2026 LOT Price Prediction: Expert Analysis and Market Forecast for Polylot Token Growth

Introduction: LOT's Market Position and Investment Value

League of Traders (LOT), positioned as South Korea's leading social trading platform that gamifies the crypto trading experience, has been making strides in the cryptocurrency ecosystem. As of February 2026, LOT maintains a market capitalization of approximately $1.31 million, with a circulating supply of 150 million tokens, and a price hovering around $0.008723. This asset, supported by notable backers including Mirana, C3 Ventures, Cadenza, and Korean gaming company Neowiz, is playing an increasingly important role in the social trading and gamified trading sectors.

This article will comprehensively analyze LOT's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. LOT Price History Review and Market Status

LOT Historical Price Evolution Trajectory

- 2025: League of Traders (LOT) launched on Gate.com on June 19, 2025, with the price experiencing significant volatility in its early trading period

- 2025: LOT reached its all-time high of $0.04947 on June 20, 2025, just one day after listing, demonstrating strong initial market interest

- 2025-2026: The token entered a downward trend, with the price declining from its peak of $0.04947 to record its all-time low of $0.008342 on February 2, 2026

LOT Current Market Status

As of February 2, 2026, League of Traders (LOT) is trading at $0.008723, showing a marginal increase of 0.32% over the past hour. However, the token has experienced negative price movements across broader timeframes, with a decline of 0.46% in the past 24 hours, 13.86% over the past 7 days, 20.14% over the past 30 days, and 43.52% over the past year.

The token's 24-hour trading volume stands at $20,662.28, with a market capitalization of approximately $1.31 million. LOT currently has a circulating supply of 150 million tokens, representing 15% of its maximum supply of 1 billion tokens. The fully diluted market capitalization is estimated at $8.72 million.

LOT's market capitalization to fully diluted valuation ratio stands at 15%, indicating that a significant portion of the token supply has yet to enter circulation. The token holds a market dominance of 0.00031% and is ranked #2,330 in the cryptocurrency market. The platform has attracted 11,021 token holders and is listed on 8 exchanges.

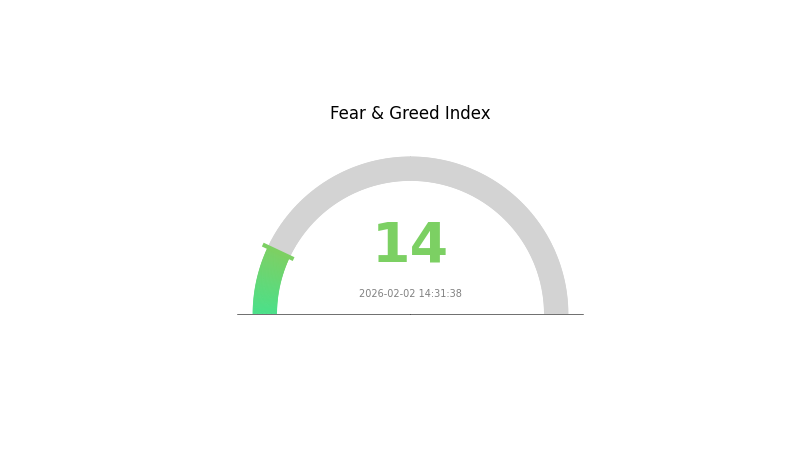

The current cryptocurrency market sentiment index stands at 14, indicating an "Extreme Fear" state, which may be contributing to the broader downward pressure on altcoin prices including LOT.

Click to view current LOT market price

LOT Market Sentiment Index

2026-02-02 Fear & Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index registering at just 14 points. This indicates intense investor pessimism and risk aversion across the market. When fear reaches such extreme levels, it often signals potential buying opportunities for long-term investors, as assets may be oversold. However, traders should remain cautious and conduct thorough analysis before entering positions. Market conditions like these typically reflect significant uncertainty or negative sentiment, but they can also mark turning points in market cycles. Consider maintaining a disciplined investment strategy during periods of extreme fear.

