2026 LONG Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: LONG's Market Position and Investment Value

Belong (LONG), positioned as an AI-powered affiliate network connecting real-world venues, promoters, and customers through verified performance-based rewards, has established its presence in the blockchain ecosystem. As of February 2026, LONG maintains a market capitalization of approximately $180,326, with a circulating supply of around 70.97 million tokens and a current price hovering near $0.002541. This asset, built by the team behind the profitable community platform Belong SaaS, is playing an increasingly significant role in bridging blockchain automation with real-world commerce and verified customer engagement.

This article will comprehensively analyze LONG's price trajectory from 2026 through 2031, combining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. LONG Price History Review and Market Status

LONG Historical Price Evolution

- November 2025: LONG reached its all-time high of $0.0946 on November 7, 2025, marking the peak price level since its launch

- December 2025: The token experienced significant correction, declining to its all-time low of $0.002319 on December 11, 2025, representing a decline of approximately 97.5% from the peak

- February 2026: LONG is trading at $0.002541, showing a 24-hour increase of 1.35% but remaining close to historical lows with continued price pressure over recent weeks

LONG Current Market Situation

As of February 9, 2026, LONG is priced at $0.002541, with a 24-hour trading volume of $10,818.72. The token has demonstrated mixed short-term performance, with a 1-hour decline of 0.24% and a 24-hour gain of 1.35%. However, broader timeframes reveal sustained downward pressure, with a 7-day decline of 13.01% and a 30-day decrease of 25.97%.

The circulating supply stands at 70,966,666 LONG tokens, representing approximately 9.46% of the maximum supply of 750,000,000 tokens. The current market capitalization is $180,326.30, while the fully diluted valuation reaches $1,905,750.00. The token maintains a market dominance of 0.000075%.

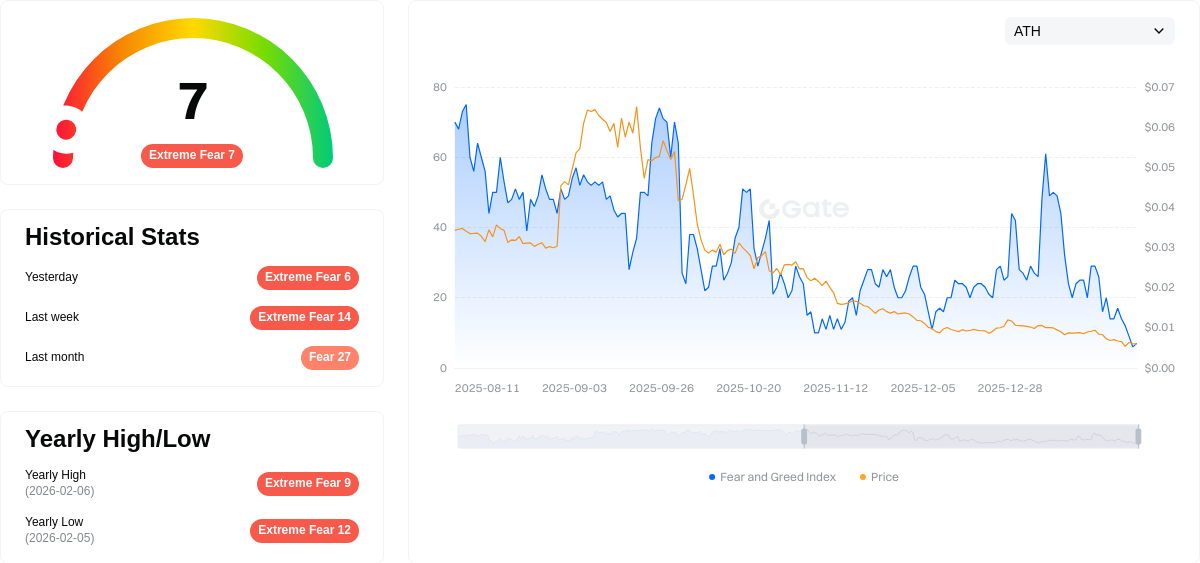

LONG's intraday trading range spans from $0.002451 to $0.002607, indicating relatively modest volatility. The token is deployed on the Binance Smart Chain (BSC) network using the BEP-20 standard, with a holder base of 17,951 addresses. Current market sentiment reflects extreme fear conditions, with a volatility index of 7.

