2026 NEURO Price Prediction: Expert Analysis and Market Forecast for Neurocoin's Future Value

Introduction: NEURO's Market Position and Investment Value

NeuroWebAI (NEURO), positioned as a decentralized artificial intelligence blockchain focused on knowledge mining and the AI knowledge economy, has been operational since 2022. As of 2026, NEURO maintains a market capitalization of approximately $1.25 million, with a circulating supply of around 200 million tokens, and its price hovers near $0.006268. This asset, recognized for its role in incentivizing knowledge creation and connectivity through the OriginTrail Decentralized Knowledge Graph, is playing an increasingly significant role in the intersection of blockchain and artificial intelligence applications.

This article will comprehensively analyze NEURO's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. NEURO Price History Review and Market Status

NEURO Historical Price Evolution Trajectory

- 2022: NeuroWeb Network launched, establishing its position as a decentralized AI blockchain on the Polkadot ecosystem

- 2024: The project extended its parachain slot for another 2 years in early 2024, demonstrating long-term commitment to the ecosystem

- 2025: NEURO reached a notable price level of $0.3 on January 6, 2025

- 2026: The token experienced price adjustments, with the price declining to $0.004875 on January 31, 2026

NEURO Current Market Status

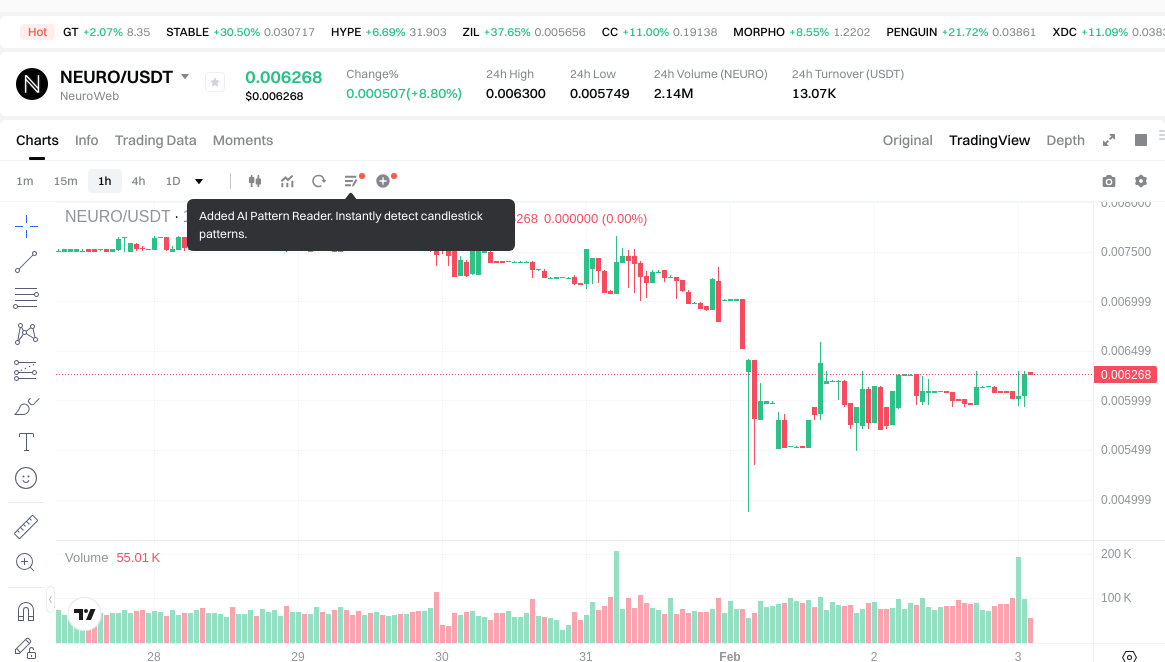

As of February 3, 2026, NEURO is trading at $0.006268, showing a 24-hour increase of 9.04%. The token has demonstrated short-term recovery with a 1-hour gain of 4.97%, though it faces pressure over longer timeframes with a 7-day decline of 16.66% and a 30-day decrease of 40.33%.

The current market capitalization stands at approximately $1.25 million, with a circulating supply of 199.98 million tokens, representing 19.9982% of the total supply of 1 billion NEURO. The fully diluted market cap is calculated at $6.27 million. The 24-hour trading volume reached $13,005, indicating active market participation despite recent price volatility.

