2026 LONG Price Prediction: Expert Analysis and Market Forecast for the Next Generation Cryptocurrency Asset

Introduction: LONG's Market Position and Investment Value

Belong (LONG), as an AI-powered affiliate network connecting real-world venues, promoters, and customers through verified performance-based rewards, has established its presence in the blockchain ecosystem since its launch. As of February 2026, LONG maintains a market capitalization of approximately $181,390, with a circulating supply of around 70.97 million tokens and a current price hovering near $0.002556. This asset, positioned as a bridge between physical business venues and blockchain automation, is playing an increasingly significant role in the performance marketing and community engagement sectors.

Built by the team behind Belong SaaS—a profitable community platform—LONG enables venues to pay only for verified visits and purchases while promoters and customers earn rewards seamlessly through blockchain technology. With over 17,951 holders and deployment on the BSC chain, the project demonstrates practical utility in connecting real-world commerce with decentralized incentive mechanisms.

This article will comprehensively analyze LONG's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide professional price forecasts and practical investment strategies for investors navigating this emerging market segment.

I. LONG Price History Review and Market Status

LONG Historical Price Evolution Trajectory

- 2025: Belong launched with LONG token, reaching an all-time high of $0.0946 on November 7, 2025, representing a significant milestone for the project

- 2025: Price experienced substantial volatility, declining from its peak of $0.0946 to reach an all-time low of $0.002319 on December 11, 2025

LONG Current Market Situation

As of February 9, 2026, LONG is trading at $0.002556, showing a modest 1.47% increase over the past 24 hours. The token's 24-hour trading range has been between $0.002451 and $0.002607, with a total trading volume of approximately $12,088.42.

LONG currently maintains a market capitalization of approximately $181,390.80, with a circulating supply of 70,966,666 tokens out of a maximum supply of 750,000,000 tokens, representing approximately 9.46% of the total supply in circulation. The fully diluted market cap stands at $1,917,000.00, and the token holds 17,951 holders.

Over the past week, LONG has experienced a decline of 14.29%, while the 30-day performance shows a decrease of 26.81%. The short-term hourly movement indicates a slight upward trend of 0.12%. The cryptocurrency market sentiment index currently registers at 7, indicating extreme fear conditions, which may be influencing LONG's price performance along with broader market dynamics.

The token operates on the BSC network using the BEP-20 standard, and is currently listed on one exchange. LONG's market dominance stands at 0.000075%, positioning it as a smaller-cap cryptocurrency within the broader digital asset ecosystem.

Click to view current LONG market price

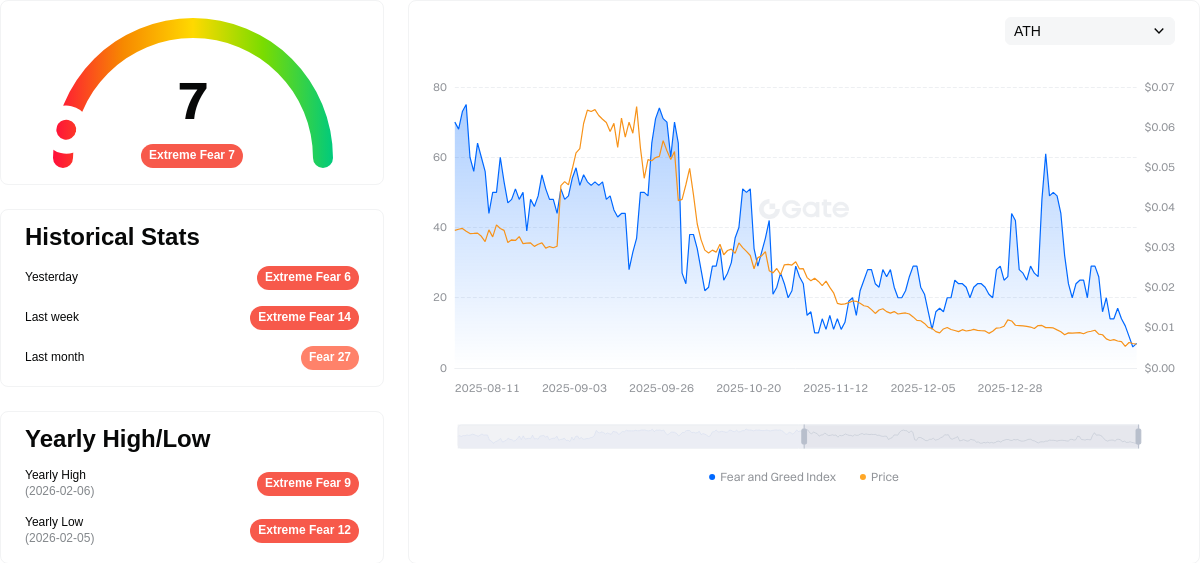

LONG Market Sentiment Indicator

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index hitting just 7. This historically low reading indicates severe market pessimism and widespread investor anxiety. Such extreme fear often presents contrarian opportunities, as panic selling may have pushed prices to unsustainable lows. However, traders should exercise caution and conduct thorough analysis before entering positions. Risk management remains critical during periods of intense market uncertainty. Monitor key support levels and market fundamentals closely for potential turning points.

