2026 HEU Price Prediction: Expert Analysis and Market Forecast for Highly Enriched Uranium

Introduction: HEU's Market Position and Investment Value

Heurist (HEU), as a decentralized AI-as-a-Service cloud platform, has been serving the blockchain and artificial intelligence sectors since its launch in 2024. By aggregating computing resources from individual GPU owners and data centers, it provides developers with serverless AI services through an API-first infrastructure. As of February 2026, HEU has a market capitalization of approximately $1.42 million, with a circulating supply of around 196 million tokens, and the price is maintained at approximately $0.00722. This asset, which bridges decentralized computing and AI services, is playing an increasingly important role in providing cost-efficient and censorship-free AI integration solutions.

This article will comprehensively analyze HEU's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. HEU Price History Review and Market Status

HEU Historical Price Evolution Trajectory

- December 2024: HEU launched on Gate.com with a publish price of $0.07, experiencing significant market volatility in its early trading period

- December 28, 2024: Price reached a peak of $0.462, representing the highest level since listing

- January 2026: Market entered a correction phase, with price declining substantially from previous highs

- January 31, 2026: Price touched a low of $0.00613, marking the lowest point in the token's trading history

HEU Current Market Dynamics

As of February 2, 2026, HEU is trading at $0.00722, showing a 24-hour decrease of 9.15%. The token has demonstrated mixed short-term performance, with a 1-hour decline of 1.77% and a 7-day decrease of 31.61%. Over the past 30 days, HEU has experienced a 33.51% decline.

The token's market capitalization stands at approximately $1.42 million, with a 24-hour trading volume of $41,423.17. The circulating supply represents 196.09 million tokens, accounting for 19.61% of the total supply of 1 billion HEU tokens. The fully diluted market cap is calculated at $7.22 million.

HEU's current price represents a significant reduction from its December 2024 peak, down approximately 98.44% from the high of $0.462. The token maintains a market share of 0.00027% and is available for trading on 4 exchanges. The holder count has reached 47,505 participants.

The 24-hour price range spans from $0.00657 to $0.00872. Market sentiment indicators show an extreme fear reading of 14 on the volatility index, suggesting heightened caution among market participants.

Click to view current HEU market price

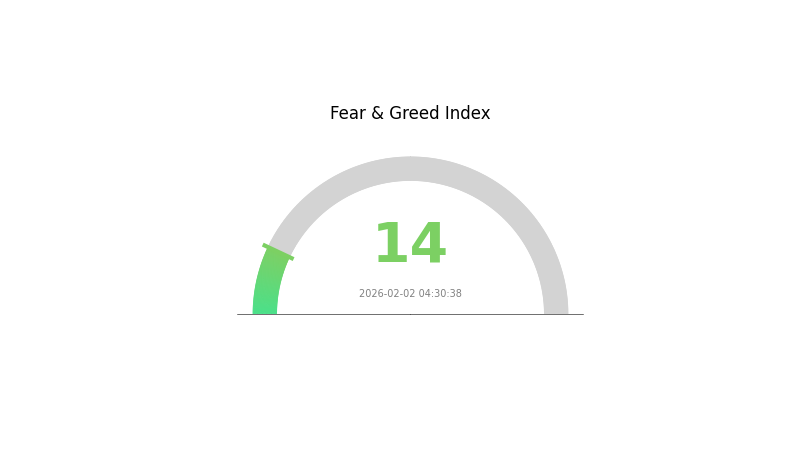

HEU Market Sentiment Index

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of 14. This exceptionally low level indicates heightened pessimism and risk aversion among investors. Market participants are showing significant concern about potential downside risks, suggesting defensive positioning and reduced appetite for risk assets. Such extreme fear conditions have historically presented contrarian opportunities for value-oriented investors. However, caution remains warranted until sentiment stabilizes and market conditions show signs of improvement. Monitor key support levels and market indicators closely during this volatile period.

