2026 ITHACA Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: ITHACA's Market Position and Investment Value

Ithaca Protocol (ITHACA), as a non-custodial and composable options protocol operating primarily on Arbitrum with planned expansion to Base and Solana, has established itself in the decentralized finance derivatives sector since its launch in December 2024. As of February 8, 2026, ITHACA maintains a market capitalization of approximately $201,809, with a circulating supply of 64.25 million tokens and a current trading price of around $0.003141. Backed by notable market makers Cumberland and Wintermute, and consistently ranking among the top 3 protocols on DeFiLlama, this asset is playing an increasingly important role in providing modular infrastructure for options markets and structured products across various underlying assets.

This article will comprehensively analyze ITHACA's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ITHACA Price History Review and Current Market Status

ITHACA Historical Price Evolution Trajectory

- December 2024: ITHACA launched on Gate.com on December 19, 2024, reaching its all-time high of $0.1456 on the same day

- 2025-2026: The token experienced significant price decline, with the price dropping from its peak to establish new lower trading ranges

- February 2026: ITHACA recorded its all-time low of $0.003062 on February 7, 2026, representing a decline of approximately 97.9% from its all-time high

ITHACA Current Market Status

As of February 8, 2026, ITHACA is trading at $0.003141, showing a modest recovery of 0.29% over the past hour. However, the broader trend remains negative, with the token declining 1.07% in the last 24 hours, 11.83% over the past 7 days, and 19.8% over the past 30 days. The one-year performance shows a substantial decline of 95.05%.

The token's 24-hour trading range spans from a low of $0.003062 to a high of $0.00322, with total trading volume reaching $30,243.75. ITHACA's current market capitalization stands at approximately $201,809, based on a circulating supply of 64.25 million tokens out of a maximum supply of 1 billion tokens, representing a circulation ratio of 6.43%. The fully diluted market cap is estimated at $3.14 million.

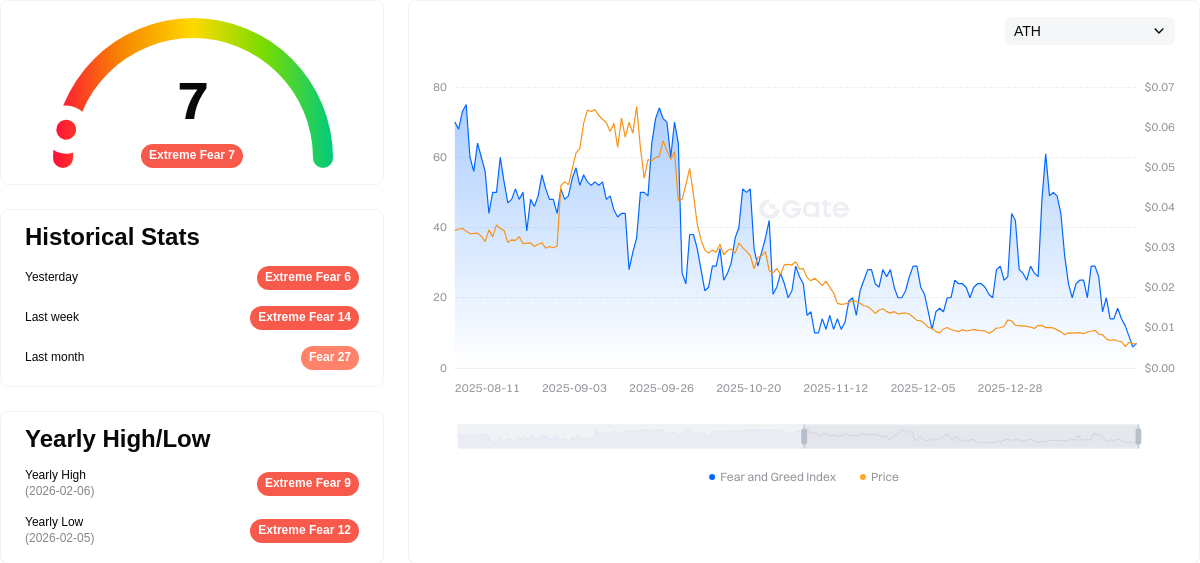

According to market sentiment indicators, the current Fear & Greed Index registers at 7, indicating an "Extreme Fear" sentiment in the broader cryptocurrency market. ITHACA ranks #3938 among tracked cryptocurrencies and holds a minimal market dominance of 0.00012%. The token currently has 1,236 holders and is available for trading on one exchange.

