2026 MEPAD Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: MEPAD's Market Position and Investment Value

MemePad (MEPAD), as a digital asset platform providing issuing services for meme coins and other small market cap tokens, has been operating since its launch in 2021. As of 2026, MEPAD maintains a market capitalization of approximately $329,313, with a circulating supply of about 453.54 million tokens, and the price hovering around $0.0007261. This asset, positioned within the meme token launchpad sector, is playing an increasingly active role in the decentralized token issuance ecosystem.

This article will comprehensively analyze MEPAD's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. MEPAD Price History Review and Market Status

MEPAD Historical Price Evolution Trajectory

- 2021: The token reached its all-time high of $0.6488 on May 18, 2021, marking the peak of its price performance since launch.

- 2021-2026: Following the historical high, MEPAD experienced a significant downward trend, with price declining substantially over the following years.

- 2026: The token hit its all-time low of $0.00064679 on February 6, 2026, representing a notable contraction from previous levels.

MEPAD Current Market Situation

As of February 7, 2026, MEPAD is trading at $0.0007261, showing a 24-hour increase of 4.53%. The token's 24-hour trading volume stands at $26,843.50, with a 24-hour price range between $0.0006337 and $0.0008601.

The current circulating supply is 453,537,445 MEPAD tokens, representing approximately 113.38% of the total supply of 399,999,999.99 tokens. The market capitalization reaches $329,313.54, with the fully diluted valuation at $290,439.99. The market cap to FDV ratio stands at 100%, and MEPAD holds a market dominance of 0.000011%.

Over different timeframes, MEPAD has demonstrated varied performance: a 1-hour decline of 0.21%, a 7-day decrease of 25.01%, a 30-day drop of 33.86%, and a 1-year decline of 29.09%. The token holder count currently stands at 24,717.

MemePad operates as a digital asset platform providing issuing services for meme coins and other small market value tokens. The token is deployed on the BSC network with the contract address 0x9d70a3ee3079a6fa2bb16591414678b7ad91f0b5, and is available for trading on one exchange.

Click to view current MEPAD market price

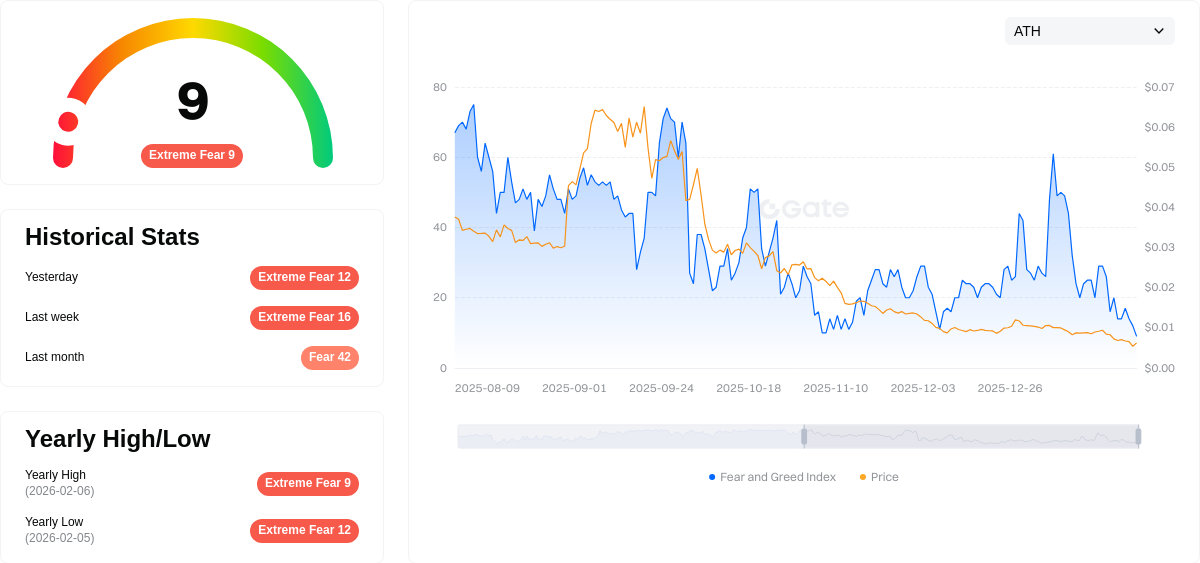

MEPAD Market Sentiment Index

2026-02-06 Fear & Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index plummeting to 9. This indicates strong bearish sentiment among investors, characterized by significant selling pressure and risk aversion. Such extreme fear levels often present contrarian opportunities for long-term investors, as markets may be oversold. However, caution is advised, as further downside risks remain. Monitor key support levels closely and consider your risk tolerance before making investment decisions. Historical data suggests that extreme fear periods can mark potential accumulation zones for patient investors.

