2026 MIRROR Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Introduction: MIRROR's Market Position and Investment Value

Black Mirror (MIRROR), as the official token bridging entertainment IP and Web3 interactive experiences, has been gaining attention since its launch in 2025. As of February 2026, MIRROR maintains a market capitalization of approximately $245,625, with a circulating supply of around 187.79 million tokens, and a current price hovering near $0.001308. This asset, positioned as a "dystopian experience enabler," is playing an increasingly notable role in merging blockchain-based reputation systems, creator tools, and tokenized rewards within the Black Mirror ecosystem.

This article will comprehensively analyze MIRROR's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. MIRROR Price History Review and Market Status

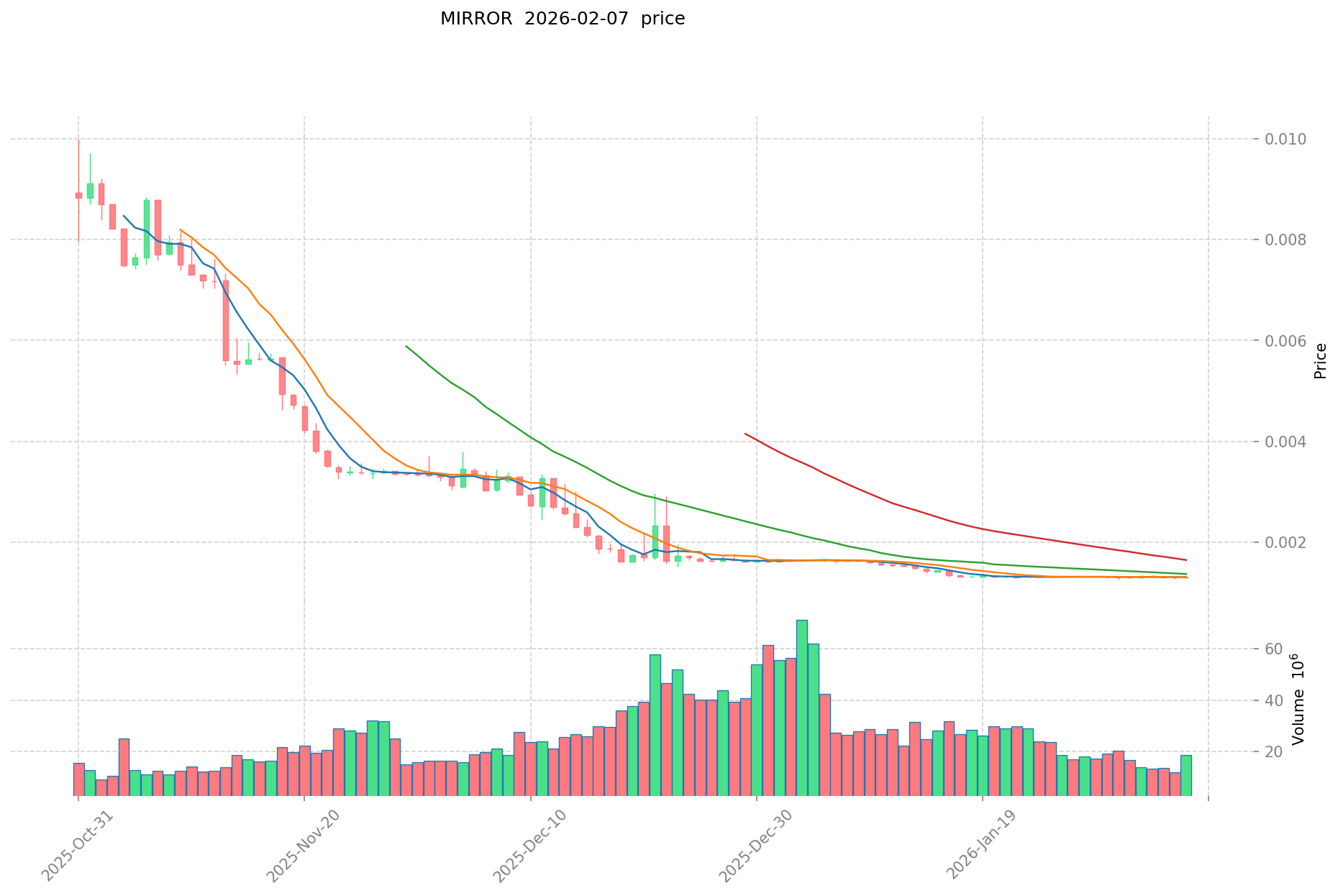

MIRROR Historical Price Evolution Trajectory

- September 2025: MIRROR reached its all-time high of $0.08582, marking a significant milestone in the token's early trading history

