2026 INSP Price Prediction: Expert Analysis and Market Forecast for Inspirato Stock Performance

Introduction: INSP's Market Position and Investment Value

Inspect (INSP), positioned as a Layer 2 solution at the forefront of Web3, has been empowering users within X (Twitter) and other social ecosystems with essential tools and insights for navigating the dynamic realms of cryptocurrencies and NFTs since its launch in 2023. As of 2026, INSP maintains a market capitalization of approximately $1.56 million, with a circulating supply of around 798.37 million tokens, and the price is hovering around $0.00195. This asset, serving as a utility token for Web3 social analytics, is playing an increasingly significant role in providing on-chain insights and social intelligence tools.

This article will comprehensively analyze INSP's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment to provide investors with professional price forecasts and practical investment strategies.

I. INSP Price History Review and Market Status

INSP Historical Price Evolution Trajectory

- 2023: Platform tokenization initiated with $INSP launch at $0.015, establishing initial market presence

- 2024: Price experienced significant volatility, reaching $0.4 in March 2024

- 2025-2026: Market correction phase, with price declining to $0.001938 in early 2026

INSP Current Market Situation

As of February 2, 2026, INSP is trading at $0.00195, reflecting a substantial decline from its March 2024 levels. The token has experienced notable price fluctuations across various timeframes, with a 0.41% decrease over the past hour, 12.82% decline in the last 24 hours, and 14.39% decrease over the past week. The 30-day performance shows a 48.97% reduction, while the annual performance indicates an 83.89% decline.

The 24-hour trading range spans from $0.001938 to $0.002325, with a trading volume of $23,725.17. The market capitalization stands at approximately $1.56 million, with 798,366,803 tokens in circulation, representing 79.84% of the maximum supply of 1 billion tokens. The fully diluted market cap is calculated at $1.95 million.

The token maintains a presence across 8 exchanges and has attracted 10,875 holders. Market sentiment indicators suggest an environment of extreme fear, with current market dominance at 0.000071%. The ratio between market cap and fully diluted valuation remains at 79.84%, indicating substantial token circulation.

Click to view current INSP market price

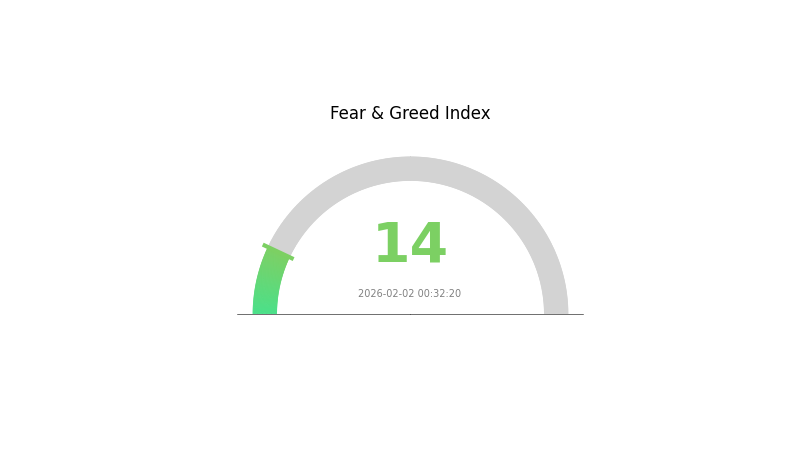

INSP Market Sentiment Indicator

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 14. This exceptionally low reading indicates investors are highly risk-averse and sentiment is deeply pessimistic. Market participants are displaying significant caution, with potential selling pressure dominating. Historically, such extreme fear levels can present contrarian buying opportunities for risk-tolerant investors, as markets often reverse when sentiment becomes overly negative. However, traders should exercise caution and conduct thorough analysis before making investment decisions during such volatile periods.

