2026 PAL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: PAL's Market Position and Investment Value

Palio (PAL), as the very first token launched on the Xterio platform with a "Community First" approach, has been developing its unique ecosystem since its inception in 2025. As of February 5, 2026, PAL maintains a market capitalization of approximately $566,770, with a circulating supply of around 190 million tokens, and the price hovering around $0.002983. This asset, characterized as an AI-driven emotional companion pet project, is playing an increasingly important role in the intersection of gaming and artificial intelligence.

This article will comprehensively analyze PAL's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. PAL Price History Review and Market Status

PAL Historical Price Evolution Trajectory

- 2025: Token launched on Xterio platform with initial price of 0.05, experiencing significant volatility in early trading period

- 2025 July: Price reached notable level of 0.0314 on July 7th, marking a significant milestone for the token

- 2026 January: Market experienced substantial correction, with price declining to 0.002127 on January 1st

PAL Current Market Situation

As of February 5, 2026, PAL is trading at 0.002983, representing a 24-hour decline of 4.01 percent. The token has demonstrated mixed short-term performance, with a modest 1-hour gain of 0.13 percent contrasted against a 7-day decline of 22.99 percent. Over the past 30 days, PAL has experienced a 4.38 percent decrease.

The token's 24-hour trading range spans from 0.00297 to 0.003123, with total trading volume reaching 13,567.92. PAL's market capitalization stands at 566,770, with a circulating supply of 190,000,000 tokens representing 19 percent of the maximum supply of 1,000,000,000 tokens. The fully diluted market capitalization is calculated at 2,983,000.

PAL maintains a market dominance of 0.00011 percent and ranks 2934 in overall market positioning. The token is held by 3,914 holders and operates on the BSC network utilizing the BEP-20 standard. Current market sentiment indicators reflect a reading of 12, suggesting prevailing cautious market conditions.

Click to view current PAL market price

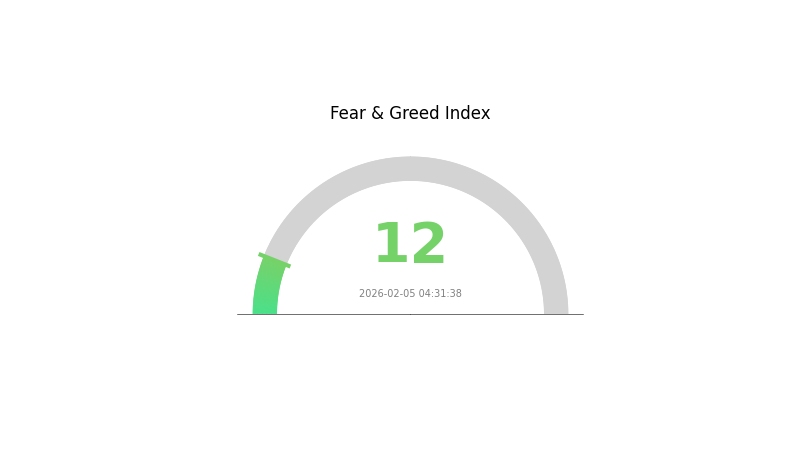

PAL Market Sentiment Index

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index at 12. This historically low reading suggests significant market pessimism and capitulation among investors. Such conditions often present contrarian opportunities, as extreme fear has frequently preceded market recoveries. However, exercise caution and conduct thorough research before making investment decisions. Consider dollar-cost averaging or building positions gradually during periods of heightened uncertainty to mitigate timing risk.

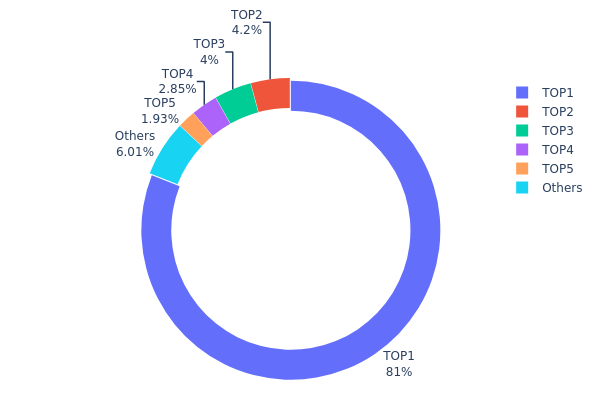

PAL Token Distribution

Based on the on-chain data as of February 5, 2026, PAL exhibits a highly concentrated holding pattern characteristic of early-stage token ecosystems. The top-ranked address controls approximately 81.00% of the total supply (810,000K tokens), while the second and third addresses hold 4.20% and 4.00% respectively. The top five addresses collectively account for 93.98% of the circulating supply, with the remaining 6.02% distributed among smaller holders. This distribution structure reveals a significant centralization of token ownership within a limited number of wallets.

