2026 LRN Price Prediction: Expert Analysis and Market Forecast for the Next Generation Learning Token

Introduction: LRN's Market Position and Investment Value

Loopring NEO (LRN), as a decentralized trading protocol deployed on the NEO network, has been serving the blockchain asset trading ecosystem since its launch in 2018. As of 2026, LRN maintains a market capitalization of approximately $224,252, with a circulating supply of about 113.60 million tokens, and the price hovering around $0.001974. This asset, designed to support decentralized token-to-token trading within the NEO ecosystem, is playing a role in facilitating trustless exchange operations through off-chain order matching and on-chain settlement mechanisms.

This article will comprehensively analyze LRN's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

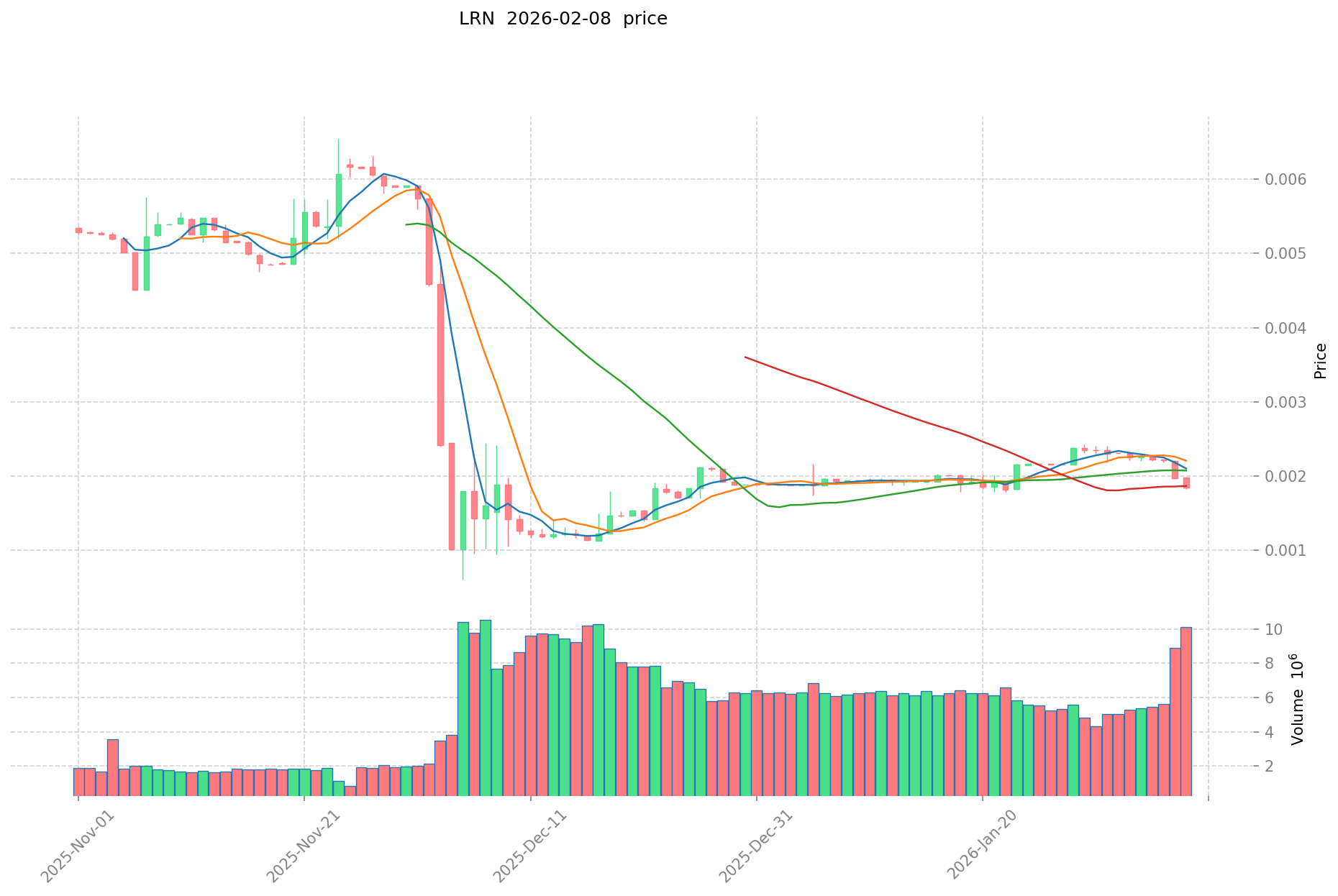

I. LRN Price History Review and Market Status

LRN Historical Price Evolution Trajectory

- 2018: LRN reached its all-time high of $3.40 on November 1, with significant price volatility during the market cycle

- 2025: The token experienced a continued downward trend, falling to its all-time low of $0.000601 on May 9

- 2026: As of February 8, the price has recovered to $0.001974, showing modest fluctuations in recent trading periods

LRN Current Market Situation

LRN is currently trading at $0.001974, with a 24-hour trading volume of $17,526.12. The token has demonstrated mixed short-term performance, recording a 6.13% increase over the past hour while experiencing a slight 0.2% decline in the 24-hour period. Over the weekly timeframe, LRN has decreased by 14.51%, though it has shown a 2.17% gain over the past 30 days.

