2026 LINGO Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: LINGO's Market Position and Investment Value

LINGO (LINGO), as the first rewards token powered by Real World Assets (RWA), has been driving sustainable and scalable Web3 adoption since its launch in 2024. As of 2026, LINGO maintains a market capitalization of approximately $1.13 million, with a circulating supply of around 118.92 million tokens, and its price holds at approximately $0.009471. This asset, recognized as a pioneering RWA-backed rewards mechanism, is playing an increasingly significant role in the consumer crypto ecosystem and Web3 user engagement.

This article will comprehensively analyze LINGO's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. LINGO Price History Review and Market Overview

LINGO Historical Price Evolution Trajectory

- December 2024: Token launched on Gate.com at an initial price of $0.2, marking the official entry of this RWA-powered rewards token into the crypto market

- December 2024: Price reached an all-time high of $0.8 on December 12, 2024, representing a significant appreciation from its launch price

- December 2025: Market experienced considerable volatility, with price declining to an all-time low of $0.008087 on December 25, 2025, reflecting a substantial correction from peak levels

- 2026: Price currently trades at $0.009471, showing gradual recovery from the December 2025 lows

LINGO Current Market Status

As of February 3, 2026, LINGO is trading at $0.009471, exhibiting short-term positive momentum with a 3.53% increase over the past hour and a 3.76% gain over the past 24 hours. The 24-hour trading range spans from $0.009053 to $0.009829, indicating moderate intraday volatility. However, the token has experienced a decline of 1.82% over the past week and 4.03% over the past month.

The token's year-over-year performance shows a decline of 97.26% from its launch period, with the current price sitting significantly below both its all-time high of $0.8 and its initial offering price of $0.2. The 24-hour trading volume stands at approximately $16,212.67, suggesting relatively modest market activity.

LINGO maintains a market capitalization of approximately $1.13 million, with a circulating supply of 118.92 million tokens representing 11.89% of the maximum supply of 1 billion tokens. The fully diluted valuation also stands at approximately $1.13 million, indicating a market cap to FDV ratio of 11.89%. The token currently ranks #2436 in the cryptocurrency market with a dominance of 0.000040%.

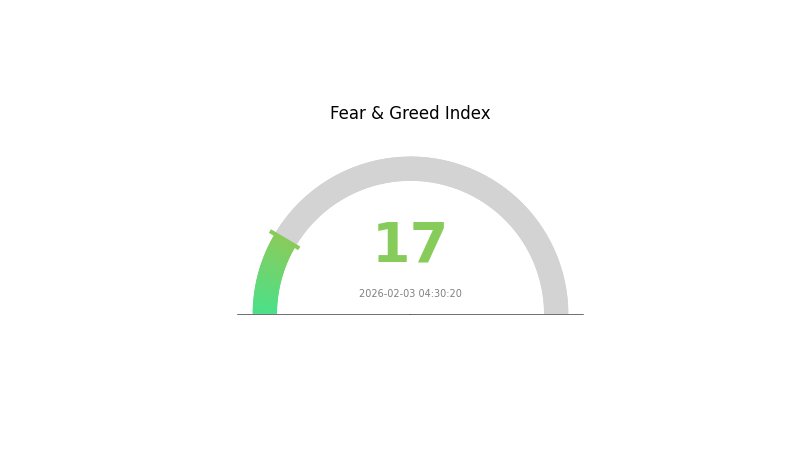

The LINGO ecosystem has attracted 31,356 token holders, demonstrating community engagement despite market price fluctuations. The token is listed on 8 exchanges, with Gate.com serving as a primary trading platform. Market sentiment indicators show an extreme fear reading of 17 on the VIX scale, reflecting broader market caution.

