2026 LNDX Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for the Coming Year

Introduction: LNDX Market Position and Investment Value

LandX Finance (LNDX), as a DeFi protocol leveraging blockchain technology for agricultural asset tokenization, has been developing since its launch in 2023. As of February 2026, LNDX maintains a market capitalization of approximately $223,456, with a circulating supply of around 13.20 million tokens, and its price stabilized near $0.01693. This asset, positioned as an innovative solution for DeFi accessibility, is playing a role in bridging traditional agricultural investments with decentralized finance.

This article will comprehensively analyze LNDX price trends from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. LNDX Price History Review and Market Status

LNDX Historical Price Evolution Trajectory

- 2023: Project launched on December 15 with token listing, reaching a historical peak price of $7.14676

- 2024-2025: Market adjustment period, experiencing significant price corrections alongside broader crypto market cycles

- 2026: Price declined to a historical low of $0.01485 on January 21, followed by slight recovery to current levels around $0.01693

LNDX Current Market Situation

As of February 8, 2026, LNDX is trading at $0.01693, representing a 1.39% decline over the past 24 hours. The token has experienced notable volatility across different timeframes, with a 0.88% decrease in the past hour, a 7.06% drop over the past week, and a 30.04% decline over the past month. The annual performance shows an 87.06% decrease from its price one year ago.

Within the 24-hour trading period, LNDX reached an intraday high of $0.01739 and a low of $0.01616, with a total trading volume of $18,131.16. The token's market capitalization stands at approximately $223,456, with a circulating supply of 13,198,820 LNDX tokens, representing 16.5% of the total supply of 70,149,916 tokens. The fully diluted market cap is calculated at $1,187,638, based on a maximum supply of 80,000,000 tokens.

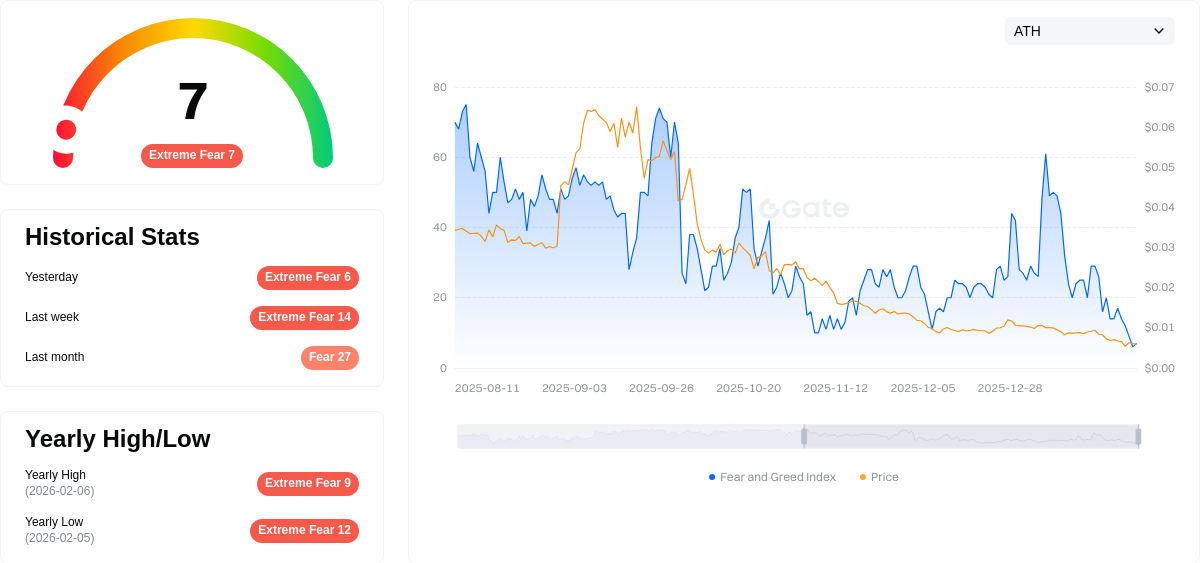

LNDX currently holds a ranking of #3802 in the cryptocurrency market, with a market dominance of 0.000047%. The token has 2,203 holders, and the market-cap-to-FDV ratio stands at 16.5%. According to market sentiment indicators, the current Fear and Greed Index registers at 7, indicating "Extreme Fear" conditions in the broader cryptocurrency market.

Click to view the current LNDX market price

LNDX Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index reading at 7. This exceptionally low sentiment indicates widespread panic and pessimism among investors. Such extreme conditions often present contrarian opportunities, as markets typically recover from fear-driven lows. Investors should exercise caution while remaining alert to potential entry points. It's advisable to conduct thorough research and risk assessment before making investment decisions during periods of extreme market fear.