Such extreme concentration presents both structural risks and strategic implications for market dynamics. The dominant position of the largest holder suggests potential connections to project treasury, team allocations, or institutional lockups, which could create substantial sell pressure upon any unlock events. The limited distribution across smaller addresses indicates minimal retail participation and constrained organic market depth. This configuration makes PAL particularly vulnerable to price volatility, as large-scale transfers from major holders could trigger significant market reactions due to insufficient liquidity absorption capacity.

From a decentralization perspective, the current holding distribution reflects an immature token economy that has yet to achieve broad-based community ownership. While concentrated holdings are common during project launch phases, sustained centralization may limit long-term price discovery mechanisms and reduce resistance to coordinated market movements. Investors should monitor whether subsequent token unlock schedules or distribution initiatives will improve holding diversification to enhance market structure stability.

Click to view current PAL Token Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3d2a...19a373 | 810000.00K | 81.00% |

| 2 | 0x8441...30bf7c | 42000.00K | 4.20% |

| 3 | 0x93de...85d976 | 40000.00K | 4.00% |

| 4 | 0x4982...6e89cb | 28526.39K | 2.85% |

| 5 | 0xcb90...bb3530 | 19329.12K | 1.93% |

| - | Others | 60144.50K | 6.02% |

II. Core Factors Influencing PAL's Future Price

Based on the available materials, there is insufficient data to provide a comprehensive analysis of the core factors that may influence PAL's future price. The reference materials do not contain specific information regarding supply mechanisms, institutional holdings, macroeconomic environment impacts, or technical development details for PAL.

Without reliable data on these fundamental aspects, it would be inappropriate to speculate on price-influencing factors. Investors interested in PAL should conduct thorough research and consult multiple sources before making any investment decisions.

III. 2026-2031 PAL Price Predictions

2026 Outlook

- Conservative prediction: $0.00167 - $0.00299

- Neutral prediction: Around $0.00299

- Optimistic prediction: Up to $0.00374 (requires favorable market conditions)

2027-2029 Mid-term Outlook

- Market phase expectation: Gradual recovery and development phase with steady growth momentum

- Price range predictions:

- 2027: $0.00289 - $0.00353, with an expected average of $0.00336

- 2028: $0.00193 - $0.00448, with an expected average of $0.00345

- 2029: $0.00246 - $0.00524, with an expected average of $0.00397

- Key catalysts: Progressive market maturation and potential ecosystem expansion driving incremental value appreciation

2030-2031 Long-term Outlook

- Baseline scenario: $0.00299 - $0.00672 (assuming continued project development and stable market conditions)

- Optimistic scenario: $0.00475 - $0.00792 (contingent upon successful implementation of key initiatives and favorable regulatory environment)

- Transformative scenario: Potential to reach $0.00792 by 2031 (requires exceptional market conditions and significant adoption growth)

- February 5, 2026: PAL trading within initial range of $0.00167 - $0.00374 (early phase of forecasted period)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00374 | 0.00299 | 0.00167 | 0 |

| 2027 | 0.00353 | 0.00336 | 0.00289 | 12 |

| 2028 | 0.00448 | 0.00345 | 0.00193 | 15 |

| 2029 | 0.00524 | 0.00397 | 0.00246 | 32 |

| 2030 | 0.00672 | 0.0046 | 0.00299 | 54 |

| 2031 | 0.00792 | 0.00566 | 0.00475 | 89 |

IV. PAL Professional Investment Strategy and Risk Management

PAL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the AI-companion ecosystem and are willing to hold through market cycles

- Operational Recommendations:

- Consider dollar-cost averaging (DCA) to mitigate entry timing risk, especially during market volatility

- Monitor project developments on the Xterio platform and AI agent pet releases as potential value catalysts

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term custody

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use 50-day and 200-day moving averages to identify trend directions and potential reversal points

- Relative Strength Index (RSI): Monitor RSI levels to identify overbought (above 70) or oversold (below 30) conditions for potential entry or exit signals

- Swing Trading Key Points:

- Watch for price action around the 24-hour high (0.003123) and low (0.00297) levels to identify short-term support and resistance

- Consider reducing exposure during periods of high volatility, particularly given the 22.99% decline over the past 7 days

PAL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-10% of crypto portfolio allocation

- Professional Investors: Up to 15% with active hedging strategies

(2) Risk Hedging Solutions

- Position Sizing: Never allocate more than you can afford to lose, given PAL's high volatility (93.99% decline from peak over 1 year)

- Stop-Loss Orders: Consider setting stop-loss orders to limit downside risk during adverse market movements

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and easy accessibility

- Cold Storage Option: For long-term holdings, consider transferring tokens to hardware wallets after accumulation

- Security Precautions: Always verify contract addresses (0xb7e548c4f133adbb910914d7529d5cb00c2e9051 on BSC), enable two-factor authentication, and never share private keys

V. PAL Potential Risks and Challenges

PAL Market Risks

- High Volatility: PAL has experienced a 93.99% decline over the past year, indicating extreme price volatility that may not suit risk-averse investors

