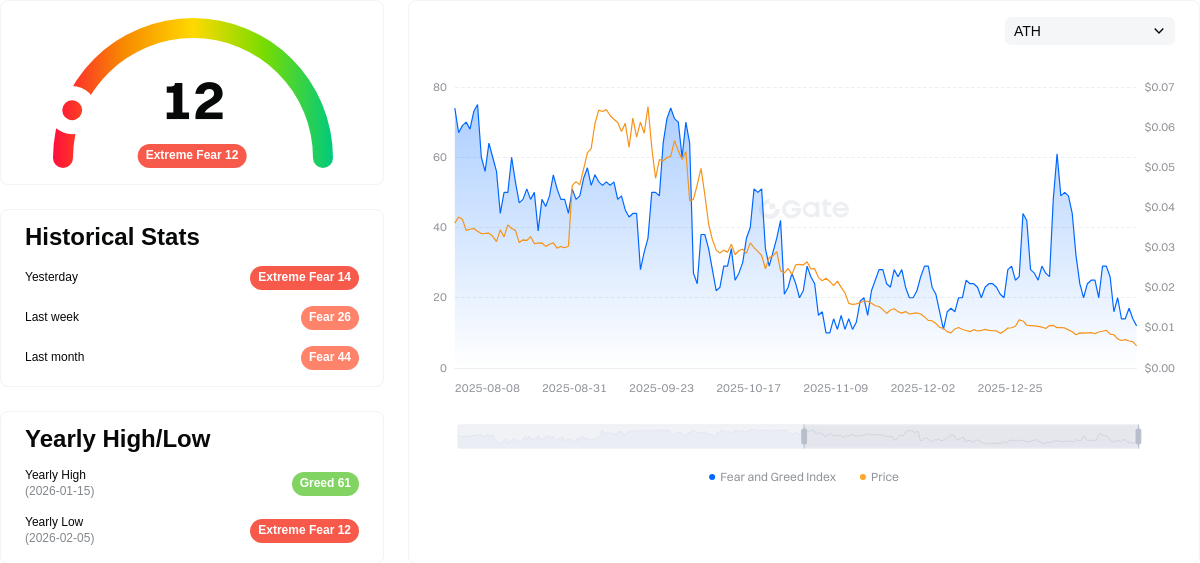

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of 12. This exceptionally low reading indicates widespread pessimism and risk aversion among investors. Market participants are showing significant anxiety about asset valuations and future price movements. During such periods of extreme fear, contrarian investors often identify potential buying opportunities, as sentiment-driven selling may create undervalued assets. However, cautious risk management remains essential, as market volatility typically accompanies such fearful conditions. Monitoring both technical indicators and fundamental developments becomes crucial for making informed trading decisions in this sentiment environment.

GORK Holding Distribution

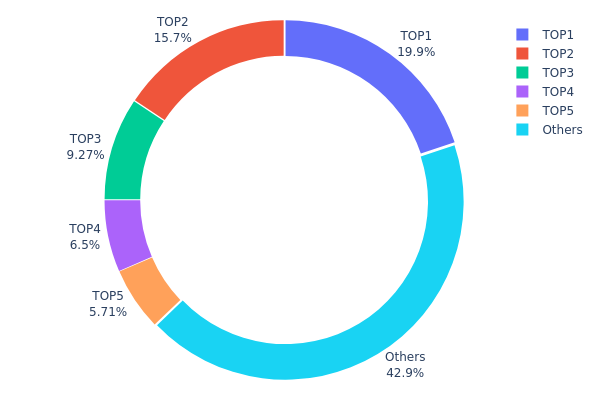

The holding distribution chart illustrates the concentration of token holdings across wallet addresses, serving as a critical indicator of decentralization and market structure. By analyzing the percentage of total supply controlled by top holders, researchers can assess potential risks related to price manipulation, selling pressure, and overall network health.