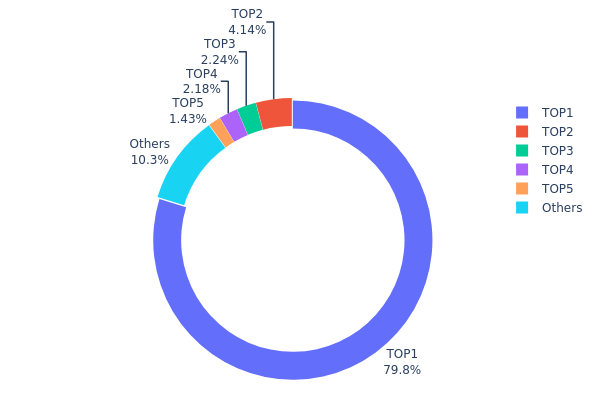

LNDX Holding Distribution

According to the on-chain address holding distribution data, LNDX exhibits a highly centralized holding structure. The top address (0x08a1...742539) holds 55,951.10K tokens, accounting for 79.75% of the total circulation, demonstrating an extremely concentrated ownership pattern. The second through fifth largest addresses hold 2,906.55K (4.14%), 1,570.24K (2.23%), 1,528.33K (2.17%), and 1,000.00K (1.42%) respectively. Combined, the top five addresses control approximately 89.71% of the total supply, while all other addresses collectively hold only 10.29%.

This extreme concentration level presents significant structural risks to the market. The dominance of a single address holding nearly 80% of the supply indicates that price movements could be heavily influenced by the actions of this major holder. Any substantial sell-off or transfer activity from this address could trigger sharp price volatility and create substantial downside pressure. Additionally, such concentrated holding patterns may raise concerns about potential market manipulation, as the largest holder possesses sufficient tokens to significantly impact liquidity and price discovery mechanisms.

From a decentralization perspective, LNDX's current address distribution reflects poor token dispersion and weak on-chain structure stability. The limited number of meaningful holders outside the top addresses suggests constrained organic market participation and shallow liquidity depth. This concentration pattern is typical of projects in early stages or those with limited distribution mechanisms, which may hinder broader market adoption and increase susceptibility to single-point risks.

Click to view current LNDX Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x08a1...742539 | 55951.10K | 79.75% |

| 2 | 0xddeb...ad9c9b | 2906.55K | 4.14% |

| 3 | 0x9642...2f5d4e | 1570.24K | 2.23% |

| 4 | 0xbe9d...4b96b0 | 1528.33K | 2.17% |

| 5 | 0x0000...00dead | 1000.00K | 1.42% |

| - | Others | 7193.71K | 10.29% |

II. Core Factors Influencing LNDX's Future Price

Supply Mechanism

- Market Demand and Adoption: LNDX price is driven by market demand, adoption trends, and institutional involvement. As more users and institutions adopt the LandX protocol, demand for LNDX tokens may increase, potentially supporting price growth.

- Speculative Behavior: The price of LNDX is influenced by speculative trading activities. Price volatility occurs as traders respond to market sentiment, news, and technical patterns.

- Current Influence: LNDX's price continues to be affected by supply-demand dynamics. With a historical low of $0.04124 recorded on October 30, 2025, market conditions and project-specific factors remain key drivers of price movements.

Institutional and Whale Activity

- Institutional Holdings: While specific institutional holdings data is not available in the provided materials, institutional participation generally affects LNDX's market stability and liquidity.

- Corporate Adoption: Information regarding well-known enterprises adopting LNDX was not mentioned in the reference materials.

- National Policy: No country-level policies specifically related to LNDX were identified in the available data.

Macroeconomic Environment

- Monetary Policy Impact: LNDX, like other crypto assets, may be influenced by broader economic factors such as central bank policies and interest rate changes, though specific forecasts were not provided in the materials.

- Inflation Hedge Characteristics: The performance of LNDX in inflationary environments was not discussed in the reference materials.

- Geopolitical Factors: Global news and geopolitical events can lead to volatility in LNDX pricing, as they affect overall cryptocurrency market sentiment and risk appetite.

Technological Development and Ecosystem Building

- Protocol Innovation: LNDX serves as the native token of the LandX protocol, which focuses on real-world asset tokenization on the blockchain. Continued development of the protocol's infrastructure and features may enhance its utility and attract more users.

- Ecosystem Applications: xTOKEN represents perpetual commodity vaults within the LandX ecosystem. The growth of DApps and ecosystem projects utilizing LNDX could expand its use cases and support long-term value.

- Major Events: Significant events such as halving mechanisms, Ethereum upgrades, whale fund movements, ETF approvals, and exchange listings often trigger price surges or declines, directly impacting LNDX's exchange rate against other currencies.