- January 2026: The token experienced substantial volatility, dropping to its all-time low of $0.001262, representing a decline of approximately 98.5% from its peak

- February 2026: Following the sharp correction, MIRROR showed signs of stabilization with modest recovery, trading around the $0.001308 level

MIRROR Current Market Situation

As of February 8, 2026, MIRROR is trading at $0.001308, positioned at number 3716 in the cryptocurrency market rankings. The token demonstrates limited short-term volatility, with a 24-hour price movement of -0.3% and a 1-hour change of -0.22%. Over the past week, MIRROR has shown slight resilience with a 0.08% increase, though the 30-day performance reveals a more pronounced decline of -20.44%.

The token's market capitalization stands at approximately $245,625, with a 24-hour trading volume of $28,048. With a circulating supply of 187.79 million tokens representing 9.6% of the total supply, MIRROR maintains a fully diluted market cap of $1,308,000. The token has attracted a community of 17,090 holders and is currently available on 4 exchanges.

MIRROR's market dominance remains minimal at 0.000052%, reflecting its position as an emerging entertainment-focused token within the broader cryptocurrency ecosystem. The significant gap between the current price and the all-time high indicates substantial room for potential recovery, though recent price action suggests the token is still finding its equilibrium in the market.

Click to view current MIRROR market price

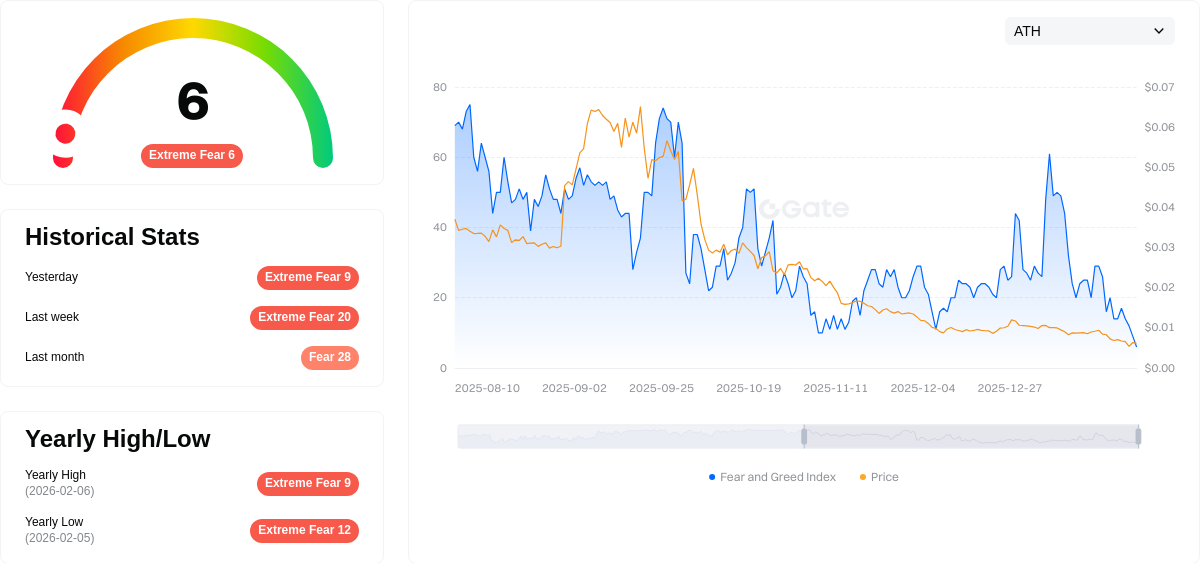

MIRROR Market Sentiment Indicator

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index hitting a critically low level of 6. This indicates severe panic among investors and heightened market pessimism. During such periods, long-term investors often view extreme fear as a potential buying opportunity, as asset prices may be significantly undervalued. However, traders should exercise caution and conduct thorough research before making investment decisions. Market conditions at extreme fear levels typically suggest increased volatility and risk, requiring careful risk management strategies.

