2026 MMPRO Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: MMPRO's Market Position and Investment Value

Market Making Pro (MMPRO), positioned as a B2B SaaS one-stop solution for market making in cryptocurrency CEX and DEX exchanges, also functions as a liquidity mining platform and launchpad where users can obtain additional income through NFT system. As of February 2026, MMPRO maintains a market capitalization of approximately $285,726, with a circulating supply of about 92.08 million tokens, and the price hovering around $0.003103. This asset, designed to facilitate market making operations across multiple exchange platforms, is playing an increasingly relevant role in providing liquidity solutions and yield opportunities for users in the cryptocurrency ecosystem.

This article will comprehensively analyze MMPRO's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. MMPRO Price History Review and Market Status

MMPRO Historical Price Evolution Trajectory

- 2022: MMPRO reached a peak price of $0.824202 on April 10, marking a significant milestone in its early trading history.

- 2025: The token experienced substantial downward pressure, declining to an all-time low of $0.00247369 on December 25, representing a considerable correction from previous levels.

- 2026: Throughout the past year, MMPRO has demonstrated a declining trend, with the price decreasing by approximately 58.96% from its position twelve months prior.

MMPRO Current Market Situation

As of February 7, 2026, MMPRO is trading at $0.003103, with a 24-hour trading volume of approximately $20,991.86. The token has shown minimal short-term volatility, with a slight decrease of 0.12% over the past 24 hours and 0.13% over the past hour. The 24-hour price range has remained relatively stable between $0.003093 and $0.003107.

Over the past week, MMPRO has experienced a modest decline of 0.77%, while the 30-day performance indicates a more pronounced decrease of 10.5%. The current circulating supply stands at 92,080,754.83 tokens, representing approximately 92.08% of the maximum supply of 100,000,000 tokens. The market capitalization is approximately $285,726.58, with a fully diluted valuation of $310,300.

The token maintains a presence on the BSC (BNB Smart Chain) with the contract address 0x6067490d05f3cf2fdffc0e353b1f5fd6e5ccdf70, and has approximately 11,607 holders. Market sentiment indicators suggest a fear-dominated environment, with a volatility index reading of 6, classified as "Extreme Fear."

