2026 PHIL Price Prediction: Expert Analysis and Market Forecast for Philips Lighting Token Growth

Introduction: PHIL's Market Position and Investment Value

Phil Token (PHIL), positioned as a community-driven memecoin focused on bringing integrity and collaboration to the crypto space, has experienced a dynamic market journey since its launch in 2024. As of February 6, 2026, PHIL maintains a market capitalization of approximately $383,500, with a circulating supply of 1 billion tokens and a current price around $0.0003835. This asset, often described as "a movement towards a more secure and interconnected crypto ecosystem," is playing an evolving role in the memecoin landscape by emphasizing transparency, trust, and meaningful partnerships within the community.

This article will comprehensively analyze PHIL's price trajectory from 2026 through 2031, combining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. PHIL Price History Review and Market Status

PHIL Historical Price Evolution Trajectory

- August 2024: Phil Token launched on the market with an initial price around $0.069114, marking its entry into the memecoin ecosystem

- August 30, 2024: Reached its peak value at $0.0735, representing the highest point in PHIL's trading history since launch

- February 2026: Price experienced significant correction, declining to $0.0003631, reflecting broader market adjustments in the memecoin sector

PHIL Current Market Situation

As of February 6, 2026, PHIL is trading at $0.0003835, experiencing a 24-hour decline of 11.27%. The token shows negative momentum across multiple timeframes, with a 1-hour decrease of 0.36%, a 7-day drop of 37.5%, and a 30-day decline of 49.76%. Over the past year, PHIL has decreased by 93.42% from its higher valuations.

The current 24-hour trading volume stands at $19,235.17, with the token's market capitalization at $383,500. PHIL maintains a circulating supply of 1 billion tokens, which represents 100% of its maximum supply of 1 billion tokens. The fully diluted valuation matches the current market cap at $383,500, indicating complete token circulation.

The 24-hour price range shows volatility between a low of $0.0003631 and a high of $0.0004451. The token holder base has grown to 11,361 addresses, demonstrating ongoing community engagement. PHIL is currently listed on 10 exchanges and operates as an ERC20 token on the Ethereum blockchain.

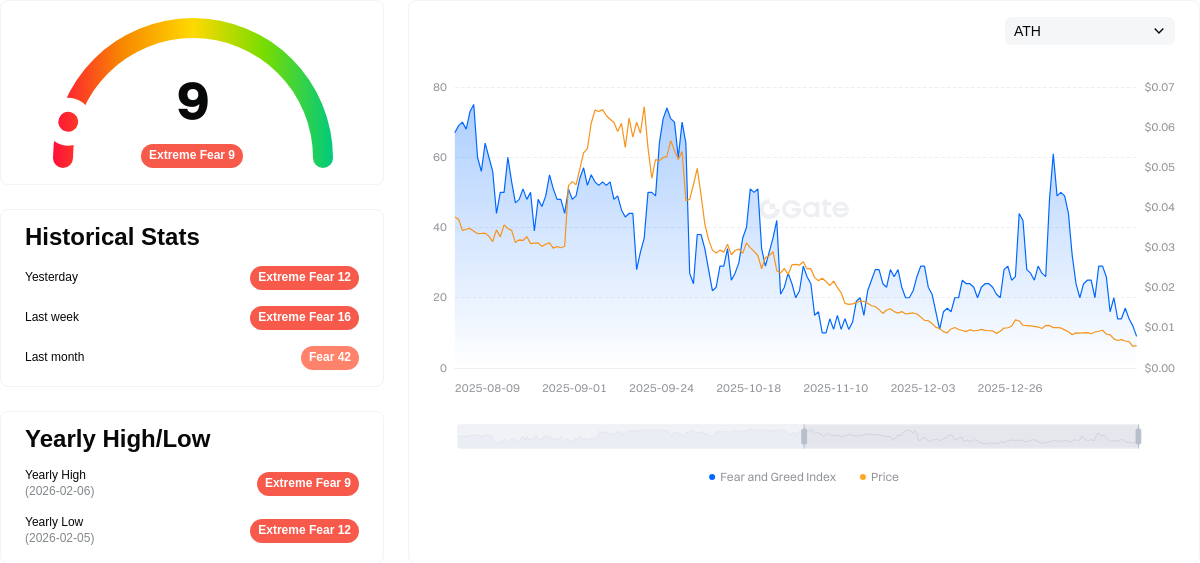

Market sentiment indicators show a fear index reading of 9, classified as "Extreme Fear," reflecting cautious investor sentiment in the broader cryptocurrency market. PHIL holds a market share of 0.000016%, positioning it in the smaller-cap segment of the memecoin category.

