2026 LOT Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: LOT's Market Position and Investment Value

League of Traders (LOT), positioned as South Korea's leading social trading platform that gamifies the crypto trading experience, has been making strides in the cryptocurrency ecosystem. As of February 2026, LOT maintains a market capitalization of approximately $1.33 million, with a circulating supply of 150 million tokens and a current price hovering around $0.0089. This asset, backed by notable investors including Mirana, C3 Ventures, Cadenza, and Korean gaming company Neowiz, is playing an increasingly significant role in the social trading and gamified crypto experience sector.

This article will comprehensively analyze LOT's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. LOT Price History Review and Market Status

LOT Historical Price Evolution Trajectory

- 2025: League of Traders (LOT) was officially listed on Gate.com on June 19, 2025, marking a significant milestone for this South Korean social trading platform. The token experienced notable volatility in its early trading period.

- 2025: On June 20, 2025, LOT reached its all-time high (ATH) of $0.04947, demonstrating strong initial market interest in the gamified crypto trading platform backed by prominent investors including Mirana, C3 Ventures, Cadenza, and Korean gaming company Neowiz.

- 2026: The token entered a downward trend, with the price declining from its peak. On February 2, 2026, LOT recorded its all-time low (ATL) of $0.008342, representing a substantial correction from its historical high.

LOT Current Market Situation

As of February 3, 2026, LOT is trading at $0.008859, showing a modest 24-hour increase of 2.46% with a price gain of approximately $0.0002127. The token has demonstrated short-term resilience with a 1-hour price change of 0.86%.

However, broader timeframe analysis reveals persistent downward pressure. The 7-day performance shows a decline of 12.82%, while the 30-day chart indicates an 18.96% decrease. The annual performance presents a more pronounced downtrend, with LOT declining 42.89% over the past year, highlighting the challenging market conditions the token has faced since its launch.

LOT's 24-hour trading volume stands at $20,311.44, reflecting moderate market activity. The token maintains a market capitalization of approximately $1.33 million, with 150 million LOT tokens currently in circulation out of a maximum supply of 1 billion tokens, representing a 15% circulation ratio. The fully diluted market capitalization is calculated at $8.86 million.

With a current market dominance of 0.00031% and ranked #2,331 among cryptocurrencies, LOT operates within a competitive landscape. The token is deployed on the BSC network and has attracted 11,021 holders, indicating a growing community base. LOT is currently available for trading on 8 exchanges, with Gate.com being one of the primary platforms.

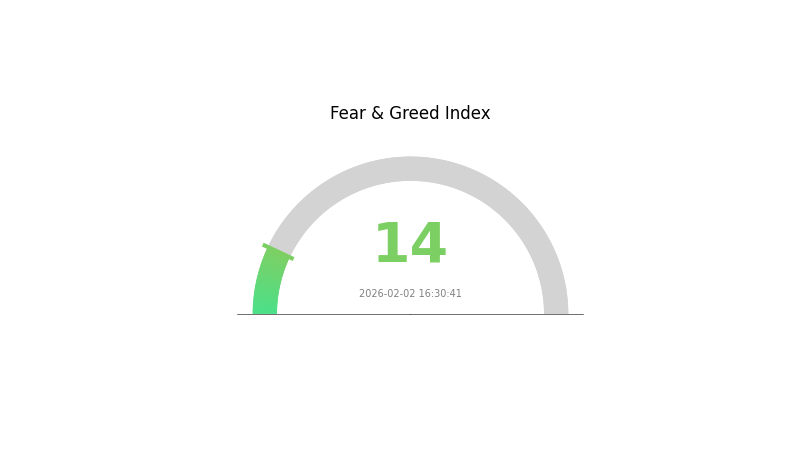

The market sentiment index for the broader cryptocurrency market currently sits at 14, indicating an "Extreme Fear" state, which may be contributing to the downward pressure on LOT and other digital assets.

