2026 IRIS Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Blockchain Adoption

Introduction: IRIS's Market Position and Investment Value

IRISnet (IRIS), positioned as a self-evolving BPoS cross-chain service hub, has been serving as a bridge between digital and real economies since its launch in 2019. As of 2026, IRIS maintains a market capitalization of approximately $942,519, with a circulating supply of around 1.63 billion tokens and a price hovering near $0.0005772. This asset, recognized as a "cross-chain infrastructure facilitator," is playing an increasingly important role in enabling interoperability across heterogeneous blockchain networks and traditional business systems.

This article will comprehensively analyze IRIS's price trends from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. IRIS Price Historical Review and Current Market Status

IRIS Historical Price Evolution Trajectory

- 2019: IRISnet launched in April with initial public offering, establishing its position as a cross-chain service hub

- 2021: Market reached peak momentum in April, with IRIS price touching $0.299467 on April 12, representing the historical high point during the broader crypto market expansion

- 2025: Market experienced significant downward pressure throughout the year, with price declining to $0.00044927 on December 2, marking the lowest recorded level

IRIS Current Market Status

As of February 3, 2026, IRIS is trading at $0.0005772, showing a 24-hour decline of 5.82%. The token has demonstrated mixed short-term momentum, with a 1-hour decrease of 0.19% and a 7-day gain of 4.10%, while experiencing a 30-day decline of 19.68%.

The current price remains substantially below the historical peak of $0.299467 recorded in April 2021, representing a distance from previous highs. However, the token has shown some recovery from its December 2025 low of $0.00044927.

Market capitalization stands at approximately $942,519, with a 24-hour trading volume of $13,875.57. The circulating supply represents 1.63 billion IRIS tokens out of a total supply of approximately 1.99 billion tokens, resulting in a circulation ratio of 81.89%. The fully diluted market cap is calculated at $1,150,912.

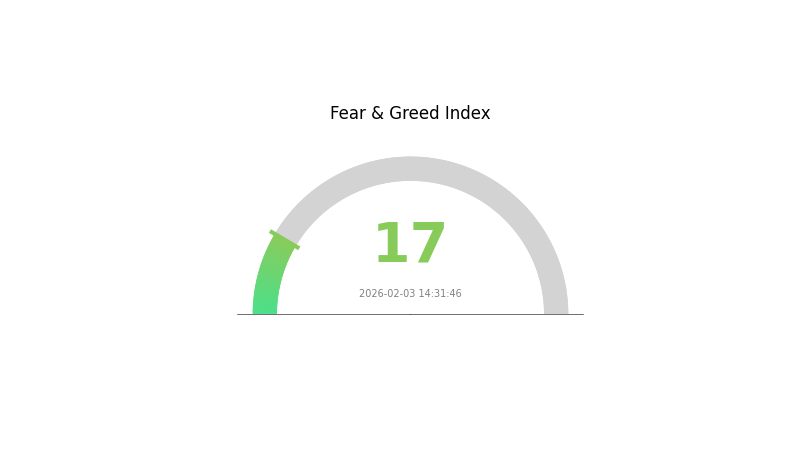

With a market dominance of 0.000041%, IRIS maintains a modest position within the broader cryptocurrency ecosystem. The current market sentiment index registers at 17, indicating extreme fear conditions across the crypto market, which may influence near-term price dynamics.

The 24-hour price range spans from $0.000531 to $0.0006191, reflecting intraday volatility. Year-over-year performance shows a 75.96% decline, highlighting the challenging market environment over the past 12 months.

Click to view current IRIS market price

IRIS Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the IRIS index dropping to 17. This signals significant market pessimism and heightened risk aversion among investors. Such extreme fear conditions historically present contrarian opportunities, as panic selling often creates attractive entry points for long-term investors. However, exercise caution and conduct thorough research before making investment decisions. Monitor market developments closely, as sentiment can shift rapidly. Consider dollar-cost averaging to mitigate timing risks during volatile periods.

IRIS Holding Distribution

The holding distribution chart provides a comprehensive overview of token allocation across different wallet addresses, serving as a crucial indicator of decentralization and market structure. By analyzing the concentration of IRIS tokens among top holders, we can assess the potential risks of market manipulation and evaluate the overall health of the network's token economy.

