2026 LOA Price Prediction: Expert Analysis and Market Forecast for Legends of Aria Token

Introduction: LOA's Market Position and Investment Value

League of Ancients (LOA), positioned as a MOBA NFT GameFi project inspired by Dota 2 and League of Legends, has been developing its ecosystem through blockchain-based free-to-play and play-to-earn mechanisms. As of February 6, 2026, LOA maintains a market capitalization of approximately $465,986, with a circulating supply of around 423.62 million tokens, and its price is hovering at $0.0011. This gaming-focused asset is gradually establishing its presence in the Web3 gaming and metaverse sectors.

This article will comprehensively analyze LOA's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. LOA Price History Review and Market Status

LOA Historical Price Evolution Trajectory

- 2021: LOA reached its peak price of $1.47 on December 12, marking a significant milestone in the early stage of the project's development, reflecting strong initial market enthusiasm for this MOBA NFT gaming token.

- 2025: The token experienced substantial volatility, with the price dropping to its historical low of $0.0006714 on December 16, representing a significant correction from previous levels.

- Recent Period: Over the past year, LOA has experienced considerable market pressure, with the price declining approximately 38.86%, reflecting broader market challenges and adjustments in the GameFi sector.

LOA Current Market Status

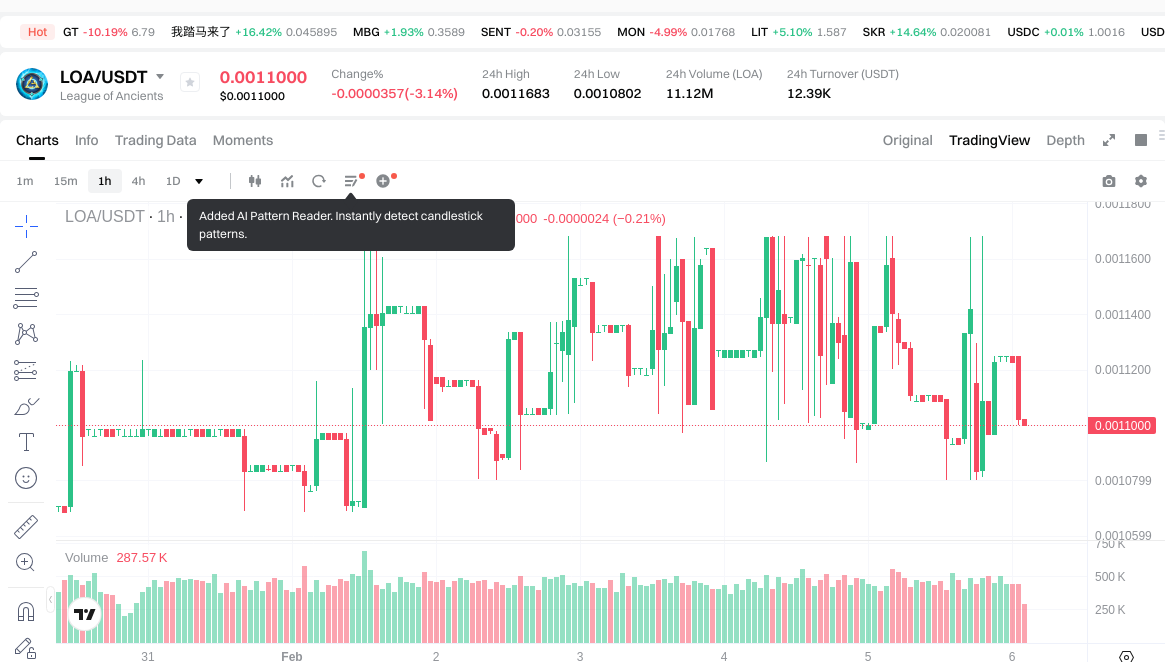

As of February 6, 2026, LOA is trading at $0.0011, showing short-term price fluctuations. The token has demonstrated a 1-hour price decline of 1.9% and a 24-hour decrease of 2.94%. However, the 7-day performance shows a recovery of 2.93%, and the 30-day trend indicates a positive movement of 6.56%, suggesting potential stabilization in recent weeks.

