2026 LOOKS Price Prediction: Expert Analysis and Market Forecast for the Collectibles Platform Token

Introduction: LOOKS Market Position and Investment Value

LooksRare (LOOKS), positioned as a community-first NFT trading platform with participant rewards, has been operating in the digital asset space since its launch in 2022. As of February 2026, LOOKS maintains a market capitalization of approximately $676,985, with a circulating supply of around 993 million tokens, and the price currently trades at approximately $0.0006817. This asset, known as a "reward-driven NFT marketplace token," plays a role in the decentralized NFT trading ecosystem where users can earn rewards through buying and selling NFTs.

This article will comprehensively analyze the price trajectory of LOOKS from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. LOOKS Price History Review and Market Status

LOOKS Historical Price Evolution Trajectory

- 2022: LooksRare platform launched in January, with LOOKS reaching an all-time high of $7.1 on January 21, marking the peak of its initial market enthusiasm

- 2023-2025: The token experienced a prolonged downward trend as the NFT market cooled, with price declining significantly from its historical peak

- 2026: As of February 1, LOOKS recorded its all-time low of $0.00064821, reflecting continued market pressure

LOOKS Current Market Situation

As of February 4, 2026, LOOKS is trading at $0.0006817, showing notable volatility in recent periods. The token has declined 5.09% in the past hour and 13.74% over the last 24 hours, with the 24-hour trading range spanning from $0.0006661 to $0.0008184.

Looking at broader timeframes, LOOKS has decreased 12.36% over the past week and 43.37% over the past month. The annual performance shows a decline of 97.03%, indicating sustained downward pressure throughout the year.

The current market capitalization stands at approximately $676,985, with a circulating supply of 993,084,046 LOOKS tokens, representing 99.31% of the maximum supply of 1 billion tokens. The 24-hour trading volume is recorded at $34,257. The market cap to fully diluted valuation ratio of 99.31% suggests that nearly all tokens are already in circulation.

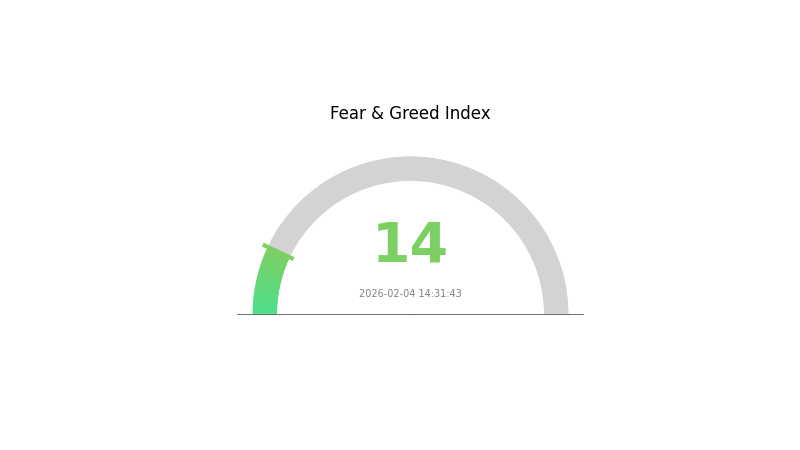

With a market dominance of 0.000025% and a ranking of 2,795 among cryptocurrencies, LOOKS maintains a relatively small market presence. The token is held by approximately 76,575 addresses and is listed on 6 exchanges. According to current market sentiment indicators, the fear and greed index stands at 14, indicating extreme fear in the broader crypto market.

Click to view current LOOKS market price

LOOKS Market Sentiment Index

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear sentiment. With the index at 14, investors are displaying significant risk aversion and pessimistic market outlook. This level typically indicates potential buying opportunities for contrarian traders, as extreme fear often precedes market recoveries. However, caution is advised as further downside movements remain possible. Traders should closely monitor key support levels and fundamental developments. Market participants are encouraged to maintain disciplined risk management strategies during this volatile period and avoid making impulsive decisions driven by fear.