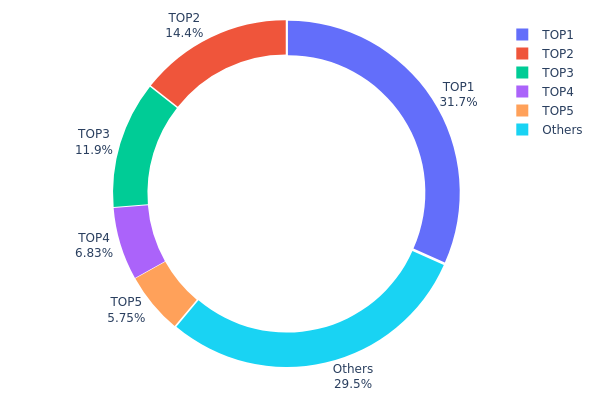

LOT Holding Distribution

The holding distribution chart reflects the concentration level of LOT tokens across different wallet addresses, serving as a critical indicator for assessing market structure and potential price manipulation risks. By analyzing the proportion of tokens held by top addresses, investors can evaluate the degree of decentralization and the stability of the token's circulation structure.

Currently, LOT exhibits a relatively high concentration pattern. The top address holds 316,666.66K tokens, accounting for 31.66% of the total supply, while the top five addresses collectively control approximately 70.52% of the circulating supply. This concentration level suggests that a small number of major holders possess significant influence over market liquidity and price movements. The second and third largest addresses hold 14.37% and 11.91% respectively, indicating that control is not limited to a single entity but rather distributed among several whale addresses.

From a market structure perspective, this concentration poses both opportunities and risks. On one hand, if these large holders are project teams, strategic investors, or long-term believers, their stable holding behavior could provide price support and reduce short-term volatility. On the other hand, the remaining 29.48% held by other addresses indicates that retail investors have limited participation, which may result in insufficient market depth and heightened vulnerability to coordinated selling pressure from major holders. Investors should closely monitor the on-chain movements of top addresses, as any significant transfers or distributions could trigger substantial price fluctuations.

Click to view the current LOT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4a4d...b16f36 | 316666.66K | 31.66% |

| 2 | 0x96ec...547c29 | 143750.00K | 14.37% |

| 3 | 0x608d...5e911b | 119166.67K | 11.91% |

| 4 | 0x86b1...51486c | 68333.34K | 6.83% |

| 5 | 0xe6bc...25c740 | 57500.00K | 5.75% |

| - | Others | 294583.33K | 29.48% |

II. Core Factors Influencing LOT's Future Price

Market Demand and Platform Activity

- Trading Platform Engagement: The future price trajectory of LOT is closely tied to the activity levels on the League of Traders platform. As the platform's user base expands and trading volumes increase, demand for LOT tokens may strengthen, potentially supporting price appreciation.

- Product Functionality Expansion: The development and rollout of new features within the League of Traders ecosystem could drive greater utility for LOT tokens. Enhanced functionalities may attract more users to the platform, thereby increasing token demand and potentially influencing price movements.

- Social Trading Adoption: The growth of social trading features represents a significant catalyst for LOT's value proposition. As more traders engage with these features, the token's role within the ecosystem becomes more pronounced, which may contribute to positive price momentum.

Investor Confidence and Liquidity Considerations

- Liquidity Profile: Token liquidity remains an important consideration for potential investors. Market depth and trading volume on supported exchanges can influence price stability and the ease with which positions can be entered or exited.

- Contract Control and Governance: Investors should be mindful of the governance structure and control mechanisms embedded in the token's smart contract. The distribution of control rights and any centralized elements may impact investor confidence and risk assessment.

- Community Staking and Governance Rights: LOT token holders may participate in staking mechanisms and governance decisions, which can affect token circulation and community engagement. These features may influence the token's perceived value and long-term sustainability.

Token Distribution and Ecosystem Growth

- Allocation Structure: The token distribution model plays a role in shaping supply dynamics and potential selling pressure. Understanding how tokens are allocated across different stakeholder groups can provide insights into future circulation patterns.