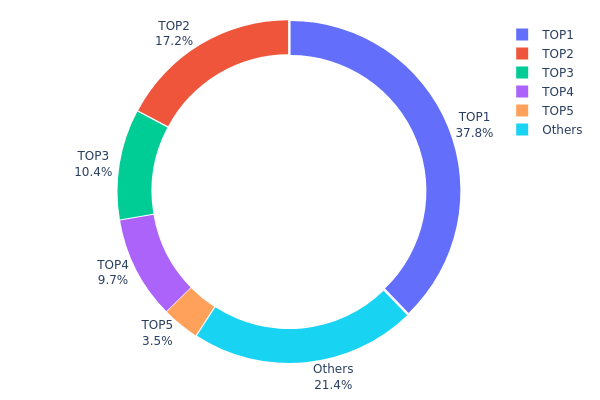

MIRROR Holding Distribution

The holding distribution chart reveals the concentration of token ownership across different wallet addresses, serving as a critical indicator of decentralization and market structure health. By examining the percentage of total supply held by top addresses versus smaller holders, analysts can assess potential risks related to market manipulation, liquidity depth, and the overall democratization of token ownership within the ecosystem.

Current data indicates a notably high concentration pattern in MIRROR's holding structure. The top address controls 377.66 million tokens, representing 37.76% of the total supply, while the top five addresses collectively hold 78.6% of all circulating tokens. This pronounced centralization suggests that a relatively small number of entities maintain substantial influence over the token's market dynamics. The "Others" category, comprising all remaining addresses, accounts for only 21.4% of the supply, highlighting an imbalanced distribution that deviates significantly from ideal decentralization standards observed in mature crypto projects.

This concentration level presents several implications for MIRROR's market behavior. The dominance of top holders creates inherent vulnerability to large-scale selling pressure, as any significant movement by major addresses could trigger substantial price volatility. Additionally, such centralization raises concerns about potential coordinated market influence, where top holders might collectively affect price discovery mechanisms. From a structural perspective, this distribution pattern suggests MIRROR remains in an early developmental phase regarding token dispersion, with limited retail participation compared to institutional or early investor holdings. While concentrated holdings can sometimes indicate strong conviction from strategic investors, it simultaneously reduces the token's resilience against single-point liquidity events and may deter broader community participation due to perceived governance centralization.

Click to view current MIRROR Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcf0b...c806da | 377658.04K | 37.76% |

| 2 | 0xe261...82431d | 172309.86K | 17.23% |

| 3 | 0xb82d...93f751 | 104289.84K | 10.42% |

| 4 | 0xab2b...8a838b | 96999.89K | 9.69% |

| 5 | 0x19c4...095f84 | 35000.00K | 3.50% |

| - | Others | 213742.38K | 21.4% |

II. Core Factors Influencing MIRROR's Future Price

Supply Mechanism

- Token Distribution and Circulation: MIRROR operates within a Web3 content creation protocol where token supply dynamics directly impact market valuation. The protocol's token distribution strategy influences circulating supply and potential price pressure.

- Historical Patterns: Historical data shows MIRROR experienced significant price volatility, with a low of $0.003265 recorded on November 23, reflecting how supply-side factors and overall market conditions can create downward pressure during unfavorable periods.

- Current Impact: The current supply structure and token unlock schedules remain critical variables. Any changes in circulating supply through staking mechanisms, burn events, or emission rates could substantially affect price trajectories.

Institutional and Major Holder Dynamics

- Institutional Positioning: While specific institutional holdings data is limited in available materials, MIRROR's position within the Web3 content creation ecosystem suggests potential institutional interest from entities focused on decentralized media and creator economy infrastructure.

- Enterprise Adoption: MIRROR serves as a revolutionary protocol reshaping Web3 content creation, positioning itself as infrastructure for the creator economy. Adoption by content platforms, media organizations, and creator-focused applications could drive fundamental value.

- Regulatory Landscape: As a Web3 protocol token, MIRROR operates in an evolving regulatory environment. Clearer frameworks for digital assets and content tokenization could reduce uncertainty and support price stability.

Macroeconomic Environment

- Monetary Policy Impact: Global monetary policy shifts, particularly from major central banks, influence risk appetite for digital assets. Accommodative policies typically support crypto valuations, while tightening cycles create headwinds.

- Inflation Hedge Characteristics: Digital assets like MIRROR may exhibit limited direct correlation with traditional inflation hedges. However, the protocol's utility in content monetization could provide indirect value preservation through creator economy growth.

- Geopolitical Factors: International developments affecting digital infrastructure, content regulation, and cross-border digital transactions can impact Web3 protocols. Market stability depends partly on the global regulatory environment for decentralized applications.

Technology Development and Ecosystem Building

- Protocol Infrastructure Enhancement: MIRROR's ongoing development as a content creation protocol directly influences its value proposition. Technical improvements in content storage, rights management, and creator monetization tools strengthen the ecosystem.