Click to view current LONG market price

LONG Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear conditions, with the Fear and Greed Index plummeting to just 7. This critically low reading signals severe market pessimism and heightened risk aversion among investors. Such extreme fear often presents contrarian opportunities, as panic-driven selling may create attractive entry points for long-term believers. However, extreme fear also indicates significant uncertainty and potential further downside risk. Traders should exercise caution and conduct thorough analysis before making investment decisions. Risk management remains paramount during such volatile periods.

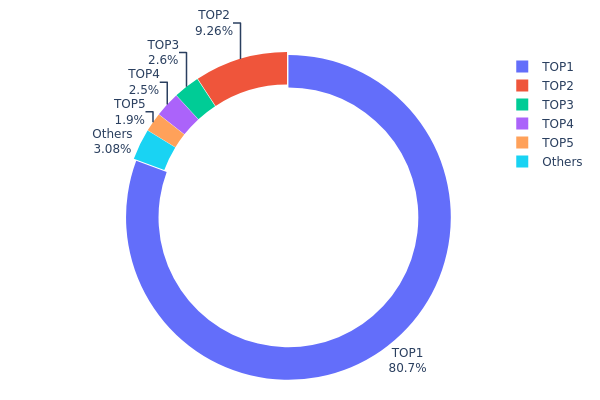

LONG Holding Distribution

The holding distribution chart illustrates the concentration of token supply across different wallet addresses, revealing the degree of centralization in token ownership. This metric serves as a critical indicator of market structure and potential manipulation risks, as highly concentrated holdings can lead to significant price volatility when large holders execute trades.

Based on the current data, LONG exhibits an extremely high concentration level, with the top address (0x8c46...d091ee) controlling approximately 80.66% of the total supply, holding 604,983.32K tokens. The top five addresses collectively account for 96.89% of all tokens in circulation, leaving only 3.11% distributed among other holders. This distribution pattern indicates a severe centralization issue that fundamentally contradicts the principles of decentralized finance.

Such extreme concentration poses substantial risks to market stability and price discovery mechanisms. The dominant holder's actions could trigger dramatic price swings, while the limited free-floating supply may result in reduced liquidity and increased susceptibility to market manipulation. This structure suggests that LONG's on-chain ecosystem lacks robust decentralization, potentially deterring institutional investors and long-term participants who prioritize fair market conditions. The current holding pattern reflects a fragile market structure where a small number of entities maintain overwhelming control over token supply and price dynamics.

Click to view current LONG Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8c46...d091ee | 604983.32K | 80.66% |

| 2 | 0x73d8...4946db | 69447.37K | 9.25% |

| 3 | 0x4982...6e89cb | 19496.27K | 2.59% |

| 4 | 0x2b70...1198a3 | 18750.01K | 2.50% |

| 5 | 0x0d07...b492fe | 14215.90K | 1.89% |

| - | Others | 23107.12K | 3.11% |

II. Core Factors Influencing LONG's Future Price

Platform Adoption Rate

- User Growth Trajectory: The price movement of LONG is closely tied to the Belong platform's ability to expand its user base. According to available projections, successful execution of user growth objectives could support price stabilization within a certain range.

- Historical Pattern: Platform tokens typically experience price appreciation when user adoption accelerates, as increased network activity drives demand for native tokens.

- Current Impact: As of February 2026, the key determinant remains whether Belong can achieve its targeted user growth milestones, which would provide fundamental support for token valuation.

Market Psychology and Technical Adjustments

- Sentiment Dynamics: Market psychology plays a considerable role in price formation. Recurring patterns of market sentiment shifts can create both support and resistance levels for LONG.

- Technical Factors: Seasonal adjustment periods and position rolling cycles may introduce short-term volatility. Investors should monitor these technical patterns when evaluating entry and exit points.

- Current Environment: Given the current market conditions in early 2026, attention to sentiment indicators and technical adjustment patterns remains important for price forecasting.

Macroeconomic Environment

- Monetary Policy Influence: Broader cryptocurrency markets are sensitive to central bank policy directions. Uncertainty around interest rate trajectories and monetary tightening or easing cycles can impact risk asset valuations, including digital tokens.

