2026 IMT Price Prediction: Expert Analysis and Market Forecast for ImageTek Token

Introduction: IMT's Market Position and Investment Value

Immortal Rising 2 (IMT), positioned as a next-generation mobile idle RPG token designed by a 2024 BAFTA-winning game designer, has emerged as a notable player in the blockchain gaming sector since its launch in 2025. As of February 2026, IMT maintains a market capitalization of approximately $307,762, with a circulating supply of around 180.4 million tokens and a current price hovering near $0.001706. This gaming-focused digital asset, recognized as a bridge between Web2 and Web3 gaming ecosystems, is playing an increasingly important role in onboarding mainstream gamers to blockchain technology through its presence on Immutable's platform.

This article will comprehensively analyze IMT's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. IMT Price History Review and Market Status

IMT Historical Price Evolution Trajectory

- March 2025: IMT reached a peak price level at $0.05026 following its initial launch, demonstrating strong early market interest

- February 2026: Price experienced a notable correction, touching a low point at $0.001161, reflecting broader market adjustment patterns

IMT Current Market Dynamics

As of February 07, 2026, IMT is trading at $0.001706, showing a 24-hour price increase of 6.22%. The token has demonstrated some recovery momentum from its recent low levels, with a 1-hour change of 0.83%. However, the broader trend indicates challenges, with a 7-day decline of 17.43% and a 30-day decrease of 38.67%.

The current market capitalization stands at approximately $307,762, with a circulating supply of 180.4 million IMT tokens out of a total supply of 1 billion tokens, representing an 18.04% circulation ratio. The 24-hour trading volume reaches $20,808, indicating active market participation. The fully diluted market capitalization is calculated at $1.706 million.

The token holder count has reached 1,092 addresses, suggesting a developing community base. IMT operates as an ERC-20 token on the Ethereum network and is currently available for trading on 2 exchanges. The market sentiment indicator shows a Fear Index reading of 6, classified as "Extreme Fear," which may reflect the current cautious atmosphere in the cryptocurrency markets.

The price distance from its all-time high of $0.05026 indicates a substantial retracement, while the recovery from the all-time low of $0.001161 demonstrates some buying interest at lower price levels. The 24-hour price range spans from $0.00147 to $0.001724, showing moderate intraday volatility.

Click to view current IMT market price

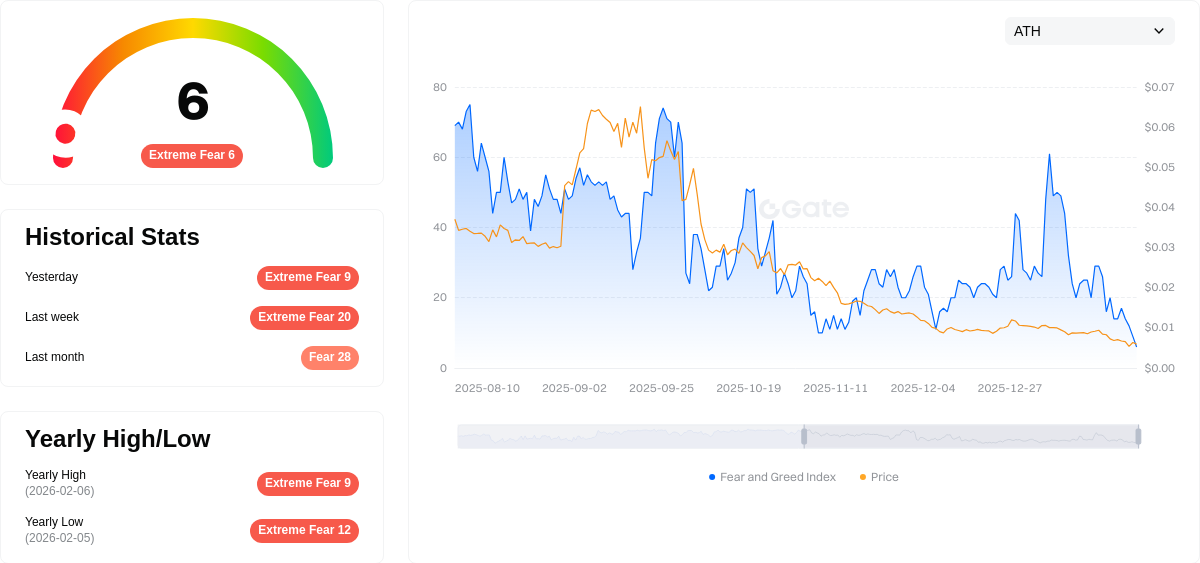

IMT Market Sentiment Index

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear sentiment with an IMT index reading of just 6 points. This exceptionally low level indicates severe panic among investors, reflecting heightened market anxiety and risk aversion. Such extreme fear conditions often present contrarian opportunities for long-term investors, as market pessimism tends to reach local bottoms before recovery phases. However, caution remains warranted as downside risks may persist. Traders should monitor key support levels and market catalysts closely while considering their risk tolerance and investment horizons carefully during this volatile period.