The current market capitalization stands at approximately $465,987, with a circulating supply of 423,624,470 LOA tokens, representing 42.36% of the maximum supply of 1 billion tokens. The 24-hour trading volume is recorded at $12,369.75, indicating moderate market activity. The token holder count has reached 17,353, demonstrating a growing community base.

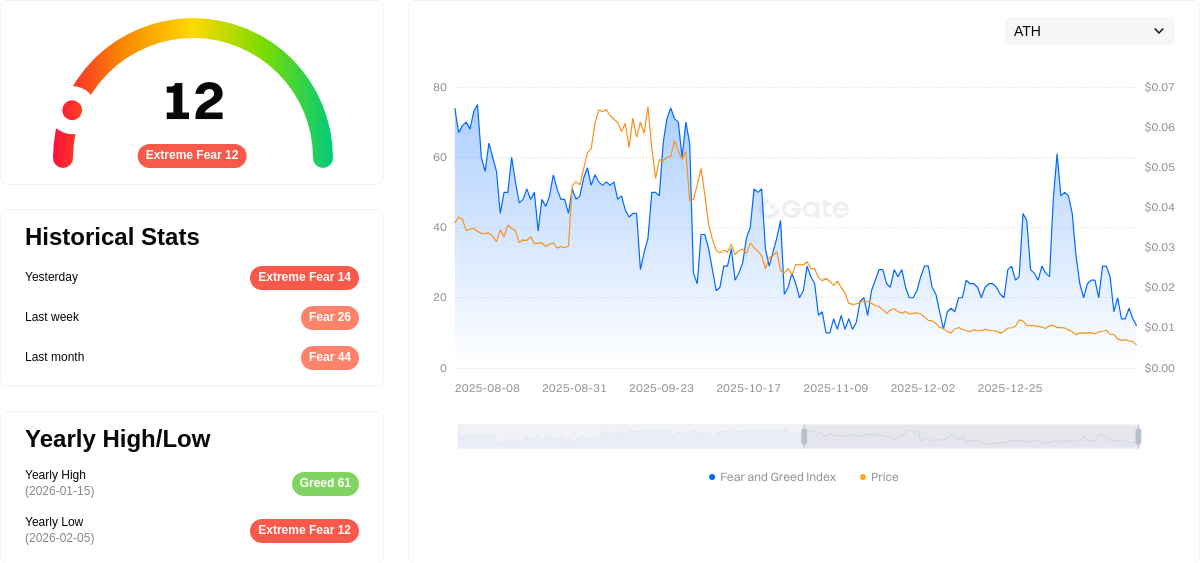

The token is currently trading significantly below its all-time high, with the current price representing a substantial discount from the peak level. The market-cap-to-fully-diluted-valuation ratio of 42.36% suggests that a considerable portion of the total supply remains to be circulated. The current market sentiment index stands at 12, indicating an "Extreme Fear" environment in the broader cryptocurrency market.

Click to view the current LOA market price

LOA Market Sentiment Indicator

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear sentiment with an index reading of 12. This exceptionally low level indicates intense market pessimism and risk aversion among investors. During such periods, asset prices often face significant downward pressure as participants rush to exit positions. However, extreme fear can also present contrarian opportunities for long-term investors seeking favorable entry points. Market participants should exercise caution while monitoring for potential turning points.