- Low Liquidity: With a 24-hour trading volume of approximately 13,567 USD and only 5 exchanges listing the token, liquidity constraints may lead to significant slippage during large transactions

- Limited Circulation: Only 19% of total supply is currently in circulation (190 million out of 1 billion tokens), which may lead to price pressure if additional tokens enter the market

PAL Regulatory Risks

- AI Regulation Uncertainty: As governments worldwide develop frameworks for AI governance, projects combining AI with blockchain may face evolving compliance requirements

- Gaming Token Classification: Regulatory bodies may scrutinize tokens associated with gaming ecosystems, potentially impacting project operations or token utility

- Cross-border Compliance: Operating on a global platform may require adherence to multiple jurisdictions' securities and digital asset regulations

PAL Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 token on BSC, PAL relies on smart contract security; any undiscovered bugs or vulnerabilities could impact token functionality

- Platform Dependency: PAL's success is closely tied to the Xterio platform's performance and adoption; any technical issues or security breaches on the platform could negatively affect PAL

- AI Agent Integration Complexity: The successful implementation of AI companion pets requires sophisticated technology; delays or technical challenges in development could impact project momentum

VI. Conclusion and Action Recommendations

PAL Investment Value Assessment

PAL represents an innovative convergence of AI companions and blockchain gaming on the Xterio platform, backed by a team with experience from major gaming companies. The "Community First" approach with no investor or team allocations offers fair distribution. However, the token faces significant challenges including extreme price volatility (declining 93.99% over one year), limited liquidity with only 5 exchange listings, and low circulation (19% of total supply). The project's long-term value depends on successful AI agent implementation, platform adoption, and sustained community engagement. Short-term risks include continued price pressure, low trading volumes, and market sentiment volatility.

PAL Investment Recommendations

✅ Beginners: Exercise extreme caution; consider starting with minimal allocation (under 1% of portfolio) only after thorough research and understanding of the project's technology and risks ✅ Experienced Investors: May consider selective exposure (2-5% of crypto portfolio) with strict risk management, focusing on project development milestones and platform adoption metrics ✅ Institutional Investors: Conduct comprehensive due diligence on team backgrounds, smart contract audits, and platform infrastructure before considering any allocation; maintain active monitoring of regulatory developments

PAL Trading Participation Methods

- Spot Trading: Purchase PAL tokens on Gate.com and other supporting exchanges, suitable for both short-term trading and long-term holding strategies

- Dollar-Cost Averaging: Implement systematic purchases over time to reduce timing risk and average out entry prices during volatile periods

- Community Engagement: Participate in the Palio ecosystem by exploring AI companion features and games, which may provide insights into project development and future token utility

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is PAL coin? What is its purpose?

PAL is a blockchain-based digital currency designed for insurance, tourism, and municipal infrastructure management sectors. It enhances operational efficiency across these industries with broad application potential and utility value.

What is the historical price trend of PAL token?

PAL token declined 4.60% over the past 90 days, with current price at $0.000200. The token has shown variable market dynamics, reflecting broader crypto market conditions and project developments. Historical price data demonstrates volatility typical of emerging digital assets.

What is the PAL coin price prediction for 2024?

Based on historical bull market patterns, PAL is projected to experience a 27% decline in 2024, consistent with previous cycles in 2012, 2016, and 2020. Current market trends align with this historical correction pattern.

What are the main factors affecting PAL coin price?

PAL price is influenced by market demand, supply volume, investor sentiment, and overall cryptocurrency market trends. Development progress and regulatory policies are also key drivers.

What advantages does PAL have compared to other tokens?

PAL offers flexibility and efficiency in token issuance, enabling rapid capital acquisition for R&D and marketing. With no VC or team reserves, funds are directed toward accelerating project development and market expansion.

What are the risks to pay attention to when investing in PAL coins?

PAL coin prices fluctuate significantly, which may result in loss of principal investment. Investors bear full responsibility for their own decisions. Market volatility and sentiment affect investment outcomes. Returns cannot be guaranteed.

What is the market liquidity and trading volume of PAL coin?

PAL coin currently shows moderate liquidity with trading volume fluctuating between $0.00387 and $0.003956 in recent periods. The coin maintains stable market activity, though liquidity levels remain relatively constrained compared to major cryptocurrencies, presenting both opportunities and considerations for traders.

What is the professional analysts' outlook on PAL coin's future prospects?

Professional analysts like Raoul Pal view PAL coin as having significant growth potential. They predict substantial long-term appreciation and recommend investors maintain patience with long-term holding strategies for potential substantial returns.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Cryptocurrency Tax – How to File PIT-38 for Cryptocurrencies

Layer-1 vs Layer-2: What Sets Them Apart?

Smart Contracts: Definition and How They Work

What is EARNM: A Comprehensive Guide to Earnings Management and Financial Reporting

What is GARI: A Comprehensive Guide to Understanding the AI-Powered Social Platform and Its Revolutionary Features