Click to view the current LOT market price

LOT Market Sentiment Index

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 14. This historically low reading signals significant market pessimism and risk aversion among investors. Such extreme sentiment often indicates potential oversold conditions, which contrarian investors may view as accumulation opportunities. However, caution is advised as further downside is possible. Market participants should monitor key support levels and await stabilizing signals before making substantial investment decisions.

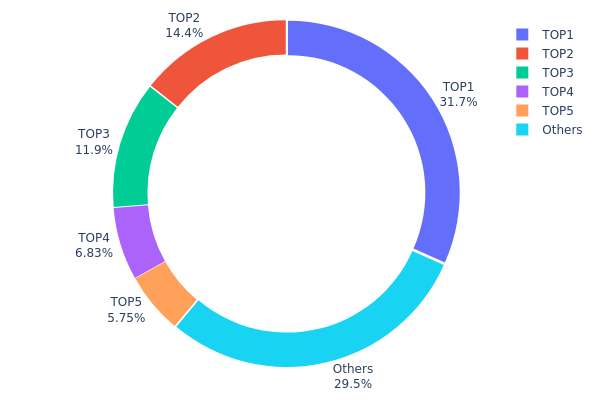

LOT Holding Distribution

The holding distribution chart reveals the concentration of token holdings among top wallet addresses, serving as a crucial indicator of market structure and decentralization level. According to the latest on-chain data, the top 5 addresses collectively hold approximately 70.52% of the total LOT supply, with the largest single address controlling 31.66% (316.67 million tokens). The second-ranked address holds 14.37%, while the third holds 11.91%. The remaining market participants, categorized as "Others," account for only 29.48% of the total supply.

This distribution pattern demonstrates a relatively high degree of centralization, which could potentially impact market stability. The concentration of holdings among a small number of addresses may increase price volatility risk, as large-scale transactions from these major holders could trigger significant price fluctuations. Additionally, such concentrated ownership structure may raise concerns about potential market manipulation, particularly during periods of low liquidity. From a decentralization perspective, this holding pattern suggests that LOT's on-chain governance and price discovery mechanisms may be influenced by a limited number of stakeholders.

However, it's worth noting that some of these large holding addresses may belong to project treasury wallets, exchange cold wallets, or institutional investment entities, rather than individual retail investors. This concentration could reflect strategic token allocation for ecosystem development, liquidity provision, or long-term value capture. The current holding structure indicates that LOT is in a phase where major stakeholders maintain significant control, which may gradually evolve as the project matures and token distribution broadens through market circulation and community participation.

Click to view current LOT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4a4d...b16f36 | 316666.66K | 31.66% |

| 2 | 0x96ec...547c29 | 143750.00K | 14.37% |

| 3 | 0x608d...5e911b | 119166.67K | 11.91% |

| 4 | 0x86b1...51486c | 68333.34K | 6.83% |

| 5 | 0xe6bc...25c740 | 57500.00K | 5.75% |

| - | Others | 294583.33K | 29.48% |

II. Core Factors Influencing LOT's Future Price

Market Demand and Platform Development

- Platform Functionality Expansion: The expansion of product features within the League of Traders platform represents a significant driver for LOT token demand. As the platform introduces new social trading tools and unlocks additional functionalities, the utility value of LOT tokens may experience corresponding growth.

- Social Trading Adoption: The proliferation of social trading practices could serve as a catalyst for LOT price appreciation. Increased user engagement with League of Traders' social features may drive higher token circulation and usage.

- Community Staking Dynamics: Token staking mechanisms within the ecosystem provide holders with governance rights and potential rewards, which may influence holding patterns and market liquidity.

Institutional and Major Holder Activity

- Contract Control Rights: Investors should monitor the control rights held by contract owners, as these administrative privileges may impact token governance and long-term value stability.

- Token Distribution Structure: The allocation framework of LOT tokens plays a role in platform ecosystem growth, with distribution patterns potentially affecting market concentration and price volatility.