The token's market capitalization stands at $224,252.19, with a fully diluted valuation of $275,388.01. The circulating supply represents 100% of the maximum supply at 113,602,931 LRN tokens, with a total supply of 139,507,605 tokens. LRN currently ranks #3798 in the cryptocurrency market, holding a market dominance of 0.000011%.

The 24-hour price range has fluctuated between $0.001825 and $0.001985, indicating moderate intraday volatility. The current price represents a substantial distance from its historical peak in 2018, while showing recovery from the all-time low recorded in May 2025.

Click to check the current LRN market price

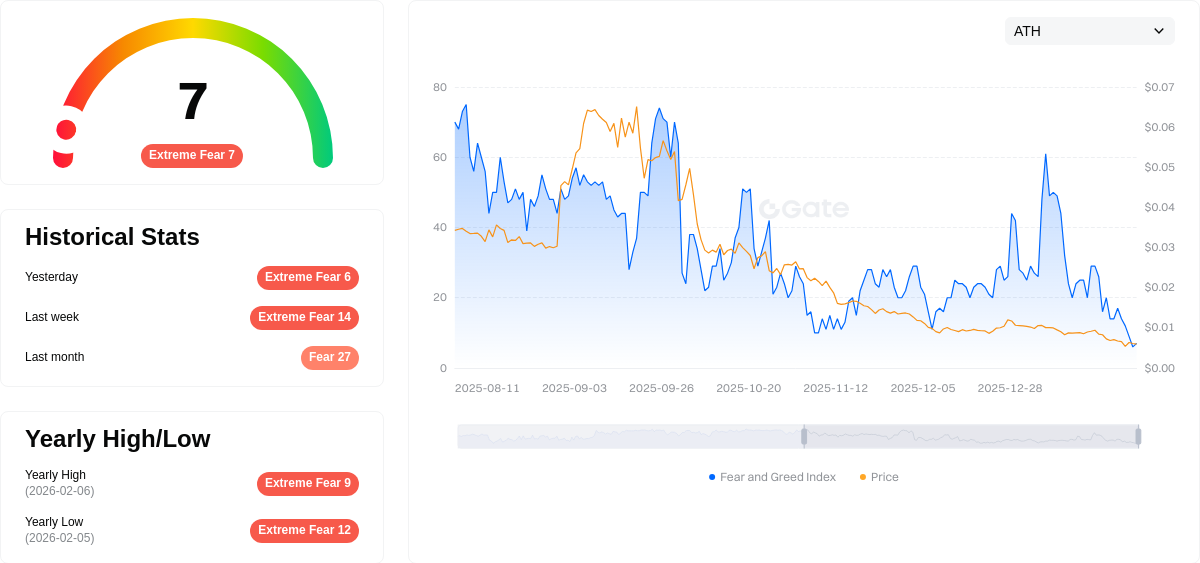

LRN Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 7. This unusually low sentiment indicates severe market pessimism and panic selling. Investors are highly risk-averse, creating potential opportunities for contrarian traders. Such extreme readings often precede market reversals. During these periods, assets typically trade at significant discounts. However, caution remains essential as fear-driven volatility can persist. Market participants should monitor sentiment shifts closely while maintaining disciplined risk management strategies.

LRN Holding Distribution

The LRN holding distribution chart reveals a moderately decentralized ownership structure. The top address holds approximately 15.3% of the total supply, while the top 10 addresses collectively control around 42.7% of circulating tokens. This concentration level falls within a relatively healthy range for emerging crypto assets, indicating neither excessive centralization that could pose manipulation risks nor extreme fragmentation that might hinder coordinated ecosystem development.

From a market structure perspective, this distribution pattern suggests a balanced power dynamic among major stakeholders. The gradual decline in holding percentages from top-tier addresses demonstrates organic accumulation patterns rather than artificial concentration. However, the combined influence of top holders remains significant enough to impact short-term price action during periods of coordinated movements, particularly in lower liquidity conditions. The presence of multiple addresses with substantial holdings (5-8% range) creates natural support levels while also introducing potential volatility triggers if these entities engage in simultaneous selling activities.

The current on-chain structure reflects a maturing asset with improving decentralization characteristics. The distribution indicates sufficient retail and institutional participation beyond whale addresses, which enhances market resilience and reduces single-point failure risks. This holding pattern typically correlates with more stable long-term price trajectories, as power is distributed across diverse market participants with varying investment horizons and risk tolerances.