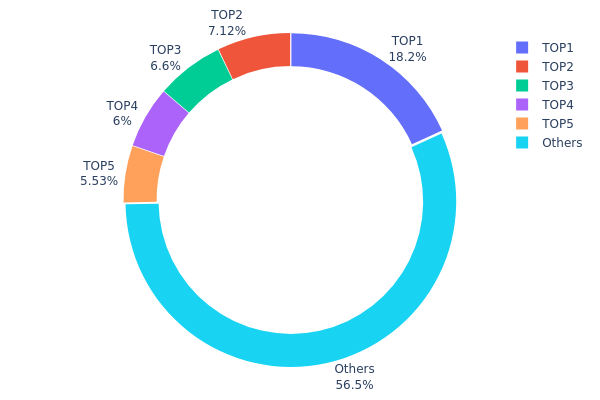

INSP Holding Distribution

The holding distribution chart illustrates the concentration of token ownership across different wallet addresses, providing insight into the decentralization level and potential market control dynamics. By examining the proportion of tokens held by top addresses versus the broader holder base, analysts can assess structural risks and market stability.

Based on the current data, INSP exhibits a moderate to high concentration pattern. The top holder controls 182,480.23K tokens (18.24%), while the top five addresses collectively hold 435,048.29K tokens, accounting for 43.49% of the total supply. This concentration level suggests a semi-centralized distribution structure where a relatively small group of addresses maintains significant influence over the circulating supply. The remaining 56.51% distributed among other holders indicates some degree of decentralization, though not at an optimal level for minimizing single-entity market impact.

This distribution structure presents both opportunities and risks. The concentrated holdings in top addresses could lead to heightened price volatility if major holders initiate large-scale transfers or sales. However, it may also indicate strong conviction from early investors or project treasury allocations designed for long-term ecosystem development. The current on-chain structure suggests that INSP maintains a relatively stable foundation, though market participants should remain vigilant regarding potential shifts in major holder positions that could trigger significant price movements.

Click to view current INSP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf89d...5eaa40 | 182480.23K | 18.24% |

| 2 | 0x2ddf...bf0f55 | 71226.58K | 7.12% |

| 3 | 0x436f...56b3b5 | 66009.25K | 6.60% |

| 4 | 0x929a...c4fc3d | 60000.00K | 6.00% |

| 5 | 0x2677...ccb975 | 55332.23K | 5.53% |

| - | Others | 564951.71K | 56.51% |

II. Core Factors Influencing INSP's Future Price

Macroeconomic Environment

- Inflation Impact: Inflationary pressures and market volatility are expected to influence INSP's price trajectory. Economic factors such as rising inflation rates can affect investor sentiment toward cryptocurrency assets.

- Market Conditions: External economic factors, including broader market turbulence, play a role in shaping price movements across digital assets.

Market Sentiment and Adoption Trends

- User Adoption: The expansion of user base and adoption trends directly correlate with INSP's price fluctuations. Historical data shows that periods of increased user engagement have corresponded with price volatility.

- Investor Behavior: Market sentiment and investor behavior remain key driving forces behind INSP's price dynamics. Shifts in confidence levels can trigger significant price movements.

Historical Price Patterns

- Price Volatility: INSP experienced notable price swings, with a recorded low of $0.00395 on March 11, 2025. These fluctuations reflect the interplay between market sentiment, adoption patterns, and external influences.

- Market Response: Historical price movements demonstrate how INSP responds to changing market conditions and user adoption trends.

III. 2026-2031 INSP Price Forecast

2026 Outlook

- Conservative prediction: $0.00166-0.00195

- Neutral prediction: $0.00195

- Optimistic prediction: $0.0024 (requires favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market stage expectation: The token is anticipated to enter a gradual growth phase with moderate price appreciation as the project potentially expands its ecosystem and user base.