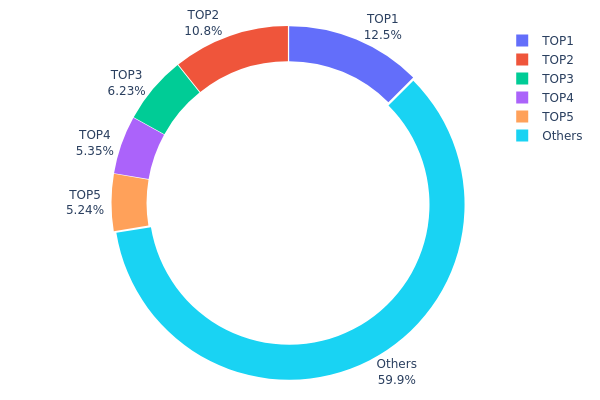

LOOKS Holdings Distribution

The holdings distribution chart illustrates how LOOKS tokens are distributed across different wallet addresses on the blockchain, serving as a key indicator of token concentration and decentralization levels. By examining the proportion of tokens held by top addresses versus the broader community, analysts can assess potential risks related to market manipulation, liquidity constraints, and overall network health.

Current data reveals a moderate concentration pattern in LOOKS token distribution. The top holder controls 12.51% of the total supply (125.12 million tokens), while the second-largest address holds 10.75% (107.52 million tokens). The top five addresses collectively account for approximately 40.07% of the circulating supply, with the remaining 59.93% distributed among other holders. This distribution structure indicates a relatively balanced ecosystem where no single entity possesses overwhelming control, though the combined influence of major holders remains significant enough to impact price dynamics during large-scale transactions.

From a market structure perspective, this concentration level presents both opportunities and challenges. While the 60% distribution among smaller holders suggests reasonable decentralization and community participation, the substantial holdings by top addresses could introduce volatility during periods of coordinated selling or strategic repositioning. The relatively even distribution among the top five addresses (ranging from 5.24% to 12.51%) mitigates the risk of single-entity manipulation compared to projects where one address dominates overwhelmingly. This structure typically correlates with improved market stability and reduced susceptibility to abrupt price swings driven by individual whale activities.

Click to view current LOOKS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 125116.35K | 12.51% |

| 2 | 0xe7ba...e13ce4 | 107521.64K | 10.75% |

| 3 | 0x91d4...c8debe | 62287.04K | 6.22% |

| 4 | 0x465a...e0d3b1 | 53543.63K | 5.35% |

| 5 | 0xf42a...36f173 | 52436.13K | 5.24% |

| - | Others | 599095.21K | 59.93% |

II. Core Factors Influencing LOOKS Future Price

Supply Mechanism

- Fixed Supply with Declining Emission Rate: LOOKS token maintains a fixed total supply with an emission rate that decreases annually. This controlled supply structure creates potential scarcity over time.

- Historical Pattern: Past supply reductions have typically led to price appreciation as selling pressure diminishes. Each supply contraction phase has historically supported upward price momentum.

- Current Impact: The ongoing supply reduction mechanism may continue to exert upward pressure on price, particularly if demand remains stable or increases.

Market Adoption and Investor Sentiment

- Platform Usage: LooksRare operates as a community-driven NFT marketplace platform, with user adoption levels directly influencing token demand and utility.

- Market Confidence: Investor sentiment toward NFT marketplaces and the broader digital art ecosystem plays a significant role in LOOKS valuation.

- Competitive Positioning: The platform's ability to maintain market share within the NFT trading space affects long-term token value prospects.

Macroeconomic Environment

- Monetary Policy Influence: Global monetary conditions, including interest rate policies and liquidity availability, impact risk asset appetite and cryptocurrency market dynamics.

- Economic Uncertainty: Broader financial market volatility and economic conditions influence investor allocation toward alternative assets including NFT marketplace tokens.

- Risk Appetite Trends: Market sentiment toward speculative assets and emerging technology sectors affects capital flows into NFT-related tokens.

Technical and Fundamental Analysis

- Technical Indicators: Short-term price movements may be assessed through technical analysis tools including MACD, RSI, and Bollinger Bands.

- Network Activity: Platform transaction volume, active user metrics, and ecosystem engagement provide fundamental value indicators.

- Institutional Interest: The level of institutional participation and investment in the NFT marketplace sector influences long-term price stability and growth potential.