Click to view current LRN Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting LRN's Future Price

Supply Mechanism

Based on the available materials, there is insufficient information regarding LRN's specific supply mechanism, historical supply patterns, or current supply change expectations. The materials focus primarily on general financial analysis factors and do not provide details about token supply dynamics for this particular asset.

Institutional and Major Holder Dynamics

- Institutional Holdings: According to industry analysis, LRN's current valuation is positioned in the mid-to-low range within its sector. The materials suggest that institutional interest may be tied to long-term trends in online education penetration rates.

- Enterprise Adoption: The provided materials do not contain specific information about enterprise adoption of LRN.

- National Policies: Policy benefits and regulatory support for the online education sector could potentially support price stability, though specific policy details were not provided in the materials.

Macroeconomic Environment

- Monetary Policy Impact: The materials note that financial data and macroeconomic indicators often show synchronized movements, which can create short-term trading opportunities. However, specific monetary policy impacts on LRN were not detailed in the available resources.

- Inflation Hedging Attributes: No specific information was provided regarding LRN's performance in inflationary environments.

- Geopolitical Factors: The materials do not contain detailed analysis of how international developments might affect LRN's price movements.

Technical Development and Ecosystem Building

- Cost Management: Company cost control capabilities represent a key technical factor that may support the stock's price center moving upward, particularly if combined with industry policy benefits.

- Earnings Stability: Q4 earnings volatility (with net profit declining 18.26% year-over-year) requires ongoing monitoring as it may impact investor confidence and price stability.

- Market Positioning: With a price momentum score of 9.29 points, LRN ranks 2nd out of 17 companies in the education services sector. The current price trades between resistance at 75.85 and support at 65.38, creating potential for range-bound trading strategies.

III. 2026-2031 LRN Price Prediction

2026 Outlook

- Conservative prediction: $0.00115 - $0.00198

- Neutral prediction: $0.00198 (average estimated value)

- Optimistic prediction: $0.00245 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: LRN may enter a gradual growth phase, with potential for moderate upward momentum as the project develops and market conditions evolve

- Price range prediction:

- 2027: $0.00128 - $0.00317 (approximately 12% potential increase)

- 2028: $0.00172 - $0.00353 (approximately 36% potential increase)

- 2029: $0.00227 - $0.00367 (approximately 57% potential increase)

- Key catalysts: Market adoption expansion, technological development progress, and broader cryptocurrency market sentiment

2030-2031 Long-term Outlook

- Baseline scenario: $0.00261 - $0.00339 (assuming steady market development and maintained project momentum)

- Optimistic scenario: $0.00366 - $0.00391 (assuming enhanced ecosystem growth and favorable regulatory environment)

- Transformative scenario: Above $0.00391 (requires exceptional adoption rates, strategic partnerships, and highly favorable market conditions)

- February 8, 2026: LRN is currently in early prediction phase with baseline average price estimated at $0.00198

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00245 | 0.00198 | 0.00115 | 0 |

| 2027 | 0.00317 | 0.00222 | 0.00128 | 12 |

| 2028 | 0.00353 | 0.00269 | 0.00172 | 36 |

| 2029 | 0.00367 | 0.00311 | 0.00227 | 57 |

| 2030 | 0.00366 | 0.00339 | 0.00261 | 71 |

| 2031 | 0.00391 | 0.00352 | 0.0018 | 78 |

IV. LRN Professional Investment Strategy and Risk Management

LRN Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in decentralized exchange protocols and the NEO ecosystem's long-term development

- Operational Suggestions:

- Consider accumulating positions during market corrections when the price approaches support levels

- Monitor the development progress of the Loopring protocol and its adoption within the NEO network

- Utilize Gate Web3 Wallet for secure storage, ensuring private key control and multi-signature protection

(II) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use 20-day and 50-day moving averages to identify trend directions and potential reversal points

- Volume Analysis: Monitor 24-hour trading volume ($17,526) relative to market cap to assess liquidity conditions

- Swing Trading Key Points:

- Pay attention to the 24-hour price range between $0.001825 and $0.001985 to identify short-term support and resistance levels

- Consider the relatively low liquidity environment when sizing positions to avoid slippage

LRN Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of cryptocurrency portfolio allocation

- Aggressive Investors: 3-5% of cryptocurrency portfolio allocation

- Professional Investors: Up to 10% of cryptocurrency portfolio allocation with active hedging strategies

(II) Risk Hedging Solutions

- Diversification: Allocate across multiple blockchain protocol tokens to reduce single-asset exposure

- Stop-loss Discipline: Set predefined exit levels based on individual risk tolerance, typically 15-25% below entry price