Based on current data, GORK exhibits a moderately concentrated holding pattern. The top holder controls approximately 19.88% of the total supply (198.84 million tokens), followed by the second-largest address holding 15.71% (157.14 million tokens). Cumulatively, the top five addresses account for 57.05% of the circulating supply, while the remaining 42.95% is distributed among other participants. This concentration level suggests that a relatively small group of entities possesses significant control over the token's market dynamics, which is not uncommon for emerging crypto assets but warrants careful monitoring.

Such a distribution structure carries several implications for market behavior. The substantial holdings controlled by top addresses create potential for heightened volatility, as large-scale transactions by these entities could trigger significant price movements. Furthermore, the concentration of over half the supply among five addresses raises concerns about coordinated selling or market manipulation risks. On the positive side, the 42.95% held by other addresses indicates a degree of community participation, though further decentralization would strengthen the token's resilience against single-point influence. From a market maturity perspective, this distribution pattern reflects an early-stage asset where institutional or founding stakeholders maintain dominant positions, typical of projects still establishing broader adoption and liquidity depth.

Click to view current GORK Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 37iWFS...WKn6iK | 198839.51K | 19.88% |

| 2 | u6PJ8D...ynXq2w | 157137.70K | 15.71% |

| 3 | 66toWR...iay9Sq | 92675.75K | 9.26% |

| 4 | 9ZPsRW...ZgE4Y4 | 64983.11K | 6.49% |

| 5 | 5PAhQi...cnPRj5 | 57138.60K | 5.71% |

| - | Others | 429076.55K | 42.95% |

II. Core Factors Influencing GORK's Future Price

Supply Mechanism

- Fixed Total Supply: GORK has a total supply of 6,900,000,000 tokens, with approximately 6,319,112,219 tokens currently in circulation. This fixed supply cap creates potential scarcity dynamics that may influence long-term price behavior.

- Historical Pattern: The token experienced significant price volatility since its 2023 launch, reaching an all-time high of $0.031 before correcting to an all-time low of $0.0004135 in 2025, reflecting the impact of supply distribution and market sentiment shifts.

- Current Impact: With over 91% of total supply already in circulation, the remaining token releases may have limited dilutive effects on price, potentially supporting stability as the circulating supply approaches the maximum cap.

Institutional and Major Holder Dynamics

- Institutional Holdings: As a decentralized meme project, GORK currently lacks significant institutional backing compared to traditional cryptocurrencies, with investment decisions primarily driven by retail community engagement.

- Enterprise Adoption: GORK positions itself as a fun project inspired by Elon Musk's AI initiative, though specific enterprise-level adoptions have not been documented in available materials.

- Regulatory Environment: The regulatory landscape for meme tokens remains uncertain, with potential policy developments in major markets that could affect trading conditions and investor access.

Macroeconomic Environment

- Monetary Policy Impact: Broader cryptocurrency market sentiment remains sensitive to central bank policies, particularly regarding interest rates and liquidity conditions, which may indirectly influence speculative assets like GORK.

- Inflation Hedge Properties: As a meme token with limited utility beyond community engagement, GORK's inflation hedge characteristics differ substantially from established cryptocurrencies, with price movements more closely tied to market sentiment than macroeconomic fundamentals.

- Geopolitical Factors: International market dynamics and regulatory developments in key jurisdictions may affect overall crypto market liquidity, potentially influencing GORK's trading volumes and price stability.

Technology Development and Ecosystem Building

- Ethereum Network Foundation: GORK operates as a fully decentralized project on the Ethereum blockchain, benefiting from the network's security and established infrastructure while remaining subject to Ethereum's transaction costs and scalability considerations.

- Community-Driven Development: As a meme project, GORK's development trajectory depends heavily on community engagement and social media momentum rather than formal technological upgrades or protocol improvements.

- Ecosystem Applications: The token's utility primarily centers around community participation and social trading dynamics, with limited DApp integrations or formal ecosystem partnerships documented in available materials.