Based on current on-chain data, IRIS demonstrates a moderately concentrated holding pattern among top addresses. The distribution reveals that a significant portion of the circulating supply is held by a relatively small number of wallets, which is common in early-stage blockchain projects. This concentration level suggests that while the network maintains a degree of decentralization, large holders retain substantial influence over market dynamics. Such distribution patterns can amplify price volatility during periods of significant trading activity, as movements by whale addresses may trigger cascading effects on market sentiment.

From a market structure perspective, the current holding distribution reflects both opportunities and challenges for IRIS. The presence of large holders could indicate strong institutional confidence or strategic reserves held by the project foundation for ecosystem development. However, this concentration also introduces vulnerability to sudden liquidity shifts if major holders decide to redistribute their positions. The relatively stable distribution pattern observed recently suggests that major stakeholders are maintaining their long-term positions, which typically indicates confidence in the project's future development trajectory and provides a foundation for more predictable market behavior.

Click to view current IRIS Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing IRIS Future Price

Supply Mechanism

- Bitcoin Mining Business Transition: Iris Energy originally operated as a Bitcoin mining company, with 97% of revenue still derived from cryptocurrency mining as of the first quarter of fiscal year 2026 (ending September 30). This means Bitcoin price fluctuations continue to directly impact the company's revenue and profit.

- Historical Pattern: As a Bitcoin mining enterprise, the company's performance has been closely tied to Bitcoin market cycles. Mining revenue responds sensitively to Bitcoin price movements, creating cyclical business characteristics.

- Current Impact: The company is implementing a long-term strategy to gradually reduce its business dependency on Bitcoin prices by shifting focus toward AI cloud infrastructure. This transition may help stabilize revenue sources and decrease exposure to cryptocurrency market volatility.

Institutional and Major Holder Dynamics

- Institutional Holdings: According to SEC filings dated November 14, 2025, Discovery Capital Management, LLC sold 784,600 shares of Iris Energy during the third quarter but still holds 3,365,700 shares valued at approximately $157.95 million, representing 8.66% of its total assets under management and ranking as the fund's second-largest holding. This indicates continued institutional confidence despite partial profit-taking.

- Corporate Adoption: Iris Energy has secured a five-year contract with Microsoft, establishing a solid foundation for future revenue. This partnership demonstrates the company's potential and technical capabilities in the AI infrastructure market, with annual recurring revenue (ARR) projected to reach $3.4 billion by the end of 2026, driven by growing AI cloud demand.

- Regulatory Environment: The Bitcoin mining industry faces influence from multiple factors, including government regulatory policies on cryptocurrencies. Global emphasis on renewable energy may provide additional opportunities for companies like Iris Energy that employ environmentally friendly mining approaches under supportive policy frameworks.

Macroeconomic Environment

- Market Volatility Impact: Market conditions, including broader economic fluctuations and investor sentiment, affect trading execution and account access. Recent market concerns about potential AI sector bubbles have contributed to stock price pressure, though these concerns may not fully reflect the company's actual business fundamentals.

- Industry Trend Shifts: With rapid AI technology development, demand for AI infrastructure continues growing. Iris Energy is positioning itself to capitalize on this trend through active transformation. Increased AI cloud demand is expected to drive significant ARR growth and enhance market competitiveness.

Technical Development and Ecosystem Building

- AI Infrastructure Transformation: To address evolving market demands and technological progress, the company is gradually transitioning from Bitcoin mining to become an AI infrastructure provider. While Bitcoin price volatility still affects the company, this influence should diminish as AI infrastructure business expands.

- Financial Health: The company maintains healthy financial conditions with a current ratio of 5.52, demonstrating capacity to meet short-term financial obligations. This financial stability is crucial for maintaining steady business operations and supporting long-term strategic transformation.

- Competitive Positioning: In the Bitcoin mining sector, Iris Energy faces competition from other mining enterprises. However, the company's commitment to sustainable expansion through renewable energy mining methods provides certain competitive advantages, particularly as environmental considerations gain importance in the industry.