Click to view the current ITHACA market price

ITHACA Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear conditions, with the Fear and Greed Index dropping to just 7 points. This historically low reading indicates severe market pessimism and heightened investor anxiety. When fear reaches such extreme levels, it often signals potential buying opportunities for contrarian investors, as market sentiment tends to be oversold. Traders should exercise caution and conduct thorough research before making investment decisions during such volatile periods. Monitor market developments closely on Gate.com for real-time data and analysis to navigate this challenging market environment effectively.

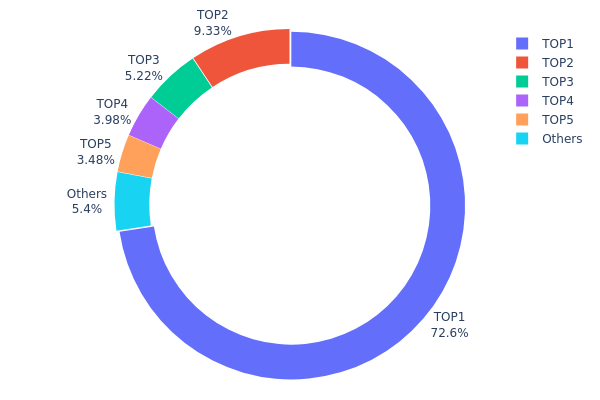

ITHACA Holding Distribution

According to the on-chain holding distribution data, ITHACA tokens exhibit a highly concentrated ownership structure. The holding distribution chart reflects the allocation of tokens across different wallet addresses, serving as a key indicator of decentralization and market structure stability. This metric helps assess potential market manipulation risks and the overall health of token circulation.

The top address (0x48ca...fb0962) holds approximately 653.32 million tokens, accounting for 72.59% of the total supply, indicating extremely high concentration. The second-largest holder (0xa107...534e75) possesses 84 million tokens (9.33%), while the third through fifth addresses hold 5.21%, 3.97%, and 3.48% respectively. Combined, the top five addresses control 94.58% of the total supply, with remaining addresses collectively holding only 5.42%. This distribution pattern suggests ITHACA's on-chain structure is dominated by a few major holders.

Such extreme concentration poses several market implications. First, the dominant position of the largest holder grants significant influence over price movements, as large-scale selling could trigger substantial volatility. Second, the limited token distribution among smaller holders indicates insufficient community participation and weak decentralization, potentially affecting long-term project sustainability. Third, this structure increases susceptibility to coordinated actions by major holders, elevating market manipulation risks. For potential investors, this concentrated holding pattern warrants heightened attention to large-holder activities and enhanced risk management strategies.

Click to view current ITHACA Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x48ca...fb0962 | 653317.43K | 72.59% |

| 2 | 0xa107...534e75 | 84000.00K | 9.33% |

| 3 | 0x81b4...300a17 | 46962.01K | 5.21% |

| 4 | 0x5d76...2f64f4 | 35804.11K | 3.97% |

| 5 | 0x560b...680880 | 31343.91K | 3.48% |

| - | Others | 48572.44K | 5.42% |

II. Core Factors Influencing ITHACA's Future Price

Supply Mechanism

- Market Cycle Impact: ITHACA's price exhibits notable sensitivity to cryptocurrency market cyclicality. Historical patterns demonstrate that price movements align closely with broader crypto market phases.

- Historical Patterns: Trading volume fluctuations during significant market movements have substantially influenced ITHACA's price trajectory in the past.

- Current Influence: The supply mechanism continues to play a role in price dynamics, though specific details about token distribution or emission schedules require further monitoring.

Institutional and Major Holder Dynamics

- Institutional Participation: Market demand and institutional involvement are expected to contribute to ITHACA's price outlook, though specific institutional positions have not been disclosed publicly.

- Adoption Trends: The protocol's adoption trajectory and participation from various market participants may influence long-term price development.