Click to view current PHIL market price

PHIL Market Sentiment Indicator

2026-02-06 Fear & Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with a Fear & Greed Index reading of 9. This exceptionally low score indicates panic selling and severe market pessimism. When the index reaches such extreme levels, historically it has created significant buying opportunities for contrarian investors. Market participants should remain cautious yet vigilant, as extreme fear often precedes market reversals. Consider dollar-cost averaging strategies to accumulate quality assets during this downturn. Monitor key support levels closely and stay informed through Gate.com's comprehensive market analysis tools to navigate this volatile period effectively.

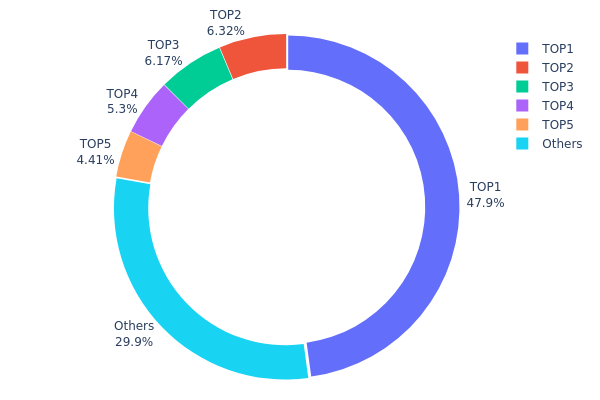

PHIL Holding Distribution

The holding distribution chart visualizes how PHIL tokens are allocated across different wallet addresses, serving as a critical indicator of token concentration and decentralization level. This metric helps assess whether token ownership is widely distributed among numerous holders or concentrated in a few large addresses, which directly impacts market stability and manipulation risk.

Current data reveals a significant concentration pattern in PHIL's holding structure. The top address controls 478.54 million tokens, representing 47.85% of the total supply—nearly half of all circulating tokens. The top five addresses collectively hold 700.62 million tokens, accounting for 70.04% of total supply. This leaves only 29.96% distributed among all other holders, indicating a highly centralized ownership structure that deviates considerably from ideal decentralization standards.

Such concentration presents notable implications for market dynamics. The dominant position of the largest holder creates substantial price volatility risk, as any significant selling activity could trigger sharp market movements. Additionally, this distribution pattern increases susceptibility to price manipulation, as coordinated actions among top holders could disproportionately influence market direction. The limited token distribution among smaller holders suggests reduced organic trading activity and potentially lower liquidity depth, which may amplify price swings during periods of heightened volatility.

Click to view current PHIL Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc357...723110 | 478538.64K | 47.85% |

| 2 | 0x58ed...a36a51 | 63246.85K | 6.32% |

| 3 | 0x0529...c553b7 | 61740.05K | 6.17% |

| 4 | 0x6368...14d6c5 | 53024.17K | 5.30% |

| 5 | 0x9642...2f5d4e | 44066.69K | 4.40% |

| - | Others | 299383.59K | 29.96% |

II. Core Factors Influencing PHIL's Future Price

Supply Mechanism

- Growth-Based Supply Model: PHIL's price outlook appears to be influenced by market demand, adoption trends, institutional participation, and broader economic factors. The available materials suggest an estimated annual growth rate of approximately 5%.

- Historical Pattern: Historical price movements have been shaped by supply dynamics and market adoption cycles, with demand-side factors playing a significant role in valuation.

- Current Impact: Based on projected growth patterns, the supply mechanism combined with increasing adoption trends may support gradual price appreciation through 2027, though specific supply adjustment details were not provided in the reference materials.

Institutional and Major Holder Dynamics

- Institutional Holdings: The available materials indicate that institutional participation is one of the key factors affecting PHIL's price prospects, though specific institutional holding data was not detailed in the provided sources.

- Enterprise Adoption: While the materials reference adoption trends as a critical factor, specific enterprises utilizing PHIL were not mentioned in the available documentation.

- National Policies: Policy frameworks at the national level were not specifically addressed in the reference materials for PHIL.

Macroeconomic Environment

- Monetary Policy Impact: Broader economic factors, including monetary policy environments, are noted as influencing PHIL's price trajectory. Economic slowdowns and labor market adjustments may affect inflation expectations, which could indirectly impact cryptocurrency valuations.