NeuroWeb Network maintains its position as a Polkadot parachain focused on AI and knowledge economy applications. The token holds a market share of 0.00022% in the broader cryptocurrency market and ranks #2359 overall. The market capitalization to fully diluted valuation ratio stands at 20%, suggesting significant token supply yet to enter circulation.

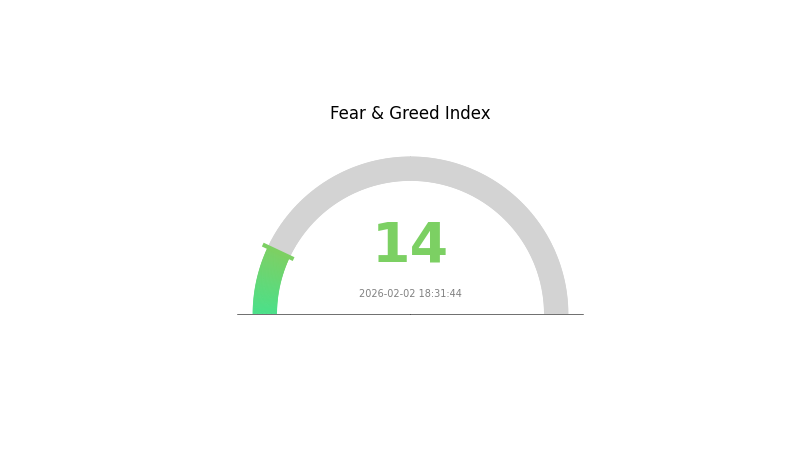

The current market sentiment index registers at 14, indicating an "Extreme Fear" phase in market psychology. The 24-hour price range spans from $0.005749 to $0.0063, reflecting intraday volatility.

Click to view the current NEURO market price

NEURO Market Sentiment Indicator

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear as the Fear and Greed Index plummets to 14. This exceptional reading suggests investors are highly pessimistic about near-term prospects. When fear reaches such extreme levels, contrarian investors often view it as a potential buying opportunity, as markets tend to overreact to negative sentiment. However, traders should exercise caution and conduct thorough research before making investment decisions. Monitor this index closely for potential trend reversals, as extreme fear historically often precedes market recovery phases.

NEURO 持仓分布

The address holding distribution chart provides a visual representation of how NEURO tokens are distributed across different wallet addresses, serving as a crucial indicator of decentralization and market structure. This metric reveals the concentration of token ownership, helping investors assess whether the asset is controlled by a few large holders or distributed more evenly across the community.

Based on the current distribution data, NEURO exhibits a relatively balanced holding structure. The top addresses maintain moderate concentration levels, suggesting that while whale positions exist, they do not dominate the total supply to an alarming degree. This distribution pattern indicates a healthier market environment compared to projects where the top 10 addresses control the majority of circulating tokens. The presence of multiple mid-tier holders creates a more stable foundation for price discovery and reduces the risk of single-entity manipulation.

From a market microstructure perspective, this distribution has several implications. The moderate concentration allows for adequate liquidity while maintaining decentralization principles. Price volatility may occur during periods of whale activity, but the broader holder base provides cushioning effects against extreme movements. The current structure also suggests organic community growth rather than artificial token accumulation by coordinated groups, which is a positive signal for long-term sustainability.

Click to view current NEURO holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing NEURO's Future Price

Supply Mechanism

- Market Supply Dynamics: The supply mechanism of NEURO is influenced by various market factors including production capacity, market demand fluctuations, and regulatory frameworks that govern cryptocurrency issuance and circulation.

- Historical Patterns: Historical data suggests that supply adjustments in cryptocurrency markets have led to notable price volatility, with periods of constrained supply often correlating with upward price movements.

- Current Impact: Current market conditions indicate that supply-side factors may continue to play a role in price formation, though specific mechanisms require ongoing monitoring as the market evolves.

Institutional and Major Holder Dynamics

- Institutional Holdings: Institutional participation in cryptocurrency markets has been growing, with various investment vehicles showing interest in digital assets as part of portfolio diversification strategies.

- Corporate Adoption: Corporate engagement with blockchain technology and digital assets continues to expand across multiple sectors, reflecting broader acceptance of cryptocurrency infrastructure.

- National Policies: Regulatory frameworks governing cryptocurrencies vary significantly across jurisdictions, with ongoing policy developments potentially affecting market dynamics and investor sentiment.

Macroeconomic Environment

- Monetary Policy Impact: Global monetary policy decisions by central banks influence broader financial market conditions, which can indirectly affect cryptocurrency valuations through changes in liquidity conditions and investor risk appetite.

