2026 MIRAI Price Prediction: Expert Analysis and Market Forecast for the Next Generation Blockchain Platform

Introduction: MIRAI's Market Position and Investment Value

MIRAI, as a pioneering project in decentralized character creation and AI-powered virtual identity, has been exploring how digital beings can evolve through meme culture, social platforms, and community-driven IP development since its launch in 2025. As of February 2026, MIRAI maintains a market capitalization of approximately $531,300 with a circulating supply of 1 billion tokens, trading at around $0.0005313. This asset, representing a new frontier in virtual identity within Web3 ecosystems, is playing an increasingly important role in the convergence of artificial intelligence and decentralized content creation.

This article will comprehensively analyze MIRAI's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. MIRAI Price History Review and Current Market Status

MIRAI Historical Price Evolution Trajectory

- 2025: Token deployment on Solana blockchain in mid-January, followed by initial trading activity

- May 2025: Price reached peak level of $0.035301 on May 17, representing the highest trading price recorded

- 2026: Price declined significantly from historical peak, dropping to $0.0005041 on February 4

MIRAI Current Market Dynamics

As of February 5, 2026, MIRAI is trading at $0.0005313, reflecting a 24-hour decline of 5.64% and a weekly decrease of 27.62%. The token has experienced a 30-day decline of 41.14% and a one-year decline of 95.81% from its previous levels.

The current 24-hour trading volume stands at $16,118.06, with the token's market capitalization at $531,300. MIRAI has a circulating supply of 1,000,000,000 tokens, representing 100% of its total supply. The market capitalization to fully diluted valuation ratio stands at 100%, indicating complete token circulation.

The 24-hour price range has fluctuated between $0.0005041 and $0.0005725. Market dominance remains at 0.000020%, with the token being listed on 2 exchanges and held by approximately 22,987 addresses. The token operates on the Solana blockchain using the SPL standard, with its contract address at 5evN2exivZXJfLaA1KhHfiJKWfwH8znqyH36w1SFz89Y.

Click to view current MIRAI market price

MIRAI Market Sentiment Index

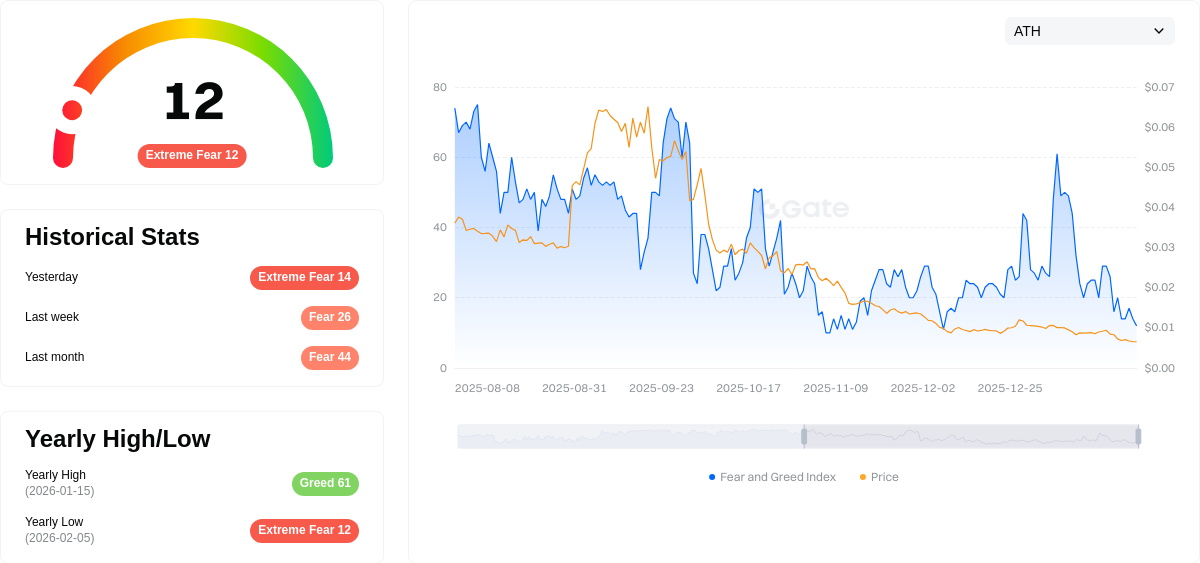

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 12. This indicates severe market pessimism and risk aversion among investors. During such periods, assets are typically undervalued as panic selling dominates. Experienced traders often view extreme fear as a contrarian buying opportunity, as historically, markets tend to recover from such lows. However, caution remains essential—fundamental analysis should guide investment decisions rather than emotional responses alone. Monitor market developments closely before making any trades.

