2026 HORD Price Prediction: Analyzing Market Trends and Future Forecast for the Horizen Token

Introduction: HORD's Market Position and Investment Value

Hord (HORD), as a platform enabling cryptocurrency professionals to tokenize and monetize their influence while allowing enthusiasts to trade through dynamic ETF strategies, has been developing since its launch in 2021. As of February 2026, HORD maintains a market capitalization of approximately $237,071, with a circulating supply of around 254.72 million tokens, and the price hovering around $0.0009307. This deflationary utility token, designed to power the Hord platform, is playing a role in the decentralized finance ecosystem by bridging professional traders with retail investors.

This article will comprehensively analyze HORD's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. HORD Price History Review and Market Status

HORD Historical Price Evolution Trajectory

- May 2021: HORD reached its historical peak at $1.79, marking a significant milestone since its launch in April 2021.

- 2021-2025: During the extended bear market cycle, HORD experienced substantial decline from its all-time high, with price corrections exceeding 99%.

- February 2026: HORD recorded its historical low at $0.00086804 on February 6, 2026, reflecting continued market pressure.

HORD Current Market Situation

As of February 8, 2026, HORD is trading at $0.0009307, representing a 6.61% decline over the past 24 hours. The token has shown mixed short-term performance, with a 1.21% increase over the past 7 days but a 1.35% decrease over the past 30 days. On an annual basis, HORD has declined 68.91%.

The 24-hour trading range spans from $0.0009001 to $0.0009955, with total trading volume reaching $18,983.58. HORD maintains a circulating supply of 254,723,582.71 tokens, representing approximately 79.60% of its maximum supply of 320,000,000 tokens. The current market capitalization stands at $237,071.24, with a fully diluted valuation of $297,824.00.

The token ranks 3750th by market capitalization, with a market dominance of 0.000012%. The market cap to fully diluted valuation ratio stands at 79.6%, indicating a relatively high proportion of tokens already in circulation. HORD has 2,651 token holders and is available for trading on Gate.com.

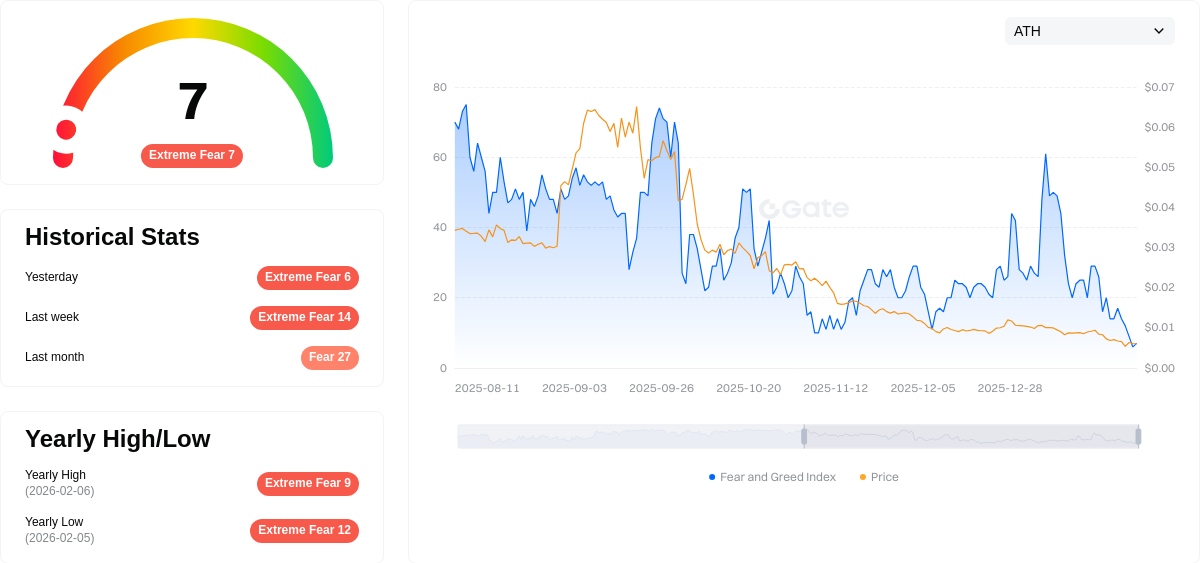

The current market sentiment index registers at 7, indicating extreme fear in the broader cryptocurrency market, which may be contributing to the recent price decline.