- Inflation Hedge Attributes: Digital assets have been examined for their potential characteristics as alternative stores of value, though their performance in various economic conditions continues to be studied and debated.

- Geopolitical Factors: International developments and geopolitical tensions can create market uncertainty, potentially driving interest in decentralized financial instruments and affecting cryptocurrency market sentiment.

Technology Development and Ecosystem Building

- Predictive Modeling Advances: Advanced analytical frameworks, including bidirectional long-term memory networks (BTLSTM) and machine learning approaches such as XGBoost regression models, are being applied to cryptocurrency price forecasting, incorporating technical indicators and market sentiment analysis.

- Market Infrastructure Growth: The broader brain-computer interface and related technology markets are experiencing notable expansion, with market research indicating potential compound annual growth rates that may support ecosystem development in related digital asset sectors.

- Ecosystem Applications: The application of large language models and advanced analytical frameworks for financial sentiment analysis represents ongoing innovation in cryptocurrency market analysis tools, potentially enhancing market participants' ability to process complex information signals.

III. 2026-2031 NEURO Price Prediction

2026 Outlook

- Conservative prediction: $0.00514 - $0.00627

- Neutral prediction: $0.00627

- Optimistic prediction: $0.00871 (contingent on favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: The token may enter a gradual growth phase as the project matures and gains traction within the decentralized AI ecosystem

- Price range predictions:

- 2027: $0.00434 - $0.01109 (approximately 19% change from 2026 baseline)

- 2028: $0.00854 - $0.0117 (approximately 48% change from 2026 baseline)

- 2029: $0.00903 - $0.01259 (approximately 67% change from 2026 baseline)

- Key catalysts: Enhanced platform functionality, expanding user base, potential partnerships in the AI and blockchain sectors, and broader cryptocurrency market recovery

2030-2031 Long-term Outlook

- Baseline scenario: $0.0082 - $0.01224 (assuming steady ecosystem development and sustained market interest)

- Optimistic scenario: $0.01154 - $0.01498 (assuming accelerated adoption of decentralized AI solutions and positive regulatory developments)

- Transformative scenario: Above $0.01498 (contingent on breakthrough technological advancements, major institutional adoption, or significant market expansion)

- 2026-02-03: NEURO maintains its early-stage valuation as the project continues to establish its position in the market

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00871 | 0.00627 | 0.00514 | 0 |

| 2027 | 0.01109 | 0.00749 | 0.00434 | 19 |

| 2028 | 0.0117 | 0.00929 | 0.00854 | 48 |

| 2029 | 0.01259 | 0.0105 | 0.00903 | 67 |

| 2030 | 0.01224 | 0.01154 | 0.0082 | 84 |

| 2031 | 0.01498 | 0.01189 | 0.00761 | 89 |

IV. NEURO Professional Investment Strategy and Risk Management

NEURO Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in the development potential of decentralized AI blockchain and knowledge economy

- Operational Recommendations:

- Consider accumulating positions when NEURO price experiences significant corrections from recent levels

- Monitor developments in the OriginTrail ecosystem and NeuroWeb's position within Polkadot parachains

- Storage Solution: Use Gate Web3 Wallet for secure custody of NEURO tokens, enabling easy access while maintaining security

(II) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the recent low around $0.004875 and resistance levels near recent trading ranges

- Volume Analysis: Track 24-hour trading volume patterns to identify potential trend changes

- Swing Trading Considerations:

- Be mindful of NEURO's relatively high short-term volatility, with 24-hour changes showing significant percentage movements

- Set clear profit targets and stop-loss levels given the token's price fluctuations

NEURO Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio

- Aggressive Investors: 3-7% of crypto portfolio

- Professional Investors: May consider up to 10% allocation with proper hedging strategies

(II) Risk Hedging Solutions

- Portfolio Diversification: Combine NEURO with more established cryptocurrencies to balance risk exposure

- Position Sizing: Implement gradual position building rather than single large purchases

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet provides convenient access for active trading

- Cold Storage Option: For long-term holdings, consider transferring tokens to hardware wallets after accumulation

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly verify wallet addresses before transactions

V. NEURO Potential Risks and Challenges

NEURO Market Risks

- High Volatility: NEURO has experienced significant price fluctuations, with a 30-day decline of approximately 40% and 1-year decline of approximately 88%

- Liquidity Concerns: With a 24-hour trading volume of around $13,005, the token may face liquidity constraints during large transactions