- Platform Utility Functions: LOT serves multiple purposes within the League of Traders platform, including payment for unlocking premium features and accessing advanced trading tools. The breadth and depth of these use cases may support sustained demand for the token as the platform grows.

III. 2026-2031 LOT Price Predictions

2026 Outlook

- Conservative forecast: $0.00492 - $0.00878

- Neutral forecast: $0.00878 (average market conditions)

- Optimistic forecast: $0.0108 (requires favorable market sentiment and increased adoption)

2027-2029 Mid-term Outlook

- Market stage expectation: Gradual growth phase with moderate volatility as the token establishes market presence and expands its user base

- Price range predictions:

- 2027: $0.00949 - $0.01067 (approximately 12% increase from 2026)

- 2028: $0.00726 - $0.01237 (17% growth potential)

- 2029: $0.00791 - $0.01627 (29% upward momentum)

- Key catalysts: Progressive market adoption, potential ecosystem developments, and broader crypto market conditions

2030-2031 Long-term Outlook

- Baseline scenario: $0.00882 - $0.01379 in 2030 (assuming steady market development)

- Optimistic scenario: $0.01572 - $0.01823 by 2031 (contingent on successful platform integration and sustained user growth)

- Transformational scenario: Up to $0.01823 in 2031 (requires exceptional market conditions and significant adoption milestones, representing approximately 80% cumulative growth)

- 2026-02-02: LOT trading within initial predicted range as market establishes baseline valuation patterns

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0108 | 0.00878 | 0.00492 | 0 |

| 2027 | 0.01067 | 0.00979 | 0.00949 | 12 |

| 2028 | 0.01237 | 0.01023 | 0.00726 | 17 |

| 2029 | 0.01627 | 0.0113 | 0.00791 | 29 |

| 2030 | 0.01765 | 0.01379 | 0.00882 | 58 |

| 2031 | 0.01823 | 0.01572 | 0.00864 | 80 |

IV. LOT Professional Investment Strategies and Risk Management

LOT Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Investors who believe in the long-term potential of gamified social trading platforms and can tolerate market volatility

- Operational Recommendations:

- Consider gradual position building during market corrections, given the significant price decline from its historical high

- Monitor the platform's user growth metrics and trading volume trends as indicators of adoption

- Implement a storage solution that balances security and accessibility for potential trading opportunities

(II) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track the 50-day and 200-day moving averages to identify potential trend reversals, particularly relevant given the recent 13.86% decline over 7 days

- Volume Analysis: Monitor the relationship between price movements and trading volume ($20,662.28 in 24-hour volume) to assess market conviction

- Swing Trading Considerations:

- Pay attention to the 24-hour price range between $0.008342 and $0.008879 to identify potential entry and exit points

- Consider the token's high volatility, with annual decline of 43.52%, when setting stop-loss levels

LOT Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% of crypto portfolio allocation with active management

(II) Risk Hedging Solutions

- Position Sizing: Limit individual position size to account for the token's current market cap of approximately $1.31 million and relatively low liquidity

- Diversification Strategy: Balance LOT holdings with established cryptocurrencies and other altcoins across different sectors

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active traders requiring frequent access to their LOT holdings

- Cold Storage Option: Hardware wallet solutions for long-term holders seeking maximum security

- Security Precautions: Enable two-factor authentication, regularly verify wallet addresses before transactions, and maintain backup recovery phrases in secure offline locations

V. LOT Potential Risks and Challenges

LOT Market Risks

- Price Volatility: LOT has experienced significant price decline, currently trading approximately 82.36% below its all-time high of $0.04947 reached in June 2025

- Liquidity Concerns: With a relatively modest 24-hour trading volume of approximately $20,662, large orders may experience slippage

- Market Cap Position: Ranked #2330 with a market capitalization of approximately $1.31 million, indicating limited market presence compared to major cryptocurrencies

LOT Regulatory Risks

- Jurisdictional Uncertainty: Social trading platforms may face varying regulatory frameworks across different regions, potentially impacting platform operations

- Compliance Evolution: Evolving regulations regarding gamified trading features could require platform adjustments