Click to view current MMPRO market price

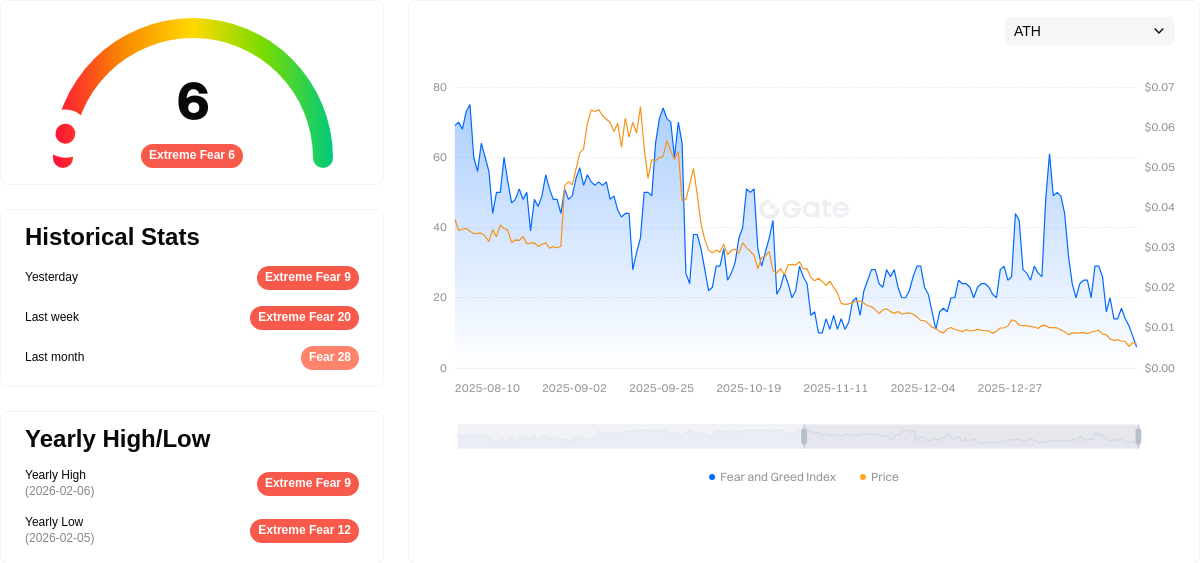

MMPRO Market Sentiment Index

February 07, 2026 Fear and Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of just 6. This exceptionally low reading indicates strong bearish sentiment across the market, with investors showing heightened anxiety and risk aversion. Such extreme fear conditions often create opportunities for contrarian traders, as markets typically recover when sentiment reaches these levels. Monitor market developments closely during this period, as extreme fear can signal either capitulation or potential bottom formation. Risk management remains crucial when navigating such volatile market conditions.

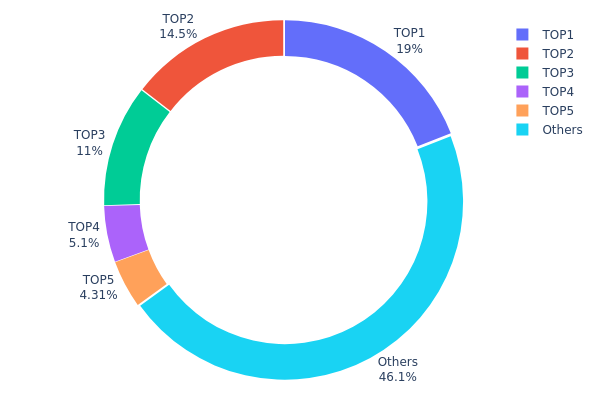

MMPRO Holding Distribution

The holding distribution chart reveals the allocation of MMPRO tokens across different wallet addresses, serving as a crucial indicator of token centralization and decentralization dynamics within the ecosystem. This metric provides valuable insights into market structure, potential price volatility, and the overall health of token distribution among holders.

Based on the current data, MMPRO exhibits a moderately concentrated holding pattern. The top address controls 19.02% of the total supply with 19.02 million tokens, while the second-largest holder possesses 14.50%. Notably, the burn address (0x0000...00dead) contains 11.01% of tokens, representing permanently removed supply. The top five addresses collectively account for approximately 53.93% of the circulating supply, indicating a significant concentration among major stakeholders. The remaining 46.07% is distributed among other holders, suggesting a reasonably diverse base of smaller participants.

This concentration level presents both opportunities and risks for market dynamics. The substantial holdings by top addresses could lead to increased price volatility if these major holders decide to execute large-scale transactions. However, the presence of 11.01% in the burn address demonstrates a deflationary mechanism that may positively impact long-term tokenomics. The current distribution structure suggests moderate centralization risk, though not at extreme levels that would typically raise immediate concerns about market manipulation. The 46.07% held by "Others" indicates sufficient distribution to maintain basic market liquidity and trading activity, while the concentration in top addresses may provide stability through long-term holder commitment.

Click to view current MMPRO Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x82ff...92889c | 19023.41K | 19.02% |

| 2 | 0x0c89...518820 | 14500.00K | 14.50% |

| 3 | 0x0000...00dead | 11010.55K | 11.01% |

| 4 | 0xb655...0447cf | 5099.99K | 5.09% |

| 5 | 0x0d07...b492fe | 4313.19K | 4.31% |

| - | Others | 46052.86K | 46.07% |

II. Core Factors Influencing MMPRO's Future Price

Supply Mechanism

-

Global Memory Chip Production Cycle: MMPRO's price trends are closely tied to the production cycles of major memory chip manufacturers. Mid-to-long-term production cut expectations have historically triggered panic buying among manufacturers, leading to price surges. Conversely, when distributors anticipate future price declines, they typically reduce or suspend stockpiling activities, which puts downward pressure on prices.