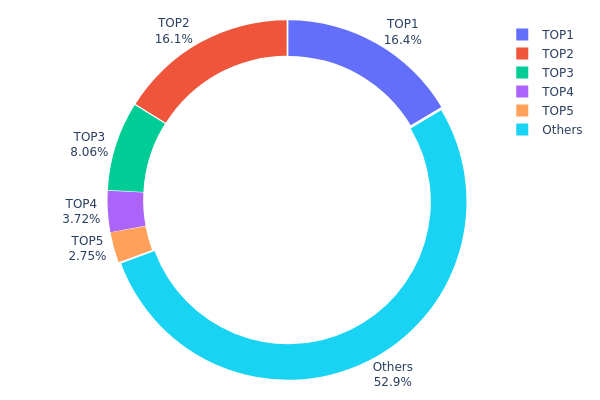

HEU Token Holding Distribution

The token holding distribution chart illustrates the concentration of HEU tokens across different wallet addresses, providing crucial insights into the decentralization level and potential market dynamics of the asset. By examining how tokens are distributed among top holders versus the broader community, analysts can assess the risk of price manipulation and evaluate the overall health of the token's ecosystem.

Current data reveals a moderately concentrated holding structure for HEU. The top two addresses collectively control approximately 32.52% of the total supply, with the largest holder possessing 16.42% (30,654.71K tokens) and the second-largest holding 16.10% (30,055.30K tokens). When expanding the view to the top five addresses, concentration increases to 47.04%, while the remaining 52.96% is distributed among other participants. This distribution pattern suggests a semi-centralized structure where major stakeholders maintain significant influence, yet more than half of the circulating supply remains dispersed across the broader market.

From a market structure perspective, this concentration level presents both opportunities and risks. The substantial holdings by top addresses could indicate strong institutional confidence or long-term strategic positioning, potentially providing price stability during volatile market conditions. However, the significant control by top holders also introduces vulnerability to coordinated selling pressure or market manipulation. Any substantial movement from these addresses could trigger cascading effects on HEU's price, particularly given that nearly half of the supply is controlled by just five entities. The 52.96% holding by other addresses provides some cushion for decentralization, though the ecosystem would benefit from further distribution to enhance resilience and reduce concentration risk.

Click to view current HEU Token Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfa13...95761c | 30654.71K | 16.42% |

| 2 | 0xa9c1...7c1bb2 | 30055.30K | 16.10% |

| 3 | 0x0d07...b492fe | 15031.80K | 8.05% |

| 4 | 0xbeb7...4b3d31 | 6945.52K | 3.72% |

| 5 | 0x4e3a...a31b60 | 5140.99K | 2.75% |

| - | Others | 98786.06K | 52.96% |

II. Core Factors Influencing HEU's Future Price

Supply Mechanism

- Natural Uranium Production Constraints: Global uranium mining faces structural limitations due to prolonged low capital investment and concentrated supply in politically unstable regions. Historical production cycles require 10-20 years from exploration to output, making supply highly inelastic.

- Historical Patterns: During 2005-2007, uranium prices surged to $138/lb driven by supply disruptions and demand growth. Following the 2011 Fukushima incident, prices declined to $18/lb by 2016 as demand weakened while supply remained elevated.

- Current Impact: Since August 2023, uranium prices have accelerated upward due to Niger's processing facility shutdown, Cameco's production guidance reduction, and U.S. import restrictions on enriched uranium. Short-term supply releases are concentrated in 2023-2026, but long-term scarcity persists.

Institutional and Major Holder Dynamics

- Institutional Holdings: Financial institutions like Sprott and Yellow Cake have continuously accumulated physical uranium inventories, intensifying market tightness. Commercial inventories held by utilities and suppliers are estimated at approximately 386,000 tU globally as of 2023, equivalent to about 5.4 years of demand, though actual releasable volumes may be significantly lower.

- Corporate Adoption: Technology giants including Microsoft have begun nuclear power deployment for AI data center energy needs, signaling potential transition of nuclear demand from expectation to reality.

- National Policies: The U.S. enacted legislation banning certain enriched uranium imports by 2028, while Russia implemented export restrictions on enriched uranium in November 2024. Kazakhstan adjusted its mining extraction tax structure in July 2024, potentially constraining domestic expansion economics.

Macroeconomic Environment

- Monetary Policy Influence: Global nuclear power revival trends remain clear despite near-term price volatility. The IAEA projects global nuclear capacity reaching 543 GW by 2035, representing a 2.9% CAGR from 2024-2035.

- Inflation Hedge Characteristics: Nuclear energy's low-carbon, stable, and high-energy-density attributes position it as a preferred power source for AI development, potentially driving uranium demand beyond traditional utility baselines.