- Token Classification: Regulatory clarity regarding the classification of platform tokens remains an ongoing consideration

LOT Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 token on BSC, potential security vulnerabilities in the underlying smart contract code could pose risks

- Platform Dependency: Token value is closely tied to the League of Traders platform's continued operation and adoption

- Limited Circulation: With only 15% of total supply in circulation (150 million out of 1 billion tokens), future token unlocks could create selling pressure

VI. Conclusion and Action Recommendations

LOT Investment Value Assessment

League of Traders (LOT) represents an innovative approach to crypto trading through gamification and social features, supported by notable backers including Mirana, C3 Ventures, Cadenza, and Neowiz. The platform's positioning as South Korea's leading social trading platform suggests potential for growth within a specific market niche. However, the token's recent performance shows considerable challenges, with a 43.52% annual decline and current trading near its all-time low of $0.008342. The relatively low market capitalization and limited circulation rate of 15% present both opportunities for growth and risks related to liquidity and potential supply expansion.

LOT Investment Recommendations

✅ Beginners: Exercise caution with LOT due to its high volatility and relatively low liquidity. Consider starting with small allocations (no more than 1-2% of crypto portfolio) and focus on understanding the platform's fundamentals before increasing exposure

✅ Experienced Investors: May consider strategic position building during periods of significant price weakness, while maintaining strict risk management protocols. Monitor platform adoption metrics, user growth (currently 11,021 holders), and trading volume trends as indicators of potential reversal

✅ Institutional Investors: Conduct thorough due diligence on platform partnerships, tokenomics, and vesting schedules. Consider the 85% of tokens yet to be circulated in long-term valuation models and assess correlation with broader gaming and social trading sector trends

LOT Trading Participation Methods

- Spot Trading: Direct purchase and sale of LOT tokens on Gate.com and other exchanges (currently listed on 8 exchanges) for straightforward exposure

- Dollar-Cost Averaging: Implement systematic periodic purchases to mitigate timing risk given the token's high volatility

- Portfolio Diversification: Include LOT as part of a broader gaming and social trading sector allocation rather than a standalone investment

Cryptocurrency investment carries extremely high risks. This article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of LOT token? How has its historical price trend been?

LOT token currently trades significantly below its all-time high of $0.0008948, down 89.10%. Historical low stands at $0.00007266. The token has experienced substantial price correction from peak levels, reflecting market volatility in the sector.

What are the main factors affecting LOT price?

LOT price is primarily influenced by market demand, supply mechanisms, macroeconomic environment, and its anti-inflation properties. Trading volume and competitive landscape also play significant roles in price movements.

What is the price prediction for LOT token in 2024-2025?

LOT token is predicted to trade in the range of $0.01287 to $0.02375 in 2025, with an average price of $0.01813. Based on current analysis models, the token is expected to show sideways movement with near-zero potential returns.

What is the fundamentals of LOT project? What are its technology and application scenarios?

LOT leverages IoT technology for smart homes and smart cities. It focuses on sensor data collection and device interconnection through network communication, enabling real-time data integration and intelligent automation across connected ecosystems.

What are the advantages or disadvantages of LOT compared to other IoT-related tokens?

LOT excels in low power consumption and multi-protocol support for long-term stable IoT device operation. However, it may lag behind competitors in scalability and cross-chain interoperability capabilities.

What are the main risks of investing in LOT tokens?

Main risks include market volatility, regulatory changes, liquidity fluctuations, platform operational risks, and competitive pressures in the trading platform sector. Investors should conduct thorough due diligence before participating.

What is LOT's circulating supply and total supply? How does this impact the price?

LOT's circulating and total supply directly influence its market price. Larger circulating supply typically results in lower prices, while increased total supply can lead to price decline. As of February 2026, specific metrics reflect current market valuation dynamics.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Top 7 GPUs Previously Used for Ethereum Mining in 2025

Top 7 Cloud Gaming Services

Top 7 Specialized Ethereum Mining Rigs for 2025

Participating in DAO Communities in the Web3 Era and Prominent DAOs

Top 10 Crypto Exchanges for Beginners: Best Choices