Click to view current HORD market price

HORD Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reaching 7. This exceptionally low reading indicates widespread pessimism and panic selling among investors. Market participants are displaying significant risk aversion, suggesting potential capitulation. Such extreme fear levels historically present contrarian opportunities for long-term investors, as sentiment extremes often precede market reversals. However, traders should remain cautious and monitor market developments closely before making investment decisions during this highly volatile period.

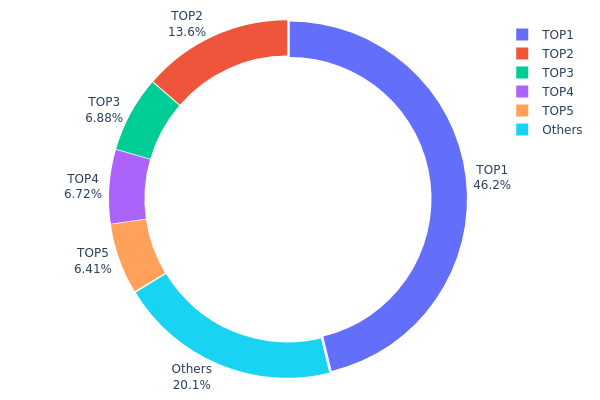

HORD Holding Distribution

The holding distribution chart reflects the concentration of token holdings across different wallet addresses, serving as a critical indicator of decentralization and potential market manipulation risks. For HORD, the current on-chain data reveals a moderately concentrated distribution pattern. The top five addresses collectively control 79.83% of the total supply, with the largest single address holding 147,830.31K tokens (46.19%), followed by the second-largest address at 13.64%. This concentration level suggests that a relatively small number of entities maintain substantial control over the circulating supply, which could pose liquidity and volatility challenges during significant market movements.

From a market structure perspective, such concentration carries both risks and implications for price dynamics. The dominance of the top address, controlling nearly half of the supply, raises concerns about potential sell-side pressure if this entity decides to liquidate positions. Additionally, the combined holdings of the top two addresses (59.83%) create a scenario where coordinated actions could significantly impact market sentiment and price stability. The remaining 20.17% distributed among other addresses provides some level of decentralization, but the overall structure indicates that HORD's market remains vulnerable to whale activities and lacks the broad distribution typically associated with mature, community-driven projects.

The current distribution pattern reflects a centralized token structure characteristic of early-stage projects or those with significant allocations to founding teams, early investors, or exchange reserves. While this concentration may facilitate coordinated development efforts and strategic partnerships, it simultaneously limits organic market participation and increases susceptibility to sudden price swings driven by large holder actions.

Click to view current HORD Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5aa5...584b47 | 147830.31K | 46.19% |

| 2 | 0xe4a8...a8e12d | 43679.00K | 13.64% |

| 3 | 0xca9a...499a46 | 22021.75K | 6.88% |

| 4 | 0xf53e...b272e1 | 21496.00K | 6.71% |

| 5 | 0xde6f...7f6e28 | 20516.97K | 6.41% |

| - | Others | 64455.97K | 20.17% |

II. Core Factors Influencing HORD's Future Price

Supply Mechanisms

The materials provided do not contain specific information about HORD's supply mechanisms, token distribution models, or historical supply-related price impacts. Without verified data on tokenomics, emission schedules, or supply adjustments, this section cannot be accurately completed.

Institutional and Large Holder Dynamics

No information regarding institutional holdings, corporate adoption, or specific national policies related to HORD is available in the provided materials. The references discuss broader cryptocurrency market trends and macroeconomic factors but do not mention HORD-specific institutional activity or adoption patterns.

Macroeconomic Environment

-

Monetary Policy Impact: According to market analysis materials, major central banks' policy directions significantly influence cryptocurrency markets. The U.S. Federal Reserve's interest rate decisions and economic outlook play a substantial role in shaping digital asset price trajectories. Materials indicate that mixed employment and inflation data have led to a "wait-and-see" stance, which could create continued volatility in cryptocurrency markets.