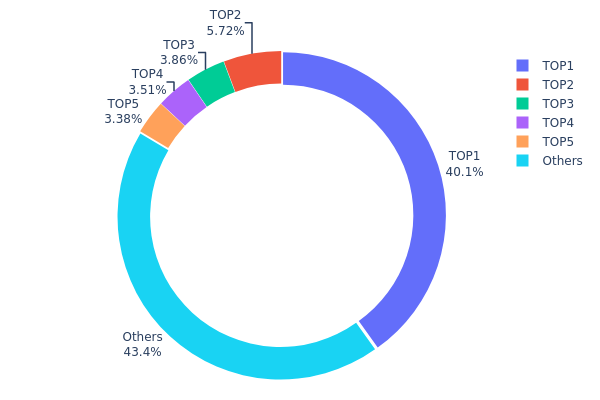

MEPAD Holding Distribution

The holding distribution chart reveals the allocation of MEPAD tokens across different wallet addresses, providing crucial insights into the token's decentralization level and potential market manipulation risks. According to the latest on-chain data, the top address holds 160,516.95K tokens, accounting for 40.12% of the total supply, while the top 5 addresses collectively control 56.57% of all circulating tokens. This concentration pattern suggests a moderately centralized ownership structure that warrants careful monitoring.

The current distribution presents a mixed market structure. While the dominant address holding over 40% of supply could theoretically exert significant influence on price movements through large-scale buying or selling activities, the relatively dispersed nature of the remaining holdings—with 43.43% distributed among numerous smaller addresses—provides some counterbalance. The presence of several mid-tier holders (ranging from 3.37% to 5.71%) indicates a developing institutional or whale investor base, which typically contributes to market stability through longer holding periods and strategic trading approaches.

From a market health perspective, this concentration level introduces moderate volatility risks. The substantial holdings by top addresses create potential for sharp price swings during significant token movements, while the decentralized portion among smaller holders helps maintain baseline liquidity and organic trading activity. This distribution pattern is characteristic of tokens in their growth phase, where early investors and project-related addresses maintain significant stakes while community adoption gradually expands the holder base.

Click to view the current MEPAD Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfa18...d3087f | 160516.95K | 40.12% |

| 2 | 0x41ed...9368ae | 22875.82K | 5.71% |

| 3 | 0x0275...3b9a4c | 15450.05K | 3.86% |

| 4 | 0x0d07...b492fe | 14043.90K | 3.51% |

| 5 | 0x52e3...0781a1 | 13517.19K | 3.37% |

| - | Others | 173596.09K | 43.43% |

II. Core Factors Influencing MEPAD's Future Price

Supply Mechanism

- Strategic Adjustment: MEPAD strategy is part of a broader business transformation focusing on solar energy industrial products.

- Historical Pattern: The strategy implementation represents a shift in business focus that may affect market positioning and resource allocation.

- Current Impact: The strategic transition toward solar energy products could influence MEPAD's market presence and adoption trajectory.

Macro-Economic Environment

- Energy Transition Influence: Global energy transformation and environmental regulations serve as primary driving factors for the sector.

- Policy Support: Environmental protection regulations and clean energy policies may create favorable conditions for solar energy-related initiatives.

- Market Competition: Competitive dynamics and production costs in the renewable energy sector could affect overall market positioning and pricing pressure.

III. 2026-2031 MEPAD Price Prediction

2026 Outlook

- Conservative Prediction: $0.00052 - $0.00073

- Neutral Prediction: Around $0.00073

- Optimistic Prediction: Up to $0.00089 (requires favorable market conditions and sustained adoption)

2027-2029 Outlook

- Market Stage Expectation: Gradual growth phase with increasing volatility as the project matures and expands its ecosystem

- Price Range Prediction:

- 2027: $0.00043 - $0.00103 (approximately 11% increase from 2026 average)

- 2028: $0.00059 - $0.00114 (approximately 26% cumulative increase)

- 2029: $0.00083 - $0.00123 (approximately 42% cumulative increase)

- Key Catalysts: Platform development progress, strategic partnerships, broader market sentiment in the crypto space, and increased user engagement

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00103 - $0.00129 (assuming steady ecosystem growth and stable market conditions)

- Optimistic Scenario: $0.00113 - $0.00155 (assuming accelerated adoption and favorable regulatory environment)

- Transformative Scenario: Potential to reach upper bounds of $0.00155 by 2031 (requires exceptional market conditions, significant technological breakthroughs, and widespread mainstream adoption)

- 2031-12-31: MEPAD could potentially experience approximately 66% cumulative growth from the 2026 baseline (under favorable conditions)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00089 | 0.00073 | 0.00052 | 0 |

| 2027 | 0.00103 | 0.00081 | 0.00043 | 11 |

| 2028 | 0.00114 | 0.00092 | 0.00059 | 26 |

| 2029 | 0.00123 | 0.00103 | 0.00083 | 42 |

| 2030 | 0.00129 | 0.00113 | 0.00103 | 55 |

| 2031 | 0.00155 | 0.00121 | 0.00092 | 66 |

IV. MEPAD Professional Investment Strategy and Risk Management

MEPAD Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors with moderate risk tolerance and belief in the meme token ecosystem