- Policy Landscape: Government intervention and regulatory developments continue to shape the operating environment for cryptocurrency projects. Policy clarity or ambiguity in key jurisdictions may affect investor confidence.

- Geopolitical Considerations: International political and economic tensions can drive flows into or out of cryptocurrency markets, though the specific impact on individual tokens like LONG depends on broader market risk appetite.

Ecosystem Development

- Platform Innovation: The evolution of Belong's service offerings and feature set will influence long-term adoption rates. Successful implementation of platform improvements could enhance token utility and demand.

- Application Scenarios: The expansion of practical use cases for LONG within the Belong ecosystem represents a potential driver of organic demand, distinguishing it from purely speculative interest.

- Partnership Development: Strategic collaborations and ecosystem partnerships may broaden LONG's utility and exposure, though specific partnership details should be verified through official channels.

III. 2026-2031 LONG Price Forecast

2026 Outlook

- Conservative forecast: $0.00142 - $0.00254

- Neutral forecast: $0.00254

- Optimistic forecast: $0.00354 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: The token may experience gradual growth as the project continues development and expands its user base

- Price range forecast:

- 2027: $0.00231 - $0.00395

- 2028: $0.00185 - $0.00374

- 2029: $0.00311 - $0.00413

- Key catalysts: Market sentiment shifts, technological developments within the ecosystem, and broader cryptocurrency market trends could influence price movements

2030-2031 Long-term Outlook

- Baseline scenario: $0.00263 - $0.00387 (assuming steady project development and stable market conditions)

- Optimistic scenario: $0.00414 - $0.00441 (assuming enhanced ecosystem adoption and positive regulatory environment)

- Transformative scenario: $0.00485 (under exceptionally favorable conditions including widespread adoption and strong market momentum)

- February 9, 2026: LONG trading within the projected range of $0.00142 - $0.00354 (current market phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00354 | 0.00254 | 0.00142 | 0 |

| 2027 | 0.00395 | 0.00304 | 0.00231 | 19 |

| 2028 | 0.00374 | 0.0035 | 0.00185 | 37 |

| 2029 | 0.00413 | 0.00362 | 0.00311 | 42 |

| 2030 | 0.00441 | 0.00387 | 0.00263 | 52 |

| 2031 | 0.00485 | 0.00414 | 0.00356 | 63 |

IV. LONG Professional Investment Strategy and Risk Management

LONG Investment Methodology

(I) Long-term Holding Strategy

- Target Audience: Investors interested in AI-powered affiliate network ecosystems and real-world business application scenarios

- Operational Recommendations:

- Monitor the development progress of Belong CheckIn's AI-driven verification system and the expansion of real-world venue partnerships

- Pay attention to the growth trends in user adoption across venues, promoters, and customers

- Consider storing LONG tokens in Gate Web3 Wallet for secure long-term custody with convenient management features

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Observe the relationship between price movements and trading volume (current 24H volume approximately $10,818) to identify potential entry and exit points

- Moving Averages: Use short-term and medium-term moving averages to identify trend changes and potential reversal signals

- Swing Trading Key Points:

- Note the current price volatility range (24H high $0.002607, 24H low $0.002451) for setting reasonable stop-loss and take-profit levels

- Consider the relatively low circulating supply (approximately 70.97 million tokens, 9.46% of total supply) which may lead to higher volatility

LONG Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: Limit allocation to 1-3% of crypto portfolio

- Aggressive Investors: May allocate 5-8% of crypto portfolio

- Professional Investors: Can allocate up to 10% while implementing hedging strategies

(II) Risk Hedging Solutions

- Position Management: Implement staged entry strategies to reduce impact of single-point entry risks

- Stop-Loss Discipline: Set dynamic stop-loss levels based on personal risk tolerance, typically 10-20% below entry price

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet provides convenient management and trading functions suitable for active trading needs

- Cold Storage Solution: For long-term holdings, consider transferring to hardware wallets to reduce online security risks

- Security Precautions: Backup private keys and mnemonic phrases, enable two-factor authentication, verify contract addresses (BSC: 0x9eca8dedb4882bd694aea786c0cbe770e70d52e3)

V. LONG Potential Risks and Challenges

LONG Market Risks

- High Volatility: Recent 7-day decline of 13.01% and 30-day decline of 25.97% demonstrate significant short-term price volatility