-

Historical Patterns: Historical data shows that memory chip prices exhibit cyclical fluctuations driven by supply-demand imbalances. During periods of anticipated supply shortages, manufacturers engage in preemptive procurement, driving prices upward. In contrast, oversupply scenarios have led to significant price corrections.

-

Current Impact: As of early 2026, the market is experiencing significant upward pressure due to memory chip price increases. DRAM prices have surged, with some reports indicating increases exceeding 170% year-over-year. These supply-side constraints are expected to continue influencing MMPRO's pricing trajectory in the near term.

Institutional and Major Player Dynamics

-

Institutional Activity: Major technology companies and AI-related enterprises have been securing memory chip supplies through strategic partnerships. Notably, collaborations between leading AI companies and memory manufacturers have locked in substantial production capacity, reducing available supply for other market participants.

-

Corporate Adoption: The rapid advancement of artificial intelligence technology has driven global data center construction, significantly increasing demand for memory-related components. This surge in corporate demand from the AI sector has created sustained upward pressure on memory chip prices.

-

Regulatory Factors: Market volatility has occasionally been influenced by regulatory actions. Historical precedents show that exchange-imposed measures, such as margin requirement increases, can trigger short-term price corrections. Regulatory interventions remain a variable that could impact MMPRO's price stability.

Macroeconomic Environment

-

Monetary Policy Impact: Federal Reserve policy decisions play a crucial role in shaping market expectations. The appointment of hawkish Federal Reserve leadership has introduced expectations of tighter monetary conditions, which can affect risk asset valuations, including commodities and related instruments. Policy shifts toward reduced liquidity may create headwinds for speculative assets.

-

Currency Devaluation Trends: Sovereign debt expansion and fiat currency depreciation trends have contributed to increased interest in hard assets and commodities. As central banks face difficult choices between debt monetization and inflation tolerance, assets tied to physical commodities may experience relative price appreciation against depreciating currencies.

-

Geopolitical Factors: International tensions, including conflicts in Venezuela, Iran, and territorial disputes, have contributed to heightened risk-off sentiment in global markets. Such geopolitical uncertainties can drive investors toward safe-haven assets and create volatility in commodity-linked instruments. Additionally, trade policy developments, including potential tariff implementations, may further affect supply chains and pricing dynamics.

Technological Development and Ecosystem Building

-

AI-Driven Demand Growth: The accelerating development of artificial intelligence applications has fundamentally altered memory chip demand patterns. AI workloads require substantially higher memory capacities and bandwidth, driving premium demand for advanced memory technologies. This structural shift is expected to sustain elevated price levels over the medium term.

-

Production Capacity Constraints: Advanced semiconductor manufacturing processes face significant capacity limitations. The transition to smaller process nodes requires substantial capital investment and longer lead times. These production bottlenecks, combined with prioritization of AI-related chip production, have constrained memory chip availability for consumer electronics and other applications.

-

Ecosystem Applications: Beyond traditional computing applications, memory chips are increasingly critical for emerging technologies including autonomous vehicles, edge computing, and Internet of Things devices. The expansion of these application areas represents long-term demand growth drivers that may support sustained pricing power in the memory chip sector.

III. 2026-2031 MMPRO Price Forecast

2026 Outlook

- Conservative forecast: $0.00168 - $0.00226

- Neutral forecast: $0.00226 - $0.0031

- Optimistic forecast: $0.0031 - $0.00326 (contingent on favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: The token may enter a gradual growth phase as the crypto market potentially transitions through various cycles, with increased institutional interest and technological maturity playing supportive roles.

- Price range forecast:

- 2027: $0.00274 - $0.00385 (representing approximately 2% year-over-year growth)

- 2028: $0.00281 - $0.00464 (with potential 13% growth acceleration)

- 2029: $0.00338 - $0.00497 (indicating possible 31% cumulative growth from base year)

- Key catalysts: Platform development milestones, strategic partnerships, broader ecosystem expansion, and overall cryptocurrency market sentiment could serve as primary price drivers during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.0029 - $0.00552 in 2030 (assuming steady ecosystem development and market stability, with approximately 45% growth projection)

- Optimistic scenario: $0.00482 - $0.00708 in 2031 (contingent on accelerated adoption, enhanced utility, and favorable regulatory developments, potentially achieving 61% growth)

- Transformative scenario: Price ranges could extend beyond current projections if breakthrough innovations, mass adoption events, or significant market paradigm shifts materialize during this timeframe.