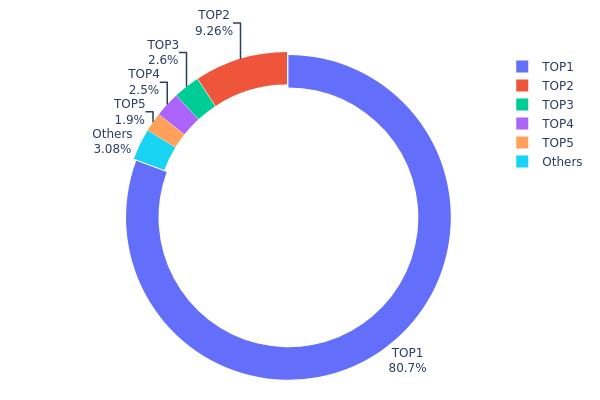

LONG Holding Distribution

The holding distribution chart reveals the concentration level of token ownership across different addresses, serving as a critical indicator for assessing market structure and potential manipulation risks. For LONG, the current distribution data demonstrates an exceptionally high degree of centralization, with the top holder (0x8c46...d091ee) controlling approximately 80.66% of the total supply, holding 604,983.32K tokens. The second-largest address (0x73d8...4946db) holds 9.25%, while the remaining top 5 addresses collectively account for less than 7% of the supply. This creates a cumulative concentration of over 96% among the top 5 holders, leaving only 3.11% distributed among all other addresses.

Such extreme concentration presents significant structural vulnerabilities to the LONG market. The dominance of a single entity controlling over four-fifths of the circulating supply introduces substantial price volatility risks and heightened susceptibility to market manipulation. Large-scale sell-offs from the primary holder could trigger cascading price declines, while coordinated actions among top holders could artificially influence market dynamics. This distribution pattern contradicts the fundamental principles of decentralization inherent to blockchain ecosystems, raising concerns about governance centralization and the potential for unilateral decision-making that may not align with broader community interests.

From an on-chain structure perspective, this concentration level indicates a fragile market foundation with limited organic distribution among retail and institutional participants. The minimal allocation to "Others" suggests restricted secondary market circulation and potentially low liquidity depth, which could amplify price swings during periods of increased trading activity. For investors and analysts, this distribution profile warrants careful monitoring, as any significant movement from top addresses could materially impact LONG's market behavior and valuation trajectory.

Click to view current LONG Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8c46...d091ee | 604983.32K | 80.66% |

| 2 | 0x73d8...4946db | 69447.37K | 9.25% |

| 3 | 0x4982...6e89cb | 19496.27K | 2.59% |

| 4 | 0x2b70...1198a3 | 18750.01K | 2.50% |

| 5 | 0x0d07...b492fe | 14215.90K | 1.89% |

| - | Others | 23107.12K | 3.11% |

II. Core Factors Influencing LONG's Future Price

Platform Adoption Rate

- User Growth Targets: The price trajectory of LONG is closely tied to whether Belong can achieve its user expansion objectives. Based on available analysis, if the platform successfully meets its growth milestones, LONG price could potentially stabilize within the $0.08-$0.12 range by the end of 2026.

- Historical Pattern: Platform adoption serves as a fundamental driver for token value, as increased user activity typically translates to higher demand for native tokens.

- Current Impact: The medium-term outlook suggests that sustained user growth momentum will be critical for maintaining price stability and supporting gradual appreciation.

Market Sentiment and Risk Preferences

- Volatility Considerations: LONG's price movements may reflect broader market sentiment shifts, particularly during periods of heightened uncertainty or risk-off behavior among cryptocurrency investors.

- Short-term Fluctuations: Market participants should be prepared for potential price fluctuations driven by changing investor sentiment and position adjustments.

- Long-term Fundamentals: Despite short-term volatility, the underlying structural support for LONG remains intact, with fundamental drivers continuing to underpin its value proposition.