Technical Development and Ecosystem Construction

- Payment and Unlock Functions: LOT serves multiple utilities within the League of Traders platform, including payment mechanisms for unlocking premium features. This functional integration supports the token's fundamental value proposition.

- Liquidity Considerations: Market participants should remain attentive to liquidity conditions, as trading volume and depth may significantly influence price stability and execution quality.

- Platform Ecosystem Growth: The overall development trajectory of the League of Traders platform, including user base expansion and feature enhancement, contributes to the long-term value proposition of LOT tokens.

III. 2026-2031 LOT Price Prediction

2026 Outlook

- Conservative Prediction: $0.006 - $0.00882

- Neutral Prediction: $0.00882

- Optimistic Prediction: $0.00961 (requires favorable market conditions)

2027-2029 Outlook

- Market Stage Expectation: Gradual growth phase with steady market development

- Price Range Prediction:

- 2027: $0.00682 - $0.00968

- 2028: $0.00737 - $0.01011

- 2029: $0.00919 - $0.01398

- Key Catalysts: Projected annual growth rates ranging from 4% to 10%, indicating potential ecosystem expansion and increased adoption

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00606 - $0.01473 (assuming moderate market conditions)

- Optimistic Scenario: $0.01188 - $0.01903 (with sustained growth momentum)

- Transformative Scenario: Up to $0.01903 (under highly favorable market conditions with potential 50% growth)

- 2026-02-03: LOT trading within initial price discovery phase

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00961 | 0.00882 | 0.006 | 0 |

| 2027 | 0.00968 | 0.00922 | 0.00682 | 4 |

| 2028 | 0.01011 | 0.00945 | 0.00737 | 6 |

| 2029 | 0.01398 | 0.00978 | 0.00919 | 10 |

| 2030 | 0.01473 | 0.01188 | 0.00606 | 34 |

| 2031 | 0.01903 | 0.01331 | 0.00812 | 50 |

IV. LOT Professional Investment Strategies and Risk Management

LOT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to social trading platforms and gamified crypto experiences

- Operational Recommendations:

- Consider accumulating positions during market downturns, given the current price near historical lows

- Monitor platform development and user growth metrics as key indicators

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term holding

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of approximately $20,311 to identify liquidity patterns

- Support/Resistance Levels: Track the 24-hour range between $0.008342 (near ATL) and $0.008879

- Swing Trading Considerations:

- Pay attention to short-term volatility, as indicated by recent 1-hour gains of 0.86% versus 7-day decline of 12.82%

- Consider entry points during price consolidation phases

LOT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Moderate Investors: 3-5% of crypto portfolio allocation

- Aggressive Investors: 5-10% of crypto portfolio allocation

(2) Risk Hedging Approaches

- Diversification: Balance LOT holdings with established cryptocurrencies and stablecoins

- Position Sizing: Limit single-position exposure based on individual risk tolerance

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet offers secure storage with user-controlled private keys

- Hot Wallet Approach: Maintain only trading amounts on exchanges, transfer majority to secure wallets

- Security Precautions: Enable two-factor authentication, regularly backup wallet information, and never share private keys

V. LOT Potential Risks and Challenges

LOT Market Risks

- Price Volatility: LOT has experienced a 42.89% decline over the past year and currently trades near its all-time low of $0.008342

- Low Market Capitalization: With a market cap of approximately $1.33 million and 0.00031% market dominance, the token faces significant liquidity constraints

- Limited Circulation: Only 15% of total supply (150 million out of 1 billion tokens) is currently circulating, creating potential dilution concerns

LOT Regulatory Risks

- Social Trading Compliance: As a social trading platform, League of Traders may face evolving regulations regarding investment recommendations and user-generated trading signals

- Gaming Regulations: The platform's gamification elements could attract scrutiny from gaming and gambling regulatory bodies