-

Inflation Hedging Characteristics: The provided materials reference gold's performance as reaching historical highs during periods of geopolitical uncertainty, suggesting that alternative assets can serve as hedges during economic instability. However, specific data on HORD's performance as an inflation hedge is not available.

-

Geopolitical Factors: Market commentary notes that geopolitical tensions have intensified, with events such as trade policy threats and international disputes creating market volatility. The materials indicate that U.S. 10-year Treasury yields reached four-month highs amid these tensions, while gold surged approximately 8%. These broader market dynamics can influence cryptocurrency sentiment, though HORD-specific impacts are not documented.

Technical Development and Ecosystem Building

The provided materials do not contain information about HORD's technical upgrades, development roadmap, ecosystem applications, or DApp projects. Without verified data on the project's technological progress or ecosystem expansion, this section cannot be substantiated with concrete details.

III. 2026-2031 HORD Price Prediction

2026 Outlook

- Conservative prediction: $0.00074 - $0.00093

- Neutral prediction: $0.00093

- Optimistic prediction: $0.00123 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual recovery phase with moderate growth momentum as the project develops its ecosystem and partnerships

- Price range predictions:

- 2027: $0.00087 - $0.0012

- 2028: $0.00108 - $0.0012

- 2029: $0.00088 - $0.00152

- Key catalysts: Platform expansion, ecosystem development, strategic partnerships, and broader market sentiment recovery

2030-2031 Long-term Outlook

- Baseline scenario: $0.00117 - $0.00145 (assuming steady market growth and continued platform development)

- Optimistic scenario: $0.0012 - $0.00205 (assuming strong user adoption, significant partnerships, and favorable regulatory environment)

- Transformative scenario: Potential to reach $0.00205 (requires exceptional market conditions, breakthrough innovations, and substantial ecosystem expansion)

- 2026-02-08: HORD maintaining early-stage valuation levels as the project continues to build its foundation

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00123 | 0.00093 | 0.00074 | 0 |

| 2027 | 0.0012 | 0.00108 | 0.00087 | 16 |

| 2028 | 0.0012 | 0.00114 | 0.00108 | 22 |

| 2029 | 0.00152 | 0.00117 | 0.00088 | 25 |

| 2030 | 0.00145 | 0.00134 | 0.00117 | 44 |

| 2031 | 0.00205 | 0.0014 | 0.0012 | 50 |

IV. HORD Professional Investment Strategy and Risk Management

HORD Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Cryptocurrency enthusiasts seeking exposure to DeFi infrastructure and tokenized influence platforms

- Operational Recommendations:

- Consider accumulating positions during market corrections when price approaches historical support levels

- Monitor project development milestones and platform adoption metrics before making investment decisions

- Storage Solution: Utilize Gate Web3 Wallet for secure on-chain asset management with self-custody capabilities

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track 50-day and 200-day moving averages to identify potential trend reversals and momentum shifts

- Volume Analysis: Monitor 24-hour trading volume patterns to gauge market participation and liquidity conditions

- Swing Trading Key Points:

- Set stop-loss orders at 5-8% below entry price to manage downside risk

- Consider taking partial profits during upward price movements of 15-20% to secure gains

HORD Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of cryptocurrency portfolio

- Aggressive Investors: 3-5% of cryptocurrency portfolio

- Professional Investors: 5-10% of cryptocurrency portfolio, with active monitoring

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine HORD holdings with established cryptocurrencies and stablecoins to balance volatility exposure

- Position Sizing: Use dollar-cost averaging to mitigate timing risk and reduce impact of short-term price fluctuations

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking activities

- Cold Storage Solution: Consider hardware wallet storage for long-term holdings exceeding investment threshold

- Security Considerations: Enable two-factor authentication, regularly update security protocols, and never share private keys or seed phrases

V. HORD Potential Risks and Challenges

HORD Market Risks

- Liquidity Concerns: With 24-hour trading volume of approximately $18,983 and limited exchange listings, HORD may experience significant price slippage during large transactions