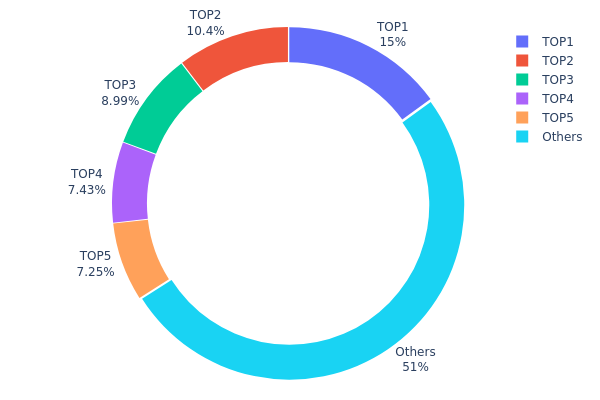

MIRAI Holdings Distribution

The holdings distribution chart provides a comprehensive view of token concentration across different wallet addresses, serving as a critical indicator of decentralization and market structure stability. By analyzing the proportion of tokens held by top addresses versus the broader holder base, investors can assess potential risks related to concentrated selling pressure and market manipulation vulnerabilities.

Current data reveals a moderately concentrated distribution pattern for MIRAI. The top five addresses collectively control approximately 49% of the total supply, with the largest single holder possessing 14.97% (149,756.07K tokens). Notably, the second and third largest addresses hold 10.35% and 8.99% respectively, while the remaining holder base ("Others") accounts for 51.01% of circulation. This distribution suggests a relatively balanced structure compared to highly concentrated projects where top holders might control 70-80% of supply.

From a market stability perspective, this distribution pattern presents both opportunities and considerations. The 51% held by smaller addresses indicates decent retail participation and a foundation for organic price discovery. However, the combined 49% concentration among top five addresses means coordinated large-scale movements could significantly impact market liquidity and price action. The relatively even distribution among top holders—rather than a single dominant whale—provides some risk mitigation, as no individual entity has unilateral market control. This structure suggests MIRAI maintains adequate decentralization for healthy market dynamics while remaining susceptible to notable volatility from large holder activity.

Click to view current MIRAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | HLnpSz...aiTLcC | 149756.07K | 14.97% |

| 2 | A4kjVf...XVH32N | 103503.78K | 10.35% |

| 3 | HGduB8...NmMHLC | 89924.99K | 8.99% |

| 4 | Dk3AEW...BX9vSM | 74328.83K | 7.43% |

| 5 | 3GWWup...ywfE9n | 72500.29K | 7.25% |

| - | Others | 509972.78K | 51.01% |

II. Core Factors Influencing MIRAI's Future Price

Market Demand and Investor Sentiment

- Market Demand Dynamics: MIRAI's price performance is closely tied to market demand fluctuations and investor confidence levels. The token's positioning within the Web3 ecosystem plays a significant role in attracting user attention and capital inflows.

- Historical Patterns: Historical trends and market observations provide valuable insights for understanding potential future price movements. Small circulation volumes and concentrated holder distribution can trigger substantial price volatility when liquidity and attention surge.

- Current Impact: The reflexive nature of micro-cap market capitalization means that during periods of increased attention, explosive price movements may occur, though similar structural factors can also lead to sharp corrections during exit phases.

Competitive Landscape

- XTZ Comparison: The performance of competitors such as XTZ represents a key benchmark for evaluating MIRAI's market position. Comparative analysis of pricing history and current market conditions helps investors understand MIRAI's relative value proposition.

