2026 MIRAI Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: MIRAI's Market Position and Investment Value

MIRAI (MIRAI) serves as a pioneering case study in decentralized character creation, exploring how AI-powered virtual humans can evolve through meme culture, social platforms, and community-driven intellectual property. Since its launch in 2025, the project has established itself within the emerging Web3 virtual identity space. As of February 2026, MIRAI maintains a market capitalization of approximately $521,700, with a circulating supply of 1 billion tokens and a price hovering around $0.0005217. This digital asset, positioned at the intersection of artificial intelligence and decentralized virtual personas, is gradually carving out its niche in the Web3 ecosystem where digital beings function as autonomous entities with potential long-term value.

This article provides a comprehensive analysis of MIRAI's price trajectory from 2026 through 2031, combining historical patterns, market supply-demand dynamics, ecosystem development considerations, and broader macroeconomic factors to offer investors professional price forecasts and practical investment strategies.

I. MIRAI Price History Review and Market Status

MIRAI Historical Price Evolution Trajectory

- 2025: MIRAI launched in mid-May with a price peak, reaching $0.035301 on May 17, 2025, marking its all-time high shortly after debut

- 2025-2026: Market experienced significant correction, with price declining from the all-time high of $0.035301 to lower levels as the token entered broader circulation

- 2026: Continued downward pressure persisted, with the price reaching its all-time low of $0.0005041 on February 4, 2026, representing a substantial decline from peak levels

MIRAI Current Market Status

As of February 5, 2026, MIRAI is trading at $0.0005217, reflecting a challenging market environment across multiple timeframes. The token has experienced a 2.55% decline over the past hour and a 6.18% decrease in the last 24 hours. The 24-hour trading range spans from $0.0005041 to $0.0005725, indicating relatively tight price consolidation near historical lows.

Looking at broader timeframes, MIRAI has declined 30.32% over the past week and 43.51% over the past 30 days. The year-long perspective shows a 95.89% decrease from previous levels, highlighting significant market volatility since the token's initial price discovery phase.

The token maintains a market capitalization of approximately $521,700, with a fully diluted valuation matching this figure as all 1 billion tokens are currently in circulation. This represents a 100% circulating supply ratio. Trading volume stands at $16,335.16 over the past 24 hours, with MIRAI listed on 2 exchanges. The token operates on the Solana blockchain using the SPL standard and has attracted a community of 22,987 holders.