III. 2026-2031 IRIS Price Prediction

2026 Outlook

- Conservative prediction: $0.0003 - $0.00058

- Neutral prediction: $0.00058

- Optimistic prediction: $0.0006 (requires sustained market momentum and positive sentiment)

2027-2029 Outlook

- Market stage expectation: The token may enter a gradual recovery phase with moderate volatility as the crypto market matures and adoption increases

- Price range prediction:

- 2027: $0.00054 - $0.00072 (approximately 2% change)

- 2028: $0.0004 - $0.00078 (approximately 13% change)

- 2029: $0.00049 - $0.00075 (approximately 24% change)

- Key catalysts: Ecosystem development, network upgrades, increased interoperability features, and broader blockchain adoption in enterprise solutions

2030-2031 Long-term Outlook

- Baseline scenario: $0.00043 - $0.0009 (assuming steady ecosystem growth and market stabilization)

- Optimistic scenario: $0.00082 - $0.00112 (assuming accelerated adoption, strategic partnerships, and favorable regulatory environment)

- Transformative scenario: Potential to exceed $0.00112 (requires breakthrough technological innovations, mass adoption of cross-chain solutions, and significant institutional investment)

- 2026-02-03: IRIS trading within $0.0003 - $0.0006 range (current market consolidation phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0006 | 0.00058 | 0.0003 | 0 |

| 2027 | 0.00072 | 0.00059 | 0.00054 | 2 |

| 2028 | 0.00078 | 0.00065 | 0.0004 | 13 |

| 2029 | 0.00075 | 0.00072 | 0.00049 | 24 |

| 2030 | 0.0009 | 0.00073 | 0.00043 | 27 |

| 2031 | 0.00112 | 0.00082 | 0.00044 | 41 |

IV. IRIS Professional Investment Strategy and Risk Management

IRIS Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors who believe in cross-chain interoperability infrastructure and are willing to hold through market cycles

- Operational Recommendations:

- Consider accumulating positions during market downturns, given IRIS has declined approximately 75.96% over the past year

- Monitor developments in IRISnet's cross-chain service hub and integration capabilities with public chains, consortium chains, and traditional business systems

- Storage Solution: Use Gate Web3 Wallet for secure asset custody with multi-signature protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Current 24-hour trading volume stands at approximately $13,875, indicating relatively low liquidity that may result in higher volatility

- Price Range Monitoring: Track the 24-hour range between $0.000531 and $0.0006191 to identify potential entry and exit points

- Swing Trading Considerations:

- Short-term price movements show -5.82% over 24 hours but +4.10% over 7 days, suggesting potential volatility-based trading opportunities

- Exercise caution with position sizing due to limited exchange listings and lower liquidity

IRIS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of cryptocurrency portfolio

- Aggressive Investors: 2-3% of cryptocurrency portfolio

- Professional Investors: Up to 5% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Diversification Approach: Combine IRIS holdings with other cross-chain and interoperability-focused assets to spread technical and market risks

- Position Scaling: Implement dollar-cost averaging to mitigate impact of price volatility, particularly given the 19.68% decline over the past 30 days

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet offers user-friendly interface with robust security features for IRIS token storage

- Cold Storage Option: Consider hardware wallet solutions for larger holdings intended for long-term investment

- Security Precautions: Enable two-factor authentication, maintain secure backup of recovery phrases, and never share private keys or sensitive information

V. IRIS Potential Risks and Challenges

IRIS Market Risks

- Low Liquidity Risk: With a market cap of approximately $942,519 and limited exchange availability, IRIS faces significant liquidity constraints that may result in price slippage

- High Volatility: The token has experienced substantial price fluctuations, with 24-hour changes of -5.82% and yearly decline of -75.96%, indicating elevated volatility

- Market Cap Position: Ranked #2548 by market capitalization with only 0.000041% market dominance, suggesting limited mainstream adoption and higher susceptibility to market sentiment shifts

IRIS Regulatory Risks

- Cross-border Compliance: As a cross-chain service hub connecting digital and traditional economies, IRISnet may face regulatory scrutiny regarding data transfer and service interoperability across jurisdictions

- Evolving Cryptocurrency Regulations: Changes in regulatory frameworks for blockchain interoperability projects could impact IRISnet's operations and token utility

- Classification Uncertainty: Regulatory classification of IRIS tokens and the services provided through the network remains subject to interpretation across different regulatory regimes

IRIS Technical Risks

- Cross-chain Integration Complexity: The technical challenges of maintaining seamless integration between public chains, consortium chains, and traditional systems present ongoing development and maintenance risks

- Competition Risk: The cross-chain interoperability space faces competition from established protocols, potentially limiting IRISnet's market share and adoption