III. 2026-2031 LOOKS Price Prediction

2026 Outlook

- Conservative prediction: $0.00052 - $0.00069

- Neutral prediction: Around $0.00069

- Optimistic prediction: Up to $0.0008 (requires favorable market conditions and increased platform adoption)

2027-2029 Outlook

- Market stage expectation: LOOKS may experience gradual growth phase as the NFT marketplace continues to evolve and attract users

- Price range prediction:

- 2027: $0.00055 - $0.00091, representing approximately 9% growth

- 2028: $0.00057 - $0.00097, showing around 21% cumulative increase

- 2029: $0.00066 - $0.00102, indicating approximately 32% growth from baseline

- Key catalysts: Platform development, NFT market recovery, ecosystem expansion, and strategic partnerships

2030-2031 Long-term Outlook

- Baseline scenario: $0.00082 - $0.00102 (assuming steady platform growth and sustained user engagement)

- Optimistic scenario: $0.00096 - $0.00102 (contingent upon significant NFT market expansion and increased trading volumes)

- Transformative scenario: Up to $0.0012 (requires breakthrough developments in NFT technology and mainstream adoption)

- 2026-02-04: LOOKS shows potential for moderate growth trajectory over the next five years, with projections suggesting cumulative gains of up to 44% by 2031

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0008 | 0.00069 | 0.00052 | 0 |

| 2027 | 0.00091 | 0.00074 | 0.00055 | 9 |

| 2028 | 0.00097 | 0.00083 | 0.00057 | 21 |

| 2029 | 0.00102 | 0.0009 | 0.00066 | 32 |

| 2030 | 0.00102 | 0.00096 | 0.00082 | 40 |

| 2031 | 0.0012 | 0.00099 | 0.00058 | 44 |

IV. LOOKS Professional Investment Strategy and Risk Management

LOOKS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term development potential of NFT trading platforms and can tolerate significant market volatility

- Operation recommendations:

- Consider accumulating positions during market downturns, avoiding concentrated purchases at high price levels

- Set reasonable position ratios, it is recommended not to exceed 5% of the total cryptocurrency portfolio

- Use Gate Web3 Wallet for secure storage to ensure asset safety

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Average (MA): Observe the 7-day and 30-day moving averages to identify short-term trend changes

- Relative Strength Index (RSI): Monitor overbought and oversold signals, set alerts when RSI is below 30 or above 70

- Band operation key points:

- Pay attention to the 24-hour high of $0.0008184 and low of $0.0006661 as reference levels for support and resistance

- Closely monitor NFT market trading volume changes, as platform activity directly affects LOOKS token demand

LOOKS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2%

- Aggressive investors: 3-5%

- Professional investors: 5-10%

(2) Risk Hedging Solutions

- Diversified holdings: Allocate funds across multiple NFT-related tokens to reduce single-token risk

- Stop-loss mechanism: Set stop-loss points at 15-20% below purchase price to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet, suitable for frequent trading needs

- Cold wallet solution: For long-term holdings, consider transferring to hardware wallets for enhanced security

- Security precautions: Never share private keys or mnemonic phrases; verify contract addresses (0xf4d2888d29d722226fafa5d9b24f9164c092421e) before transactions; be alert to phishing websites and scam messages

V. LOOKS Potential Risks and Challenges

LOOKS Market Risks

- Extreme price volatility: LOOKS has experienced a 97.03% decline over the past year, showing significant market volatility

- Low liquidity risk: With a 24-hour trading volume of only $34,257, large transactions may face difficulties in execution

- Market capitalization shrinkage: Current market cap is approximately $677,000, ranking 2795, indicating weak market recognition

LOOKS Regulatory Risks

- NFT trading platform compliance: Global regulatory policies for NFT platforms are still evolving, and potential regulatory changes may affect platform operations

- Token classification uncertainty: Regulatory authorities in different jurisdictions may have varying definitions of LOOKS tokens, which could affect their legal status

- Cross-border trading restrictions: Some countries may impose restrictions on NFT trading, which could impact the platform's user base and trading volume

LOOKS Technical Risks

- Smart contract vulnerabilities: As an ERC-20 token deployed on Ethereum, it may face risks from smart contract bugs or security vulnerabilities