- Price range forecast:

- 2027: $0.00209-0.00274 (approximately 11% increase from 2026)

- 2028: $0.00233-0.0029 (approximately 25% cumulative increase)

- 2029: $0.00209-0.00287 (approximately 37% cumulative increase)

- Key catalysts: Market sentiment shifts, potential technological developments, and broader cryptocurrency market trends may serve as primary drivers for price movement during this period.

2030-2031 Long-term Outlook

- Base scenario: $0.00277 (assuming steady market conditions and consistent project development)

- Optimistic scenario: $0.00358 in 2030, $0.00454 in 2031 (assuming enhanced market adoption and positive regulatory environment)

- Transformational scenario: $0.00454 (requires exceptional market conditions, significant partnerships, or breakthrough developments)

- 2026-02-02: INSP trading within predicted range of $0.00166-0.0024 (early-stage market positioning)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0024 | 0.00195 | 0.00166 | 0 |

| 2027 | 0.00274 | 0.00217 | 0.00209 | 11 |

| 2028 | 0.0029 | 0.00246 | 0.00233 | 25 |

| 2029 | 0.00287 | 0.00268 | 0.00209 | 37 |

| 2030 | 0.00358 | 0.00277 | 0.0015 | 42 |

| 2031 | 0.00454 | 0.00317 | 0.00298 | 62 |

IV. INSP Professional Investment Strategy and Risk Management

INSP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to Web3 infrastructure and social layer solutions with a medium to long-term horizon

- Operational Recommendations:

- Consider accumulating positions during market corrections, as INSP has declined approximately 83.89% from its historical high

- Monitor the project's user growth beyond the current 300,000+ user base and platform tokenization progress

- Storage Solution: Utilize Gate Web3 Wallet for secure storage of INSP tokens on the Ethereum network

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the current 24-hour trading volume of approximately $23,725 to identify liquidity patterns and potential breakout opportunities

- Support and Resistance Levels: Track the recent low of $0.001938 as key support and the 24-hour high of $0.002325 as near-term resistance

- Swing Trading Points:

- Consider the high volatility evidenced by recent price movements, with 24-hour fluctuations of -12.82%

- Implement stop-loss orders below recent support levels to manage downside risk

INSP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 7-10% with active risk management protocols

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance INSP holdings with established cryptocurrencies and other Layer 2 solutions to reduce concentration risk

- Position Sizing: Limit individual position size relative to the token's market cap of approximately $1.56 million and consider the circulating supply of 798.37 million tokens

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking access

- Cold Storage Option: Hardware wallet solutions for long-term holdings exceeding trading requirements

- Security Precautions: Enable two-factor authentication, verify contract addresses (0x186eF81fd8E77EEC8BfFC3039e7eC41D5FC0b457 on Ethereum), and avoid sharing private keys

V. INSP Potential Risks and Challenges

INSP Market Risks

- High Volatility: INSP has experienced substantial price decline of 83.89% over the past year, indicating significant market volatility and downside risk

- Liquidity Constraints: With a market cap of approximately $1.56 million and 24-hour trading volume around $23,725, liquidity may be limited during market stress

- Market Cap Concentration: The fully diluted market cap to circulating market cap ratio of 79.84% suggests potential dilution risk as more tokens enter circulation

INSP Regulatory Risks

- Social Media Integration Uncertainty: As a Layer 2 solution operating within social ecosystems like X (Twitter), regulatory changes affecting social platforms could impact INSP's operational model

- Token Classification: Evolving regulatory frameworks regarding utility tokens and their classification may affect INSP's compliance requirements

- Cross-border Operations: Operating across multiple jurisdictions may expose the project to varying regulatory standards and potential compliance challenges

INSP Technical Risks

- Smart Contract Vulnerabilities: As an Ethereum-based token, INSP relies on smart contract security, and any undiscovered vulnerabilities could pose risks to user funds

- Platform Dependency: Heavy reliance on integration with X (Twitter) and other social platforms creates dependency risks if these platforms alter their APIs or policies