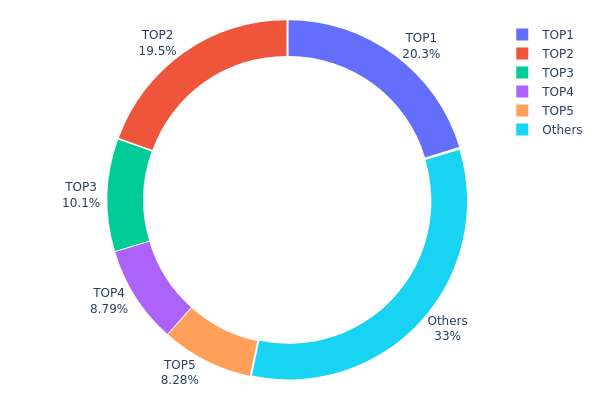

IMT Holding Distribution

The holding distribution chart reveals the concentration of token ownership across different addresses on the blockchain. By analyzing the percentage held by top addresses versus smaller holders, we can assess the degree of decentralization and potential risks associated with concentrated holdings. For IMT, the current distribution data presents a moderately concentrated ownership structure that warrants careful examination.

According to the latest on-chain data, the top five addresses collectively control approximately 67% of the total IMT supply, with the largest single address holding 20.33% (203,379.31K tokens) and the second-largest holding 19.48% (194,846.34K tokens). The remaining 33% is distributed among other addresses, indicating a relatively concentrated market structure. This level of concentration suggests that major holders possess significant influence over price movements and market sentiment. Such distribution patterns could potentially expose the token to increased volatility, as large-scale transactions by these top addresses may trigger substantial price fluctuations or create selling pressure during market downturns.

From a market structure perspective, this concentration level reflects a developing ecosystem that has not yet achieved broad-based distribution. While some concentration is common in early-stage projects or those with specific tokenomics designs, investors should remain aware that decisions made by these major holders could materially impact market dynamics. The current distribution suggests a market environment where on-chain structural stability depends heavily on the behavior and intentions of these top addresses, highlighting the importance of monitoring large wallet movements and understanding the identity and commitment level of major stakeholders.

Click to view current IMT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa49e...8ad76e | 203379.31K | 20.33% |

| 2 | 0x4dda...8d4b88 | 194846.34K | 19.48% |

| 3 | 0xc3e8...22af17 | 101327.01K | 10.13% |

| 4 | 0xf62d...01bd58 | 87855.88K | 8.78% |

| 5 | 0xdb06...ebbfc5 | 82820.75K | 8.28% |

| - | Others | 329770.71K | 33% |

II. Core Factors Influencing IMT's Future Price

Supply Mechanism

-

IMT-2030 Framework Development: The International Telecommunication Union (ITU-R) has defined IMT-2030 as the next-generation mobile communication system framework, which incorporates AI and communication as one of six typical use scenarios. This framework aims to provide ubiquitous AI services through distributed intelligence connections.

-

Historical Pattern: Previous generations of mobile communication systems (from 2G to 5G) have primarily focused on communication services with data transmission as the main task. Each generational leap has been driven by performance requirements and has shown cyclical patterns in operator capital expenditure (Capex), deeply tied to wireless communication technology transitions.

-

Current Impact: The IMT-2030 system introduces new capabilities beyond traditional communication, including AI-related abilities such as distributed data processing, distributed learning, and AI model execution. This evolution may influence the pricing dynamics through increased infrastructure demands and new service capabilities.

Institutional and Major Holder Dynamics

-

Institutional Positioning: Research institutions including China's IMT-2030 Promotion Group and Europe's Hexa-X have highlighted that 6G AI services will be key factors in next-generation network design. These organizations are actively involved in defining performance requirements and evaluation methods for AI services.

-

Enterprise Adoption: Major technology companies such as Huawei are conducting extensive research on 6G AI and communication performance requirements and evaluation methodologies. The wireless technology laboratories are developing standards for AI service quality metrics including AI service accuracy and latency.

-

National Policy: China's Ministry of Industry and Information Technology established the IMT-2030 (6G) Promotion Group in June 2019, indicating government-level support for next-generation communication technology development.