Macroeconomic Environment

- Monetary Policy Impact: Changes in monetary policy and interest rate adjustments could affect ITHACA's attractiveness relative to other asset classes. Global currency market movements, particularly strength in major currencies, may influence capital flows in the cryptocurrency sector.

- Inflation Hedge Characteristics: While some digital assets position themselves as inflation hedges, ITHACA's role in this context remains under development.

- Geopolitical Factors: Geopolitical uncertainties may contribute to increased interest in alternative assets, potentially including ITHACA.

Technical Development and Ecosystem Building

- Non-Custodial Composable Options Protocol: ITHACA operates as a non-custodial composable options protocol on Arbitrum, representing its core technical value proposition.

- Market Sentiment Indicators: Social and sentiment metrics, including media coverage, community growth, and developer activity, serve as important indicators for assessing ITHACA's ecosystem health.

- On-Chain Metrics: Transaction volume, active addresses, and network health status provide essential data for understanding ITHACA's technical fundamentals and ecosystem vitality.

III. 2026-2031 ITHACA Price Prediction

2026 Outlook

- Conservative prediction: $0.00209 - $0.00312

- Neutral prediction: $0.00312

- Optimistic prediction: $0.0034 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: transitional phase with gradual growth momentum

- Price range prediction:

- 2027: $0.00189 - $0.00371

- 2028: $0.00314 - $0.00492

- 2029: $0.00344 - $0.00517

- Key catalysts: ecosystem development, technological improvements, and broader market recovery

2030-2031 Long-term Outlook

- Baseline scenario: $0.00431 - $0.00468 (assuming steady market growth and consistent project development)

- Optimistic scenario: $0.00539 - $0.00609 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: $0.00695 (under exceptionally favorable conditions including mainstream adoption and significant network expansion)

- 2026-02-08: ITHACA trading within early-stage price discovery range

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0034 | 0.00312 | 0.00209 | 0 |

| 2027 | 0.00371 | 0.00326 | 0.00189 | 3 |

| 2028 | 0.00492 | 0.00349 | 0.00314 | 10 |

| 2029 | 0.00517 | 0.0042 | 0.00344 | 33 |

| 2030 | 0.00609 | 0.00468 | 0.00431 | 49 |

| 2031 | 0.00695 | 0.00539 | 0.00431 | 71 |

IV. ITHACA Professional Investment Strategy and Risk Management

ITHACA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with moderate to high risk tolerance seeking exposure to DeFi options protocols

- Operational Recommendations:

- Consider gradual accumulation during market corrections, given the current trading price of $0.003141 represents a significant discount from the all-time high of $0.1456

- Monitor the protocol's expansion to additional chains beyond Arbitrum (Base and Solana deployment mentioned in roadmap)

- Storage Solution: Utilize Gate Web3 Wallet for secure, non-custodial storage with multi-chain compatibility

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Monitor the 24-hour range ($0.003062-$0.00322) and key support at the recent low of $0.003062

- Volume Analysis: Track the 24-hour trading volume of $30,243 to identify liquidity patterns and potential breakout opportunities

- Swing Trading Considerations:

- Consider short-term volatility patterns, with recent 1-hour gain of 0.29% contrasting with 7-day decline of 11.83%

- Implement stop-loss orders below recent support levels to manage downside exposure

ITHACA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Active Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 7-10% with active monitoring capabilities

(2) Risk Hedging Strategies

- Portfolio Diversification: Balance ITHACA exposure with established DeFi protocols and major cryptocurrencies

- Position Sizing: Given the low circulating supply ratio of 6.43%, maintain position sizes appropriate to available liquidity

(3) Secure Storage Solutions

- Primary Recommendation: Gate Web3 Wallet for BEP-20 token custody with enhanced security features

- Multi-signature Option: For larger holdings, consider implementing multi-signature wallet configurations

- Security Considerations: Verify contract address (0x49f1d4db3ea1a64390e990c6debeac88eac007ca on BSC), enable two-factor authentication, and maintain secure backup of recovery phrases

V. ITHACA Potential Risks and Challenges

ITHACA Market Risks

- High Volatility: The token has experienced a 95.05% decline over one year, indicating substantial price volatility and market uncertainty

- Limited Liquidity: With a 24-hour trading volume of approximately $30,244 and market cap of $201,809, liquidity constraints may impact larger trades