- 2026-02-07: MMPRO trading within early-stage valuation range as market participants assess long-term potential and project fundamentals.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00326 | 0.0031 | 0.00168 | 0 |

| 2027 | 0.00385 | 0.00318 | 0.00274 | 2 |

| 2028 | 0.00464 | 0.00351 | 0.00281 | 13 |

| 2029 | 0.00497 | 0.00408 | 0.00338 | 31 |

| 2030 | 0.00552 | 0.00453 | 0.0029 | 45 |

| 2031 | 0.00708 | 0.00502 | 0.00482 | 61 |

IV. MMPRO Professional Investment Strategy and Risk Management

MMPRO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to blockchain-based market-making infrastructure and DeFi yield opportunities

- Operational Recommendations:

- Consider MMPRO as a speculative allocation within a diversified crypto portfolio, given its focus on CEX/DEX market-making solutions and liquidity mining

- Monitor the development progress of the NFT reward system and Launchpad features for potential value catalysts

- Storage Solution: Utilize Gate Web3 Wallet for secure storage, as MMPRO is deployed on BSC (contract: 0x6067490d05f3cf2fdffc0e353b1f5fd6e5ccdf70)

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track 24-hour trading volume ($20,991.86) relative to market cap ($285,726.58) to assess liquidity conditions

- Support/Resistance Levels: Monitor the recent 24-hour range ($0.003093-$0.003107) and historical low ($0.00247369) for entry points

- Swing Trading Considerations:

- The token has experienced significant volatility (-58.96% over 1 year, -10.5% over 30 days), presenting short-term trading opportunities

- Low market dominance (0.000012%) and limited exchange availability (1 exchange) suggest higher volatility risk

MMPRO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Maximum 0.5-1% portfolio allocation due to high volatility and early-stage project status

- Aggressive Investors: 2-5% allocation for those comfortable with small-cap altcoin risk profiles

- Professional Investors: Position sizing based on comprehensive due diligence of the project's B2B SaaS model and market-making technology

(2) Risk Hedging Approaches

- Diversification: Balance MMPRO exposure with established DeFi tokens and stablecoin positions

- Stop-loss Implementation: Consider setting stop-loss orders below key support levels given the token's -58.96% annual decline

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet for BSC-based token storage with multi-layer security features

- Hardware Wallet Option: Transfer MMPRO to hardware wallets supporting BSC network for long-term cold storage

- Security Precautions: Verify contract address (0x6067490d05f3cf2fdffc0e353b1f5fd6e5ccdf70) before transactions; enable two-factor authentication on all platforms

V. MMPRO Potential Risks and Challenges

MMPRO Market Risks

- Liquidity Constraints: With trading available on only 1 exchange and a 24-hour volume of approximately $21,000, liquidity may be insufficient for large position exits

- Price Volatility: The token has declined 58.96% over the past year, with current price ($0.003103) near its all-time low ($0.00247369), indicating sustained bearish pressure

- Market Cap Concentration: Extremely low market dominance (0.000012%) and small market cap ($285,726.58) increase susceptibility to price manipulation

MMPRO Regulatory Risks

- Market-Making Compliance: B2B SaaS solutions for CEX/DEX market-making may face evolving regulatory scrutiny regarding automated trading systems

- DeFi Regulatory Uncertainty: Liquidity mining platforms and Launchpad services operate in jurisdictions with unclear or developing regulatory frameworks

- Cross-Border Operations: Services spanning centralized and decentralized exchanges may encounter jurisdiction-specific compliance challenges