- Web3 Content Creation Integration: The protocol's integration with broader Web3 entertainment and media infrastructure creates network effects. Enhanced interoperability with other decentralized platforms could drive adoption and utility.

- Ecosystem Applications: MIRROR's success depends on the growth of applications built on its protocol. The expansion of decentralized publishing platforms, NFT marketplaces for content, and creator monetization tools utilizing MIRROR infrastructure represents key growth drivers. The protocol's positioning within the evolving Black Mirror-inspired Web3 entertainment space suggests potential for innovative use cases that could differentiate it from competing content platforms.

III. 2026-2031 MIRROR Price Forecast

2026 Outlook

- Conservative estimate: $0.00077 - $0.00131

- Neutral estimate: $0.00131 average trading range

- Optimistic estimate: up to $0.00186 (requires favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market stage expectation: potential gradual recovery phase with moderate volatility as the project continues to develop its ecosystem and expand user base

- Price range forecast:

- 2027: $0.00085 - $0.00231, representing approximately 21% growth from 2026 baseline

- 2028: $0.00113 - $0.0021, with potential 48% increase reflecting broader market momentum

- 2029: $0.00128 - $0.00247, possibly reaching 54% growth as ecosystem maturity advances

- Key catalysts: technological upgrades, partnership expansions, broader cryptocurrency market trends, and enhanced platform utility

2030-2031 Long-term Outlook

- Baseline scenario: $0.00119 - $0.00225 in 2030 (assuming steady ecosystem development and moderate market conditions)

- Optimistic scenario: $0.00244 - $0.0035 by 2031 (contingent upon successful protocol enhancements and increased market penetration)

- Transformative scenario: approaching upper bounds of $0.0035 (requires exceptional adoption rates, significant partnerships, and favorable regulatory environment)

- February 8, 2026: MIRROR trading within initial forecast range as the market enters a new evaluation phase

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00186 | 0.00131 | 0.00077 | 0 |

| 2027 | 0.00231 | 0.00158 | 0.00085 | 21 |

| 2028 | 0.0021 | 0.00195 | 0.00113 | 48 |

| 2029 | 0.00247 | 0.00202 | 0.00128 | 54 |

| 2030 | 0.0029 | 0.00225 | 0.00119 | 71 |

| 2031 | 0.0035 | 0.00257 | 0.00244 | 96 |

IV. MIRROR Professional Investment Strategy & Risk Management

MIRROR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors interested in entertainment IP integration with Web3 technology and willing to hold through market cycles

- Operational recommendations:

- Consider dollar-cost averaging to build positions gradually given the project's early stage

- Monitor ecosystem development milestones including app launches, RWA tokenization progress, and community growth metrics

- Utilize Gate Web3 Wallet for secure self-custody with support for BASE network tokens

(2) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: With 24-hour trading volume around $28,048, monitor volume spikes during ecosystem announcements

- Support/resistance levels: Current trading range shows support near $0.001262 (historical low) and resistance approaching previous levels

- Swing trading considerations:

- Track 7-day price movements which have shown slight positive momentum (+0.08%)

- Be aware of the 30-day decline (-20.44%) indicating recent downward pressure

MIRROR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio allocation

- Aggressive investors: 3-5% of crypto portfolio allocation

- Professional investors: Up to 5-7% with active monitoring and rebalancing

(2) Risk Hedging Approaches

- Portfolio diversification: Balance MIRROR holdings with established cryptocurrencies and stablecoins

- Position sizing discipline: Limit exposure considering the token's market cap of approximately $245,625 and ranking at #3716

(3) Secure Storage Solutions

- Non-custodial wallet recommendation: Gate Web3 Wallet with BASE network support for self-custody

- Multi-signature setup: Consider for larger holdings to enhance security

- Security precautions: Never share private keys, enable two-factor authentication, and verify contract address (0xe1bfa25468af64e366ddafc9d91bcc6c97439a14 on BASE) before transactions

V. MIRROR Potential Risks & Challenges

MIRROR Market Risks

- Low liquidity: With approximately $28,000 in 24-hour volume, larger trades may face slippage challenges

- High volatility: Recent 30-day decline of 20.44% demonstrates significant price fluctuations

- Limited market depth: Ranking at #3716 with market share of 0.000052% indicates nascent market presence

MIRROR Regulatory Risks

- Entertainment IP tokenization: Evolving regulatory frameworks around intellectual property rights and tokenization may impact operations