- Geopolitical Factors: Supply disruption risks persist given uranium's concentrated production in developing nations with frequent political instability. Recent concerns over potential nuclear arms reduction agreements affecting high-enriched uranium (HEU) conversion to low-enriched uranium (LEU) for civilian use appear overreacted, as current geopolitical dynamics differ substantially from the 1993 Megatons to Megawatts program context.

Technical Development and Ecosystem Construction

- Enrichment Capacity Constraints: Global uranium enrichment capacity has shifted from surplus to shortage since 2022, with separative work unit (SWU) prices tripling to $176. New capacity faces significant barriers due to strategic sensitivity and capital intensity, likely sustaining constraints on re-enriched tails and underfeeding supply.

- Advanced Reactor Technologies: Development of small modular reactors (SMR) and high-assay low-enriched uranium (HALEU) production capabilities represents emerging demand drivers. Companies like Centrus Energy hold exclusive HALEU production licensing in the U.S., positioning them at policy and geopolitical price-volume pivots.

- Ecosystem Applications: Expanding nuclear applications beyond traditional baseload power generation into AI data center energy supply demonstrates uranium's evolving role in the global energy transition, with potential structural demand shifts favoring nuclear over other generation sources.

III. 2026-2031 HEU Price Prediction

2026 Outlook

- Conservative Prediction: $0.00628 - $0.00757

- Neutral Prediction: $0.00757 - $0.00893

- Optimistic Prediction: $0.00893 (requires favorable market conditions and ecosystem development)

2027-2029 Outlook

- Market Stage Expectation: The token may enter a steady growth phase, with gradual market recognition and adoption. Price movements could reflect broader crypto market trends alongside project-specific developments.

- Price Range Prediction:

- 2027: $0.00553 - $0.01163

- 2028: $0.00716 - $0.01472

- 2029: $0.00814 - $0.01492

- Key Catalysts: Potential factors driving price movement may include technological upgrades, ecosystem expansion, increased user adoption, and overall cryptocurrency market sentiment shifts.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00804 - $0.01362 (assuming moderate market growth and stable project development)

- Optimistic Scenario: $0.01362 - $0.01662 (requires sustained project momentum and favorable regulatory environment)

- Transformative Scenario: $0.00847 - $0.01694 (contingent upon significant adoption breakthroughs and market-wide positive catalysts)

- 2026-02-02: HEU maintains early-stage positioning with potential for gradual appreciation

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00893 | 0.00757 | 0.00628 | 0 |

| 2027 | 0.01163 | 0.00825 | 0.00553 | 9 |

| 2028 | 0.01472 | 0.00994 | 0.00716 | 31 |

| 2029 | 0.01492 | 0.01233 | 0.00814 | 62 |

| 2030 | 0.01662 | 0.01362 | 0.00804 | 79 |

| 2031 | 0.01694 | 0.01512 | 0.00847 | 99 |

IV. HEU Professional Investment Strategies and Risk Management

HEU Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Individuals who believe in the potential of decentralized AI infrastructure and are willing to accept high volatility

- Operational Recommendations:

- Consider accumulating positions during significant price pullbacks, given HEU's recent decline of over 31% in the past 7 days

- Monitor project development milestones and ecosystem expansion to assess long-term viability

- Store assets securely using Gate Web3 Wallet for convenient access and management

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track short-term (7-day) and medium-term (30-day) price trends to identify potential entry and exit points

- Volume Analysis: Monitor the 24-hour trading volume ($41,423) to gauge market interest and liquidity conditions

- Swing Trading Considerations:

- Be aware of high volatility, with 24-hour price range between $0.00657 and $0.00872

- Set appropriate stop-loss levels to protect against sudden downward movements

HEU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio

- Aggressive Investors: 5-10% of crypto portfolio

- Professional Investors: May consider higher allocations based on thorough due diligence and risk tolerance

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance HEU holdings with established cryptocurrencies and stablecoins

- Position Sizing: Avoid over-concentration in a single asset, especially given HEU's relatively low market cap of approximately $1.42 million

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and convenient access

- Cold Storage Option: Consider hardware wallets for long-term holdings to minimize security risks

- Security Precautions: Enable two-factor authentication, regularly update security settings, and never share private keys or seed phrases