- Low Circulation Ratio: Only 6.43% of total supply is currently circulating (64.25 million out of 1 billion tokens), creating potential dilution risk as more tokens enter circulation

ITHACA Regulatory Risks

- DeFi Protocol Scrutiny: Options trading platforms may face increased regulatory attention as authorities develop frameworks for decentralized derivatives

- Multi-chain Compliance: The protocol's planned expansion across multiple chains (Arbitrum, Base, Solana) introduces complexity in navigating different regulatory environments

- Token Classification: Potential regulatory uncertainty regarding the classification of tokens associated with options protocols

ITHACA Technical Risks

- Smart Contract Vulnerabilities: As a composable options protocol, complex smart contract interactions may introduce potential security risks

- Multi-chain Integration Complexity: Planned deployment across multiple chains increases technical complexity and potential points of failure

- MEV Resistance Implementation: While the protocol employs an auction-based mechanism for MEV resistance, the effectiveness of this approach remains subject to ongoing validation

VI. Conclusion and Action Recommendations

ITHACA Investment Value Assessment

Ithaca Protocol presents an innovative approach to decentralized options trading with backing from established market makers Cumberland and Wintermute. The protocol's modular infrastructure and ranking among top platforms on DeFiLlama demonstrate technical competence. However, investors should carefully weigh the significant price decline (95.05% from all-time high) and limited current liquidity against the potential long-term value proposition of expanding decentralized derivatives infrastructure. The low 6.43% circulation ratio suggests substantial token unlock risk that may impact future price performance.

ITHACA Investment Recommendations

✅ Beginners: Limit exposure to 1-2% of crypto portfolio; thoroughly research options protocols before investing; prioritize learning about the underlying technology and market dynamics

✅ Experienced Investors: Consider 3-5% allocation with active monitoring of protocol development milestones, especially multi-chain expansion progress; implement technical analysis strategies within the established price ranges

✅ Institutional Investors: Evaluate strategic positions of 5-10% with comprehensive due diligence on protocol mechanics, market maker partnerships, and competitive positioning in the DeFi derivatives landscape

ITHACA Trading Participation Methods

- Spot Trading: Available on Gate.com with ITHACA trading pairs, providing immediate exposure to price movements

- Dollar-Cost Averaging: Implement systematic accumulation strategy to mitigate timing risk, particularly suitable given current price levels relative to historical data

- Yield Strategies: Monitor protocol developments for potential staking or liquidity provision opportunities as the platform expands

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ITHACA? What are its uses and application scenarios?

ITHACA is an options trading protocol offering 250+ executable prices for various options products including vanilla options, digital options, option strategies, forwards, and structured products. It utilizes an auction-based matching engine for efficient price execution and serves institutional traders and DeFi participants seeking diverse options trading solutions.

How to predict ITHACA price? What are the analysis methods?

ITHACA price prediction relies on analyzing on-chain metrics and transaction data. Key indicators include daily active addresses and network activity. Time series analysis and regression models are commonly used methods for data-driven forecasting.

What are the main factors affecting ITHACA price?

ITHACA price is primarily driven by market demand, technological advancements, ecosystem development, and external market events. Trading volume and investor sentiment also significantly influence price movements.

ITHACA的历史价格表现如何?

ITHACA past year showed 42.36% price change, with 52-week range between $120.40 and $242.50. Daily average trading volume demonstrates consistent market activity, reflecting investor interest in the asset.

What are the main risks to be aware of when investing in ITHACA?

Key risks include market volatility, price manipulation, regulatory uncertainty, and technical vulnerabilities. ITHACA's value may fluctuate significantly based on market conditions, protocol updates, and broader crypto market trends. Investors should conduct thorough research before participating.

What are the advantages of ITHACA compared to other cryptocurrencies?

ITHACA excels in decentralized derivatives, offering superior flexibility for options and structured products. It provides efficient settlement and advanced strategic capabilities beyond basic transactions.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

7 Ways To Survive the Crypto Bear Market

Blockchain Developer Salaries: What Web3 Developers Are Paid

Revolut Quiz Answers: Complete Guide to Earning Free Cryptocurrency

Best Non-Custodial Wallets: Top Choices

Comprehensive Guide to Moving Averages