Click to view current LINGO market price

LINGO Market Sentiment Indicator

02-03-2026 Fear and Greed Index: 17 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index plummeting to 17. This indicates significant market pessimism and heightened risk aversion among investors. During such periods, market volatility typically increases as traders reassess their positions. Extreme fear often presents contrarian opportunities for long-term investors, as assets may be undervalued. However, caution is advised, as further downside risks remain. Monitor key support levels closely and consider your risk tolerance before making investment decisions. Stay informed through Gate.com's market data tools to navigate these challenging market conditions effectively.

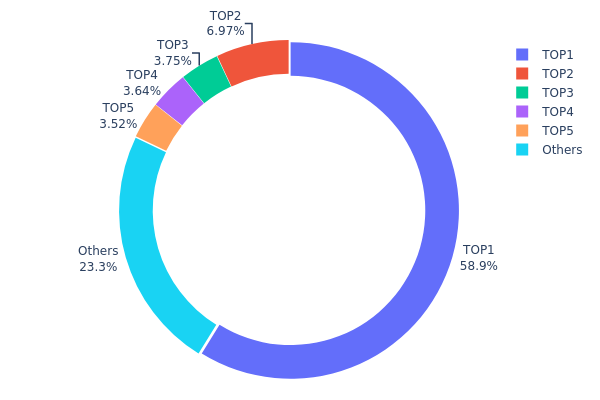

LINGO 持仓分布

The LINGO address holding distribution reveals a significant concentration of tokens among top holders. The largest address controls approximately 338.91 million tokens, representing 58.85% of the total supply, while the top 5 addresses collectively hold 441.87 million tokens, accounting for 76.71% of the circulating supply. This leaves only 23.29% distributed among other addresses, indicating a highly centralized token ownership structure.

Such concentration levels present notable implications for market dynamics. The dominant position of the top holder, controlling nearly 60% of supply, creates substantial influence over price movements and liquidity conditions. Large-scale transactions from this address could trigger significant volatility, while the collective control exercised by top holders may limit organic price discovery. This structure also raises considerations regarding potential coordinated actions that could impact market sentiment and trading patterns.

From a decentralization perspective, LINGO's current distribution pattern suggests limited token dispersion across the network. The heavy weighting toward major holders indicates that on-chain governance participation and ecosystem activities may be concentrated within a relatively small group of stakeholders. While such concentration can sometimes reflect strategic allocations or ecosystem development reserves, it simultaneously presents structural vulnerabilities regarding market stability and community-driven growth dynamics.

Click to view current LINGO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0e0b...1502b6 | 338908.39K | 58.85% |

| 2 | 0x9af8...2398ac | 40124.58K | 6.96% |

| 3 | 0x7e3e...057513 | 21593.57K | 3.74% |

| 4 | 0x6989...c97bcb | 20969.02K | 3.64% |

| 5 | 0x9399...9b2445 | 20277.81K | 3.52% |

| - | Others | 133994.45K | 23.29% |

II. Core Factors Influencing LINGO's Future Price

Supply Mechanism

- Maximum Supply and Current Circulation: LINGO has a maximum supply of 1 billion tokens, with a current total supply of 118.92 million tokens matching its circulating supply. The circulation remains significantly below the maximum supply, and this scarcity dynamic may influence price movements.

- Historical Patterns: Historical supply distribution and ecosystem allocation have been key factors affecting LINGO's price. Understanding the tokenomics structure is essential for price forecasting.

- Current Impact: With circulating supply substantially lower than the total maximum supply, the scarcity effect could potentially support upward price pressure as market demand evolves.

Market Demand and Adoption Trends

- Market Demand Dynamics: LINGO's price prospects are shaped by market demand, adoption trends, institutional participation, and broader economic factors. The token's value is closely tied to its integration within decentralized linguistics applications.

- Growth Projections: Market analysis suggests a potential annual growth rate of approximately 5%, reflecting moderate expansion expectations based on current adoption patterns and ecosystem development.

- Ecosystem Development: The systematic analysis of LINGO's trajectory from 2025 to 2030 incorporates historical data, supply-demand dynamics, ecosystem progress, and macroeconomic factors to provide professional price forecasting and operational strategies for investors.