- Network congestion: During periods of high Ethereum network activity, transaction fees may increase significantly, affecting user experience

- Platform competitive pressure: The NFT trading market is highly competitive, and LooksRare needs to continuously innovate to maintain its market position

VI. Conclusion and Action Recommendations

LOOKS Investment Value Assessment

LooksRare (LOOKS) is a community-driven NFT trading platform token, currently facing significant market challenges. With a market capitalization of approximately $677,000 and ranking 2795, combined with a 97.03% price decline over the past year, the token demonstrates high risk characteristics. While the platform's reward mechanism provides certain incentives for users, the low 24-hour trading volume of $34,257 reflects weak market liquidity. The circulating supply is 993,084,046 LOOKS, accounting for 99.31% of the maximum supply of 1 billion, with limited room for future supply expansion. Long-term value depends on the platform's ability to enhance competitiveness and user activity in the NFT market.

LOOKS Investment Recommendations

✅ Beginners: Not recommended for beginners due to extremely high risk; if interested in NFT-related investments, it is advisable to start with mainstream cryptocurrencies and gradually understand the market ✅ Experienced investors: May consider small position allocation (no more than 1-2% of portfolio) with strict stop-loss settings; closely monitor NFT market trends and platform development dynamics ✅ Institutional investors: Conduct thorough due diligence to assess the platform's competitive advantages and long-term development potential; consider it as part of a diversified NFT sector layout

LOOKS Trading Participation Methods

- Spot trading: Purchase LOOKS tokens directly through Gate.com, supporting multiple trading pairs

- Limit orders: Set target prices to automatically execute trades when market conditions are met, reducing the need for constant monitoring

- Dollar-cost averaging: For long-term investors, consider using a fixed amount to regularly purchase LOOKS to smooth out the impact of price volatility

Cryptocurrency investment carries extremely high risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is LOOKS token and what are its uses?

LOOKS is the native token of LooksRare, an Ethereum-based NFT trading platform. It enables trading, governance voting, and user rewards within the ecosystem. LOOKS powers the platform's core functions and incentive mechanisms.

What is the current price of LOOKS token? How has its historical price trend been?

LOOKS token is currently trading at 0.00072815 USD, down 8.24% in the past 24 hours. You can view detailed historical price trends and charts on TradingView for comprehensive market analysis.

How will LOOKS price prediction develop in 2024-2025?

Based on a monthly growth rate of 0.42%, LOOKS is predicted to reach $0.0007961 by November 2026, with an expected return rate of 4.28%. Price predictions beyond this period are unavailable.

What are the advantages of LOOKS token compared to other NFT platform tokens such as BLUR and X2Y2?

LOOKS token offers lower trading fees and maintains stable user activity. It provides higher liquidity in the NFT market compared to competitors, with consistent performance and community engagement supporting long-term value growth.

What are the main factors affecting LOOKS price?

LOOKS price is primarily influenced by NFT market trends, platform competitiveness, trading volume, user adoption, and overall cryptocurrency market sentiment. These factors collectively determine market demand and price movements.

What risks should I pay attention to when investing in LOOKS tokens?

LOOKS faces high volatility with significant short-term price fluctuations. The NFT marketplace sector experiences intense competition from established platforms. Additionally, regulatory uncertainty in crypto and NFT markets could impact project development and token value.

What are the circulating supply, total supply, and tokenomics of LOOKS tokens?

LOOKS has a total supply of 100 million tokens. Circulating supply comprises 1% of total supply for initial liquidity provision. The tokenomics model is decentralized with fair distribution to the community.

Treasure NFT Marketplace: A 2025 Guide for Web3 Gamers and Investors

What are the new trends in the NFT market in 2025?

NFT Treasure Hunting: Top Strategies for Web3 Collectors in 2025

How to Create and Sell NFTs: A Step-by-Step Guide for Beginners

The technical principles and application scenarios of 2025 NFTs

How to Create an NFT in 2025: A Step-by-Step Guide

What is a node in cryptocurrency and how do you set one up

Who Is John J. Ray III, FTX's New CEO?

Top Platforms for Learning and Earning with Cryptocurrencies

Top 5 Best Crypto Airdrops for Early Adopters

How to Create an NFT for Free with Picsart