Macroeconomic Environment

- Inflation Dynamics: Macroeconomic factors such as inflation expectations can influence demand for digital assets, including LONG, as investors seek portfolio diversification strategies.

- Economic Growth: Broader economic growth trends may affect risk appetite and capital allocation decisions, indirectly impacting LONG's market performance.

- Geopolitical Stability: International political and economic developments can create periods of uncertainty that influence cryptocurrency market dynamics and investor positioning.

Ecosystem Development

- Modular Naming Service (MNS): The adoption trajectory benefits from technological innovations such as modular naming services, which enhance user experience and platform functionality.

- On-chain Reputation Scoring: Integration of reputation systems helps build trust and engagement within the ecosystem, potentially driving increased user activity.

- Cross-chain Capabilities: Ecosystem expansion initiatives, including interoperability features, may broaden LONG's utility and market reach over time.

III. 2026-2031 LONG Price Prediction

2026 Outlook

- Conservative prediction: $0.00138 - $0.00256

- Neutral prediction: $0.00256

- Optimistic prediction: $0.00345

2027-2029 Outlook

- Market stage expectation: The token may enter a gradual adjustment and recovery phase, with price movements potentially influenced by broader market sentiment and project development milestones.

- Price range prediction:

- 2027: $0.00171 - $0.00321, with an average around $0.00300

- 2028: $0.00211 - $0.00401, with an average around $0.00311

- 2029: $0.00292 - $0.00438, with an average around $0.00356

- Key catalysts: Market adoption trends, technological developments within the project ecosystem, and overall cryptocurrency market conditions could serve as primary drivers for price movements during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00373 - $0.00567 (assuming steady project development and moderate market growth)

- Optimistic scenario: $0.00405 - $0.00612 (assuming favorable market conditions and increased adoption)

- Transformative scenario: Potential to exceed $0.00612 (under exceptionally favorable conditions including significant technological breakthroughs or widespread adoption)

- 2026-02-09: LONG is currently positioned within its predicted baseline range for early 2026, with potential for gradual appreciation over the coming years based on market dynamics and project fundamentals.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00345 | 0.00256 | 0.00138 | 0 |

| 2027 | 0.00321 | 0.003 | 0.00171 | 17 |

| 2028 | 0.00401 | 0.00311 | 0.00211 | 21 |

| 2029 | 0.00438 | 0.00356 | 0.00292 | 39 |

| 2030 | 0.00567 | 0.00397 | 0.00373 | 55 |

| 2031 | 0.00612 | 0.00482 | 0.00405 | 88 |

IV. LONG Professional Investment Strategy and Risk Management

LONG Investment Methodology

(I) Long-Term Holding Strategy

- Suitable for: Community-focused investors and believers in AI-driven affiliate networks

- Operational Recommendations:

- Consider accumulating positions during significant price corrections, given the current trading price of $0.002556 is significantly below the historical high of $0.0946

- Monitor the project's real-world venue partnership developments and user growth metrics

- Utilize Gate Web3 Wallet for secure storage of LONG tokens with built-in security features

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of $12,088.42 to identify liquidity trends and potential breakout levels

- Support and Resistance Levels: Key levels include the 24-hour low of $0.002451 and high of $0.002607

- Swing Trading Points:

- Watch for short-term momentum shifts given the 1-hour change of 0.12% and recent 7-day decline of -14.29%

- Consider the current circulating supply of 70.97 million tokens (9.46% of max supply) when evaluating market cap potential

LONG Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: 5-8% with active monitoring and adjustment capabilities

(II) Risk Hedging Approaches

- Diversification Strategy: Balance LONG exposure with established assets to mitigate project-specific risks

- Position Sizing: Avoid concentration given the token's current ranking of 4075 and market dominance of 0.000075%

(III) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet offers comprehensive security features for BEP-20 tokens

- Storage Protocol: Transfer tokens to secure wallets after purchase, avoiding prolonged exchange storage

- Security Considerations: Verify the official contract address (0x9eca8dedb4882bd694aea786c0cbe770e70d52e3) on BSCScan before any transactions

V. LONG Potential Risks and Challenges

LONG Market Risks

- Volatility Exposure: The token has declined -26.81% over 30 days, indicating potential continued downward pressure

- Liquidity Constraints: With a market cap of approximately $181,391 and trading on limited exchanges, liquidity may impact exit strategies

- Price Discovery: Currently trading near its all-time low of $0.002319 (recorded on December 11, 2025), suggesting uncertain price stability

LONG Regulatory Risks

- Jurisdiction Uncertainty: AI-driven affiliate networks involving real-world venues may face varying regulatory treatment across jurisdictions