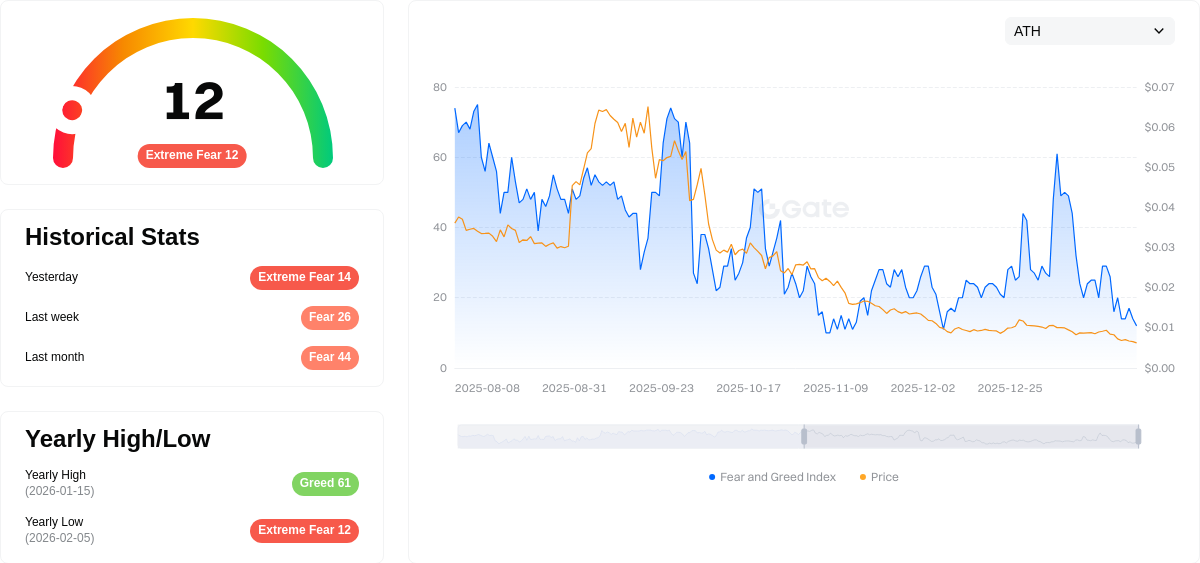

Market sentiment data indicates an Extreme Fear reading of 12 on the volatility index, suggesting cautious investor behavior in the current environment. MIRAI's market dominance remains minimal at 0.000020%, positioning it as a smaller market cap token within the broader cryptocurrency landscape, currently ranked at position 3003.

Click to view current MIRAI market price

MIRAI Market Sentiment Index

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of just 12. This indicates investors are highly anxious about market conditions and sentiment has reached critically low levels. Such extreme fear often presents opportunities for contrarian investors, as markets tend to recover from these sentiment extremes. However, caution is still advised as the underlying market dynamics may continue to deteriorate. Monitor key support levels and risk management strategies remain essential during this period of heightened uncertainty and pessimism.

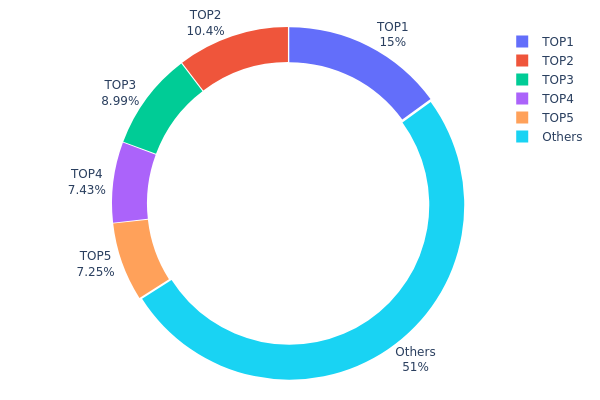

MIRAI Holdings Distribution

The holdings distribution chart provides a comprehensive view of token allocation across different wallet addresses, serving as a critical indicator of decentralization and market structure. By analyzing the concentration of tokens among top holders versus dispersed ownership, investors can assess potential risks related to price manipulation and evaluate the overall health of the token's ecosystem.

Based on the current data, MIRAI demonstrates a moderately concentrated holdings pattern. The top five addresses collectively control approximately 48.99% of the total supply, with the largest holder possessing 14.97% (149,756.07K tokens). The second and third largest addresses hold 10.35% and 8.99% respectively, while the remaining circulating supply is distributed among other market participants at 51.01%. This concentration level suggests a relatively balanced structure where major stakeholders maintain significant influence without achieving absolute dominance.

This distribution pattern presents a mixed risk-reward scenario for market participants. While the 51.01% holdings in dispersed addresses indicates reasonable decentralization and organic market participation, the combined 48.99% concentration in top five addresses creates potential volatility risks. Large holders could theoretically coordinate movements that significantly impact price action, particularly during low liquidity periods. However, this level of concentration is not uncommon for emerging tokens and may actually provide stability if these addresses represent project treasury, ecosystem funds, or long-term institutional investors rather than speculative traders.

Click to view current MIRAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | HLnpSz...aiTLcC | 149756.07K | 14.97% |

| 2 | A4kjVf...XVH32N | 103503.78K | 10.35% |

| 3 | HGduB8...NmMHLC | 89924.99K | 8.99% |

| 4 | Dk3AEW...BX9vSM | 74328.83K | 7.43% |

| 5 | 3GWWup...ywfE9n | 72500.29K | 7.25% |

| - | Others | 509972.78K | 51.01% |

II. Core Factors Influencing MIRAI's Future Price

Supply Mechanism

- Micro-cap Reflexivity: Small circulation supply and concentrated holder distribution can trigger explosive price volatility when liquidity and attention surge. However, this structure may also lead to severe price declines during exit phases.

- Historical Pattern: Limited token circulation has historically created high-risk, high-reward characteristics, attracting investors seeking alpha opportunities in volatile market conditions.