- RWA compliance: Real-world asset tokenization faces varying jurisdictional requirements that could affect project scope

- Securities classification: Potential regulatory scrutiny regarding token classification depending on utility versus investment characteristics

MIRROR Technical Risks

- Smart contract vulnerability: BASE-deployed contracts require ongoing security audits and monitoring

- Network dependency: Reliance on BASE network infrastructure for transaction processing and smart contract execution

- Ecosystem development risk: Project success depends on execution of interactive apps, social features, and creator tools as outlined in roadmap

VI. Conclusion & Action Recommendations

MIRROR Investment Value Assessment

MIRROR represents an experimental convergence of entertainment IP and Web3 technology, targeting fans of the Black Mirror franchise with blockchain-based engagement mechanisms. The project's long-term value proposition centers on creating immersive experiences through reputation scoring, creator tools, and RWA tokenization. However, current metrics including low market capitalization ($245,625), limited trading volume, and recent price decline (-20.44% over 30 days) suggest significant near-term uncertainty. The circulating supply represents only 9.6% of total supply, indicating potential future dilution considerations.

MIRROR Investment Recommendations

✅ Beginners: Limit allocation to experimental funds only (under 1% of total portfolio), thoroughly research the project ecosystem, and start with small test transactions to understand token mechanics

✅ Experienced investors: Consider small speculative positions (2-3% of crypto portfolio) with strict stop-loss protocols, monitor ecosystem development announcements, and track holder growth from current 17,090 addresses

✅ Institutional investors: Conduct comprehensive due diligence on IP licensing agreements, evaluate RWA tokenization framework, assess team credentials and execution capability before considering any allocation

MIRROR Trading Participation Methods

- Spot trading: Available on Gate.com and 3 other exchanges with current price around $0.001308

- Self-custody storage: Use Gate Web3 Wallet with BASE network support for direct control of holdings

- Community engagement: Participate through official channels (blackmirrorclub.com, Twitter @blackmirror_xp) to stay informed on ecosystem developments

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MIRROR token and what is its purpose?

MIRROR token grants access to exclusive Black Mirror content, enables task participation and NFT minting. Holders can vote on platform governance proposals and influence future development through staking rewards.

MIRROR price today will rise to how much this year?

Based on current market analysis, MIRROR is expected to appreciate approximately 5% this year, potentially reaching around $0.005. However, crypto markets remain highly volatile and influenced by multiple factors.

What are the main factors affecting MIRROR price?

MIRROR price is primarily influenced by leverage levels, margin requirements, market volatility, and trading volume. High market volatility increases liquidation frequency and price fluctuations. Supply and demand dynamics also play a crucial role in price movement.

What is the difference between MIRROR and other synthetic asset platform tokens?

MIRROR distinguishes itself through its over-collateralization mechanism and open protocol design. Unlike competitors, MIRROR supports diverse collateral types and offers superior capital efficiency, enabling users to mint synthetic assets with greater flexibility and lower barriers to entry in the synthetic asset ecosystem.

How to analyze MIRROR's technical and fundamental aspects?

MIRROR technical analysis focuses on price patterns and trading signals for short-term opportunities. Fundamental analysis examines project utility, ecosystem development, and long-term value drivers. Combine both approaches: use technicals for entry timing, fundamentals for conviction on holding through market cycles.

What are MIRROR's future prospects and risks?

MIRROR shows strong growth potential driven by rising DeFi adoption and synthetic asset demand. Key risks include market volatility, regulatory uncertainty, and liquidity fluctuations. Success depends on ecosystem expansion and user adoption.

How to buy and hold MIRROR tokens?

Register on a crypto exchange, complete identity verification, and purchase MIRROR using bank transfer or credit card. Transfer tokens to a secure personal wallet for safe storage and long-term holding.

Treasure NFT Marketplace: A 2025 Guide for Web3 Gamers and Investors

What are the new trends in the NFT market in 2025?

NFT Treasure Hunting: Top Strategies for Web3 Collectors in 2025

How to Create and Sell NFTs: A Step-by-Step Guide for Beginners

The technical principles and application scenarios of 2025 NFTs

How to Create an NFT in 2025: A Step-by-Step Guide

Pepe: A Comprehensive Guide to What It Is and How It Works

The 7 Hottest Blockchain Stocks to Watch in the Coming Years

What is the Relative Strength Index? Application in Crypto Trading

Top Cryptocurrency Exchanges for Polish Traders

Master Japanese candlestick analysis like a professional and explore the most well-known patterns with real-world examples