- Market Positioning: MIRAI's role in the evolving Web3 space continues to develop, with its competitive advantages and challenges becoming more apparent through direct comparison with established blockchain platforms.

Technology Development and Ecosystem Building

- Web3 Integration: MIRAI's revolutionary Web3 blockchain technology applications span decentralized finance, omnichain smart wallets, and real-world asset tokenization. These technological capabilities enhance user experience and expand potential use cases.

- Ecosystem Applications: The platform's focus on strengthening user engagement through various Web3 applications contributes to its long-term growth potential. Technical development progress and ecosystem expansion remain critical factors for price trajectory.

- Innovation Focus: Ongoing technological evolution within MIRAI's framework positions it as an emerging player in the blockchain technology landscape, with growth factors tied to successful implementation of its technological roadmap.

III. 2026-2031 MIRAI Price Forecast

2026 Outlook

- Conservative forecast: $0.0003

- Neutral forecast: $0.00053

- Optimistic forecast: $0.00062 (subject to favorable market conditions)

2027-2029 Outlook

- Market stage expectation: The token may enter a gradual growth phase, with price movements potentially influenced by broader cryptocurrency market trends and project development milestones.

- Price range forecast:

- 2027: $0.00053 - $0.00075

- 2028: $0.00063 - $0.00098

- 2029: $0.00076 - $0.00117

- Key catalysts: Sustained project development, community expansion, and potential integration with additional blockchain ecosystems could serve as primary drivers for price appreciation.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00058 - $0.00109 (assuming steady market conditions and continued project execution)

- Optimistic scenario: $0.001 - $0.0015 (contingent upon significant adoption growth and favorable regulatory developments)

- Transformative scenario: $0.0015+ (requires exceptional market conditions, major partnerships, or breakthrough technological implementations)

- February 5, 2026: MIRAI trading at early-stage price levels as the token establishes its market position

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00062 | 0.00053 | 0.0003 | 0 |

| 2027 | 0.00075 | 0.00057 | 0.00053 | 7 |

| 2028 | 0.00098 | 0.00066 | 0.00063 | 24 |

| 2029 | 0.00117 | 0.00082 | 0.00076 | 54 |

| 2030 | 0.00109 | 0.001 | 0.00058 | 87 |

| 2031 | 0.0015 | 0.00104 | 0.00065 | 96 |

IV. MIRAI Professional Investment Strategy and Risk Management

MIRAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to AI-driven virtual identity and Web3 ecosystem innovation

- Operational recommendations:

- Consider dollar-cost averaging to mitigate volatility given the significant price fluctuations observed

- Monitor community-driven developments and platform integrations that may enhance long-term value

- Utilize secure storage solutions such as Gate Web3 Wallet for asset protection

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages: Track short-term trends given the observed -5.64% 24-hour and -27.62% 7-day price movements

- Volume indicators: Monitor the $16,118 daily trading volume for liquidity assessment

- Swing trading considerations:

- Establish clear entry and exit points considering the 24-hour range between $0.0005041 and $0.0005725

- Set stop-loss orders to manage downside risk in this highly volatile asset

MIRAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio allocation

- Moderate investors: 3-5% of crypto portfolio allocation

- Experienced investors: Up to 10% of crypto portfolio allocation, with active monitoring

(2) Risk Hedging Approaches

- Portfolio diversification: Balance MIRAI exposure with established cryptocurrencies and stablecoins

- Position sizing: Limit individual trade size to minimize impact from sudden price movements

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for active trading and easy access

- Cold storage consideration: Hardware wallet solutions for long-term holdings exceeding your active trading allocation

- Security precautions: Enable two-factor authentication, verify contract addresses (5evN2exivZXJfLaA1KhHfiJKWfwH8znqyH36w1SFz89Y on Solana), and never share private keys

V. MIRAI Potential Risks and Challenges

MIRAI Market Risks

- High volatility: The token has experienced a -95.81% decline over one year, indicating substantial price instability

- Limited liquidity: With approximately $16,118 in 24-hour trading volume and only 2 exchanges listing the asset, liquidity constraints may impact execution