- Compliance Evolution: Performance-based reward mechanisms could attract regulatory scrutiny as frameworks develop

- Token Classification: Potential regulatory examination of LONG's utility versus security characteristics

LONG Technical Risks

- Smart Contract Dependencies: As a BEP-20 token, LONG relies on BSC network security and stability

- Project Development Stage: Limited exchange listings (1 exchange) may indicate early-stage development with execution risks

- Integration Complexity: The success of connecting venues, promoters, and customers through blockchain automation depends on technical execution

VI. Conclusion and Action Recommendations

LONG Investment Value Assessment

LONG represents an innovative approach to performance-based marketing through blockchain technology, targeting the affiliate network space with AI integration. The project's connection to the profitable Belong SaaS platform provides some operational foundation. However, significant challenges remain: the token has experienced substantial decline (-26.81% in 30 days), trades at a low market cap with minimal liquidity, and maintains limited exchange presence. The current price of $0.002556 sits 97% below its all-time high, while the circulating supply represents only 9.46% of maximum supply, creating potential dilution concerns. Long-term value depends heavily on the team's ability to scale venue partnerships and demonstrate real-world adoption.

LONG Investment Recommendations

✅ Beginners: Exercise extreme caution. Consider allocating no more than 1% of your crypto portfolio, and only after thoroughly understanding the project's business model and affiliate network mechanics. Start with minimal exposure to assess volatility tolerance.

✅ Experienced Investors: May consider a 2-3% allocation with active monitoring of partnership announcements and user metrics. Focus on tracking holder growth (currently 17,951 addresses) and real-world venue integration progress as key performance indicators.

✅ Institutional Investors: Conduct comprehensive due diligence on the Belong SaaS business model and team execution capabilities. Consider pilot allocations while monitoring liquidity development and exchange expansion plans.

LONG Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and trading with access to LONG/USDT pairs and competitive liquidity

- Gate Web3 Wallet Integration: Self-custody option allowing direct interaction with BEP-20 tokens and DeFi applications

- Dollar-Cost Averaging: Systematic accumulation approach to mitigate timing risk given current price volatility

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is LONG token, and what are its uses and application scenarios?

LONG token is a cryptocurrency asset designed for spot and futures trading in the crypto market. It enables traders to manage risk exposure and execute investment strategies based on individual risk preferences and market predictions.

What is the historical price performance of LONG token, including its highest and lowest price points?

LONG token reached an all-time high of $2,320.82. The current price stands at $42.73. LONG has experienced significant price volatility since inception, reflecting market dynamics and adoption phases. Historical lows remain part of its accumulated trading history.

What are the main factors affecting LONG price fluctuations?

LONG price fluctuations are primarily driven by platform adoption rates, user growth, and market demand. Trading volume and investor sentiment significantly impact price movements. Network expansion and ecosystem development also play crucial roles in price dynamics.

What is the price prediction for LONG token in 2024, and what analysis methods are based on?

LONG token's 2024 price prediction is based on technical analysis and trading volume trends. No official forecast was released. Predictions utilize market sentiment assessment and historical price patterns to estimate potential price movements.

What are the advantages and disadvantages of LONG token compared to other DeFi tokens?

LONG token offers decentralized lending and yield generation with transparent, community-driven governance. However, it faces smart contract risks and market volatility like other DeFi tokens. Its key advantage lies in accessibility and lower transaction costs versus traditional finance alternatives.

What are the main risks of investing in LONG tokens and how to mitigate them?

Main risks include market volatility, liquidity fluctuations, and technology uncertainties. Mitigate by diversifying your portfolio, conducting thorough research, setting stop-losses, and investing only what you can afford to lose.

How is the liquidity and trading volume of LONG tokens, and on which exchanges can they be traded?

LONG tokens have strong liquidity with 24-hour trading volume reaching US$14,760.61. They are available on both centralized and decentralized exchanges, with LONG/USDT being the most active trading pair, providing robust market access for traders.

What is the development team and project progress of LONG token?

LONG token's development team is actively advancing the project, currently in post-token phase with high community engagement. Project progress is steady, with the team continuously optimizing and expanding the ecosystem.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Rafał Zaorski – Who Is He? What Is His Net Worth?

Games You Can Earn Money From – TOP 11 Games in 2025

Six Cryptocurrencies That Have Achieved Over 1,000x Total Growth

How to Choose and Set Up the Best Cryptocurrency Wallet in Recent Years

NANO/XNO Cryptocurrency Project: Future Prospects and Analysis