LOA Token Holdings Distribution

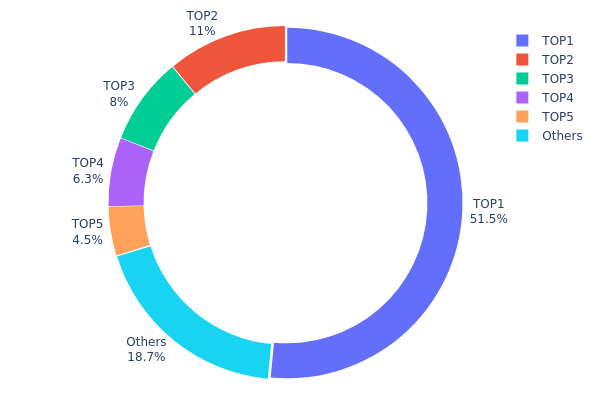

The LOA token holdings distribution reveals a highly concentrated ownership structure, with the top 5 addresses collectively controlling approximately 81.3% of the total token supply. The largest holder alone possesses 515,065.31K tokens, representing 51.50% of the entire circulation, indicating significant centralization in a single address. The second and third largest addresses hold 11.01% and 8.00% respectively, while the remaining addresses outside the top 5 account for only 18.7% of the total supply.

This concentration pattern presents both opportunities and risks for market participants. The dominant position of the top holder suggests potential for significant price volatility, as large-scale transactions from this address could substantially impact market liquidity and price stability. From a decentralization perspective, such concentrated holdings may raise concerns about governance centralization and potential market manipulation risks. However, if these major addresses belong to project treasuries, liquidity pools, or locked vesting contracts, this concentration could reflect normal token economics rather than immediate market threats.

The current distribution structure indicates a relatively immature circulation phase, where token ownership has not yet dispersed widely across the market. This configuration is common among newer projects or tokens in early development stages, where founding teams, early investors, and strategic partners typically retain substantial holdings. Market participants should closely monitor on-chain movements from these major addresses, as any significant transfer activity could signal important market developments or strategic changes in project direction.

Click to view current LOA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x94b6...02ad50 | 515065.31K | 51.50% |

| 2 | 0x08c3...e7b75f | 110171.23K | 11.01% |

| 3 | 0xf837...95179e | 80000.00K | 8.00% |

| 4 | 0xc134...d4bc61 | 62979.18K | 6.29% |

| 5 | 0xa94d...831cfb | 45000.00K | 4.50% |

| - | Others | 186784.29K | 18.7% |

II. Core Factors Influencing LOA's Future Price

Supply Mechanism

- Token Supply and Scarcity: LOA's token supply mechanism plays a crucial role in determining its market value. The tokenomics design directly affects scarcity levels and long-term price potential.

- Historical Pattern: Supply concentration patterns have historically influenced price volatility. When a single address controls a significant portion of total supply, it can lead to substantial price fluctuations.

- Current Impact: The high concentration of token holdings may continue to affect price stability. Large holders can significantly impact market prices through substantial transactions, while concentrated ownership tends to reduce liquidity and amplify volatility during periods of low trading volume.

Institutional and Major Holder Dynamics

- Holder Concentration Risk: A highly concentrated holder structure presents both decentralization and market stability concerns. The concentration of tokens among top holders could lead to price manipulation risks and reduced market predictability.

- Market Acceptance: The level of institutional investment and mainstream adoption will remain a determining factor for LOA's price trajectory. Broader market acceptance can help mitigate concentration risks over time.

Macroeconomic Environment

- Economic Policy Impact: Macroeconomic conditions continue to influence cryptocurrency markets broadly. Monetary policy shifts, inflation trends, and global economic growth patterns may affect investor sentiment toward digital assets including LOA.

- Market Sentiment: The overall cryptocurrency market environment and risk appetite among investors will play a role in LOA's price development alongside project-specific fundamentals.

Technology Development and Ecosystem Building

- Gaming Technology Evolution: As a blockchain-based MOBA game project, LOA's technological advancement and game development progress are key drivers of long-term value. Improvements in gameplay experience and technical infrastructure can enhance user adoption.

- Ecosystem Expansion: The development of LOA's gaming ecosystem, including user growth, community engagement, and platform features, represents an important factor in sustaining token demand and supporting price appreciation over time.