- Market cap concentration: A relatively small market cap of $531,300 suggests susceptibility to large holder movements

MIRAI Regulatory Risks

- Virtual asset classification: Evolving regulations around AI-driven digital entities and virtual identities may impact project operations

- Cross-border compliance: As a decentralized character creation platform, regulatory interpretation may vary across jurisdictions

- Platform accountability: Potential regulatory scrutiny regarding autonomous AI entities in financial contexts

MIRAI Technical Risks

- Smart contract dependency: Built on Solana blockchain, subject to network-specific risks and potential vulnerabilities

- Project maturity: Recent launch (January 2025) indicates limited operational history and unproven long-term viability

- Community reliance: Success depends heavily on sustained community engagement and meme culture adoption

VI. Conclusion and Action Recommendations

MIRAI Investment Value Assessment

MIRAI represents an experimental approach to decentralized character creation within the Web3 ecosystem, exploring the intersection of AI-powered virtual humans and community-driven intellectual property. While the project offers exposure to emerging trends in virtual identity and digital autonomous entities, investors should note the significant price volatility, with a -95.81% decline from its historical peak. The limited trading volume and early-stage development suggest this remains a highly speculative opportunity suitable primarily for risk-tolerant participants interested in frontier Web3 innovations.

MIRAI Investment Recommendations

✅ Beginners: Consider observing the project's development and community growth before allocating capital; if participating, limit exposure to less than 1% of your total investment portfolio ✅ Experienced investors: May allocate 2-5% for speculative positioning, employing strict risk management and stop-loss orders given the documented volatility ✅ Institutional investors: Conduct thorough due diligence on the project's technical infrastructure, team credentials, and competitive positioning before considering exposure

MIRAI Trading Participation Methods

- Spot trading: Available on Gate.com and one other exchange, allowing direct purchase with established cryptocurrencies

- Wallet integration: Store MIRAI tokens in Gate Web3 Wallet or compatible Solana wallets for secure custody

- Community engagement: Monitor project developments through the official Twitter channel and community platforms to stay informed about updates

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MIRAI? What are its main uses and characteristics?

MIRAI is a hydrogen fuel cell vehicle designed for zero-emission transportation. Its main features include high efficiency, environmental sustainability, and advanced fuel cell technology that converts hydrogen into clean energy.

How to predict MIRAI's price? What analysis methods are available?

Predict MIRAI's price using qualitative and quantitative analysis. Qualitative analysis relies on market trends and expert judgment. Quantitative analysis uses statistical models, historical data, trading volume, and on-chain metrics to forecast price movements.

What is MIRAI's historical price performance and what are the main factors affecting price fluctuations?

MIRAI's price is primarily driven by market demand, project development progress, community sentiment, and broader crypto market conditions. Historical performance shows volatility typical of emerging digital assets, influenced by adoption milestones and ecosystem growth.

What are MIRAI's future prospects? What do experts think about price predictions for it?

MIRAI shows promising potential in the Web3 ecosystem. Experts project moderate growth trajectory with increasing adoption driving value appreciation. Market analysts anticipate upward momentum as the project expands its community and utility. Long-term forecasts suggest competitive positioning within the crypto market landscape.

What are the risks of investing in MIRAI? How should I evaluate investment returns and risks?

MIRAI offers high-risk, high-reward opportunities. Evaluate by analyzing project fundamentals, market volatility, and your risk tolerance. Focus on technical background and market prospects while avoiding overinvestment.

What are MIRAI's advantages or disadvantages compared to similar projects?

MIRAI excels with advanced tokenomics, strong community governance, and innovative yield mechanisms. Compared to peers, it offers superior transaction efficiency and lower fees, though it faces competition from established projects with larger ecosystems and user bases.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

LIY vs RUNE: A Comprehensive Comparison of Two Emerging Blockchain Tokens in the Crypto Market

Comprehensive Guide to Token Generation Events

What Are the Differences Between Web2 and Web3? Analyzing Future Trends in Web3

What is Grayscale, the cryptocurrency asset management firm?

A Comprehensive Guide to Decentralized Exchanges (DEXs): Leading Platforms and Selection Criteria