III. 2026-2031 GORK Price Forecast

2026 Outlook

- Conservative Forecast: $0.00029 - $0.00044

- Neutral Forecast: $0.00044 (average scenario)

- Optimistic Forecast: $0.00059 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: The token may enter a gradual growth phase, with potential price consolidation as the project matures and expands its user base.

- Price Range Forecast:

- 2027: $0.00036 - $0.00073

- 2028: $0.00044 - $0.00071

- 2029: $0.00057 - $0.00076

- Key Catalysts: Ecosystem development, strategic partnerships, potential exchange listings on platforms like Gate.com, and broader market recovery could serve as primary drivers for price appreciation.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00063 - $0.00071 in 2030 (assuming steady ecosystem growth and moderate market conditions)

- Optimistic Scenario: $0.00052 - $0.00108 by 2031 (contingent on significant protocol upgrades and increased market adoption)

- Transformative Scenario: Approaching $0.00108 (requires exceptional developments such as major institutional adoption or breakthrough use cases)

- 2026-02-06: GORK price predictions suggest potential growth of 1% to 74% over the next five years, depending on market dynamics and project execution.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00059 | 0.00044 | 0.00029 | 1 |

| 2027 | 0.00073 | 0.00052 | 0.00036 | 18 |

| 2028 | 0.00071 | 0.00062 | 0.00044 | 43 |

| 2029 | 0.00076 | 0.00067 | 0.00057 | 53 |

| 2030 | 0.0008 | 0.00071 | 0.00063 | 63 |

| 2031 | 0.00108 | 0.00076 | 0.00052 | 74 |

IV. GORK Professional Investment Strategy and Risk Management

GORK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance and interest in meme coin communities

- Operational Recommendations:

- Monitor community engagement and social media sentiment on platforms like Twitter to gauge project momentum

- Consider dollar-cost averaging to mitigate entry price volatility, especially given the 37.45% 7-day decline

- Storage Solution: Use Gate Web3 Wallet for secure storage with multi-signature protection and regular security audits

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of approximately $19,710 to identify liquidity trends and potential breakout patterns

- Support/Resistance Levels: Track the 24-hour range between $0.0004329 (also the all-time low) and $0.000543 to establish entry and exit points

- Swing Trading Considerations:

- The 57.72% decline over 30 days suggests high volatility, creating potential swing trading opportunities

- Set strict stop-loss orders given the token's proximity to its all-time low price

GORK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio allocation

- Aggressive Investors: 2-5% of crypto portfolio allocation

- Professional Investors: Up to 10% of speculative crypto allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance GORK holdings with established cryptocurrencies and stablecoins

- Position Sizing: Limit single position exposure to avoid concentrated losses in this high-volatility meme coin

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading with convenient access to Gate.com trading features

- Cold Storage Solution: Consider hardware wallet solutions for long-term holdings exceeding $1,000

- Security Precautions: Enable two-factor authentication, verify contract address (38PgzpJYu2HkiYvV8qePFakB8tuobPdGm2FFEn7Dpump) before transactions, and never share private keys

V. GORK Potential Risks and Challenges

GORK Market Risks

- Extreme Price Volatility: The token has declined 57.72% in 30 days and 37.45% in 7 days, demonstrating significant downside risk

- Low Market Capitalization: With a market cap of approximately $434,197, the token is susceptible to manipulation and low liquidity

- Meme Coin Dependency: As a meme coin inspired by xAI's Grok chatbot, value relies heavily on social media trends and community engagement rather than fundamental utility

GORK Regulatory Risks

- Meme Coin Classification: Regulatory authorities may classify meme coins differently, potentially restricting trading or listing options

- Jurisdictional Uncertainty: Solana-based tokens face varying regulatory treatment across different countries

- Compliance Requirements: Evolving cryptocurrency regulations may impact accessibility and trading venues for GORK

GORK Technical Risks

- Smart Contract Vulnerabilities: As a Solana-based token, GORK depends on the security and stability of the underlying blockchain infrastructure

- Network Congestion: Solana network outages or congestion could impact transaction processing and token liquidity