- Network Security: As a BPoS (Bonded Proof-of-Stake) consensus mechanism, the network's security depends on validator participation and token staking levels

VI. Conclusion and Action Recommendations

IRIS Investment Value Assessment

IRISnet presents a specialized value proposition as a cross-chain service infrastructure aimed at bridging digital and traditional economies. The project's focus on interoperability and its BPoS consensus mechanism position it within the broader blockchain infrastructure narrative. However, investors should carefully weigh the significant challenges: the token has declined substantially over the past year, demonstrating considerable price pressure; liquidity remains constrained with limited exchange listings; and market capitalization suggests early-stage adoption. The long-term value proposition depends on IRISnet's ability to execute its technical roadmap and gain traction in facilitating cross-chain services, while short-term risks include continued volatility, liquidity constraints, and competitive pressures in the interoperability sector.

IRIS Investment Recommendations

✅ Beginners: Approach with extreme caution; if interested in cross-chain technology exposure, limit allocation to less than 1% of total cryptocurrency portfolio and focus on education about interoperability protocols before investing

✅ Experienced Investors: Consider small speculative positions (1-3% of portfolio) if aligned with thesis on cross-chain infrastructure growth; employ strict risk management including stop-loss orders and position sizing appropriate to liquidity constraints

✅ Institutional Investors: Conduct thorough due diligence on IRISnet's technical development, partnership ecosystem, and competitive positioning; consider participation only as part of a diversified blockchain infrastructure strategy with appropriate risk assessment

IRIS Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale of IRIS tokens through Gate.com trading pairs, suitable for both long-term accumulation and short-term trading strategies

- Storage in Gate Web3 Wallet: Secure custody solution offering ease of access combined with non-custodial security features for IRIS holdings

- Dollar-Cost Averaging: Systematic periodic purchases to mitigate timing risk and smooth out price volatility, particularly appropriate given recent price declines

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is IRIS coin? What are its main uses and value?

IRIS is a cryptocurrency for decentralized applications and smart contracts. It primarily facilitates digital identity verification and asset trading on blockchain networks. Its value lies in enabling secure, transparent transactions and reducing intermediaries in Web3 ecosystems.

What are the main factors affecting IRIS price?

IRIS price is influenced by market sentiment, adoption rates, and overall cryptocurrency market trends. Investor confidence, technical developments, and network activity also play key roles in price movements.

How to predict IRIS price? What analysis methods are available?

IRIS price prediction uses technical analysis with indicators like moving averages and RSI. Traders identify support and resistance levels through chart patterns to gauge market trends and potential price movements.

What is the historical price trend of IRIS? What were the highest and lowest prices in the past?

IRIS reached an all-time high of US$4.12 and an all-time low of US$0.001044. The current price trades significantly below its peak while remaining well above its historical minimum, reflecting substantial price volatility throughout its trading history.

What are the risks to pay attention to when investing in IRIS?

IRIS investment carries high volatility and market uncertainty risks. The project background and technology remain unclear, requiring careful investor assessment. Market performance is unstable, so conduct thorough due diligence before investing.

What are the differences and advantages of IRIS compared to similar tokens?

IRIS focuses on decentralized commerce infrastructure for distributed business applications, unlike other cross-chain solutions that primarily handle token transfers. It offers robust inter-chain communication and commercial-grade functionality.

What are professional analysts' price predictions for IRIS in the future?

Professional analysts have varying predictions for IRIS. Some forecast prices could decline to $0.0005991, while others project it reaching approximately $0.0005836 by year-end 2026. Predictions vary significantly among different analysis firms.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Survey Note: Detailed Analysis of the Best AI in 2025

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Kaspa’s Journey: From BlockDAG Innovation to Market Buzz

Best Crypto Wallets 2025: How to Choose and Secure Your Digital Assets

Popular GameFi Games in 2025

What is NEAR Protocol's current market cap and 24-hour trading volume in 2026?

How active is the Chiliz community and what is the size of its DApp ecosystem?

What are the key derivatives market signals showing about funding rates, open interest, and liquidation data in 2026?

How to Use Technical Indicators (MACD, RSI, KDJ) to Predict Crypto Price Movements in 2026

What is Euler (EUL) DeFi Super App: Whitepaper logic, use cases, and technical innovations explained