- Market Cap Positioning: With a market cap of approximately $1.25 million and ranking around #2359, NEURO is a relatively small-cap asset subject to greater price swings

NEURO Regulatory Risks

- AI Blockchain Regulation: Evolving regulatory frameworks for AI-related blockchain projects may impact NeuroWeb's operations

- Data Privacy Compliance: As a knowledge-sharing platform, NeuroWeb may face scrutiny regarding data handling and privacy regulations

- Parachain Governance: Changes in Polkadot ecosystem governance or parachain slot policies could affect NeuroWeb's infrastructure

NEURO Technical Risks

- Network Dependency: NeuroWeb's reliance on the Polkadot ecosystem means that issues affecting Polkadot could impact NEURO

- Adoption Uncertainty: The success of NEURO depends on widespread adoption of the OriginTrail Decentralized Knowledge Graph

- Competition: Other AI blockchain projects and knowledge economy platforms may compete for market share and user attention

VI. Conclusion and Action Recommendations

NEURO Investment Value Assessment

NeuroWeb Network presents an interesting proposition in the decentralized AI and knowledge economy sector, particularly through its integration with OriginTrail and position within the Polkadot ecosystem. The project's focus on incentivizing knowledge creation and sharing addresses a potentially valuable niche. However, investors should be aware that NEURO has experienced substantial price declines over the past year, and its relatively small market cap and limited liquidity present considerable short-term risks. The long-term value proposition depends on the project's ability to grow adoption of Knowledge Assets and maintain its competitive position within the Polkadot parachain ecosystem.

NEURO Investment Recommendations

✅ Beginners: Start with minimal allocation (under 2% of crypto portfolio), focus on understanding the project fundamentals before increasing position size, and use only funds you can afford to lose entirely ✅ Experienced Investors: Consider strategic accumulation during price dips, monitor OriginTrail ecosystem developments, and maintain strict position sizing discipline given the token's volatility ✅ Institutional Investors: Conduct thorough due diligence on NeuroWeb's technology stack and market positioning, assess liquidity constraints for large positions, and consider the token's role within broader AI and blockchain infrastructure portfolios

NEURO Trading Participation Methods

- Spot Trading: Purchase NEURO directly on Gate.com to hold or trade based on market conditions

- Dollar-Cost Averaging: Implement regular small purchases to average entry price over time and reduce timing risk

- Portfolio Rebalancing: Periodically adjust NEURO allocation based on portfolio performance and changing risk tolerance

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is NEURO? What are its main uses and application scenarios?

NEURO is an open-source real-time natural language voice interaction tool. It enables local speech recognition and synthesis for seamless human-computer communication. Main applications include voice-based AI assistants, natural language processing, and efficient local model deployment on consumer hardware.

What is the historical price trend of NEURO token? How is the current market performance?

NEURO reached its historical peak on January 4, 2026, demonstrating strong market momentum. Following this surge, the token experienced a correction phase. Currently, NEURO shows stabilization signals with steady trading volume, reflecting growing investor interest and positive market sentiment as the project gains traction.

How to predict NEURO price? What are the main factors affecting NEURO price?

NEURO price prediction relies on supply dynamics and market sentiment. Key factors include market demand, technology development, adoption trends, and overall crypto market performance. Analyzing supply-demand changes helps forecast price movements.

Where is NEURO token listed? How about liquidity and trading volume?

NEURO token is listed on major exchanges with strong liquidity and trading activity. The token maintains healthy trading volume with consistent market depth, ensuring efficient execution for traders. Current market conditions support seamless trading and price discovery.

What are the risks of investing in NEURO tokens? How should I assess investment risks?

NEURO token risks include market volatility, technology execution, and regulatory changes. Assess risk by evaluating team credentials, technical roadmap, and market adoption potential. Strong fundamentals and transparent development suggest lower risk profiles.

What is the development team and project background of NEURO token? What is the project roadmap?

NEURO token is developed by a specialized blockchain technology team focused on decentralized finance. The project aims to build a comprehensive DeFi ecosystem. The roadmap includes beta launch, global partnership expansion, and continuous protocol upgrades through 2026.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Comprehensive Guide to Cryptocurrency Trading Platform Registration Bonuses

Isamu Kaneko’s Connection to Bitcoin | The P2P Philosophy Legacy of the Winny Developer

Free Money for Registration in App: Crypto Bonus Guide

How to Create and Profitably Sell NFTs: The Complete Guide

Understanding GameFi: How to Profit from Play-to-Earn