- Inflation Hedging Properties: The materials do not provide specific evidence regarding PHIL's performance as an inflation hedge, though macroeconomic conditions are acknowledged as relevant to its price outlook.

- Geopolitical Factors: International economic conditions and market confidence levels related to global economic recovery may influence PHIL's market performance, though specific geopolitical impacts were not detailed.

Technological Development and Ecosystem Building

- Market Adoption Infrastructure: The development of adoption infrastructure and increasing market penetration represent key drivers for PHIL's technological ecosystem, though specific technical upgrades were not outlined in the available materials.

- Ecosystem Applications: While the importance of ecosystem development and adoption trends is emphasized in the materials, particular DApps or ecosystem projects associated with PHIL were not specified in the provided documentation.

III. 2026-2031 PHIL Price Prediction

2026 Outlook

- Conservative prediction: $0.00037

- Neutral prediction: $0.00038

- Optimistic prediction: $0.00044 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: The token may enter a gradual growth phase as the cryptocurrency market matures and adoption increases

- Price range prediction:

- 2027: $0.00028 - $0.00052

- 2028: $0.00037 - $0.00057

- 2029: $0.00034 - $0.00076

- Key catalysts: Market sentiment shifts, technological developments, and increased trading volume could serve as primary drivers

2030-2031 Long-term Outlook

- Baseline scenario: $0.00046 - $0.00092 (assuming steady market growth)

- Optimistic scenario: $0.00061 - $0.00101 (with enhanced ecosystem development and broader adoption)

- Transformative scenario: Potential to reach upper ranges if significant partnerships and utility expansion materialize

- 2026-02-06: PHIL is projected to trade within a narrow range, with price change expected to remain relatively stable at 0% compared to current levels

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00044 | 0.00038 | 0.00037 | 0 |

| 2027 | 0.00052 | 0.00041 | 0.00028 | 7 |

| 2028 | 0.00057 | 0.00047 | 0.00037 | 21 |

| 2029 | 0.00076 | 0.00052 | 0.00034 | 35 |

| 2030 | 0.00092 | 0.00064 | 0.00046 | 66 |

| 2031 | 0.00101 | 0.00078 | 0.00061 | 103 |

IV. PHIL Professional Investment Strategy and Risk Management

PHIL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Community-driven memecoin enthusiasts and believers in collaborative crypto ecosystems

- Operational Recommendations:

- Consider dollar-cost averaging (DCA) to mitigate volatility risks associated with memecoin price fluctuations

- Monitor Phil Token's progress in uniting top memecoins and building partnerships within the crypto space

- Storage Solution: Use Gate Web3 Wallet for secure ERC20 token storage with enhanced security features

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume (currently $19,235) to identify potential breakout or breakdown signals

- Support and Resistance Levels: Track the 24-hour range ($0.0003631 - $0.0004451) to identify key price levels for entry and exit points

- Swing Trading Considerations:

- Given the high volatility (-11.27% in 24H, -37.5% in 7D), implement strict stop-loss orders to protect capital

- Monitor social sentiment and community developments on Twitter (@Philtokeneth) for potential catalyst-driven price movements

PHIL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: 5-10% of speculative allocation with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance PHIL exposure with established cryptocurrencies and stablecoins

- Position Sizing: Limit individual position size based on personal risk tolerance and market capitalization ($383,500)

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and easy access to ERC20 tokens

- Cold Storage Option: Consider hardware wallet solutions for long-term holdings exceeding trading needs

- Security Precautions: Never share private keys, enable two-factor authentication, verify contract address (0xc328a59e7321747aebbc49fd28d1b32c1af8d3b2) before transactions, and be cautious of phishing attempts

V. PHIL Potential Risks and Challenges

PHIL Market Risks

- Extreme Volatility: PHIL has experienced a -93.42% decline from its ATH of $0.0735 in August 2024, demonstrating significant price instability typical of memecoin assets

- Limited Liquidity: With a market cap of approximately $383,500 and relatively low 24-hour trading volume, large trades may experience substantial slippage

- Market Sentiment Dependency: As a community-driven memecoin, PHIL's value is heavily influenced by social media trends and community engagement, which can change rapidly

PHIL Regulatory Risks

- Memecoin Classification Uncertainty: Regulatory bodies in various jurisdictions continue to evolve their stance on memecoins and community-driven tokens

- Enhanced Scrutiny: As regulatory frameworks develop, memecoins may face increased compliance requirements or potential restrictions