III. 2026-2031 LNDX Price Forecast

2026 Outlook

- Conservative estimate: $0.01494 - $0.01698

- Neutral estimate: $0.01698

- Optimistic estimate: $0.01817 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: gradual growth phase with moderate volatility as the project seeks broader market recognition

- Price range forecast:

- 2027: $0.01248 - $0.0188

- 2028: $0.01564 - $0.02492

- 2029: $0.01767 - $0.03125

- Key catalysts: ecosystem development, strategic partnerships, and overall crypto market sentiment

2030-2031 Long-term Outlook

- Baseline scenario: $0.01584 - $0.0264 (assuming steady project development and stable market conditions)

- Optimistic scenario: $0.02554 - $0.03908 (requires significant technological breakthroughs and mainstream adoption)

- Transformational scenario: $0.03274 - $0.04518 (contingent on exceptional market conditions, major institutional adoption, and comprehensive ecosystem expansion)

- 2026-02-08: LNDX shows potential for measured growth with projected price appreciation of up to 93% by 2031 compared to 2026 baseline levels

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01817 | 0.01698 | 0.01494 | 0 |

| 2027 | 0.0188 | 0.01757 | 0.01248 | 3 |

| 2028 | 0.02492 | 0.01819 | 0.01564 | 7 |

| 2029 | 0.03125 | 0.02155 | 0.01767 | 27 |

| 2030 | 0.03908 | 0.0264 | 0.01584 | 55 |

| 2031 | 0.04518 | 0.03274 | 0.02554 | 93 |

IV. LNDX Professional Investment Strategy and Risk Management

LNDX Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: DeFi enthusiasts and investors seeking agricultural asset exposure through blockchain technology

- Operational Recommendations:

- Accumulate LNDX during price consolidation phases below $0.020 to establish a cost-effective position

- Monitor the project's Layer 2 deployment progress with LayerZero, Arbitrum, and Optimism for potential value catalysts

- Storage Solution: Utilize Gate Web3 Wallet for secure storage with direct integration to the Ethereum mainnet, supporting seamless interaction with LandX's smart contracts

(II) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Apply 20-day and 50-day moving averages to identify trend reversals, particularly useful given LNDX's high volatility with 30-day price decline of 30.04%

- Volume Analysis: Monitor the 24-hour trading volume of approximately $18,131 against market cap movements to gauge accumulation or distribution phases

- Swing Trading Key Points:

- Target entry zones near the recent low of $0.01485 established on January 21, 2026, with stop-loss placement below this level

- Consider taking partial profits during rallies toward the 24-hour high range around $0.0174, as the token exhibits intraday volatility patterns

LNDX Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 7-10% of speculative portfolio allocation

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance LNDX exposure with established DeFi blue-chip tokens to mitigate project-specific risks

- Position Sizing: Implement dollar-cost averaging to reduce entry price volatility, particularly important given the 87.06% decline from all-time high

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet offers multi-chain support and direct integration with Ethereum mainnet for active traders

- Cold Storage Solution: For long-term holders managing larger positions, consider hardware wallet integration with proper backup of seed phrases

- Security Precautions: Never share private keys, enable two-factor authentication, verify contract addresses (0x08A1C30BBB26425c1031ee9E43FA0B9960742539) before transactions, and remain vigilant against phishing attempts

V. LNDX Potential Risks and Challenges

LNDX Market Risks

- Extreme Volatility: LNDX has experienced significant price decline of 87.06% over one year, indicating susceptibility to broad market downturns and investor sentiment shifts

- Limited Liquidity: With only $18,131 in 24-hour trading volume and market cap of approximately $223,456, the token faces liquidity constraints that may result in increased slippage during large transactions

- Low Market Capitalization: Ranked at #3802 with market dominance of only 0.000047%, LNDX remains a micro-cap asset vulnerable to manipulation and extreme price swings

LNDX Regulatory Risks

- Agricultural Tokenization Uncertainty: As a platform tokenizing agricultural assets, LandX operates in a regulatory gray area where securities laws may apply to asset-backed tokens

- Cross-jurisdictional Compliance: The project's integration with multiple Layer 2 solutions and global agricultural assets may trigger diverse regulatory requirements across different jurisdictions

- Evolving DeFi Regulations: Ongoing regulatory developments in major markets could impact the project's operational model or accessibility to users in certain regions

LNDX Technical Risks

- Smart Contract Vulnerabilities: Despite open-source code deployment on Ethereum mainnet, smart contracts remain susceptible to exploits or undiscovered bugs that could compromise user funds

- Layer 2 Integration Complexity: The planned expansion to multiple Layer 2 solutions including Arbitrum and Optimism introduces technical coordination risks and potential cross-chain bridge vulnerabilities