- Limited Liquidity: Current 24-hour trading volume of approximately $10,818 may lead to higher slippage when executing larger trades

- Low Market Cap: Total market cap of approximately $180,326 indicates early-stage project status with higher investment uncertainty

LONG Regulatory Risks

- Affiliate Network Compliance: AI-driven affiliate models connecting real-world venues may face scrutiny under evolving business regulations in different jurisdictions

- Payment Verification Regulations: Blockchain-based payment verification and reward distribution systems may be subject to financial service regulations

- Token Classification Uncertainty: Regulatory frameworks for tokens providing performance-based rewards continue to evolve globally

LONG Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 token on BSC, potential smart contract security vulnerabilities could impact fund safety

- AI System Reliability: The project's core AI verification system's accuracy and resistance to fraud require ongoing validation

- Scalability Challenges: As venue and user numbers grow, the underlying blockchain infrastructure needs to maintain efficient performance

VI. Conclusion and Action Recommendations

LONG Investment Value Assessment

LONG represents an innovative attempt to bridge real-world business activities with blockchain technology through its AI-powered affiliate network model. The project demonstrates practical utility by addressing real venue verification and reward distribution challenges. However, given the early-stage nature (low market cap, limited circulation), significant price volatility (recent declines of 13% and 26% over 7 and 30 days respectively), and limited market liquidity, LONG carries substantial investment risk. The project's long-term value depends on successful execution of the Belong CheckIn platform, expansion of venue partnerships, and proven effectiveness of the AI verification system.

LONG Investment Recommendations

✅ Beginners: Start with minimal position sizing (no more than 1-2% of portfolio), focus on learning about the project fundamentals and AI affiliate network concepts, and avoid emotional trading during high volatility periods

✅ Experienced Investors: Consider small to moderate positions (3-5% of crypto portfolio) with staged entry approach, actively monitor development milestones and partnership announcements, and implement strict stop-loss discipline

✅ Institutional Investors: Conduct thorough due diligence on the Belong SaaS team background and CheckIn platform technical architecture, evaluate long-term scalability of the real-world affiliate network model, and consider strategic positioning with comprehensive risk hedging

LONG Trading Participation Methods

- Spot Trading: Purchase LONG directly through Gate.com spot market for straightforward exposure to price movements

- Dollar-Cost Averaging: Implement regular periodic purchases to reduce timing risk and smooth out entry costs

- Community Engagement: Monitor official channels (Twitter: @belongnet, Website: belong.net) for project updates and participate in the ecosystem to better understand development progress

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price performance of LONG token?

LONG token reached its all-time high of $0.00372202 on December 5, 2024, and dropped to $0.00000731 on February 1, 2026. As of February 8, 2026, the price continues to fluctuate in the market.

What are the main factors affecting LONG token price?

LONG token price is primarily driven by community sentiment, tokenomics, supply-demand dynamics, exchange listings, market demand, and technical indicators. Positive ecosystem development and adoption growth also significantly influence price movements.

What is the price prediction for LONG token in 2024?

LONG token is projected to trade between $0.05 and $0.08 in 2024. Early volatility is expected as a newly launched token. Price movement will depend on market sentiment and user growth on the Belong platform.

What are the advantages of LONG token compared to other cryptocurrencies?

LONG token offers superior long-term growth potential with stronger fundamentals and narrative. It demonstrates greater stability during market volatility, attracting long-term investors. Compared to other cryptocurrencies, LONG token typically provides better risk-reward ratios and more consistent performance trajectories.

What risks should I be aware of when investing in LONG tokens?

LONG token investments carry price volatility risks and potential principal loss. Market conditions are unpredictable, and investors may not recover their full investment. Investors bear full responsibility for their trading decisions.

How to analyze LONG token price trends?

Analyze LONG price trends by reviewing historical data, identifying key support and resistance levels, and observing volatility patterns. Monitor trading volume and market sentiment to predict future price movements effectively.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Bitcoin Chart Analysis Guide for Cryptocurrency Beginners

Sylwester Suszek: The Story of Poland's Cryptocurrency King

Ethereum Mining Rigs: The Best Hardware for ETH Mining

The Most Affordable Cryptocurrencies to Invest in for 2025–2026

How to Create an NFT Token for Free and Sell It on NFT Marketplaces: Complete Guide