Macroeconomic Environment

-

Monetary Policy Impact: Global economic conditions show wave-like development with challenges including insufficient effective demand and weak social expectations. These factors may affect investment attractiveness in communication infrastructure and related technologies.

-

Inflation Hedge Attributes: The development of 6G communication infrastructure requires substantial capital investment, with estimates suggesting that by 2029, the global optical module market alone could exceed 22.4 billion USD, representing an 11% compound annual growth rate from 2024-2029.

-

Geopolitical Factors: Trade friction escalation and potential technology embargoes remain core risk factors. Current communication sector dependencies on certain international suppliers could impact technology deployment if comprehensive restrictions are implemented.

Technology Development and Ecosystem Construction

-

AI and Communication Integration: The IMT-2030 framework introduces AI service capabilities including distributed AI model training, real-time high-precision model inference, and AI service density metrics. This represents a fundamental shift from communication-only to communication-AI integrated systems.

-

Performance Enhancement: 6G aims to significantly enhance 5G capabilities with peak rates reaching 50-200 Gbps per terminal (compared to 5G's 20 Gbps) and spectrum efficiency improvements of 1.5 to 3 times over 5G standards.

-

Ecosystem Applications: Key application scenarios include collaborative robots in industrial environments, remote surgery, autonomous vehicle coordination, and smart grid real-time monitoring. The system supports distributed computing and AI applications including data collection, local/distributed computing offload, and distributed AI model training and inference.

III. 2026-2031 IMT Price Prediction

2026 Outlook

- Conservative Prediction: $0.00152 - $0.00171

- Neutral Prediction: Around $0.00171

- Optimistic Prediction: Up to $0.00205 (requires favorable market conditions)

2027-2029 Outlook

- Market Phase Expectation: IMT may enter a gradual growth phase, with price volatility potentially increasing as the market matures and adoption expands.

- Price Range Predictions:

- 2027: $0.0018 - $0.00274

- 2028: $0.00148 - $0.00307

- 2029: $0.00145 - $0.00312

- Key Catalysts: Potential drivers include broader ecosystem development, increased trading volume on platforms like Gate.com, and positive market sentiment in the crypto space.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00224 - $0.00290 (assuming steady market conditions and moderate adoption growth)

- Optimistic Scenario: $0.00296 - $0.00375 (assuming enhanced utility, stronger partnerships, and favorable regulatory environment)

- Transformational Scenario: Up to $0.00402 (requires breakthrough technological integration or significant ecosystem expansion)

- 2026-02-07: IMT trading within the range of $0.00152 - $0.00205 (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00205 | 0.00171 | 0.00152 | 0 |

| 2027 | 0.00274 | 0.00188 | 0.0018 | 10 |

| 2028 | 0.00307 | 0.00231 | 0.00148 | 35 |

| 2029 | 0.00312 | 0.00269 | 0.00145 | 57 |

| 2030 | 0.00375 | 0.0029 | 0.00224 | 70 |

| 2031 | 0.00402 | 0.00333 | 0.00296 | 94 |

IV. IMT Professional Investment Strategy and Risk Management

IMT Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: GameFi enthusiasts and blockchain gaming supporters who believe in the web2 to web3 gaming transition

- Operational Recommendations:

- Consider accumulating IMT during market corrections, as the token has shown a 30-day decline of 38.67%, potentially offering entry opportunities

- Monitor the project's performance on Immutable platform, where it currently ranks as the leading game

- Storage Solution: Use Gate Web3 Wallet for secure IMT token storage, which supports ERC-20 tokens

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of approximately $20,808, which may indicate liquidity levels for entry and exit points

- Price Range Indicators: Track the 24-hour high of $0.001724 and low of $0.00147 to identify potential support and resistance levels

- Swing Trading Considerations:

- The 24-hour price increase of 6.22% suggests short-term volatility that active traders might leverage

- Consider the significant gap between the all-time high of $0.05026 (March 27, 2025) and current price of $0.001706 when setting profit targets

IMT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-10% of crypto portfolio allocation

- Professional Investors: Up to 15% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Diversification Approach: Balance IMT holdings with other gaming tokens and established cryptocurrencies to reduce sector-specific risk

- Position Sizing Strategy: Implement gradual entry positions rather than lump-sum investments, particularly given the token's recent 38.67% decline over 30 days

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and easy access to liquidity

- Cold Storage Solution: For long-term holdings exceeding trading needs, consider hardware wallet solutions that support ERC-20 tokens