- Geographic Restrictions: Certain jurisdictions may implement limitations on memecoin trading or ownership as regulatory landscapes evolve

PHIL Technical Risks

- Smart Contract Vulnerabilities: As an ERC20 token on Ethereum, PHIL is subject to potential smart contract bugs or exploits despite blockchain security

- Blockchain Dependency: PHIL relies entirely on Ethereum network performance, meaning network congestion or technical issues could impact token functionality

- Developer Dependence: While built by an experienced developer, the project's long-term viability depends on continued development and maintenance commitment

VI. Conclusion and Action Recommendations

PHIL Investment Value Assessment

Phil Token ($PHIL) represents a community-driven memecoin initiative with a vision to foster collaboration and transparency within the crypto space. With a mission to unite top memecoins and build meaningful partnerships, PHIL offers a value proposition beyond typical meme tokens. However, its current market performance (-93.42% from ATH) and small market cap ($383,500) reflect both the speculative nature of memecoin investments and the early-stage positioning of the project. The circulating supply of 1 billion tokens (100% of max supply) provides full transparency regarding tokenomics. Short-term risks include high volatility, limited liquidity, and dependency on community engagement, while long-term value hinges on successful execution of partnership strategies and ecosystem development.

PHIL Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of portfolio) to understand memecoin dynamics; use educational resources before investing; trade only on reputable platforms like Gate.com ✅ Experienced Investors: Consider PHIL as a speculative position within a diversified memecoin portfolio; implement strict risk management with stop-loss orders; monitor community developments and partnership announcements ✅ Institutional Investors: Conduct thorough due diligence on project fundamentals and team background; assess community engagement metrics and holder distribution (11,361 holders); evaluate PHIL within broader memecoin sector exposure with appropriate position sizing

PHIL Trading Participation Methods

- Spot Trading on Gate.com: Access PHIL through Gate.com trading platform with various fiat and crypto pairs

- ERC20 Token Interaction: Use Gate Web3 Wallet to interact directly with PHIL's smart contract for decentralized trading options

- Community Engagement: Follow Phil Token's official Twitter (@Philtokeneth) and visit the website (philtoken.com) to stay informed about partnership developments and ecosystem updates

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is PHIL? What are its purposes and value?

PHIL Token ($PHIL) is a community-driven meme coin emphasizing trust and cooperation. It brings transparency and secure partnerships to the meme coin sector, with primary use in trading and community engagement within the Web3 ecosystem.

What is PHIL's historical price trend and current market performance?

PHIL reached its all-time high of $0.0735 on August 30, 2024. The token has shown resilience in the market with steady trading activity. Currently, PHIL maintains strong momentum with growing ecosystem adoption and positive community engagement driving its market presence.

How to predict PHIL price? What analysis methods are available?

PHIL price prediction employs time series analysis and machine learning methods. Based on historical data and market trends, the average predicted price for PHIL from 2026 to 2036 is $0.001261. Technical analysis of trading volume and price patterns provides additional forecasting insights.

What are the advantages and disadvantages of PHIL compared to other cryptocurrencies?

PHIL advantages: strong positioning in content creation ecosystem, high explosive potential in memecoin sector. Disadvantages: less institutional adoption compared to mature Layer 2 solutions like LRC, smaller trading volume in market.

What are the risks of investing in PHIL? What should I pay attention to?

PHIL investment carries high volatility risk with potential losses. Market fluctuations are significant. Understand crypto asset risks thoroughly before investing. Monitor price movements and trading volume carefully for informed decisions.

What are PHIL's future development prospects and price potential?

PHIL shows strong future prospects with anticipated growth through 2025-2030. Long-term holding and active trading strategies are recommended for investors seeking exposure to this evolving digital asset in the expanding crypto ecosystem.

How to Mine Ethereum in 2025: A Complete Guide for Beginners

Ethereum 2.0 in 2025: Staking, Scalability, and Environmental Impact

What is Ethereum: A 2025 Guide for Crypto Enthusiasts and Investors

How does Ethereum's blockchain technology work?

What are smart contracts and how do they work on Ethereum?

Ethereum Price Analysis: 2025 Market Trends and Web3 Impact

Comprehensive Guide to Trading Indicators

Top 7 Crypto Prop Trading Firms for Funded Trading Accounts

How To Get Free NFT (5 Easy Ways)

What is Bitcoin dominance and why does this metric matter

Comprehensive Guide to OpenSea NFT Trading