III. 2026-2031 LINGO Price Prediction

2026 Outlook

- Conservative Prediction: $0.00644 - $0.00947

- Neutral Prediction: $0.00947

- Optimistic Prediction: $0.01222 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: Gradual growth phase with increasing market recognition and potential ecosystem expansion

- Price Range Predictions:

- 2027: $0.00802 - $0.01507

- 2028: $0.00778 - $0.01788

- 2029: $0.01465 - $0.01974

- Key Catalysts: Progressive price appreciation driven by sustained market development, with average prices showing consistent upward momentum from $0.01084 in 2027 to $0.01542 in 2029

2030-2031 Long-term Outlook

- Baseline Scenario: $0.01354 - $0.02496 (assuming continued market maturation and stable growth trajectory)

- Optimistic Scenario: $0.02127 - $0.0234 (contingent on enhanced market adoption and favorable ecosystem developments)

- Transformative Scenario: Potential to reach upper bounds of $0.02496 by 2030 and $0.0234 by 2031 (under exceptionally favorable market conditions with significant technological breakthroughs and widespread adoption)

- 2026-02-03: LINGO positioned at the initial phase of its projected growth cycle with an average predicted price of $0.00947

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01222 | 0.00947 | 0.00644 | 0 |

| 2027 | 0.01507 | 0.01084 | 0.00802 | 14 |

| 2028 | 0.01788 | 0.01296 | 0.00778 | 36 |

| 2029 | 0.01974 | 0.01542 | 0.01465 | 62 |

| 2030 | 0.02496 | 0.01758 | 0.01354 | 85 |

| 2031 | 0.0234 | 0.02127 | 0.01276 | 124 |

IV. LINGO Professional Investment Strategy and Risk Management

LINGO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to Real World Asset (RWA)-backed reward tokens with a tolerance for high volatility

- Operational Recommendations:

- Consider accumulating positions during periods of market consolidation, given LINGO's significant decline from its all-time high

- Monitor the project's ecosystem development and RWA integration progress as key indicators of long-term value

- Storage Solution: Utilize Gate Web3 Wallet for secure storage with convenient access to the Base network ecosystem

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the current 24-hour trading volume of approximately $16,213 against historical averages to identify potential breakout patterns

- Support and Resistance Levels: Key levels include the recent 24-hour low of $0.009053 and high of $0.009829

- Swing Trading Considerations:

- The token shows short-term volatility with +3.76% in 24 hours but negative momentum over 7-day (-1.82%) and 30-day (-4.03%) periods

- Consider the low circulating supply ratio of approximately 11.89% when evaluating potential price movements

LINGO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Position Sizing: Implement strict position limits given the token's 97.26% decline over the past year

- Stop-Loss Mechanism: Set protective stops below recent support levels to manage downside risk

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet provides seamless integration with Base network for active traders

- Cold Storage Option: For long-term holdings, consider transferring larger positions to hardware wallet solutions after accumulation

- Security Precautions: Always verify contract address (0xfb42da273158b0f642f59f2ba7cc1d5457481677) before transactions, enable two-factor authentication, and never share private keys

V. LINGO Potential Risks and Challenges

LINGO Market Risks

- Extreme Volatility: The token has experienced a 97.26% decline from its ATH of $0.8 to current levels near $0.009471, indicating substantial price volatility

- Limited Liquidity: With a relatively modest 24-hour trading volume and market capitalization of approximately $1.13 million, liquidity constraints may amplify price swings

- Low Market Dominance: Ranking at #2436 with 0.000040% market dominance suggests vulnerability to broader market movements and limited institutional interest

LINGO Regulatory Risks

- RWA Classification Uncertainty: As a token backed by Real World Assets, regulatory frameworks for such hybrid instruments remain evolving and may subject the project to future compliance requirements

- Cross-Jurisdictional Compliance: The integration of real-world assets with blockchain tokens may face varying regulatory interpretations across different jurisdictions