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly update wallet software to protect against potential vulnerabilities

V. IMT Potential Risks and Challenges

IMT Market Risks

- High Volatility: The token has experienced significant price fluctuations, with a 38.67% decline over 30 days and a 96.6% drop from its all-time high

- Limited Liquidity: With only 2 exchanges listing IMT and relatively modest 24-hour trading volume, liquidity constraints may impact large order execution

- Market Capitalization Concerns: At approximately $307,762 market cap and 0.000069% market dominance, IMT remains highly speculative with limited market presence

IMT Regulatory Risks

- Gaming Token Classification: Evolving regulations around gaming tokens and NFT-based assets may impact IMT's utility and trading status

- Cross-border Gaming Regulations: As a mobile gaming project, IMT may face varying regulatory requirements across different jurisdictions

- Web3 Gaming Compliance: Regulatory uncertainty surrounding blockchain-based gaming economies could affect project operations and token utility

IMT Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token, IMT is subject to potential smart contract risks inherent in Ethereum-based projects

- Platform Dependency: The project's success is closely tied to the Immutable platform, creating concentration risk

- Adoption Challenges: The transition from web2 to web3 gaming faces technical barriers that may slow user acquisition and engagement

VI. Conclusion and Action Recommendations

IMT Investment Value Assessment

IMT presents a high-risk, high-potential investment opportunity in the blockchain gaming sector. The project's recognition by a BAFTA-winning designer and its position as the leading game on Immutable demonstrate technical and creative merit. However, the significant price decline from its all-time high, limited market capitalization, and restricted exchange listings indicate substantial volatility. The token's long-term value proposition depends on successful user acquisition from web2 to web3 and sustained engagement within the Immortal Rising 2 ecosystem. Short-term risks include continued price pressure, liquidity constraints, and the inherent uncertainty of early-stage gaming token projects.

IMT Investment Recommendations

✅ Beginners: Exercise extreme caution with IMT due to its high volatility and limited liquidity. If interested, allocate no more than 1-2% of your crypto portfolio and focus on understanding blockchain gaming fundamentals before investing

✅ Experienced Investors: Consider IMT as a speculative position within a diversified gaming token portfolio. Implement strict risk management with stop-loss orders and monitor project development milestones on the Immutable platform

✅ Institutional Investors: Conduct thorough due diligence on the project's tokenomics, user acquisition metrics, and competitive positioning. Given the limited liquidity and early-stage nature, consider strategic allocation with direct engagement with project developers if possible

IMT Trading Participation Methods

- Spot Trading: Purchase IMT directly on Gate.com with support for multiple trading pairs and access to real-time market data

- Dollar-Cost Averaging: Implement systematic investment plans to reduce timing risk, particularly given the token's recent price volatility

- Active Monitoring: Track project updates through official channels (website: immortalrising2.com, Twitter: @immortalrising2) and Immutable platform rankings to inform investment decisions

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is IMT? What are its uses and value?

IMT is a utility token designed for the Web3 ecosystem, enabling governance, staking, and transaction incentives. Its value derives from utility within decentralized platforms, scarcity mechanics, and growing adoption in blockchain applications.

IMT's Historical Price Trend? What is the Current Price?

IMT currently trades at $0.0016. It reached an all-time high of $0.0227 in March 2025 and hit a recent low of $0.001580 on February 6, 2026. The token has experienced significant volatility, declining approximately 92.5% from its peak.

What are the main factors affecting IMT price?

IMT price is primarily influenced by supply mechanisms, including halving events that reduce new coin issuance and reshape supply-demand dynamics. Historical halvings have typically driven price increases. Current demand stability and market adoption also play crucial roles in price movement.

How will IMT price develop in 2024? What is the predicted target price?

IMT price is expected to remain stable in 2024 with potential modest growth in coming years. Target price forecast maintains current levels in 2024, with gradual appreciation projected for future years ahead.

What are the risks to pay attention to when investing in IMT?

IMT investment carries price volatility risk that may result in capital loss. Investors bear full responsibility for their decisions. Market risks are unpredictable and require careful consideration.

What are the advantages and disadvantages of IMT compared to similar tokens?

IMT's main advantages include high innovation potential, flexible architecture, and strong utility in telecom sectors. Disadvantages include market fragmentation, limited customer base in vertical industries, and high customization costs compared to more standardized tokens.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Comprehensive Guide to Smart Contracts

Comprehensive Guide to CPU Mining

What is the Fear and Greed Index in Crypto

Comprehensive Guide to Inflation and Investment Solutions

What Are Meme Coins? 7 Top Tokens to Watch