III. 2026-2031 LOA Price Prediction

2026 Outlook

- Conservative Forecast: $0.00103 - $0.0011

- Neutral Forecast: $0.0011 (average estimate)

- Optimistic Forecast: $0.00155 (requires favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual growth phase with progressive market maturation

- Price Range Forecast:

- 2027: $0.00121 - $0.00148 (approximately 20% growth potential)

- 2028: $0.00097 - $0.00198 (approximately 27% growth trajectory)

- 2029: $0.00105 - $0.00223 (approximately 53% growth momentum)

- Key Catalysts: Broader cryptocurrency market trends, potential ecosystem developments, and increasing token utility

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00151 - $0.00293 (assuming steady market conditions and continuous project development)

- Optimistic Scenario: $0.00196 - $0.00333 (with enhanced ecosystem expansion and favorable regulatory environment)

- Transformative Scenario: Up to $0.00333 (under exceptionally favorable conditions including significant platform upgrades and mass adoption)

- 2026-02-06: LOA trading at approximately $0.0011 (baseline projection for current year)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00155 | 0.0011 | 0.00103 | 0 |

| 2027 | 0.00148 | 0.00133 | 0.00121 | 20 |

| 2028 | 0.00198 | 0.00141 | 0.00097 | 27 |

| 2029 | 0.00223 | 0.00169 | 0.00105 | 53 |

| 2030 | 0.00293 | 0.00196 | 0.00151 | 78 |

| 2031 | 0.00333 | 0.00245 | 0.00171 | 122 |

IV. LOA Professional Investment Strategies and Risk Management

LOA Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in the GameFi and MOBA NFT gaming sector's long-term growth potential

- Operational Recommendations:

- Consider accumulating LOA tokens during market pullbacks, as the token has shown a 30-day increase of 6.56%

- Monitor the project's development milestones and community engagement on platforms like Twitter and Discord

- Storage Solution: Use Gate Web3 Wallet for secure storage of LOA tokens, ensuring private key management best practices

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume (currently $12,369.75) to identify potential breakout or breakdown levels

- Price Action: Track key support at $0.0010802 (24h low) and resistance at $0.0011683 (24h high)

- Swing Trading Points:

- Consider entry points near the lower range of the 24-hour price fluctuation

- Set stop-loss orders below recent support levels to manage downside risk

LOA Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 10% with active risk management protocols

(II) Risk Hedging Solutions

- Diversification: Combine LOA holdings with other gaming tokens and established cryptocurrencies to reduce sector-specific risk

- Position Sizing: Use dollar-cost averaging to build positions gradually, especially given the token's volatility (down 38.86% over 1 year)

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and easy access

- Cold Storage Solution: For long-term holdings, consider hardware wallet solutions with offline storage

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (BSC: 0x94b69263FCA20119Ae817b6f783Fc0F13B02ad50) before transactions

V. LOA Potential Risks and Challenges

LOA Market Risks

- High Volatility: LOA has experienced significant price fluctuations, with a historical high of $1.47 and a recent low of $0.0006714, representing extreme volatility that may not suit all investors

- Limited Liquidity: With a 24-hour trading volume of approximately $12,370, liquidity may be insufficient for large position entries or exits without significant price impact

- Market Competition: The GameFi and MOBA gaming sector is highly competitive, with numerous projects vying for user attention and market share

LOA Regulatory Risks

- Gaming Token Classification: Regulatory frameworks for play-to-earn and GameFi tokens remain unclear in many jurisdictions, potentially affecting LOA's operational model

- Securities Law Concerns: Token utility and governance features may face scrutiny under evolving securities regulations globally

- Geographic Restrictions: Certain regions may impose restrictions on gaming-related crypto tokens, limiting market access

LOA Technical Risks

- Smart Contract Vulnerabilities: As with all blockchain-based projects, smart contract bugs or exploits could impact token functionality and user funds