- Reward Token Classification: Regulatory authorities may scrutinize the reward mechanism structure, potentially affecting operational models

LINGO Technical Risks

- Smart Contract Vulnerabilities: Operating on Base network requires continuous security audits to prevent potential exploits or vulnerabilities

- Low Circulating Supply: Only 11.89% of maximum supply is currently circulating, creating uncertainty around future token release schedules and potential dilution

- Ecosystem Development Risk: The success of the RWA-backed reward model depends heavily on successful ecosystem development and user adoption, which remains unproven at scale

VI. Conclusion and Action Recommendations

LINGO Investment Value Assessment

LINGO presents an innovative approach as the first RWA-backed reward token, positioning itself at the intersection of traditional asset value and crypto incentive mechanisms. However, the significant price decline of 97.26% from its ATH, combined with limited liquidity and low market capitalization, indicates substantial execution and adoption challenges. While the long-term vision of onboarding mainstream users through tangible rewards is compelling, short-term risks remain elevated due to market volatility, regulatory uncertainty, and the early-stage nature of the ecosystem.

LINGO Investment Recommendations

✅ Beginners: Exercise extreme caution; if considering exposure, limit allocation to less than 1% of crypto portfolio and prioritize learning about RWA tokens and Base network ecosystem before committing significant capital ✅ Experienced Investors: Consider small speculative positions (2-3% of crypto portfolio) with strict risk management; focus on monitoring ecosystem development milestones and trading volume trends before increasing exposure ✅ Institutional Investors: Conduct thorough due diligence on RWA backing mechanisms and regulatory compliance framework; consider pilot positions with enhanced monitoring of token economics and unlock schedules

LINGO Trading Participation Methods

- Spot Trading: Available on Gate.com and 7 other exchanges, providing multiple liquidity venues for entry and exit

- Dollar-Cost Averaging: Systematic accumulation strategy to mitigate timing risk given current volatility patterns

- Ecosystem Participation: Engage with LINGO ecosystem applications to understand the reward mechanism and utility firsthand before making investment decisions

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is LINGO? What are its uses and value?

LINGO is a mathematical modeling software designed to solve linear and nonlinear programming problems for optimizing management decisions. It enhances operational efficiency and resource allocation in complex business scenarios.

What factors influence LINGO's price?

LINGO's price is influenced by market demand, trading volume, investor sentiment, technological developments, regulatory changes, and macroeconomic conditions. Network adoption and competitive dynamics also play significant roles in price movements.

How to predict the future price trend of LINGO?

Analyze historical price data, market trends, and trading volume to identify patterns. Monitor project developments, community sentiment, and broader crypto market conditions. Technical analysis tools and on-chain metrics provide additional insights for informed predictions.

What are the risks and limitations of LINGO price prediction?

LINGO price prediction risks include market volatility and technological uncertainty. Technical improvements may drive price growth, but market demand and competition also influence value. Predictions may be inaccurate due to unpredictable market dynamics and adoption rates.

How does LINGO perform in price compared to similar tokens?

LINGO demonstrates relatively stable price performance with a market cap of $5.32 million as of February 2026. Its stability and consistent trading volume position it competitively among similar utility tokens in the crypto market.

Detailed Analysis of the Top 10 RWA Cryptocurrencies in 2025

Benefits of RWAs in Crypto

How to Earn with The RWA DePin Protocol in 2025

Detailed Analysis of RWA in Crypto Assets

Rexas Finance: A Blockchain-Powered Real-World Asset Tokenization Ecosystem

SIX Token (SIX): Core Logic, Use Cases and 2025 Roadmap Analysis

8 Best NFT Wallets

What Is an IDO? Demystifying Initial DEX Offerings

Best Graphics Card for Mining: Leading GPUs from Recent Years

What Is Tokenomics: A Basic Guide

Free Money for App Registration: Crypto Bonus Guide