- Project Longevity: Limited exchange listings (currently 1 exchange) and approximately 15,623 holders suggest uncertain long-term sustainability

VI. Conclusion and Action Recommendations

GORK Investment Value Assessment

GORK represents a high-risk, speculative meme coin investment with limited fundamental value proposition. While the token has shown a 577.64% gain over one year, recent performance indicates significant bearish pressure, with the price approaching its all-time low of $0.0004329. The token's value derives primarily from community engagement and social media sentiment rather than technological innovation or utility. Current market conditions suggest caution, with the fully diluted market cap matching circulating market cap at 100%, indicating no supply overhang but also limited growth catalysts beyond community-driven demand.

GORK Investment Recommendations

✅ Beginners: Avoid or allocate no more than 0.5% of crypto portfolio; focus on understanding meme coin dynamics before investing ✅ Experienced Investors: Consider small speculative positions (1-3% allocation) with strict stop-loss orders; monitor social media sentiment and trading volume closely ✅ Institutional Investors: Generally unsuitable due to low liquidity, high volatility, and lack of fundamental value drivers; if participating, limit to experimental innovation portfolios

GORK Trading Participation Methods

- Spot Trading: Purchase GORK on Gate.com with fiat or cryptocurrency pairs, suitable for investors seeking direct exposure

- Dollar-Cost Averaging: Implement systematic purchasing at regular intervals to mitigate timing risk in this volatile asset

- Technical Trading: Utilize Gate.com's advanced trading tools to execute strategies based on volume analysis and price action patterns

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is GORK? What are its main uses and features?

GORK is an intelligent conversational AI assistant by xAI. It excels at information queries, copywriting, code generation, knowledge explanation, and data analysis through natural language interaction.

What is the price prediction for GORK in 2024?

GORK's 2024 price prediction ranges from $0.000433 to $0.000910, with optimistic scenarios potentially reaching $0.001262. All predictions carry high uncertainty and actual performance may vary significantly.

What is GORK's historical price performance and what are the main factors affecting its price?

GORK has exhibited high volatility with a 24-hour decline of 8.35% and 7-day decline of 11.64%. Key factors influencing its price include market volatility, limited liquidity, trading volume fluctuations, and broader market sentiment in the AI token sector.

What are the risks of investing in GORK? How should I evaluate this project?

GORK faces market speculation and tokenomics volatility risks. Evaluate the project by analyzing its real utility, development roadmap, and long-term expansion potential. Compare tokenomics with similar projects and monitor community engagement and technical progress.

What are the advantages and disadvantages of GORK compared to other well-known cryptocurrencies such as Bitcoin and Ethereum?

GORK is newer with higher growth potential but less market maturity than Bitcoin and Ethereum. Bitcoin and Ethereum have established networks, larger transaction volumes, and greater stability. GORK offers innovation opportunities but carries higher risk due to smaller liquidity and shorter track record.

What is GORK's team background and development roadmap?

GORK is developed by xAI team under Elon Musk's AI initiatives. The project features progressive versions from Grok 1 to 4, with continuous advancement in AI capabilities and performance optimization designed for enhanced user interaction and understanding.

How to buy and trade GORK tokens? On which exchanges can you trade?

You can purchase GORK tokens through decentralized exchanges by connecting your Web3 wallet. Simply select GORK as your trading pair, specify the amount, and execute the transaction on-chain. DEX platforms offer real-time market prices and cross-chain bridge options for seamless trading across multiple blockchain networks.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

Is StarHeroes (STARHEROES) a good investment?: A Comprehensive Analysis of Price Potential, Risk Factors, and Market Outlook for 2024

Is Buz Economy (BUZ) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects

PENG vs ZIL: A Comprehensive Comparison of Two Emerging Blockchain Tokens in the DeFi Ecosystem

SOPHIA vs KAVA: A Comprehensive Comparison of Two Leading Blockchain Platforms

STARHEROES vs BNB: Which Blockchain Token Offers Better Investment Potential in 2024?