- Network Dependency: LOA operates on Binance Smart Chain, making it subject to network congestion, fees, and potential security issues on the underlying blockchain

- Game Development Delays: Technical challenges in game development or updates could affect user adoption and token utility

VI. Conclusion and Action Recommendations

LOA Investment Value Assessment

League of Ancients (LOA) represents a high-risk, high-potential opportunity within the GameFi sector. The project aims to democratize esports earnings through a free-to-play, play-to-earn MOBA game inspired by popular titles. With a market cap of approximately $466,000 and a circulating supply of 42.36% of total tokens, LOA remains a relatively small-cap project with significant growth potential but also substantial downside risk. The token's recent 30-day performance (+6.56%) shows some positive momentum, though the 1-year decline of 38.86% highlights ongoing volatility challenges. The project's success depends heavily on user adoption, game quality, and the broader GameFi market sentiment.

LOA Investment Recommendations

✅ Beginners: Limit exposure to no more than 1-2% of your crypto portfolio. Focus on learning about the project fundamentals and GameFi sector before investing. Consider starting with small amounts through dollar-cost averaging.

✅ Experienced Investors: May allocate 3-5% to LOA as part of a diversified GameFi portfolio. Monitor project development milestones, user growth metrics, and community engagement. Use technical analysis to identify optimal entry and exit points.

✅ Institutional Investors: Conduct thorough due diligence on the team, tokenomics, and competitive landscape. Consider LOA as a speculative allocation within a broader gaming and metaverse investment thesis, with appropriate risk management frameworks in place.

LOA Trading Participation Methods

- Spot Trading: Purchase LOA tokens through Gate.com or other exchanges that list the token, allowing direct ownership and potential staking opportunities

- Portfolio Allocation: Include LOA as part of a diversified GameFi portfolio alongside other gaming and metaverse tokens to spread sector-specific risks

- Research-Based Approach: Follow the project's official channels (Twitter, Discord, whitepaper) to stay updated on development progress before making investment decisions

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is LOA's historical price performance? What is the price change over the past year?

LOA has demonstrated volatility in its price history. Over the past 24 hours, LOA increased by 4.32%. While specific annual data varies, LOA has shown fluctuations reflecting market dynamics in the gaming and NFT sectors throughout 2025.

What are the main factors affecting LOA price?

LOA price is primarily influenced by supply and demand dynamics, market sentiment, trading volume, and overall cryptocurrency market conditions. Community adoption and project developments also play significant roles in price movements.

How to predict LOA price? What are the analysis methods?

LOA price prediction combines technical analysis (studying charts and trends), fundamental analysis (evaluating project metrics and market data), and on-chain metrics analysis (transaction volume, holder distribution). Time series forecasting and sentiment analysis also help identify price movements.

What are LOA's future price prospects and development potential?

LOA currently has zero market cap but shows significant growth potential during bull markets. With limited current market recognition, LOA could experience substantial value appreciation as adoption increases and market conditions improve in the coming years.

What are the risks to pay attention to when investing in LOA?

LOA investment carries market volatility risk, technology risk, and regulatory risk. Investors should monitor market changes closely and diversify their portfolio to manage potential losses effectively.

What are the differences between LOA and other crypto assets?

LOA maintains stricter identity verification and compliance standards compared to other crypto assets, implementing higher KYC/AML requirements to enhance transaction security and prevent fraud, making it more suitable for regulated institutional transactions.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Comprehensive Guide to Coffeezilla: Crypto's Leading Fraud Investigator

Comprehensive Guide to Quantitative Analysis

7 Ideas for Beginners To Create Digital Art

What Is an Airdrop in Cryptocurrency?

![How to Create Tokens on Base Blockchain Without Programming [No-Code Guide]](https://gimg.staticimgs.com/learn/31a024cb83a1a5b0a9847d4ebb6be5b3b64d4d47.png)

How to Create Tokens on Base Blockchain Without Programming [No-Code Guide]