V. HEU Potential Risks and Challenges

HEU Market Risks

- High Volatility: HEU has experienced a 31.61% decline over 7 days and 33.51% over 30 days, indicating significant price instability

- Low Liquidity: With a relatively modest 24-hour trading volume of $41,423 and listing on only 4 exchanges, liquidity constraints may lead to price slippage

- Market Cap Vulnerability: The current market cap of approximately $1.42 million represents only 19.61% of fully diluted valuation, suggesting potential dilution risks

HEU Regulatory Risks

- AI Services Regulation: Evolving regulations around decentralized AI services could impact project operations and token utility

- Jurisdictional Uncertainty: Regulatory treatment of AI-focused blockchain projects remains unclear in many regions

- Compliance Requirements: Future compliance obligations may affect the project's operational model and cost structure

HEU Technical Risks

- Infrastructure Dependencies: The project relies on aggregating GPU resources from individual owners and data centers, creating potential coordination challenges

- Competition: Rapidly evolving AI and blockchain landscapes may introduce competing solutions with superior technology or adoption

- Smart Contract Vulnerabilities: As an ERC-20 token deployed on Base and zkSync Era, HEU is subject to smart contract security risks inherent to blockchain platforms

VI. Conclusion and Action Recommendations

HEU Investment Value Assessment

HEU represents a high-risk, high-potential opportunity in the emerging decentralized AI infrastructure space. The project addresses growing demand for accessible, censorship-free AI services through its serverless API-first approach. However, recent price declines of over 30% in the past month and 89.7% from its all-time high, combined with low liquidity and market cap, underscore significant near-term volatility and uncertainty. Long-term value will depend on successful ecosystem development, user adoption, and the project's ability to differentiate in a competitive market.

HEU Investment Recommendations

✅ Beginners: Exercise extreme caution. If considering investment, limit exposure to a very small percentage of your portfolio and prioritize education about decentralized AI projects ✅ Experienced Investors: Conduct thorough due diligence on the project's technology, team, and roadmap. Consider small speculative positions with strict risk management protocols ✅ Institutional Investors: Evaluate as part of a diversified AI and blockchain infrastructure portfolio, with emphasis on fundamental analysis and long-term potential

HEU Trading Participation Methods

- Spot Trading: Purchase HEU directly on Gate.com or other supporting exchanges for long-term holding or active trading

- Dollar-Cost Averaging: Gradually accumulate positions over time to mitigate timing risk in volatile market conditions

- Portfolio Integration: Incorporate HEU as a minor component within a broader cryptocurrency and AI-focused investment strategy

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is HEU? What factors affect its price?

HEU is a cryptocurrency whose price is influenced by market sentiment, trading volume, technical development, and macroeconomic factors like interest rate changes. User adoption trends also play a significant role in price movement.

What is the historical price trend of HEU? What are the major changes in recent years?

HEU has experienced significant volatility over the past years. In the last 30 days, the price declined 2.31%. On February 2, 2026, HEU rose 3.48%. Market demand and investor sentiment drive major price movements.

How to predict HEU price? What are the analysis methods?

You can predict HEU price using technical analysis methods like moving averages and RSI indicators, combined with fundamental analysis by monitoring market demand, supply changes, and transaction volume trends.

What are the main risk factors affecting HEU price?

HEU price is primarily influenced by token scarcity, institutional investment flows, macroeconomic conditions, and ecosystem development. Market volatility and regulatory changes also impact price movements significantly.

How is HEU price correlated with other commodities or assets?

HEU price correlation is influenced by market demand, investor sentiment, and global economic factors. It shows certain correlation with major cryptocurrencies like Bitcoin. HEU's market performance is affected by regulatory changes and technological developments.

What is the price prediction trend for HEU in 2024-2025?

HEU is expected to experience moderate growth during 2024-2025, driven by increased adoption and market demand. Price momentum depends on broader market conditions and ecosystem development progress.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Everything You Need to Know About Sybil Attacks

Games You Can Earn From – TOP 11 Games

Phil Konieczny – Who Is He? What Is His Wealth? Why Does He Wear a Mask?

What is ZULU: A Comprehensive Guide to South Africa's Warrior Culture and Heritage

What is LANDSHARE: A Revolutionary Platform for Sustainable Agriculture and Community Land Access