- Current Impact: The concentrated supply structure continues to influence price dynamics, with potential for significant movements driven by changes in market liquidity and investor sentiment.

Institutional and Major Holder Dynamics

- Holder Concentration: MIRAI demonstrates a concentrated ownership structure typical of micro-cap tokens, which can amplify both upward and downward price movements based on major holder activities.

- Market Attention: The token's performance is closely tied to shifts in market focus and liquidity conditions within the Web3 and blockchain technology sectors.

Macroeconomic Environment

- Technology Sector Trends: As hydrogen energy technology and blockchain applications continue to develop, these broader technological trends may indirectly influence investor sentiment toward innovation-focused tokens.

- Investment Risk Appetite: MIRAI's price trajectory is sensitive to changes in overall market risk appetite, particularly within the cryptocurrency and emerging technology investment landscape.

Technology Development and Ecosystem Building

- Web3 Technology Integration: MIRAI is positioned within the Web3 blockchain technology space, with its value proposition tied to developments in decentralized finance and blockchain applications.

- Blockchain Application Expansion: The token's ecosystem development is connected to broader trends in blockchain technology adoption and the evolution of decentralized applications.

- Innovation Cycle: As a project associated with emerging technology trends, MIRAI's price dynamics are influenced by the pace of innovation and adoption within the blockchain and Web3 sectors.

III. 2026-2031 MIRAI Price Prediction

2026 Outlook

- Conservative prediction: $0.00038 - $0.00052

- Neutral prediction: $0.00052 (average scenario)

- Optimistic prediction: $0.0007 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual growth phase with potential volatility, as the token seeks to establish stronger market positioning

- Price range prediction:

- 2027: $0.00055 - $0.00082

- 2028: $0.0004 - $0.00078

- 2029: $0.00045 - $0.00108

- Key catalysts: Market sentiment shifts, potential ecosystem developments, and broader crypto market trends may influence price movement during this period

2030-2031 Long-term Outlook

- Baseline scenario: $0.00058 - $0.0012 (assuming steady market development and sustained interest)

- Optimistic scenario: $0.00091 - $0.00122 (conditional on positive market conditions and increased utility)

- Transformative scenario: Potential to reach upper range of $0.00122 (requires exceptionally favorable market environment and widespread adoption)

- 2026-02-05: MIRAI trading within projected 2026 range (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0007 | 0.00052 | 0.00038 | 0 |

| 2027 | 0.00082 | 0.00061 | 0.00055 | 16 |

| 2028 | 0.00078 | 0.00071 | 0.0004 | 36 |

| 2029 | 0.00108 | 0.00075 | 0.00045 | 43 |

| 2030 | 0.0012 | 0.00091 | 0.00058 | 74 |

| 2031 | 0.00122 | 0.00106 | 0.00057 | 102 |

IV. MIRAI Professional Investment Strategy and Risk Management

MIRAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of AI-driven virtual identity projects and decentralized character creation within Web3 ecosystems

- Operational Recommendations:

- Consider accumulating positions during market corrections, given MIRAI's current trading near its all-time low of $0.0005041

- Monitor the project's development in meme culture integration and social platform expansion

- Storage Solution: Use Gate Web3 Wallet for secure storage of MIRAI tokens with multi-signature protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of $16,335.16 to identify potential breakout patterns

- Support/Resistance Levels: Track the 24-hour range between $0.0005041 (low) and $0.0005725 (high) for entry and exit points

- Swing Trading Key Points:

- Consider short-term volatility patterns, as MIRAI has shown -2.55% movement in 1 hour and -6.18% in 24 hours

- Set stop-loss orders below the recent low to manage downside risk

MIRAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 7-10% with active hedging strategies

(2) Risk Hedging Solutions

- Diversification Strategy: Balance MIRAI exposure with established cryptocurrencies and stablecoins

- Position Sizing: Given the -95.89% decline from all-time high, employ dollar-cost averaging to mitigate timing risk

(3) Secure Storage Solutions

- Recommended Wallet: Gate Web3 Wallet with support for Solana SPL tokens

- Multi-signature Setup: Configure 2-of-3 multi-signature protection for larger holdings

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly update security protocols