(III) Secure Storage Solutions

- Hot Wallet Solution: Gate Web3 Wallet for active trading positions requiring frequent access

- Cold Storage Plan: Hardware wallet solutions for long-term holdings to minimize online exposure risks

- Security Precautions: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts; verify withdrawal addresses carefully

V. LRN Potential Risks and Challenges

LRN Market Risks

- High Volatility: Recent 7-day decline of 14.51% demonstrates significant price fluctuation potential

- Limited Liquidity: Daily trading volume of approximately $17,526 may result in execution challenges for larger orders

- Market Cap Position: Ranking at #3798 with extremely low market dominance (0.000011%) indicates heightened volatility risk

LRN Regulatory Risks

- Decentralized Exchange Regulations: Evolving regulatory frameworks for decentralized trading protocols may impact project operations

- Cross-border Compliance: Operating across multiple jurisdictions may present compliance challenges

- Token Classification Uncertainty: Regulatory treatment of protocol tokens remains subject to change in various markets

LRN Technical Risks

- Smart Contract Vulnerabilities: Decentralized exchange protocols face potential smart contract exploit risks

- Network Dependency: LRN's functionality relies on NEO network stability and continued development

- Competition Risk: Increasing competition from other decentralized exchange protocols may affect adoption rates

VI. Conclusion and Action Recommendations

LRN Investment Value Assessment

LRN represents a specialized protocol token within the NEO ecosystem focused on decentralized exchange functionality. While the project addresses genuine market needs for trustless token trading, investors should carefully weigh several considerations. The current low market capitalization and limited liquidity present both opportunity and risk. The recent price performance shows notable volatility with a 14.51% decline over seven days, though the one-year performance of -5.68% suggests relative stability compared to short-term fluctuations. Long-term value depends significantly on continued development of the Loopring protocol, adoption within the NEO ecosystem, and broader market acceptance of decentralized exchange solutions. Short-term risks include market volatility, liquidity constraints, and ongoing competitive pressures from alternative platforms.

LRN Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of portfolio) to gain exposure while learning about decentralized exchange protocols; prioritize education on protocol mechanics before increasing position size ✅ Experienced Investors: Consider strategic accumulation during market weakness while maintaining strict position sizing discipline; actively monitor protocol development updates and ecosystem growth metrics ✅ Institutional Investors: Evaluate LRN within a broader portfolio of protocol tokens; conduct thorough due diligence on smart contract security and team credentials before significant allocation

LRN Trading Participation Methods

- Spot Trading: Purchase LRN directly on Gate.com for immediate ownership and transfer to secure storage

- Dollar-Cost Averaging: Implement systematic purchasing at regular intervals to reduce timing risk and average entry price

- Portfolio Rebalancing: Periodically adjust LRN allocation within your cryptocurrency portfolio to maintain target risk exposure

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price performance of LRN tokens? What are the past price trends?

LRN tokens have experienced significant price volatility with multiple notable upswings and downturns. The token has shown considerable fluctuation patterns, reflecting market dynamics and investor sentiment shifts. Current momentum suggests potential for continued price discovery in the coming periods.

What are the main factors affecting LRN price?

LRN price is primarily influenced by market demand, trading volume, project development progress, community sentiment, and broader cryptocurrency market trends. Regulatory changes and macroeconomic factors also significantly impact its valuation.

What is the LRN price prediction for 2024? What analyses predict LRN's future trend?

LRN's 2024 price prediction remains unclear, with no consensus among market analysts. Various technical and fundamental analyses suggest mixed trends. Monitor project developments and market sentiment for future direction.

What are the advantages or disadvantages of LRN token compared to similar projects?

LRN token excels in transparency and traceability, offering fast transaction speeds and low costs. However, adoption levels and regulatory clarity remain uncertain compared to established competitors.

What is the fundamentals of LRN project? How about the team background and technical strength?

LRN provides K-12 online and hybrid learning solutions. CEO has strong finance background but recent platform implementation issues caused significant performance decline, raising concerns about operational execution capabilities.

What risks should I be aware of when purchasing LRN tokens?

LRN token investments carry market volatility risks, liquidity constraints, and regulatory uncertainties. Early-stage projects may face technical challenges or development delays. Conduct thorough research on tokenomics and team credibility before investing.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

How can crypto derivatives market signals predict future price movements: analyzing futures open interest, funding rates, and liquidation data

What is POWERLOOM: A Comprehensive Guide to Decentralized Data Infrastructure for Web3

How Does Lagrange (LA) Zero-Knowledge Proof Network Drive Web3 Infrastructure Innovation by 2026?

What is SCCP: A Comprehensive Guide to Signaling Connection Control Part in Telecommunications Networks

What is DFYN: A Comprehensive Guide to the Decentralized Finance Platform and Its Features