- Geographic Restrictions: Being primarily focused on the Korean market, changes in South Korean crypto regulations could significantly impact platform operations

LOT Technical Risks

- Smart Contract Dependencies: Operating on BSC (BEP-20 standard), the platform is subject to risks associated with the underlying blockchain infrastructure

- Platform Security: As a social trading platform handling user funds and trading activities, security breaches could severely impact token value

- Competition Risk: The platform operates in a competitive space with established trading platforms and emerging social trading solutions

VI. Conclusion and Action Recommendations

LOT Investment Value Assessment

League of Traders (LOT) represents an innovative approach to crypto trading through gamification and social features, backed by notable investors including Mirana, C3 Ventures, Cadenza, and Neowiz. The platform's positioning as South Korea's leading social trading platform provides a unique market niche. However, the token currently faces challenges, trading near its all-time low with a significant decline from its peak price of $0.04947. The limited circulating supply of 15% and relatively small market capitalization of $1.33 million suggest both high risk and potential upside. Long-term value depends on successful user acquisition, platform development, and broader adoption of social trading features.

LOT Investment Recommendations

✅ Newcomers: Approach with caution and allocate only a small portion (1-2%) of your crypto portfolio. Focus on understanding the platform's features and community before investing.

✅ Experienced Investors: Consider LOT as a speculative position within a diversified portfolio, limiting exposure to 3-5%. Monitor platform metrics, user growth, and token unlock schedules carefully.

✅ Institutional Investors: Conduct thorough due diligence on the platform's business model, tokenomics, and competitive positioning. Consider the low liquidity and market cap in position sizing decisions.

LOT Trading Participation Methods

- Spot Trading on Gate.com: Purchase LOT directly using USDT or other trading pairs on Gate.com, benefiting from the platform's liquidity and security features

- Dollar-Cost Averaging: Implement a systematic investment plan to mitigate timing risk, particularly given current price volatility

- Community Engagement: Participate in the League of Traders platform and community through Discord and Twitter to better understand the project's development and user sentiment

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is LOT token? What practical uses does it have?

LOT is the native token of League of Traders, designed for spot trading in the cryptocurrency market. Users can buy, sell, hold, and transfer LOT tokens directly at current market prices without leverage, enabling straightforward participation in crypto trading.

What are the main factors affecting LOT price?

LOT price is primarily influenced by market demand, supply mechanisms, and macroeconomic environment. Its anti-inflationary properties and trading volume also play significant roles in price movements.

How to analyze and predict LOT price trends?

Analyze LOT price trends by monitoring supply dynamics, market demand, trading volume, and overall crypto market sentiment. Use technical analysis on price charts and fundamental analysis of project developments. Market cycles and investor sentiment also significantly influence price movements.

What are the main risks and uncertainties in LOT price prediction?

Key risks include market volatility, price manipulation, regulatory uncertainty, and technical security vulnerabilities. Trading volume fluctuations and macroeconomic factors also significantly impact LOT price movements and prediction accuracy.

What were the major price fluctuation events for LOT in history?

LOT experienced significant growth in early 2021, followed by a sharp decline in mid-2022. The market recovered progressively through 2023. In 2024, new project launches drove another price surge. These cycles reflect ecosystem development, macro conditions, and trading volume dynamics.

What are the advantages and disadvantages of LOT compared to similar tokens?

LOT offers faster transaction speeds and lower transaction fees than comparable tokens. However, it experiences greater market volatility and lower stability compared to traditional cryptocurrencies, presenting both growth potential and higher risk factors.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Investigating the True Identity of Bitcoin Founder Satoshi Nakamoto

How to Participate in Cryptocurrency Airdrops and Essential Security Measures

Top 7 Hardware Picks for Cryptocurrency Mining

What Does DYOR Mean in Crypto?

What Is a Cryptocurrency Airdrop: Where to Find Them and How to Profit