- Dependency on Third-party Infrastructure: Reliance on LayerZero and other L2 protocols creates external dependencies where issues in partner systems could affect LandX functionality

VI. Conclusion and Action Recommendations

LNDX Investment Value Assessment

LandX Finance presents an innovative approach to agricultural asset tokenization through DeFi infrastructure, leveraging Ethereum mainnet security and Layer 2 scalability solutions. The project's collaboration with established protocols like LayerZero, Arbitrum, and Optimism demonstrates technical sophistication. However, the substantial 87.06% annual decline and micro-cap status of approximately $223,456 market capitalization indicate significant short-term headwinds. The low circulating supply ratio of 16.5% suggests potential future dilution concerns. While the long-term vision of accessible agricultural investments on blockchain remains compelling, investors should approach with extreme caution given current market positioning and volatility patterns.

LNDX Investment Recommendations

✅ Beginners: Avoid allocation until demonstrating stronger market stability and increased liquidity; focus on understanding DeFi fundamentals and agricultural tokenization concepts before considering entry ✅ Experienced Investors: Limit exposure to 1-2% of speculative portfolio; consider small position entry near recent lows with strict stop-loss discipline; monitor Layer 2 deployment milestones for potential catalysts ✅ Institutional Investors: Conduct thorough due diligence on agricultural asset backing and legal structure; assess regulatory implications of agricultural tokenization in target markets; consider pilot allocation only after comprehensive risk assessment

LNDX Trading Participation Methods

- Spot Trading on Gate.com: Access LNDX trading pairs with competitive fees and deep liquidity infrastructure suitable for both retail and professional traders

- DeFi Interaction: Connect Gate Web3 Wallet directly to LandX smart contracts on Ethereum mainnet for direct protocol participation and yield farming opportunities

- Dollar-Cost Averaging Strategy: Establish systematic purchase plans to mitigate volatility impact, particularly effective given current price levels near historical lows established in January 2026

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is LNDX? What is its purpose?

LNDX is the token of LandX Finance, a pioneering DeFi platform bridging decentralized finance and agriculture. It primarily provides crucial funding support for farmers and enables agricultural financing through blockchain technology.

What is the current price of LNDX? What are the all-time high and all-time low prices?

LNDX currently trades between $0.01637 and $0.01752. Its all-time high is $3.58 and all-time low is $0.0156.

2024年LNDX价格会涨到多少?

Based on current momentum and market trends, LNDX could potentially reach $0.05-$0.08 by end of 2024, driven by increased adoption and project developments.

What are LNDX future prospects? Is it worth investing?

LNDX demonstrates strong growth potential driven by real-world asset tokenization trends. Market analysis suggests bullish momentum with projected price appreciation over the next 2-3 years. Early adopters may benefit from ecosystem expansion and increased adoption in the web3 real estate space.

What are the main factors affecting LNDX price?

LNDX price is influenced by supply and demand dynamics, market sentiment, regulatory developments, institutional adoption, and broader macroeconomic trends including inflation and interest rates.

What are LNDX's advantages and disadvantages compared to mainstream cryptocurrencies?

LNDX offers high liquidity and low trading fees, but has lower market recognition and fewer trading pairs compared to mainstream coins like BTC and ETH, lacking a broad user base.

What are the risks to pay attention to when investing in LNDX?

LNDX investment risks include market volatility, liquidity fluctuations, regulatory uncertainty, and technology risks. Monitor token fundamentals, team credibility, and market conditions carefully. Diversify your portfolio and only invest what you can afford to lose.

Where can I buy LNDX?

LNDX can be purchased on multiple cryptocurrency exchanges including both centralized exchanges (CEX) and decentralized exchanges (DEX). Popular platforms support LNDX trading. Visit major cryptocurrency exchange platforms to check real-time availability and trading pairs for LNDX.

What is the technical team and project background of LNDX?

LNDX was founded in 2023, focusing on solving blockchain scalability and user experience challenges. The technical team specializes in Layer 2 solutions and DeFi innovations, building a decentralized finance ecosystem with advanced blockchain protocols.

Detailed Analysis of the Top 10 RWA Cryptocurrencies in 2025

Benefits of RWAs in Crypto

How to Earn with The RWA DePin Protocol in 2025

Detailed Analysis of RWA in Crypto Assets

Rexas Finance: A Blockchain-Powered Real-World Asset Tokenization Ecosystem

SIX Token (SIX): Core Logic, Use Cases and 2025 Roadmap Analysis

Revolut Quiz Answers: Complete Guide to Earning Free Cryptocurrency

Best Non-Custodial Wallets: Top Choices

Comprehensive Guide to Moving Averages

Six Cryptocurrencies That Have Achieved Over 1,000x Total Growth

Top 8 Crypto Wallets for Secure Digital Asset Management