- Scalability Challenges: As a Layer 2 solution aiming to serve 300,000+ users, technical scalability limitations could hinder growth and user experience

VI. Conclusion and Action Recommendations

INSP Investment Value Assessment

INSP presents a speculative opportunity in the Web3 social infrastructure space, targeting cryptocurrency and NFT enthusiasts within social media ecosystems. While the project serves a user base of over 300,000 and aims to expand its reach through tokenization, investors should carefully weigh the substantial price decline of 83.89% year-over-year and limited market capitalization of approximately $1.56 million. The token's value proposition lies in its potential to bridge social media and Web3 functionality, though this remains subject to execution risks and market adoption uncertainties.

INSP Investment Recommendations

✅ Beginners: Consider minimal exposure (under 1% of crypto portfolio) only after thoroughly researching the project's whitepaper and understanding Web3 social layer solutions. Start with small test positions to understand price volatility patterns.

✅ Experienced Investors: May allocate 2-5% of crypto portfolio with active monitoring of platform development milestones, user growth metrics, and partnership announcements. Implement strict stop-loss protocols given the token's high volatility profile.

✅ Institutional Investors: Conduct comprehensive due diligence on the project's technical architecture, team credentials, and competitive positioning before consideration. Any allocation should be part of a diversified Web3 infrastructure portfolio with appropriate risk management frameworks.

INSP Trading Participation Methods

- Spot Trading: Access INSP through Gate.com and other supporting exchanges, with current availability on 8 exchanges according to market data

- Dollar-Cost Averaging: Implement systematic purchase strategies to mitigate timing risk, particularly given the token's high volatility characteristics

- Community Engagement: Monitor INSP's official channels including Twitter (@inspectxyz) and documentation (inspect.gitbook.io/inspect) for project updates and feature releases

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is INSP token? What are its practical use cases?

INSP is the native token of the Inspect platform, used for trading, governance, and community rewards. With a maximum supply of 1 billion tokens, it facilitates platform transactions and decentralized decision-making while incentivizing user participation in the ecosystem.

How to analyze INSP price trends? What are the key indicators for technical and fundamental analysis?

Analyze INSP price trends using technical indicators like moving averages and MACD for price momentum. Monitor fundamental factors including project developments, market adoption rate, and overall crypto market sentiment. Key metrics include trading volume, market cap, and network activity growth.

INSP price prediction main risk factors?

INSP price is influenced by market sentiment, news announcements, and community activity. Fundamental analysis, trading strategies, market volatility, and regulatory policies are key factors affecting price predictions.

What are the advantages and disadvantages of INSP compared to similar tokens?

INSP offers governance voting rights and promotes community participation in the ecosystem. However, it may lack market liquidity and widespread adoption compared to competitors with higher liquidity and more functionalities.

What is the price outlook for INSP in 2024? How is market recognition?

INSP reached a peak of $0.4 on March 9, 2024, but subsequently declined to a low of $0.00395. Market recognition has fluctuated without significant improvement, reflecting volatility in investor sentiment.

What risks should I be aware of when investing in INSP? How to mitigate them?

Monitor market volatility and project fundamentals carefully. Diversify your portfolio, invest gradually over time, and only allocate capital you can afford to lose. Stay updated on project developments and community sentiment.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Ethereum 2.0 in 2025: Staking, Scalability, and Environmental Impact

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is BOOP: Understanding the Web3 Token in 2025

Altcoin Season Index 2025: How to Use and Invest in Web3

How Active Is BULLA's Community and Ecosystem in 2026? Twitter, Telegram, and DApp Growth Analysis

What are MERL compliance and regulatory risks in 2026?

Top 4 Coins with the Best Mining Profitability

How does Merlin Chain (MERL) community drive ecosystem growth with 70% activity rate on Twitter, Telegram, and Reddit?

What is the COINX price volatility analysis: historical trends, support resistance levels, and correlation with BTC in 2026?