V. MIRAI Potential Risks and Challenges

MIRAI Market Risks

- High Volatility: MIRAI has experienced significant price fluctuations, with a -30.32% decline over 7 days and -43.51% over 30 days

- Low Market Cap: With a market capitalization of approximately $521,700 and ranking at #3003, MIRAI faces liquidity challenges

- Limited Exchange Availability: Currently listed on only 2 exchanges, which may impact trading accessibility and price stability

MIRAI Regulatory Risks

- Virtual Identity Classification: Evolving regulatory frameworks around AI-driven virtual characters may impact the project's operational model

- Web3 Compliance: Regulatory uncertainty in decentralized content creation and autonomous digital entities

- Token Classification: Potential regulatory scrutiny regarding token utility and securities law compliance

MIRAI Technical Risks

- Smart Contract Vulnerabilities: As a Solana SPL token, MIRAI inherits platform-specific technical risks

- Holder Concentration: With 22,987 holders for 1 billion total supply, distribution patterns may affect price stability

- Project Development: The success of AI-powered virtual human evolution depends on continued technological advancement and community engagement

VI. Conclusion and Action Recommendations

MIRAI Investment Value Assessment

MIRAI represents an experimental venture into decentralized character creation and AI-driven virtual identity within the Web3 ecosystem. While the project explores innovative territory combining meme culture with autonomous digital entities, investors should note the substantial decline from its all-time high of $0.035301 to the current price of $0.0005217. The token's 100% circulation rate provides transparency, but the limited exchange listings and market capitalization dominance of only 0.000020% indicate a highly speculative asset. Long-term value depends on the project's ability to establish sustainable utility for virtual humans as content creators and the broader adoption of community-driven IP in Web3 environments.

MIRAI Investment Recommendations

✅ Beginners: Approach with extreme caution. Allocate no more than 1% of crypto portfolio and only invest funds you can afford to lose completely. Focus on education about AI and Web3 before investing.

✅ Experienced Investors: Consider MIRAI as a high-risk speculative position within a diversified portfolio. Monitor project development milestones and community growth. Implement strict stop-loss protocols.

✅ Institutional Investors: Evaluate MIRAI within the context of emerging AI and virtual identity sector trends. Due diligence should include assessment of team credentials, technological roadmap, and competitive positioning in decentralized character creation.

MIRAI Trading Participation Methods

- Spot Trading: Purchase MIRAI directly through Gate.com with available trading pairs

- Dollar-Cost Averaging: Implement systematic investment plans to mitigate volatility risk

- Secure Storage: Transfer tokens to Gate Web3 Wallet for long-term holding with enhanced security features

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MIRAI? What are its main uses and application scenarios?

MIRAI is a hydrogen fuel cell vehicle designed to reduce carbon emissions and promote clean energy transportation. Its main applications include urban and long-distance transport, offering zero-emission mobility solutions for sustainable future transportation.

What is MIRAI's historical price trend? How has it performed over the past year?

MIRAI demonstrated a 23.5% price change over the past year. Its 52-week range fluctuated between 40,000.0 and 51,300.0, reflecting moderate volatility in the market. As of February 2026, the token continues to show steady activity in trading volumes.

What is the MIRAI price prediction for 2024-2025? What do experts think?

MIRAI price predictions for 2024-2025 lack specific expert consensus data. Market analysts project modest growth potential, though exact forecasts remain limited. Current market conditions and adoption trends will significantly influence future price movements.

What are the main factors affecting MIRAI price?

MIRAI price is primarily influenced by market demand, technological developments, investor sentiment, Web3 ecosystem growth, trading volume, competition, and overall crypto market conditions.

What are MIRAI's advantages and risks compared to similar cryptocurrencies?

MIRAI offers strong AI narrative potential with high growth prospects in emerging markets. Advantages include unique tokenomics and community-driven development. Risks include small market cap volatility and market liquidity challenges. Investors should monitor on-chain metrics closely for optimal timing.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

What is Jupiter Coin: Investment Analysis and Future Outlook

The 10 Best Play-to-Earn NFT Games for Earning Rewards

7 Ideas for Beginners To Create Digital Art

Squid Game – The Most Shocking Rug Pull in History. What Exactly Is a Rug Pull?

The link between Elon Musk's "America Party" and the world of cryptocurrencies