- Price Volatility: The token has declined 6.61% in the past 24 hours and 68.91% over the past year, indicating substantial downside volatility potential

- Market Capitalization: With a market cap of approximately $237,071, HORD represents a micro-cap asset susceptible to manipulation and extreme price movements

HORD Regulatory Risks

- DeFi Regulatory Uncertainty: Evolving regulations surrounding decentralized finance platforms may impact HORD's operational model and token utility

- Tokenization Compliance: Regulations regarding the tokenization of influence and investment products may require platform adjustments

- Cross-border Operations: Operating across multiple jurisdictions exposes the project to varying regulatory requirements and potential compliance challenges

HORD Technical Risks

- Smart Contract Vulnerabilities: As an Ethereum-based token, HORD faces potential security risks from smart contract exploits or protocol bugs

- Platform Dependency: Token utility is closely tied to the Hord platform's continued operation and user adoption

- Competition: The dynamic ETF and tokenized influence space faces increasing competition from established DeFi protocols and traditional finance entrants

VI. Conclusion and Action Recommendations

HORD Investment Value Assessment

HORD presents a speculative opportunity in the tokenized influence and dynamic ETF sector, targeting cryptocurrency professionals and enthusiasts seeking simplified investment replication. However, the token's significant price decline of 68.91% over the past year, extremely low market capitalization of approximately $237,071, and limited trading volume of $18,983 indicate substantial risk. While the platform addresses a niche use case in DeFi infrastructure, investors should carefully weigh the long-term value proposition against elevated short-term volatility and liquidity constraints.

HORD Investment Recommendations

✅ Beginners: Avoid allocation until establishing foundational cryptocurrency knowledge and diversified portfolio, or limit exposure to less than 1% of total crypto holdings

✅ Experienced Investors: Consider small speculative position (1-3% of crypto portfolio) only after thorough due diligence on platform development and competitive positioning

✅ Institutional Investors: Conduct comprehensive risk assessment including liquidity analysis, regulatory compliance review, and technical audit before considering allocation

HORD Trading Participation Methods

- Spot Trading: Purchase HORD directly on Gate.com with various trading pairs for immediate ownership

- Dollar-Cost Averaging: Implement systematic periodic purchases to reduce timing risk and average entry price over time

- Gate Web3 Wallet Integration: Utilize self-custody solutions for secure on-chain storage and potential participation in platform features

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is HORD token? What are its uses and value?

HORD is the native token of the Hord protocol, designed to incentivize ecosystem development and growth. It captures value to support the protocol's reward mechanisms and drives ecosystem participation and adoption.

How to conduct HORD price prediction? What are the analysis methods and tools?

HORD price prediction can be done through technical analysis and trading volume analysis. Key tools include CoinGecko for real-time price data and Uniswap for liquidity monitoring. Track 24-hour price ranges and market trends to forecast price movements.

What are the main factors affecting HORD price fluctuations?

HORD price is primarily influenced by market demand, trading volume, blockchain ecosystem development, project fundamentals, investor sentiment, and macroeconomic conditions. Strong project performance and increased adoption typically drive price increases.

What are the risks and limitations of HORD price predictions?

HORD price predictions carry high market volatility risks and are limited by unpredictable DeFi trends and tokenization factors. Predictions rely on expert analysis but lack absolute reliability. Investors should conduct thorough research before making decisions.

What are the key differences between HORD and other cryptocurrencies?

HORD specializes in DeFi and decentralized applications, focusing on efficient lending and yield generation services. Unlike Bitcoin or Ethereum primarily used for transactions, HORD delivers advanced financial infrastructure for users seeking passive income and capital efficiency in blockchain ecosystems.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Bitcoin Dominance Chart: What Is It and Why Is It Important?

Who Is Charles Hoskinson, the Founder of Cardano?

Bitcoin Dominance: A Comprehensive Guide to Using BTC.D in Trading

7 Ideas for Beginners to Create Digital Art

What is Leverage Trading? A Comprehensive Strategy for Maximizing Cryptocurrency Investment Returns