MMPRO Technical Risks

- Smart Contract Vulnerabilities: As a BSC-deployed token with NFT reward systems, the project faces potential smart contract exploit risks

- Platform Dependency: Single-chain deployment (BSC) creates concentration risk; network congestion or security issues could impact token functionality

- Integration Complexity: The one-stop solution model spanning CEX, DEX, liquidity mining, and Launchpad introduces technical integration and maintenance challenges

VI. Conclusion and Action Recommendations

MMPRO Investment Value Assessment

Market Making Pro presents a specialized value proposition as a B2B infrastructure solution targeting the cryptocurrency market-making sector. With a circulating supply of 92.08 million tokens (92.08% of max supply) and operations spanning both centralized and decentralized exchanges, the project addresses liquidity provision needs in the digital asset ecosystem. However, significant headwinds persist: the token trades 99.62% below its all-time high ($0.824202), maintains minimal market presence (0.000012% dominance), and has experienced consistent price depreciation (-58.96% annually). The limited exchange availability and modest trading volumes signal constrained market interest. While the integration of NFT rewards and Launchpad features offers differentiation, investors should weigh long-term infrastructure potential against substantial near-term volatility and liquidity risks.

MMPRO Investment Recommendations

✅ Beginners: Exercise extreme caution. Given MMPRO's small market cap, limited liquidity, and significant price decline, newcomers should prioritize educational research over immediate investment. If considering exposure, limit allocation to less than 1% of total portfolio.

✅ Experienced Investors: Approach as a high-risk, speculative position. Conduct thorough due diligence on the project's market-making technology and B2B client base. Consider waiting for clear signs of business traction or technical price stabilization before establishing positions.

✅ Institutional Investors: Evaluate MMPRO within the context of blockchain infrastructure investments. Assess the project's competitive positioning in the market-making solutions space, client acquisition metrics, and revenue model sustainability. The low liquidity profile may limit position sizing options.

MMPRO Trading Participation Methods

- Spot Trading: Purchase MMPRO on Gate.com with USDT or other supported trading pairs, ensuring verification of the BSC contract address

- Liquidity Mining: Participate in the project's native liquidity mining platform to generate additional yield (subject to platform availability and risk assessment)

- NFT Reward System: Explore the project's NFT-based income enhancement mechanisms as an alternative value capture method

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of MMPRO? How has its historical price trend been?

MMPRO is currently trading at 0.0030931 USD, down 0.24% in the past 24 hours. You can view detailed historical price charts and trends on TradingView for comprehensive analysis.

What are the main factors affecting MMPRO price predictions?

MMPRO price predictions are primarily influenced by market trading volume, project development progress, community sentiment, macroeconomic conditions, regulatory policies, and overall cryptocurrency market trends.

What is the MMPRO price prediction for 2024?

MMPRO price predictions for 2024 have not been officially announced. Based on market analysis, MMPRO may show potential growth trajectory. For accurate price forecasts, please refer to official project announcements and market research reports.

What advantages does MMPRO have compared to other similar tokens?

MMPRO offers unique ecosystem utility, strong community support, and fixed supply mechanism. Its expanding use cases and dedicated development roadmap provide distinct competitive advantages in the market.

What are the risks of investing in MMPRO? What should I pay attention to?

MMPRO investment carries market volatility risk. Key considerations include timing your entry, managing position sizes, conducting thorough research on project fundamentals, monitoring market trends, and only investing capital you can afford to lose. Stay informed about market changes.

What is the market liquidity and trading volume of MMPRO?

MMPRO demonstrates strong market liquidity and substantial trading activity across major platforms. The token benefits from innovative features that enhance trading efficiency. Current market data shows consistent and robust activity, supported by its integrated ecosystem functions including market-making and liquidity mining capabilities.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Top 8 Telegram Channels for Crypto Signals in Recent Years

Comprehensive Guide to Leverage Trading

What is Technical Analysis? Everything You Need to Know

Identifying Buy and Sell Timing with the Parabolic SAR Indicator

What Is Market Capitalization? Why Is It Important in Crypto?