- Operational Recommendations:

- Consider accumulating positions during market downturns when volatility is high

- Monitor the platform's token issuance activity and community engagement metrics

- Utilize Gate Web3 Wallet for secure storage with multi-signature protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume (currently $26,843.50) to identify potential breakout patterns

- Support and Resistance Levels: Track the 24-hour range ($0.0006337 - $0.0008601) for entry and exit points

- Swing Trading Key Points:

- Consider the high volatility demonstrated by recent price movements (-25.01% over 7 days)

- Set appropriate stop-loss levels given the token's historical price range

MEPAD Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 8% with active hedging strategies

(2) Risk Hedging Solutions

- Position Sizing: Limit individual trade exposure to minimize impact from high volatility

- Diversification: Balance MEPAD holdings with other established digital assets

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading needs

- Cold Storage Option: Hardware wallet solutions for long-term holdings

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly verify smart contract addresses on BSC (0x9d70a3ee3079a6fa2bb16591414678b7ad91f0b5)

V. MEPAD Potential Risks and Challenges

MEPAD Market Risks

- High Volatility: The token has experienced significant price fluctuations, with a 33.86% decline over 30 days

- Low Liquidity: With a market cap of approximately $329,313, the token faces potential liquidity constraints

- Market Dominance: The token's market share stands at 0.000011%, indicating limited market presence

MEPAD Regulatory Risks

- Platform Compliance: Meme token launchpad platforms may face increasing regulatory scrutiny

- Token Classification: Potential regulatory challenges regarding the classification of meme tokens

- Jurisdictional Variations: Different regulatory approaches across markets may impact platform operations

MEPAD Technical Risks

- Smart Contract Vulnerability: BSC-based tokens may be exposed to potential smart contract exploits

- Platform Dependency: Token value is closely tied to the MemePad platform's operational success

- Competition: The meme token launchpad sector faces increasing competition from alternative platforms

VI. Conclusion and Action Recommendations

MEPAD Investment Value Assessment

MemePad (MEPAD) represents a specialized play in the meme token ecosystem, offering exposure to a platform facilitating small market cap token launches. The token's current price of $0.0007261 is significantly below its historical peak of $0.6488, suggesting substantial downside risk has been realized. However, the token's high volatility and limited liquidity present considerable short-term risks. Long-term value depends on the platform's ability to maintain relevance in the competitive meme token sector and expand its user base beyond the current 24,717 holders.

MEPAD Investment Recommendations

✅ Beginners: Consider observing the project's development before investing; if participating, limit exposure to a minimal portion of portfolio (under 1%) ✅ Experienced Investors: May consider small speculative positions with strict risk controls, focusing on technical trading opportunities within established support and resistance levels ✅ Institutional Investors: Exercise caution due to limited liquidity and market depth; conduct thorough due diligence on platform operations and token economics

MEPAD Trading Participation Methods

- Spot Trading: Available on Gate.com with USDT trading pairs

- Limit Orders: Utilize limit orders to capture favorable entry points during volatile periods

- Portfolio Integration: Consider MEPAD as a small-cap, high-risk component within a diversified crypto portfolio

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make careful decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MEPAD? What are its uses and features?

MEPAD is an intelligent energy management platform integrating clean energy technologies. Its core features are micro-emission and smart efficiency, designed for homes and factories to optimize energy utilization and reduce environmental impact.

What is the historical price trend of MEPAD tokens and what are the main factors affecting the price?

MEPAD's price typically rises with market adoption and technological breakthroughs, but declines from regulatory concerns and security issues. Key drivers include market sentiment, technology development, trading volume, and ecosystem growth.

How to predict MEPAD price? What are the analysis methods?

Use technical analysis with moving averages and RSI indicators. Apply fundamental analysis by evaluating project team and market demand. Analyze historical trading volume data and market trends to forecast price movements.

What are the risks of investing in MEPAD? What should I pay attention to?

MEPAD investment risks include market volatility and project execution risk. Monitor the team background, tokenomics, and whitepaper carefully. Diversify your portfolio and only invest what you can afford to lose.

What are MEPAD's advantages and disadvantages compared to other platform tokens?

MEPAD offers strong security and cross-chain compatibility, attracting tech-focused users. However, it faces competition from established platforms with larger user bases and higher trading volume. Limited mainstream adoption remains a challenge.

MEPAD的未来发展前景和价格潜力如何?

MEPAD currently has a market value of $0.00 with limited market recognition. However, during bull markets, MEPAD demonstrates significant growth potential and could experience substantial increases in market capitalization and trading volume.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is Inflation? How Does It Affect Our Lives? Understanding Inflation Rates

Rafał Zaorski – Who Is He? Background, Net Worth, and Career Overview

7 Ideas for Beginners to Create Digital Art

What Are Nodes?

Comprehensive Guide to Buying and Trading Cryptocurrencies